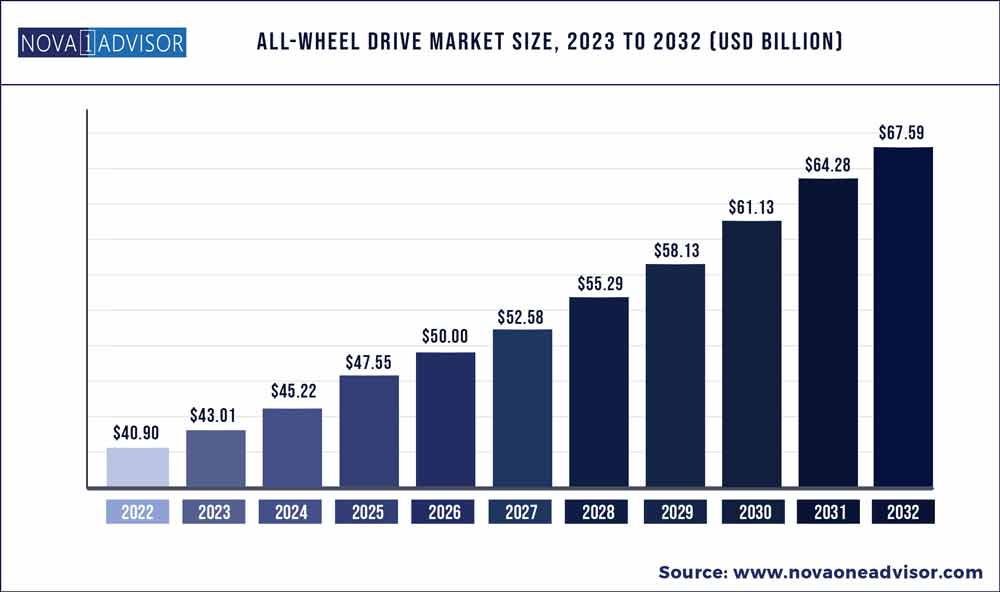

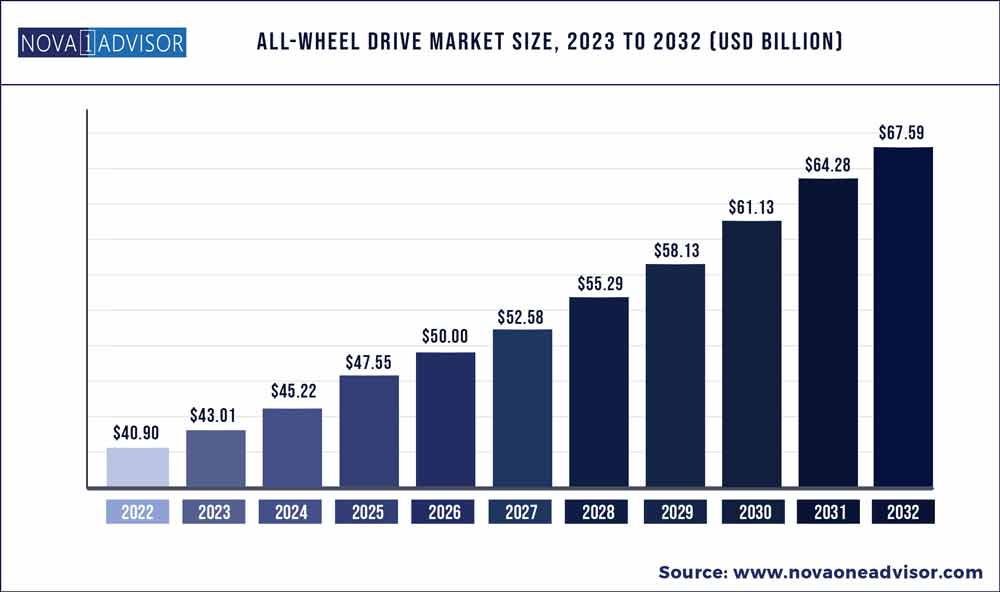

The global all-wheel drive market size was exhibited at USD 40.9 billion in 2022 and is projected to hit around USD 67.59 billion by 2032, growing at a CAGR of 5.15% during the forecast period 2023 to 2032.

Key Pointers:

- On the basis of the type, the manual all-wheel drive segment is expected to have a larger market share in the coming years period.

- On the basis of propulsion, the conventional vehicles which are powered with the help of internal combustion engine will have the largest market share in the coming years period.

- On the basis of application, the on-road segment is expected to have the largest market share in the coming years.

- Passenger vehicle segment will dominate the market in the coming years.

