Animal Ultrasound Market Size and Trends

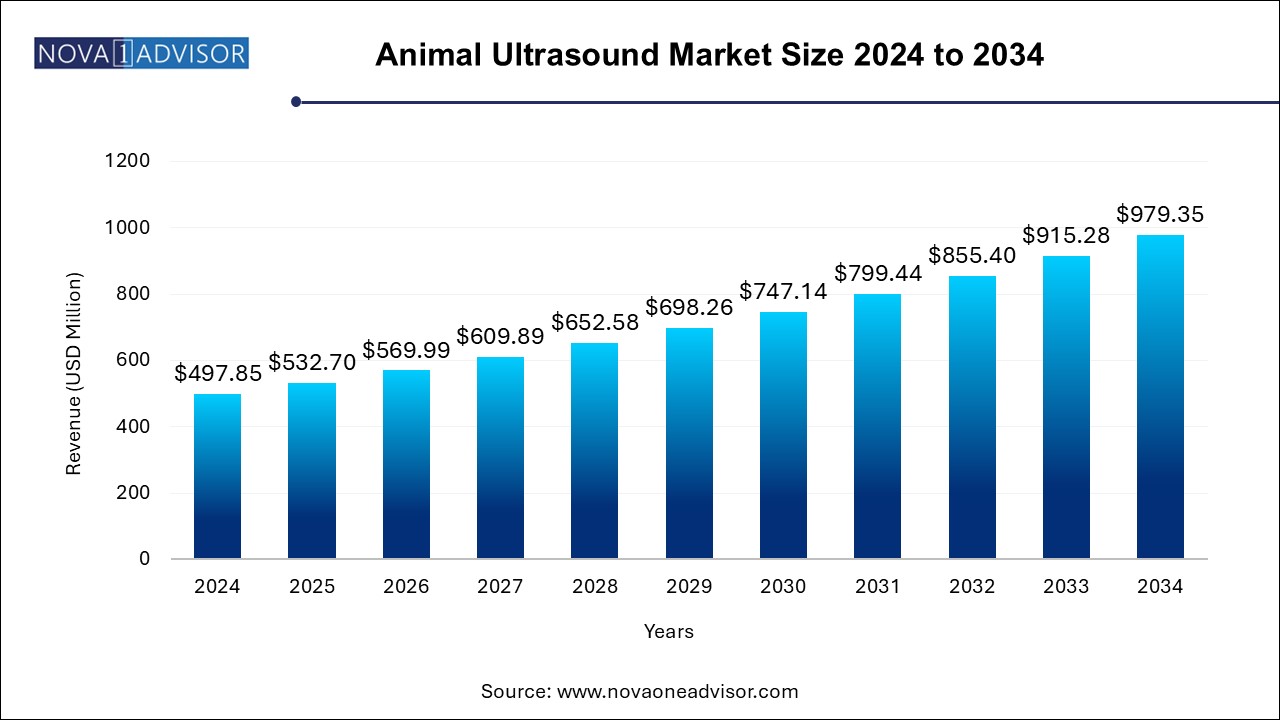

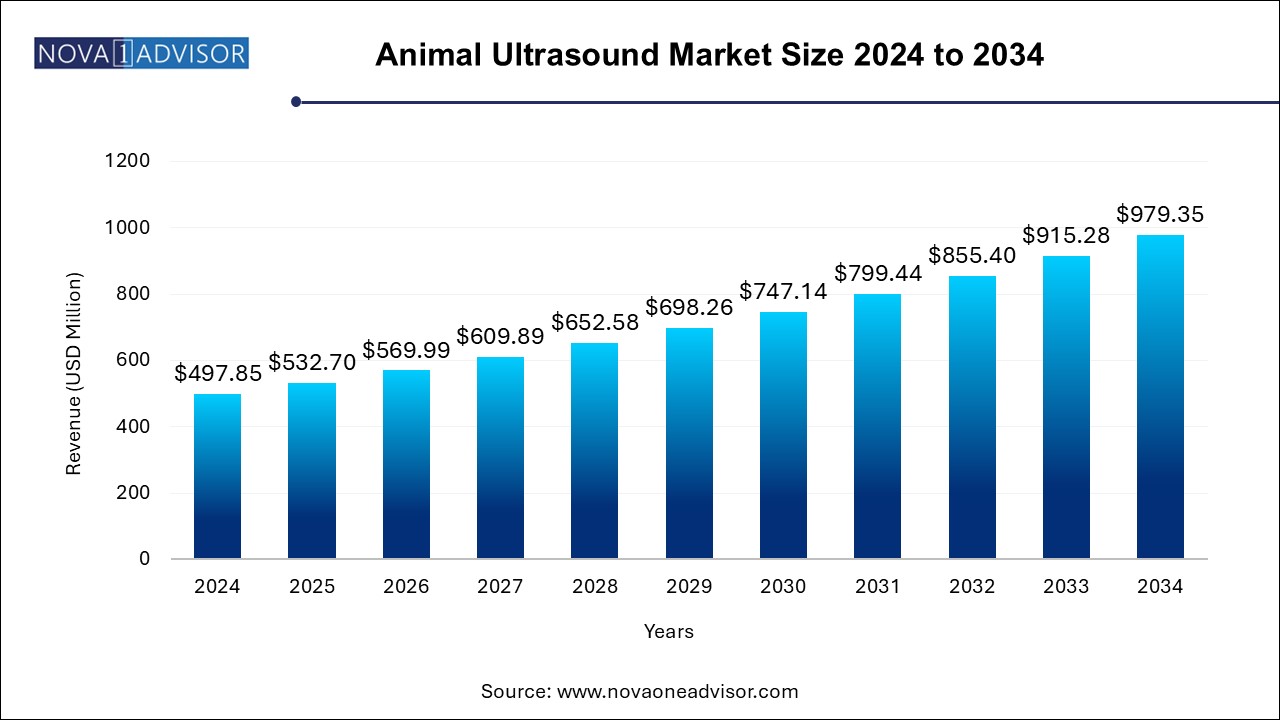

The animal ultrasound market size was exhibited at USD 497.85 million in 2024 and is projected to hit around USD 979.35 million by 2034, growing at a CAGR of 7.0% during the forecast period 2025 to 2034. The animal ultrasound market is expansion is driven by increased pet ownerships, rising awareness of animal healthcare, and growing prevalence of animal and zootonic diseases.

Animal Ultrasound Market Key Takeaways:

- The small animals segment held a significant market share of around 67% in 2024 and is expected to show the fastest growth rate over the forecast period of 2025 - 2030.

- The equipment segment held the highest market share in 2024 because of their ease of use.

- The PACS segment is anticipated to grow at the highest CAGR of 8.01% over the forecast period.

- 2-D ultrasound imaging held the highest share in 2024.

- By technology, digital imaging dominated the animal ultrasound market in 2024

- The contrast imaging segment is anticipated to grow at the fastest CAGR from 2025 to 2034.

- The abdominal segment led the animal ultrasound market with a share of 27.34% in 2024.

- Veterinary hospitals & clinics led the market in 2024 in terms of revenue share.

- North America animal ultrasound market held the largest share of 38.29% of the global market in 2024.

Market Overview

The global animal ultrasound market is witnessing a profound transformation driven by growing pet ownership, increased demand for advanced diagnostic tools in veterinary practices, and technological innovation in imaging systems. Ultrasound imaging, once limited to large-scale animal hospitals or academic institutions, has now become widely adopted across veterinary clinics, livestock farms, and mobile diagnostic services. Its non-invasive, radiation-free, real-time capabilities make it ideal for diverse clinical applications, from abdominal imaging in pets to reproductive monitoring in livestock.

