Advanced Wound Care and Closure Market Size and Research

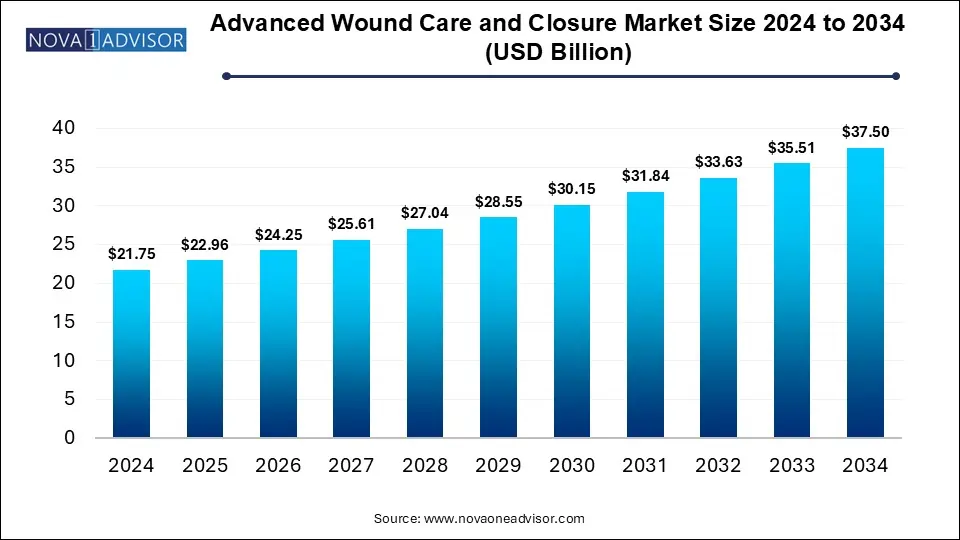

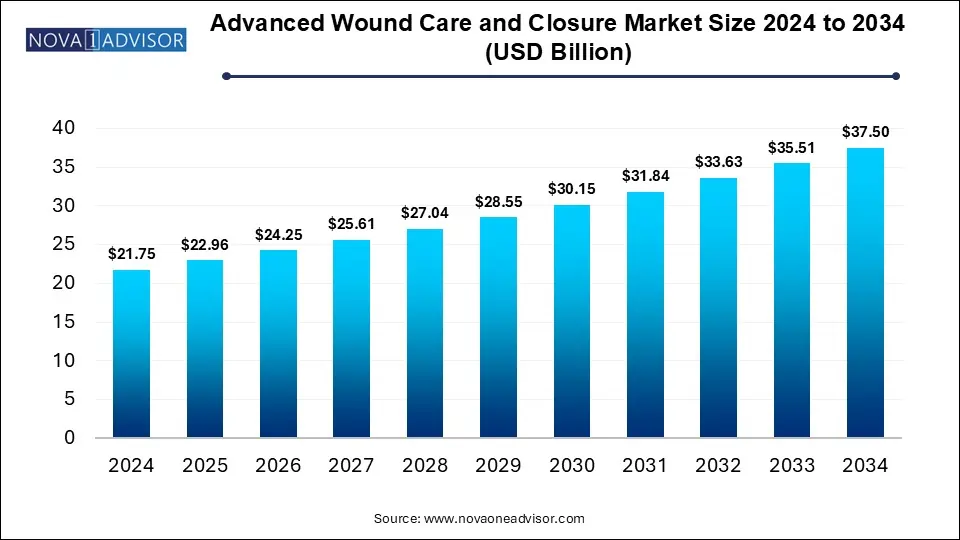

The global advanced wound care and closure market size is calculated at USD 21.75 billion in 2024, grow to USD 22.96 billion in 2025, and is projected to reach around USD 37.50 billion by 2034, growing at a CAGR of 5.6% from 2025 to 2034. The market is growing due to the rising prevalence of chronic wounds like diabetic ulcers and pressure sores. An aging global population and increasing surgical procedures also drive demand. Additionally, technological advancement in wound care products improves healing outcomes, boosting market growth.

Key Takeaways

- North America dominated the advanced wound care and closure market in 2024.

- Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By type, the advanced wound care segment dominated the market in 2024.

- By type, the advanced wound closures segment grew at the fastest rate in the market during the studied years.

- By application, the ulcers segment held the major market share.

- By application, the burns segment is projected to grow at the fastest rate between 2025 and 2034.

- By end user, the hospitals segment held the highest share of the market in 2024.

- By end user, the clinics and nursing homes segment is expected to grow at the fastest rate in the market during the forecast period.

How are Technology Advancement Shaping the Advanced Wound Care and Closure Market?

Advanced wound care and closure refer to specialized medical treatment and technologies designed to promote the efficiency of chronic, complex, or surgical wounds by maintaining optimal conditions, preventing infection, and securely closing the wound with minimal scaring. Technological advancements are significantly shaping the advanced wound care and closure market by introducing innovative products like bioactive dressings, skin substitutes, and negative pressure wound therapy. This technology enhances healing, reduces infection risks, and improves patient outcomes. Additionally, smart dressing with sensor and data-tracking capabilities is enabling personalized care, while minimally, invasive closure techniques are reducing recovery times and healthcare costs, driving market growth.

