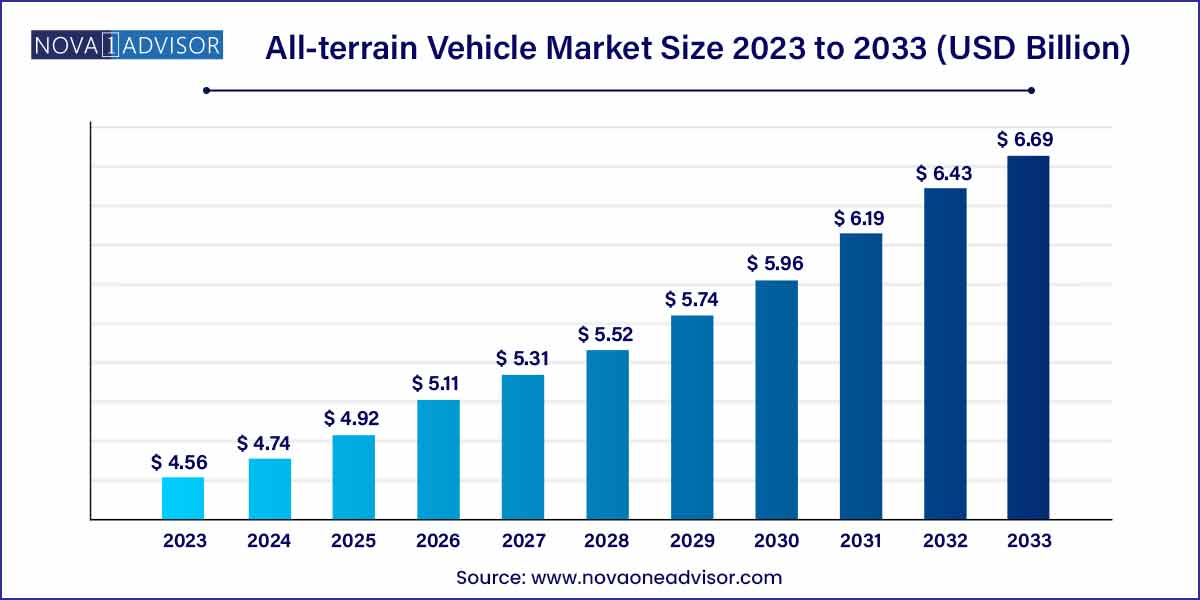

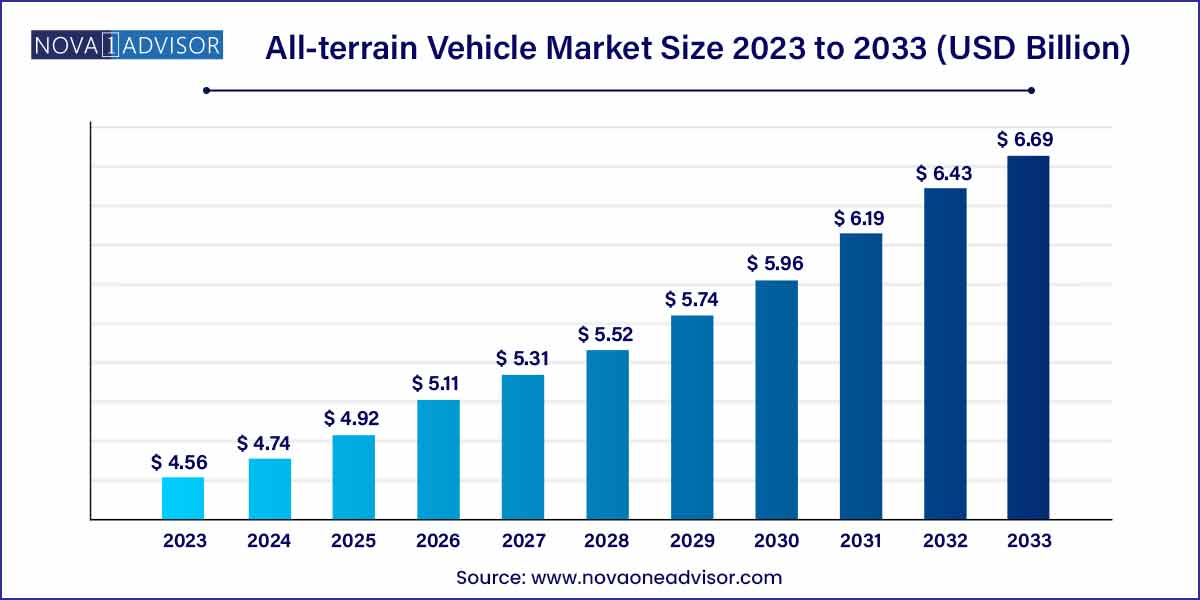

The global all-terrain vehicle market size was exhibited at USD 4.56 billion in 2023 and is projected to hit around USD 6.69 billion by 2033, growing at a CAGR of 3.9% during the forecast period of 2024 to 2033.

Key Takeaways:

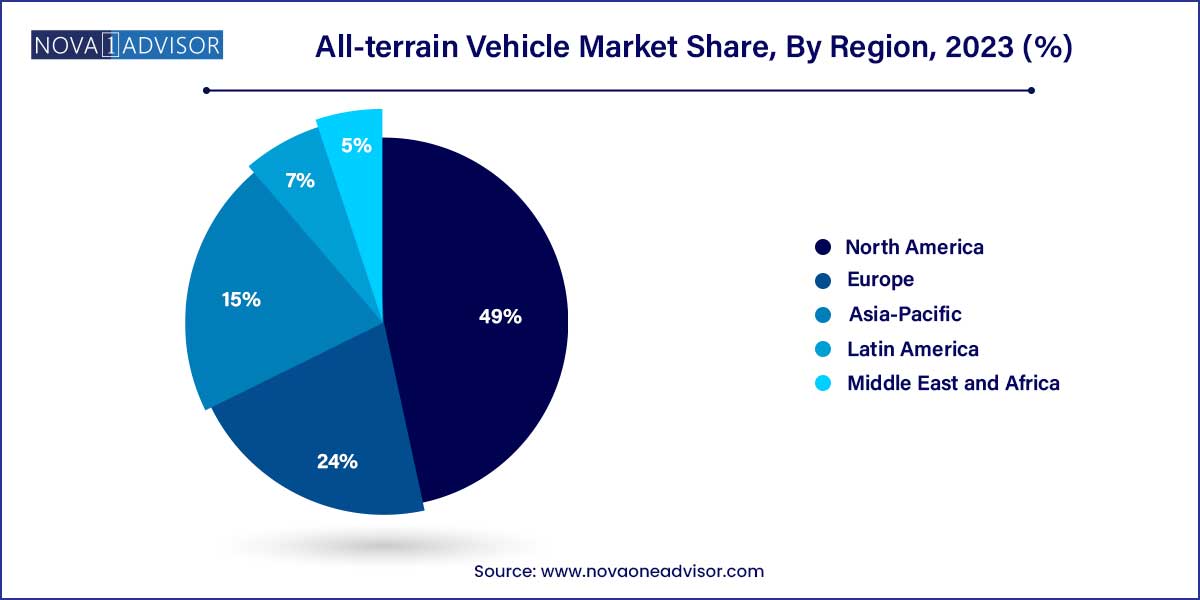

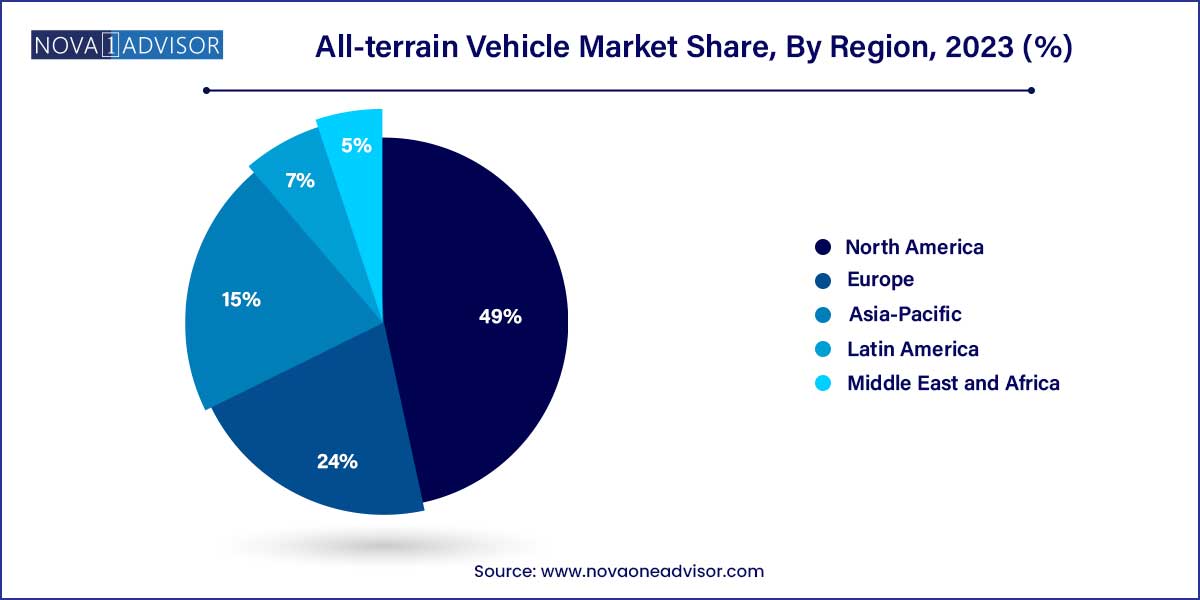

- North America dominated the market and accounted for the largest revenue share of 49.0% in 2023.

