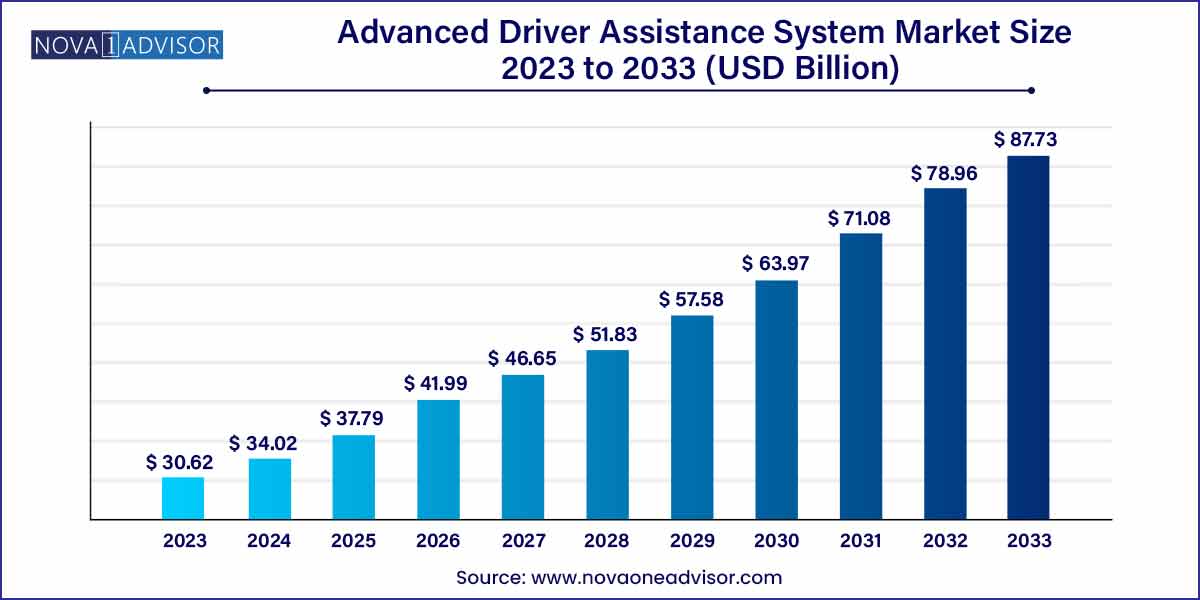

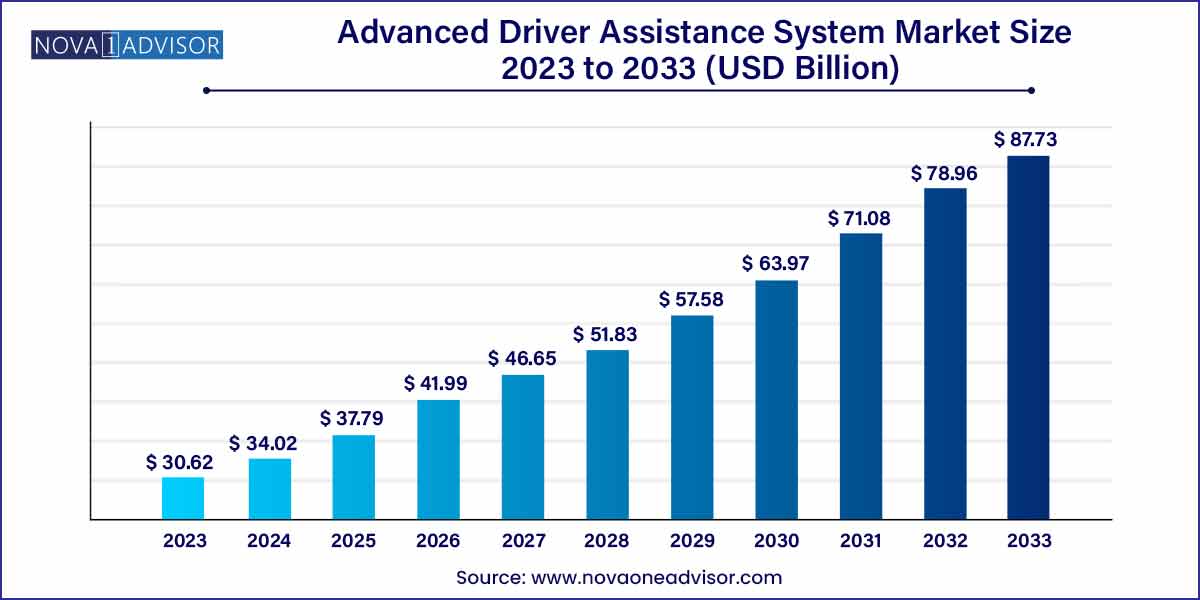

The global advanced driver assistance system market size was estimated at USD 30.62 billion in 2023, is expected to surpass around USD 87.73 billion by 2033, and is poised to grow at a compound annual growth rate (CAGR) of 11.1% during the forecast period of 2024 to 2033.

Key Takeaways:

