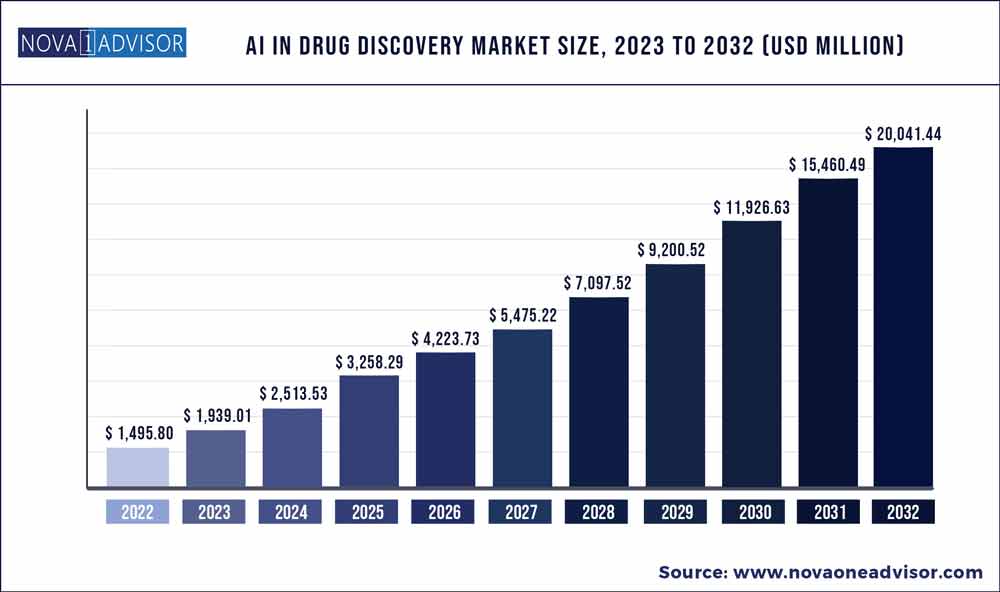

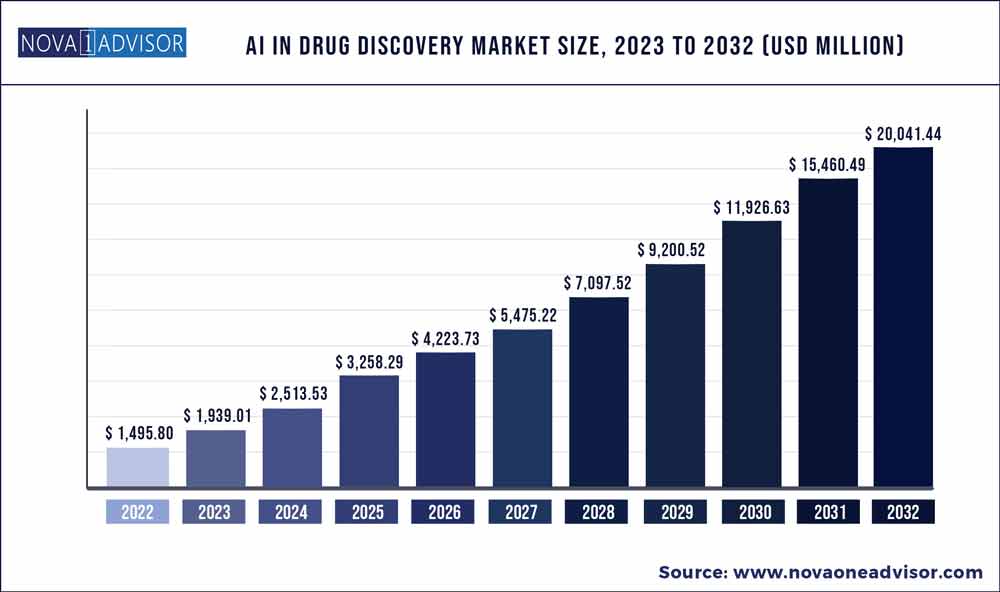

The artificial intelligence (AI) In drug discovery market size accounted for USD 1,495.8 million in 2022 and is estimated to achieve a market size of USD 20,041.44 million by 2032, growing at a CAGR of 29.63% from 2023 to 2032.

Key Pointers:

- The oncology sub-segment held the largest revenue share of over 21.0% in 2022.

