Anal Fistula Drugs Market Size Trends Analysis and Forecast till 2034

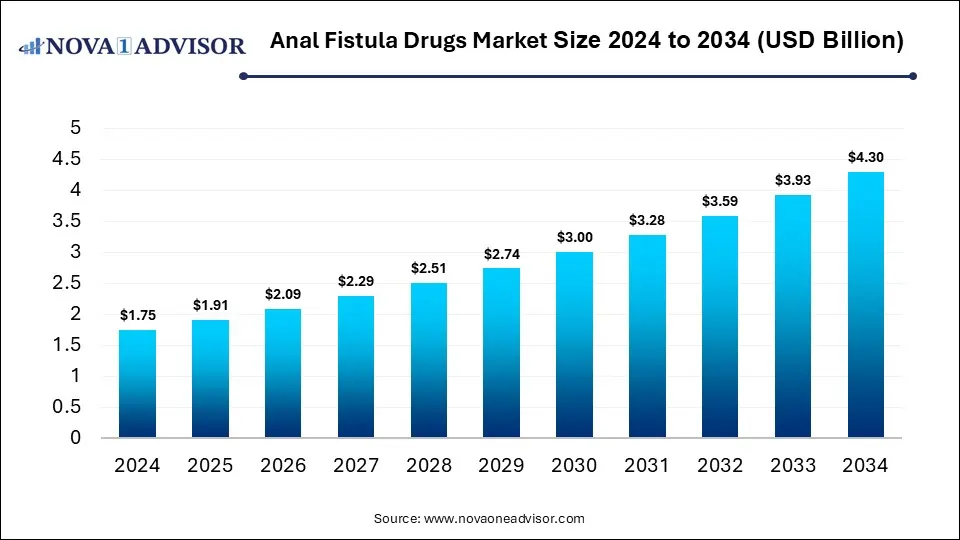

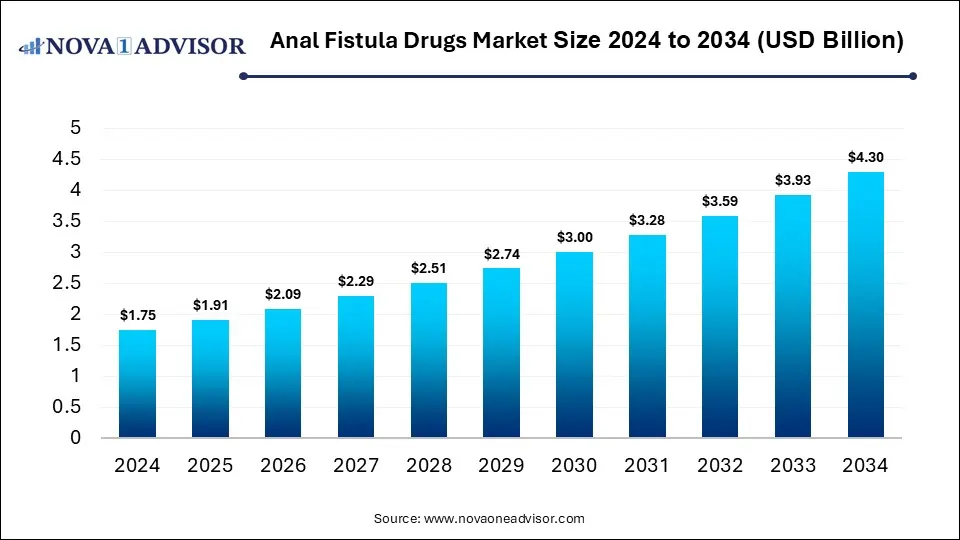

The global anal fistula drugs market size was estimated at USD 1.75 billion in 2024 and is expected to reach USD 4.30 billion in 2034, expanding at a CAGR of 9.4% during the forecast period of 2025 and 2034. The market growth is driven by the rising prevalence of inflammatory bowel disease (especially Crohn’s), increasing patient awareness and early diagnosis, advances in biologics and other novel drug therapies, higher healthcare spending, and demand for treatments with fewer recurrences and side effects.

Anal Fistula Drugs Market Key Takeaways

- By region, North America held the largest share of the anal fistula drugs market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By drug type, the antibiotics segment led the market in 2024.

- By application, the Crohn’s disease-related anal fistulas segment led the market in 2024.

