Animal Biotechnology Market Size and Growth Analysis Report 2026 to 2035

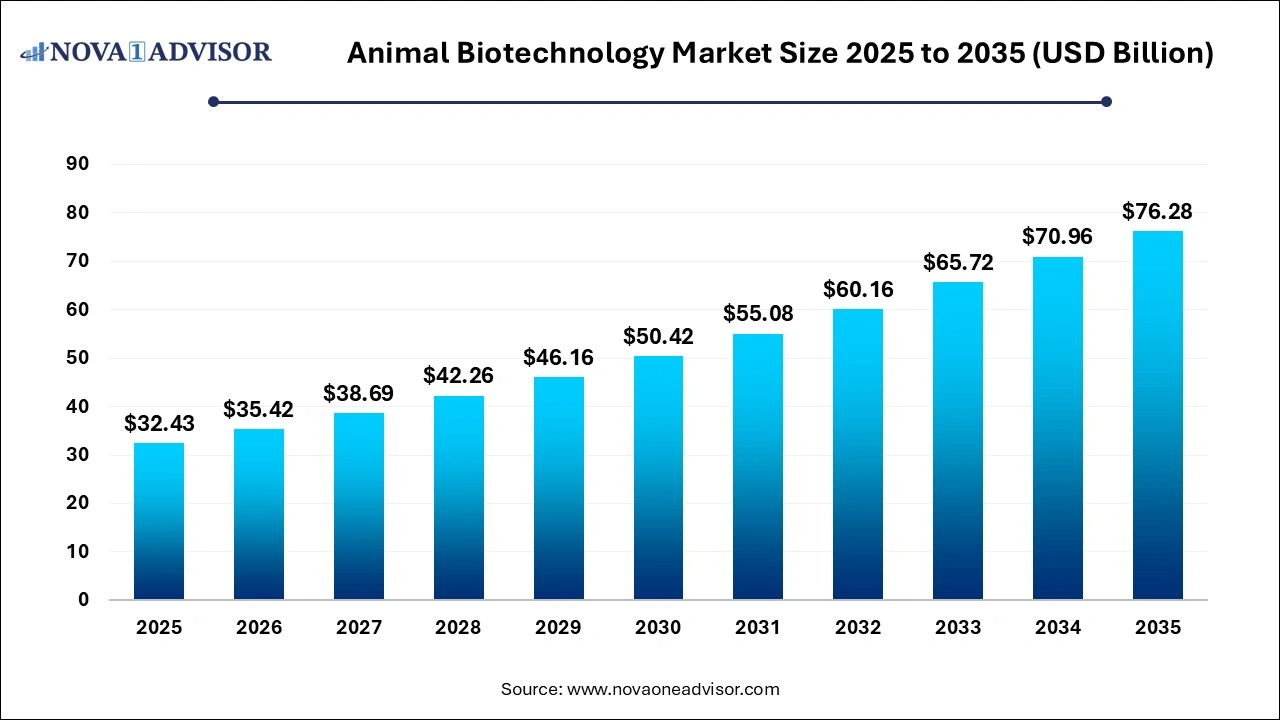

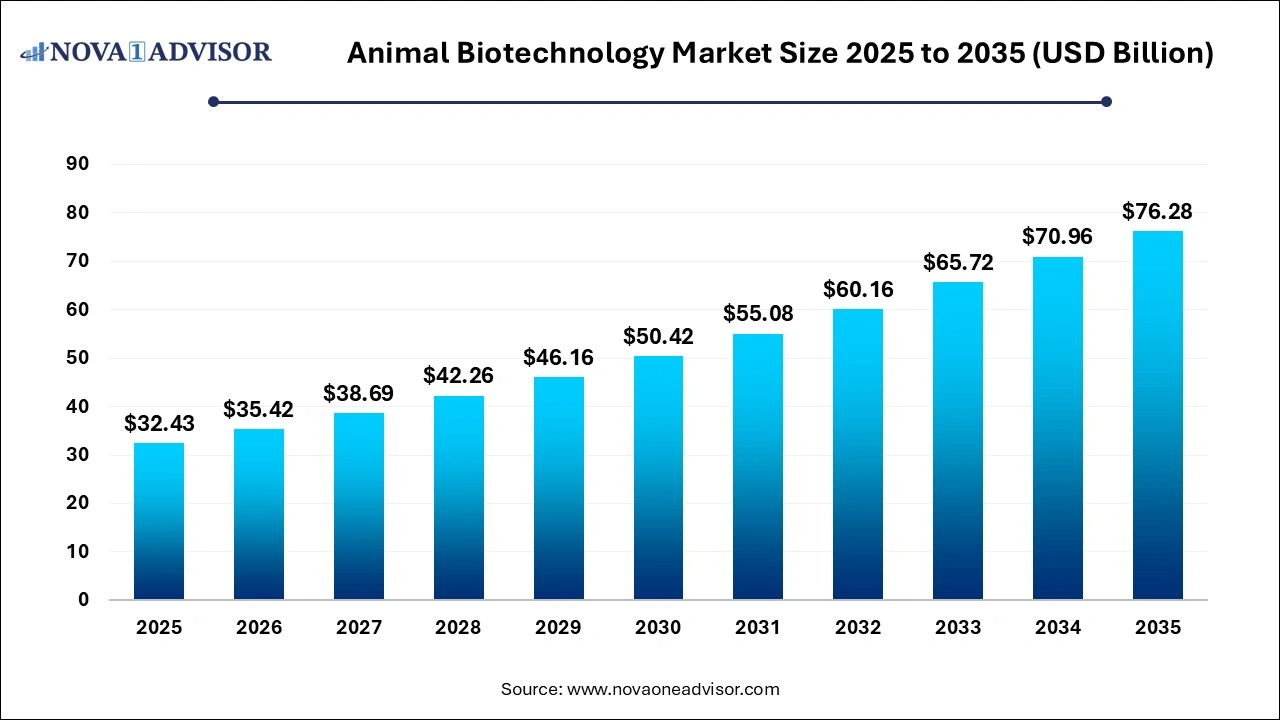

The global animal biotechnology market size was valued at USD 32.43 billion in 2026 and is anticipated to reach around USD 76.28 billion by 2035, growing at a CAGR of 8.93% from 2026 to 2035.