- The drug optimization and repurposing segment accounted for the largest revenue share of over 51.0% in 2022.

- North America held the largest revenue share of over 56.0% in 2022.

Report Scope of the Artificial Intelligence (AI) In Drug Discovery Market

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 1,939.01 million

|

|

Market Size by 2032

|

USD 20,041.44 million

|

|

Growth Rate from 2023 to 2032

|

CAGR of 29.63%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Application, therapeutic area, component, region

|

|

Key companies profiled

|

IBM Watson; Exscientia; GNS Healthcare; Alphabet (DeepMind); Benevolent AI; BioSymetrics; Euretos; Berg Health; Atomwise; Insitro; Cyclica

|

The growing demand for the discovery and development of novel drug therapies and increasing manufacturing capacities of the life science industry are driving the demand for artificial intelligence (AI) empowered solutions in the drug discovery processes. Manufacturers in the life science industry constantly focus on replenishing their product pipelines as the majority of the big sellers go off patent. Furthermore, a growing number of public-private partnerships boosting the adoption of AI-powered solutions in drug discovery and development processes is driving the market. Countries such as France, the U.S., Spain, and Japan dominate the clinical trial space, while the U.K. is focused on enhancing research & development activities.

Drug discovery and development is a cost-intensive and time-consuming process. As per the data published in industry journals, the average costs of discovering and developing novel drug therapies are USD 2.6 billion, and the time period of more than 10 years. Most of the candidate therapies are eliminated within the initial phases of the clinical trial, specifically preclinical and phase-1 trials owing to the narrow development testing funnel, which directly contributes to the high costs and vast timelines involved in the process.

The adoption of AI solutions in the clinical trial process eliminates possible obstacles, reduces clinical trial cycle time, and increases the productivity and accuracy of the clinical trial process. Therefore, the adoption of these advanced AI solutions in drug discovery processes is gaining popularity amongst life science industry stakeholders. According to Clinical Trials Arena data estimates in 2021, the strategic collaborations and partnerships between major AI-based drug discovery companies and pharmaceutical companies increased from 4 partnerships in 2015 to 27 partnerships in 2020.

Digitalization in biomedical and clinical research spaces is paving a path for the implementation of AI solutions. The wide array of datasets generated from drug discovery processes such as molecule screening phase and preclinical studies is boosting the adoption of AI-powered solutions. The monumental datasets make it difficult for researchers to analyze the studies accurately and through the implementation of AI solutions, the screening processes can be accelerated and the turnaround time can be reduced. Furthermore, the ongoing Covid-19 pandemic has dramatically changed the perception toward clinical trials and has increased the penetration and utilization of AI solutions. For instance, renowned pharmaceutical companies such as Pfizer, Novartis, Bayer, Sanofi, and Johnson & Johnson are collaborating with AI-based drug discovery solutions providers.

The availability of myriad options such as data mining and personalization capabilities in adopting AI solutions in drug discovery processes is driving the market. Furthermore, enhanced accuracy is achieved through the integration of deep learning and machine learning algorithms in AI platforms in identifying molecule binding properties of the drug. Moreover, the incorporation of advanced technologies such as electronic data capture (EDC) supports manufacturers in improving patient data management and reduces monitoring costs. Process errors can be minimized by integrating electronic Clinical Outcome Assessment (e-COA) in the AI solutions. Lately, advanced analytics are being integrated into these advanced AI solutions, which aid stakeholders in data mining, patient recruitment, and medical and clinical records management.

Amongst the different phases of a clinical trial study, preclinical testing accounts for the highest revenue loss with low returns. Through the adoption of AI solutions, the preclinical testing phase can be optimized to minimize costs. AI-based models are implemented to accurately analyze human physiological responses and eliminate experimental costs. Stringent regulations pertaining to clinical trial studies laid down by regulatory authorities across the globe are anticipated to drive the demand for AI solutions in drug discovery processes. On the other hand, government authorities of various developed and emerging economies are undertaking favorable initiatives to increase the penetration of AI solutions and increase the number of clinical trials.

