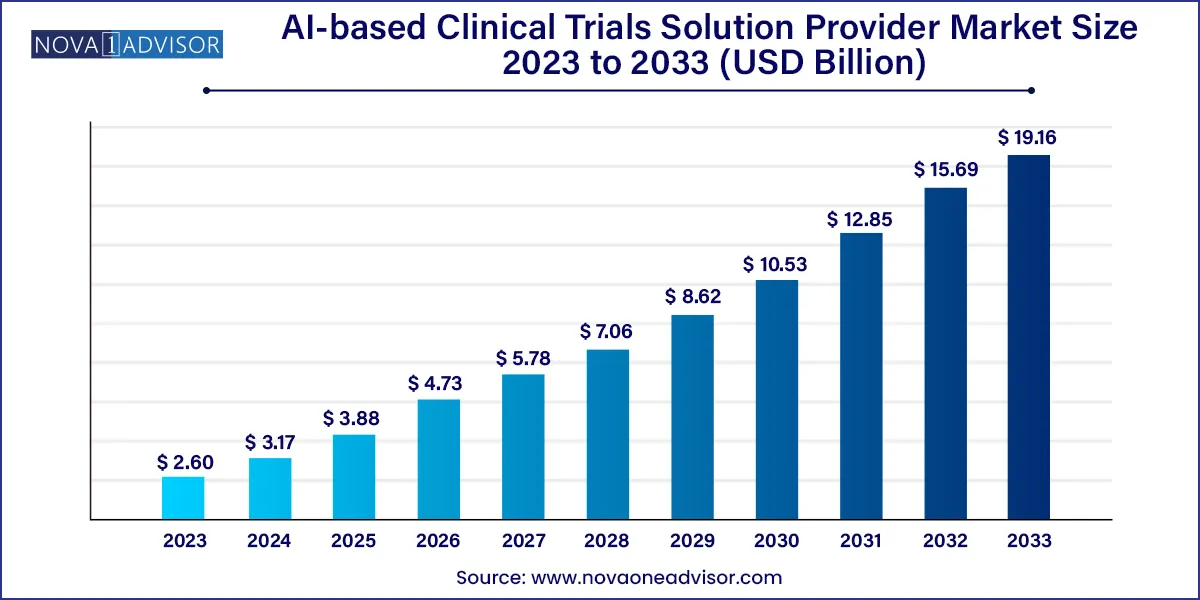

The global AI-based clinical trials solution provider market size was exhibited at USD 2.60 billion in 2023 and is projected to hit around USD 19.16 billion by 2033, growing at a CAGR of 22.11% during the forecast period 2024 to 2033.

Key Takeaways:

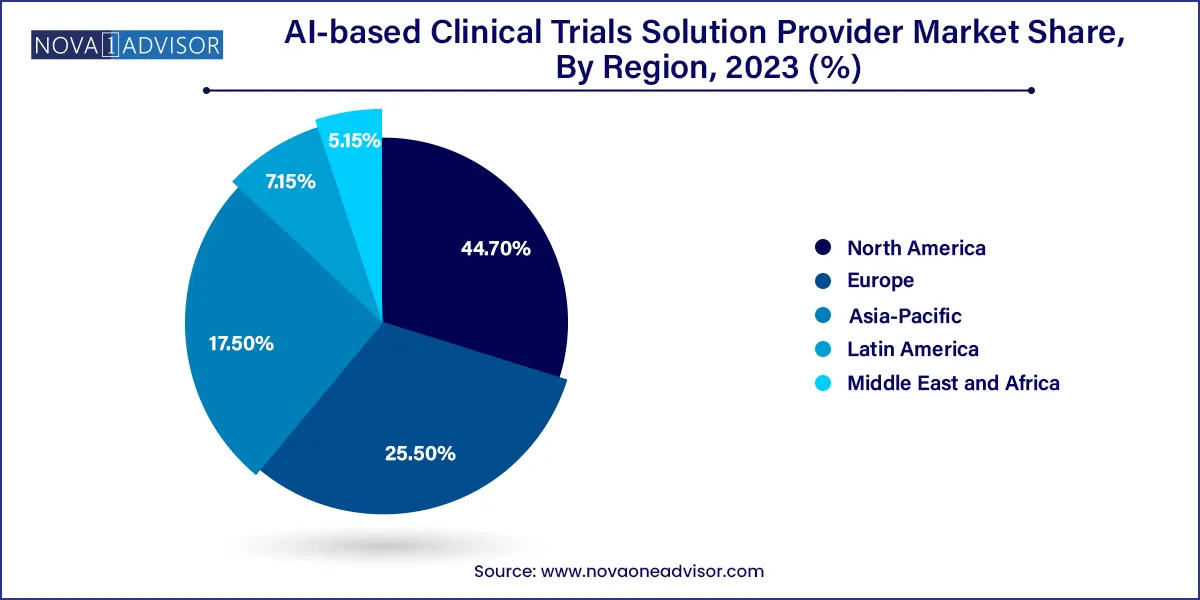

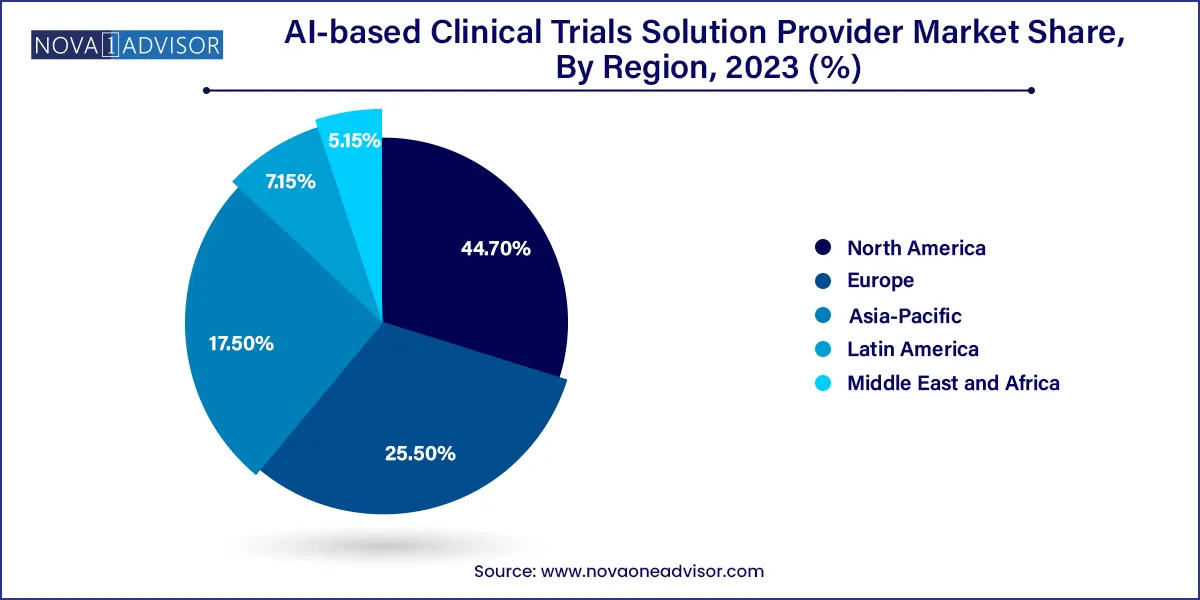

- North America dominated the global AI-based clinical trials solution providers market and accounted for a revenue share of 44.7% in 2023.

- Asia Pacific, the market for AI-based clinical trial solution providers is anticipated to register the fastest growth rate of 30.0% over the forecast period

- The phase-II segment dominated the market for AI-based clinical trial solution providers and accounted for a revenue share of 46.1% in 2023,

- Phase I is anticipated to register the fastest growth rate of 24.2% during the forecast period.

- The oncology segment accounted for the highest revenue share of 22.4% in 2023.

- cardiovascular disease is anticipated to register the fastest growth rate of 25.6% during the forecast period

