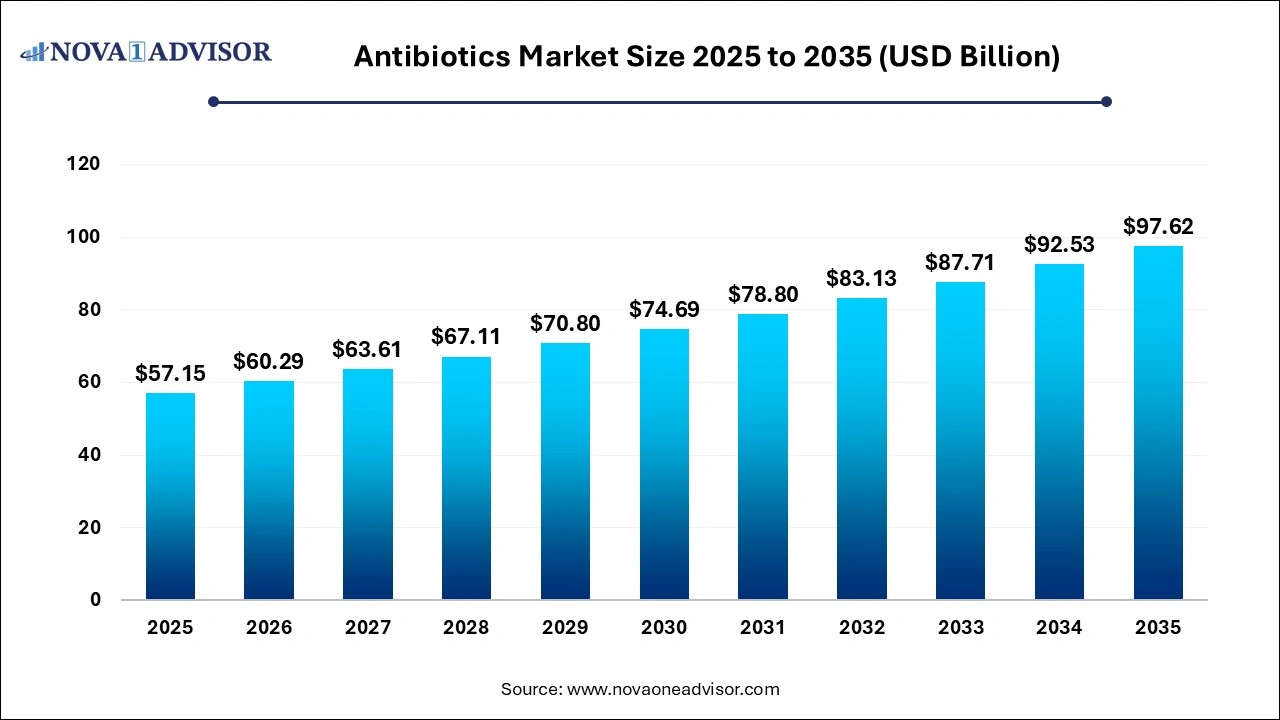

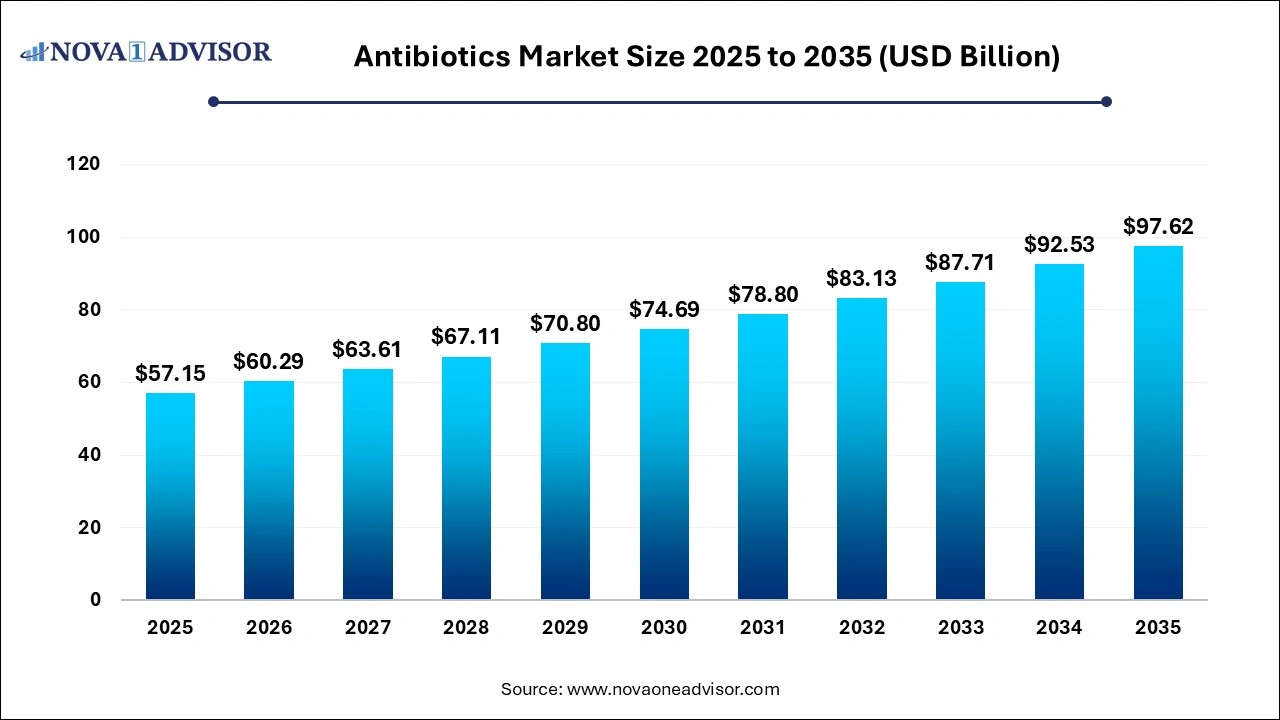

Antibiotics Market Size and Growth 2026 to 2035

The global antibiotics market size was valued at USD 57.15 billion in 2025 and is projected to surpass around USD 97.62 billion by 2035, registering a CAGR of 5.5% over the forecast period of 2026 to 2035.

Antibiotics Market Key Takeaways

- Asia Pacific accounted for the highest market share of over 46.00% in 2025.

- North America and Europe region held the market share of around 45.00% in 2025.

- By drug class, penicillin hit highest market share of over 27% in 2025.

