Animal Gelatin Capsules Market Size Trends Analysis and Forecast till 2034

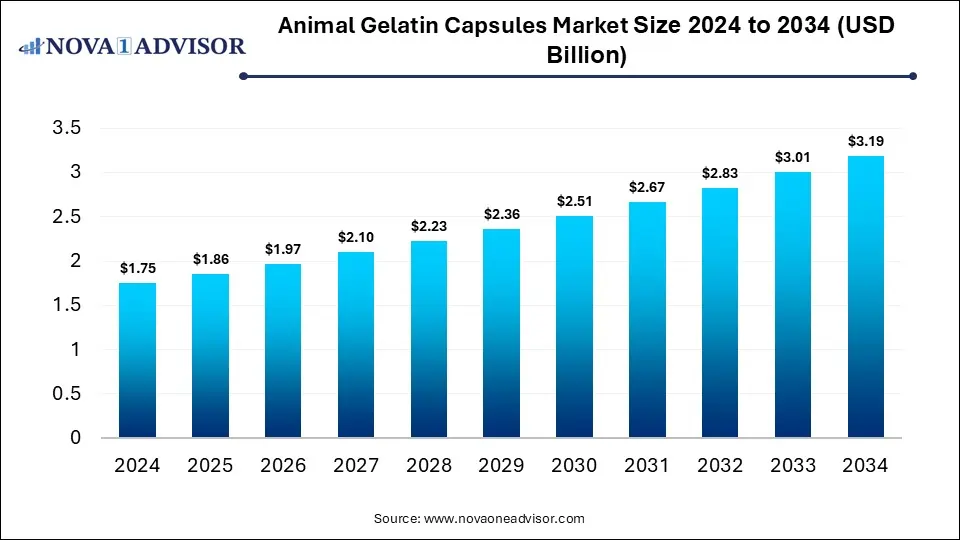

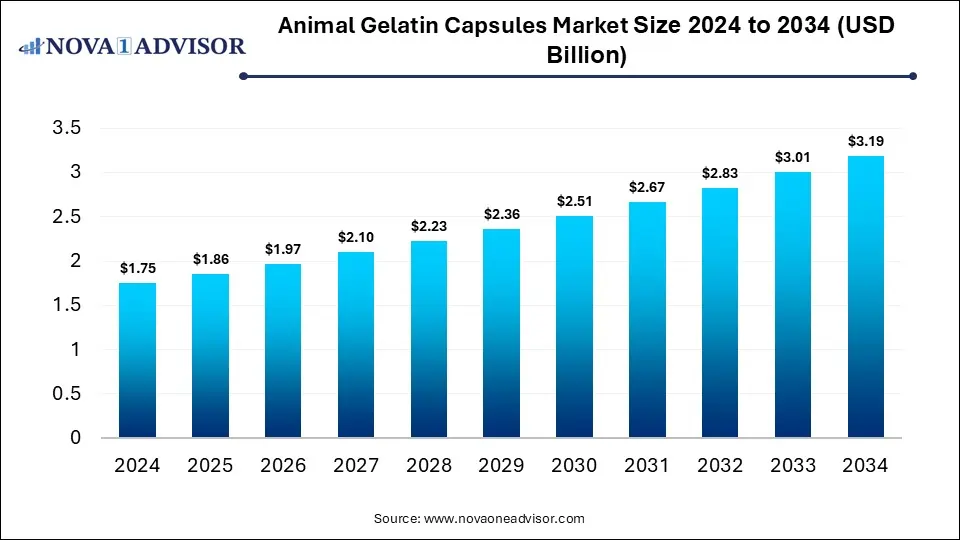

The global animal gelatin capsules market size was estimated at USD 1.75 billion in 2024 and is expected to reach USD 3.19 billion in 2034, expanding at a CAGR of 6.2% during the forecast period of 2025 and 2034. The rising demand from pharmaceutical and nutraceutical sectors for convenient delivery systems, increasing consumer interest in health, wellness, and preventive healthcare, and the growing ageing population needing easier‑to‑swallow dosage forms are driving market growth. Improvements in capsule technology, which enhance product performance, also support market expansion.

