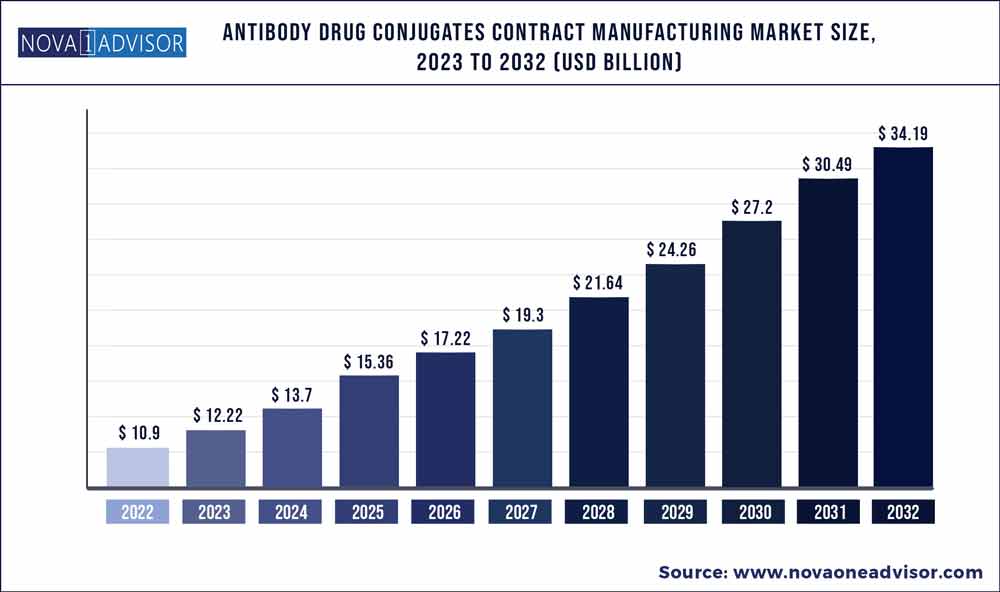

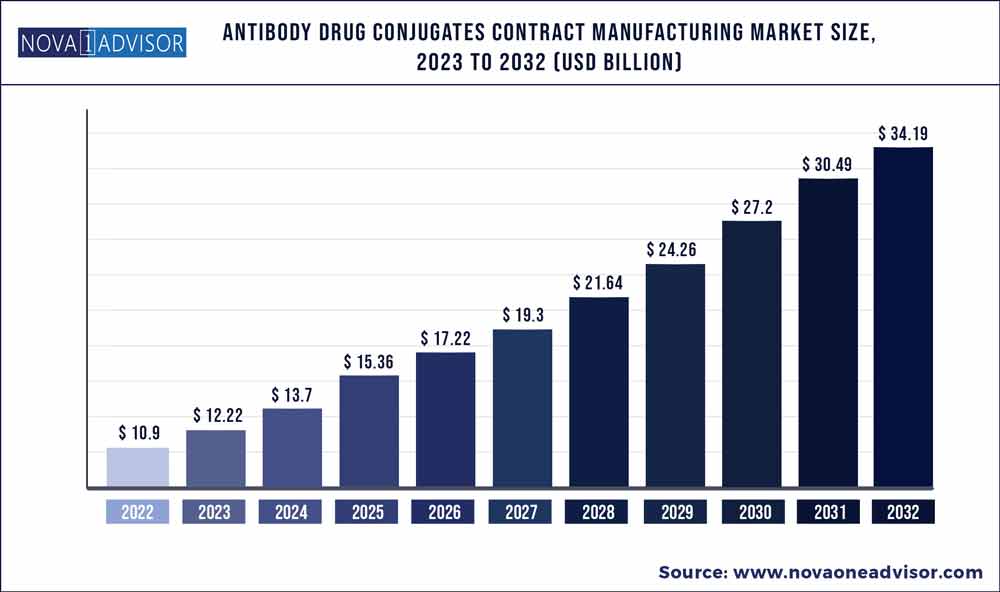

The global antibody drug conjugates contract manufacturing market size was exhibited at USD 10.9 billion in 2022 and is projected to hit around USD 34.19 billion by 2032, growing at a CAGR of 12.11% during the forecast period 2023 to 2032.

Key Pointers:

- Asia Pacific dominated the global industry in 2022 and accounted for the maximum share of more than 40.19% of the overall revenue.

- North America also accounted for a considerable revenue share in 2022.

- The myeloma segment dominated the industry and accounted for the largest revenue share of more than 49.49% in 2022.

- The lymphoma segment is expected to register the fastest CAGR over the forecast period.

- The cleavable linker segment dominated the industry in 2022 and accounted for the highest share of more than 56.09% of the overall revenue.

- The non-cleavable linker segment is expected to register the fastest CAGR over the forecast period.

Antibody Drug Conjugates Contract Manufacturing Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 12.22 Billion

|

|

Market Size by 2032

|

USD 34.19 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 12.11%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Condition, Linker,

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Sterling; Recipharm AB; Lonza; Catalent, Inc.; Sartorius AG; Wuxi Biologics; Samsung BioLogics; Piramal Group (Piramal Pharma Solutions); Abbvie, Inc. (Abbvie Contract Manufacturing); Merck KGaA

|

The factors driving the industry growth include the complex nature of antibody drug conjugates (ADCs) contributing to the demand for contract manufacturing, the increasing number of research on antibody therapies, and the rise in cancer incidence. During the pandemic, the clinical trials for cancer were stopped for a short period. However, owing to the severity of the disease, the trials were started again. As per the IQVIA Oncology Trends Report 2022, the number of clinical trials for cancer is growing.