- By application, the non-Crohn’s anal fistula segment is expected to expand at the highest CAGR over the projection period.

- By route of administration, the injectable drugs segment led the market in 2024.

- By distribution channel, the hospital pharmacies segment held the dominant share in 2024.

- By end user, the hospital & clinics segment led the market in 2024.

Impact of AI on the Anal Fistula Drugs Market

AI is accelerating drug discovery and development through predictive modelling and data analysis. Machine learning algorithms help identify potential drug candidates more efficiently and optimize clinical trial design by analyzing patient data for better targeting and outcomes. AI-driven diagnostic tools are also improving early detection and classification of anal fistulas, leading to more timely and effective treatments. Additionally, AI enhances personalized medicine approaches, allowing for tailored drug regimens that reduce recurrence and side effects. Overall, AI is streamlining R&D, improving patient outcomes, and boosting market growth through innovation and efficiency.

Market Overview

The market growth is attributed to increasing prevalence of inflammatory bowel diseases, advancements in drug delivery systems, growing awareness and diagnosis rates, and rising demand for minimally invasive treatment options. As innovation continues, the integration of biotech solutions is expected to further enhance therapeutic outcomes and expand market opportunities. The anal fistula drugs market focuses on pharmaceutical treatments aimed at managing and healing anal fistulas, abnormal connections between the anal canal and skin, often caused by infections or conditions like Crohn's disease. In this context, the use of viral vectors and plasmid DNA manufacturing is gaining traction for delivering gene-based therapies that promote tissue regeneration and reduce inflammation, offering targeted and long-lasting treatment options. These technologies are advantageous due to their high efficiency, precision, and potential in chronic disease management.

- In August 2025, Signum Surgical's BioHealx Anal Fistula Device, an absorbable implant, received FDA approval and was first used in the U.S. Designed to close the fistula tract while preserving sphincter integrity, early European data showed an 84% success rate for complex cases.

What are the Major Trends in the Anal Fistula Drugs Market?

- Rising Use of Biologics and Immunotherapies

Biologic drugs, especially TNF inhibitors and monoclonal antibodies, are gaining popularity for treating complex or Crohn ''' s-related anal fistulas due to their targeted immune-modulating effects.

- Increased Focus on Personalized Medicine

With a better understanding of individual patient profiles and genetic markers, personalized drug regimens are being developed to improve efficacy and reduce recurrence or side effects.

- Growing Awareness and Early Detection Rates

Public health initiatives and improved diagnostic technologies are leading to earlier identification of anal fistulas, increasing the demand for non-surgical, drug-based treatments.

Report Scope of Anal Fistula Drugs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.91 Billion |

| Market Size by 2034 |

USD 4.30 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Drug Type, By Application, By Route of Administration, By Distribution Channel, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Patient Preference for Less Invasive, Non‑Surgical Options

The market growth is driven by concerns about pain, long recovery times, and the risk of complications such as incontinence. Drug-based therapies, especially biologics, antibiotics, and immunomodulators, offer less invasive solutions that can manage symptoms, promote healing, and reduce recurrence without the need for surgical intervention. This shift in patient preference is encouraging pharmaceutical companies to invest in the development of more effective and targeted drug treatments.

- In May 2025, ECM Therapeutics, Inc. (ECMT) received FDA approval of its Investigational Device Exemption (IDE) for ECMT-100, a hydrogel derived from complete extracellular matrix, to begin a first-in-human clinical trial for anorectal fistulas. The non-surgical, regenerative hydrogel is derived from extracellular matrix and is intended to promote natural healing of anorectal fistulas.

Technological Integration and Innovation

The market growth is attributed to advancements in drug formulation and targeted delivery systems, such as controlled-release medications and localized therapies, which are enhancing treatment efficacy and patient outcomes. Innovations in diagnostic imaging and AI-driven tools are also enabling earlier and more accurate detection of anal fistulas, which supports timely medical intervention over surgical options. Additionally, the integration of biotechnology, including gene therapy and biologics, is opening new avenues for treating complex or recurrent cases. These technological breakthroughs not only improve treatment success rates but also encourage greater investment and adoption of drug-based solutions in the market.