Animal Gelatin Capsules Market Key Takeaways

- By region, North America held the largest share of the animal gelatin capsules market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By capsule type, the hard gelatin capsules segment led the market in 2024.

- By capsule type, the soft gelatin capsules segment is expected to expand at the highest CAGR over the projected timeframe.

- By source of gelatin, the bovine gelatin segment led the market in 2024.

- By source of gelatin, the fish gelatin segment is expected to expand at the highest CAGR over the projection period.

- By functionality, the immediate-release capsules segment led the market in 2024.

- By application, the pharmaceuticals segment held the dominant share in 2024.

- By end use, the pharmaceutical companies segment led the market in 2024.

- By distribution channel, the B2B sales segment is dominant with the largset market share in 2024.

Impact of AI on the Animal Gelatin Capsules Market

AI is significantly impacting the animal gelatin capsules market by streamlining manufacturing processes, enhancing quality control, and optimizing supply chain operations. AI-driven systems help in predictive maintenance of capsule-filling machinery and ensure consistent capsule weight and sealing, reducing human error and waste. In R&D, AI is accelerating formulation development by analyzing ingredient compatibility and bioavailability more efficiently. Additionally, AI-powered analytics are being used by companies to better understand consumer trends and customize capsule offerings based on regional demand. Overall, AI is boosting efficiency, product quality, and responsiveness across the gelatin capsule value chain.

Market Overview

The animal gelatin capsules market refers to the global industry involved in the production and distribution of capsules made from gelatin derived from animal sources, primarily used for encapsulating drugs, supplements, and other bioactive ingredients. These capsules are favored for their high bioavailability, rapid dissolution, and ease of swallowing, making them ideal for pharmaceutical, nutraceutical, and even some cosmetic applications. Key growth factors driving the market include rising demand for dietary supplements, increasing geriatric population, and the expanding pharmaceutical sector, especially in developing economies. In addition, advancements in encapsulation technologies and customized capsule solutions are further boosting adoption.

- RAPISOL is a fast-release gelatin offered by GELITA, designed for the rapid dissolution of the capsule shell to ensure quick and reliable release of active ingredients.

What are the Major Trends in the Animal Gelatin Capsules Market?

- Rise in Demand for Nutraceuticals

The increasing consumer focus on preventive healthcare and wellness is driving the demand for vitamins, supplements, and herbal products encapsulated in animal gelatin capsules. This trend is particularly strong among ageing populations and fitness-conscious consumers.

- Technological Advancements in Capsule Manufacturing

Innovations like liquid-fill hard capsules, improved sealing techniques, and multi-phase release systems are enhancing the functionality of gelatin capsules. These advances support higher drug stability, better bioavailability, and customized dosage forms.

- Expansion in Emerging Markets

Countries in Asia-Pacific, Latin America, and the Middle East are witnessing increased pharmaceutical production and consumption, creating a robust market for animal-based gelatin capsules. Factors such as population growth, rising healthcare access, and local manufacturing are accelerating this trend.

- Sustainability and Ethical Sourcing Pressures

Consumers and regulators are increasingly scrutinizing the animal origin and environmental impact of gelatin. This is pushing manufacturers toward transparent sourcing, better waste management, and even hybrid approaches that combine animal and plant-based materials.

- Customization and Specialty Capsule Demand

There is a growing demand for customized gelatin capsules, including flavored, colored, or branded variants for marketing differentiation and improved consumer experience. This trend is especially prominent in the nutraceutical and functional food segments.

Report Scope of Animal Gelatin Capsules Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.86 Billion |

| Market Size by 2034 |

USD 3.19 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Capsule Type, By Source of Gelatin, By Functionality, By Application, By End User, By Distribution Channel, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Expansion of the Pharmaceutical Industry

The rapid expansion of the pharmaceutical industry increases the demand for efficient and reliable drug delivery systems. With the rise in production of generic drugs, over-the-counter medications, and specialty pharmaceuticals, animal gelatin capsules are favored for their high bioavailability and ease of swallowing. Pharmaceutical companies are increasingly adopting gelatin capsules due to their ability to protect sensitive ingredients and enable faster dissolution. Moreover, growing investment in drug research and development fuels the need for versatile encapsulation solutions. This industry growth, combined with increasing healthcare access globally, continues to propel the demand for animal gelatin capsules.