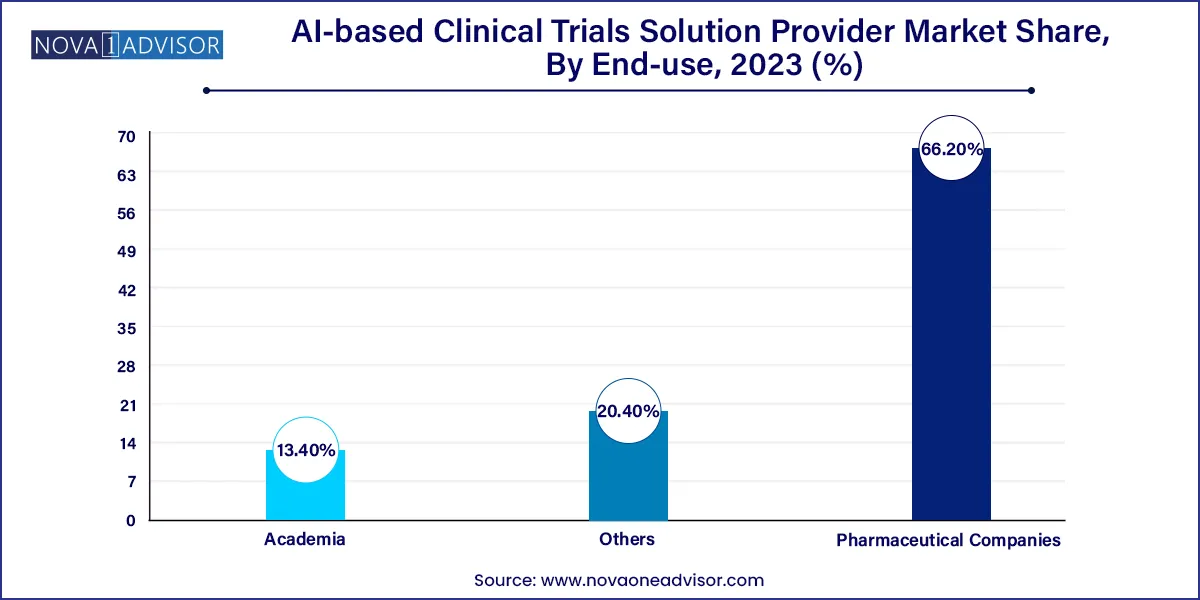

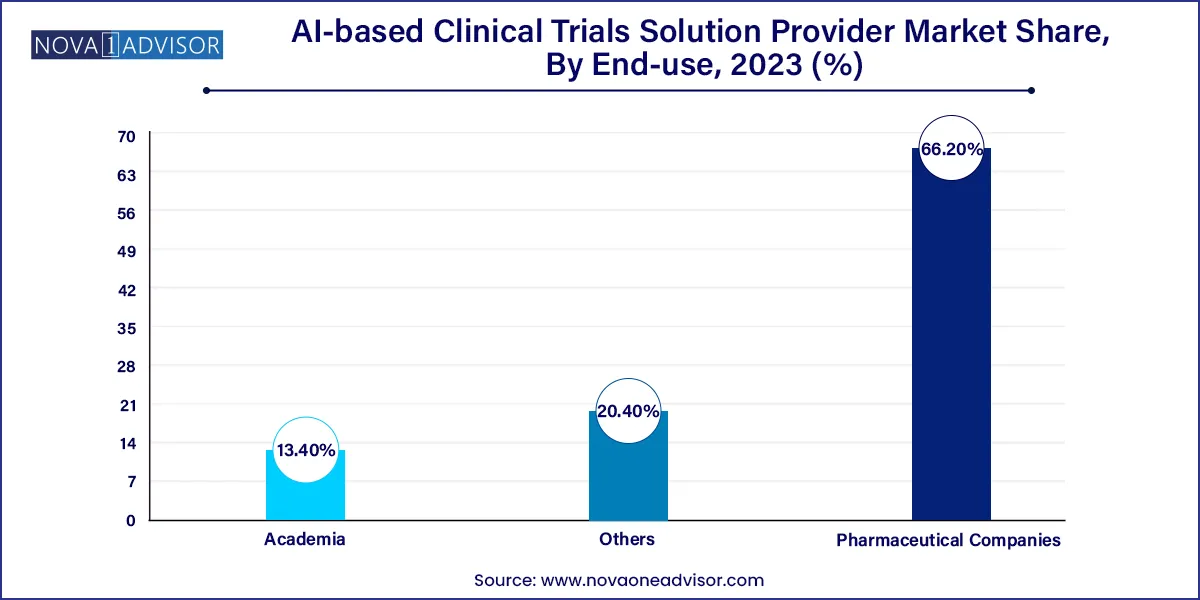

- In 2023, based on end-use, the pharmaceutical companies segment accounted for the highest revenue share of 66.20%.

- The others is anticipated to register the fastest growth rate of 25.0% during the forecast period.

Market Overview

The AI-based Clinical Trials Solution Provider Market is rapidly transforming the traditional pharmaceutical research landscape. With the increasing complexity and cost of clinical trials, artificial intelligence (AI) has emerged as a revolutionary tool that is reshaping protocol design, patient recruitment, site selection, real-time monitoring, and outcome analysis. AI-driven platforms leverage machine learning algorithms, natural language processing (NLP), and predictive analytics to optimize trial efficiency, improve success rates, and reduce time-to-market for new drugs.