Restraints

Limited Availability of Targeted Drugs

The market growth is hindered by the relatively few approved medications specifically designed to treat anal fistulas, which restricts treatment options and forces many patients to rely on surgical interventions or off-label drug use. This lack of targeted therapies can lead to suboptimal outcomes, higher recurrence rates, and patient dissatisfaction. Furthermore, the slow pace of new drug development and regulatory approvals hampers the introduction of innovative treatments.

High Cost of Biologic and Gene Therapies

The high cost of biologic and gene therapies significantly restrains the growth of the anal fistula drugs market. These advanced treatments, while often more effective, come with expensive manufacturing processes and pricing that can limit patient access, especially in low- and middle-income regions. The financial burden on healthcare systems and patients can lead to slower adoption rates and restrict market penetration. Additionally, insurance coverage and reimbursement policies may not fully support these costly therapies, further limiting their use.

Opportunities

Expansion in Emerging Markets

The expansion in emerging markets creates immense opportunities for the anal fistula drugs market by tapping into large, underserved patient populations with increasing healthcare awareness and improving medical infrastructure. As access to healthcare services and diagnostic facilities improves in regions like Asia-Pacific, Latin America, and the Middle East, more patients are diagnosed and treated for anal fistulas, driving demand for effective drug therapies. Growing government initiatives, rising healthcare spending, and expanding insurance coverage further support market growth. Additionally, pharmaceutical companies are increasingly focusing on these markets for product launches and collaborations, creating new revenue streams. This expansion not only boosts sales but also encourages innovation tailored to local needs, fueling long-term market potential.

Development of Gene-Based Therapies

The development of gene-based therapies is creating immense opportunities in the anal fistula drugs market by offering innovative solutions that address the root causes of fistula formation and promote long-term healing. These therapies use viral vectors or plasmid DNA to deliver targeted treatments that can modulate immune responses and stimulate tissue regeneration, which traditional drugs often cannot achieve. As research advances and clinical trials demonstrate their effectiveness, gene-based therapies are positioned to revolutionize treatment options for complex and recurrent anal fistulas. This innovation attracts significant investment and interest from pharmaceutical companies, driving market growth.

How Macroeconomic Variables Influence the Anal Fistula Drugs Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth, increasing healthcare spending, improving infrastructure, and enhancing patient access to advanced treatments. Higher income levels enable more individuals to afford costly therapies, including biologics and gene-based drugs. However, in regions with slower economic growth, limited healthcare budgets can restrain market expansion due to affordability challenges.

Inflation & Drug Pricing Pressures

It can positively affect the growth of the anal fistula drugs market, increasing healthcare spending, improving infrastructure, and enhancing patient access to advanced treatments. Higher income levels enable more individuals to afford costly therapies, including biologics and gene-based drugs. However, in regions with slower economic growth, limited healthcare budgets can restrain market expansion due to affordability challenges.

Exchange Rates

Exchange rate fluctuations can positively affect, boosting healthcare investments and increasing patient spending capacity. A strong economy enables better access to advanced treatments and supports pharmaceutical research and development. Conversely, a slow or declining economic rate can restrain market growth by limiting healthcare budgets and reducing affordability for expensive therapies.

Segment Outlook

Drug Type Insights

Why Did the Antibiotics Segment Lead the Market in 2024?

In 2024, the antibiotics segment led the anal fistula drugs market primarily due to their widespread use as a first-line treatment to manage infection and inflammation associated with fistulas. Although antibiotics do not close the fistula, they are essential in controlling symptoms, reducing abscess formation, and preparing patients for further surgical or non-surgical interventions. Their cost-effectiveness, accessibility, and role in preventing complications made them the most commonly prescribed drug type, especially in early-stage or uncomplicated cases.

The biologics segment is expected to grow at the fastest rate due to its proven effectiveness in treating complex and Crohn’s disease-related anal fistulas, which are often resistant to conventional therapies. These targeted treatments, such as anti-TNF agents and monoclonal antibodies, help modulate the immune system to reduce inflammation and promote healing, leading to better patient outcomes. The growing adoption of biologics is supported by increasing clinical evidence, physician preference, and patient demand for therapies with fewer side effects compared to surgery. Additionally, advancements in biologic formulations and delivery methods are improving patient compliance and expanding their use.

Application Insights

Why Did the Crohn’s Disease-Related Anal Fistulas Segment Dominate the Anal Fistula Drugs Market in 2024?

