Allergy Diagnostics Market Size and Trends

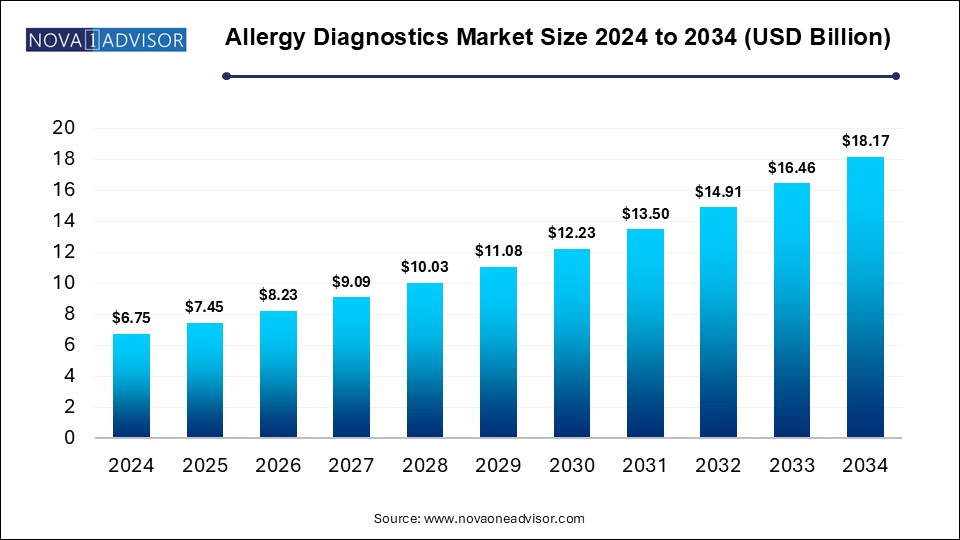

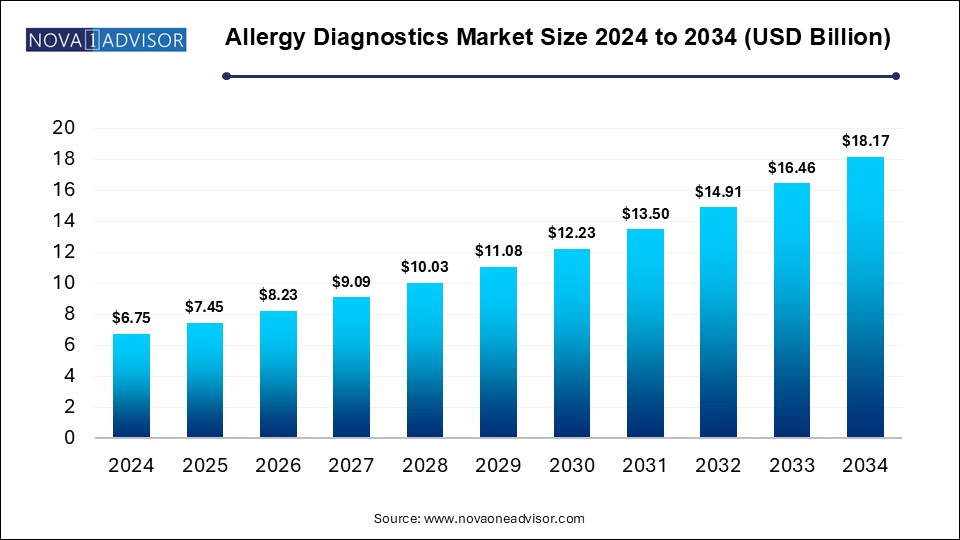

The Allergy Diagnostics Market size was exhibited at USD 6.75 billion in 2024 and is projected to hit around USD 18.17 billion by 2034, growing at a CAGR of 10.41% during the forecast period 2025 to 2034.

Key Takeaways:

- In 2024, consumables emerged as the top revenue-generating segment in the allergy diagnostics market, contributing 63.14% to the overall market share.