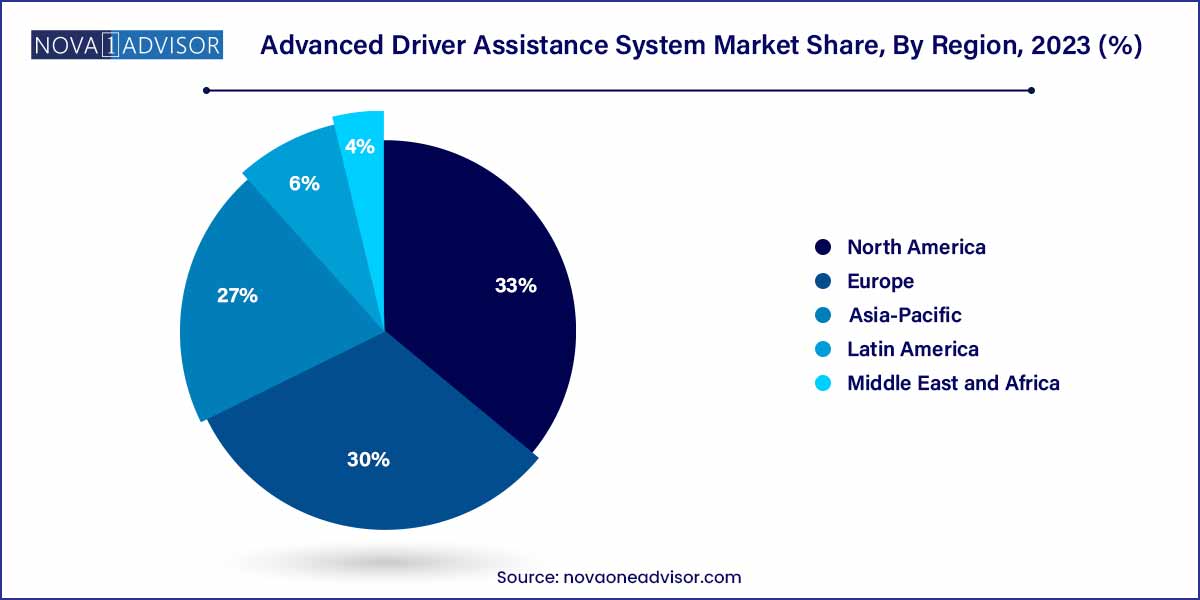

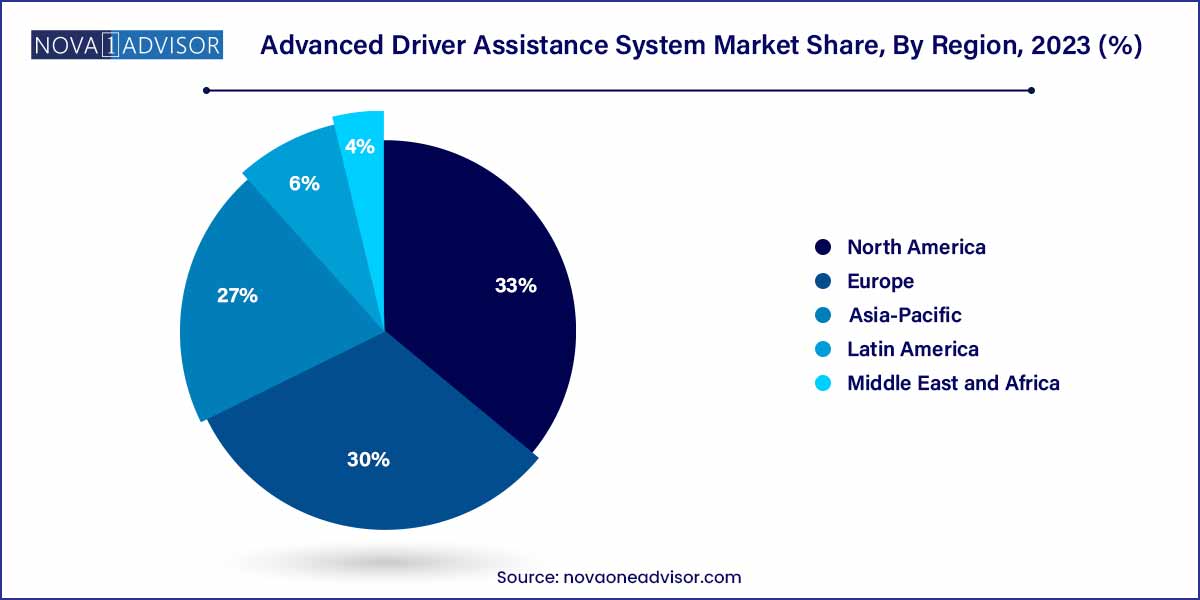

- North America will hold the highest market share of 33.0% in 2023.

- The adaptive cruise control (ACC) segment dominated the market in 2023 and accounted for the highest market share of 19.7%.

- The sensor segment accounted for the largest revenue share of 31.9% in 2023.

