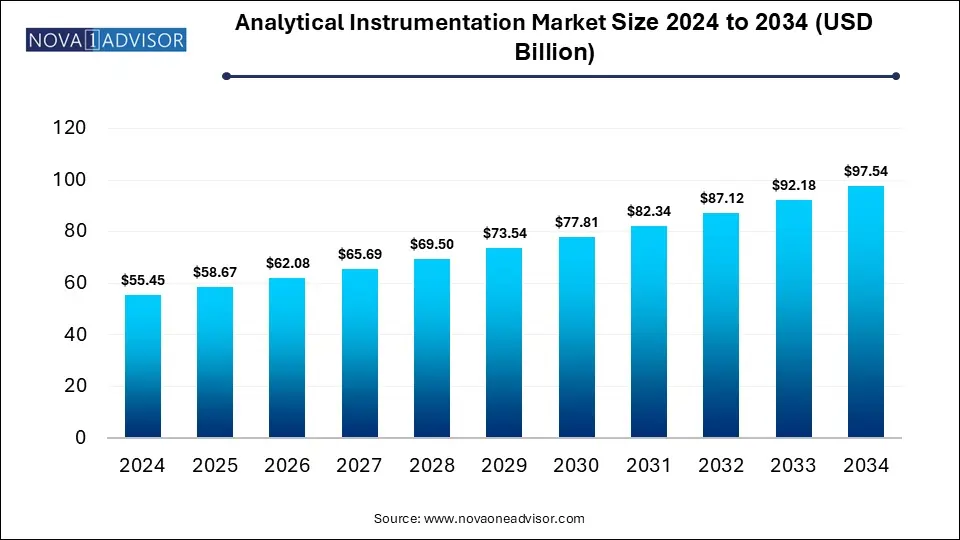

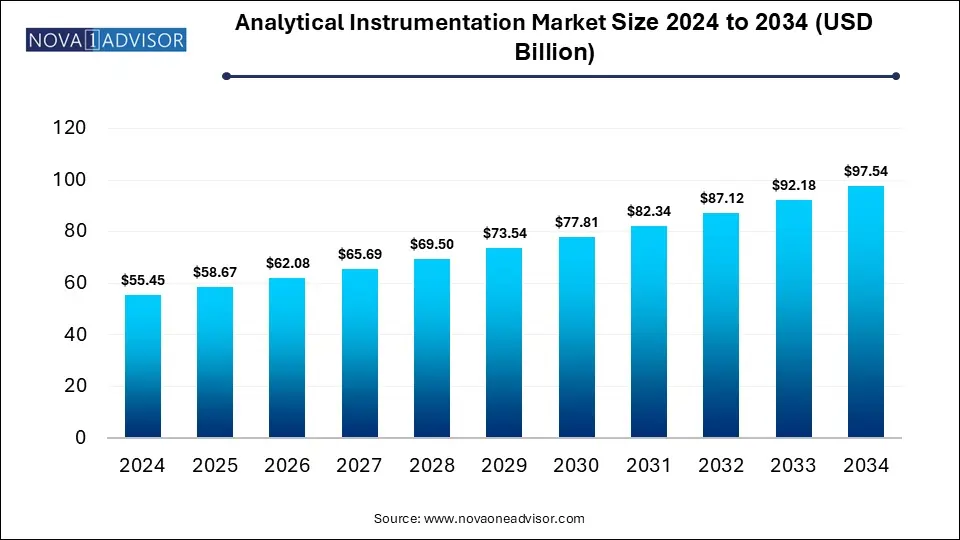

Analytical Instrumentation Market Size and Growth

The global analytical instrumentation market size is calculated at USD 55.45 billion in 2024, grows to USD 58.67 billion in 2025, and is projected to reach around USD 97.54 billion by 2034, growing at a CAGR of 5.81% from 2025 to 2034. The growth of the analytical instrumentation market is driven by advancements in analytical instruments, focus on precision medicine, stringent regulatory frameworks, and increased demand for high-quality research.

Analytical Instrumentation Market Key Takeaways

- North America dominated the global analytical instrumentation market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

- By product, the instruments segment dominated the market with the largest share in 2024.

- By product, the software segment is expected to show the fastest growth over the forecast period.

- By technology, the polymerase chain reaction segment accounted for the highest market share in 2024.