- North American region will have the largest market share in the coming years period.

Growing demand for SUVs, premium cars and, improved vehicle safety, stability, & enhanced driving dynamics are driving the demand for all wheel drive systems around the globe. The emission regulations and high fuel consumption are major challenges for all wheel drive system manufacturers.

All-Wheel Drive Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 43.01Billion

|

|

Market Size by 2032

|

USD 67.59 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 5.15%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Type, Propulsion, Application, Vehicle Type, EV Type, Component

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

ZF Friedrichshafen AG (Germany), Magna International Inc. (Canada), BorgWarner Inc. (U.S.), Continental AG (Germany), JTEKT Corporation (Japan)

|

Market Dynamics

DRIVER: Increasing demand for improved vehicle safety, stability, & enhanced driving dynamics

According to the WHO Global Status Report on Road Safety, more than 1.24 million deaths occurred due to road accidents in 2010 globally. The increasing rate of accidents has incentivized countries to implement stringent vehicle safety norms. The European Union and the U.S. government are leaders, in terms of vehicle safety norms. As a result, OEMs are introducing vehicles with in-built safety features that control vehicle stability, safety, and provide enhanced driving dynamics. The all wheel drive(AWD) systems as compared to RWD or FWD systems add to the vehicle stability with better traction providing the capability to the automobile. Thus, in the developed regions such as Europe and North America, the demand for these multi-wheel drive systems is on the rise, however, in the emerging markets such as Asia-Pacific and the rest of the world, this growth is steady given the lack of any such safety regulations.

RESTRAINT: High cost of the all wheel drive system compared to 4WD and 2WD

The all wheel drive system is more expensive than the conventional two-wheel (FWD or RWD drive systems) drive vehicles. The cost of the AWD and 4x4 systems can range from $1,000 to $4,000, which depends on the type of the systems and components involved. Thus, this poses a restraint over the market of the system, as it increases the overall cost of the vehicle. Even though the vehicles with AWD or 4WD systems offer better resale values, the initial cost of the vehicle is high. In addition to the high initial cost of the system, the AWD system is also expensive in terms of maintenance, since all the four tyres need to be changed together at once. Moreover, vehicles installed with the AWD or 4WD system do not offer great performance with normal or summer tires. These systems require all-season tires, which are costlier than the conventional tires meant for in-city driving. The use of differential in the multi-wheel drive system results in the extra cost of differential oil that is required for maintenance. The differential oil is not changed as frequently as engine oil; however, it still adds a cost of $30–$50 to the buyer’s pocket. Considering these factors, the associated cost of the vehicle with the AWD or 4WD systems is much higher than that of the conventional two-wheel (front or rear-wheel drive) drive vehicles. This can act as a restraint on the growth of all wheel drive systems.

OPPORTUNITY:Automatic AWD system

The automatic AWD system acts as a combination of all present systems such as 2WD and manual AWD. Functions of the present-day AWD-Disconnect system include detection of the need for AWD, detection of steering angle for the distribution of torque in a required ratio for turning wheels, using the electronic power steering for better angle detection, proper distribution of torque between the front and rear wheels separately, and so on. The system developed by Honda Motor Company can provide better performance and can respond to driver input and improves vehicle stability. It also combines front-rear torque distribution control with independently regulated torque distribution to the left and right rear wheels. This leads to the free distribution of the optimum amount of torque to all four wheels based on driving conditions. The key challenge in the development of such systems would be their compatibility with the hybrid or plug-in hybrid vehicles. Additionally, the cost of the new automatic AWD and its influence on the fuel efficiency of the vehicle would be the deciding factor in the demand for such systems.

CHALLENGE: Lack of awareness among consumers about the multi-wheel drive systems in developing nations

In the developed regions such as Europe and North America, due to bad weather conditions such as snowfall and heavy rains, the terrains become slippery and unfavourable for safe driving. This favours the incorporation of the AWD or 4WD system in the vehicle. However, in the Asia Pacific region, consumers are less aware of the advantages of this system, due to low exposure to such extreme weather conditions. Consumers own vehicles equipped with AWD systems or 4x4 systems but do not use them to their complete potential, given the lack of knowledge about the benefits offered by such systems. North America and Europe’s automobile markets are mature and people are aware of the latest trends whereas, in the Asia Pacific, the automobile market is still developing.

