Anti-counterfeit Packaging Market Size and Research 2026 to 2035

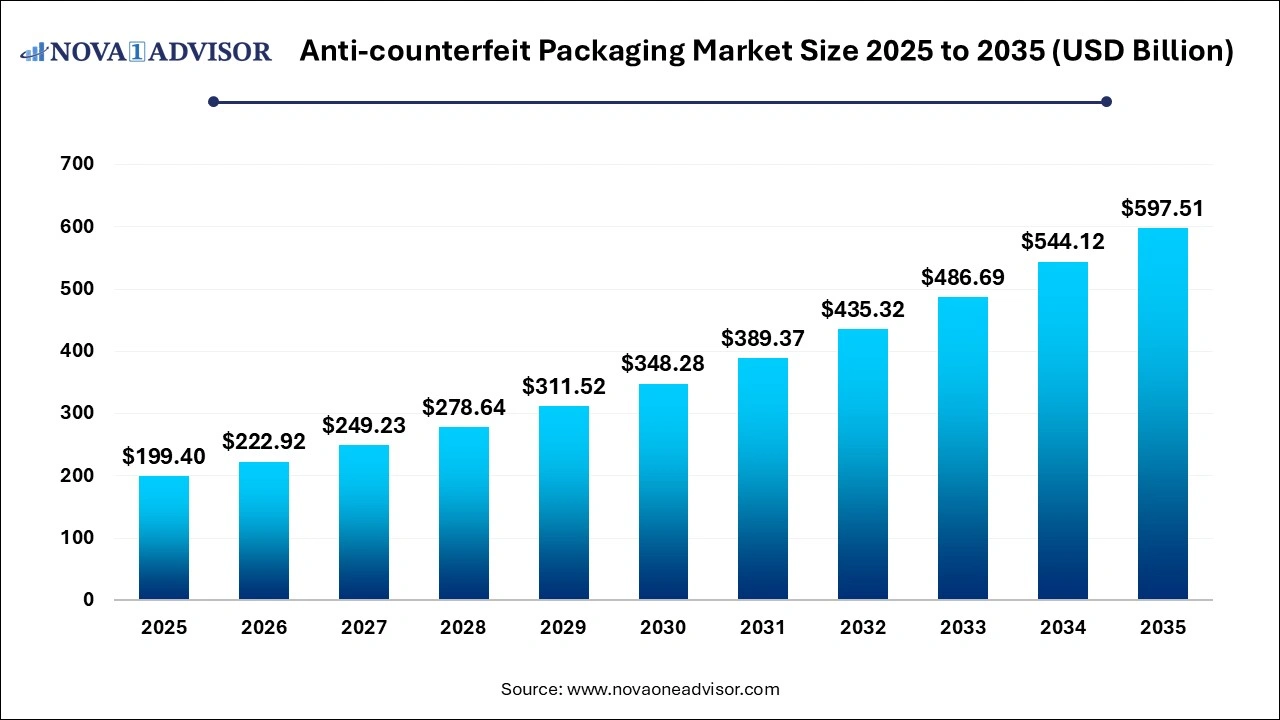

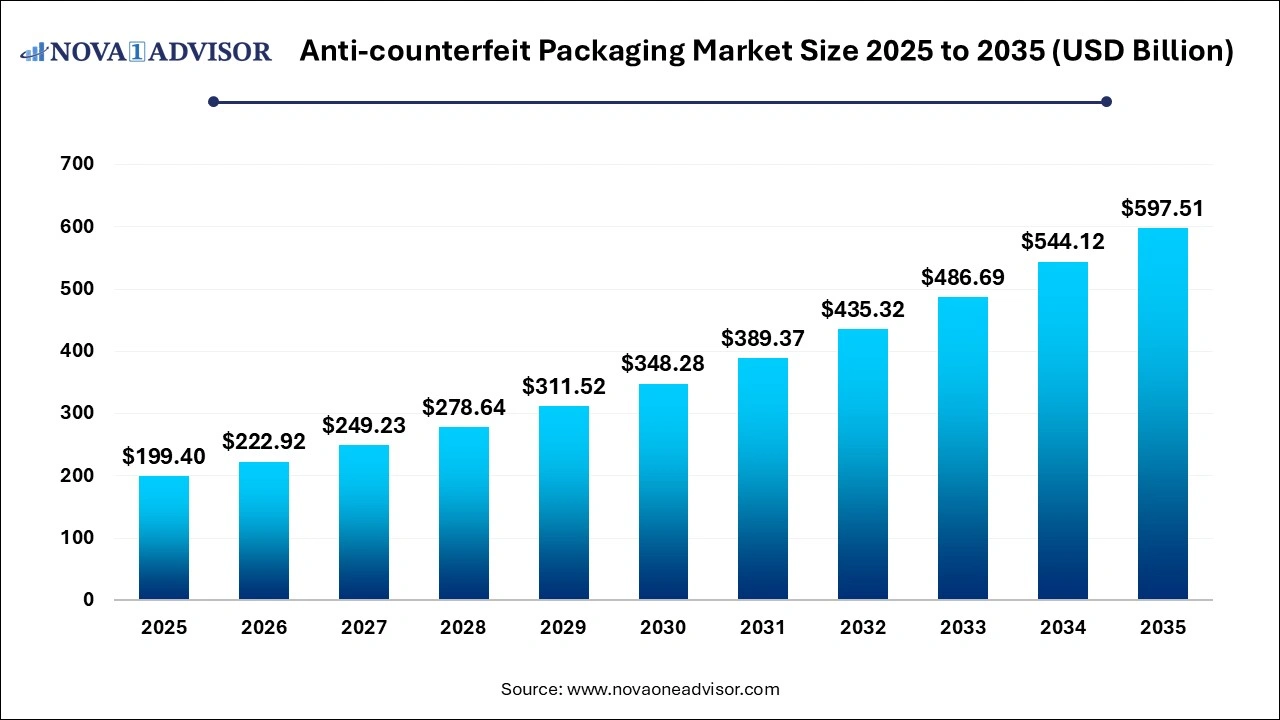

The anti-counterfeit packaging market size was exhibited at USD 199.4 billion in 2025 and is projected to hit around USD 597.51 billion by 2035, growing at a CAGR of 11.6% during the forecast period 2026 to 2035. The market growth can be linked to escalated incidents of counterfeit products, evolving regulatory frameworks and rising complexity of global supply chains. Increased consumer demand for secure packaging is driving the adoption of anti-counterfeit technologies by companies.

Anti-counterfeit Packaging Market Key Takeaways:

- North America dominated the global anti-counterfeit packaging market with the largest share in 2025.

- Asia Pacific is anticipated to witness lucrative growth in the market over the forecast period.