- By technology, the sequencing segment is expected to expand rapidly during the predicted timeframe.

- By application, the life sciences research & development segment held the largest market share in 2024.

- By application, the clinical & diagnostic analysis segment is expected to register fastest growth during the forecast period.

How is the Analytical Instrumentation Market Expanding?

Analytical instruments are tools and platforms used for analyzing the composition and properties of materials across various fields such as chemistry, environmental science and pharmaceuticals, further allowing qualitative and quantitative analysis of samples. The analytical instrumentation market is expanding significantly due to rising demand for advanced diagnostic tools to tackle chronic diseases, expanding applications, innovative product launches and increased use in the pharmaceutical industry.

Stringent regulations across various industries are driving the demand for compliant instruments meeting specific regulatory standards with robust data management and reporting features for regulatory audits. Increased public awareness regarding importance of safety standards and quality control in various industries are driving the market growth.

What Are the Key Trends in the Analytical Instrumentation Market in 2025?

- In July 2025, BDC Laboratories introduced a specialized service program, the Equipment Care Program designed for keeping its advanced test equipment operations at peak performance. The program offers preventative maintenance, calibration, and optional upgrades for the VDT-3600i, RWT-4600i, and HDTi-6000 test systems, further minimizing downtime, extension of system lifespan while ensuring seamless operation with scheduled service and expert support.

- In June 2025, Thermo Fisher Scientific Inc., launched its next-generation mass spectrometers, namely the Thermo Scientific Orbitrap Astral Zoom mass spectrometer (MS) and the Thermo Scientific Orbitrap Excedion Pro mass spectrometer (MS) at ASMS 2025.

Where is AI Finding Applications in the Analytical Instrumentation Market?

Artificial intelligence (AI) is actively being employed in analytical instrumentation processes for automating workflows and enhancing instrument performance. Large datasets generated by analytical instruments can be analysed by AI algorithms for identifying patterns, further enhancing data processing. Machine learning (ML) and deep learning (DL) algorithms can be trained for assisting in tasks such as peak identification in chromatography and spectral analysis. AI-powered models can enhance the efficiency and reliability of analytical processes by monitoring instrument parameters in real-time and make timely adjustments for optimizing performance. Automation of sample preparation steps such as dilution and mixing with AI-powered systems can mitigate human error and improve throughput.

Report Scope of Analytical Instrumentation Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 58.67 Billion |

| Market Size by 2034 |

USD 97.54 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.81% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Technology, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Agilent Technologies, Inc, Avantor, Inc., Bruker Corp., Bio-Rad Laboratories, Inc., Danaher, Eppendorf SE, F. Hoffmann-La Roche AG, Illumina, Inc., Mettler Toledo, PerkinElmer, Inc., Sartorius AG, Shimadzu Corp., Thermo Fisher Scientific, Inc., Waters Corp., Zeiss Group |

Market Dynamics

Driver

Rising Demand Across Various Industries

Analytical instrumentation is widely used in diverse fields for identifying and quantifying substances, studying molecular structure and properties, and for determining chemical and physical properties. Various applications such as in pharmaceutical and biotechnology industries for drug discovery and development and production of biologics, in materials science for product development, in environmental monitoring and testing for industrial wastewater treatment and complying with stringent regulations regarding pollution control as well as in food and beverage industry for ensuing food safety and quality control are driving the demand for advanced analytical instruments.

Restraint

High Costs of Analytical Instruments

Purchase and implementation of costly advanced analytical instruments can be a potential barrier for certain companies and organizations, especially small businesses with limited budgets. Ongoing maintenance and calibration of these instruments as well as requirement of skilled personnel with specialized training for operating them can restrain the market growth. Furthermore, adherence to stringent regulations for analytical instruments used in regulated industries can increase the complexity and costs.

Opportunity

Continuous Technological Improvements and Sustainability Initiatives

Rising demand for high-resolution and high-sensitivity instruments is encouraging manufacturers to develop more accurate and precise analytical instruments such as advanced mass spectrometers for providing deeper insights in clinical proteomics, battery materials and food authenticity. Development of hyphenated techniques such as LC-MS and GC-MS are enabling comprehensive analysis and streamlining workflows. Miniaturization and development of portable analytical instruments is improving accessibility and enabling on-site analysis in different fields such as point-of-care diagnostics and forensic science.