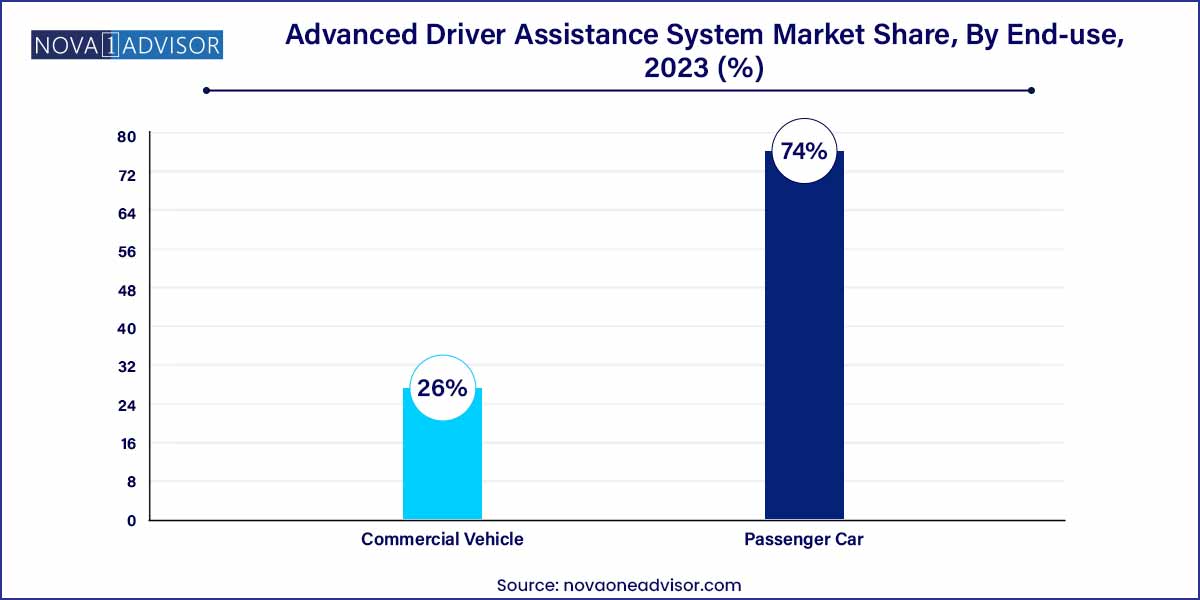

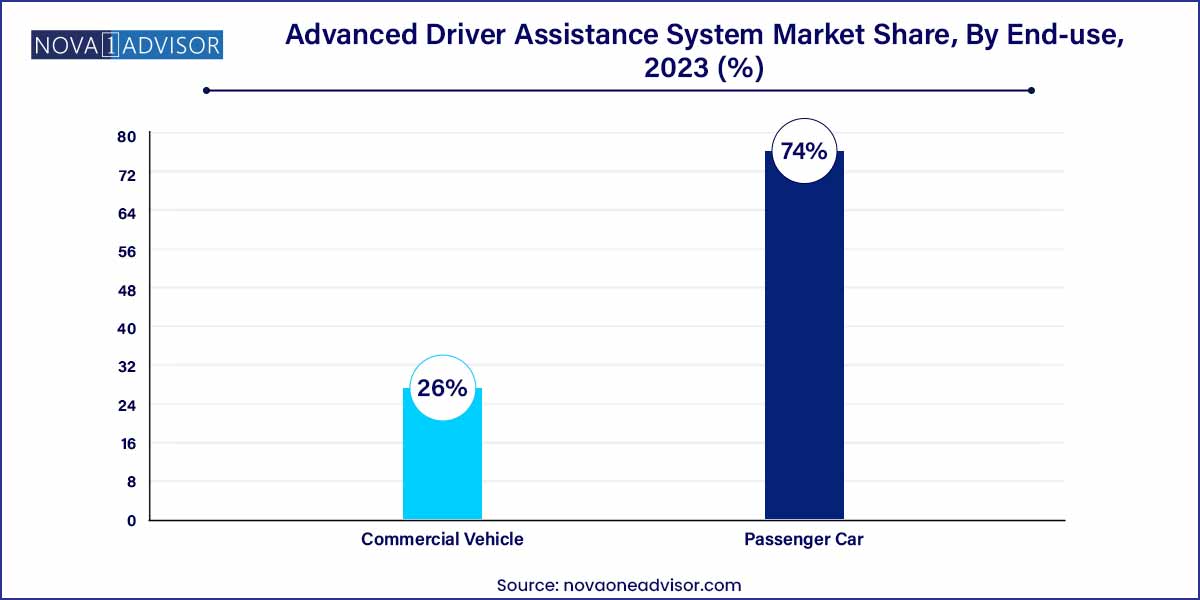

- The passenger car segment accounted for the largest revenue share of 74.0% in 2023.

Advanced Driver Assistance System Market by Overview

The Advanced Driver Assistance System (ADAS) market is experiencing unprecedented growth as the automotive industry undergoes a profound transformation driven by safety, automation, and connectivity. ADAS comprises electronic technologies embedded in vehicles to aid the driver with safer and more efficient vehicle operation. These systems use sensor technologies such as radar, LiDAR, cameras, ultrasonic sensors, and software algorithms to detect, prevent, or mitigate accidents.

The scope of ADAS has expanded significantly—from basic features like parking sensors and lane-departure warnings to more complex functionalities like adaptive cruise control (ACC), automatic emergency braking (AEB), and blind spot monitoring. These systems are foundational components of semi-autonomous and autonomous driving solutions and are becoming standard across vehicle classes.

Governments across the globe have played a catalytic role in the ADAS market’s growth. Regulatory bodies in the U.S. (NHTSA), European Union (Euro NCAP), and Japan (NASVA) are mandating inclusion of specific safety features like AEB and TPMS in all new vehicles, spurring demand for ADAS components. Consumer preference for safer driving experiences and rising awareness of road fatalities have further accelerated OEM investments into ADAS-enabled platforms.

