Anti-Inflammatory Therapeutics Market Size and Trends

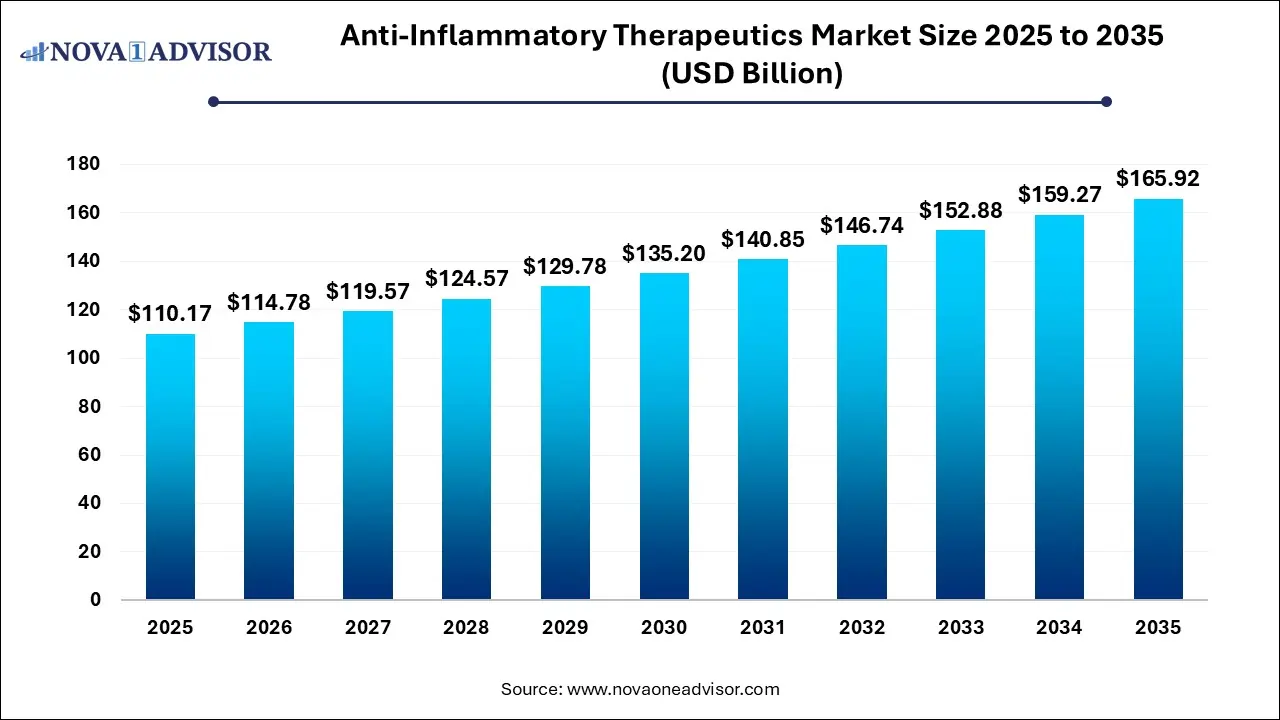

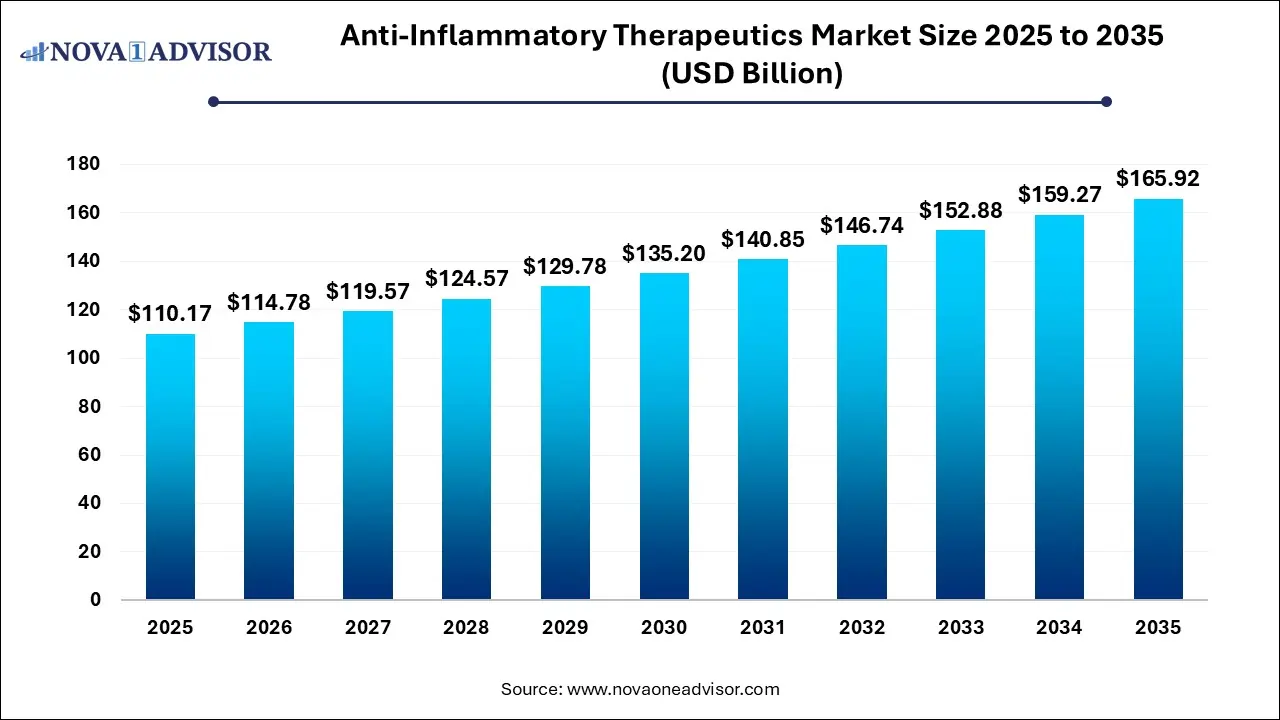

The global anti-inflammatory therapeutics market size is calculated at USD 110.17 billion in 2025, grow to USD 114.78 billion in 2026, and is projected to reach around USD 165.92 billion by 2035. registering a CAGR of 4.18% from 2026 to 2035. The Market is expanding due to the increasing prevalence of chronic inflammatory conditions and aging populations, advancements in biologics and targeted therapies are also driving the market growth.

Key Takeaways

- North America dominated the anti-inflammatory therapeutics market in 2025.

- Asia-Pacific is expected to grow at the highest CAGR in the market during the forecast period.

- By drug class, the nonsteroidal anti-inflammatory drug segment held the largest revenue market share.

- By drug class, the corticosteroids segment is expected to grow at the fastest CAGR in the market during the studied years.

- By indication, the arthritis segment dominated the market.

- By indication, the respiratory disease segment is expected to grow at the fastest CAGR in the market during the forecast period.

How is Innovation Impacting the Anti-inflammatory Therapeutics Market?

