Alopecia Market Size and Trends

The alopecia market size was exhibited at USD 9.65 billion in 2024 and is projected to hit around USD 23.27 billion by 2034, growing at a CAGR of 9.2% during the forecast period 2024 to 2034.

Alopecia Market Key Takeaways:

- Alopecia areata held the largest market share of 34.61% in 2024.

- The alopecia universalis segment is anticipated to grow at the fastest CAGR over the forecast period.

- The pharmaceutical segment dominates the global alopecia market.

- The devices segment is expected to grow at the fastest growth rate during the forecast period.

- The male segment dominated the market in 2024.

- However, the female alopecia market is anticipated to grow at the fastest rate over the forecast period.

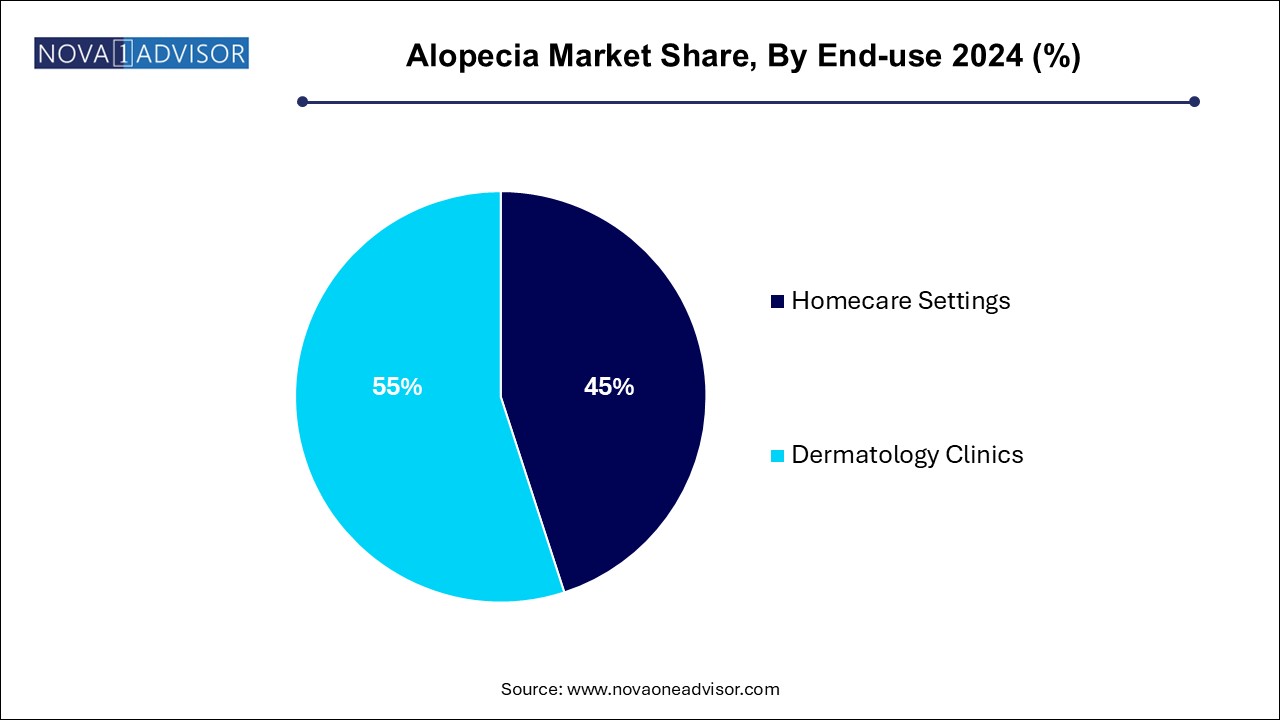

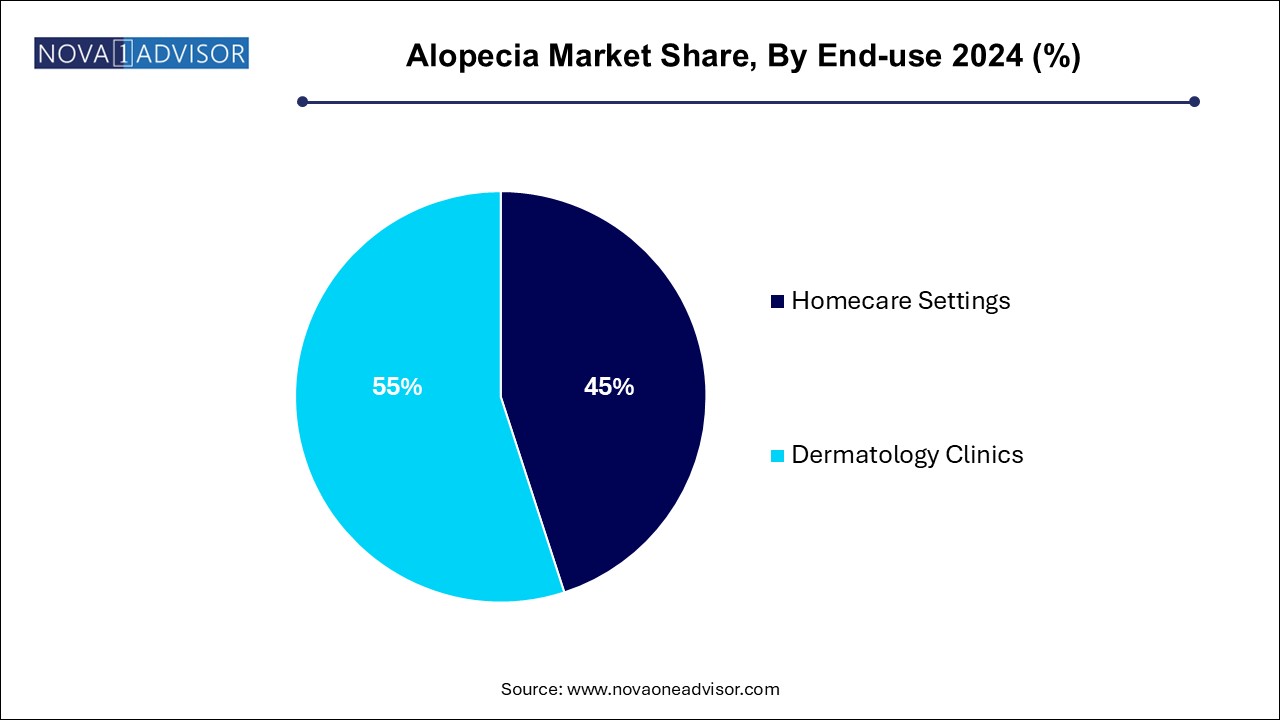

- The end-use market for alopecia is currently dominated by dermatology clinics with the highest share and is also expected to grow strongly over the forecast period.

- North America commanded the regional shares in alopecia treatment in 2024 with a share of 38.34%.

- The Asia Pacific region is estimated to grow at the fastest CAGR for the forecast period.

Market Overview

The global alopecia market represents a crucial and growing segment within the broader healthcare and dermatology industries. Alopecia, commonly referred to as hair loss, encompasses various forms such as alopecia areata, androgenetic alopecia, traction alopecia, and alopecia totalis, among others. Affecting millions of individuals worldwide across all age groups and genders, alopecia is not merely a cosmetic concern but often leads to psychological distress, impacting the overall quality of life.

Increasing awareness about hair disorders, coupled with improved access to treatment options like pharmaceuticals, laser devices, and regenerative therapies such as platelet-rich plasma (PRP), is driving market growth. Moreover, societal emphasis on appearance, rising disposable incomes, and technological advancements in therapeutic devices are further propelling market expansion.

With major investments in R&D aimed at discovering new therapeutic targets (including JAK inhibitors and novel biologicals), the alopecia treatment landscape is undergoing significant innovation. As demand for effective, affordable, and minimally invasive treatments rises, the global alopecia market is projected to witness robust growth in the coming years.

Major Trends in the Market

-

Rising Popularity of Regenerative Therapies: Platelet-rich plasma (PRP) and stem cell-based treatments gaining traction for alopecia management.

-

Increased Focus on JAK Inhibitors: Emerging as a promising therapeutic class for severe forms of alopecia such as alopecia areata and universalis.

-

Growth of OTC Hair Loss Products: Increasing consumer preference for non-prescription topical and oral solutions.

