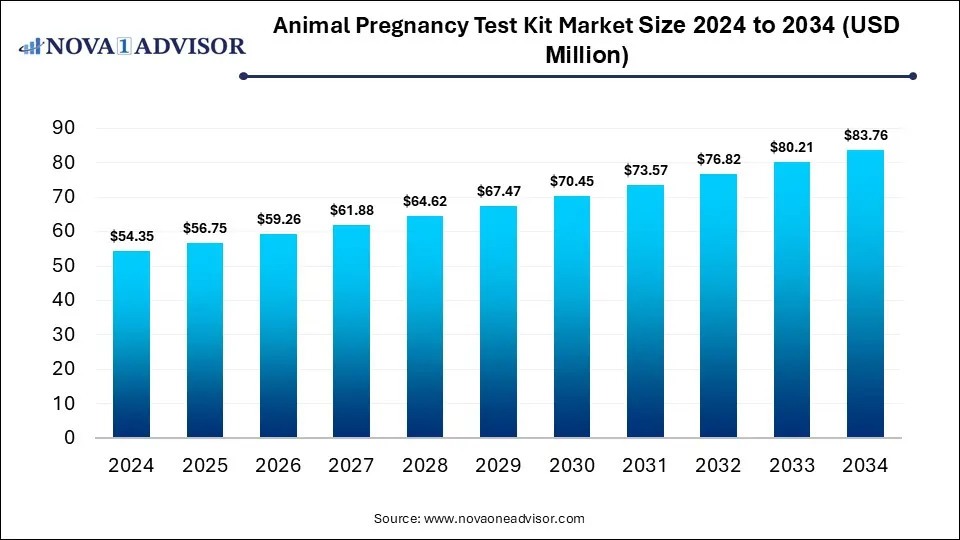

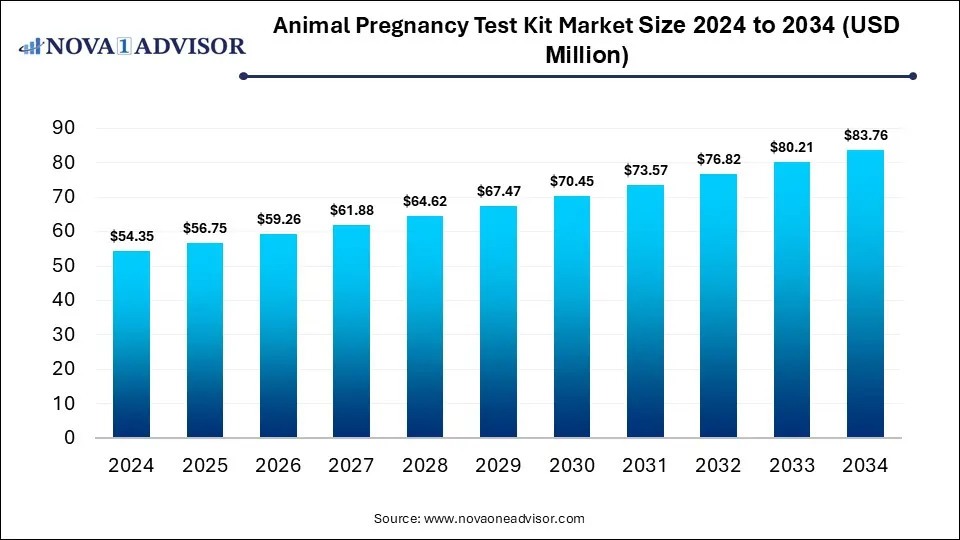

Animal Pregnancy Test Kit Market Size and Growth 2025 to 2034

The global animal pregnancy test kit market size was estimated at USD 54.35 million in 2024 and is projected to reach USD 83.76 million by 2034, growing at a CAGR of 4.42% from 2025 to 2034.

Animal Pregnancy Test Kit Market Key Takeaways

- By test type, urine tests dominated the market in 2024.

- By test type, blood tests are seen to have the fastest growth rate throughout the forecast years.

- By animal type, the livestock animals segment led the market as of this year.

- By animal type, the companion animals segment is expected to have the fastest growth rate.

- By end user, veterinary clinics dominated the market in 2024.

- By end user, animal farmers are projected to be the fastest growing.

- By region, North America held the largest market share in 2024.

- By region, Asia-Pacific is seen to grow at the fastest rate throughout the forecast period.

What is an Animal Pregnancy Test Kit?

An animal pregnancy test kit is diagnostic device which detects pregnancy in animals, whether it be farm animals or pets via urine, blood, or ultrasound. This helps breeders optimize reproduction as well as ensure the health and productivity of their animals. These kits include rapid test strips, ELISA assays or portable ultrasound gadgets that can identify pregnancy markers like progesterone or PAGs. These types of tests are versatile in nature, designed for farms, clinics and even home use.