Rising Geriatric Population

Older adults often face difficulties swallowing traditional tablets, making gelatin capsules a preferred alternative due to their smooth texture and easy swallowability. Additionally, the elderly tend to have increased healthcare needs, requiring multiple medications and dietary supplements, many of which are conveniently delivered in capsule form. Gelatin capsules also offer faster dissolution and absorption, which is beneficial for patients needing quick relief or consistent drug bioavailability. This demographic trend, combined with growing awareness of health and wellness among seniors, is steadily boosting the demand for animal gelatin capsules worldwide.

- By 2030, one in six people globally will be aged 60 years or over, with that cohort increasing from about 1 billion in 2020 to 1.4 billion. The 80+ age group is expected to more than triple by 2050, reaching approximately 426 million worldwide.

Restraint

Shift Toward Vegan and Plant-Based Alternatives

There is high demand for vegetarian and vegan capsules made from materials like hydroxypropyl methylcellulose (HPMC) or pullulan, which are perceived as more sustainable and cruelty-free. As a result, pharmaceutical and nutraceutical companies are gradually adopting these plant-based options to cater to changing consumer preferences. This shift limits the market share and growth potential for traditional animal gelatin capsules, especially in regions with high vegan populations or strict dietary restrictions. Consequently, the animal gelatin capsule market faces challenges in maintaining its dominance amid this evolving landscape.

Opportunities

Emerging Markets and Healthcare Access Expansion

As countries in Asia, Latin America, and Africa improve healthcare infrastructure and insurance coverage, more people gain access to pharmaceutical and nutraceutical products, driving capsule consumption. Rising urbanization and a growing middle class in these regions further boost the market, as consumers seek convenient and reliable medication forms. Additionally, local pharmaceutical manufacturing is expanding, creating a higher need for raw materials like animal gelatin. These factors combined present a strong growth trajectory for the market in emerging economies.

Increased Use in Functional Foods and Cosmetics

Animal gelatin capsules are finding applications beyond traditional pharmaceuticals. In the functional food sector, gelatin capsules are being used to deliver nutrients, probiotics, and bioactive compounds in a convenient and controlled manner, aligning with rising consumer interest in health and wellness. Similarly, in cosmetics and beauty supplements, these capsules are utilized to encapsulate ingredients like collagen, vitamins, and antioxidants that support skin, hair, and nail health. This crossover into lifestyle and beauty markets broadens the consumer base and diversifies revenue streams for manufacturers. As demand for health-enhancing and anti-ageing products grows, the role of animal gelatin capsules in these segments is set to expand rapidly.

How Macroeconomic Variables Influence the Animal Gelatin Capsules Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth, increased healthcare spending, improved pharmaceutical infrastructure, and higher consumer purchasing power. In wealthier economies, there is a greater demand for high-quality medications and dietary supplements, many of which utilize gelatin capsules for their effectiveness and convenience. Additionally, economic stability enables governments and private sectors in emerging markets to invest in healthcare systems, further supporting the expansion of capsule-based drug and supplement delivery.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the animal gelatin capsules market, increasing production costs and reducing profit margins for pharmaceutical and nutraceutical companies. Rising prices of raw materials, including animal-derived gelatin, can make capsule manufacturing more expensive, leading to higher end-product prices or shifts toward alternative delivery formats. Additionally, stricter cost controls and pricing regulations in various regions may discourage the use of premium capsule technologies, limiting market expansion.

Exchange Rates

Exchange rate fluctuations can positively and negatively affect, depending on the direction and stability of currency movements. For exporters, favorable exchange rates can make gelatin capsules more competitively priced in global markets, boosting international sales. However, volatile or unfavorable exchange rates can increase the cost of imported raw materials and manufacturing equipment, thereby restraining profit margins and limiting market growth, especially in regions heavily reliant on imports.

Segment Outlook

Capsule Type Insights

Why Did the Hard Gelatin Capsules Segment Lead the Market in 2024?