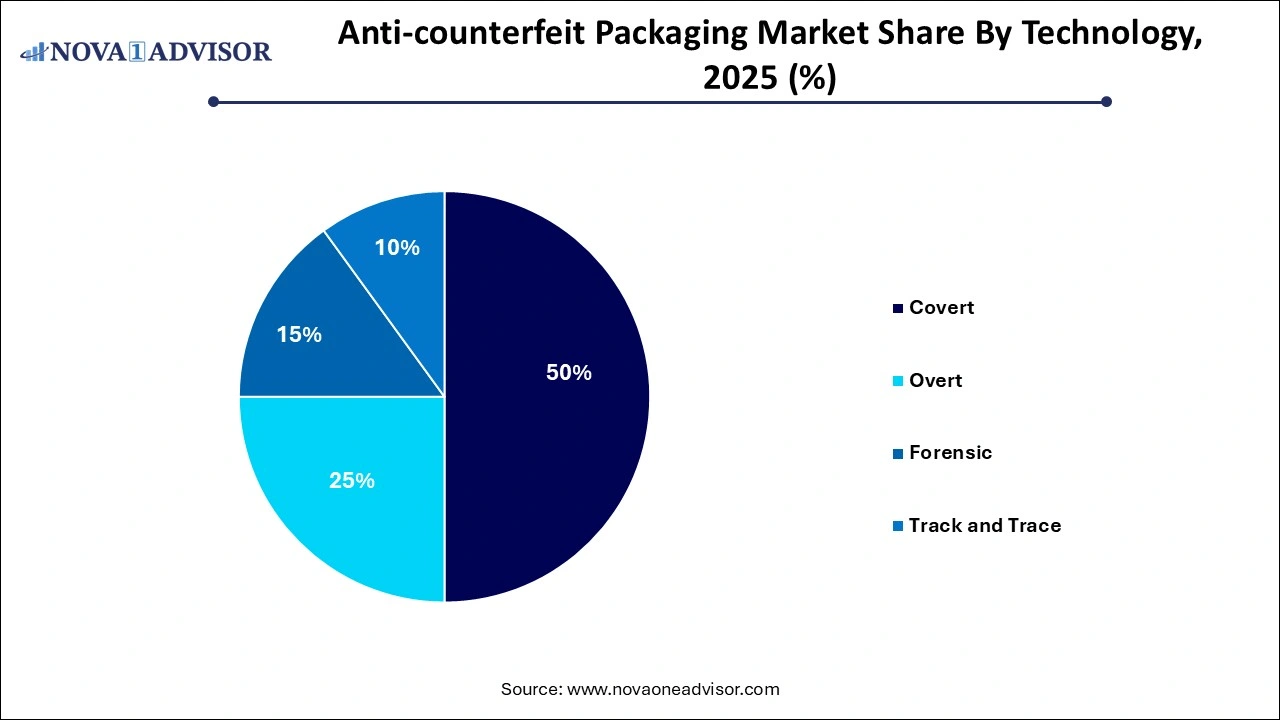

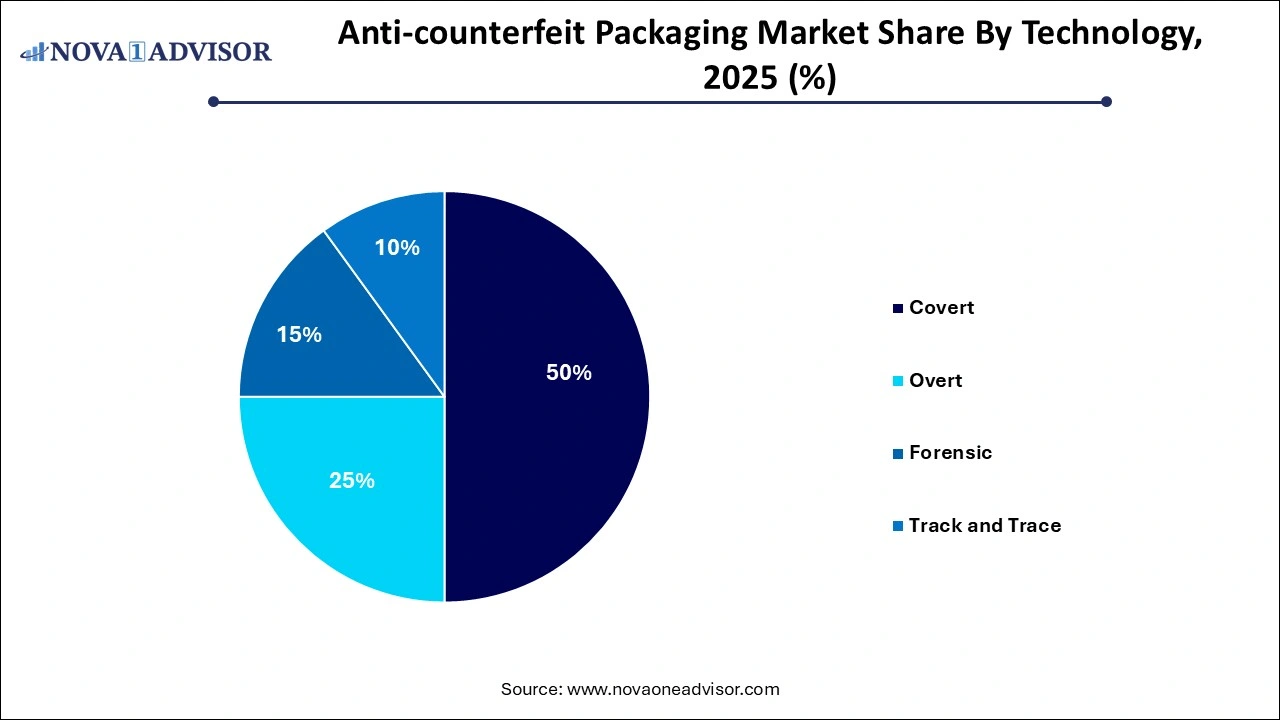

- By technology, the track & trace segment held the largest market share in 2025.

- By technology, the covert segment is expected to grow at the fastest rate during the forecast period.

- By application, the pharmaceutical segment accounted for the largest share in 2025.

- By application, the food & beverages segment is predicted to expand rapidly over the forecast period.