The IQVIA report states that there was a 56% increase in oncology clinical trials between 2016 and 2021. This number of clinical studies is expected to rise even further owing to the growing prevalence of cancer worldwide. This is expected to support the ADC development and manufacturing activities, thus supporting industry growth post-pandemic. Antibody drug conjugates have high efficiency in treating cancer as it only targets the cancerous cells and does not affect the healthy cells of the body. As a result, several biopharmaceutical companies have received significant funding for ADC-related research.

For instance, in October 2022, Mablink Bioscience, raise USD 32 million from Series A funding to build its antibody drug conjugate pipeline. Thus, heavy investments in the R&D of ADCs are expected to improve their availability in the coming years and thus support the demand for ADC contract manufacturing. In September 2021, the U.S. FDA provided accelerated approval for ADC tisotumab vedotin-tftv for treating adult patients with recurrent or metastatic cervical cancer with disease progression or after chemotherapy. Such approvals, in the coming years, are expected to boost the demand for contract manufacturing services for ADC.

Condition Insights

The myeloma segment dominated the industry and accounted for the largest revenue share of more than 49.49% in 2022. Based on the condition, the industry is segmented into myeloma, lymphoma, breast cancer, and others (urothelial cancer and cervical cancer). ADCs for myeloma is a novel type of treatment that delivers a powerful cytotoxic chemical only to the myeloma cell. This mode of action reduces bystander cell damage and opens up a therapeutic window. ADCs have a high potential for use in the treatment of myeloma as they are “off-the-shelf” therapies. It can be utilized in almost all myeloma treatment clinics and for a diverse spectrum of patients. These factors are supporting ADCs demand for myeloma treatment and thus contributing to the segment growth.

The lymphoma segment is expected to register the fastest CAGR over the forecast period. Lymphoma affects a significant number of people worldwide. According to Cancer Tomorrow, in 2020, 83,100 cases of Hodgkin lymphoma were reported globally, while over 544,000 cases of non-Hodgkin lymphoma were reported. Currently, there are three approved ADC products for lymphoma: Adcetris, Polivy, and Zynlonta. Among the commercially available ADCs, the majority are used for the treatment of lymphoma and breast cancer. The segment is supported by a large number of commercially available ADCs used for treating lymphoma. As of 2021, over 10 ADC for Lymphoma is under the preclinical and clinical stage of development. This is likely to improve the demand for its contract manufacturing during the forecasted period.

Linker Insights

Based on linkers, the industry is segmented into cleavable and non-cleavable linkers. The cleavable linker segment dominated the industry in 2022 and accounted for the highest share of more than 56.09% of the overall revenue. The segment is likely to remain dominant over the coming years. A major factor that influences the growth of this segment is the advantages that cleavable linkers offer in certain circumstances to deliver the medication to the target cell. The characteristics of the linker between the antibody and the payload are seen as crucial to an ADC’s success. The capacity of cleavable linkers to efficiently distinguish between circulatory and target-cell circumstances accounts for their effectiveness.

The non-cleavable linker segment is expected to register the fastest CAGR over the forecast period. ADCs produced using a non-cleavable linker are reliant on the ADC’s lysosomal degradation, which releases the cytotoxic molecules after the ADC molecule has been internalized in the target cell. This prevents the non-specific release of the drug, thus reducing the overall cytotoxicity of the ADC to surrounding healthy cells. Furthermore, one of the major advantages of non-cleavable linkers is that they have higher plasma stability than cleavable linkers, thus increasing the therapeutic window, they also have a longer half-life in circulation. The above-listed factors are supporting the segment growth.

Regional Insights

In terms of region, Asia Pacific dominated the global industry in 2022 and accounted for the maximum share of more than 40.19% of the overall revenue. It is expected to remain dominant growing at the fastest CAGR during the forecast period. This region has a high burden of cancer as compared to other regions. According to Cancer Tomorrow,9.4 million cases of cancer were reported in 2020 in Asia, and this number is expected to rise to 14.2 million by 2040. Thus, a rise in the cancer cases is expected to boost the demand for targeted therapies like ADC for treatment, thereby supporting its demand for manufacturing. In addition, the cost of contract manufacturing in Asia Pacific countries is relatively low compared to that in developed economies.

Thus, it further supports regional market growth. North America also accounted for a considerable revenue share in 2022. This growth can be attributed to the increasing number of biopharmaceutical companies within the U.S. and Canada. The presence of a large number of major players in this region is expected to contribute significantly to the region’s growth. Moreover, the regulatory authority in the region is actively providing regulatory approval for ADCs. For instance, the USFDA has approved 12 ADCs as of 2021. This improves its commercial availability and, thus, supports its adoption in the region. The above-mentioned factors are boosting regional market growth.

Some of the prominent players in the Antibody Drug Conjugates Contract Manufacturing Market include:

- Sterling

- Recipharm AB

- Lonza

- Catalent, Inc.

- Sartorius AG

- Wuxi Biologics

- Samsung BioLogics

- Piramal Group (Piramal Pharma Solutions)

- Abbvie, Inc. (Abbvie Contract Manufacturing)

- Merck KGaA

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Antibody Drug Conjugates Contract Manufacturing market.

By Condition

- Myeloma

- Lymphoma

- Breast Cancer

- Others (Urothelial Cancer)

By Linker

- Cleavable Linker

- Non-cleavable Linker

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)