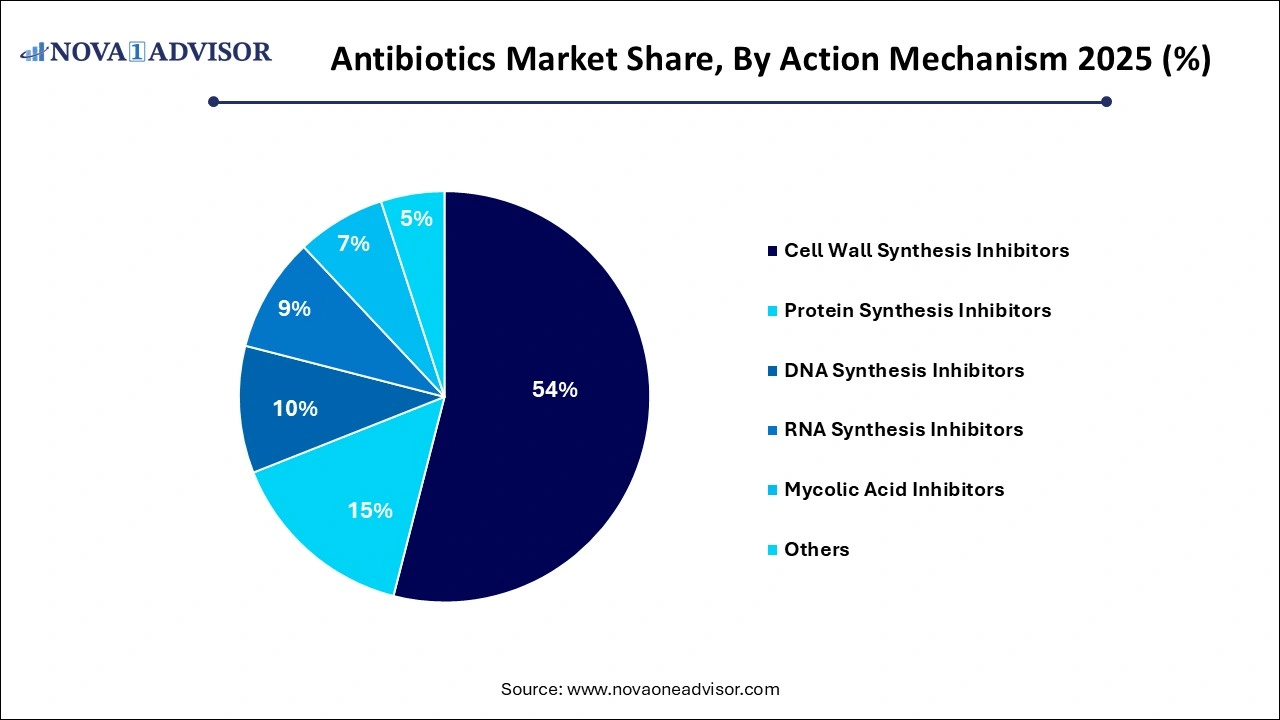

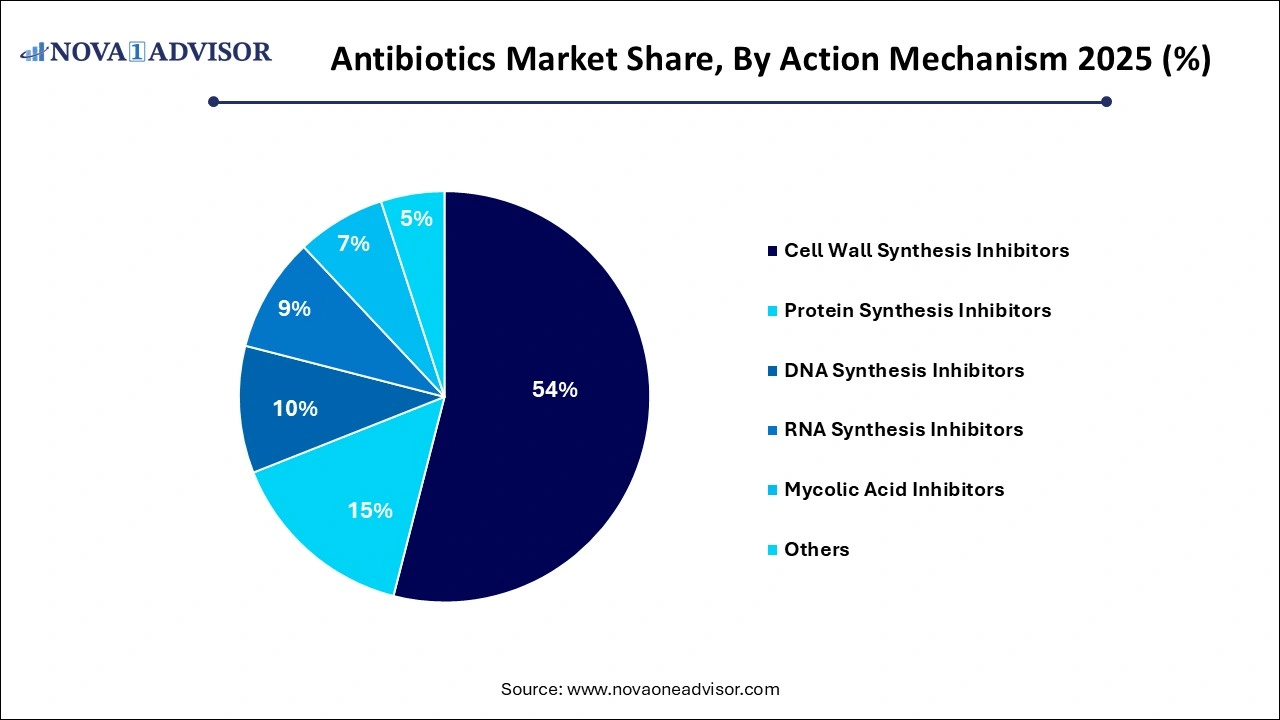

- By action mechanism, cell wall synthesis inhibitors segment has garnered revenue share of 54% in 2025.

Antibiotics Market Overview

The global antibiotics market is a critical pillar in the healthcare sector, serving as the frontline defense against bacterial infections. Antibiotics, also known as antibacterials, are agents that kill or inhibit the growth of bacteria and are instrumental in reducing morbidity and mortality caused by bacterial diseases. With the rising burden of infectious diseases, increased awareness regarding appropriate antibiotic use, and growing healthcare infrastructure, the antibiotics market continues to witness steady demand.