What Factors Are Fuelling the Anti-Counterfeit Packaging Market?

Anti-counterfeit packaging refers to deploying specialized packaging for goods which is designed for preventing and detecting the production and sale of counterfeit goods. These solutions help in safeguarding brand integrity, protection of revenue for companies, in maintaining profitability and enhancing consumer experience leading to increased security and trust regarding authenticity of the product. Increased penetration of counterfeit goods globally across various industries is necessitating comprehensive anti-counterfeit solutions. Rising investments by various brands for value preservation, globalization of supply chains, increased rates of direct-to-consumer (D2C) shipments, continuous advancements in anti-counterfeit technologies, evolving consumer needs and compliance requirements imposed by regulatory bodies are the factors driving the market growth.

What are the Key Trends in the Anti-Counterfeit Packaging Market in 2025?

- In April 2025, Inovar Packaging Group, LLC, a leader in innovative and sustainable label printing and packaging solutions, expanded its presence and capabilities in Northeast America with the acquisition of ModTek LLC, a regionally leading producer of prime label.

- In February 2025, Kezzler boosted its global presence and expanded its product offering with the procurement of Scanbuy's Smart Packaging and QR Code consumer engagement business. The acquisition will provide access to Kezzler's world-class traceability platform for Scanbuy’s customers, further catering the rising demand for product transparency, visibility in supply chain, disclosure and enhanced consumer interaction.

How is AI Integration Benefitting the Anti-Counterfeit Packaging Market?

The use of artificial intelligence in anti-counterfeit packaging is enabling development of robust solutions for brands and consumers to address the universal concern of fake products. AI algorithms can enhance accuracy and efficiency in detection of fake products by analyzing product images, logos and packaging details such as micro-features and serial numbers with computer vision and image recognition technologies. Integration of supply chain tracking technologies such as NFC chips, QR codes and RFID tags with AI enables real-time data monitoring for detection of anomalies, unauthorized diversions and identification of potential entry points for counterfeit goods.

AI-powered solutions help in improving consumer safety and protection of brand reputation by enabling consumer verification for product authenticity through a simple code scanned with smartphones. Furthermore, utilization of AI algorithms in predictive analytics and behavioural enables identification of patterns and prediction of potential counterfeit activities, allowing companies to act before issues escalate.

- For instance, in February 2025, Systech, subsidiary of Markem-Imaje and Dover and a leader in digital identification and traceability software solutions, introduced UniSecure artAI, a revolutionary AI-driven authentication solution developed for safeguarding brands in the life sciences and pharmaceutical industries. By leveraging existing packaging artwork and AI applications like machine vision, machine learning and neural networks, the cloud-based Software as a Service (SaaS) solution, artAI enhances packaging quality and protection of patients.

Report Scope of Anti-counterfeit Packaging Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 222.92 Billion |

| Market Size by 2035 |

USD 597.51 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 11.6% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Technology, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

3M; AVERY DENNISON CORPORATION; CCL Industries; DuPont; Zebra Technologies Corp.; ITL Group; SML Group; SATO Holdings Corporation; SICPA HOLDING SA; Systech International; Applied DNA Sciences; AlpVision SA; Authentix; Atlantic Zeiser GmbH |

Anti-counterfeit Packaging Market Dynamics

Drivers

Rising global threat of product counterfeiting

Counterfeit goods are costing a fortune for several businesses leading to reduced market share, lost sales and infringement affecting brand reputation and consumer trust. Companies are actively adopting anti-counterfeit packaging solutions to address these issues for ensuring public safety and compliance with regulations, further driving the growth of the anti-counterfeit packaging. Additionally, adoption of advanced technologies by counterfeiters is creating the demand for robust solutions by businesses.

Restraint

High initial investments

Implementation of advanced anti-counterfeit packaging technologies such as RFID, serialization systems and integration of digital platforms requires significant upfront capital expenditure which can be complex, time-consuming and expensive, especially for small and medium-sized enterprises (SMEs) significantly restraining the market growth. Furthermore, ongoing expenses associated with the maintenance and management of these advanced systems as well as lack of global standardization restraints the market growth across various industries

Opportunities

Demand for Authenticity

With the rising penetration of counterfeit products is driving consumer awareness and demand for authentic products. Businesses are actively implementing advanced anti-counterfeit solutions in their products to maintain brand integrity, consumer safety and protect their revenue. Governments across the world are taking initiatives for mitigating the economic impact of counterfeiting by implementing policies to support legitimate businesses, strengthening customs enforcement and promoting public awareness campaigns for educating consumers.