Animal Biotechnology Market Key Takeaways

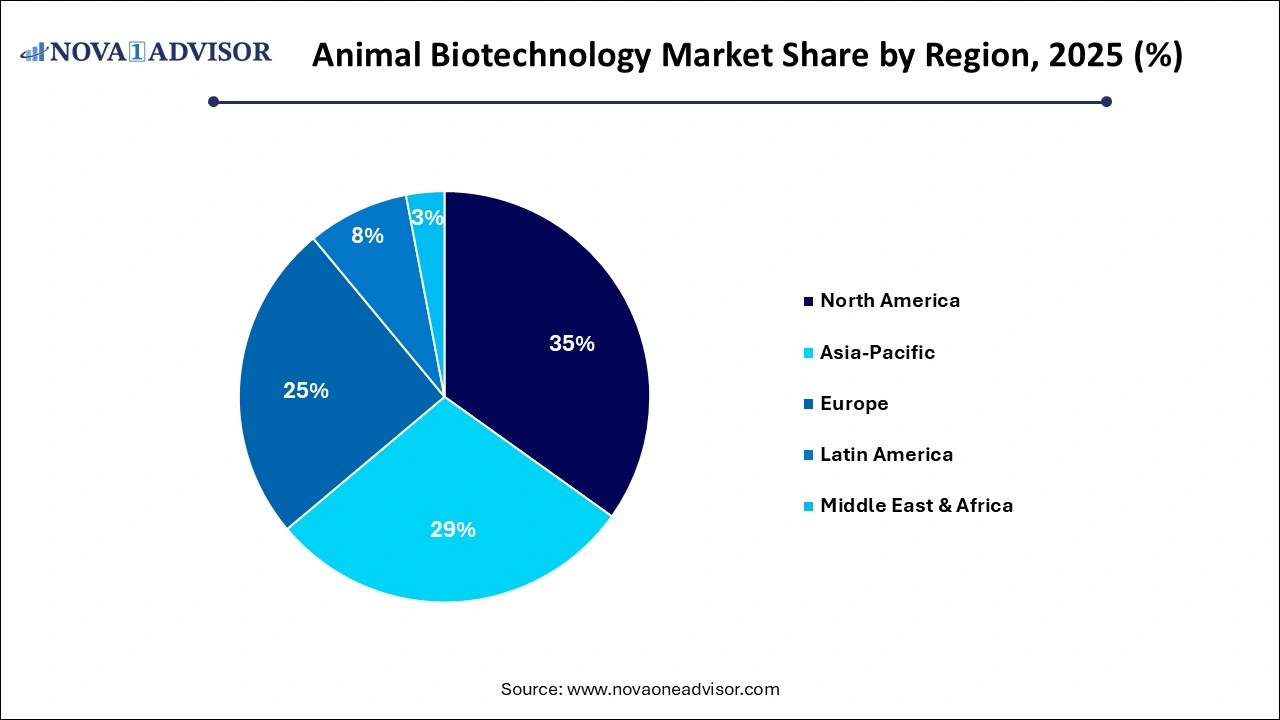

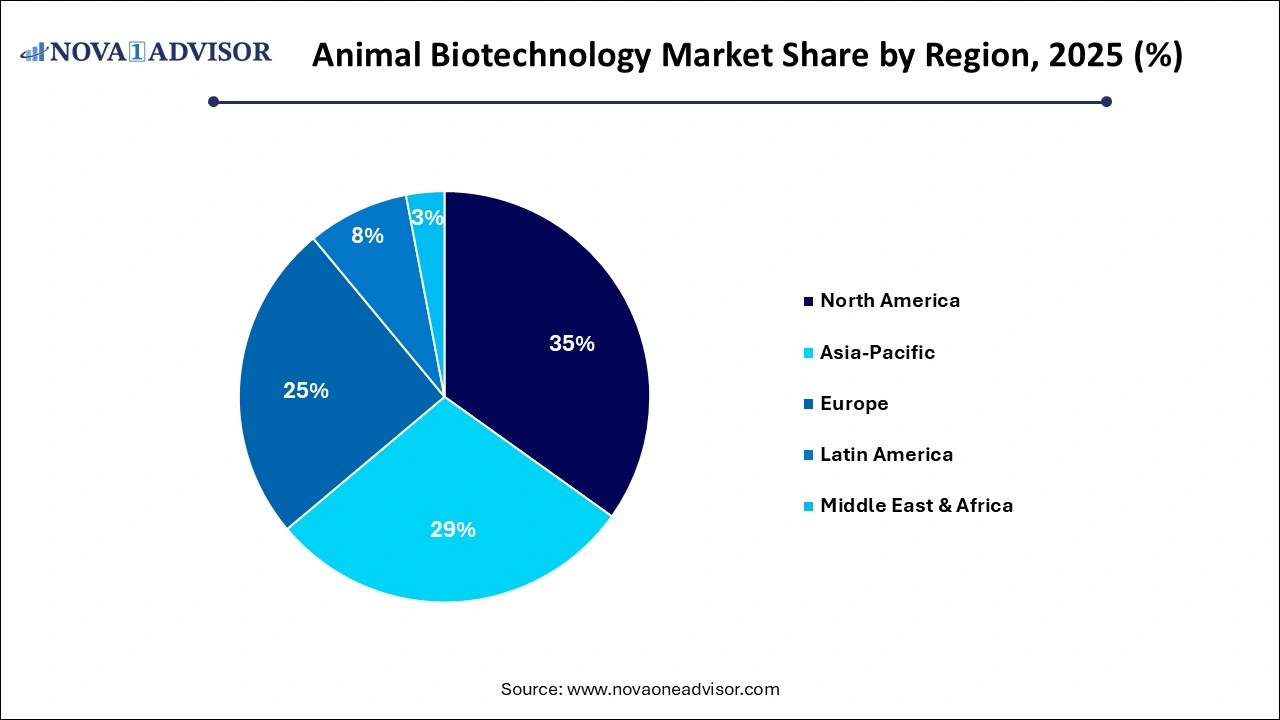

- North America dominated in the animal biotechnology market with the largest market share of 34.87% in 2025.

- Asia Pacific is observed to be the fastest growing in the animal biotechnology market during the forecast period.

- The vaccines segment held the largest revenue share of over 28.68% in 2025.

- The diagnostics tests segment is anticipated to witness exponential growth throughout the forecast period.

- The preventive care of animals segment held the largest revenue share of over 28.45% in 2025.

- The drug development application is anticipated to witness exponential growth throughout the forecast period.