Which technological trends are influencing the future of the Advanced Wound Care and Closure Market?

- In October 2023, DuPont introduced Liveo MG 7-9960, a new soft skin adhesive (SSA) designed for wound care dressings and skin-applied medical devices. This advanced adhesive offers stronger adhesion with reduced cyclic silicone levels, enabling longer wear and gentle removal, making it ideal for sensitive skin applications.

- In June 2023, JeNaCell (an Evonik company) launched Epicite Balance in Germany, a wound dressing tailored for chronic wounds with low to moderate exudate. It is particularly effective for treating conditions like diabetic foot ulcers, venous and arterial leg ulcers, and soft tissue injuries.

How is AI enhancing advancements in the Advanced Wound Care and Closure Market?

AI is revolutionizing the market by enabling precise wound assessment, personalized treatment plans, and real-time healing monitoring. AI-powered imaging tools help clinicians detect infection risks early, while predictive analytics optimize therapy outcomes. Additionally, smart dressings integrated with sensors and AI track wound progress remotely, enhancing patient care, reducing hospital visits, and improving overall treatment efficiency and effectiveness.

Report Scope of Advanced Wound Care and Closure Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 22.96 Billion |

| Market Size by 2034 |

USD 37.50 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Application, By End User, By Type, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Smith & Nephew Plc., Mölnlycke Health Care AB, Acelity (KCI Licensing, Inc.), Convatec Group PLC., Baxter, Ethicon Inc. (Johnson & Johnson), Coloplast Corp, Medtronic, 3M, Medline Industries, Inc.

|

Market Dynamics

Driver

The Rising Prevalence of Chronic Wound

The increasing prevalence of chronic wounds, such as diabetic foot ulcers, pressure sores, and venous leg ulcers, is a major driver for the advanced wound care and closure market. These types of wounds are often difficult to heal and require prolonged, specialized care beyond conventional treatments. Advanced wound care solution risk, and better patient outcomes. As chronic conditions become more common, the demand for effective, technology-driven wound management continues to grow.

For Instance, Each year, over 2.5 million people in the U.S. suffer from pressure ulcers, according to the Agency for Healthcare Research & Quality. Additionally, studies show that the occurrence of pressure ulcers in healthcare settings varies widely, ranging between 4% and 38%, highlighting the significant challenge these wounds pose in clinical care.

Restraint

High Cost of Advanced Wound Care Treatment

The high cost of advanced wound care treatment and products acts as a restraint because it limits accessibility, especially in the low-income region because it limits accessibility, especially in low-income regions among uninsured or underinsured patients, Many advanced dressing, devices, and theories are significantly more expensive than traditional methods, making them less affordable for widespread use. Additionally, limited reimbursement from healthcare systems and insurance can discourage hospitals and clinics from adopting these solutions, thereby slowing market growth despite their clinical benefits.

Opportunity

The Increasing Number Aging Population

The rising aging population presents a major opportunity in the advanced wound care and closure market. Older adults are more prone to chronic wounds and undergo more surgeries, increasing demand for effective healing solutions. Aging skin heals slower and is more susceptible to complications, requiring specialized care. As healthcare systems focus more on elderly care and quality of life, the need for advanced, minimally, invasive, and home-based wound management products will continue to grow significantly.

For Instance, According to the WHO, the global elderly population is projected to increase significantly, reaching around 2 billion by 2050 from 84 million in 2014. As older individuals are more vulnerable to chronic illnesses and ulcers, this demographic shift is expected to drive demand for advanced wound care solutions, boosting market growth in the coming years.

Segmental Insights

The Advanced Wound Care Segment Dominated

By type, the advanced wound care segment dominated the market in 2024, due to the rising prevalence of chronic wounds such as diabetic foot ulcers and pressure ulcers, driven by an aging population and increasing chronic diseases. These products offer faster healing, and better infection control, and are more effective than traditional dressings. Technological advancements and a growing preference for non-invasive, home-based treatments further boosted demand. Additionally, supportive reimbursement policies contributed to the widespread adoption of advanced wound care solutions.

For Instance, According to a November 2024 report by Mass General Brigham Incorporated, over 900,000 cardiac surgeries, including coronary bypass procedures, are performed annually in the U.S., with global numbers being even higher. These surgeries typically involve the heart and major blood vessels like the aorta and pulmonary arteries. The high volume of such procedures highlights the growing need for effective and advanced wound closure solutions to support recovery and reduce complications.

The Advanced Wound Closures Segment: Fastest-Growing

By type, the advanced wound closures segment grew at the fastest rate in the market during the studied years due to increasing demand for efficient, minimally invasive, and rapid healing solutions. These products such as tissue adhesives, absorbable sutures, and hemostatic agents offer better cosmetic outcomes, reduced healing time, and lower risk of infection compared to traditional methods. Rising surgical procedures, trauma cases, and advancements in closure technologies are also accelerating their adoption across hospitals and outpatient settings.