The Crohn’s disease-related anal fistulas segment dominated the market with the largest share in 2024. This is because Crohn’s disease is one of the leading causes of complex and treatment-resistant anal fistulas. Patients with Crohn’s often require specialized drug therapies, such as biologics and immunomodulators, to manage both the underlying inflammation and fistula healing. The high prevalence of Crohn’s disease globally, along with growing diagnosis rates, fuels demand for effective medical treatments within this segment. Moreover, ongoing research and development focused on Crohn ’s-associated fistulas have led to the introduction of targeted therapies, reinforcing the segment’s market leadership.

- In May 2025, Uptadacitinib post-hoc analysis of trials for the oral Janus kinase inhibitor Upadacitinib, a non-biologic, showed higher rates of fistula healing in Crohn's disease patients.

The non-Crohn’s anal fistula segment is expected to grow at the fastest CAGR during the projection period, owing to increasing awareness and improved diagnosis of fistulas caused by factors other than Crohn’s disease, such as infections, trauma, or post-surgical complications. As more patients seek less invasive and effective drug treatments over surgery, demand in this segment rises. Additionally, pharmaceutical companies are expanding their focus to develop therapies targeting a broader range of fistula types, driving innovation and market growth. Growing healthcare infrastructure and access in emerging markets also contribute to faster adoption of treatments for non-Crohn’s anal fistulas.

Route of Administration Insights

Why Did the Injectable Drugs Segment Lead the Market in 2024?

The injectable drugs segment led the anal fistula drugs market in 2024 due to the widespread use of biologics and immunomodulators, which are often administered via injection or infusion for optimal efficacy. Injectable formulations ensure better bioavailability and targeted delivery, which is crucial for managing complex and Crohn ’s-related anal fistulas. Healthcare providers prefer injectables because they allow controlled dosing and monitoring, improving treatment outcomes and patient adherence. Furthermore, many of the latest advanced therapies, including monoclonal antibodies, are available only in injectable forms, reinforcing this segment’s market dominance. This clinical effectiveness, combined with strong physician and patient acceptance, sustains the injectable segment’s leading position.

The oral formulations segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing patient preference for convenient, non-invasive treatment options. Oral drugs improve adherence and comfort, especially for long-term therapy, making them a favorable alternative to injectable or hospital-based treatments. Pharmaceutical advancements are enabling the development of more effective oral immunomodulators and anti-inflammatory agents tailored for fistula management. Additionally, as healthcare access expands in emerging markets, the ease of distribution and self-administration of oral drugs makes them more accessible.

Distribution Channel Insights

Why Did the Hospital Pharmacies Segment Lead the Market in 2024?

The hospital pharmacies segment led the anal fistula drugs market in 2024 due to the clinical nature of most treatments, particularly biologics and injectables, which require administration and monitoring in controlled healthcare settings. Hospitals are often the first point of care for patients with complex or severe anal fistulas, especially those related to Crohn’s disease, ensuring a steady flow of prescriptions through in-house pharmacies. Additionally, hospital pharmacies have better access to advanced and high-cost therapies, supported by institutional purchasing power and reimbursement frameworks. The need for physician supervision and patient monitoring further reinforces the preference for hospital-based drug dispensing.

The online pharmacies segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing digital adoption, convenience, and accessibility for patients seeking discreet and timely access to medications. As more individuals prefer home delivery and remote consultations, online platforms provide a seamless way to refill prescriptions, especially for chronic conditions like anal fistulas that require ongoing treatment. The rise of telemedicine and digital health platforms further supports this growth by integrating e-prescriptions with online pharmacy services. Additionally, competitive pricing, discounts, and wider product availability attract more consumers to digital channels.

End User Insights

Why Did the Hospital and Clinics Segment Lead the Market in 2024?

The hospital and clinic segment led the anal fistula drugs market in 2024 due to their role as the primary treatment centers for diagnosing and managing complex and chronic anal fistula cases. These healthcare facilities provide specialized care, including the administration of biologics and injectable therapies that require professional supervision. Physicians in hospitals and clinics are more likely to prescribe advanced or newly approved drugs, ensuring higher adoption rates within these settings. Additionally, hospitals are equipped with diagnostic and monitoring tools essential for comprehensive fistula treatment, making them central to patient care.