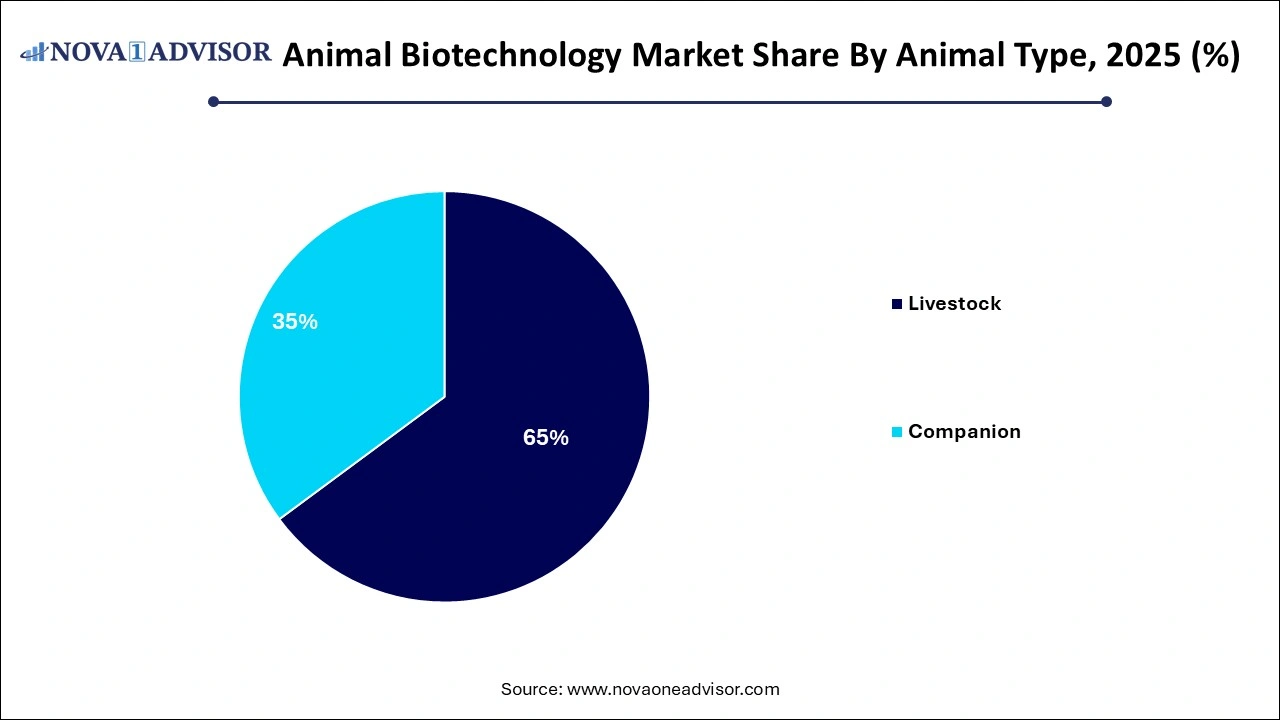

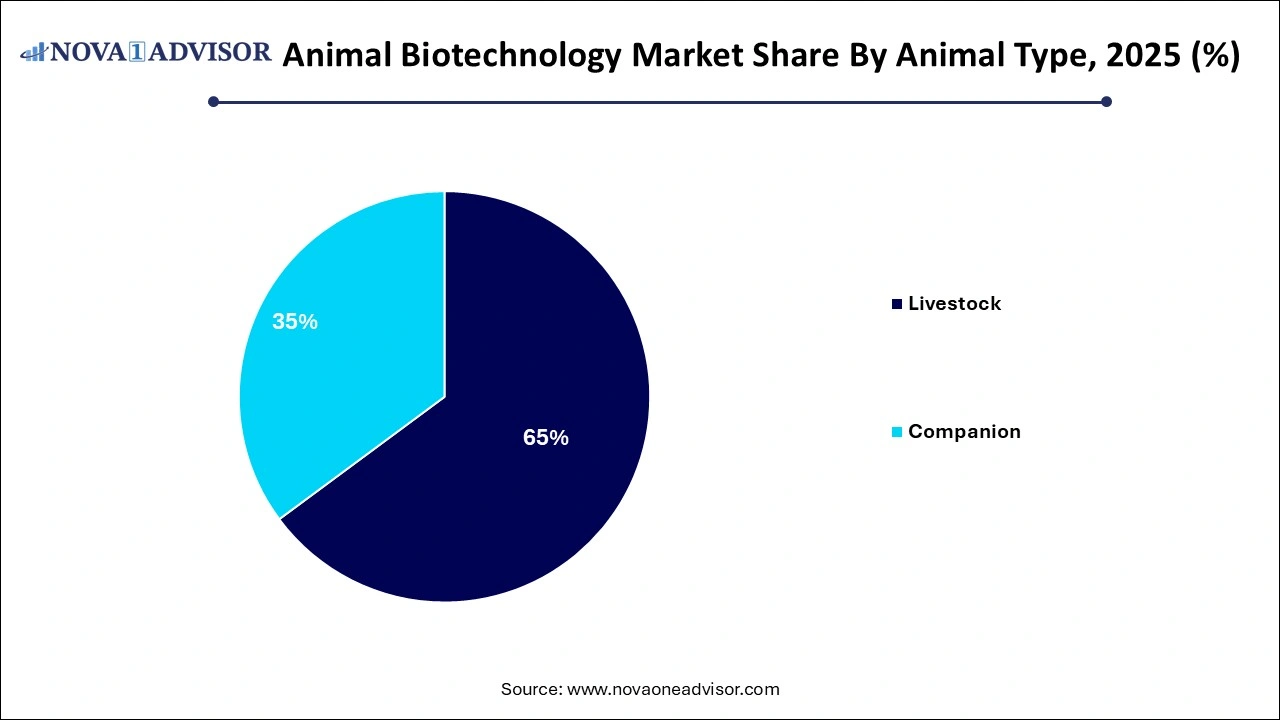

- The livestock segment held the largest share of over 64.86% in 2025.