Additionally, the convergence of artificial intelligence, machine learning, and sensor fusion technologies is propelling ADAS capabilities. From urban commuter cars to long-haul commercial vehicles, ADAS is redefining how drivers interact with vehicles, enhancing mobility with real-time situational awareness and control. As the push for fully autonomous vehicles gains traction, ADAS is positioned as a vital bridge between today’s vehicles and tomorrow’s driverless future.

Major Trends in the Market

-

Mandatory Safety Regulations Across Key Markets

Governments are enforcing regulations for AEB, TPMS, LDWS, and other ADAS functions to reduce accidents, particularly in passenger vehicles.

-

Sensor Fusion and AI Integration

Next-gen ADAS uses sensor fusion combining data from radar, LiDAR, and cameras with AI algorithms for better decision-making and real-time response.

-

Growth in LCV and HCV Adoption

Commercial vehicles are increasingly being equipped with ADAS features like blind spot monitoring, rear collision warnings, and adaptive cruise systems.

-

OEM Partnerships with Tech Giants

Automakers are collaborating with AI companies (e.g., NVIDIA, Mobileye, Waymo) to develop advanced processing platforms for higher ADAS levels.

-

Electrification and ADAS Convergence

Electric vehicle manufacturers like Tesla, BYD, and Rivian are using ADAS as a key differentiator by integrating it with energy-efficient autonomous driving.

-

Edge Computing for Real-Time Processing

Processing ADAS data closer to the source reduces latency, enabling faster reaction times—critical for functions like AEB and pedestrian detection.

-

Cost Reduction of Radar and Camera Sensors

Economies of scale and technological improvements are making ADAS affordable even in mid-range and compact vehicle segments.

Advanced Driver Assistance System Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 30.62 Billion |

| Market Size by 2033 |

USD 87.73 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.1% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Solution Type, Component Type, Vehicle Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Altera Corporation (Intel Corporation); Autoliv Inc.; DENSO CORPORATION.; Continental AG; Garmin Ltd.; Infineon Technologies AG; Magna International Inc.; Mobileye; Robert Bosch GmbH; Valeo SA; Wabco Holdings Inc. |

Advanced Driver Assistance System Market Dynamics

- Regulatory Imperatives and Safety Standards:

One of the primary driving forces behind the Advanced Driver Assistance System (ADAS) market dynamics is the stringent regulatory landscape mandating enhanced safety measures in vehicles. Governments worldwide are imposing rigorous safety standards, compelling automakers to integrate advanced technologies like ADAS to mitigate road accidents and improve overall road safety.

- Technological Advancements and Innovation:

The dynamic landscape of the ADAS market is significantly shaped by rapid technological advancements and continuous innovation. The integration of cutting-edge technologies such as artificial intelligence, machine learning, and sensor fusion has revolutionized the capabilities of ADAS. These technological advancements enable vehicles to perceive and respond to their surroundings in real-time, offering features like adaptive cruise control, automatic emergency braking, and lane departure warning systems.

Advanced Driver Assistance System Market Restraint

A significant restraint affecting the Advanced Driver Assistance System (ADAS) market is the growing concern over cybersecurity. As vehicles become more connected and reliant on sophisticated software and communication systems, they become vulnerable to cyber threats. The integration of numerous sensors, cameras, and communication modules in ADAS makes vehicles susceptible to hacking and unauthorized access. The potential compromise of these systems poses serious safety risks, leading to a reluctance among consumers and manufacturers to fully embrace ADAS technologies.

- Interoperability and Standardization Challenges:

The lack of standardized regulations and interoperability standards presents a significant restraint in the ADAS market. With various manufacturers implementing their proprietary ADAS solutions, achieving seamless integration and communication between different systems becomes challenging. This lack of standardization hampers the widespread adoption of ADAS technologies, as consumers may face compatibility issues and limited choices when selecting vehicles with integrated ADAS features.

Advanced Driver Assistance System Market Opportunity

- Rising consumer awareness and demand:

An opportune factor driving the Advanced Driver Assistance System (ADAS) market is the escalating awareness of road safety among consumers. As individuals become more conscious of the benefits of advanced safety features, there is a growing demand for vehicles equipped with ADAS functionalities. Consumers recognize the potential of ADAS in preventing accidents, reducing collisions, and enhancing overall driving safety.

