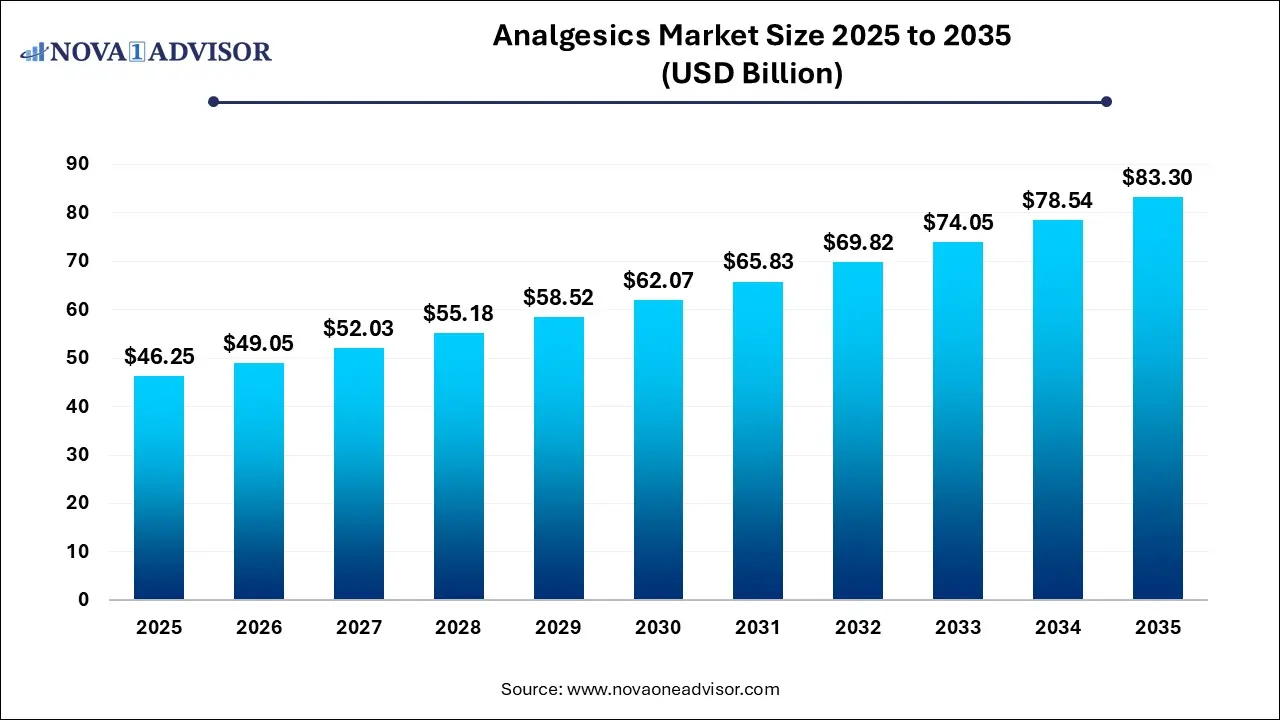

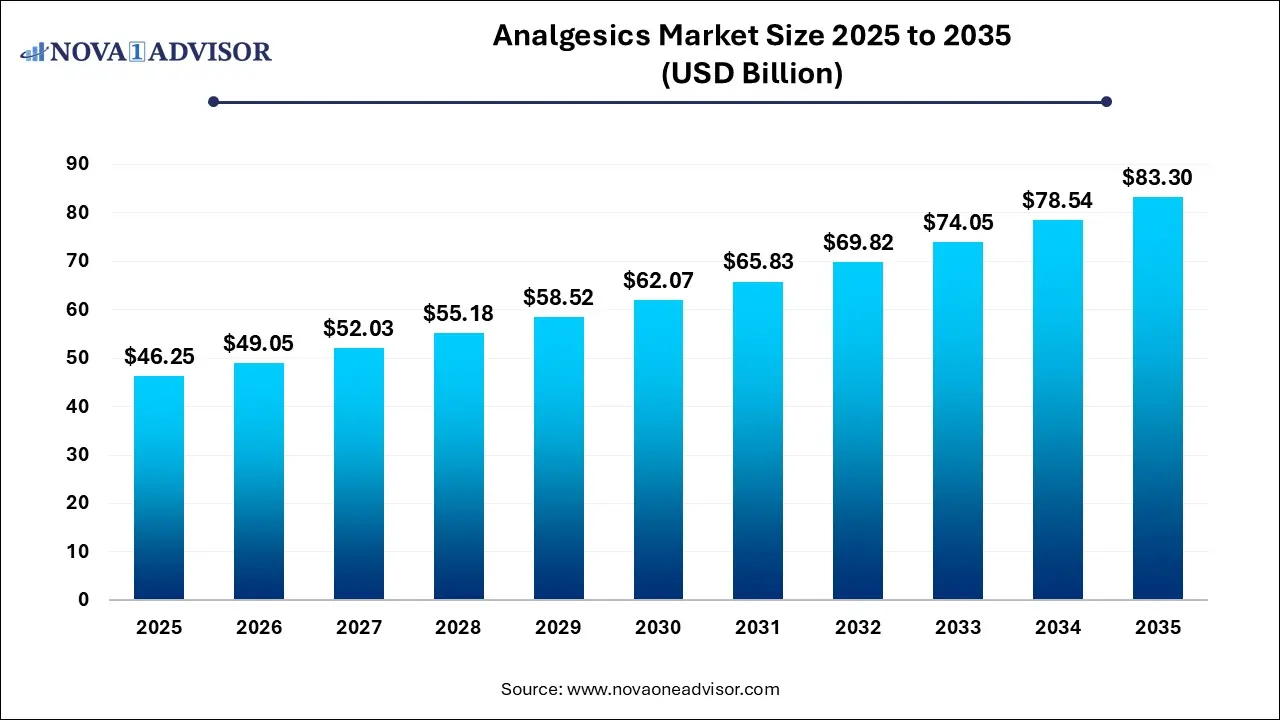

Analgesics Market Size and Trends

The global analgesics market size is calculated at USD 46.25 billion in 2025, grow to USD 49.05 billion in 2026, and is projected to reach around USD 83.3 billion by 2035, growing at a CAGR of 6.06% from 2026 to 2035. The market is growing due to the rising prevalence of chronic pain and age-related conditions, increasing surgical procedures and cancer cases also drive demand. Additionally, greater awareness and improved access to pain management therapies contribute the market expansion.

Key Takeaways

- North America dominated the analgesics market in 2025.

- Asia-Pacific is expected to grow at the highest CAGR in the market during the forecast period.

- By type, the non-opioids drugs segment held the largest revenue market share.

- By type, the opioid drugs segment is expected to grow at the fastest CAGR in the market during the studied years.

- By route of administration, the oral administration segment dominated the market.

- By route of administration, the topical administration segment is expected to grow at the fastest CAGR in the market during the forecast period.

How is Innovation Impacting the Analgesics Market?

Analgesics are a class of drugs that relieve pain by blocking pain signals to the brain or interfering with the brain's interpretation of those signals, without causing loss of consciousness. They are commonly used to treat conditions ranging from mild headaches to chronic pain disorders. Innovation is significantly transforming the analgesic market by introducing novel drug formulations, targeted delivery systems, and non-opioid alternatives that offer effective pain relief with fewer side effects. Advances in biotechnology and precision medicine are enabling the development of personalized pain management therapies. Additionally, research into alternative pathways and mechanisms of pain is expanding treatment options, enhancing patient outcomes, and addressing issues related to opioid dependence, ultimately driving market growth and improving quality of care.

- For Instance, According to the CDC, approximately 58.5 million U.S. adults, or about 1 in 4 (23.7%), are affected by arthritis. The condition is more common in women and its occurrence tends to rise with age.

What are the leading trends shaping the Analgesics Market in 2025?