Anti-inflammatory therapeutics are treatments designed to reduce inflammation in the body, helping to manage symptoms and improve outcomes in conditions like arthritis, asthma, and inflammatory bowel disease. Innovation is driving the anti-inflammatory therapeutics market by introducing advanced biologics, monoclonal antibodies, and small molecular drugs that precisely target inflammation pathways. These breakthroughs are improving treatment effectiveness and minimizing side effects for conditions like rheumatoid arthritis and inflammatory bowel disease. Emerging technologies like precision medicine and biomarkers-based therapies are enabling more personalized care. Combined with faster drug development through AI and data analytics, these innovations are expanding treatment options and driving strong market growth.

- For Instance, In September 2024, the University of Queensland released a blog post emphasizing that rheumatoid arthritis (RA), a long-term and painful inflammatory disease, impacts around 23 million people worldwide. The post also pointed out that women are disproportionately affected by this condition, experiencing a higher rate of incidence compared to men.

What are the leading trends shaping the Anti-inflammatory Therapeutics market in 2025?

- In July 2025, Teva Pharmaceuticals and Sanofi shared a timeline update on their Duvakitug program, which focuses on developing a human IgG1-λ2 monoclonal antibody that targets TL1A for treating moderate-to-severe inflammatory bowel disease (IBD). This joint effort aims to advance precision therapies for IBD, to provide more effective treatment options for patients managing this long-term condition.