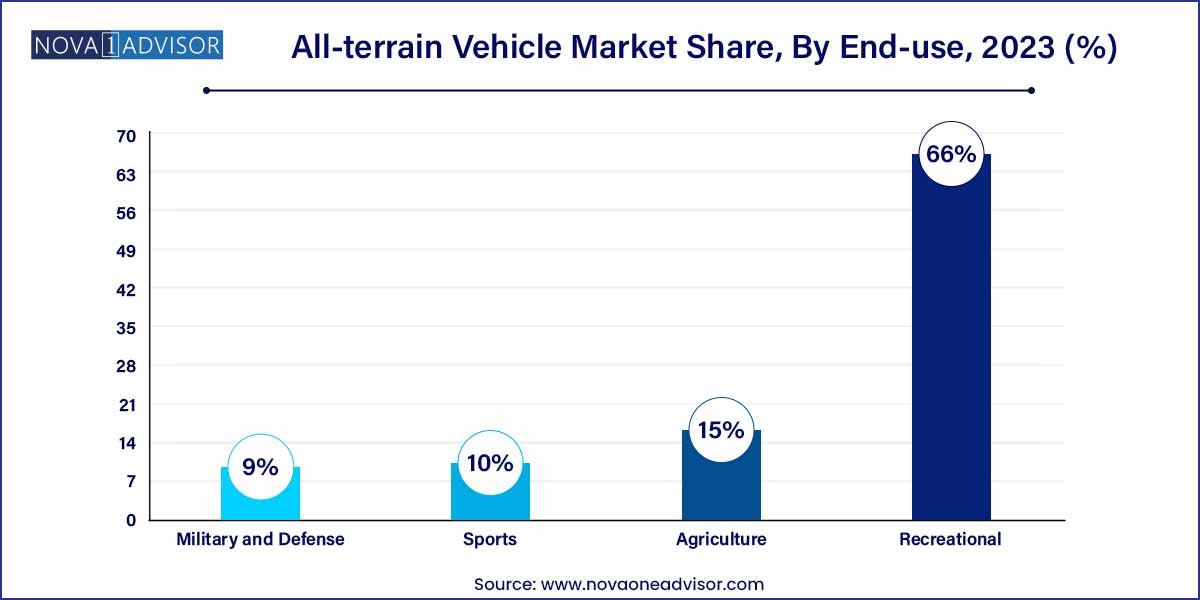

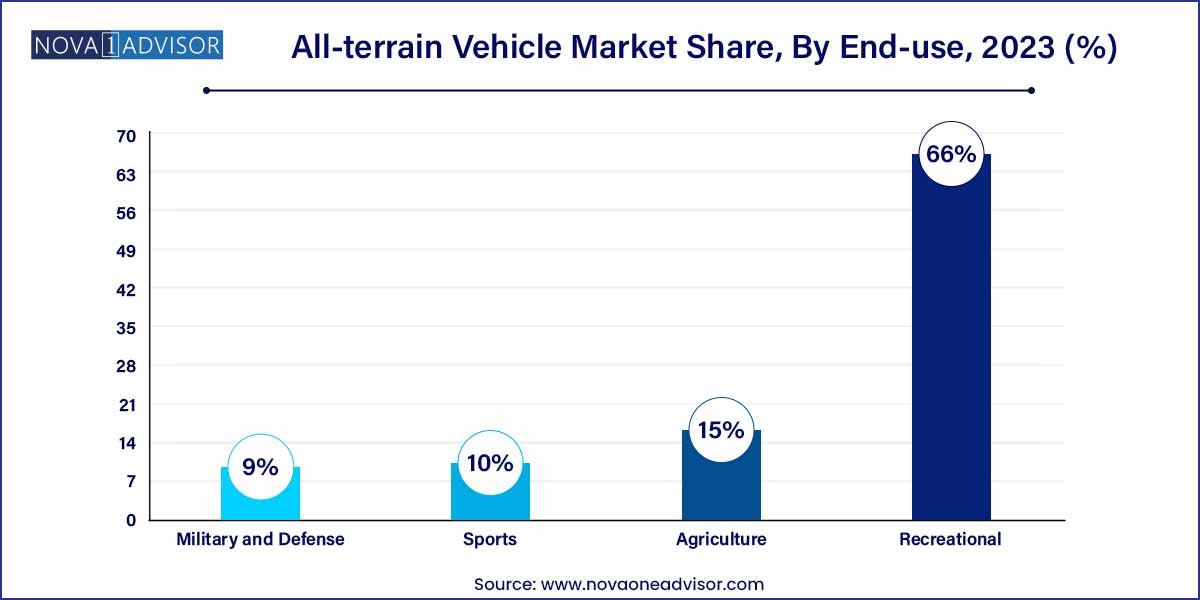

- The recreational segment held the largest revenue share of 66.0% in 2023.

All-terrain Vehicle Market: Overview

The All-Terrain Vehicle (ATV) market has witnessed a remarkable evolution, transforming from a niche off-road recreational segment into a versatile mobility solution across numerous industries. An ATV is defined as a motorized vehicle designed to traverse various terrain conditions, such as mud, sand, snow, and rocky trails. With a robust frame, wide tires, high ground clearance, and enhanced suspension, ATVs are built for durability, control, and maneuverability, especially in areas inaccessible to conventional vehicles.

Originally used for recreational and sports purposes, ATVs have now penetrated multiple sectors such as agriculture, military, forestry, search and rescue, and tourism. Their utility across diverse applications has driven steady demand, especially in regions with rugged geographies or poor road infrastructure. For example, in farming, ATVs are used for livestock herding, crop monitoring, and transporting supplies, while in military operations, they are deployed for rapid mobility in remote terrains.

The ATV industry has benefitted significantly from technological advancements. Today’s models are more powerful, fuel-efficient, and equipped with smart features such as GPS tracking, electronic fuel injection (EFI), and integrated communication systems. The growing consumer trend toward outdoor adventure and motorsports, especially in North America and Europe, is further boosting demand. Meanwhile, increasing applications in defense and agriculture in developing regions point toward new growth opportunities.

Governments are also beginning to support ATV usage, particularly for agricultural modernization and emergency response initiatives. However, regulatory concerns related to safety and emissions, along with environmental challenges, continue to shape industry dynamics. As manufacturers strive to innovate and diversify their product lines, the global ATV market stands at the intersection of utility, entertainment, and technological transformation.

Major Trends in the Market

-

Electrification of ATVs

Manufacturers are introducing electric ATVs to cater to eco-conscious consumers and comply with emission regulations, especially in Europe and California.

-

Multi-Utility Adaptability

ATVs are increasingly being designed with modular attachments to serve farming, snow plowing, fire suppression, and rescue missions.

-

Growth of Recreational ATV Tourism

Adventure tourism and off-road parks are gaining popularity in North America, Australia, and parts of Southeast Asia, supporting ATV rental services.

-

Integration of Smart Technology

GPS navigation, ride tracking, Bluetooth communication, and digital dashboards are enhancing rider experience and safety.

-

Military Investment in Tactical ATVs

Lightweight, high-mobility ATVs are being adopted by defense forces for border patrol, scouting missions, and rapid deployment in rugged terrains.

-

Surge in Youth and Entry-Level Models

To appeal to new users, companies are launching beginner-friendly models with lower engine displacement and built-in safety features.