- Inhaled allergens represented the leading allergen type segment in 2024, generating the highest portion of market revenue.

- The in vitro testing category led the allergy diagnostics market in 2024, securing the largest share among test types.

- Hospitals and clinics dominated the end-use segment of the allergy diagnostics market in 2024, accounting for the highest revenue contribution.

- North America maintained its position as the largest regional market for allergy diagnostics in 2024, capturing a 37% share of global revenue.

Market Overview

The Allergy Diagnostics Market is gaining significant momentum globally, driven by the rising prevalence of allergic disorders, improved awareness about allergy-related conditions, and growing adoption of precise diagnostic tools in both developed and developing regions. Allergies ranging from food and drug sensitivities to airborne allergens like pollen, dust mites, and pet dander affect millions of individuals globally and can significantly impair quality of life. Early and accurate diagnosis is essential for effective allergy management, especially as comorbidities such as asthma and eczema become more widespread.

This market encompasses a diverse range of diagnostic instruments, consumables, services, and testing technologies, addressing the growing demand for both in vivo and in vitro diagnostic methods. Technological advancements, such as high-throughput screening platforms and automated allergy analyzers, have made diagnostics more efficient, reproducible, and accessible in clinical settings. Furthermore, personalized medicine and tailored immunotherapy strategies are contributing to the demand for high-resolution allergen profiling.

Global health authorities and private healthcare systems are acknowledging the economic burden of untreated or misdiagnosed allergies, encouraging early testing and preventive care. With more investments pouring into research institutions, diagnostic labs, and allergy-focused biotech firms, the allergy diagnostics market is poised for sustained expansion in the coming decade.

Major Trends in the Market

-

Surge in Food Allergies Among Children and Young Adults: Increasing dietary sensitivities are driving demand for food-specific allergen testing panels.

-

Integration of AI in Diagnostics: AI-powered software is enhancing interpretation of skin test results and lab-based assays.

-

Rising Use of Multiplex Assay Systems: Labs are adopting multiplex systems to simultaneously detect multiple allergens, improving efficiency and diagnostic accuracy.

-

Home-based Allergy Testing Kits: DTC (direct-to-consumer) allergy test kits are gaining traction for preliminary assessments.

-

Expansion of Allergen Panels: Diagnostic companies are introducing extensive panels for regional and rare allergens.

-

Greater Demand for Drug Allergy Testing: With increasing polypharmacy, adverse drug reactions are being evaluated more frequently using standardized protocols.

-

Shift Toward Preventive Healthcare: Allergy testing is being incorporated into wellness checkups and preventive health programs.

-

Public Awareness Campaigns: Governments and healthcare organizations are promoting allergy testing, particularly in schools and urban populations.

Report Scope of Allergy Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 7.45 Billion |

| Market Size by 2034 |

USD 18.17 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.41% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Products and Services, Allergen, Test Type, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; HYCOR Biomedical; EUROIMMUN Medizinische Labordiagnostika AG (PerkinElmer, Inc.); Omega Diagnostics Group PLC; Lincoln Diagnostics, Inc.; AESKU.GROUP GmbH; Minaris Medical America, Inc.; HOB Biotech Group Corp., Ltd.; DASIT Group SPA; R-Biopharm AG; bioMérieux; Siemens Healthcare GmbH |

Market Driver: Increasing Global Burden of Allergic Diseases

The growing global prevalence of allergic conditions including food allergies, allergic rhinitis, asthma, and drug-induced hypersensitivity has become one of the leading drivers of the allergy diagnostics market. According to the World Allergy Organization (WAO), allergic diseases affect over 30-40% of the global population, and this figure is steadily rising due to factors like urbanization, pollution, and dietary changes.

For instance, in the United States alone, approximately 50 million people experience allergies annually. Similarly, countries like India and China are witnessing a rapid increase in allergen sensitization, especially among children. This rising burden is prompting individuals and healthcare professionals to opt for timely diagnostic tests to identify triggers and enable targeted treatment. As medical institutions expand their allergy diagnostic capabilities and insurance reimbursement policies evolve to include these tests, the market is experiencing a sustained growth trajectory.