The expansion of this market is further fueled by increasing bacterial resistance and the subsequent need for novel formulations. Governments and private entities are pouring substantial investments into R&D to address the escalating antimicrobial resistance (AMR) crisis, leading to the development of next-generation antibiotics. Additionally, supportive regulatory frameworks in regions like the U.S. and EU have provided a relatively fast-track mechanism for critical antibiotic approvals, particularly for those classified under "orphan" or "breakthrough" status.

Despite a robust pipeline and consistent market demand, the antibiotics market grapples with challenges such as stringent regulatory approvals, lengthy R&D cycles, and diminishing returns on antibiotic innovation due to low pricing pressures and limited prescription periods. Nevertheless, the critical role of antibiotics in surgical procedures, chronic care, and emergency medical services underlines their indispensable role in global healthcare systems.

Major Trends in the Antibiotics Market

-

Rising Prevalence of Antimicrobial Resistance (AMR): The global emergence of multi-drug-resistant bacteria such as MRSA and CRE has intensified the demand for newer and stronger antibiotics.

-

Surge in Hospital-Acquired Infections (HAIs): Hospitals, especially in developing nations, are facing an increasing incidence of HAIs, which in turn propels the need for broad-spectrum and last-resort antibiotics.

-

Growth in Outpatient Parenteral Antibiotic Therapy (OPAT): OPAT is gaining traction, particularly in North America and Europe, owing to convenience, lower cost, and reduced hospital stay.

-

Shift Towards Narrow-Spectrum Antibiotics: Increasing emphasis on antibiotic stewardship is promoting the use of narrow-spectrum antibiotics to target specific pathogens and minimize resistance.

-

Increased R&D Investments by Government Initiatives: Programs like BARDA and CARB-X are financing antibiotic development to fill the gaps left by major pharmaceutical exits.

-

Rising Utilization of AI and Genomics: Advanced technologies are now being used to develop personalized antibiotics and improve diagnostic speed for faster treatment.

-

Expansion of Online Pharmacies: The accessibility of antibiotics through digital platforms has increased, especially in urban regions of developing countries.

-

Biosimilar Antibiotics Entering Market: With patents expiring, biosimilars and generics are gaining a strong foothold, providing cost-effective alternatives.

Antibiotics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 60.29 Billion |

| Market Size by 2035 |

USD 97.62 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.5% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Drug Class, Application, Action Mechanism, Drug Origin, Spectrum Of Activity, Route of Administration, Distribution Channel, Geography |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Abbott Laboratories (US), Pfizer Inc. (US), Johnson & Johnson Services, GlaxoSmithKline PLC (UK), Sanofi (France), Bristol-Myers Squibb Company (US), Eli Lilly and Company (US), Novartis AG (Switzerland), Bayer AG (Germany), Astellas Pharma Inc. (Japan) |

Market Driver: Antimicrobial Resistance as a Catalyst for Innovation

One of the most compelling drivers in the antibiotics market is the alarming rise in antimicrobial resistance (AMR). Pathogens are evolving rapidly, rendering many first-line treatments ineffective. According to WHO, nearly 700,000 deaths occur annually due to antibiotic resistance, a figure projected to surge to 10 million by 2050 if no action is taken. This scenario has galvanized governments, NGOs, and pharmaceutical companies into urgent innovation. Regulatory bodies have introduced frameworks like the GAIN Act in the U.S., offering market exclusivity and expedited approvals. This, in turn, has revived interest among smaller biotech firms and academic institutions to develop potent antibiotics that can address resistant bacterial strains.

Market Restraint: Diminishing Profitability and Industry Exit

Despite the life-saving potential of antibiotics, profitability remains a key challenge, deterring major pharmaceutical companies from investing in antibiotic R&D. These drugs are typically prescribed for short durations, unlike chronic therapies such as insulin or antihypertensives. Coupled with increasing pricing pressures and stringent regulatory barriers, antibiotics offer limited commercial returns. Companies such as Novartis and Sanofi have either spun off or discontinued their antibiotic programs. The absence of a sustainable economic model threatens future innovation, creating a paradox where the world needs new antibiotics, but few are willing to bear the cost of bringing them to market.

Market Opportunity: Emerging Markets with High Infection Rates

Emerging economies in Asia-Pacific, Latin America, and parts of Africa represent an untapped reservoir of growth for the antibiotics market. These regions witness a disproportionately high burden of infectious diseases like tuberculosis, bacterial pneumonia, gastrointestinal infections, and sepsis. For instance, India and Indonesia account for a significant percentage of the global antibiotic consumption due to both over-the-counter access and widespread bacterial infections. As healthcare infrastructure improves and insurance coverage expands in these regions, the demand for both broad and narrow-spectrum antibiotics is expected to soar. Additionally, governments are actively combating counterfeit antibiotics, increasing trust in branded and generic pharmaceutical suppliers.