Anti-counterfeit Packaging Market Segmental Insights

By Technology Insights

The Track & Trace Segment’s Dominant Share

By technology, the track & trace segment dominated the market with the largest share in 2025. Global proliferation of counterfeit products across various industries leading to heavy financial losses and damage to brand reputation is driving the demand for track and trace systems to enable authentic verification and detection of irregularities. Brands are actively implementing track and trace systems for protection of their intellectual property and safeguarding product authenticity to maintain customer loyalty and market share.

Advancements in tracking technologies such as integration of AI, Internet of Things (IoT), blockchain and cloud-based platforms as well as use of enhanced identifiers like barcodes (2D Data Matrix codes), NFC chips and RFID tags is enabling access to efficient solutions at reduced costs. Furthermore, rapid expansion of e-commerce, increased complexity of global supply chains, strict mandates for serialization and traceability by governments as well as growing consumer demand for robust authentication solutions for their products are the factors driving the growth of this segment.

The covert segment is anticipated to witness lucrative growth over the forecast period. Covert anti-counterfeit solutions are actively being deployed due to their features such as invisibility to the naked eye and requirement of specialized tools or knowledge for verification. The stealth and undetectability offered by covert features is driving its demand for high-value goods requiring superior level of security. Advanced covert technologies such as holograms, invisible inks, microtext or microprinting, taggants, digital watermarks and forensic markers can be seamlessly integrated into existing packaging designs without redesigning or altering aesthetics of products.

Brands are adopting multi-layered security approaches by combining overt, semi-covert and covert features to enhance anti-counterfeiting packaging. Moreover, reduced risk of disclosure and protection against product diversion and gray market trade offered by covert technologies is expected to boost the market growth in the upcoming years.

By Application Insights

The Pharmaceutical Segment’s Largest Share

The pharmaceutical segment accounted for the largest market share in 2025. Pharmaceutical companies are proactively investing in anti-counterfeit packaging for protecting their patents, brand reputation and to enhance consumer safety, further enabling longevity in the market and prevention of significant financial losses. Stringent regulations imposed by government bodies such as the Drug Supply Chain Security Act (DSCSA) in U.S. and the Falsified Medicines Directive (FMD) in Europe requires pharmaceutical products to include unique identifiers at the unit level for end-to-end traceability. Furthermore, growing concerns regarding life-threatening risks of counterfeit drugs, rising complexity of global pharmaceutical supply chains, increased penetration of e-commerce platforms and online pharmacies, and surging consumer awareness and demand for drug safety is driving the market growth of this segment.

- According to WHO, countries across the globe spend an estimated US$ 30.5 billion annually on substandard and falsified medicinal products. Additionally, in low- and middle-income countries (LMICs), at least 1 out of 10 medicines are substandard or falsified.

The Food & Beverages Segment Fastest Growing

The food & beverage segment is expected to show the fastest growth over the forecast period. Counterfeit food and beverages (F&B) comprise public health and safety as they contain unhygienic, substandard and even harmful ingredients which can cause foodborne illnesses, allergies and other health issues. Increased rates of food adulteration, mislabelling and substitution are driving the demand for anti-counterfeit packaging by consumers and regulators to enhance safety, transparency and product authenticity of F&B. Stringent regulations by governments worldwide are mandating the use of tamper-evident features, unique identifiers and robust tracking systems by manufacturers and suppliers to ensure packaging compliance and increased traceability to avoid penalties.