-

Technological Advancements in Laser Devices: Evolution of laser caps, helmets, and combs offering non-invasive hair regrowth stimulation.

-

Customization and Personalization of Treatments: Tailored hair loss solutions based on genetic profiling and patient-specific factors.

-

Social Media Influence and Dermatology Awareness: Heightened exposure to aesthetic standards driving early treatment-seeking behavior.

-

Emergence of Combination Therapies: Using pharmaceutical agents alongside devices and PRP for synergistic outcomes.

-

Expansion of Male Grooming and Female Hair Care Markets: Widening the addressable patient pool, especially among younger demographics.

Report Scope of Alopecia Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 10.54 Billion |

| Market Size by 2034 |

USD 23.27 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 9.2% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Disease Type, Treatment, Gender, Sales Channel, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Janssen Global Services Inc.; Cipla Limited; Merck & Co., Inc.; GlaxoSmithKline plc; Sun Pharmaceuticals Industries Ltd; Dr. Reddy’s Laboratories Ltd; Aurobindo Pharma; Viatris Inc.; Pfizer, Inc.; Lilly; Lexington Intl., LLC (Devices); Freedom Laser Therapy (iRestore ID-520 helmet); Curallux, LLC.; Apira Science Inc. (iGROW Laser); Revian Inc.; Theradome; Lutronic |

Key Market Driver: Rising Prevalence of Alopecia Globally

The most prominent driver of the market is the rising prevalence of alopecia across all age groups.

Alopecia affects approximately 2% of the global population at some point in their lives, with androgenetic alopecia alone impacting nearly 50% of men and a significant proportion of women by middle age. Lifestyle factors like stress, pollution, poor nutrition, and hormonal imbalances are escalating the incidence of hair loss disorders.

Moreover, autoimmune conditions like alopecia areata are on the rise, necessitating advanced therapeutic interventions. With increased public awareness and willingness to seek professional treatment, the demand for effective alopecia therapies is expanding steadily across developed and emerging markets alike.

Key Market Restraint: High Costs Associated with Advanced Therapies

A significant challenge for market expansion is the high cost associated with advanced alopecia therapies.

While OTC options like minoxidil are relatively affordable, newer treatments such as JAK inhibitors, PRP therapy, and laser-based devices can be prohibitively expensive, limiting access for many patients. Hair transplant surgeries, another effective option, often cost several thousand dollars and are not covered by insurance in most cases.

High price points coupled with inconsistent efficacy across patients deter broader adoption of innovative therapies. Addressing cost concerns through affordable product development and improved reimbursement pathways will be crucial for market penetration.

Key Market Opportunity: Expansion of JAK Inhibitors and Biologics for Severe Alopecia

An exciting opportunity within the alopecia market lies in the expansion of Janus kinase (JAK) inhibitors and biologic therapies.

Clinical trials have shown that JAK inhibitors like baricitinib and ruxolitinib can significantly promote hair regrowth in patients with moderate to severe alopecia areata — a condition historically resistant to treatment. Regulatory approvals (e.g., FDA approval of baricitinib for alopecia areata in 2022) are paving the way for increased adoption.

Biologic therapies targeting specific immune pathways implicated in alopecia are also under investigation, holding promise for personalized, highly effective interventions. Pharmaceutical companies focusing on innovative immunomodulators will likely gain a competitive advantage in this evolving therapeutic landscape.

Alopecia Market By Disease Type Insights

Androgenetic alopecia dominates the disease type segment, accounting for the majority of alopecia cases globally. Commonly known as male-pattern or female-pattern baldness, it is a hereditary condition driven by hormonal factors and typically progresses with age.

Alopecia areata is growing fastest, fueled by increasing autoimmune disease prevalence and heightened awareness. Unlike androgenetic alopecia, alopecia areata can affect individuals of any age and manifests as sudden, patchy hair loss. Breakthrough therapies like JAK inhibitors are boosting clinical focus and treatment uptake in this segment.

Alopecia Market By Treatment Type Insights

Pharmaceuticals dominate the treatment segment, led by widely used topical agents like minoxidil and oral medications like finasteride. These drugs are often first-line therapies, supported by strong clinical evidence and widespread availability across prescription and OTC channels.