Segmental Analysis

By Drug Class Analysis

Penicillin continues to dominate the antibiotics market due to its widespread use in both outpatient and inpatient settings. Its proven efficacy, low toxicity, and cost-effectiveness make it a first-line treatment for many bacterial infections, including respiratory tract infections, otitis media, and skin infections. Amoxicillin, in particular, remains a staple in pediatric medicine. Countries with extensive public health systems still rely heavily on penicillin derivatives due to their affordability and established safety profile. In both emerging and developed nations, penicillin-based antibiotics remain a key revenue generator for both branded and generic pharmaceutical manufacturers.

On the other hand, fluoroquinolones are emerging as the fastest-growing segment within the drug class category. Their broad-spectrum efficacy, favorable pharmacokinetics, and high tissue penetration make them ideal for complicated infections like UTIs, prostatitis, and multidrug-resistant tuberculosis. Levofloxacin and ciprofloxacin are widely used for their once-daily dosing convenience and high bioavailability. However, regulatory scrutiny related to potential side effects like tendon rupture and arrhythmias has prompted rational use strategies, which are being counterbalanced by increasing clinical demand in high-resistance settings.

By Application Analysis

Respiratory infections represent the leading application for antibiotics owing to their high prevalence, especially during seasonal outbreaks. Conditions such as bronchitis, pneumonia, and sinusitis drive considerable antibiotic prescriptions. Regions experiencing extreme cold or pollution, like Northern Europe or Northern India, report high rates of respiratory infections. Amoxicillin-clavulanate, azithromycin, and ceftriaxone are commonly used agents in such cases. Public health campaigns encouraging early treatment of respiratory symptoms have further propelled demand for quick-acting antibiotics.

Meanwhile, septicemia is becoming a high-growth application segment, fueled by increasing hospitalization and immunocompromised populations. Patients with diabetes, cancer, and those undergoing surgeries are particularly susceptible. The rise in ICU admissions globally and focus on reducing sepsis-related mortality has placed significant importance on broad-spectrum, parenteral antibiotics. Carbapenems and newer beta-lactamase inhibitors are being fast-tracked in hospital formularies due to their critical role in treating bloodstream infections.

By Action Mechanism Analysis

Cell wall synthesis inhibitors lead this category, primarily represented by penicillins, cephalosporins, and carbapenems. These antibiotics are essential for combating Gram-positive and certain Gram-negative infections. Their wide spectrum of activity, especially against common respiratory and skin pathogens, solidifies their top market position. Furthermore, these drugs are preferred in surgical prophylaxis due to their proven bactericidal activity and low incidence of resistance.

Conversely, DNA synthesis inhibitors like fluoroquinolones are rapidly gaining traction. Their mechanism allows effective action against both Gram-negative and some Gram-positive bacteria, making them versatile agents. The growing cases of multidrug-resistant pathogens in hospital and community settings make DNA synthesis inhibitors an attractive treatment option.

Conversely, DNA synthesis inhibitors like fluoroquinolones are rapidly gaining traction. Their mechanism allows effective action against both Gram-negative and some Gram-positive bacteria, making them versatile agents. The growing cases of multidrug-resistant pathogens in hospital and community settings make DNA synthesis inhibitors an attractive treatment option.

By Drug Origin Analysis

Synthetic antibiotics dominate due to their scalable production, longer shelf life, and cost efficiency. These include popular drugs like ciprofloxacin, levofloxacin, and trimethoprim-sulfamethoxazole. Synthetic origin antibiotics often offer broader spectrum activity and are less dependent on fermentation processes, making them easier to mass produce.

Natural antibiotics like tetracycline and erythromycin still hold value but are increasingly being replaced by semi-synthetic and fully synthetic alternatives that offer better efficacy and resistance profiles.

By Spectrum of Activity Analysis

Broad-spectrum antibiotics continue to dominate due to their ability to act against a wide range of bacteria, especially when the exact pathogen is unknown. In emergency care and rural healthcare settings where diagnostics are limited, physicians often opt for broad-spectrum agents like cephalosporins, fluoroquinolones, and macrolides to initiate empirical therapy.