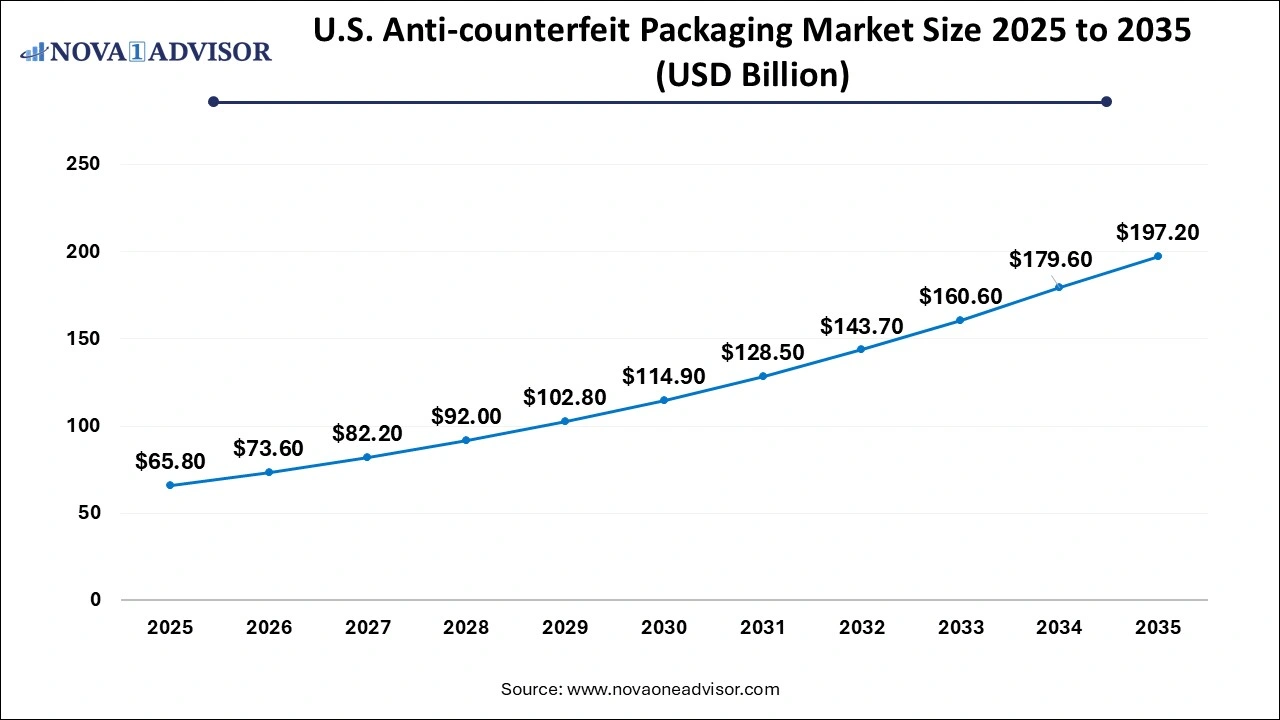

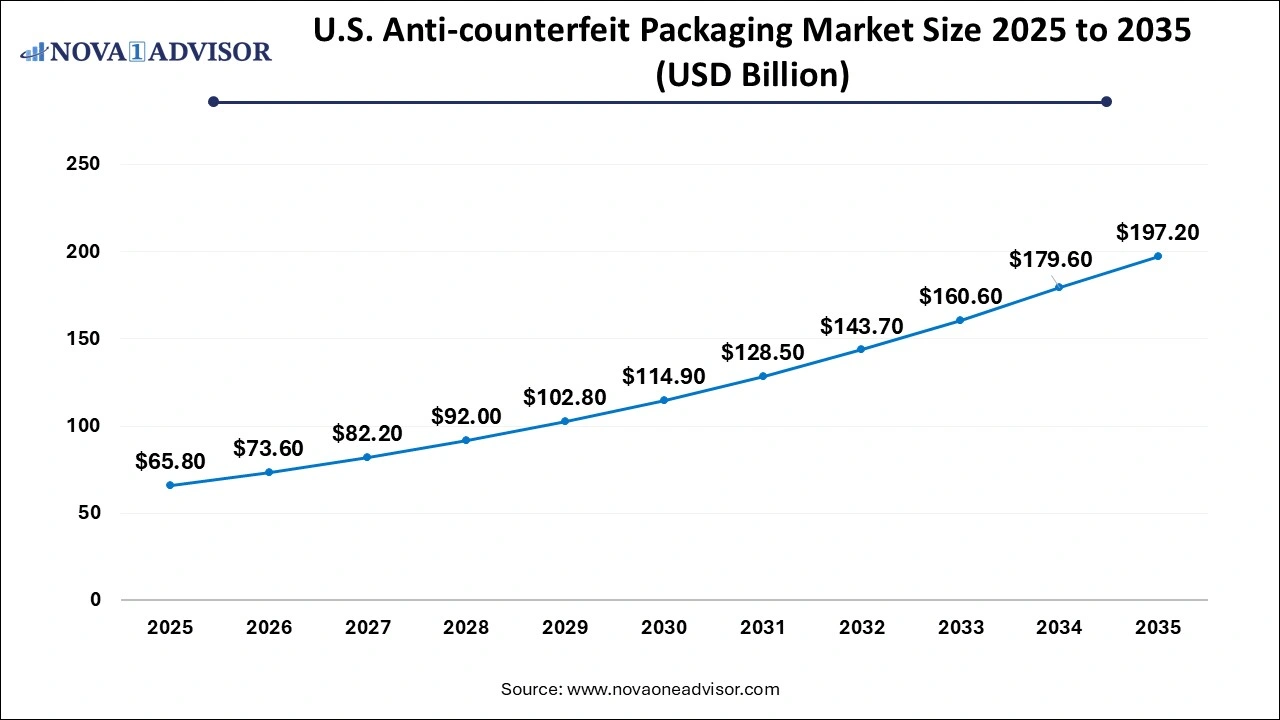

U.S. Anti-Counterfeit Packaging Market Size and Growth 2026 to 2035

The U.S. anti-counterfeit packaging market size is evaluated at USD 65.8 billion in 2025 and is projected to be worth around USD 197.2 billion by 2035, growing at a CAGR of 10.49% from 2026 to 2035.

Anti-counterfeit Packaging Market Regional Insights

What Drives North America’s Dominance in the Anti-Counterfeit Packaging Market?

North America dominated the global anti-counterfeit packaging market with the largest share in 2024. The region has experienced significant financial losses for businesses due to counterfeit goods leading to brand dilution, lost sales and legal expenses. Companies are proactively investing in anti-counterfeit packaging for protecting their intellectual property, brand reputation and revenue from illegal counterfeit activities. Widespread availability and adoption of advanced anti-counterfeit technologies, well-established pharmaceutical industry, rapid expansion of e-commerce platforms, strict government regulations and increased consumer awareness demanding authentic products are the factors fuelling the market growth.

How Significant is the Asia Pacific Market in Anti-Counterfeit Packaging?

Asia Pacific is anticipated to grow at the fastest rate in the market over the forecast period. The rapidly evolving economic landscape of Asia Pacific being a major manufacturing hub is becoming a significant source and destination for counterfeit goods throughout all kinds of industries creating the need for robust anti-counterfeit packaging solutions. Expanding pharmaceutical and food & beverages industries in major regional countries like India and China to meet the rising demand of large populations is driving the adoption of secure and traceable packaging solutions to ensure consumer safety and tackle problems like fake drugs and food fraud.