Market Restraint: High Cost of Specialized Testing Equipment and Services

Despite increasing demand, the cost-intensive nature of allergy diagnostics equipment and services remains a significant challenge for market expansion, especially in low- and middle-income countries. Advanced diagnostic platforms such as ImmunoCAP or multiplex immunoassays can cost thousands of dollars per unit, and the per-test cost remains high for the average patient without insurance coverage.

Additionally, comprehensive allergen panels are expensive and not always deemed essential in primary healthcare settings. The lack of trained professionals and infrastructure in developing countries further hinders the penetration of these diagnostics. As a result, allergy testing is often limited to major urban centers, leaving rural populations underserved. This pricing and accessibility disparity restricts market scalability and equitable healthcare delivery.

Market Opportunity: Integration with Telehealth and At-Home Testing

An exciting growth opportunity lies in integrating allergy diagnostics with telehealth platforms and at-home testing solutions. During and after the COVID-19 pandemic, there has been a substantial shift toward decentralized healthcare. This trend has encouraged diagnostic companies to innovate consumer-friendly, non-invasive allergy testing kits that can be self-administered and reviewed remotely by clinicians.

Companies such as Everlywell and myLAB Box are developing at-home collection kits for preliminary allergy panels, which are then confirmed in centralized labs. Paired with teleconsultations, these tools are enabling early diagnosis even in areas with limited healthcare infrastructure. Moreover, such services are particularly beneficial for pediatric patients and individuals with mobility challenges. This growing synergy between home diagnostics and virtual care is expected to expand access, especially among tech-savvy and underserved populations.

Segmental Analysis

By Products and Services

The consumables segment dominated the allergy diagnostics market, holding the largest share due to the high volume of reagents, allergens, and assay kits used in daily laboratory operations. Reusable and single-use test kits are constantly in demand, as most allergy tests involve consumable-based procedures such as ELISA and skin prick tests. Frequent replenishment and the rise in diagnostic procedures across hospitals and labs drive this segment forward. Major players are focusing on innovating standardized, high-sensitivity allergen extracts that minimize cross-reactivity and deliver reliable results.

Meanwhile, the services segment is poised to grow at the fastest rate, thanks to the rising number of diagnostics laboratories offering comprehensive allergy screening and immunotherapy assessments. Outsourced lab testing services, particularly in developing regions, are on the rise as hospitals and clinics without in-house allergy labs rely on external partners. Moreover, DTC models are creating demand for convenient service delivery that includes sample collection, test processing, and follow-up consultations.

By Allergen Type

Inhaled allergens held the largest market share, driven by the widespread occurrence of allergic rhinitis and asthma linked to environmental triggers like dust mites, mold, pollen, and pet dander. These allergens are often chronic and seasonal, necessitating regular testing to track patient response to therapy or changing exposure levels. Regions with high urban pollution and industrial emissions show particularly high test volumes in this segment.

In contrast, food allergens are projected to grow at the highest rate, fueled by increasing awareness and diagnoses of food intolerances, especially among children. Allergens such as peanuts, shellfish, and dairy products are now commonly screened in both clinical and home settings. The global rise in anaphylaxis cases and the implementation of school-based allergy action plans are further pushing demand for food allergen diagnostics. Innovations in multiplex testing now allow for simultaneous detection of multiple food allergens with a single test, enhancing both speed and accuracy.

By Test Type

In vitro tests accounted for the dominant share of the market, mainly due to their reliability, quantitative results, and low risk of adverse reactions. Blood-based assays like specific IgE and component-resolved diagnostics (CRD) are increasingly used in hospital settings and large diagnostic labs. They are especially suitable for patients with skin conditions, those on antihistamines, or individuals at high risk of anaphylaxis.