- In July 2025, Concentric Analgesics announced promising Phase 2 results for Vocacapsaicin, an investigational drug for postoperative pain, published in a peer-reviewed journal. The drug is the first to show pain relief lasting over seven days while lowering opioid use. The company is now preparing for Phase 3 trials to further its development.

- In June 2025, GSK acquired Elsie Biotechnologies for over USD 50 million to boost its development of oligonucleotide-based therapies. This move strengthens GSK’s research capabilities and expands its pipeline targeting difficult-to-treat diseases. By combining Elsie’s expertise with its own, GSK aims to accelerate innovative drug development for broader patient groups, aligning with its focus on advancing science and technology in medicine.

How is AI enhancing advancements in the Analgesics Market?

AI is accelerating advancements in the analgesic market by streamlining drug discovery, identifying novel pain targets, and predicting compound effectiveness with greater speed and accuracy. It aids in analyzing large datasets to understand pain mechanisms and patient responses, enabling the development of more targeted and personalized treatments. AI also enhances clinical trial design and patient monitoring, reducing time and costs. Overall, it is driving innovation and efficiency across the entire analgesic drug development process.

Report Scope of Analgesics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 49.05 Billion |

| Market Size by 2035 |

USD 83.3 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.06% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

By Type, By Route of Administration, By Regions |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Abbott, Pfizer Inc., Eli Lilly & Company, Endo International plc, F. Hoffmann-La Roche AG Bausch Health Companies Inc., Merck & Co. Inc., AbbVie Inc., Novartis AG, Johnson & Johnson Private Limited, GSK plc., Purdue Pharma L.P. |

Market Dynamics

Driver

Increasing Incidence of Chronic Conditions

The rising incidence of a chronic condition such as arthritis, cancer, and diabetes-related neuropathy is a major factor in the analgesics market. These long-term health issues often involve persistent pain, requiring ongoing management through effective pain relief solutions. As global populations age and lifestyle-related diseases become more common, the demand for both prescription and over-the-counter analgesics continues to grow. This trend fuels innovation and expansion in the market.

- For Instance, According to CDC estimates, around 129 million Americans are affected by at least one major chronic illness such as heart disease, cancer, diabetes, obesity, or hypertension. Additionally, about 42% of the U.S. population is living with two or more chronic conditions, while roughly 12% are managing five or more.

Restraint

Regulatory Restriction for Opioid-Based Products

Regulatory restrictions on opioids limit their use despite their effectiveness in managing severe pain. These limitations make it harder for healthcare providers to prescribe opioids, leading to delays or gaps in pain treatment for certain patients. Additionally, companies face increased costs and complexities in meeting compliance standards, which can reduce investment in opioid research. As a result, these strict regulations hinder the growth potential of opioids. Products within the broader analgesics market.

Opportunity

Rise Increasing use of OTC Analgesics

The increasing reliance on OTC analgesics is opening new avenues for market growth, as more individuals seek quick and convenient pain relief without visiting a doctor. Factors like busy lifestyles, greater health awareness, and improved availability are encouraging consumers to manage mild to moderate pain on their own. This shift is pushing companies to innovate with user-friendly formulations, expand retail distribution, and invest in branding to capture a larger share of this growing market growth.

- For Instance, In April 2024, Glenmark Pharmaceuticals received approval from the USFDA for its generic version of Acetaminophen and Ibuprofen tablets.

Segmental Insights

How Non-opioid Drugs Segment Dominate the Analgesics Market in 2025?

The dominance of the non-opioids segment in the analgesics market is driven by growing concerns over opioid-related side effects and dependency issues. Non-opioid drugs are increasingly favored for managing mild to moderate pain, especially in chronic conditions, due to their safer long-term use. Additionally, expanding use in both prescription forms has boosted their adoption across all age groups, contributing to the market growth.

- For Instance, In January 2025, the FDA approved Journavx, the first new non-opioid painkiller in over 20 years, targeting acute moderate-to-severe pain through selective sodium channel inhibition.