This market is gaining momentum as the pharmaceutical industry faces mounting pressure to reduce R&D expenses while accelerating innovation. From small biotech startups to multinational pharmaceutical companies, organizations are investing in AI platforms to enhance data-driven decision-making. COVID-19 acted as a catalyst, necessitating remote monitoring, virtual trials, and adaptive study designs, all of which align with AI capabilities. Moreover, regulatory bodies such as the FDA and EMA are showing increasing openness to the use of AI in clinical trials, further reinforcing market growth.

Major Trends in the Market

-

Use of AI for decentralized and virtual clinical trials, allowing greater flexibility and patient participation.

-

AI-enabled patient recruitment and retention tools, improving enrollment timelines and diversity.

-

Predictive modeling for trial outcomes and protocol optimization, reducing costly mid-trial amendments.

-

Natural language processing (NLP) for EHR and literature mining, aiding in faster hypothesis generation.

-

Blockchain integration for secure, transparent data sharing in multi-site trials.

-

Increased collaboration between AI startups and CROs, enabling scalable trial management platforms.

-

Adoption of AI in real-world evidence (RWE) collection, improving post-market surveillance and regulatory submissions.

Report Scope of the AI-based Clinical Trials Solution Provider Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.17 Billion |

| Market Size by 2033 |

USD 19.16 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 22.11% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Clinical Trial Phase, Therapeutic Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Unlearn.AI, Inc.; Saama Technologies; Antidote Technologies, Inc.; Phesi; Deep 6 AI; Innoplexus; Mendel.ai; Intelligencia; Median Technologies; Symphony AI; BioAge Labs, Inc.; AiCure, LLC; CONSILX; DEEP LENS AI; Halo Health Systems; Pharmaseal; Ardigen; Trials.Ai; Koneksa Health; Euretos; BioSymetrics; Google- Verily; GNS Healthcare; IBM Watson; Exscientia |

Key Market Driver

Need for Enhanced Trial Efficiency and Cost Reduction

The cost of bringing a new drug to market can exceed $2 billion, with clinical trials comprising a significant share of that investment. High failure rates, patient dropout, and administrative overhead plague traditional trials. AI addresses these challenges by enabling smarter patient matching, automating data collection, and predicting trial risks. For example, Deep 6 AI uses real-time EHR analysis to recruit eligible patients from vast datasets in days rather than months. This not only shortens enrollment periods but also increases the likelihood of trial success. The cumulative cost savings and improved time efficiency are propelling the adoption of AI solutions in clinical trials.

Major Market Restraint

Data Privacy and Regulatory Uncertainty

Despite the promise of AI, concerns surrounding patient data privacy and compliance hinder widespread adoption. Clinical trials involve sensitive personal health information, and AI platforms must navigate complex regulatory landscapes like HIPAA, GDPR, and region-specific frameworks. Additionally, the interpretability of AI algorithms remains a challenge—regulatory bodies often demand transparency in decision-making, which "black box" AI models struggle to provide. For instance, AI-generated patient stratification may lack clear rationale, posing compliance and ethical questions. Until there are universal standards for AI validation in clinical trials, some sponsors may remain cautious in fully deploying these technologies.

Emerging Market Opportunity

AI-Powered Precision Medicine Trials

The synergy between AI and precision medicine is opening new frontiers in clinical trials. AI can stratify patients based on genetic, phenotypic, and behavioral data to design highly targeted trials. This approach enhances trial efficacy and reduces variability. For instance, GNS Healthcare uses AI to simulate patient responses to treatments, optimizing trial protocols for specific sub-populations. As oncology and rare disease research increasingly require individualized approaches, AI-based solutions will be indispensable in developing and managing biomarker-driven trials. The ability to combine omics data with real-world evidence creates a fertile ground for innovation and investment.

Segments

AI-based Clinical Trials Solution Provider Market By Clinical Trial Phase Insights

Phase-III trials dominate the AI-based clinical trials solution market, owing to their scale, cost, and criticality in the drug approval process. These trials often involve thousands of participants across multiple geographies, making AI essential for managing complexity. AI helps in protocol adherence, real-time data monitoring, and anomaly detection, reducing the risk of trial failure. Companies like Medidata Solutions and Saama Technologies offer AI-powered platforms tailored for Phase-III study needs.

