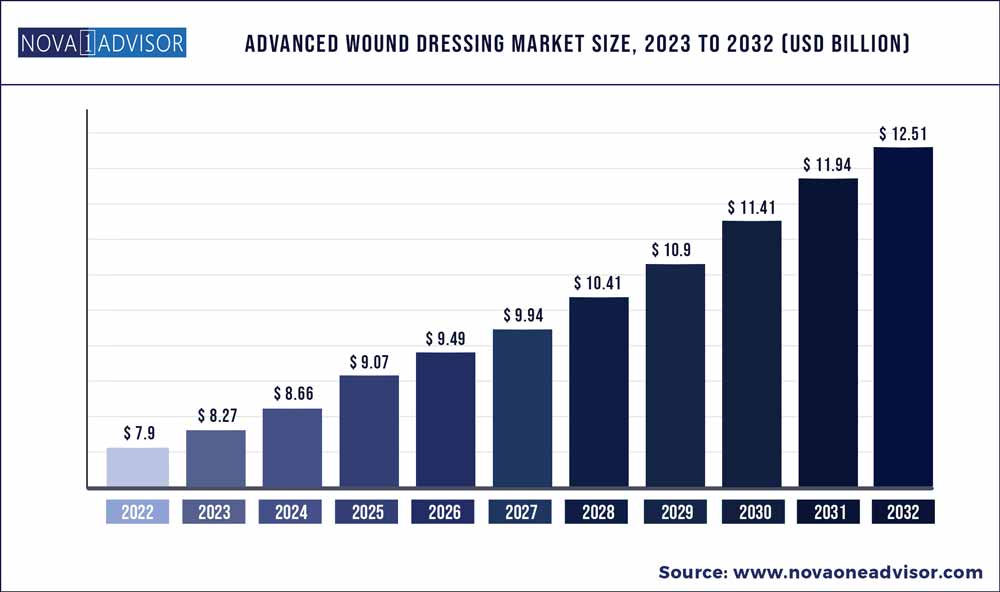

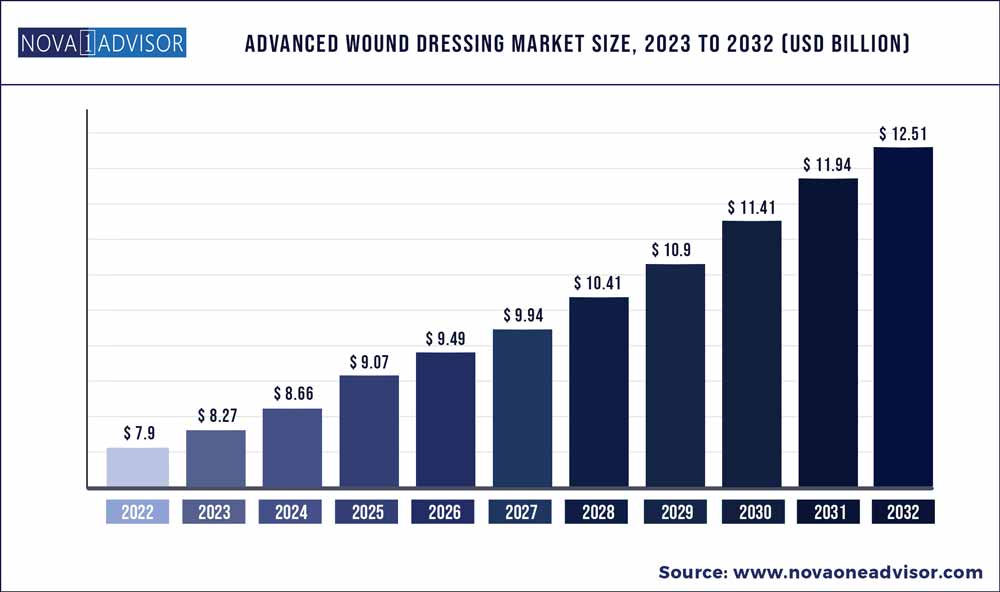

The global advanced wound dressing market size was exhibited at USD 7.9 billion in 2022 and is projected to hit around USD 12.51 billion by 2032, growing at a CAGR of 4.7% during the forecast period 2023 to 2032.

Key Pointers:

- North America dominated the advanced wound dressing industry and accounted for the largest revenue share of 45.9% in 2022.