Therapeutic Area Insights

The oncology sub-segment held the largest revenue share of over 21.0% in 2022. Disease diagnosis is prone to human error, thus using AI systems can prove beneficial in the early detection of diseases. In recent years, AI has become more precise in identifying diseases. Lung cancer is mostly detected at later stages when survival rates become very less, in this scenario, earlier detection with the help of AI systems can prove an asset. A researcher at Northwestern University was able to successfully detect lung cancer in scans where any radiologists would not find anything. AI can be used to provide personalized treatments to patients by improving on the existing AI systems, which are designed to scan through enormous data sets and draw meaningful conclusions. Scans along with genetic sequences and patient histories can be a set pattern to detect cancers early and also to deliver medicine designed specifically for the patients.

The infectious diseases segment is expected to emerge as the fastest-growing application segment from 2023 to 2032. AI and related platforms such as the Internet of Things (IoT) are currently being deployed to understand infectious diseases, their transmission, and infection mechanism, and to improve vaccine design. These platforms use a network of connected devices like smartphones and other medical devices and data collected from these devices can be used for understanding lifestyle patterns and anomalies for studying diseases. In the wake of the current situation, it has become more necessary to develop methods for detecting infectious diseases and how to treat them.

A French start-up Clevy.io launched a chatbot, with information from the French government and the WHO, it was used to assess symptoms of users and direct them to better evaluation of risks, policies formed by the government for COVID, and various other questions related to the disease. This not only lessened the burden on the healthcare institutions but also paved the way to use AI more in terms of how the industry deals with infectious diseases. Many hospitals and institutions around Europe are coming together to use AI for a better diagnosis of COVID-19. They plan to design algorithms to read CT scans by feeding the substantial number of anonymous data from various sources and train the algorithm to detect signs of COVID where radiologists would not be able to identify early signs of the disease based on CT scans.

Application Insights

Based on application, the drug optimization and repurposing segment accounted for the largest revenue share of over 51.0% in 2022. Advanced AI systems such as Deep Learning (DL) and drug modeling can be used to study adverse drug effects and the efficacy of the drug on the whole. The advancements in AI technology have also made it easier for drugs to be studied and compared, for them to be repurposed into more effective forms so that the side effects are minimized and overall efficacy is improved. The pharmaceutical industry is adopting this approach to improve its existing drugs and also use them by altering them for different indications than previously used, which, in turn, reduces the cost of development.

The preclinical testing segment is another application of AI in drug development that is growing at the fastest pace. Manual selection of patients based on their history and suitability for the study can take a lot of time and using AI systems and related technologies can reduce the overall clinical timeline of the drug. Predictive machine learning algorithms can also assist in selecting lead molecules and patient populations based on genome-specific data. Amplion uses its AI platform to carefully choose biomarkers and helps its researchers to recruit appropriate patients and select the right biomarkers, thereby reducing the timeline of clinical studies.

Regional Insights

North America held the largest revenue share of over 56.0% in 2022. Since the beginning of AI, the U.S. has been the forerunner in this technology. IBM used its supercomputer ‘Watson’ to win a trivia game called ‘Jeopardy’, which led to the company improving on the idea of AI since then AI has become a major part of the tech industries and is frequently being deployed on multiple fronts such as the pharmaceutical sector. Major tech giants in the U.S. have all collaborated with prestigious institutes to fast forward drug discovery, designing, and repurposing. They are also using AI to study diseases to come to meaningful conclusions, which will improve disease management.

The APAC market is expected to expand at the fastest CAGR from 2022 to 2030. Developing countries in Asia Pacific are also adopting AI as a means to understand diseases and aid drug discovery. An AI company in India, Intuition Systems has collaborated with Lantern Pharma for drug discovery and biomarker identification. Niramai and Sigtuple are other such AI companies devoted to improving healthcare via faster drug discovery and better identification of target proteins and biomarkers.

Some of the prominent players in the Artificial Intelligence (AI) In Drug Discovery Market include:

- IBM Watson

- Exscientia

- GNS Healthcare

- Alphabet (DeepMind)

- Benevolent AI

- BioSymetrics

- Euretos

- Berg Health

- Atomwise

- Insitro

- Cyclica

Segments Covered in the Report

This report forecasts the volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor has segmented the Artificial Intelligence (AI) In Drug Discovery market.

By Application

- Drug Optimization and Repurposing

- Preclinical Testing

- Others

By Therapeutic Area

- Oncology

- Neurodegenerative Diseases

- Cardiovascular Diseases

- Metabolic Diseases

- Infectious Diseases

- Others

By Component

- Software

- Hardware

- Services

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa