Antibody Drug Conjugates Market Size and Growth

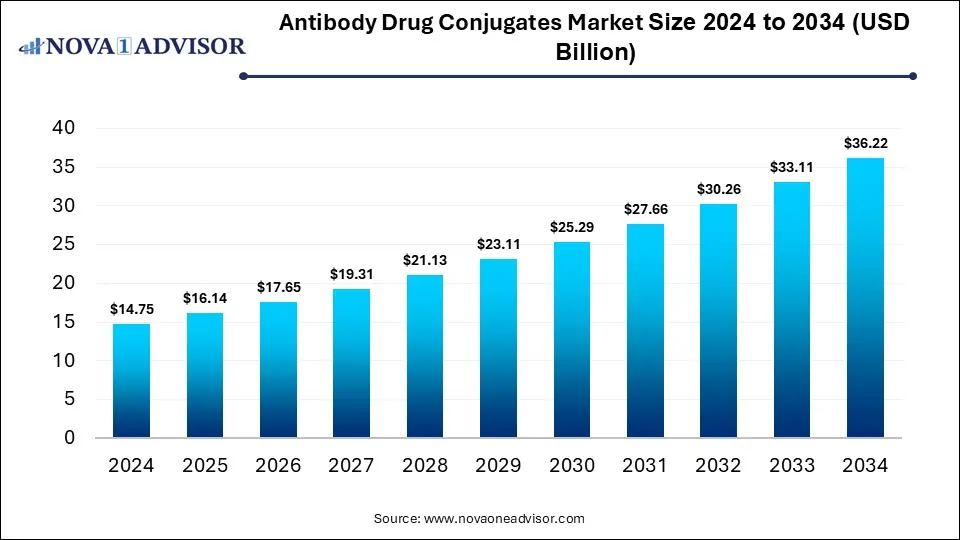

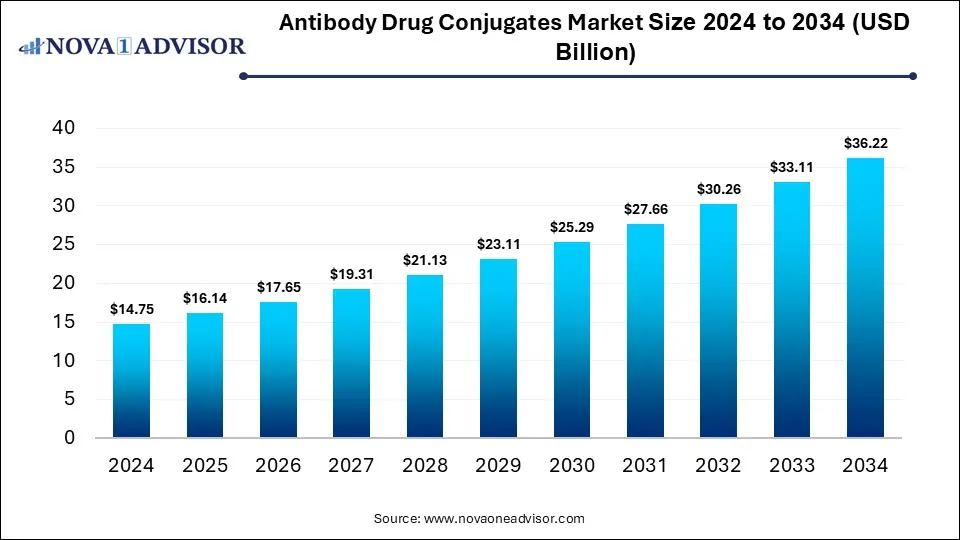

The global antibody drug conjugates market size was valued at USD 14.75 billion in 2024 and is anticipated to reach around USD 36.22 billion by 2034, growing at a CAGR of 9.4% from 2025 to 2034. The market is growing due to rising cancer prevalence and the increasing demand for targeted therapies with fewer side effects. Advancements in ADC technology and strong R&D investments are further driving its adoption.

Antibody Drug Conjugates Market Key Takeaways

- North America dominated the antibody drug conjugates (ADC) market revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the breast cancer segment held the largest market share in 2024.

- By application, the blood cancer segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the Kadcyla segment dominated the market with a major revenue share in 2024.

- By product, the Enhertu segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By target, the HER2 segment led the market with the largest revenue share in 2024.

- By target, the CD22 segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology, the cleavable linker segment held the largest market share in 2024.

- By technology, the non-cleavable linker segment is expected to grow at the fastest CAGR in the market during the forecast period.

How Antibody Drug Conjugates (ADC) Market Evolving?

Antibody drug conjugates (ADCs) are targeted biopharmaceuticals designed by linking a monoclonal antibody to a potent cytotoxic drug through a stable chemical linker. The antibody specifically binds to antigens on cancer cells, delivering the toxic payloads directly to the tumor while minimizing damage to healthy tissues. The antibody drug conjugates (ADC) market is evolving as healthcare systems prioritize personalized treatments and demand for targeted oncology therapies increases. Regulatory agencies are accelerating approvals, reflecting confidence in ADC effectiveness. Manufacturing innovations are reducing complexity and cost, making ADC more accessible. Moreover, strategic mergers, licensing deals, and clinical trials in solid tumors and hematologic cancers are expanding the therapeutic landscape. This shift towards precision-driven and safer alternatives to conventional chemotherapy is driving significant momentum in the ADC market.

What are the Key trends in the Antibody Drug Conjugates (ADC) Market in 2024?

- In April 2025, Heidelberg Pharma AG researchers introduced a new antibody-drug conjugate (ADC) demonstrating strong potential in treating pancreatic ductal adenocarcinoma (PDAC). The therapy, named hRS7 ATAC, specifically targets the trophoblast cell surface antigen 2 (TROP2), which is commonly expressed in pancreatic tumors, and its promising results were formally presented.

- In January 2024, Celltrion, Inc. partnered with WuXi XDC through a Memorandum of Understanding (MOU) to provide integrated solutions for antibody-drug conjugates (ADCs), covering both their development and manufacturing processes.

How Can AI Affect the Antibody Drug Conjugates (ADC) Market?

AI is poised to significantly impact the market by accelerating drug discovery, optimizing antibody design, and improving linker-payload selection. It enables advanced data analysis to identify novel targets, predict drug efficacy, and minimize toxicity, thereby reducing development timelines and costs. AI-driven clinical trial optimization enhances patient selection and monitoring, increasing trial success rates. Furthermore, AI can support large-scale manufacturing efficiency, making ADCs more accessible and strengthening their role in precision oncology.

Antibody Drug Conjugates Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 16.14 Billion |

| Market Size by 2034 |

USD 36.22 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.4% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Application, Product, Target, Technology, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Seagen, Inc., (previously Seattle Genetics, Inc.); Takeda Pharmaceutical Company Ltd.; AstraZeneca PLC, F. Hoffmann-La Roche Ltd.; Pfizer, Inc.; ImmunoGen, Inc.; Gilead Sciences, Inc. (acquired Immunomedics); Daiichi Sankyo Company Ltd. |

Market Dynamics

Driver

Rising Global Cancer Prevalence

The growing incidence of cancer worldwide drives the antibody drug conjugate (ADC) market as healthcare providers seek innovative therapies to manage hard-to-treat tumors. Many cancers show resistance to standard treatment, creating an urgent need for alternatives with higher precision and efficacy. ADCs address this gap by combining targeted antibodies with potent drugs, offering new hope for patients with limited options. This rising cancer burden compels pharmaceutical companies to accelerate ADC development and broaden their clinical applications.

Restraint

High Development and Manufacturing Cost

High development and manufacturing costs restrain the antibody drug conjugates (ADC) market because the supply chain requires highly controlled environments, expensive raw materials, and complex analytical testing. Scaling up production is also challenging, as even minor variations can affect product stability and safety. These financial and technical hurdles delay commercialization and limit widespread adoption. Consequently, many healthcare systems struggle to integrate ADCs into routine care, slowing down their global reach despite strong therapeutic potential.

Opportunity

Expansion of ADC Applications Beyond Oncology

Expanding ADC use beyond oncology offers a strong future opportunity as it allows pharmaceutical companies to tap into larger therapeutic areas with unmet medical needs. Chronic diseases such as autoimmune disorders or persistent infections require long-term treatment, and ADCs could provide more durable and targeted options. This diversification not only reduces reliance on the oncology segment but also enhances commercial potential, encouraging broader clinical research, strategic partnerships, and regulatory pathways for innovative applications of ADC technology.

Segmental Insights

How did Breast Cancer dominate the Antibody Drug Conjugates (ADC) Market in 2024?

The breast cancer segment leads the ADC market in revenue shares because of strong industry focus and consistent R&D investments dedicated to this indication. Pharmaceutical companies prioritize breast cancer trials, resulting in a robust pipeline of novel ADCs under development. Additionally, supportive regulatory frameworks and rapid drug approvals in this area accelerate market entry. The growing availability of advanced diagnostics for early detection also boosts demand, reinforcing breast cancer as the most commercially significant ADC application segment.

The blood cancer segment is projected to witness the fastest CAGR as researchers increasingly explore ADCs to address resistance to stem cell transplants and standard chemotherapies. Advances in identifying unique surface markers on blood cancer cells enable more precise ADC targeting, enhancing treatment effectiveness. Moreover, growing collaboration between biotech firms and academic institutions is accelerating novel ADC development in hematology. This focus, combined with rising demand for safer long-term treatment alternatives, positions blood cancer as the fastest-growing ADC application area.

What made the Kadcyla Segment Dominant in the Antibody Drug Conjugates (ADC) Market in 2024?

The Kadcyla segment led the ADC market in 2024 as its commercial success was driven by strong brand recognition and broad availability across multiple regions. Its established market position gave it a competitive edge over newer ADCs, ensuring high prescription rates. Strategic marketing initiatives by the manufacturer, along with expanded patient access programs, further strengthened sales. Additionally, long-term clinical experience with Kadcyla built confidence among healthcare providers, supporting its dominance in overall revenue share during the year.

- For Instance, In August 2023, Seagen announced results from its phase 3 HER2CLIMB-02 trial evaluating TUKYSA with the ADC Kadcyla in HER2-positive breast cancer patients previously treated with taxanes and trastuzumab for advanced disease. The study met its primary goal of improving progression-free survival, even in patients with brain metastases. While more treatment discontinuations occurred in the combination group due to side effects, no new safety concerns emerged. Overall survival findings remain early, with detailed results to be presented at an upcoming meeting.

The Enhertu segment is anticipated to grow at the fastest CAGR as its innovative design with a high drug-to-antibody ratio offers superior therapeutic potential compared to many existing ADCs. Strong physician confidence and rapid inclusion in treatment guidelines are accelerating its use in clinical practice. Additionally, increasing manufacturing scale-up and global commercialization strategies by its developers are expanding patient access. These factors, along with rising demand for next-generation ADCs, position Enhertu as the most dynamic product during the forecast period.

- For Instance, In January 2024, AstraZeneca India Pharma Ltd. launched Trastuzumab deruxtecan for adults with metastatic or unresectable HER2-positive breast cancer who had previously received anti-HER2 therapy. Developed in collaboration with Daiichi Sankyo, this HER2-targeted antibody-drug conjugate is designed to deliver precise and effective treatment for patients with advanced disease.

How did the HER2 Segment Dominate the Antibody Drug Conjugates (ADC) Market in 2024?

The HER2 segment led the ADC market in 2024 as major pharmaceutical companies prioritize this target, ensuring a strong commercial presence and extensive patient reach. Competitive activity, including product launches and lifecycle management strategies, further strengthened its dominance. High physician familiarity with HER2-targeted approaches also accelerated treatment adoption compared to newer targets. Moreover, significant investment in research pipelines focusing on HER2 variations sustained its revenue leadership, positioning it as the most influential segment in the global ADC market.

- For Instance, In September 2023, Bex Medical Analytics, a leader in AI-based cancer diagnostics, introduced Galen Breast HER2, an artificial intelligence tool designed to enhance accuracy and consistency in HER2 scoring for breast cancer patients. Since HER2 is a key protein linked to tumor growth in many breast cancers, precise assessment is crucial to identify patients who can benefit most from HER2-targeted therapies. This innovation aims to support pathologists in delivering more reliable diagnostic outcomes.

The CD22 segment is projected to expand at the fastest CAGR as researchers are increasingly focusing on novel approaches to overcome resistance seen with existing blood cancer treatments. Its growing importance in precision medicine, combined with innovative linker and payloads technologies, is driving strategic collaboration between biotech firms and academic centers is driving rapid progress in CD22-targeted candidates, positioning this segment as a key growth area within the antibody drug conjugates market.

How Does the Cleavable Linker Segment Dominate the Antibody Drug Conjugates (ADC) Market?

The cleavable linker segment led the market in 2024 as its design supports flexibility across multiple therapeutic areas, enabling broader clinical applications of ADCs. Its compatibility with drivers, payloads, and stability during circulation further increased its acceptance among developers. Strong industry preference for this technology in late-stage clinical trials, along with continuous improvements enhancing controlled drug release, reinforced its leadership. These factors collectively made cleavable linkers the most widely adopted technology in the ADC market during the year.

The non-cleavable linker segment is anticipated to register the fastest CAGR as researchers focus on improving durability and therapeutic consistency in ADCs. Unlike cleavable types, these linkers provide stronger transport, reducing systemic toxicity risks. Their growing use in next-generation ADC candidates reflects a shift towards safer and more predictable treatments. With expanding clinical investigations and increasing confidence from regulatory bodies, non-cleavable linkers are emerging as a promising technology for future market growth.

Regional Insights

How is North America Contributing to the Expansion of the Antibody Drug Conjugates (ADC) Market?

North America dominated the antibody drug conjugates (ADC) market share in 2024 due to strong R&D investment, rapid adoption of advanced oncology therapies, and the presence of leading pharmaceutical players driving innovation. Favorable FDA regulatory pathways and frequent product approvals accelerated commercialization. Additionally, well-established healthcare infrastructure, high cancer prevalence, and supportive reimbursement systems boosted treatment accessibility. Strategic collaborations between biotech firms and research institutions further strengthened the region’s leadership, positioning North America as the largest contributor to global ADC revenues.

- For Instance, In April 2025, Innate Pharma SA shared preclinical findings on IPH4502, a novel antibody-drug conjugate (ADC) using a topoisomerase I inhibitor to target Nectin-4. The results were presented at the American Association for Cancer Research (AACR) Annual Meeting 2025, highlighting its potential as a differentiated therapeutic candidate.

How is Asia-Pacific Accelerating the Market?

Asia-Pacific is projected to record the fastest CAGR in the ADC market as pharmaceutical companies increasingly shift manufacturing and R&D activities to the region to leverage cost advantages and skilled talent. Expanding biotech hubs in countries like China, India, and South Korea are fostering innovation and partnerships. Rising awareness of precision medicine and broader patient enrollment in global clinical trials are also fueling adoption. These factors collectively position Asia-Pacific as a major growth engine for ADC development and commercialization.

Antibody Drug Conjugate Market Recent Developments

- In June 2024, Adcytherix SAS announced its establishment and secured €30 million in seed funding to advance the development of novel antibody-drug conjugates (ADCs). The company aims to address critical unmet medical needs, particularly in cancer treatment, through its innovative ADC pipeline.

- In February 2024, Daiichi Sankyo launched its Singapore unit to expand access to antibody-drug conjugates (ADCs) for cancer patients. With cancer accounting for nearly 30% of deaths in the country, the company aims to strengthen oncology care by addressing treatment gaps and improving both survival and quality of life for patients.

Antibody Drug Conjugates Market Top Key Companies:

The following are the leading companies in the antibody drug Conjugates market. These companies collectively hold the largest market share and dictate industry trends.

- Seagen, Inc.

- Takeda Pharmaceutical Company Ltd.

- AstraZeneca

- F. Hoffmann-La Roche Ltd.

- Pfizer, Inc.

- Gilead Sciences, Inc.

- Daiichi Sankyo Company Ltd.

- GlaxoSmithKline Plc

- Astellas Pharma, Inc.

- ADC Therapeutics SA

Antibody Drug Conjugates Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Antibody Drug Conjugates market.

By Application

- Blood Cancer

- Leukemia

- Lymphoma

- Multiple Myeloma

- Breast Cancer

- Urothelial Cancer & Bladder Cancer

- Other Cancer

By Product

- Kadcyla

- Enhertu

- Adcetris

- Padcev

- Trodelvy

- Polivy

- Others

By Target

By Technology

- Type

- Cleavable Linker

- Non-cleavable Linker

- Linkerless

- Linker Technology Type

- VC

- Sulfo-SPDB

- VA

- Hydrazone

- Others

- Payload Technology

- MMAE

- MMAF

- DM4

- Camptothecin

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)