The home care setting segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing demand for convenient, cost-effective, and patient-centric treatment options. As more therapies, including oral medications and some self-administered injectables, become available, patients can manage their condition at home with minimal clinical supervision. The rise of telemedicine and remote monitoring tools further supports this trend, allowing healthcare providers to track patient progress without requiring frequent hospital visits. This shift not only enhances comfort and compliance but also reduces the burden on healthcare facilities.

Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the anal fistula drugs market while holding the largest share in 2024. The region’s dominance is primarily attributed to the advanced healthcare infrastructure, high prevalence of inflammatory bowel diseases such as Crohn’s, and strong adoption of innovative therapies such as biologics and gene-based treatments. The region benefits from significant investments in research and development, well-established pharmaceutical companies, and favorable reimbursement policies that support access to high-cost drugs. Additionally, early diagnosis and greater patient awareness contribute to higher treatment rates. Regulatory support from agencies like the FDA also accelerates the approval and availability of novel therapies.

The U.S. is a major contributor to the North American anal fistula drugs market due to its highly developed healthcare system and high prevalence of Crohn’s disease, a leading cause of anal fistulas. The country’s strong pharmaceutical industry, extensive research activities, and early adoption of advanced therapies like biologics and gene-based treatments further boost its market dominance. Additionally, supportive insurance coverage and reimbursement frameworks enhance patient access to high-cost medications.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for anal fistula drugs. This is due to a combination of rising healthcare awareness, increasing prevalence of inflammatory bowel diseases, and rapid improvements in medical infrastructure across countries like India, China, and Japan. Growing patient populations, particularly in densely populated regions, are driving demand for more accessible and effective treatment options. Governments and the private sectors are investing heavily in healthcare, improving access to diagnostics and advanced therapies. Additionally, the expansion of pharmaceutical companies into emerging Asian markets and the rise of telemedicine and e-pharmacies are accelerating drug availability and adoption.

Mesenchymal stem cells (MSCs) show promising results in treating perianal fistulas in Crohn’s disease by reducing inflammation and promoting tissue healing. Clinical trials demonstrate MSC therapy is safe and effective, offering hope where traditional treatments often fail. While not yet FDA-approved for this use, MSCs are gaining recognition as a novel regenerative option. Future therapies may include easier-to-use stem cell-derived products, improving patient outcomes and quality of life.

China is a major player in the Asia Pacific anal fistula drugs market due to its large and growing patient population, increasing prevalence of inflammatory bowel diseases, and expanding healthcare infrastructure. The country’s rising awareness about anal fistula treatments and improving access to affordable medications are driving demand. Additionally, India’s growing pharmaceutical manufacturing capabilities and favorable government initiatives to enhance healthcare accessibility further boost its market leadership in the region.

Region-Wise Market Outlook

| Region |

Market Size (2024) |

Projected CAGR (2025–2034) |

Growth Factors |

Restraints |

Growth Overview |

| North America |

USD 0.7 Million |

6.5% |

High prevalence of IBD, advanced healthcare infrastructure, and adoption of stem cell-based therapies |

High treatment costs, insurance limitations |

Dominant region |

| Europe |

USD 0.5 Million |

7.43% |

Rising awareness, availability of specialized treatment centers, and government support |

High treatment costs, insurance limitations |

Sustainable market growth |

| Asia Pacific |

USD 0.4 Million |

10.5% |

Increasing healthcare expenditure, improved diagnostic capabilities, and a large population base |

Limited access to advanced treatments, economic disparities |

Fastest growth rate |

| Latin America |

USD 0.1 Million |

6.5% |

Improving healthcare investment |

Economic instability, limited reimbursement |

Potential growth |

| Middle East and Africa |

USD 0.1 Million |

0% |

Increasing investment in healthcare, government initiatives |

Resource constraints, limited insurance coverage |

Emerging market growth |

Anal Fistula Drugs Market Value Chain Analysis

1. Research & Development (R&D)

This is the initial stage where pharmaceutical companies and biotech firms invest in discovering new drug formulations and therapies targeting anal fistula treatment. The focus here is on developing effective, minimally invasive, and safer drug therapies, often involving stem cells, immunomodulators, or biologics.

- Key players in this stage include Takeda Pharmaceutical Company Ltd., Ferring Pharmaceuticals, and AbbVie Inc., which heavily invest in clinical trials and innovative drug discovery to enhance treatment efficacy.