Furthermore, rising environmental concerns are encouraging the development of sustainable analytical practices such as reduced solvent consumption through techniques like microextraction methods and supercritical fluid chromatography (SFC), designing instruments that consume less energy and minimizing waste generation by decreasing reliance on single-use plastics in lab workflows. Specialized instruments are being developed for microplastic detection and analysis.

Segmental Insights

What Made Instruments the Dominant Segment in 2024?

By product, the instruments segment captured the largest market share in 2024. The rising focus on drug discovery, development of innovative therapies and quality control in the pharmaceutical and biotechnology industries, due to rise of personalized medicine, biologics and biosimilars, is creating the demand for advanced analytical instruments. Furthermore, expanding applications in key industries such as food & beverages, environmental testing, chemicals and petrochemicals, among others, is fueling the market growth. Advancements in analytical instruments such as automation, miniaturization, portability, enhanced accuracy and sensitivity, multi-functional platforms are driving their adoption across various sectors.

By product, the software segment is expected to register the fastest growth during the forecast period. Software are crucial component of analytical instruments used for collecting, processing, interpreting and visualizing generated data, further allowing researchers and scientists in academic research, clinical diagnosis and various other industrial applications to gain valuable insights.

Advanced data analytics solutions, cloud-based platforms, and Laboratory Information Management Systems (LIMS) as well as integration of technologies such as AI and Internet-of-Things (IOT) with analytical instruments are automating workflows, reducing manual interventions, facilitating real-time monitoring and data streaming, and supporting informed decision-making, further enhancing overall laboratory efficiency.

Additionally, continuous innovations and improvements in software technology, rising demand for advanced applications, lab-on-a-chip systems, and stringent regulatory requirements are bolstering the market growth of this segment.

How Polymerase Chain Reaction Segment Dominated the Market in 2024?

By technology, the polymerase chain reaction segment dominated the market with the largest share in 2024. Polymerase chain reaction (PCR) is widely used in clinical diagnostics for diagnosing infectious diseases like COVID-19 and tuberculosis, in genetic testing for detection genetic disorders and in prenatal genetic testing as well as in cancer research and diagnosis for detecting cancer cells and supervising gene therapy. Continuous innovations in PCR technologies such as real-time PCR (qPCR), digital PCR (dPCR), development of small and field-deployable PCR devices for on-site molecular testing as well as integration of artificial intelligence (AI) and automation into PCR systems is enhancing the speed, efficiency, sensitivity, specificity and convenience. Expanding applications in various fields such as genomics and proteomics, drug discovery, forensic science, environmental testing and agriculture makes PCR an indispensable tool.

By technology, the sequencing segment is expected to show the fastest growth over the forecast period. Continuous advancements in next-generation sequencing (NGS) technologies, reduced costs of sequencing platforms, rise of personalized medicine and initiatives for conducting large-scale genomic projects are boosting the market growth. Rising incidences of genetic and oncological disorders is creating the demand for accurate and efficient diagnostic tools such as DNA sequencing for disease diagnosis, treatment and prevention.

Increasing demand for non-invasive, NGS-based prenatal testing for early detection of genetic malformations such as cystic fibrosis, Down syndrome and sickle cell anemia as well as development of cell-free DNA sequencing kits for identifying chromosomal abnormalities in early pregnancy are contributing to the market growth. Rising trend of consumer genomics, expanding applications of genomic technologies in biomedical field like clinical research and drug discovery, and increasing investments by companies for developing advanced analytical instruments like sequencers are expanding the market potential.

Why Did the Life Sciences Research & Development Segment Dominate in 2024?

By application, the life sciences research & development segment generated the highest revenue share in 2024. Sophisticated analytical instruments are widely used in life sciences research & development for accelerating complex drug discovery and development process which include biologics such as cell and gene therapies, monoclonal antibodies and therapeutic proteins. Advancements in genomics and proteomics with the adoption of next-generation sequencing (NGS) technologies, mass spectrometry and gene editing technologies like CRISPR-Cas9 are contributing to the market growth. Increased investments by private organizations, pharmaceutical companies and governments into biomedical research are creating the need for cutting-edge analytical instruments.