The rapid growth of the opioids segment is driven by its critical role in treating intense unmanageable pain where other therapies fall short. Conditions such as advanced-stage cancer, major surgeries, and severe injuries often require stronger pain control, making opioids essential in clinical settings. Additionally, ongoing R&D efforts to create safer formulations with reduced addiction potential are expanding their medical use, contributing to increased acceptance and faster growth in the market growth.

Why Did the Oral Administration Segment Dominate in Analgesics Market 2025?

The oral administration segment led the market largely due to practical and wide accessibility across healthcare and retail settings. It allows for self-administration without medical supervision, which appeals to patients managing ongoing or mild pain conditions. Moreover, pharmaceutical companies frequently prioritize oral formulations in product development, ensuring a broader range of options. This widespread adoption across both acute and chronic pain treatment has solidified its leading role in the market.

For Instance, In July 2024, Hikma Pharmaceuticals introduced COMBOGESIC IV in the U.S., combining oral standard analgesics (acetaminophen and ibuprofen) in an intravenous format—highlighting how companies expand familiar oral formulations into various delivery methods while retaining patient preference for non-invasive routes.

Regional Insights

How is North America Contributing to the Expansion of the Analgesics Market?

In 2025, North America led the analgesic market due to the region has a large population affected by chronic diseases and aging-related pain conditions, driving consistent demand for effective pain relief. Well-established healthcare systems and higher per capita healthcare expenditure enable greater access to advanced analgesic treatments. Furthermore, North America’s robust pharmaceutical industry focuses heavily on innovation, including the development of novel and non-opioid pain therapies. Strong regulatory frameworks and increased patient awareness about pain management also support market growth, making North America the dominant region in the global analgesics landscape.

- For Instance, In March 2025, pharmacies can order mail-back envelopes (MBEs) from opioid analgesic REMS manufacturers to offer patients a safe way to dispose of unused opioids. This is optional and complements existing disposal programs. Each MBE includes a Patient Education Sheet, and an updated Patient Guide is available for healthcare providers to counsel patients on safe disposal methods.

How is Asia-Pacific approaching the Analgesics Market in 2025?

Asia-Pacific is projected to experience the highest CAGR in the market due to factors like increasing population, rising prevalence of chronic diseases, and growing awareness of pain management. Rapid improvements in healthcare infrastructure, expanding access to affordable medications, and increasing disposable income are boosting demand. Additionally, rising urbanization, government initiatives to improve healthcare access, and the entry of global pharmaceutical companies are driving market growth in this region during the forecast period.

- For Instance, In September 2025, Mankind Pharma launched Nimulid Strong, a topical analgesic with double the diclofenac concentration for quicker relief from neck pain. Offered in both gel and spray formats, this product enhances India's pain relief market by providing consumers with an effective and affordable topical treatment option.

Top Companies in the Analgesics Market

- Abbott

- Pfizer Inc.

- Eli Lilly & Company

- Endo International plc

- F. Hoffmann-La Roche AG Bausch Health Companies Inc.

- Merck & Co. Inc.

- AbbVie Inc.

- Novartis AG

- Johnson & Johnson Private Limited

- GSK plc.

- Purdue Pharma L.P.

Recent Developments in the Analgesics Market

- In February 2025, Nivaan Care secured USD 4.25 million in funding to scale its chronic pain management clinics throughout India. Focused on evidence-based therapies, regenerative medicine, and holistic approaches, the expansion aims to improve access to long-term pain relief solutions and strengthen the country’s overall pain management market.

- In May 2025, Novartis announced its acquisition of Mariana Oncology, a biotech firm focused on radioligand therapies for treating solid tumors. This deal includes multiple radioligand therapy programs and aims to boost Novartis’ pipeline and research capabilities in this area. The agreement involves an upfront payment of USD 1 billion, with additional milestone-based payments. The transaction is currently awaiting standard closing approvals.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the analgesics market

By type

By Route of Administration

- Rectal

- Transdermal

- Topical

- Oral

- Intravenous

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)