Animal ultrasound refers to the application of high-frequency sound waves to visualize internal organs, tissues, and physiological processes in animals. This technology plays an indispensable role in preventive care, early diagnosis of diseases, trauma assessment, and pre-surgical evaluations. Furthermore, its utility in animal breeding—especially for monitoring pregnancies in cattle, sheep, and pigs—has cemented its relevance in the agricultural and livestock sectors.

Recent years have seen a shift from traditional console-based machines to portable and handheld ultrasound devices, reflecting a broader push toward point-of-care diagnostics. This change is especially important in large animal practice, where mobility is critical. In the companion animal segment, ultrasound helps assess conditions like tumors, heart diseases, and musculoskeletal issues, contributing to better clinical outcomes.

The expansion of veterinary services, particularly in emerging economies, alongside rising pet insurance penetration and increasing awareness of animal health, are key factors propelling the market forward. With digital integration and AI-driven interpretation solutions now entering the picture, the animal ultrasound market is poised for continued innovation and expansion.

Major Trends in the Market

-

Portable and Handheld Ultrasound Devices Surge in Popularity

Mobility, affordability, and ease of use are making portable ultrasound systems highly attractive for both small and large animal practices.

-

Rising Adoption of Ultrasound in Reproductive and Fertility Monitoring

Ultrasound has become a critical tool in livestock management, enabling farmers to increase breeding efficiency and monitor fetal health.

-

Integration of Artificial Intelligence (AI) in Imaging Analysis

AI algorithms are being integrated to assist in image interpretation, automate anomaly detection, and reduce diagnostic time.