However, in vivo tests such as skin prick and intradermal tests are experiencing notable growth, particularly in outpatient clinics. These tests are cost-effective, provide immediate visual results, and remain a mainstay in allergy practices. Skin prick tests are especially popular in pediatric and dermatology settings due to their speed and relatively non-invasive nature. New allergen standardizations and safety protocols have further boosted their credibility.

By End Use

Hospitals and clinics dominated the end-use segment, largely due to their integrated diagnostic and treatment capabilities. Allergy testing in hospital settings is often conducted in conjunction with immunotherapy, asthma management, or dermatological services. Additionally, hospitals tend to invest in more advanced, high-throughput diagnostic systems and employ allergists or immunologists who can interpret results with precision.

However, diagnostic laboratories are emerging as the fastest growing end-use segment. Many labs are expanding their allergy testing panels, offering same-day results and integrating with telehealth portals. With the growing number of standalone labs and chains operating in tier-2 and tier-3 cities, accessibility to allergy diagnostics is improving. The trend of outsourcing diagnostics by smaller hospitals and clinics to these labs also contributes to the segment's rapid growth.

Regional Analysis

North America held the largest share of the global allergy diagnostics market, driven by high disease prevalence, favorable reimbursement policies, and strong infrastructure. The U.S. has one of the highest rates of food and respiratory allergies, with over 8% of children and 10% of adults affected. Institutions such as the American Academy of Allergy, Asthma & Immunology (AAAAI) play an active role in promoting early diagnosis and treatment.

Moreover, healthcare providers in the region utilize sophisticated in vitro platforms and automated diagnostic tools, ensuring accuracy and efficiency. Regulatory support from the FDA for rapid test approvals and inclusion of allergy testing in health insurance plans also underpin the region's dominance.

Asia Pacific is the fastest growing region in the allergy diagnostics market, owing to increasing urbanization, industrialization, and healthcare modernization. Countries like China, India, and Japan are witnessing a rise in environmental and dietary allergens, leading to higher disease burden. Rising disposable incomes, growing public awareness, and health tech adoption are enabling broader access to diagnostic services.

For instance, in India, initiatives like Ayushman Bharat and increased government funding for diagnostic labs are boosting the availability of allergy testing even in semi-urban areas. Moreover, partnerships between international diagnostic companies and local players are accelerating product rollouts across the region.

Some of The Prominent Players in The Allergy Diagnostics Market Include:

- Thermo Fisher Scientific, Inc.

- HYCOR Biomedical

- EUROIMMUN Medizinische Labordiagnostika AG (PerkinElmer, Inc.)

- Omega Diagnostics Group PLC

- Lincoln Diagnostics, Inc.

- AESKU.GROUP GmbH

- Minaris Medical America, Inc.

- HOB Biotech Group Corp., Ltd.

- DASIT Group SPA

- R-Biopharm AG

- bioMérieux

- Siemens Healthcare GmbH

Recent Developments

-

May 2025: Thermo Fisher Scientific introduced a next-generation ImmunoCAP CRD panel in Europe, expanding its food and respiratory allergen test coverage.

-

February 2025: EUROIMMUN, a PerkinElmer company, launched an AI-powered allergy diagnostic software platform for its multiplex systems in Germany.

-

December 2024: Siemens Healthineers announced a strategic partnership with Indian lab chain Metropolis Healthcare to provide allergy testing automation solutions.

-

October 2024: Danaher Corporation completed its acquisition of a startup developing home-based IgE testing kits, expanding its DTC diagnostics portfolio.

-

August 2024: BioMerieux partnered with Saudi Arabia’s Ministry of Health to establish reference labs specializing in allergy and infectious disease diagnostics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Products and Services

- Instruments

- Consumables

- Services

By Allergen

-

- Dairy Products

- Poultry Product

- Tree Nuts

- Peanuts

- Shellfish

- Wheat

- Soys

- Other Food Allergens

- Inhaled

- Drug

- Other Allergens

By Test Type

-

- Skin Prick Test

- Intradermal Test

- Patch Test

By End Use

- Hospitals & Clinics

- Diagnostics Laboratories

- Research Institutions

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)