However, with rising awareness about AMR, narrow-spectrum antibiotics are also gaining prominence in targeted therapies, particularly in well-equipped urban hospitals.

By Route of Administration Analysis

Oral antibiotics remain the most common and preferred mode of administration due to ease of use, patient compliance, and cost efficiency. Antibiotics like amoxicillin, doxycycline, and azithromycin are commonly dispensed in oral formulations for outpatient management of mild to moderate infections.

Parenteral antibiotics are primarily used in hospital and ICU settings where rapid drug action is required. Though they represent a smaller share, this segment is critical for managing severe infections like meningitis, sepsis, and hospital-acquired pneumonia.

By Distribution Channel Analysis

Hospitals dominate the distribution landscape, given the high volume of critical infections treated in inpatient settings. Hospital formularies typically stock advanced antibiotics including carbapenems, beta-lactamase inhibitors, and combination therapies, particularly for surgical patients and those with HAIs.

Online pharmacies are showing explosive growth, especially in urban Asia-Pacific and North America. These platforms offer convenience, home delivery, and price comparisons, making them increasingly popular for common oral antibiotics.

By Regional Analysis

North America, led by the U.S., holds the dominant share in the global antibiotics market. The region benefits from a robust healthcare infrastructure, a strong pipeline of antibiotic candidates, and well-established reimbursement systems. Regulatory initiatives like the GAIN Act and funding programs from BARDA have accelerated the approval of critical antibiotics. Moreover, the prevalence of lifestyle-related immunosuppressive conditions like diabetes and cancer has increased the incidence of secondary infections, boosting antibiotic use. High adoption of antimicrobial stewardship programs and OPAT further ensures optimal antibiotic utilization.

The Asia-Pacific region is emerging as the fastest-growing antibiotics market, driven by a high population base, growing awareness, and increasing healthcare spending. Countries like India and China have witnessed a surge in bacterial infections due to pollution, antibiotic misuse, and inadequate sanitation. Moreover, the rise of online pharmacies, improved access to insurance, and government-sponsored healthcare initiatives are driving demand. Pharmaceutical manufacturing hubs in India also contribute significantly to global antibiotic exports, reinforcing the region’s strategic role.

Antibiotics Market Top Key Companies:

Recent Developments

-

February 2025: GSK announced promising Phase III trial results for its novel antibiotic "Zabiflox," aimed at treating drug-resistant UTIs.

-

December 2024: India-based Lupin launched a new combination antibiotic under the brand "Resimox Duo" for respiratory tract infections in Southeast Asia.

-

October 2024: Pfizer received FDA Fast Track designation for a new broad-spectrum injectable antibiotic aimed at combating carbapenem-resistant Enterobacteriaceae.

-

July 2024: Merck invested $100 million in a biotech startup developing AI-powered antibiotic discovery platforms.

-

May 2024: Roche collaborated with a European diagnostic company to co-develop a rapid bacterial identification test to support targeted antibiotic therapy.

Antibiotics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Antibiotics market.

By Drug Class

- Cephalosporin

- Penicillin

- Fluoroquinolone

- Macrolide

- Carbapenem

- Aminoglycoside

- Sulfonamide

- 7-ACA

- Others

By Application

- Skin infections

- Urinary tract infection

- Ear infection

- Septicemia

- Respiratory infections

- Gastrointestinal infections

By Action Mechanism

- Cell Wall Synthesis Inhibitors

- Protein Synthesis Inhibitors

- DNA Synthesis Inhibitors

- RNA Synthesis Inhibitors

- Mycolic Acid Inhibitors

- Others

By Drug Origin

By Spectrum Of Activity

- Broad-spectrum Antibiotic

- Narrow-spectrum Antibiotic

By Route of Administration

By Distribution Channel

- Retail pharmacies

- Online pharmacies

- Hospitals

- Clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Conversely, DNA synthesis inhibitors like fluoroquinolones are rapidly gaining traction. Their mechanism allows effective action against both Gram-negative and some Gram-positive bacteria, making them versatile agents. The growing cases of multidrug-resistant pathogens in hospital and community settings make DNA synthesis inhibitors an attractive treatment option.

Conversely, DNA synthesis inhibitors like fluoroquinolones are rapidly gaining traction. Their mechanism allows effective action against both Gram-negative and some Gram-positive bacteria, making them versatile agents. The growing cases of multidrug-resistant pathogens in hospital and community settings make DNA synthesis inhibitors an attractive treatment option.