-

Telemedicine Expansion in Veterinary Care

With the rise of remote consultations, ultrasound imaging is increasingly being shared digitally, allowing off-site specialists to assist in diagnosis.

-

Growing Use of Ultrasound in Oncology and Cardiology for Companion Animals

High-resolution ultrasound imaging is now essential in monitoring tumor growth and assessing cardiac function, particularly in aging pets.

-

Customized Imaging for Exotic and Wildlife Species

Demand is growing for adaptable ultrasound equipment capable of handling the anatomical diversity of reptiles, birds, and zoo animals.

-

Education and Training Platforms on the Rise

Online courses and simulation-based training for veterinary ultrasound usage are expanding access and improving diagnostic competencies globally.

Where is AI Finding Applications in the Animal Ultrasound Market?

Integration of artificial intelligence algorithms such as machine learning and deep learning in animal ultrasound can potentially improve accuracy, efficiency and speed of diagnostic procedures. AI can be applied for analysing ultrasound images for identification of abnormalities, automating measurements and calculations, further reducing efforts and time spent of these tasks. AI-powered models can be deployed for disease diagnosis in animals such as detection of canine chronic kidney disease by analysing renal ultrasound images. Monitoring of animal pregnancies and detection of high-risk cases can be achieved with the use of AI-enabled animal ultrasound devices.

Furthermore, integration of AI-powered ultrasound with other types of imaging techniques such as radiography and thermography is helping in gaining comprehensive diagnostic insights. Cloud-based AI analytics platforms can assist in precision livestock farming and improved health management of animal population.

Report Scope of Animal Ultrasound Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 532.70 Million |

| Market Size by 2033 |

USD 979.35 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 7.0% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Animal, Solution, Type, Technology, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

IDEXX, Esaote SpA, Mars Inc. (Sound & Heska), FUJIFILM Holdings America Corporation, Shenzhen Mindray Bio-Medical Electronics, Siemens Healthcare Limited (PLH Medical Ltd.), Samsung Healthcare, ASUSTeK Computer Inc., IMV Imaging, CHISON Medical Technologies Co., Ltd. , BenQ Medical Technology Corp., Avante Animal Health, Contec Medical Systems Co. Ltd., Wuhan Zoncare Bio-medical Electronics Co., Ltd, and Butterfly Network, Inc. |

Market Driver: Rising Pet Ownership and Companion Animal Expenditure

One of the most potent forces driving the animal ultrasound market is the sharp rise in pet ownership worldwide, particularly across urban and suburban regions. The emotional bond between humans and their companion animals has transformed pets from mere domestic animals into family members, driving increased expenditure on their healthcare. In the United States alone, pet spending exceeded $140 billion in 2023, a significant portion of which was directed toward diagnostic and preventive services.

As more pet parents seek high-quality care for their animals, veterinary clinics are increasingly investing in modern diagnostic tools like ultrasound systems. Abdominal imaging for gastrointestinal issues, cardiac monitoring for breed-specific heart conditions, and musculoskeletal assessments for aging dogs are common use cases. The affordability and accessibility of ultrasound compared to CT or MRI also make it the first-line diagnostic choice in many settings. This surge in diagnostic demand has created a thriving ecosystem for ultrasound manufacturers and service providers alike.

Market Restraint: High Cost of Advanced Imaging Systems

Despite growing demand, one of the key restraints hampering broader adoption of animal ultrasound systems, particularly in developing regions, is the high cost of advanced imaging technologies. While portable ultrasound systems have somewhat bridged the affordability gap, high-end Doppler and 3D/4D systems still come with significant capital investment requirements, which can be a barrier for smaller clinics and independent veterinarians.

Additionally, the cost is not limited to equipment alone. Training requirements, software upgrades, maintenance contracts, and accessories further increase the total cost of ownership. In countries with limited veterinary infrastructure or where veterinary care is not subsidized, these costs can be prohibitive. The result is a disparity in diagnostic capabilities between urban and rural facilities, limiting timely access to advanced imaging for large segments of the animal population.

Market Opportunity: Tele-ultrasound and Remote Diagnostics

As veterinary practices evolve, a significant opportunity lies in the integration of tele-ultrasound services—allowing ultrasound data to be captured locally and interpreted remotely by specialists. This model holds immense potential in rural and underserved regions, where veterinary radiologists are scarce and animal transportation can be stressful or logistically challenging.