The hard gelatin capsules segment led the animal gelatin capsules market in 2024 due to its established use in pharmaceuticals and dietary supplements for delivering solid formulations like powders and granules. These capsules are preferred for their cost-effectiveness, ease of manufacturing, and versatility in encapsulating a wide range of active ingredients. Additionally, hard gelatin capsules offer better stability and longer shelf life, making them suitable for mass production and global distribution. Their widespread acceptance by regulatory authorities and healthcare providers further strengthens their market position.

The soft gelatin capsules segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing consumer demand for liquid and oil-based formulations, especially in the nutraceutical and cosmeceutical industries. Softgels are highly effective for encapsulating lipophilic ingredients like omega-3 fatty acids, vitamins, and herbal extracts, which are gaining popularity for their health benefits. Their easy-to-swallow texture, appealing appearance, and enhanced bioavailability make them favored by both manufacturers and consumers. Additionally, advancements in softgel manufacturing technologies and rising interest in personalized nutrition are driving rapid adoption.

Source of Gelatin Insights

Why Did the Bovine Gelatin Segment Dominate the Animal Gelatin Capsules Market in 2024?

The bovine gelatin segment dominated the market with the largest share in 2024. This is mainly due to wide availability, cost-efficiency, and excellent functional properties such as gelling strength and stability. Derived primarily from cow bones and hides, bovine gelatin is widely accepted across the pharmaceutical and nutraceutical industries, making it the preferred choice for large-scale capsule production. Its compatibility with a broad range of active pharmaceutical ingredients and regulatory approvals across major markets further strengthens its position. Additionally, bovine gelatin faces fewer cultural and religious restrictions compared to porcine gelatin, enabling broader global acceptance.

The fish gelatin segment is expected to grow at the fastest CAGR during the projection period, owing to its rising demand as a culturally and religiously acceptable alternative to bovine and porcine gelatin. Fish gelatin is suitable for consumers adhering to Halal, Kosher, and pescatarian diets, making it an attractive option in regions with dietary restrictions, such as the Middle East and parts of Asia. Additionally, growing awareness about sustainability and ethical sourcing is encouraging manufacturers to explore fish-based gelatin, which is often derived from fish processing byproducts, reducing environmental impact. Technological improvements are also enhancing the functional performance of fish gelatin to match traditional sources. As a result, its adoption is accelerating, especially in the nutraceutical and global health supplement sectors.

Functionality Insights.

Why Did the Immediate-Release Capsules Segment Lead the Market in 2024?

The immediate-release capsules segment led the animal gelatin capsules market in 2024 due to its widespread use in delivering fast-acting medications and supplements that require rapid absorption. These capsules are preferred by pharmaceutical and nutraceutical manufacturers for their simple formulation, cost-effectiveness, and quick disintegration in the gastrointestinal tract. Immediate-release capsules are highly versatile, accommodating a wide range of active ingredients, which makes them suitable for treating acute conditions and providing timely relief. Their established regulatory acceptance and ease of manufacturing contribute to their continued dominance.

The sustained release capsule segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing demand for controlled drug delivery systems that improve patient compliance and therapeutic outcomes. These capsules allow for the gradual release of active ingredients over time, reducing the frequency of dosing and minimizing side effects. Advances in formulation technology have made sustained-release capsules more effective and versatile, appealing to both pharmaceutical and nutraceutical sectors. Additionally, the rising prevalence of chronic diseases that require long-term medication management is driving the adoption of sustained-release products. As a result, this segment is poised for rapid growth driven by the need for innovative, patient-friendly drug delivery options.

Application Insights.

Why Did the Pharmaceutical Segment Lead the Market in 2024?

The pharmaceutical segment led the animal gelatin capsules market in 2024 due to the extensive use in delivering a wide range of medications, including antibiotics, pain relievers, and vitamins. Pharmaceuticals require reliable and effective capsule forms, and animal gelatin capsules provide excellent stability, bioavailability, and ease of swallowing, making them a preferred choice. The stringent regulatory standards in the pharmaceutical industry also favor well-established gelatin capsules, ensuring consistent quality and safety. Furthermore, the ongoing development of new drugs and growing healthcare awareness globally continue to drive strong demand from this segment.