2. Manufacturing

At this stage, approved drugs are produced in large quantities under strict regulatory compliance to ensure quality and safety. This includes synthesis, formulation, and packaging of anal fistula drugs.

- Key Players, like Mylan N.V. (now part of Viatris), Sun Pharmaceutical Industries Ltd., and Pfizer Inc., are prominent manufacturers known for their robust production capabilities and adherence to Good Manufacturing Practices (GMP).

3. Distribution & Logistics

Efficient distribution channels ensure the timely delivery of drugs to hospitals, clinics, pharmacies, and wholesalers. Cold chain logistics might be involved for biologics and other temperature-sensitive drugs.

Key players in this stage are distributors and logistics firms such as McKesson Corporation, Cardinal Health, and AmerisourceBergen, who facilitate smooth supply chain operations across global markets.

4. Marketing & Sales

Pharmaceutical companies deploy strategic marketing and sales efforts to increase awareness among healthcare providers and patients. This includes collaborations with healthcare professionals, attending medical conferences, and educational campaigns about new treatments.

Companies like Takeda, AbbVie, and Ferring actively engage in marketing initiatives to expand their market reach and promote product adoption.

Anal Fistula Drugs Market Companies

- Takeda Pharmaceutical Company Ltd.

Takeda leads the market by developing advanced biologic therapies, such as anti-TNF agents, which target the underlying inflammation in anal fistula patients, especially those with Crohn’s disease. Their strong pipeline and global reach enable them to drive innovation and improve patient outcomes worldwide.

AbbVie contributes through its expertise in immunology and biologics, particularly with drugs like Humira (adalimumab) that are widely prescribed for treating fistulizing Crohn’s disease. Their extensive clinical research and marketing efforts help expand treatment access and awareness.

Ferring specialises in gastroenterology and focuses on innovative treatments, including stem cell therapy for complex anal fistulas, positioning itself as a pioneer in regenerative medicine for this market. Their targeted approach addresses unmet medical needs with novel therapeutic options.

Pfizer supports the market by providing a range of pharmaceutical products that manage inflammation and infection associated with anal fistula. Their global distribution network ensures the broad availability of essential drugs, and they continue to invest in research for improved therapies.

- Sun Pharmaceutical Industries Ltd.

Sun Pharma contributes through affordable generic drugs that enhance accessibility of treatment options for anal fistula patients, especially in emerging markets. Their cost-effective portfolio supports wider adoption where healthcare budgets are limited.

- Mylan N.V. (now part of Viatris)

Mylan, now merged into Viatris, provides generic and branded medications for inflammatory bowel disease and related complications such as anal fistula. Their focus on quality generics helps reduce treatment costs and expand patient reach worldwide.

Recent Development

- In July 2024, Signum Surgical has received FDA marketing clearance for its BioHealx™ technology, the first-of-its-kind device approved for treating anal fistula.

Case Study:

According to the National Library of Medicine, success rates vary by procedure. A study involving over 1,000 patients found that highly invasive techniques like fistulotomy had a high healing rate (98.6%) for simple fistulas, but sphincter-sparing techniques were necessary for complex ones. A study corroborated this, finding an 88.5% overall healing rate with acceptable complication rates.

Segments Covered in the Report

By Drug Type

- Biologics (e.g., anti-TNF agents, monoclonal antibodies)

- Immunosuppressants

- Antibiotics

- Anti-inflammatory drugs

- Others (e.g., analgesics, wound healing agents)

By Application

- Crohn’s disease-related anal fistulas

- Non-Crohn’s anal fistulas

- Post-surgical treatment

- Other associated conditions

By Route of Administration

- Oral drugs

- Injectable drugs

- Topical formulations

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

By End User

- Hospitals & clinics

- Ambulatory surgical centers

- Home care settings

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

- Table 1: Global Anal Fistula Drugs Market Size (USD Billion) by Drug Type, 2024–2034

- Table 2: Global Anal Fistula Drugs Market Size (USD Billion) by Application, 2024–2034

- Table 3: Global Anal Fistula Drugs Market Size (USD Billion) by Route of Administration, 2024–2034

- Table 4: Global Anal Fistula Drugs Market Size (USD Billion) by Distribution Channel, 2024–2034