Supply Chain Analysis

The passenger car segment would lead the all wheel drive market during the forecast period, by vehicle type

Due to higher cost AWD systems were only popular with high-end (premium) passenger cars and SUVs. However, advancements in technology and increasing demand for a safe drive system for all climatic and road conditions have incentivized manufacturers to introduce the AWD drive system, which is cost-effective and can be available across all vehicle segments. Given this ‘buyer-driven demand’, OEMs have started introducing passenger cars and compact utility vehicles incorporated with automatic or manual AWD systems globally, without much addition to the overall cost of the vehicle. Looking at the advantages, these systems are also being introduced in the light commercial and heavy commercial vehicles. Growing demand for these systems has been observed in western countries as well as in the developing countries of Asia Pacific.

The automatic AWD segment would witness significantly faster growth than manual AWD during the forecast period

Manual and automatic AWD systems offer better traction, stability, torque, steering, and even distribution of weight. Safety standards, extreme weather conditions, and consumer preference for safety features are the key reasons for the growth of the AWD systems market in Europe and North America. The flaws associated with manual AWD systems such as high fuel consumption issues and high maintenance have been resolved to a certain extent by the introduction of intelligent AWD or disconnect and decoupling AWD systems. Thus, the market share of automatic AWD systems is set to surpass that of manual AWD systems. The RoW region comprises many developing economies such as Brazil and South Africa, with increasing purchasing power, customer preference for safety features, and road conditions being the factors driving the demand for automatic AWD systems.

Differentials would lead the all wheel drive components market

Automatic all wheel drive vehicles use a differential to maximize traction when needed. As the wheels begin to slip, more power is automatically directed to the wheels where there is no slippage. The driver in no way can switch from an all wheel drive mode into any other drive mode. However, the fuel efficiency provided by this system is comparatively lesser than that of 4WD, FWD or RWD systems. Thus, to overcome this problem, there is a disconnecting AWD system, which activates or deactivates the AWD system. The differential undergoes constant wear and tear due to its operations that cause overheating. There have been recent developments in the design that allows superior performance even in high-performance settings. For example, Torque Vectoring Differential (TVD) is an advanced electronic differential that regulates the torque distribution to the individual wheel, reducing the power loss and overheating.

BEV segment would hold the largest all wheel drive market share during the forecast period

Factors such as an increase in passenger safety regulations, straightforward design of EV AWD systems, and the need for higher performance are driving demand for AWD systems in BEVs. Moreover, BEVs are equipped with sophisticated computer systems and sensors, which reduce the cost incurred on auxiliary electronics systems. In an electric car, batteries are the most expensive component, and adding a second motor up front to deliver All Wheel drive is likely to make All Wheel-drive BEVs more affordable. Developments in AWD technologies would drive the market. For instance, in April 2022, Toyota launched the all-electric Toyota bZ4X SUV with AWD capability and X-MODE system. Another impressive feature of the AWD system is Grip-Control, a low-speed system that leverages motor drive power modulation to achieve capable off-road performance during turns.

Increasing demand for better performance and fuel efficiency is contributing would lead to higher growth rate of growth of eLSD differential

eLSD (Electric Limited Slip Differential) provides better handling in off-roading activities. Factors such as better fuel efficiency, lower probability of failure, and improved traction while cornering than LSD has resulted in higher growth in the adoption of electronic limited-slip differential.

Various OEMs are focusing on developing advanced electronic limited-slip differential for better efficiency and performance. For instance, in 2022, Eaton introduced InfiniTrac, an electronically controlled, hydraulically actuated, variable-bias limited-slip differential that delivers optimized vehicle performance at any speed and traction condition. This enhances vehicle stability control by redirecting power to the wheels with traction.

Asia Pacific is projected to be the largest market by 2030

The Asia Pacific region is one of the largest production and manufacturing hubs in the world. India and China have emerged as manufacturing hubs in the region, and their revenue from the automobile sector accounted for 7.8% and 2.9%, respectively, in 2022. The road networks of China and India are among the largest in the world. In 2019, according to the Road Chronicle, China and India were constructing roads at a rate of 47 km and 29 km per day, respectively. SUVs(Sports Utility Vehicles0 are the most popular vehicle in China and India, whereas sedans and MUVs(Multi Utility Vehicles) are popular in Japan and South Korea. Due to the increased demand for such AWD vehicles, the requirement for AWD systems is increasing.

Some of the prominent players in the All-Wheel Drive Market include:

- ZF Friedrichshafen AG (Germany)

- Magna International Inc. (Canada)

- BorgWarner Inc. (U.S.)

- Continental AG (Germany)

- JTEKT Corporation (Japan)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global All-Wheel Drive market.

By Type

By Propulsion

By Application

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By EV Type

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

By Component

- Differential

- Transfer case

- Propeller shaft

- Power Transfer Unit

- Final Drive Unit

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)