Increased penetration of digital technologies and use of online retail platforms, supportive regulatory frameworks, growing adoption of advanced anti-counterfeit technologies and rising consumer awareness are boosting the market expansion.

Some of the prominent players in the anti-counterfeit packaging market include:

- 3M

- AVERY DENNISON CORPORATION

- CCL Industries

- DuPont

- Zebra Technologies Corp.

- ITL Group

- SML Group

- SATO Holdings Corporation

- SICPA HOLDING SA

- Systech International

- Applied DNA Sciences

- AlpVision SA

- Authentix

- Atlantic Zeiser GmbH

Anti-counterfeit Packaging Market Recent Developments

- In December 2024, Dana Inc., revamped the design of its Victor Reinz Reinzosil room-temperature vulcanizing (RTV) silicone gasket maker with new blister packaging featuring a secure sticker made up of a serialized QR code from Authentic Vision for enhancing protection from product piracy and forgery.

- In November 2024, Ennoventure, Inc., a globally leading AI-powered brand protection and authentication solutions provider, successfully closed a Series A funding round by securing $8.9 million. The company aims at investing the funds for scaling up global operations and driving innovation in brand protection technology.

- In October 2024, Digimarc Corporation, a globally leading provider of digital watermarking technologies, launched a breakthrough out-of-the-box solution, the Digimarc Validate mobile app developed for helping businesses to tackle counterfeit products.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the anti-counterfeit packaging market

By Technology

-

- Security Labels

- Invisible Printing

- Others

-

- Holograms

- Color Shifting Inks

- Others

-

- Machine Readable Data

- RFID

- Others

By Application

- Pharmaceutical

- Food & Beverage

- Apparel & Footwear

- Automotive

- Personal Care

- Electrical & Electronics

- Luxury Goods

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)