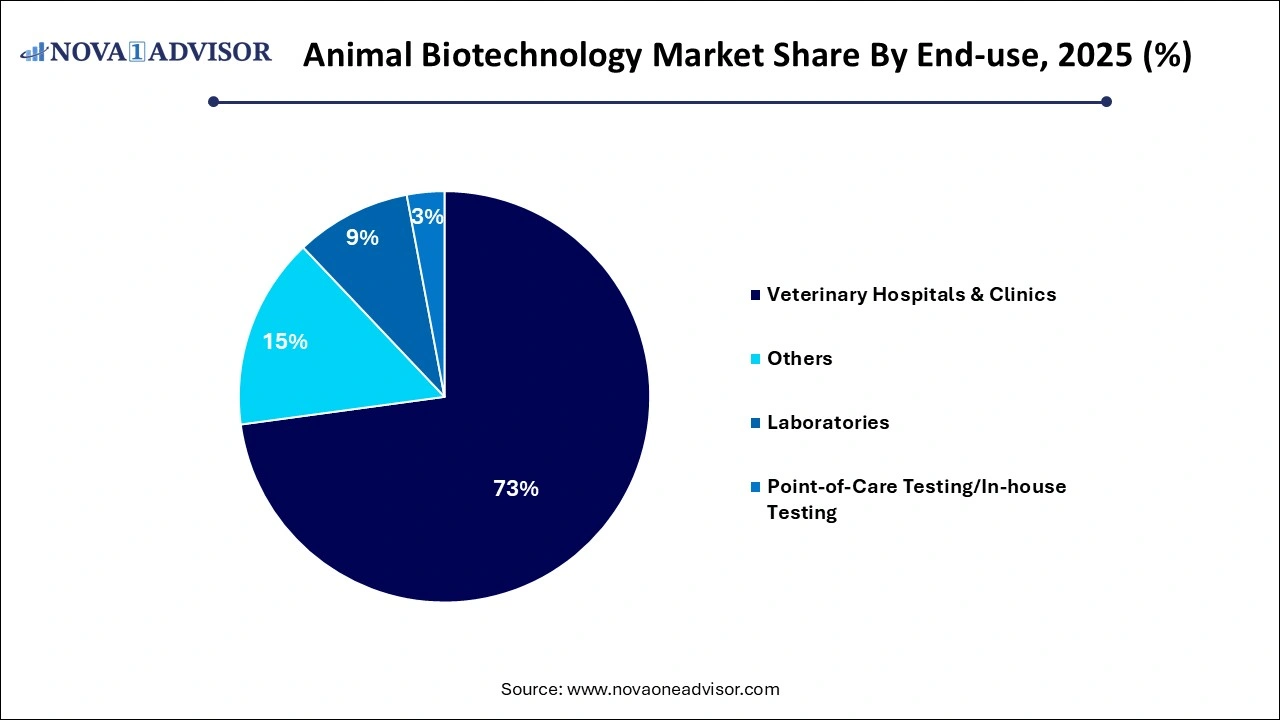

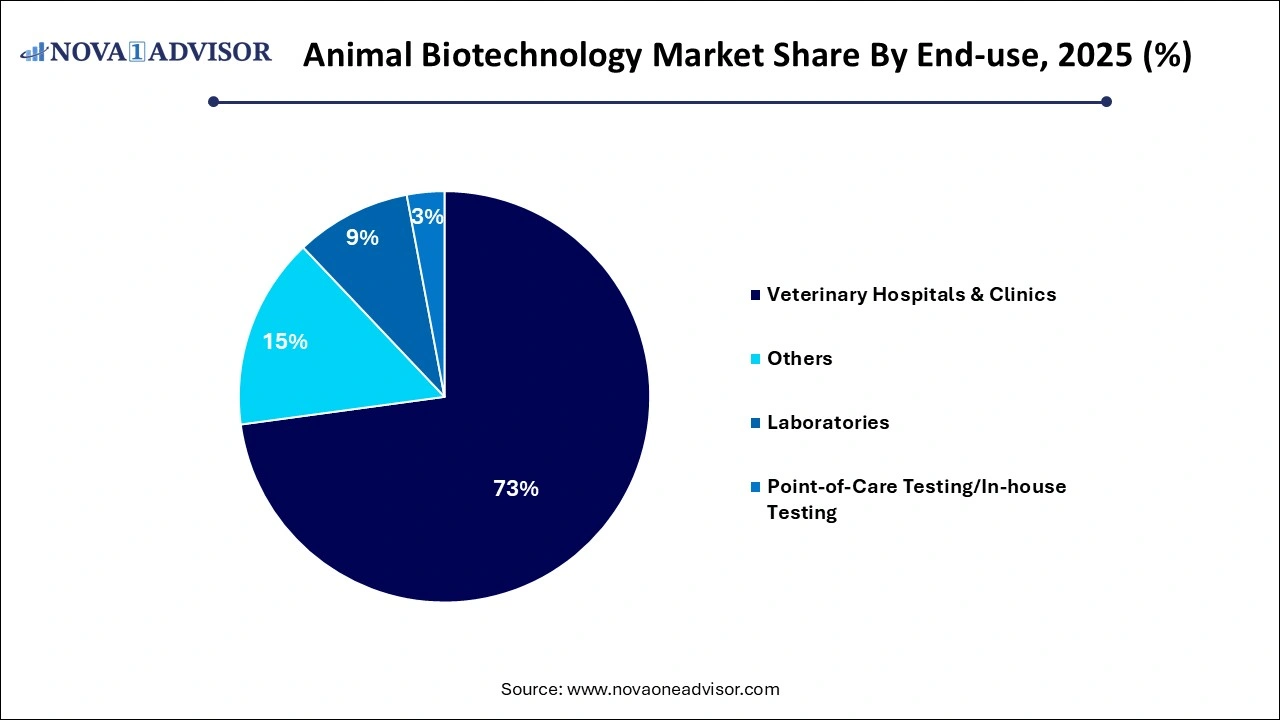

- The veterinary hospitals and clinics segment held the largest revenue share of over 72.85% in 2025 and is anticipated to continue leading the market over the forecast period.

Animal Biotechnology Market Overview

Molecular biology methods are applied in animal biotechnology to genetically alter animals or change their genomes to make them more suitable for industrial, medicinal, or agricultural use. Recent developments in gene expression, metabolic cell profiling, and animal genome sequencing have made animal biotechnology advances more uncomplicated. Recent advancements in genome editing technologies, such as Zinc Finger Nucleases, TALENS, and CRISPR-Cas systems, have made generating animal genetic changes that enhance agricultural productivity, health and well-being, and disease resistance easier.

Animal Biotechnology Market Trends

- The ICAR-National Research Centre on Equines (NRC) in Haryana is the organization that created the animal COVID-19 vaccine, Anocovax. An animal vaccination against SARS-CoV-2 Delta (COVID-19) called Anocovax is inactivated. Both the Delta and Omicron strains of SARS-CoV-2 are neutralized by the immunity brought on by Anocovax.

- In October 2023, The Central Drugs Standard Control Organization, India's US Food and Drug Administration equivalent, approved NexCAR19 as the country's first CAR-T cell therapy.

- In May 2023, by using genome editing to modify animal genomes, the U.S. Food and Drug Administration and the National Institute of Standards and Technology (NIST) announced a collaborative project that will serve as a valuable new resource for scientists and businesses developing cutting-edge animal biotechnology products. The FDA is working to advance the creation of safe and helpful biotechnology products, and this project is one of those efforts.

Animal Biotechnology Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 35.42 Billion |

| Market Size by 2035 |

USD 76.28 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 8.93% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product, By Animal Type, By Application, By End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Merck & Co., Inc., Virbac, Elanco, Idexx Laboratories, NXGN Management, LLC, Heska Corporation, Zoetis, Boehringer Ingelheim International GmbH, Biogénesis Bagó, Indian Immunologicals Ltd., HESTER BIOSCIENCES LIMITED, Kareo, Inc., and Others. |

Animal Biotechnology Market Dynamics

Drivers

Rising need to develop genetically modified therapeutic proteins

Therapeutic proteins can replace an aberrant or insufficient protein in each condition. Moreover, they can increase the body's supply of healthy protein to lessen the effects of chemotherapy and illness. Proteins that have been genetically modified can be made to resemble better the natural proteins they are meant to replace, or they can be made to function longer by including sugars or other compounds.

Among the macromolecular therapeutic proteins are cytokines, IFNs, and monoclonal antibodies. CYP enzymes are not suitable substrates for proteins. Generally, they are eliminated through renal filtration or broken down into smaller peptides or amino acids in various tissues by phagocytic cells that circulate or target antigen-containing cells. This is what fuels the expansion. This drives the growth of the animal biotechnology market.