- Integration of Artificial Intelligence (AI) and Machine Learning (ML):

The integration of artificial intelligence (AI) and machine learning (ML) technologies presents a substantial opportunity for the ADAS market. These advanced technologies empower ADAS systems to continuously learn and adapt to diverse driving scenarios, improving their accuracy and effectiveness over time. The use of AI and ML enhances the capabilities of ADAS features, such as object recognition, predictive analysis, and decision-making algorithms. As the automotive industry embraces the potential of these technologies, there is a significant market opportunity for companies to develop innovative ADAS solutions that provide not only enhanced safety but also intelligent and adaptive driving experiences.

Advanced Driver Assistance System Market Challenges

- Cost Implications and Affordability:

A prominent challenge facing the Advanced Driver Assistance System (ADAS) market is the associated cost implications and concerns related to affordability. The integration of advanced sensors, cameras, and processing units required for comprehensive ADAS functionalities adds a significant cost to vehicle manufacturing. As a result, the adoption of ADAS features may be hindered, especially in price-sensitive market segments. Striking a balance between offering cutting-edge safety technologies and ensuring affordability for a broader consumer base is a challenge that industry players must address to foster widespread acceptance of ADAS in the automotive market.

- Lack of Standardization and Regulatory Framework:

The absence of standardized regulations and a cohesive regulatory framework pose a considerable challenge to the ADAS market. With varying standards and regulations across different regions, manufacturers face complexities in designing and implementing ADAS features that comply with diverse requirements. The lack of a unified approach hampers interoperability and may lead to inconsistencies in safety standards. Harmonizing regulatory frameworks globally and establishing standardized guidelines for the development and deployment of ADAS technologies are critical steps in overcoming this challenge and promoting a more cohesive and streamlined market landscape.

Segments Insights:

By Solution Type Insights

Adaptive Cruise Control (ACC) dominated the solution segment, particularly in mid-to-premium passenger vehicles and commercial fleet vehicles. ACC maintains a set speed and distance from the vehicle ahead, significantly reducing driver fatigue and improving highway safety. Automakers like BMW, Honda, Toyota, and Ford have standardized ACC across various models. It has also gained traction in long-distance trucking operations where driver rest and monotony are major concerns.

Autonomous Emergency Braking (AEB) is the fastest-growing ADAS feature, driven by regulation and consumer safety concerns. AEB automatically applies brakes when a collision is imminent, reducing crash severity or preventing it altogether. Euro NCAP and NHTSA assessments heavily weigh AEB availability, pushing OEMs to prioritize its implementation. Fleet operators in logistics and school transportation are also investing in AEB systems to reduce liability and increase passenger safety.

By Components Type Insights

Sensors, especially radar systems, dominate the component type segment, serving as the primary detection and monitoring hardware for real-time ADAS functionalities. Radar is widely used for adaptive cruise control, blind spot detection, and collision avoidance due to its weather-independent functionality. Its cost-effectiveness compared to LiDAR has also made it more accessible across a broader vehicle range. With the advancement of 4D radar and corner radar, coverage and resolution have significantly improved.

LiDAR and AI-powered processors are the fastest-growing components, especially in Level 2+ and Level 3 autonomous driving platforms. LiDAR offers superior object detection and depth accuracy, critical for urban navigation and emergency decision-making. Leading automakers such as Volvo, Nio, and Toyota are integrating LiDAR into next-gen vehicles. At the same time, automotive-grade processors like NVIDIA’s Drive Orin and Qualcomm’s Snapdragon Ride are enabling real-time sensor fusion and predictive analytics, driving the intelligent evolution of ADAS.

By Vehicle Type Insights

Passenger cars dominate the ADAS vehicle type segment, benefiting from consumer safety demand, regulatory pressure, and OEM competition on features. Most new models from manufacturers like Hyundai, Volkswagen, Mercedes-Benz, and Toyota now come equipped with at least basic ADAS functionalities. Mass-market integration of AEB, lane assist, and park assist is transforming consumer expectations and making ADAS a default feature rather than a luxury add-on.