These kits are essential tools for identifying pregnancy in various animals, such as cattle, sheep, goats, and other livestock, as well as pets like dogs and cats. The market is driven by the need for early pregnancy detection to optimize breeding practices, improve reproductive efficiency, and ensure better care for animals.

Market Trends

- Increased Livestock Management: Efficient livestock management is being increasingly focused on for maximizing productivity, leading to an escalating demand for veterinary pregnancy test kits.

- Advancements in Diagnostic Technology: Continuous innovations in diagnostic technology such as improved accuracy and user-friendly designs propel the market forward, making these kits indispensable tools in modern veterinary practices.

- Rising Awareness of Reproductive Health: Increased awareness regarding reproductive health management in animals has boosted the need for advanced pregnancy test kits.

- Growing Pet Ownership: The surge in pet ownership has also impacted the demand for veterinary pregnancy test kits. This is because pet owners are becoming more and more proactive in ensuring their pet’s health and well-being.

- Innovations in Testing: Innovations like Veterinary Rapid Tests are further enhancing diagnostic efficiency, meeting the growing need for quick and reliable solutions.

What is the impact of AI in this field?

The integration of AI is revolutionizing the animal pregnancy kit market, enabling accurate and timely diagnosis of pregnancy in animals. Traditional diagnostic methods including ultrasonography, hormonal assays and palpation often require expert interpretation and may be limited due to lack of skilled personnel and advanced equipment. This is where AI presents a transformative solution, offering improved accuracy, efficiency and objectivity.

AI systems can now analyze hormone levels such as progesterone and relaxin over time and classify animals as pregnant or non-pregnant with high accuracy. Time-series analysis using Recurrent Neural Networks (RNNs) also allows the prediction of gestational stage as well as potential pregnancy failures. AI-driven decision support integrates clinical findings, hormonal assays and behavioral data to provide a holistic view of reproductive status. This is particularly useful in remote areas or large-scale farms, automated breeding programs and during early detection of embryonic losses.

By scalable pregnancy detection, AI not only enhances animal welfare but also supports the productivity and profitability which is continued in research, collaboration and animal husbandry. Through all these factors, we can see how AI will prove to be essential for mainstream adoption.

Report Scope of Animal Pregnancy Test Kit Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 56.75 Million |

| Market Size by 2034 |

USD 83.76 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 4.42% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Test Type, By Animal Type, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

IDEXX Laboratories, Inc., Zoetis Services LLC, Ring Biotechnology Co Ltd., Hangzhou Testsea Biotechnology Co. LTD., Novis Animal Solutions, Secure Diagnostics Pvt. Ltd, J&G Biotech Ltd, EMLAB GENETICS LLC., BIOTRACKING, INC. |

Market Dynamics

Driver

Awareness of Animal Health and Livestock Management

One of the key drivers pushing the animal pregnancy test kits market is the heightened awareness of animal health and welfare among farmers and pet owners. This awareness has led to a greater emphasis on preventive care and early detection of pregnancy, which are essential factors for maintaining the health of both, the animals and the overall herd. Educational campaigns and veterinary outreach programs are on the rise, playing a crucial role in informing stakeholders about the advantages of using pregnancy kits. This trend also reflects a broader commitment towards improving animal welfare standards on a global level.

The market is also driven by the rising demand for effective livestock management solutions. As the global population continues to grow, the need for increased food production also becomes a priority. Farmers are increasingly adopting pregnancy detection kits in order to optimize breeding programs and enhance herd productivity. They are able to identify pregnant animals early, which allows for better resource allocation and more extensive care.

Restraint

Regulatory and Compliance Challenges

Despite various growth drivers, the market does face a few challenges that could hinder its growth and development. One such challenge is navigating the complex landscape of regulatory compliance and approvals. Different regions have different regulatory requirements for veterinary diagnostic tools. This can cause significant hurdles for companies who are seeking to enter the market. These procedures can be both, time-consuming as well as costly, making it difficult for small scale or medium scale companies to keep up.

Moreover, the dynamic nature of regulatory frameworks influenced by technological advancements and evolving animal health standards necessitates continuous adaptation by manufacturers. This constant requirement for re-adjustment can delay product launches and increase operational costs, thus slowing down market growth.

Opportunity

Sustainable Farming Practices and Technological Advancements

One key opportunity boosting the market is the rise of sustainable farming practices, which is, in turn, influencing the demand for pregnancy detection kits. Farmers all over the world are increasingly adopting eco-friendly methods that prioritize animal welfare and environmental sustainability. The use of pregnancy kits aligns with these practices by enabling more efficient breeding and reducing the need for any chemical interventions. As consumers become more conscious about their food origins, the adoption of pregnancy kits is also expected to go up in the upcoming years, reflecting a broader movement towards responsible and sustainable agriculture.