Tele-ultrasound platforms leverage cloud storage, encrypted data transmission, and AI-enhanced image processing to deliver expert insights across geographical boundaries. For instance, a rural livestock farm in Canada could capture ultrasound images of a pregnant cow and transmit them to a reproductive specialist in real-time. This model not only reduces costs and travel time but also enhances the quality of care through specialist support. Companies developing cloud-native PACS and integrated telehealth solutions stand to gain considerably from this emerging trend.

Animal Ultrasound Market By Animal Insights

The small animals segment held a significant market share of around 67% in 2024 owing to increasing pet ownership, growing awareness about pet health, and the expanding range of diagnostic services in urban veterinary clinics. Dogs and cats, in particular, frequently require ultrasound imaging for internal diagnostics, including heart conditions, tumors, and reproductive issues. The use of ultrasound for pregnancy detection, pyometra evaluation, and liver and kidney assessments is especially common in small animal practice. Companion animal diagnostics are often driven by pet owners’ willingness to invest in preventive and therapeutic procedures, especially in markets like North America and Europe.

Large animals are the fastest-growing segment, driven by the rising use of ultrasound in livestock breeding programs. Dairy farms and cattle ranches use ultrasound to assess fertility, monitor pregnancy stages, and ensure herd health. Reproductive efficiency directly impacts profitability, making ultrasound an indispensable tool. In countries like India, Brazil, and Australia, government initiatives promoting livestock productivity have further accelerated the use of diagnostic tools in veterinary practice. Moreover, the growing use of mobile ultrasound units in field-based diagnostics has expanded access in remote farming regions.

Animal Ultrasound Market By Solutions Insights

The equipment segment held the highest market share in 2024 because of their ease of use. Especially due to high sales of both portable and console-based ultrasound machines. Veterinary hospitals and high-volume clinics invest in advanced ultrasound machines equipped with color Doppler and 3D capabilities to offer premium services. Among equipment types, console/cart-based systems are preferred in stationary setups due to superior imaging quality, processing power, and multiple probe compatibility. These machines are typically used in multispecialty clinics and university veterinary hospitals where a broad range of diagnostic imaging is required.

The PACS segment is anticipated to grow at the highest CAGR of 8.01% over the forecast period. These systems are particularly valuable in farm settings, mobile veterinary practices, and equine care. With increasing miniaturization and wireless connectivity, veterinarians can now conduct thorough examinations in the field and share results instantly with specialists. For instance, brands like Clarius and Butterfly iQ have developed compact, smartphone-compatible devices that enable full-scale diagnostic capabilities at a fraction of the traditional cost.

Animal Ultrasound Market By Type Insights

2-D ultrasound imaging held the highest share in 2024. It provides real-time, grayscale imaging that is sufficient for many abdominal, musculoskeletal, and reproductive evaluations. Most entry-level and portable devices are designed around 2D technology, making them accessible even to smaller veterinary practices. The simplicity of image interpretation and minimal training requirements further contribute to the widespread use of 2D ultrasound.

3D/4D ultrasound imaging is witnessing the fastest growth, especially in specialized practices and academic institutions. These advanced modalities offer more detailed spatial visualization and are increasingly used in cardiology, oncology, and prenatal assessments in animals. For example, 4D ultrasound, which provides real-time 3D imaging, is used to observe fetal movement and structural development in equine and bovine species. As these technologies become more affordable and training programs expand, their adoption is expected to rise significantly.

Animal Ultrasound Market By Technology Insights

By technology, digital imaging dominated the animal ultrasound market in 2024. The Digital platforms allow seamless sharing, editing, and archiving of ultrasound scans, which is crucial for longitudinal case studies and specialist consultations. The shift from analog to digital imaging is now nearly complete in developed markets, and digital dominance is expanding in emerging economies through portable, USB-connected devices.

The contrast imaging segment is anticipated to grow at the fastest CAGR from 2025 to 2034 due to its increasing adoption in veterinary hospitals and clinics. It enhances visualization of blood flow, organ perfusion, and tissue vascularization, improving diagnostic precision. The use of contrast-enhanced ultrasound (CEUS) in small animal tumor characterization and equine cardiovascular assessments is rising rapidly. However, limited availability of contrast agents and training requirements have restricted its use to specialized facilities.

Animal Ultrasound Market By Application Insights

The abdominal segment led the animal ultrasound market with a share of 27.34% in 2024, the driven by the prevalence of gastrointestinal and renal disorders in both pets and farm animals. Ultrasound is commonly used to detect obstructions, tumors, bladder stones, liver irregularities, and uterine issues. It provides critical information for surgical planning and early diagnosis, making it a cornerstone in veterinary medicine. In livestock, it also helps identify abdominal infections and reproductive abnormalities.