- In June 2025, AbbVie revealed its acquisition of Celsius Therapeutics, Inc., a private biotech firm focused on developing novel treatments for inflammatory conditions. Celsius’ key investigational drug, CEL383—an anti-TREM1 antibody with first-in-class potential—has completed a Phase 1 trial for treating inflammatory bowel disease (IBD).

How is AI enhancing advancements in the Anti-inflammatory Therapeutics Market?

AI is significantly advancing the market by accelerating drug discovery, identifying novel targets, and optimizing clinical trial designs. Through machine learning and data analysis, AI helps predict treatment responses, personalize therapies, and reduce development time. It also enables early detection of inflammatory conditions by analyzing medical data and biomarkers. These innovations are driving more efficient, cost-effective, and targeted treatment approaches, ultimately improving outcomes for patients with chronic inflammatory diseases.

Report Scope of Anti-Inflammatory Therapeutics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 110.15 Billion |

| Market Size by 2035 |

USD 165.92 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 4.8% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

By Drug Class, By Indication, By Regional |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Eli Lily and Company, AstraZeneca PLC, Amgen Inc., F. Hoffman, Abbvie, Inc., Johnson & Johnson, GlaxoSmithKline, Merck & CO., Inc., Novartis, Pfizer, Inc., La Roche AG, Ferring Pharmaceuticals, Bioventus, Zimmer Biomet Holdings, Inc., Flexion Therapeutics, Inc |

Market Dynamics

Driver

Increased Research and Development

Increased research and development is a major driver in the anti-inflammatory therapeutics market as it leads to the discovery of novel drug targets, more effective treatment options, and improved drug safety profiles. R&D efforts are enabling the creation of advanced biologics, targeted therapies, and personalized medicine approaches, which offer better outcomes for patients with chronic inflammatory diseases. This continuous innovation is meeting unmet medical needs, attracting investment, and accelerating the introduction of new, market-leading therapies.

- For Instance, In March 2024, UCB strategically invested in IMIDomics, Inc., a company dedicated to creating therapies for immune-mediated inflammatory diseases (IMIDs). This move reflects UCB's commitment to advancing innovative treatments in the inflammatory disease space through strategic partnerships and targeted investments.

Restraint

Side effect And Safety Concerns

Side effects and safety concerns remain significant limiting factors in the anti-inflammatory therapeutics market. Many treatments, including NSAIDs and corticosteroids, can cause adverse effects such as gastrointestinal issues, cardiovascular risks, or immune suppression with long-term use. These risks often lead to patient non-compliance and hesitation among healthcare providers, highlighting the need for safer, more targeted therapies to improve patient outcomes and ensure broader treatment acceptance.

Opportunity

Development of Targeted Biologic Therapies

The development of targeted biologic therapies offers a major future opportunity in the anti-inflammatory therapeutics market due to their ability to precisely modulate specific components of the immune system. Unlike conventional treatments that often affect the entire immune response and cause broad side effects, biologics focus on particular molecules or pathways, leading to improved efficacy and reduced adverse effects. This targeted approach allows for more personalized treatment plans, especially for chronic inflammatory conditions like rheumatoid arthritis and inflammatory bowel disease. As research advances and demand doe safer, more effective therapies grows, biologics are expected to play a central role in future treatment strategies.

For Instance, In June 2024, the FDA approved VYVGART Hytrulo, a biologic developed by Argenx, for treating chronic inflammatory demyelinating polyneuropathy (CIDP). This approval highlights the increasing importance of biologics in managing complex inflammatory disorders.

Segmental Insights

How Nonsteroidal anti-inflammatory Drug Segment Dominate the Anti-inflammatory Therapeutics Market in 2025?

In 2025, non-steroidal anti-inflammatory drugs dominated the market, driven by their widespread use in managing conditions like arthritis, migraines, and musculoskeletal disorders. NSAIDs held a significant market share due to their efficacy, affordability, and over-the-counter availability, making them accessible for self-medication. The oral route of administration remained the most preferred, accounting for a substantial portion of NSAID consumption, owing to convenience and patient compliance. Additionally, the expansion of retail pharmacies and the increasing prevalence of chronic inflammatory conditions contribute to the sustained demand and market dominance.