Advancements in portable point-of-care devices, rapid immunoassay-based tests, and improved early-stage detection accuracy is also one more opportunity. The increasing integration of biosensors and smartphone-based diagnostics now allows farmers and veterinarians to perform quick, precise and non-invasive testing. Such innovations help in enhancing livestock productivity, optimizing reproductive efficiency and leads to faster adoption of general herd management strategies.

Animal Pregnancy Test Kit Market Segmental Analysis

By Test Type Insights

Which test type dominated the market in 2024?

Urine pregnancy kits dominated the market in 2024. This is due to their straightforward testing procedure and their ability to give instant results. They are widely used in both, domestic pets and agriculture animals. The advantage of this segment lies in its ability to provide quick assessments without the need for any professional veterinary intervention.

Blood pregnancy kits are expected to have the fastest growth rate. This is due to their enhanced precision in pregnancy detection. They are increasingly preferred in situations where urine kits may give inconclusive results. We can see that animal healthcare providers are increasingly investing in these sophisticated testing methods in order to ensure the best outcomes for animal reproductive management.

By Animal Insights

Which animal segment led the market as of this year?

The livestock segment dominated the market in 2024. This dominance is due to their critical importance in the agricultural domain as well as food supply chains. The extensive use of pregnancy detection kits helps to improve reproductive efficiency, helping farmers optimize herd management. This segment benefits from the widespread adoption of pregnancy detection technologies among farmers, enabling enhanced reproductive management and improved herd efficiency.

The companion animal segment is expected to be the fastest growing over the forecast period. This growth is fueled by the growing trend of pet ownership and the increased focus on reproductive health among dogs, cats and exotic pets. Pet owners are increasingly adopting scientific and safe methods to monitor breeding and pregnancy, seeking accurate and convenient testing solutions. User friendly and at-home diagnostic kits are also gaining popularity in this particular segment.

By End User Insights

Which end user held the largest market share in 2024?

Veterinary clinics held the largest market share in 2024 due to their vital role in animal healthcare and reproductive management. These clinics not only use pregnancy kits for diagnostics but also act as trusted sources for educating pet owners and farmers about various reproductive health challenges that may arise. The consistent demand from pet owners and livestock producers has further solidified this segment’s position.

The animal farmers segment is estimated to have the fastest rate of growth throughout the forecast period. This growth is propelled by the rising demands for livestock productivity and advancements in fertility diagnostics. The integration of technology in farming practices further accelerates the growth of this segment, as farmers are actively looking for effective tools to improve animal health management.

By Regional Analysis

Why is North America dominating the market?

North America dominated the market in 2024. This dominance is due to its technologically advanced veterinary healthcare infrastructure, high adoption rates of precise livestock farming practices and a strong pet care culture. The region is home to large-scale dairy and meat industries and also witnesses significant investments in animal health research and development. Moreover, the presence of key market players in North America helps to boost innovation and speed up market penetration.

What are the advancements in Asia-Pacific?

Asia-Pacific is expected to have the fastest growth rate throughout the forecast period. This growth is due to the rapid expansion of commercial livestock farming, especially in countries such as India and China, where optimizing breeding efficiency has become a critical aspect for meeting the soaring demand for meat and dairy. Government backed precision farming initiatives, rising pet ownership and increasing local production of cost-effective diagnostic kits has further accelerated market adoption.

Some of The Prominent Players in The Cell Culture Market Include:

- IDEXX Laboratories, Inc.

- Zoetis Services LLC

- Ring Biotechnology Co Ltd.

- Hangzhou Testsea Biotechnology Co. LTD.

- Novis Animal Solutions

- Secure Diagnostics Pvt. Ltd

- J&G Biotech Ltd

- EMLAB GENETICS LLC.

- BIOTRACKING, INC.

Recent Developments

- In August 2025, Zoetis (US) announced the launch of a new line of animal pregnancy kits that are designed to provide faster results with enhanced accuracy. This strategic move is significant as it aligns with the growing demand for rapid diagnostics in veterinary practices, potentially increasing Zoetis's market share and reinforcing its reputation as a leader in animal health solutions. The introduction of these kits may also stimulate competition, prompting other players to innovate further.

- In September 2025, Merck Animal Health (US) expanded its distribution network in Europe, aiming to enhance accessibility to its pregnancy detection products. This expansion is crucial as it not only broadens Merck's market reach but also positions the company to better serve the growing European livestock sector. Such strategic actions indicate a commitment to regional growth and responsiveness to local market demands.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the animal pregnancy test kit market.

By Test Type

- Urine

- Blood

- Plasma

- Others

By Animal Type

- Livestock Animals

- Cattle

- Horses

- Pigs

- Sheep and Goats

- Poultry

- Companion Animals

- Canine

- Feline

- Equine

- Others

By End User

- Veterinary Hospitals and Clinics

- Animal Farmers

- Researchers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)