The nutraceutical segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing consumer awareness about health, wellness, and preventive care. Demand for dietary supplements, vitamins, and herbal products is rising globally, driven by trends toward natural and functional foods. Animal gelatin capsules are favored for nutraceuticals because they provide excellent bioavailability, ease of swallowing, and better protection of sensitive ingredients compared to other delivery forms. Additionally, the growing ageing population and focus on immunity-boosting supplements further accelerate this segment's growth. As a result, nutraceutical manufacturers are increasingly adopting gelatin capsules to meet consumer preferences and regulatory requirements.

End Use Insights.

Why Did the Pharmaceutical Companies Segment Lead the Market in 2024?

The pharmaceutical companies segment led the animal gelatin capsules market in 2024 due to their large-scale production and consistent demand for reliable and effective drug delivery systems. These companies prefer animal gelatin capsules for their proven stability, compatibility with a wide range of APIs, and regulatory acceptance across global markets. Pharmaceutical firms also benefit from the cost-efficiency and ease of manufacturing that gelatin capsules offer, making them ideal for both branded and generic medications. Additionally, ongoing drug development and increasing prevalence of chronic and acute diseases continue to drive the high demand for gelatin capsules within this segment.

The nutraceutical manufacturers segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the rising consumer demand for health supplements and functional foods that promote wellness and preventive care. Increasing awareness about nutrition, immunity, and chronic disease management is fueling the popularity of nutraceutical products globally. Animal gelatin capsules are favored by manufacturers for their ability to effectively encapsulate a variety of vitamins, minerals, and herbal extracts while enhancing bioavailability and consumer compliance. Additionally, the expansion of e-commerce and direct-to-consumer sales channels is enabling faster market penetration for nutraceutical products.

Distribution Channel Insights.

Why Did the B2B Sales Segment Lead the Market in 2024?

The B2B sales segment led the animal gelatin capsules market in 2024 because of the large-scale purchasing needs of pharmaceutical and nutraceutical manufacturers who require consistent, bulk supplies of high-quality gelatin capsules. This segment benefits from strong relationships between gelatin capsule producers and industry players, enabling streamlined procurement and supply chain efficiency. B2B sales also facilitate customization and contract manufacturing, catering to specific formulation and regulatory requirements of clients.

The online pharmacies & e-commerce segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing shift toward digital purchasing and the convenience it offers to consumers. The rise of telemedicine, direct-to-consumer healthcare, and growing internet penetration have made online platforms a preferred choice for buying supplements and medications. Online channels provide greater product variety, competitive pricing, and doorstep delivery, enhancing consumer accessibility and satisfaction. Additionally, younger, tech-savvy consumers are driving demand for online health products, including animal gelatin capsules. This digital transformation in healthcare distribution is fueling rapid growth in the e-commerce segment.

Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the animal gelatin capsules market while holding the largest share in 2024. The region’s dominance is primarily attributed to the well-established pharmaceutical and nutraceutical industries, supported by advanced healthcare infrastructure and high consumer awareness. The region benefits from stringent regulatory frameworks that ensure product quality and safety, fostering trust and widespread adoption of gelatin capsules. Additionally, the growing demand for dietary supplements and functional foods, driven by an ageing population and health-conscious consumers, further propels market growth. Strong presence of key market players and continuous investments in R&D for innovative capsule formulations also contribute to North America’s leading position.

The U.S. is a major contributor to the North American animal gelatin capsules market due to the large pharmaceutical and nutraceutical sectors. The country’s advanced healthcare system, high consumer awareness about health and wellness, and strong regulatory environment support robust demand for gelatin capsules. Additionally, the presence of leading pharmaceutical companies and ongoing innovations in drug delivery technologies further boost the U.S. market. These factors make the United States the key driver of North America’s animal gelatin capsules industry.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for animal gelatin capsules. This is due to the rapidly expanding pharmaceutical and nutraceutical industries, fueled by rising healthcare awareness and improving infrastructure. Increasing disposable incomes and a growing middle-class population are driving higher demand for dietary supplements and health products in countries like China and India. Additionally, government initiatives to enhance healthcare access and regulatory reforms are encouraging market growth. The region’s large geriatric population and rising prevalence of chronic diseases further boost the demand for gelatin capsules. Together, these factors position the Asia Pacific as the fastest-growing market globally.