By application, the clinical & diagnostic analysis segment is expected to expand rapidly during the predicted timeframe. Escalating healthcare demands due to rising burden of chronic and infectious diseases is creating the demand for analytical instruments for accurate and timely detection of disease biomarkers, genetic predispositions and pathogens, further enabling early diagnosis and effective treatment. Improved diagnostic capabilities with continuous innovation in analytical technologies such as molecular diagnostic methods like PCR and NGS, advanced MS techniques, automation and robotics, point-of-care (POC) testing are fuelling the market growth.

Regional Insights

What Drives North America’s Dominance in the Analytical Instrumentation Market?

North America dominated the analytical instrumentation market with the largest share in 2024. Rising complexity of biologics, cell and gene therapies, focus on drug discovery, improving disease diagnosis and patient monitoring has potentially increased research and development activities in the pharmaceutical and biotechnology sectors, driving the demand for advanced analytical instrumentation to ensure accuracy and reliability of analysis. Stringent regulations imposed by governments in North America, especially for food safety are necessitating the use of analytical instruments for contaminant detection and quality control. Supportive government initiatives, innovative product launches, and growing emphasis on data-driven decision-making using sophisticated analytical tools are driving the market dominance of this region.

What Fuel Expansion of the Analytical Instrumentation Market in Asia Pacific?

Asia Pacific is anticipated to register the fastest growth in the market over the forecast period. The market growth can be linked to the rapid urbanization and industrialization in countries like China, Japan, India and South Korea driving the demand for analytical instruments across different industries, including pharmaceuticals and biotechnology, electronics and materials science, chemicals and petrochemicals, among others. Rising disease burden in rapidly growing populations as well as increasing investments in advancing healthcare infrastructure such as hospitals, research institutions and diagnostic laboratories is creating huge demand for advanced analytical instruments for clinical diagnostics, disease detection, R&D to improve patient care.

Growing awareness regarding environmental pollution and strict policies implemented by governments in the region is necessitating the use of analytical instruments for environmental monitoring and testing. Moreover, automation of industrial processes, government initiatives, emergence of local manufacturers and rising demand for high-quality products from consumers are the factors fuelling the market expansion.

Some of the Prominent Players in the Analytical Instrumentation Market

- Agilent Technologies, Inc

- Avantor, Inc.

- Bruker Corp.

- Bio-Rad Laboratories, Inc.

- Danaher

- Eppendorf SE

- F. Hoffmann-La Roche AG

- Illumina, Inc.

- Mettler Toledo

- PerkinElmer, Inc.

- Sartorius AG

- Shimadzu Corp.

- Thermo Fisher Scientific, Inc.

- Waters Corp.

- Zeiss Group

Analytical Instrumentation Market Recent Developments

- In May 2025, Thermo Fisher Scientific Inc., introduced its spectral-enabled Invitrogen Attune Xenith Flow Cytometer which offers enhanced speed, reliability and versatility to labs. The flow cytometer contains multiple innovative features such as high-speed acoustic technology, clog-resistant design, longer uptime and higher parametric analysis, further allowing immunology and immune-oncology researchers to automate and streamline their workflows for obtaining comprehensive and accurate insights from critical cellular samples.

- In March 2025, BrightSpec, a leading provider of molecular rotational resonance (MRR) spectroscopy, launched its BrightSpec-MRR product suite at PittCon 2025. Brightspec’s groundbreaking product line is the world’s first commercial MRR platform and includes three instruments: the spectraMRR, isoMRR, and nanoMRR.

- In December 2024, Roche launched its cobas Mass Spec solution including the cobas i 601 analyser and the first Ionify reagent pack of four assays for steroid hormones, after receiving the Conformite Europeenne (CE) mark approval, further bringing mass spectrometry diagnostics to the routine clinical laboratories worldwide. The cobas Mass Spec solution launch rolls out a menu offering more than 60 analytes for testing of vitamin D metabolites, immunosuppressant drugs (ISD), steroid hormones, therapeutic drug monitoring (TDM) and drugs of abuse testing (DAT).

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the global Analytical Instrumentation market.

By Product

- Instruments

- Services

- Software

By Technology

- Polymerase Chain Reaction

- Spectroscopy

- Microscopy

- Chromatography

- Flow Cytometry

- Sequencing

- Microarray

- Others

By Application

- Life Sciences Research & Development

- Clinical & Diagnostic Analysis

- Food & Beverage Analysis

- Forensic Analysis

- Environmental Testing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)