- Asia Pacific, the market for advanced wound dressing is anticipated to witness the fastest CAGR of 5.3% over the forecast period.

- The foam dressings segment dominated the market for advanced wound dressing and accounted for the largest revenue share of 23.8% in 2022.

- The hydrocolloid dressings segment is projected to witness the fastest growth rate of CAGR of 5.8% over the forecast period.

- The chronic wounds segment dominated the market for advanced wound dressing and accounted for the largest share of 59.14% in 2022.

- The hospital segment dominated the market for advanced wound dressing and accounted for the largest revenue share of 38.12% in 2022.

Advanced Wound Dressing Market Report Scope

The demand for advanced wound dressing is increasing owing to technological advancements, the increasing number of surgical procedures, and the rising prevalence of chronic wounds across the globe. Increasing incidences of chronic diseases such as diabetes, cancer, and other autoimmune diseases are driving the demand for advanced wound dressings. Factors such as antimicrobial resistance, adoption of unhealthy and sedentary lifestyles, alcohol consumption, and smoking are some of the major factors contributing to the rise in the prevalence of non-communicable diseases.

According to International Diabetes Federation (IDF), 537 million individuals aged 20 to 79 are living with diabetes as of 2021, whereas, this number is predicted to increase to 643 million in 2030, and 783 million in 2045. In addition, the IDF reported that in 2021 approximately 6.9 million deaths globally were caused due to diabetes.

The increasing number of accidents, the impact of COVID-19, and technological advancements are the key driving factors for the market. The increasing incidence of accidents such as road accidents, burns, and trauma events across the globe is anticipated to drive the market. For instance, as per the WHO (2018), around 1,000,000 people are severely or moderately burnt in India per year. In addition, as per NCBI, in 2017, countries such as Bulgaria, Finland, the Netherlands, China, Australia, and the U.K. reported a rise in the incidence of burn injuries.

Furthermore, as per the American Association for the Surgery of Trauma, in 2017, around 1.2 million people died globally, accounting for the deaths of around 3,242 people per day in road accidents every year. Road accidents mostly occur in middle- or low-income countries. The advanced wound dressing is majorly used for the faster healing of all kinds of burns injuries. Moreover, bandages and gauze are also used for the treatment of minor injuries. Thus, the rising number of accidents is expected to boost the demand for advanced wound dressing, which is expected to lead to considerable market growth over the forecast period.

The rising number of surgical procedures is also expected to boost the demand for home healthcare services. According to the American Society for Metabolic and Bariatric Surgery (ASMB) in 2018, the number of people who underwent sleeve gastrectomy increased by 8.05% from 2016 to 2017 in the U.S. Patients undergoing surgeries are required to stay at hospitals for a longer period; thus, most patients prefer home healthcare services over hospital stays. Therefore, these factors are likely to boost the demand for home healthcare services, thereby fueling market growth during the forecast period.

North America dominated the advanced wound dressing industry and accounted for the largest revenue share of 45.9% in 2022. Increasing road accidents, sports injuries, and the presence of several key players in the region are anticipated to drive the market for advanced wound dressing in the region. In addition, the presence of an adequate number of skilled professionals and highly developed healthcare infrastructure is also expected to drive the market in the region over the forecast period.

In Asia Pacific, the market for advanced wound dressing is anticipated to witness the fastest CAGR of 5.3% over the forecast period. The presence of developing countries such as China, India, and Japan is anticipated to boost growth. In addition, the rapidly growing medical tourism industry in these countries can also be attributed to the increase in demand for advanced wound dressings in this region. Further, the rising geriatric population in this region is expected to drive the advanced wound dressing industry. For instance, as per the People’s Archive of Rural India, an estimated 138 million elderly population resided in India in 2019.

Some of the prominent players in the Advanced wound dressing Market include:

- 3M

- Coloplast Corp.

- Medline Industries

- Smith & Nephew

- ConvaTec Group PLC

- Derma Sciences (Integra LifeSciences)

- Ethicon (Johnson & Johnson)

- Baxter International

- Molnlycke Heath Care AB

- Medtronic

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global advanced wound dressing market.

By Product

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Collagen Dressings

- Other Advanced Dressings

By Application

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

By End-use

- Hospitals

- Specialty Clinics

- Home Healthcare

- Physician’s Office

- Nursing Homes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)