Devices are growing fastest, particularly laser-based systems such as laser caps and helmets. These non-invasive modalities stimulate follicular activity, appeal to patients seeking drug-free options, and are gaining popularity for home-based use. Device manufacturers focusing on ergonomics, efficacy, and affordability are poised for strong growth.

Alopecia Market By Gender Insights

Males dominate the gender segment, reflecting the higher prevalence of androgenetic alopecia among men and greater societal acceptance of hair loss treatments among the male demographic.

The female segment is growing fastest, driven by changing beauty standards, increased awareness about female hair loss conditions, and rising demand for aesthetic dermatology services among women. Female-pattern hair loss is being diagnosed and treated earlier, expanding the market opportunity within this group.

Alopecia Market By Sales Channel Insights

Prescription sales dominate the sales channel segment, primarily due to the stronger potency of prescription treatments like oral finasteride and corticosteroids, which require physician supervision.

The OTC segment is growing fastest, with growing consumer trust in self-managed hair loss solutions such as minoxidil foams, serums, and supplements. E-commerce platforms and pharmacy chains are significantly boosting OTC product accessibility and visibility.

Alopecia Market By End-use Insights

Homecare settings dominate the end-use segment, reflecting the convenience and privacy offered by at-home topical treatments, oral medications, and portable laser devices.

Dermatology clinics are growing fastest, particularly for patients seeking PRP therapies, hair transplant surgeries, and laser treatments requiring professional administration. Clinics are expanding their service offerings to meet rising demand for medically supervised, multi-modal hair restoration programs.

Alopecia Market By Regional Insights

North America holds the largest share of the global alopecia market, driven by high consumer awareness, greater willingness to spend on aesthetic procedures, widespread access to advanced dermatological care, and early adoption of innovative therapies.

The United States, in particular, leads the region with a strong concentration of dermatology clinics, cosmetic surgery centers, and pharmaceutical companies actively investing in R&D for alopecia treatments. Aggressive direct-to-consumer marketing and a well-established OTC market also support North American dominance.

Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, increased urbanization, and growing cultural emphasis on physical appearance across emerging economies like China, India, and South Korea.

Rapid expansion of dermatology services, greater availability of advanced hair loss treatments, and government initiatives to promote healthcare access are boosting market growth. Asia-Pacific’s large population base and growing middle class present substantial opportunities for both multinational and domestic alopecia product manufacturers.

Some of the prominent players in the alopecia market include:

- Janssen Global Services Inc.

- Cipla Limited

- Merck & Co., Inc.

- GlaxoSmithKline plc

- Sun Pharmaceuticals Industries Ltd

- Dr. Reddy’s Laboratories Ltd

- Aurobindo Pharma

- Viatris Inc.

- Pfizer, Inc.

- Lilly

- Lexington Intl., LLC (Devices)

- Freedom Laser Therapy (iRestore ID-520 helmet)

- Curallux, LLC.

- Apira Science Inc. (iGROW Laser)

- Revian Inc.

- Theradome

- Lutronic

Alopecia Market By Recent Developments

-

March 2025: Pfizer announced positive phase 3 trial results for ritlecitinib (a JAK3 inhibitor) in treating alopecia areata, with regulatory submission planned for late 2025.

-

February 2025: Sun Pharmaceutical launched its topical minoxidil foam for female-pattern hair loss in India, expanding its dermatology portfolio.

-

January 2025: Lexington International introduced a next-generation laser helmet for home-use, featuring improved coverage and smart connectivity features.

-

December 2024: Concert Pharmaceuticals reported successful completion of its phase 3 clinical trials for CTP-543 (deuterium-modified ruxolitinib) targeting moderate-to-severe alopecia areata.

-

November 2024: Capillus, LLC released a wearable laser therapy cap integrating AI-based compliance tracking to improve treatment adherence.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the alopecia market

By Disease Type

By Treatment

-

-

-

- Betamethasone Dipropionate

- Fluocinolone Acetonide

- Finasteride

- Minoxidil

-

-

-

- Prescription

- Minoxidil

- Finasteride

- Corticosteroids

- Others (JAK inhibitors and others)

-

- Laser Cap

- Laser Comb

- Laser Helmet

By Gender

By Sales Channel

By End Use

- Homecare Settings

- Dermatology Clinics

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)