Application in cancer treatment

Cancer is a hotspot for medical research because it has historically been the subject of global human interest. Researchers utilize animals in their studies to learn more about the mechanisms underlying cancer, including tumor growth and dissemination, and to create novel approaches to diagnosing, treating, and preventing the illness. Mice whose tumors can resemble those of human cancer patients are the primary tool used in research at the ICR. Research on cancer in mice replicates the intricate processes involved in tumor growth and metastasis in humans.

Animal models can be used for gene therapy research, cancer treatment screening, and the biochemical and physiological mechanisms of cancer incidence and progression in objects.

Restraint

High development costs pose challenge for small players

The development of biotechnology solutions necessitates pricey cutting-edge equipment and knowledge. Small businesses frequently lack the funding essential to invest in the cutting-edge labs, and knowledgeable staff required for creative R&D. Small players must negotiate a complicated web of national, international, and local laws, each with specific criteria for compliance. Because businesses frequently need to pay regulatory specialists or consultants to manage this process, this increases the financial burden. This limits the growth of the animal biotechnology market.

Opportunity

Growing awareness regarding animal health and welfare

Animal welfare, as defined by the Farm Animal Welfare Council (FAWC), concerns the physical and emotional health of animals. Another name for it is the "quality of life" of an animal. Legally speaking, a person's need to assume responsibility for and care for animals protects animal welfare.

Even in the most developed nations today, there is still a noticeable lack of dedication to animal care, primarily due to a lack of public knowledge and responsibility for pet ownership. Since the Internet and the media are so widely accessible, information regarding unresolved pet-related queries is easily obtainable. As a result, a veterinarian's job is more comprehensive, mainly when he provides his patients with information that helps them understand their condition and prevents misunderstandings.

Animal Biotechnology Market Segment Insights

By Product Type Insights

The vaccines segment held the largest revenue share of over 28.68% in 2025. The growth of the vaccine segment is primarily attributed to the increasing burden of animal infections. These infections are naturally transmitted from animals to humans owing to contaminated food and water consumption or direct communication with infected humans or animals. Vaccination is an effective way to lower the disease burden in animals, and it plays an important role in preventive healthcare and disease control. Additionally, the increase in vaccine introductions for animals by the key market players is projected to drive the segment. In December 2023, Indian Immunologicals Ltd. introduced Goat Pox Vaccine (Raksha Goat Pox). Likewise, in May 2023, Boehringer Ingelheim India released its poultry vaccine VAXXITEK HVT+IBD. Such launches will lead to the increased adoption of vaccines, fueling segment growth.

The diagnostics tests segment is anticipated to witness exponential growth throughout the forecast period. The growth in this segment is attributed to factors, such as growing animal health expenditure, rising incidence of zoonotic diseases, increase in the number of veterinary practitioners, and increasing disposable income levels in developing territories. Besides, the overall market is determined by deeply understanding the demand for these products from veterinary hospitals, clinics, labs, etc., and increasing R&D investments from industry players. In August 2021, INDICAL BIOSCIENCE GmbH acquired the Check-Points, Dutch R&D-focused corporation. INDICAL is a global leader in the advancement of complete solutions for molecular and immunological veterinary testing.

By Application Insights

The preventive care of animals segment held the largest revenue share of over 28.45% in 2025 due to the growing adoption of companion animals. The advent of pet parents as part of the pet humanization trend is a key revenue-generating trend in the market. Besides, an international survey by HABRI and Zoetis indicates a direct relationship between the human-animal bond and consistent veterinary care. The study including participants from the U.S., France, the U.K., Spain, Germany, Japan, Brazil, and China showed a clear global phenomenon of the improved bond between humans and pets, with 95% of respondents stating that they consider their pets to be a part of the family. Thus, such a human-animal bond advances better preventive care.

The drug development application is anticipated to witness exponential growth throughout the forecast period. Leveraging the monoclonal antibodies in animal health generated great potential to address unmet needs. For instance, in September 2023, Boehringer Ingelheim and Invetx announced that they have entered a collaboration agreement to develop innovative, species-specific monoclonal antibody biotherapeutics targeting a broad range of infections in the veterinary species, primarily focused on dogs and cats. This partnership will address Boehringer Ingelheim’s commitment to delivering unmet needs in the rapidly growing animal health biotechnology market.

By Animal Type Insights

The livestock segment held the largest share of over 64.86% in 2025. Livestock is becoming increasingly vital in the growth of agriculture in developing nations. The contributions made by livestock to both agriculture and gross domestic product have risen in various nations. The demand for livestock products is a function of income in different parts of the world. The growing urban population and changes in diet and lifestyle are promoting growth in livestock production, thus contributing to the segment growth. Furthermore, government initiatives undertaken for livestock vaccinations promote market growth.

For instance, in June 2025, Indonesia launched a countrywide livestock vaccination program as the number of cattle affected with foot and mouth disease surged to more than 151,000. In the livestock segment, cattle held the largest revenue share in 2025. The U.S. is home to about 100.8 million cattle and calves as of 2022. The companion animal type segment is likely to grow lucratively during the forecast period owing to an increase in the demand for efficient animal care and the pet-human bond owing to the associated health benefits. Banfield Pet Hospital, in January 2023, confirmed a huge boom in U.S. pet ownership, thus supporting the segment growth.

By End-use Insights

The veterinary hospitals and clinics segment held the largest revenue share of over 72.85% in 2025 and is anticipated to continue leading the market over the forecast period. The availability of a wide range of treatment and diagnostic options in veterinary hospitals and clinics is a high-impact rendering growth driver for this segment. An increase in the incidence of zoonotic diseases caused by globalization and climate change is expected to drive the demand for diagnostic procedures, which is expected to drive the point-of-care testing/in-house testing segment in the coming years.