China is a major player in the Asia Pacific animal gelatin capsules market due to its rapidly growing pharmaceutical and nutraceutical sectors, supported by increasing healthcare expenditure and urbanization. The country’s large population and rising health consciousness drive strong demand for dietary supplements and functional foods. Additionally, ongoing government support for healthcare infrastructure and favorable regulatory reforms make China a key hub for gelatin capsule production and consumption.

Region-Wise Market Outlook

| Region |

Market Size (2024) |

Projected CAGR (2025–2034) |

Growth Drivers |

Restraints |

Growth Overview |

| North America |

USD 0.7 Million |

6.5% |

Strong pharmaceutical industry, high healthcare expenditure, and consumer awareness |

Ethical concerns over animal-derived products |

Dominant market share with steady growth, driven by established infrastructure |

| Asia Pacific |

USD 0.5 Million

|

7.43% |

Rapid urbanization, rising healthcare demand, and a large population base |

Regulatory challenges, competition from plant-based alternatives |

Leading growth due to increasing demand for health supplements and pharmaceuticals |

| Europe |

USD 0.4 Million

|

10.5% |

Stringent regulations, focus on quality, and an ageing population growth

|

Ethical concerns, preference for plant-based options |

Stable growth with emphasis on quality and sustainability |

| Latin America |

USD 0.1 Million

|

6.5% |

Expanding healthcare infrastructure, rising middle class |

Economic instability, limited access to healthcare |

Gradual growth as healthcare access improves |

| Middle East & Africa |

USD 0.1 Million

|

0% |

Increasing healthcare investments, growing awareness |

Cultural and religious dietary restrictions |

Slow growth due to cultural and economic factors |

Animal Gelatin Capsules Market Value Chain Analysis

1. Raw Material Sourcing (Gelatin Extraction)

This initial stage involves obtaining gelatin from animal by-products, primarily bovine and porcine sources. The extraction process includes hydrolysis of collagen-rich tissues such as skin, bones, and connective tissues. The quality and source of gelatin are crucial, as they impact the final product's stability, bioavailability, and consumer acceptance.

2. Gelatin Processing & Capsule Manufacturing

In this phase, the extracted gelatin is processed into capsule forms—either hard or soft gelatin capsules. The manufacturing process includes molding, drying, and quality control to ensure consistency in size, weight, and integrity. Advanced technologies in capsule filling and coating are employed to enhance the capsule's functionality, such as controlled release and moisture protection.

3. Formulation Development

Pharmaceutical and nutraceutical companies collaborate with capsule manufacturers to develop specific formulations that meet therapeutic or dietary needs. This stage involves selecting appropriate active pharmaceutical ingredients (APIs), excipients, and determining the optimal capsule type and size. The goal is to ensure the capsule delivers the intended dosage effectively and safely.

4. Quality Control & Regulatory Compliance

Stringent quality control measures are implemented to test for purity, dissolution rate, and stability of the capsules. Compliance with regulatory standards set by authorities like the FDA, EMA, and WHO is mandatory. This ensures the capsules meet safety and efficacy requirements before reaching the market.

5. Packaging & Distribution

After passing quality checks, capsules are packaged in blister packs, bottles, or other suitable containers to protect them from environmental factors. The packaging process also includes labeling with dosage instructions, expiration dates, and regulatory information. The final products are then distributed to wholesalers, pharmacies, hospitals, and direct to consumers.

6. End-Use Applications

The final stage involves the use of animal gelatin capsules in various applications. In the pharmaceutical industry, they are used for drug delivery, offering benefits like ease of swallowing and precise dosing. In nutraceuticals, they encapsulate vitamins, minerals, and herbal supplements, catering to the growing consumer demand for health and wellness products.

Animal Gelatin Capsules Market Companies

- Capsugel (a Lonza Company)

Capsugel, part of Lonza Group, is a global leader in capsule manufacturing, offering a wide portfolio of animal gelatin-based capsules used in both pharmaceuticals and nutraceuticals. The company’s advanced encapsulation technologies and global presence allow it to serve a wide range of healthcare applications efficiently.