All-terrain Vehicle Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.56 Billion |

| Market Size by 2033 |

USD 6.69 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Engine Type, Application, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

American Honda Motor Co., Inc; ArcticInsider.com; BRP; CFMOTO;Kawasaki Motors Corp., U.S.A.; KYMCO; LINHAI POWERSPORTS USA CORPORATION; Polaris Inc.; Suzuki Motor of America, Inc.; Yamaha Motor Corporation, USA. |

All-terrain Vehicle Market Dynamics

- Rising Demand for Outdoor Recreation:

The dynamics of the all-terrain vehicle (ATV) market are strongly influenced by the increasing demand for outdoor recreational activities. The surge in popularity of off-roading, trail riding, and adventure sports has propelled the need for versatile and high-performance ATVs. Consumers are actively seeking vehicles that can navigate diverse terrains, providing a thrilling and safe experience during their outdoor adventures.

- Technological Advancements:

A key driving force behind the dynamic landscape of the all-terrain vehicle market is the continuous stream of technological advancements. Manufacturers are investing significantly in research and development to enhance the overall performance and features of ATVs. Innovations such as improved suspension systems, electronic fuel injection, and cutting-edge design elements contribute to the vehicles' capability to tackle challenging terrains.

All-terrain Vehicle Market Restraint

The all-terrain vehicle (ATV) market faces significant restraint in the form of regulatory challenges. Compliance with safety standards, emissions regulations, and land usage restrictions poses a complex landscape for manufacturers. Adhering to stringent regulations is imperative for ensuring the marketability and safety of ATV products. Navigating through diverse regulatory frameworks demands substantial investments in research and development to meet evolving compliance standards.

An emerging restraint in the all-terrain vehicle market pertains to growing environmental concerns. With an increasing global emphasis on sustainability, there is heightened scrutiny regarding the environmental impact of ATV usage. The traditional internal combustion engines in many ATVs contribute to carbon emissions and environmental degradation. As a response, manufacturers are exploring eco-friendly alternatives, such as electric and hybrid models, to mitigate the ecological footprint of these vehicles. However, transitioning to sustainable solutions involves intricate challenges, including technological advancements, infrastructure development, and consumer acceptance.

All-terrain Vehicle Market Opportunity

- Expansion of Recreational Tourism:

An opportune avenue within the all-terrain vehicle (ATV) market lies in the expansion of recreational tourism. As the global tourism industry grows, there is a parallel increase in the demand for outdoor recreational activities, contributing to the rising popularity of ATV adventures. Tourist destinations with diverse terrains are leveraging the appeal of ATV experiences, offering guided tours and rental services.

- Evolving Electric and Hybrid Technologies:

The evolution of electric and hybrid technologies represents a significant opportunity for the all-terrain vehicle market. With a heightened focus on sustainability and environmental consciousness, there is a growing demand for eco-friendly alternatives in recreational and utility vehicles. Manufacturers exploring electric and hybrid ATV models have the potential to meet this demand, offering consumers an environmentally responsible option without compromising performance.

All-terrain Vehicle Market Challenges

- Terrain-Specific Challenges:

The all-terrain vehicle (ATV) market grapples with challenges inherent to the diverse terrains these vehicles are designed to navigate. The rugged landscapes, including mud, snow, sand, and rough trails, pose engineering challenges for manufacturers. Designing ATVs capable of optimal performance across varied terrains requires constant innovation in suspension systems, tire technology, and overall vehicle durability. Additionally, ensuring user safety and preventing accidents in challenging terrain remains a persistent challenge.

- Consumer Safety and Regulatory Compliance:

The all-terrain vehicle market faces ongoing challenges related to ensuring consumer safety and regulatory compliance. ATV accidents, often linked to improper usage or lack of adherence to safety guidelines, raise concerns among consumers and regulatory bodies. Stricter safety standards and regulations necessitate continuous improvements in ATV design, including enhanced safety features and clear user guidelines.

Segments Insights:

By Engine Type

The 400–800cc engine segment dominated the ATV market, owing to its balance between power, fuel efficiency, and versatility across multiple applications. ATVs in this engine range are ideal for both recreational and utility tasks, including trail riding, hunting, light farming, and snow removal. Models such as the Yamaha Grizzly 700 and Polaris Sportsman 570 are widely popular in North America and Europe for offering reliable performance and comfort at mid-range price points.