The others segment is expected to witness the fastest growth over the forecast period. Veterinary research institutes and universities are expected to grow at a lucrative rate over the forecast period. This can be attributed to the growing R&D funding to develop advanced diagnostic tools and therapeutically advanced vaccines and medicines. Research institutes are primarily responsible for the development of these diagnostics.

The others segment is expected to witness the fastest growth over the forecast period. Veterinary research institutes and universities are expected to grow at a lucrative rate over the forecast period. This can be attributed to the growing R&D funding to develop advanced diagnostic tools and therapeutically advanced vaccines and medicines. Research institutes are primarily responsible for the development of these diagnostics.

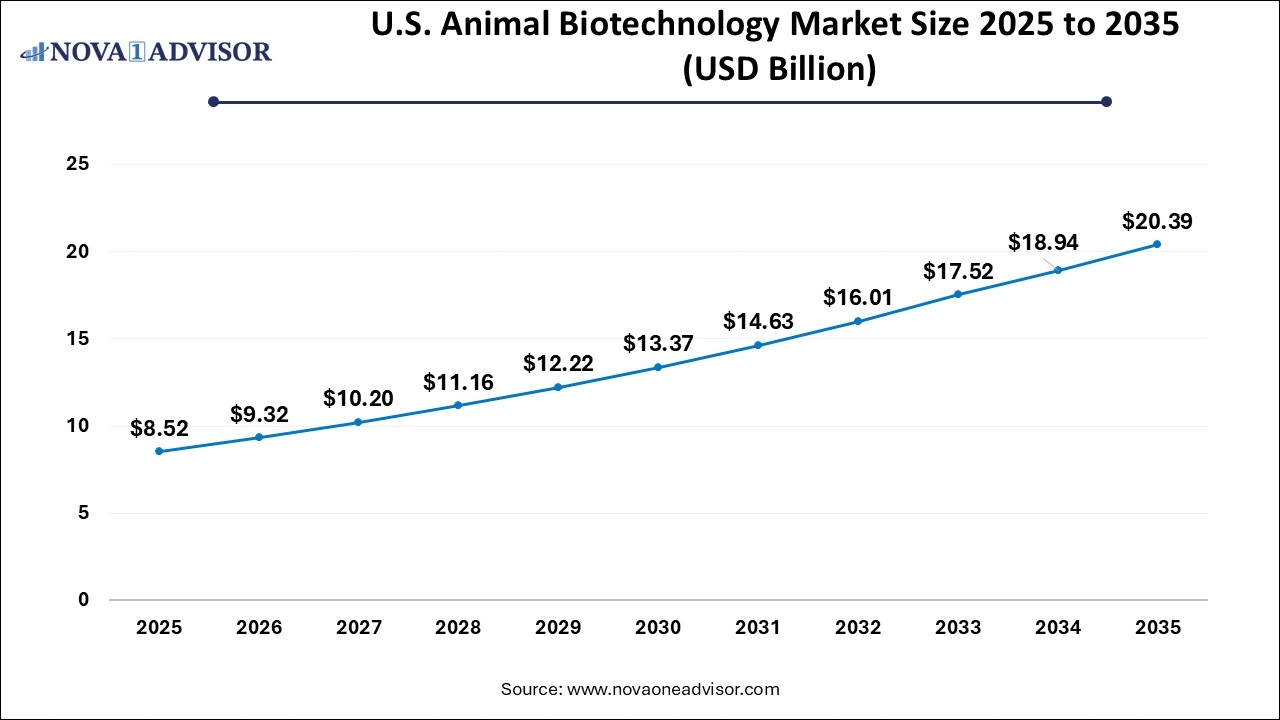

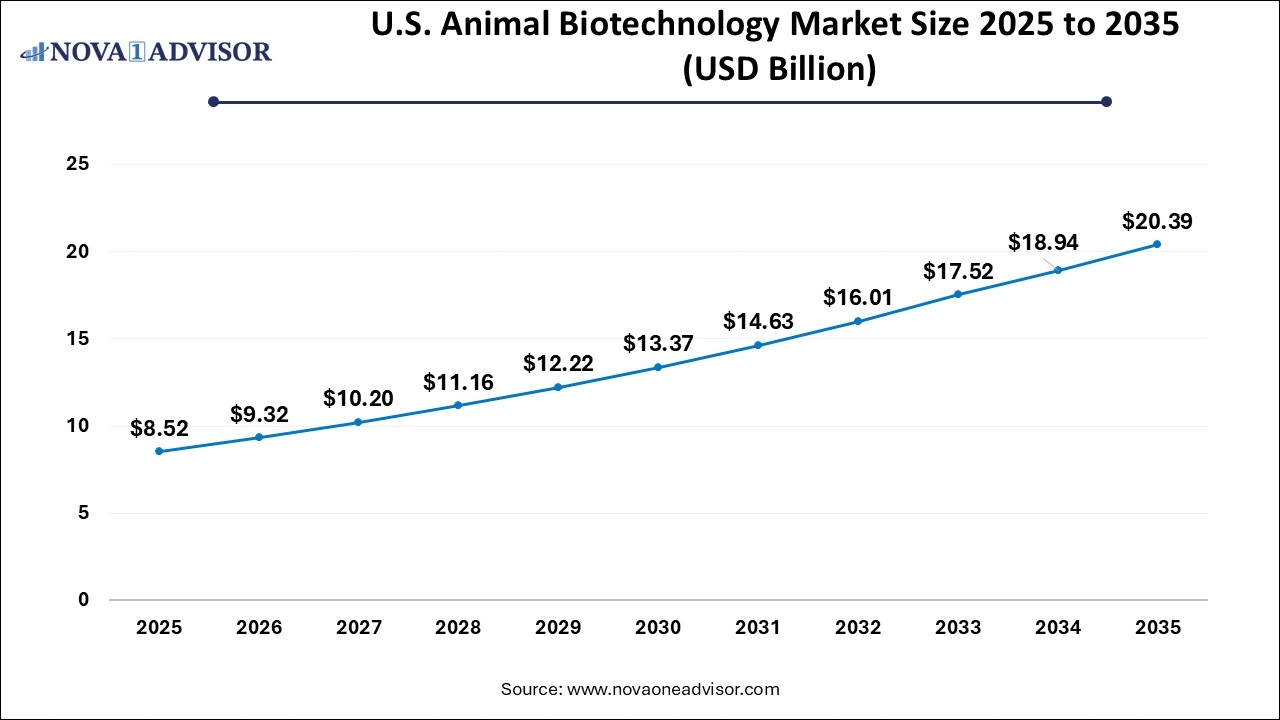

U.S. Animal Biotechnology Market Size and Growth 2026 to 2035

The U.S. animal biotechnology market size was exhibited at USD 32.43 billion in 2025 and is projected to be worth around USD 76.28 billion by 2035, poised to grow at a CAGR of 9.12% from 2026 to 2035.

North America dominated in the animal biotechnology market in 2024. The United States Food and Drug Administration (FDA) and the Canadian Food Inspection Agency (CFIA) are two examples of established regulatory bodies in North America that offer precise standards and frameworks for developing and approving biotechnological goods. These organizations guarantee goods' efficacy and safety, promoting customer confidence and market access. Rigorous intellectual property regulations well protect biotechnological innovations in the United States and Canada. This instills confidence in businesses to engage in R&D since they know their innovations will be protected from unlawful usage.

- In September 2023, The U.S. Food and Drug Administration has announced new measures to improve regulatory flexibility, predictability, and efficiency. These measures will further modernize its methodology for assessing and assisting in developing cutting-edge animal and veterinary products.

Asia-Pacific is observed to be the fastest-growing in the animal biotechnology market during the forecast period. Increasing disposable incomes result from the rapid economic expansion of Southeast Asian, Indian, and Chinese nations. This, in turn, fuels the demand for premium animal products and cutting-edge veterinary care. Biotechnological advancements find fertile ground as farming and animal husbandry operations become more advanced and efficient due to the growing urban population.

Anand Srivastava of the National Institute of Animal Biotechnology (NIAB) and his colleagues used a computational biology method to build a multi-epitope protein, a collection of numerous tiny peptides combined into a single continuous protein fragment, as a potential LSD virus vaccine.