Catalent provides comprehensive drug delivery solutions, including softgel and hard gelatin capsules for pharmaceutical clients worldwide. Their innovation in formulation and scale-up manufacturing helps meet high-volume and complex gelatin capsule demands.

ACG is one of the world’s largest manufacturers of hard gelatin capsules and capsule production machinery, catering to both pharmaceutical and nutraceutical companies. With a global supply network and regulatory compliance, ACG ensures consistent quality and customization for clients.

Qualicaps specializes in producing hard gelatin capsules and filling machines for pharmaceutical and dietary supplement applications. Its focus on quality, safety, and customization supports various drug delivery solutions globally.

Suheung is a major South Korean capsule manufacturer known for producing high-quality gelatin capsules, serving both domestic and international markets. It emphasizes cost-effective solutions and technical support to meet the evolving needs of capsule users.

Roxlor LLC manufactures animal gelatin capsules primarily for the nutraceutical sector, offering both standard and custom capsule solutions. The company is recognized for its flexibility in production and dedication to clean-label, high-performance capsules.

Sunil Healthcare is a leading Indian manufacturer of hard gelatin capsules used in pharmaceuticals, ayurvedic formulations, and dietary supplements. The company focuses on innovation, affordability, and global regulatory compliance to expand its export footprint.

Recent Development

- In December 2023, Darling Ingredients' health brand Rousselot has been granted U.S. Patent No. 11795489B2 for StabiCaps™, a specialized gelatin designed to enhance the formulation and stability of soft gel capsules. This innovation addresses crosslinking, a common issue where molecular bonds form within the capsule shell, hindering the dissolution and release of active ingredients. By mitigating this challenge, StabiCaps™ ensures more consistent and efficient delivery of nutrients and medications.

Segments Covered in the Report

By Capsule Type

- Hard Gelatin Capsules

- Soft Gelatin Capsules

By Source of Gelatin

- Bovine Gelatin

- Porcine Gelatin

- Fish Gelatin

- Mixed/Blended Animal Gelatin

By Functionality

- Immediate-Release Capsules

- Sustained/Controlled-Release Capsules

- Enteric-Coated Capsules

By Application

- Pharmaceuticals

- Nutraceuticals / Dietary Supplements

- Cosmeceuticals / Beauty Supplements

- Functional Foods

By End User

- Pharmaceutical Companies

- Nutraceutical Manufacturers

- Contract Manufacturing Organisations (CMOs)

- Cosmetic & Personal Care Brands

By Distribution Channel

- Business-to-Business (B2B)

- Retail Pharmacies

- Online Pharmacies & E-Commerce

- Health Stores / Speciality Retailers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

- Table 1: Global Animal Gelatin Capsules Market Size (USD Million) by Purity / Type, 2024–2034

- Table 2: Global Animal Gelatin Capsules Market Size (USD Million) by Application / Use Case, 2024–2034

- Table 3: Global Animal Gelatin Capsules Market Size (USD Million) by Route of Administration, 2024–2034

- Table 4: Global Animal Gelatin Capsules Market Size (USD Million) by Formulation / Product Type, 2024–2034

- Table 5: Global Animal Gelatin Capsules Market Size (USD Million) by End User, 2024–2034

- Table 6: Global Animal Gelatin Capsules Market Size (USD Million) by Distribution Channel, 2024–2034

- Table 7: North America Market Size (USD Million) by Purity / Type, 2024–2034

- Table 8: North America Market Size (USD Million) by Application / Use Case, 2024–2034

- Table 9: North America Market Size (USD Million) by Route of Administration, 2024–2034

- Table 10: North America Market Size (USD Million) by Formulation / Product Type, 2024–2034

- Table 11: North America Market Size (USD Million) by End User, 2024–2034

- Table 12: North America Market Size (USD Million) by Distribution Channel, 2024–2034

- Table 13: U.S. Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 14: Canada Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 15: Mexico Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 16: Europe Market Size (USD Million) by Purity / Type, 2024–2034