Commercial vehicles particularly light commercial vehicles are the fastest-growing segment, driven by fleet operators' focus on minimizing accidents, fuel costs, and insurance liabilities. Heavy-duty trucks are also being equipped with systems like lane-keeping assist, pedestrian detection, and adaptive lighting to ensure operational safety. The integration of telematics with ADAS features allows fleet managers to monitor driver behavior, prevent accidents, and reduce maintenance expenses, creating a robust growth avenue.

By Regional Insights

Europe leads the global ADAS market, due to strong government mandates, high safety standards, and early technology adoption. The European Commission’s Vision Zero initiative, which aims to reduce road fatalities to zero by 2050, has prompted early enforcement of AEB, LDWS, and pedestrian detection technologies in new vehicles. Euro NCAP ratings further accelerate the adoption of ADAS, influencing both manufacturer compliance and consumer choice.

Luxury car manufacturers like Audi, BMW, Volvo, and Mercedes-Benz, headquartered in Europe, are pioneers in deploying advanced ADAS systems. The region also hosts several Tier-1 ADAS suppliers including Bosch, Continental, and Valeo, ensuring a localized supply chain. Urban infrastructure in cities like Amsterdam, Oslo, and Berlin is also designed to support intelligent mobility systems, enhancing ADAS effectiveness and data collection.

Asia-Pacific is the fastest-growing region in the ADAS market, driven by rapid vehicle production, rising disposable incomes, and government efforts to modernize transport systems. China, in particular, is pushing for widespread ADAS adoption through policies aligned with its New Energy Vehicle (NEV) roadmap. Leading Chinese automakers like Nio, XPeng, and BYD are integrating high-end ADAS features in electric models at competitive prices.

India and ASEAN countries are also catching up, introducing safety mandates and supporting ADAS integration in vehicles under the Bharat NCAP and local road safety programs. Japanese OEMs such as Toyota, Honda, and Subaru are leading in regional development, offering standard ADAS packages across domestic and export models. The presence of electronics giants like Hitachi, Sony, and Denso further accelerates innovation and manufacturing in this region.

Recent Developments

-

March 2025 – Tesla began global rollout of “Autopilot 2.0”, its updated ADAS suite, with improved lane navigation, object recognition, and neural net processing, enabling near Level 3 automation.

-

February 2025 – Bosch introduced its new Radar Sensor Generation 6, offering higher resolution and a 50% range increase for ACC and AEB features, tailored for both passenger and commercial vehicles.

-

January 2025 – Mobileye (Intel) announced collaboration with Zeekr to integrate its SuperVision ADAS platform in upcoming Chinese EVs, offering hands-free driving and HD mapping.

-

December 2024 – Valeo launched its SCALA 3 LiDAR system, capable of detecting objects at 300 meters, and aimed at deployment in autonomous shuttle fleets across Europe.

-

November 2024 – Continental unveiled a scalable ADAS-in-a-box solution for emerging markets, bundling radar, camera, processor, and software in a single plug-and-play module.

Some of the prominent players in the advanced driver assistance system market include:

- Altera Corporation (Intel Corporation)

- Autoliv Inc.

- DENSO CORPORATION.

- Continental AG

- Garmin Ltd.

- Infineon Technologies AG

- Magna International Inc.

- Mobileye

- Robert Bosch GmbH

- Valeo SA

- Wabco Holdings Inc

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global advanced driver assistance system market.

Solution Type

- Adaptive Cruise Control (ACC)

- Blind Spot Detection System (BSD)

- Park Assistance

- Lane Departure Warning (LDWS) System

- Tire Pressure Monitoring System (TPMS)

- Autonomous Emergency Braking (AEB)

- Adaptive Front Lights (AFL)

- Others

Component Type

-

- Radar

- LiDAR

- Ultrasonic

- Others

Vehicle Type

- Passenger Car

- Commercial Vehicle

-

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)