Cardiology is the fastest-growing application, as heart conditions like mitral valve disease, dilated cardiomyopathy, and congenital defects are increasingly diagnosed in aging companion animals. Advanced Doppler ultrasound systems allow veterinarians to evaluate blood flow and cardiac structure in detail. The rise in breed-specific cardiovascular screening, especially among pedigree dogs, is further fueling demand in this segment.

Animal Ultrasound Market By End-use Insights

Veterinary hospitals & clinics led the market in 2024 in terms of revenue share. These facilities typically offer a wide range of diagnostic services and have the resources to invest in advanced imaging technologies. They serve as referral centers for complex cases, including surgeries and cancer treatment, where ultrasound plays a pivotal diagnostic role.

Among the other end-uses are academic & research centers, Point-of-Care (PoC) facilities, diagnostic laboratories, and reference laboratories. Mobile units, in particular, are vital in rural and agricultural communities, enabling on-site diagnostics and reducing animal stress during transportation. Academic institutions use ultrasound as a training tool, increasing adoption among new generations of veterinary professionals.

Animal Ultrasound Market By Regional Insights

North America animal ultrasound market held the largest share of 38.29% of the global market in 2024. Driven by advanced veterinary infrastructure, high pet ownership, and strong government support for animal welfare. The U.S. leads with thousands of small animal clinics, a growing network of mobile vet services, and leading research institutions focused on veterinary innovation. Regulatory support for farm diagnostics and livestock health also contributes to the widespread use of ultrasound in large animal practice. Major manufacturers, including GE HealthCare and Mindray, are headquartered or have substantial operations in the region, supporting robust product availability and after-sales support.

How is U.S. Dominating the Animal Ultrasound Market?

U.S. is leading the animal ultrasound market in North America. The market growth can be attributed to the increased adoption of companion animals such as cats and dogs, rising animal healthcare expenditure, availability of pet insurance and growing emphasis on animal health for preventive care. According to American Pet Products Association, almost 66% or 86.9 million homes in U.S. owned a pet in 2024.

Asia Pacific is the Fastest-growing Region

Asia Pacific is emerging as the fastest-growing region in the animal ultrasound market, propelled by rapid urbanization, rising disposable incomes, and increased awareness of pet healthcare. Countries like China, India, and Australia are experiencing a boom in companion animal ownership, driving demand for modern diagnostic tools. Additionally, government-led livestock development programs in India and Southeast Asia are encouraging the adoption of reproductive monitoring systems. Portable ultrasound devices tailored to local needs are gaining popularity, supported by veterinary training initiatives and expanding digital connectivity.

What Fuels China’s Growth in the Animal Ultrasound Market?

China’s animal ultrasound market is expected to show the fastest growth in Asia Pacific. Expansion of livestock industry and increased demand for animal protein is leading to adoption of advanced veterinary diagnostic technologies such as animal ultrasound for effective disease control and reproductive management. Government support for modernization of animal husbandry infrastructure and stringent regulations imposed for food safety are driving the marker growth. Rising adoption of pets, increasing disposable incomes in the middle class, and availability of portable and handheld ultrasound devices are the factors fuelling the market growth.

Some of the prominent players in the animal ultrasound market include:

Animal Ultrasound Market Recent Developments

- In May 2025, the Assam state government announced plans for setting up three dedicated pet care hospitals in Birubari (Guwahati), Khanikar (Dibrugarh), and Bokakhat by the end of the year for improving access to quality pet healthcare across Assam. Each hospital will include four specialist doctors dedicated to medicine, surgery, pathology, and gynaecology.

- In March 2025, IVC Evidensia launched two new state-of-the-art veterinary training centres which are equipped with phantom models for abdominal ultrasound training, high-tech audio-visual equipment with ceiling-mounted cameras to relay demonstrations, and advanced simulators for practicing echocardiography. The centres are located at Vets Now headquarters in Dunfermline and Blaise Referral Hospital in Birmingham.

- In March 2025, Rwanda’s Agriculture and Animal Resources Development Board (RAB) started an initiative for monitoring pregnant cows with ultrasound technology for improving management of livestock and increasing the success rates of artificial insemination (AI) throughout the country.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the animal ultrasound market

Animal

- Small Animals

- Large Animals

Solution

-

- Console/Cart-Based Ultrasound

- Portable/Handheld Ultrasound

- Accessories/Consumables

- PACS

Type

- 2-D Ultrasound Imaging

- 3-D/4-D Ultrasound Imaging

- Doppler Imaging

Technology

- Digital Imaging

- Contrast Imaging

Application

- Musculoskeletal

- Cardiology

- Oncology

- Abdominal

- Other Applications

End-use

- Veterinary Hospitals & Clinics

- Other End-Use

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)