- Table 17: Europe Market Size (USD Million) by Application / Use Case, 2024–2034

- Table 18: Germany Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 19: France Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 20: UK Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 21: Italy Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 22: Asia Pacific Market Size (USD Million) by Purity / Type, 2024–2034

- Table 23: Asia Pacific Market Size (USD Million) by Application / Use Case, 2024–2034

- Table 24: China Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 25: Japan Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 26: India Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 27: South Korea Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 28: Southeast Asia Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 29: Latin America Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 30: Brazil Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 31: Middle East & Africa Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 32: GCC Countries Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 33: Turkey Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Table 34: Africa Market Size (USD Million) by Purity / Type & Application, 2024–2034

- Figure 1: Global Market Share by Purity / Type, 2024

- Figure 2: Global Market Share by Application / Use Case, 2024

- Figure 3: Global Market Share by Route of Administration, 2024

- Figure 4: Global Market Share by Formulation / Product Type, 2024

- Figure 5: Global Market Share by End User, 2024

- Figure 6: Global Market Share by Distribution Channel, 2024

- Figure 7: North America Market Share by Purity / Type, 2024

- Figure 8: North America Market Share by Application / Use Case, 2024

- Figure 9: North America Market Share by Route of Administration, 2024

- Figure 10: North America Market Share by Formulation / Product Type, 2024

- Figure 11: North America Market Share by End User, 2024

- Figure 12: North America Market Share by Distribution Channel, 2024

- Figure 13: U.S. Market Share by Purity / Type, 2024

- Figure 14: U.S. Market Share by Application / Use Case, 2024

- Figure 15: Canada Market Share by Purity / Type, 2024

- Figure 16: Canada Market Share by Application / Use Case, 2024

- Figure 17: Mexico Market Share by Purity / Type, 2024

- Figure 18: Mexico Market Share by Application / Use Case, 2024

- Figure 19: Europe Market Share by Purity / Type, 2024

- Figure 20: Europe Market Share by Application / Use Case, 2024

- Figure 21: Germany Market Share by Purity / Type, 2024

- Figure 22: Germany Market Share by Application / Use Case, 2024

- Figure 23: France Market Share by Purity / Type, 2024

- Figure 24: France Market Share by Application / Use Case, 2024

- Figure 25: UK Market Share by Purity / Type, 2024

- Figure 26: UK Market Share by Application / Use Case, 2024

- Figure 27: Italy Market Share by Purity / Type, 2024

- Figure 28: Italy Market Share by Application / Use Case, 2024

- Figure 29: Asia Pacific Market Share by Purity / Type, 2024

- Figure 30: Asia Pacific Market Share by Application / Use Case, 2024

- Figure 31: China Market Share by Purity / Type, 2024

- Figure 32: China Market Share by Application / Use Case, 2024

- Figure 33: Japan Market Share by Purity / Type, 2024

- Figure 34: Japan Market Share by Application / Use Case, 2024

- Figure 35: India Market Share by Purity / Type, 2024

- Figure 36: India Market Share by Application / Use Case, 2024

- Figure 37: South Korea Market Share by Purity / Type, 2024

- Figure 38: South Korea Market Share by Application / Use Case, 2024

- Figure 39: Southeast Asia Market Share by Purity / Type, 2024

- Figure 40: Southeast Asia Market Share by Application / Use Case, 2024

- Figure 41: Latin America Market Share by Purity / Type, 2024

- Figure 42: Latin America Market Share by Application / Use Case, 2024

- Figure 43: Brazil Market Share by Purity / Type, 2024

- Figure 44: Brazil Market Share by Application / Use Case, 2024

- Figure 45: Middle East & Africa Market Share by Purity / Type, 2024

- Figure 46: Middle East & Africa Market Share by Application / Use Case, 2024

- Figure 47: GCC Countries Market Share by Purity / Type, 2024

- Figure 48: GCC Countries Market Share by Application / Use Case, 2024

- Figure 49: Turkey Market Share by Purity / Type, 2024

- Figure 50: Turkey Market Share by Application / Use Case, 2024

- Figure 51: Africa Market Share by Purity / Type, 2024

- Figure 52: Africa Market Share by Application / Use Case, 2024