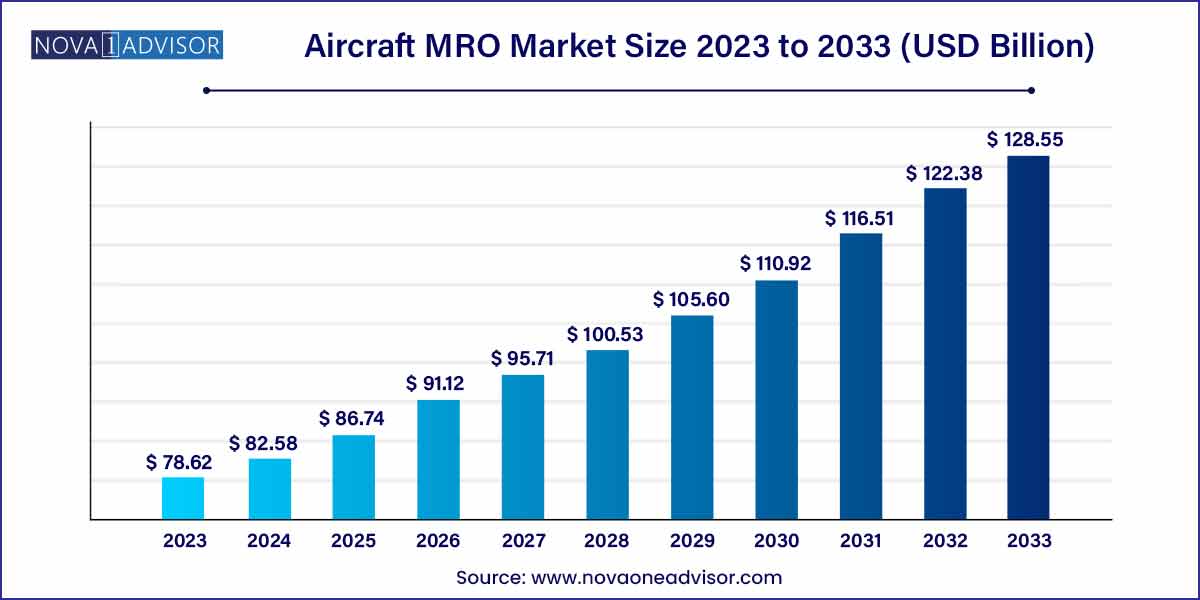

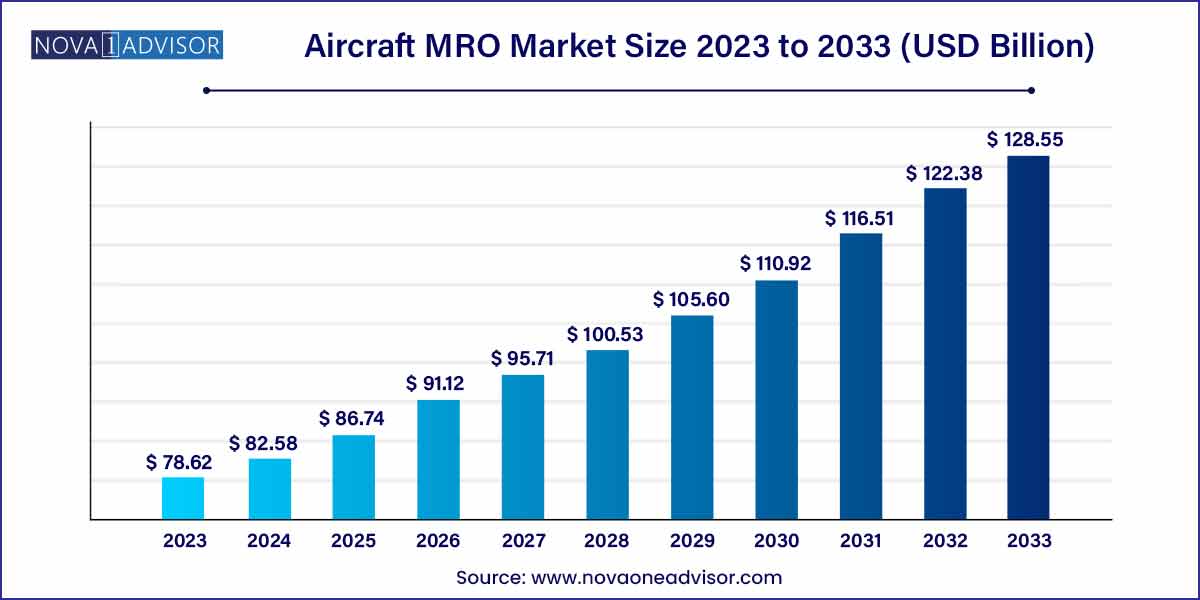

The global aircraft MRO market size was exhibited at USD 78.62 billion in 2023 and is projected to hit around USD 128.55 billion by 2033, growing at a CAGR of 5.04% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific held the largest market share of 35% in 2023

- The engine overhaul segment is expected to grow with a leading market share of above 41.0% in 2023.

- Independent MRO is expected to account for the largest share of the market in 2023 and is expected to reach USD 50.11 billion by 2033.

- The narrow-body aircraft in the commercial aircraft MRO market is anticipated to generate USD 58.77 billion in revenue in 2033.

Aircraft MRO Market: Overview

The global Aircraft Maintenance, Repair, and Overhaul (MRO) market is a critical pillar sustaining the aviation industry's operational reliability, safety standards, and regulatory compliance. MRO services encompass a broad range of activities designed to ensure the airworthiness of aircraft, including engine overhauls, airframe maintenance, line services, modifications, and component repairs. As commercial and defense aviation fleets expand, and with the industry recovering post-pandemic, the MRO sector has witnessed a strong resurgence.

Rapid growth in global air travel, fleet modernization initiatives, and the rising adoption of next-generation aircraft are major factors driving the demand for sophisticated MRO services. Simultaneously, airlines' increasing focus on cost efficiency and service reliability is reshaping MRO dynamics, pushing providers to adopt advanced digital technologies, predictive analytics, and new business models such as "power-by-the-hour" contracts.

Moreover, the influx of narrow-body aircraft, burgeoning low-cost carrier operations, and sustainability imperatives—including the push for fuel efficiency and emission reduction—have created new challenges and opportunities in the sector. In this evolving landscape, the aircraft MRO market is poised for robust growth, fueled by innovation, consolidation, and globalization.

Aircraft MRO Market Growth

The growth of the Aircraft MRO market is fueled by several key factors. Firstly, the continuous expansion of the global aviation fleet, driven by rising air travel demand, necessitates ongoing maintenance and repair services to ensure the airworthiness of aircraft. Additionally, advancements in aircraft technology, such as composite materials and sophisticated avionics systems, increase the complexity of maintenance tasks, spurring demand for specialized MRO expertise. Moreover, the implementation of stringent safety regulations and airworthiness standards mandates regular maintenance checks and component replacements, further driving the demand for MRO services. Furthermore, the increasing trend towards outsourcing MRO activities to third-party service providers offers cost-saving opportunities for airlines, contributing to market growth. Overall, these factors converge to create a favorable environment for the expansion of the aircraft MRO market.

Aircraft MRO Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 78.62 Billion |

| Market Size by 2033 |

USD 128.55 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.04% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service, Organization Type, Aircraft Type, Aircraft Generation, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

AAR Corp.; Airbus SE; Delta Airlines, Inc. (Delta TechOps); Hong Kong Aircraft Engineering Company Limited; KLM U.K. Engineering Limited; Lufthansa Technik; MTU Aero Engines AG; Raytheon Technologies Corporation (Previously United Technologies Corporation); Singapore Technologies Engineering Ltd; TAP Maintenance & Engineering (TAP Air Portugal). |

Aircraft MRO Market Dynamics

- Technological Advancements:

The dynamics of the Aircraft MRO market are significantly influenced by ongoing technological advancements in the aerospace industry. With the introduction of innovative materials, propulsion systems, and avionics technologies, aircraft have become more complex and sophisticated. As a result, MRO providers are required to continually upgrade their capabilities and expertise to effectively maintain and repair modern aircraft. Moreover, the emergence of digitalization, IoT, and predictive maintenance solutions has transformed traditional MRO practices, enabling proactive maintenance strategies and optimizing operational efficiency.

- Regulatory Compliance and Safety Standards:

Another crucial dynamic shaping the Aircraft MRO market is the stringent regulatory environment and safety standards governing the aviation industry. Regulatory bodies such as the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency) impose strict requirements on aircraft maintenance and airworthiness, mandating regular inspections, repairs, and component replacements. Compliance with these regulations is paramount for airlines and MRO providers to ensure the safety and reliability of aircraft operations. As regulations continue to evolve and become more stringent, MRO providers must adapt their practices and procedures to maintain compliance, thereby driving demand for their services.

Aircraft MRO Market Restraint

- Skilled Workforce Shortage:

One of the primary restraints faced by the Aircraft MRO market is the shortage of skilled aviation technicians and engineers. As the demand for MRO services continues to grow, the industry grapples with an insufficient pool of qualified personnel to perform maintenance, repair, and overhaul tasks. This shortage is exacerbated by factors such as an aging workforce, lack of specialized training programs, and competition from other industries.

- Cost and Financial Pressures:

Another significant restraint on the Aircraft MRO market is the cost and financial pressures faced by both airlines and MRO providers. Aircraft maintenance and repair activities entail substantial expenses, including labor costs, spare parts, equipment, and facility maintenance. Additionally, fluctuations in fuel prices, currency exchange rates, and economic conditions can impact airlines' budgets and spending on MRO services.

Aircraft MRO Market Opportunity

- Emerging Technologies and Innovation:

One of the significant opportunities in the Aircraft MRO market lies in the adoption of emerging technologies and innovative solutions. Digitalization, data analytics, IoT, and artificial intelligence are revolutionizing traditional MRO practices, enabling predictive maintenance, condition monitoring, and real-time diagnostics. By harnessing these technologies, MRO providers can enhance operational efficiency, reduce downtime, and optimize maintenance processes. Moreover, advancements in additive manufacturing (3D printing) offer the potential to produce customized aircraft components on-demand, streamlining supply chains and reducing lead times for repairs.

- Growing Focus on Sustainability:

Another compelling opportunity in the Aircraft MRO market is the growing focus on sustainability and environmental responsibility. With increasing awareness of climate change and carbon emissions, the aviation industry is under pressure to reduce its environmental footprint. MRO providers can capitalize on this trend by implementing sustainable practices and offering eco-friendly solutions for aircraft maintenance and repair. This may include the use of alternative fuels, adoption of energy-efficient technologies, recycling and repurposing of aircraft components, and implementing environmentally-friendly processes.

Aircraft MRO Market Challenges

- Rapid Technological Evolution:

One of the primary challenges facing the Aircraft MRO market is the rapid evolution of aircraft technology. Modern aircraft incorporate increasingly complex systems and components, including advanced avionics, composite materials, and digital systems. Keeping pace with these technological advancements requires MRO providers to continually update their skills, tools, and infrastructure. Moreover, the rapid introduction of new aircraft models and variants presents challenges in terms of obtaining technical documentation, training personnel, and developing specialized expertise.

- Stringent Regulatory Environment:

Another major challenge in the Aircraft MRO market is the complex and stringent regulatory environment governing aviation safety and airworthiness. Regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) impose strict requirements on aircraft maintenance, repair, and overhaul activities. Compliance with these regulations necessitates meticulous documentation, adherence to prescribed procedures, and rigorous quality control measures. Non-compliance can lead to severe consequences, including fines, grounding of aircraft, and damage to reputation.

Segments Insights:

Service Insights

Engine Overhaul dominated the service type segment of the aircraft MRO market. Engine maintenance, particularly overhauls and repairs, represents the largest and most expensive part of the MRO value chain. Modern engines like the CFM LEAP and Pratt & Whitney GTF involve intricate designs and cutting-edge materials, necessitating specialized overhauls to ensure performance and safety. Airlines, given the criticality of engine performance to operational efficiency and regulatory compliance, prioritize regular engine maintenance, making it a dominant revenue stream for MRO providers.

Meanwhile, Modification services are witnessing the fastest growth within this segment. Increasing aircraft upgrades, cabin refurbishments, passenger-to-freighter (P2F) conversions, and retrofitting for connectivity and inflight entertainment systems have driven modification demand. With the rise of e-commerce, P2F conversions, in particular, have seen a surge, with companies like ST Engineering and Israel Aerospace Industries (IAI) reporting robust order books. Airlines are also investing heavily in cabin reconfigurations to enhance passenger experience and optimize fleet utilization.