Animal Biotechnology Market Top Key Companies:

- Merck & Co., Inc.

- Virbac

- Elanco

- Idexx Laboratories

- NXGN Management, LLC

- Heska Corporation

- Zoetis

- Boehringer Ingelheim International GmbH

- Biogénesis Bagó

- Indian Immunologicals Ltd.

- HESTER BIOSCIENCES LIMITED

- Kareo, Inc.

Animal Biotechnology Market Recent Developments

- In December 2023, Indian Immunologicals Limited (IIL), a reputable biotechnology company in India committed to producing vaccinations that save lives, has started building its state-of-the-art Greenfield veterinary vaccine facility. The new facility will feature a Fill-Finish capability to make both the FMD and the FMD+HS vaccines and a BSL3 facility for manufacturing pharmacological compounds.

- In April 2022, Pharmaceutical company Cadila Pharmaceuticals produced the first-ever innovative three-dose rabies vaccine. As per the company's press release, the 'ThRabis' vaccine is a three-dose regimen administered over just one week. It is a G protein vaccine that is recombinant nanoparticle-based and manufactured utilizing Virus-like Particle technology.

- In March 2022, Hester Biosciences Limited, India's second-largest poultry vaccine manufacturer, plans to enter the pet care market by April 2022. The Ahmedabad-based business, specializing in animal health and vaccinations, is seeking to expand its pet care line to include dermatology, nutrition, grooming, anti-infective, and specialist items.

Animal Biotechnology Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the Animal Biotechnology market.

By Product

- Diagnostics Tests

- Vaccines

- Drugs

- Reproductive and Genetic

- Feed Additives

By Animal Type

- Companion

- Livestock

- Poultry

- Swine

- Cattle

- Sheep & Goats

- Fish

By Application

- Diagnosis of Animal Diseases

- Treatment of Animal Diseases

- Preventive Care of Animals

- Drug Development

- Others

By End-use

- Laboratories

- Point-of-Care Testing/In-house Testing

- Veterinary Hospitals & Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

The others segment is expected to witness the fastest growth over the forecast period. Veterinary research institutes and universities are expected to grow at a lucrative rate over the forecast period. This can be attributed to the growing R&D funding to develop advanced diagnostic tools and therapeutically advanced vaccines and medicines. Research institutes are primarily responsible for the development of these diagnostics.

The others segment is expected to witness the fastest growth over the forecast period. Veterinary research institutes and universities are expected to grow at a lucrative rate over the forecast period. This can be attributed to the growing R&D funding to develop advanced diagnostic tools and therapeutically advanced vaccines and medicines. Research institutes are primarily responsible for the development of these diagnostics.