The above 800cc segment is the fastest growing, primarily driven by professional sports, heavy-duty military use, and extreme recreational activities. High-performance ATVs like the Can-Am Renegade 1000 or Arctic Cat Alterra 900 cater to enthusiasts who demand maximum torque, speed, and suspension capabilities. In defense and rescue missions, these powerful machines are used for climbing steep slopes, hauling heavy equipment, and rapid traversal in tactical zones. As consumer appetite for adventure grows, so too does demand for these top-end, feature-rich ATVs.

Application Insights

Recreational use currently dominates the ATV application segment, fueled by the rising popularity of off-road adventure sports, motorsports competitions, and leisure tourism. In the U.S. and Canada, recreational trail networks and off-road parks are expanding, offering guided ATV tours and competitive racing events. The growth of rural tourism and outdoor hobbies, especially post-COVID-19, has accelerated interest in ATV ownership among younger demographics.

The military and defense segment is growing at the fastest rate, as armed forces seek lightweight, maneuverable, and rugged vehicles for tactical mobility. Militarized ATVs are being deployed for patrol missions, rapid response in mountainous regions, casualty evacuation, and logistical support. Recent procurement by the U.S. Army and NATO forces reflects this trend, with suppliers like Polaris Government & Defense developing ATVs with low heat signatures, enhanced suspension, and encrypted communication systems.

Regional Insights

North America is the leading region in the global ATV market, accounting for a substantial share in terms of production, sales, and innovation. The U.S. and Canada are both home to a mature off-roading culture, vast natural landscapes, and numerous trail networks that support recreational ATV activities. Moreover, agricultural and hunting communities across states like Texas, Montana, Alberta, and Saskatchewan rely on ATVs for daily operations.

Major manufacturers such as Polaris Industries, Arctic Cat, and BRP (Bombardier Recreational Products) are headquartered in this region, and their strong dealership and service networks have cemented customer loyalty. The legal environment is also conducive to ATV usage, with designated off-road trails and seasonal permits widely available. With a strong aftermarket ecosystem and high disposable income, North America continues to set the benchmark for ATV innovation and consumption.

Asia-Pacific is witnessing the fastest growth, driven by rapid urbanization, expanding rural economies, and rising demand in agriculture, forestry, and adventure tourism. Countries like India, China, Australia, and Thailand are seeing increased adoption of ATVs in farms, mines, and public safety operations. In Australia, for example, ATVs are a staple on cattle stations and outback properties due to their durability in harsh terrains.

Manufacturers are also focusing on cost-effective models suited for regional needs, such as low-maintenance engines and multi-utility attachments. Furthermore, rising disposable income and the popularity of motorsport events in Southeast Asia are drawing interest from younger consumers. Government support for modern farming equipment in countries like India and Vietnam further supports ATV adoption. As infrastructural development continues across remote areas, Asia-Pacific is expected to be a key growth frontier for both local and global ATV manufacturers.

Recent Developments

-

January 2025 – Polaris Inc. launched its new Ranger XP Kinetic, an all-electric ATV offering 110 HP and a range of up to 80 miles, targeting both recreational and utility users.

-

November 2024 – Yamaha Motor Corporation introduced its Yamaha Grizzly 450 Utility Edition in Australia, featuring upgraded towing capacity and precision steering for agricultural use.

-

September 2024 – BRP (Can-Am) announced plans to electrify its entire off-road lineup by 2026, starting with the launch of the Can-Am Origin e-ATV in Canada and Europe.

-

July 2024 – CF Moto (China) signed a joint venture with a Southeast Asian partner to manufacture entry-level ATVs locally for regional export, boosting accessibility in cost-sensitive markets.

-

May 2024 – Kawasaki Motors debuted its Teryx4 Military Tactical Edition with improved off-road traction, armor reinforcement, and satellite communication integration.

Some of the prominent players in the All-terrain Vehicle Market include:

- Polaris Inc.

- American Honda Motor Co., Inc.

- BRP

- Yamaha Motor Corporation, USA.

- ArcticInsider.com

- CFMOTO

- Kawasaki Motors Corp., U.S.A.

- KYMCO

- LINHAI POWERSPORTS USA CORPORATION

- Suzuki Motor of America, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global all-terrain vehicle market.

Engine Type

- Below 400cc

- 400 - 800cc

- Above 800cc

Application

- Agriculture

- Sports

- Recreational

- Military and Defense

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)