Organization Type Insights

Airline/Operator MRO dominated the organization type segment. Many full-service carriers maintain their own in-house MRO capabilities to manage fleet-specific requirements and maintain tighter operational control. Airlines such as Lufthansa Technik and Delta TechOps not only serve their fleets but also offer third-party MRO services, creating additional revenue streams. This vertical integration enables cost savings, fleet optimization, and service reliability.

Conversely, Independent MRO providers are growing fastest. Companies like AAR Corp, SR Technics, and HAECO have expanded aggressively, benefiting from airlines increasingly outsourcing maintenance to reduce costs and focus on core operations. Independent MROs often offer flexible pricing models, global networks, and tailored services, making them highly attractive, especially for low-cost carriers (LCCs) and smaller airlines.

Aircraft Insights

Narrow-body aircraft dominated the aircraft type segment. Narrow-body jets like the Boeing 737 series, Airbus A320 family, and their newer variants continue to be the workhorses of short- and medium-haul routes globally. The sheer number of narrow-body aircraft in service, combined with their higher flight frequencies and quicker turnaround times, translates to greater maintenance needs, ensuring the dominance of this segment in the MRO market.

At the same time, Regional Jets are experiencing the fastest growth. Operators are increasingly deploying regional jets to serve secondary cities, especially in emerging markets. Aircraft such as Embraer's E2 series and Mitsubishi's SpaceJet (under development) are creating fresh demand for specialized MRO services focused on smaller, fuel-efficient aircraft. The expansion of regional aviation routes across Asia-Pacific and Latin America is contributing significantly to this trend.

Aircraft Generation Insights

Mid-Generation aircraft dominated the aircraft generation segment. Aircraft like the Airbus A330, Boeing 777-300ER, and Boeing 737NG are mid-generation models forming the bulk of many airlines' active fleets. These aircraft are entering periods requiring heavy maintenance checks, engine overhauls, and upgrades to avionics and interiors. Consequently, mid-generation aircraft drive a substantial portion of current MRO demand.

However, New Generation aircraft are the fastest-growing segment. The proliferation of models such as the Boeing 787, Airbus A350, and A320neo has accelerated the need for specialized MRO capabilities aligned with newer materials and technologies. Although these aircraft initially require less frequent maintenance compared to older models, as fleet sizes grow and warranty periods lapse, demand for MRO services tailored to new-generation aircraft is expected to rise sharply.

Regional Insights

North America dominated the global aircraft MRO market. The region, led by the United States, benefits from the presence of a large commercial and military fleet, well-established airline networks, and numerous MRO facilities. Major hubs like Miami, Dallas, and Atlanta are centers for MRO activities. Leading MRO providers, including Delta TechOps, AAR Corp, and StandardAero, contribute to North America’s preeminence. Additionally, technological leadership and robust regulatory frameworks ensure high service standards.

Asia-Pacific is the fastest-growing region in the aircraft MRO market. Rapidly expanding aviation sectors in China, India, Vietnam, and Indonesia are driving massive fleet expansions. Additionally, the rise of low-cost carriers and regional connectivity schemes under initiatives like India’s UDAN have spurred air traffic growth. In response, MRO facilities are proliferating across the region, with significant investments in Singapore, Malaysia, and China. Government incentives, strategic location advantages, and burgeoning middle-class air travel demand make Asia-Pacific the most dynamic market for MRO growth.

Some of the prominent players in the aircraft MRO market include:

- AAR Corp.

- Airbus SE

- Delta Airlines, Inc. (Delta TechOps)

- Hong Kong Aircraft Engineering Company Limited

- KLM U.K. Engineering Limited

- Lufthansa Technik

- MTU Aero Engines AG

- Raytheon Technologies Corporation (Previously United Technologies Corporation)

- Singapore Technologies Engineering Ltd

- TAP Maintenance & Engineering (TAP Air Portugal)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global aircraft MRO market.

Service Type

- Engine Overhaul

- Airframe Maintenance

- Line Maintenance

- Modification

- Components

Organization Type

- Airline/Operator MRO

- Independent MRO

- Original Equipment Manufacturer (OEM) MRO

Aircraft Type

- Narrow-body

- Wide-body

- Regional Jet

- Others

Aircraft Generation

- Old Generation

- Mid Generation

- New Generation

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)