- Table 5: Global Anal Fistula Drugs Market Size (USD Billion) by End User, 2024–2034

- Table 6: North America Market Size (USD Billion) by Drug Type, 2024–2034

- Table 7: North America Market Size (USD Billion) by Application, 2024–2034

- Table 8: North America Market Size (USD Billion) by Route of Administration, 2024–2034

- Table 9: North America Market Size (USD Billion) by Distribution Channel, 2024–2034

- Table 10: North America Market Size (USD Billion) by End User, 2024–2034

- Table 11: U.S. Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 12: Canada Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 13: Mexico Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 14: Europe Market Size (USD Billion) by Drug Type, 2024–2034

- Table 15: Europe Market Size (USD Billion) by Application, 2024–2034

- Table 16: Germany Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 17: France Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 18: UK Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 19: Italy Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 20: Asia Pacific Market Size (USD Billion) by Drug Type, 2024–2034

- Table 21: Asia Pacific Market Size (USD Billion) by Application, 2024–2034

- Table 22: China Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 23: Japan Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 24: India Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 25: South Korea Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 26: Southeast Asia Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 27: Latin America Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 28: Brazil Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 29: Middle East & Africa Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 30: GCC Countries Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 31: Turkey Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Table 32: Africa Market Size (USD Billion) by Drug Type & Application, 2024–2034

- Figure 1: Global Market Share by Drug Type, 2024

- Figure 2: Global Market Share by Application, 2024

- Figure 3: Global Market Share by Route of Administration, 2024

- Figure 4: Global Market Share by Distribution Channel, 2024

- Figure 5: Global Market Share by End User, 2024

- Figure 6: North America Market Share by Drug Type, 2024

- Figure 7: North America Market Share by Application, 2024

- Figure 8: North America Market Share by Route of Administration, 2024

- Figure 9: North America Market Share by Distribution Channel, 2024

- Figure 10: North America Market Share by End User, 2024

- Figure 11: U.S. Market Share by Drug Type, 2024

- Figure 12: U.S. Market Share by Application, 2024

- Figure 13: Canada Market Share by Drug Type, 2024

- Figure 14: Canada Market Share by Application, 2024

- Figure 15: Mexico Market Share by Drug Type, 2024

- Figure 16: Mexico Market Share by Application, 2024

- Figure 17: Europe Market Share by Drug Type, 2024

- Figure 18: Europe Market Share by Application, 2024

- Figure 19: Germany Market Share by Drug Type, 2024

- Figure 20: Germany Market Share by Application, 2024

- Figure 21: France Market Share by Drug Type, 2024

- Figure 22: France Market Share by Application, 2024

- Figure 23: UK Market Share by Drug Type, 2024

- Figure 24: UK Market Share by Application, 2024

- Figure 25: Italy Market Share by Drug Type, 2024

- Figure 26: Italy Market Share by Application, 2024

- Figure 27: Asia Pacific Market Share by Drug Type, 2024

- Figure 28: Asia Pacific Market Share by Application, 2024

- Figure 29: China Market Share by Drug Type, 2024

- Figure 30: China Market Share by Application, 2024

- Figure 31: Japan Market Share by Drug Type, 2024

- Figure 32: Japan Market Share by Application, 2024

- Figure 33: India Market Share by Drug Type, 2024

- Figure 34: India Market Share by Application, 2024

- Figure 35: South Korea Market Share by Drug Type, 2024

- Figure 36: South Korea Market Share by Application, 2024

- Figure 37: Southeast Asia Market Share by Drug Type, 2024

- Figure 38: Southeast Asia Market Share by Application, 2024

- Figure 39: Latin America Market Share by Drug Type, 2024

- Figure 40: Latin America Market Share by Application, 2024

- Figure 41: Brazil Market Share by Drug Type, 2024

- Figure 42: Brazil Market Share by Application, 2024

- Figure 43: Middle East & Africa Market Share by Drug Type, 2024

- Figure 44: Middle East & Africa Market Share by Application, 2024

- Figure 45: GCC Countries Market Share by Drug Type, 2024

- Figure 46: GCC Countries Market Share by Application, 2024

- Figure 47: Turkey Market Share by Drug Type, 2024

- Figure 48: Turkey Market Share by Application, 2024

- Figure 49: Africa Market Share by Drug Type, 2024

- Figure 50: Africa Market Share by Application, 2024