The corticosteroids segment is growing at the fastest rate in the anti-inflammatory segment market due to its strong effectiveness in rapidly reducing inflammation and managing acute flare-ups in chronic conditions like asthma, arthritis, and IBD. Their broad application across various inflammatory diseases and availability in multiple formulations boost their demand. Additionally, ongoing research to develop corticosteroids with fewer side effects enhances their therapeutic value and drives faster market growth.

Why Did the Arthritis Segment Dominate in Anti-inflammatory Therapeutics 2025?

The arthritis segment dominated the market due to the high global prevalence of both osteoarthritis and rheumatoid arthritis, especially, especially among aging populations. The chronic nature of the disease requires long-term treatment, driving consistent demand for anti-inflammatory medications such as NSAIDs corticosteroids, and biologics. Additionally, increased awareness, early diagnosis, and the availability of advanced therapies have further contributed to the market growth.

The respiratory segment is anticipated to grow at the fastest rate due to the rising incidence of chronic respiratory conditions such as asthma and chronic obstructive pulmonary disease(COPD). Increasing air pollution, lifestyle changes, and higher smoking rates are major contributing factors. Additionally, advancements in inhalation therapies, growing awareness, and the introduction of targeted biologics for severe asthma are boosting treatment adoption and driving rapid growth of the market.

Regional Insights

How is North America Contributing to the Expansion of the Anti-inflammatory Therapeutics Market?

North America dominated the market in 2025 due to the high prevalence of chronic inflammatory conditions such as arthritis, asthma, and IBD. The region benefits from advanced healthcare infrastructure, widespread access to treatment, and strong awareness among both patients and healthcare providers. Additionally, the presence of leading pharmaceutical companies and continuous innovation in drug development contributed to the widespread availability and adoption of advanced anti-inflammatory therapies across the region.

- For Instance, In June 2025, AMGEN demonstrated its dedication to advancing treatments for inflammatory and rheumatic diseases by presenting 27 abstracts at the European Alliance of Associations for Rheumatology (EULAR) Congress. This effort reflects the company's strong focus on research and innovation in the field of inflammation-related conditions.

How is Asia-Pacific approaching the Anti-inflammatory Therapeutics Market in 2025?

The region's large and aging population is experiencing a rising prevalence of chronic inflammatory conditions such as arthritis, respiratory diseases, and inflammatory bowel disease. Additionally, increased healthcare spending, improved access to medical services, and heightened awareness of biological therapies are contributing to market expansion. Ongoing research and development efforts, along with supportive regulatory environments, are further facilitating the introduction of innovative treatments, positioning Asia-Pacific as a rapidly growing market for anti-inflammatory therapeutics.

- For Instance, In January 2023, Sun Pharma enhanced its anti-inflammatory portfolio by acquiring three drug brands, strengthening its position in the market and increasing its growth potential in the therapeutic segment.

Top Companies in the Anti-inflammatory Therapeutics Market

Recent Developments in the Anti-inflammatory Therapeutics Market

- In June 2025, the FDA approved Verona Pharma PLC’s Ohtuvayre (ensifentrine) as a maintenance therapy for adults with chronic obstructive pulmonary disease (COPD). This innovative drug uniquely combines bronchodilator and non-steroidal anti-inflammatory effects by selectively inhibiting both phosphodiesterase 3 and 4 enzymes in a single molecule.

- In March 2025, AbbVie Inc. announced a definitive agreement to acquire Landos Biopharma Inc. The acquisition includes NX-13, Landos’ promising oral drug candidate that targets NLRX1, offering both anti-inflammatory effects and support for epithelial healing through its unique dual-action mechanism.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Drug Class

- Nonsteroidal Anti-inflammatory Diseases (NSAIDs)

- Corticosteroids

- Biologics

By Indication

- Arthritis

- Respiratory Disease

- Multiple Sclerosis

- Psoriasis

- Anti-inflammatory Bowel Disease (IBD)

- Other Anti-inflammatory disease

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)