Phase-I trials are witnessing the fastest growth in AI integration. These early-stage trials benefit significantly from predictive modeling and simulation tools that assess drug toxicity and optimal dosing. AI can rapidly analyze preclinical data and forecast patient responses, enhancing trial design accuracy. Startups like Owkin and Unlearn.AI are developing synthetic control arms and digital twins to optimize Phase-I research, making it safer and more efficient.

AI-based Clinical Trials Solution Provider Market By Therapeutic Application Insights

Oncology dominates the therapeutic application segment, driven by the demand for biomarker-driven studies and the high failure rate of cancer drugs. AI is used extensively in oncology trials to predict tumor progression, identify eligible patient cohorts, and monitor adverse events. For instance, PathAI utilizes AI for pathology image analysis in cancer trials, improving diagnostic precision and stratification.

Neurological disease trials are growing fastest due to the increasing burden of conditions like Alzheimer’s, Parkinson’s, and multiple sclerosis. These trials are inherently complex, requiring long durations and sensitive endpoints. AI platforms like NeuroInitiative use modeling to predict neurological progression, helping design better trials. AI-enabled speech and behavior analysis tools are also improving remote assessment capabilities, making them ideal for decentralized trials in neurodegenerative research.

AI-based Clinical Trials Solution Provider Market By End-use Insights

Pharmaceutical companies remain the largest end-users of AI-based clinical trial solutions, due to their capacity for high R&D spending and strong regulatory frameworks. Big pharma firms such as Novartis and Pfizer are investing in in-house AI capabilities or partnering with tech companies to enhance trial outcomes. For example, Novartis' collaboration with PathAI and Microsoft showcases the strategic embrace of AI in trial optimization.

Academic institutions are the fastest-growing end-users. Universities and research hospitals are increasingly using AI to manage investigator-initiated trials, often in collaboration with tech providers. The need to publish high-impact research and secure grant funding drives innovation adoption. Moreover, public-private partnerships are enabling these institutions to test cutting-edge AI tools, often serving as pilots for broader commercial deployment.

AI-based Clinical Trials Solution Provider Market By Regional Insights

North America holds the dominant share in the AI-based clinical trials solution provider market, attributed to robust digital infrastructure, strong funding ecosystems, and regulatory openness. The U.S. is home to several pioneering AI startups like Deep 6 AI, ConcertAI, and Unlearn.AI, all focused on revolutionizing trial design and execution. Additionally, the FDA has initiated programs such as the "Digital Health Software Precertification Program," signaling a welcoming attitude toward AI innovation.

The presence of global pharmaceutical giants and established contract research organizations (CROs) further reinforces North America’s leadership. Moreover, collaborations between tech firms and healthcare providers are thriving due to high interoperability standards and availability of EHR data.

Asia-Pacific is the fastest-growing region in this market, owing to rising clinical trial activity, favorable government initiatives, and large patient pools. Countries like China, India, Japan, and South Korea are investing heavily in digital health infrastructure. China’s National Medical Products Administration (NMPA) has introduced reforms to accelerate trial approvals and support technology integration.

Local startups are emerging with AI solutions tailored to regional languages, genetic data, and population diversity. Moreover, Western CROs are partnering with APAC institutions to run hybrid trials using AI-powered platforms. This growth is further supported by increasing cloud adoption and mobile connectivity, enabling real-time data sharing and decentralized trial models.

Some of the prominent players in the AI-based clinical trials solution provider market include:

- Unlearn.AI, Inc.

- Saama Technologies

- Antidote Technologies, Inc.

- Phesi

- Deep 6 AI

- Innoplexus

- Mendel.ai

- Intelligencia

- Median Technologies

- Symphony AI

- BioAge Labs, Inc.

- AiCure, LLC

- CONSILX

- DEEP LENS AI

- Halo Health Systems

- Pharmaseal

- Ardigen

- Trials.Ai

- Koneksa Health

- Euretos

- BioSymetrics

- Google- Verily

- GNS Healthcare

- IBM Watson

- Exscientia

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global AI-based clinical trials solution provider market.

Clinical Trial Phase

- Phase-I

- Phase-II

- Phase-III

Therapeutic Application

- Oncology

- Cardiovascular Diseases

- Neurological Diseases or Conditions

- Metabolic Diseases

- Infectious Diseases

- Others

End-user

- Pharmaceutical Companies

- Academia

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)