The Ulcers Segment: Major Shares

By application, the ulcers segment held the major market share, due to the high global prevalence of chronic ulcers, particularly diabetic foot ulcers, pressure ulcers, and venous leg ulcers. These conditions require long-term, specialized wound care to prevent complications and promote healing. With rising diabetes rates, an aging population, and increased hospitalization, the demand for effective ulcer management has surged ultimately driving advanced wound care and closure market demand.

The Burns Segment: Fastest Growing

By application, the burns segment is projected to grow at the fastest rate between 2025 and 2034, due to the rising incidence of burn injuries worldwide, especially in low- and middle-income countries. Technological advancements in burn care, such as bioengineered skin and stem cell therapies, are improving treatment outcomes. Additionally, increasing awareness, and supportive government in emerging markets are driving demand for advanced burn wound care solutions.

The Hospitals Segment: Highest Shares

By end user, the hospitals segment held the highest share of the market in 2024, due to their role as primary centers for treating complex wounds, including surgical and chronic ulcers. Hospitals offer advanced infrastructure, skilled medical professionals, and access to innovative wound care technologies. The growing number of surgical procedures and trauma cases further boosted demand. Additionally, favorable reimbursement policies and the availability of specialized therapies supported the widespread adoption of advanced wound care products in hospital settings.

The Clinics and Nursing Homes Segment: Fastest-Growing

By end user, the clinics and nursing homes segment is expected to grow at the fastest rate in the market during the forecast period. The growth is driven by the rising geriatric population, which increases the demand for long-term wound management. These facilities offer cost-effective care and are increasingly adopting advanced wound care technologies. Additionally, supportive healthcare policies and reimbursement systems are encouraging the use of specialized wound care services outside of hospitals, enhancing their role in chronic wound treatment.

Regional Insights

How is North America influencing the Development of the Advanced Wound Care and Closure Market?

North America is significantly influencing the development of the advanced wound care and closure market due to its well-established healthcare infrastructure, high prevalence of chronic wounds, and growing geriatric population. Technological advancements, strong government support, and favorable reimbursement policies further drive market growth. Additionally, increasing awareness and adoption of innovative wound care products in hospitals and clinics contribute to North America’s leading role in this market.

- For Instance, According to the National Center for Chronic Disease Prevention and Health Promotion’s May 2023 report, 60% of people in the U.S. have at least one chronic condition like cancer, diabetes, stroke, or heart disease. This high prevalence of chronic illnesses is expected to increase the need for advanced wound care solutions, driving significant growth in this segment over the coming years.

How is Asia-Pacific Driving the Expansion of the Advanced Wound Care and Closure Market?

Asia Pacific is driving the expansion of the advanced wound care and closure market due to a rising incidence of chronic wounds linked to diabetes and aging populations in countries like Japan and China. Technological advancements such as negative pressure therapy and bioactive dressings improve healing outcomes. Additionally, the increasing number of surgeries, supportive government policies, and favorable reimbursement schemes are boosting market growth. Together, these factors are fueling strong demand for advanced wound care solutions in the region.

- For Instance, According to a report by the State Council of China in October 2024, the country’s aging population is a major demographic change, with around 297 million people aged 60 and older in 2023, making up 21.1% of the population. This growing elderly group is a key driver for market expansion, increasing the demand for advanced wound care and related healthcare services.

Some of The Prominent Players in The Advanced Wound Care and Closure Market Include:

- Smith & Nephew Plc.

- Mölnlycke Health Care AB

- Acelity (KCI Licensing, Inc.)

- Convatec Group PLC.

- Baxter

- Ethicon Inc. (Johnson & Johnson)

- Coloplast Corp

- Medtronic

- 3M

- Medline Industries, Inc.

Recent Developments in the Advanced Wound Care and Closure Market

- In January 2024, Coloplast introduced Biatain Silicone Fit to the U.S. market. This advanced silicone foam dressing is developed to support both the prevention of pressure injuries and effective wound care. It provides healthcare providers with an innovative solution aimed at enhancing patient care and promoting better healing outcomes.

- In January 2023, Convatec Group plc introduced ConvaFoam in the U.S.—a range of advanced foam dressings created to meet the needs of both patients and healthcare professionals. Designed for use on various wound types and at any stage of healing, ConvaFoam offers a versatile and straightforward option for wound care and skin protection.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Application

- Burns

- Ulcers

- Type

- Pressure Ulcers

- Diabetic Foot Ulcers

- Venous Ulcers

- Others

By End User

- Hospitals

- Clinics and Nursing Homes

- Others

By Type

-

-

- Hemostatic and Sealing Agent

- Topical Tissue Adhesive

- Wound Closure Devices

-

-

- Moist Wound Dressings

- Active Wound Care

-

-

-

-

- Skin Substitutes

- Growth Factors

-

-

-

-

- Negative Pressure Wound Therapy

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)