Antiemetics Drugs Market Size and Trends

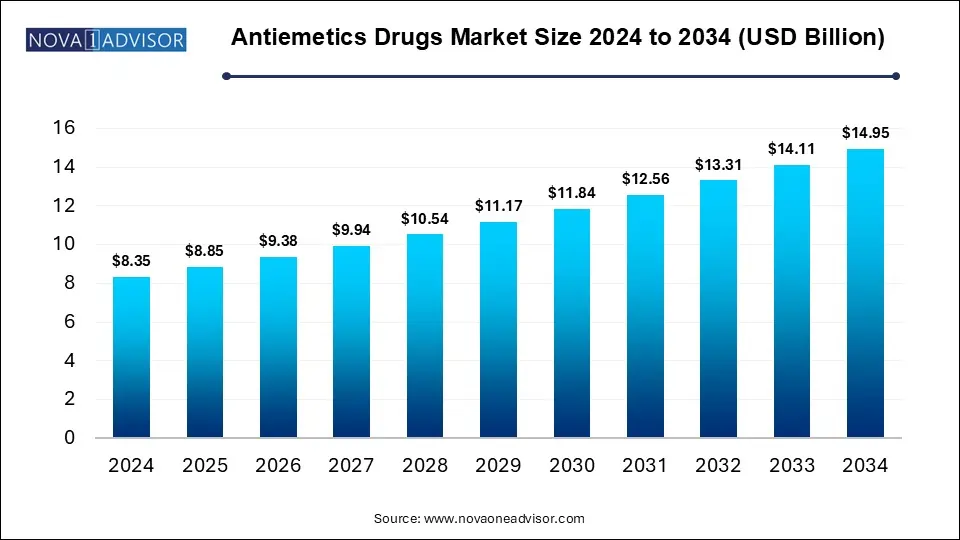

The global antiemetics drugs market size is calculated at USD 8.35 billion in 2024, grow to USD 8.85 billion in 2025, and is projected to reach around USD 14.95 billion by 2034, registering a CAGR of 6.0% from 2025 to 2034. The market is expanding due to the increasing prevalence of gastrointestinal disorders and cancer treatment. Growing awareness and improved healthcare infrastructure further drive demand.

Key Takeaways

- North America dominated the antiemetics market in 2024.

- Asia-Pacific is expected to grow at the highest CAGR in the market during the forecast period.

- By drug type, the serotonin-receptor antagonists segment held the largest market shares.

- By drug type, the dopamine receptor antagonist segment is expected to grow at the fastest CAGR in the market during the studied years.

- By application, the chemotherapy segment dominated the market in 2024.

- By application, the postoperative surgery segment is expected to grow at the fastest CAGR in the market during the studied years.

- By end-use, the retail pharmacies segment led the antiemetics market.

- By end-use, the hospitals and clinics segment is expected to grow at the fastest CAGR in the market during the years studied.

U.S. Antiemetics Drugs Market Size and Growth 2025 to 2034

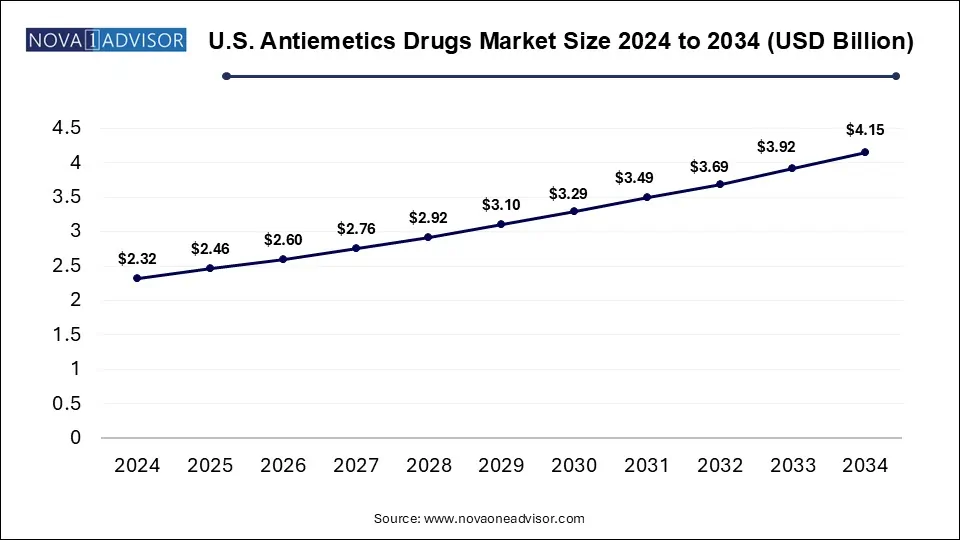

The U.S. antiemetics Drugs market size accounted for USD 2.32 billion in 2024 and is expected to be worth around USD 4.15 billion by 2034, poised to grow at a CAGR of 5.42% from 2025 to 2034.

How is North America Contributing to the Expansion of the Antiemetics Drugs Market?

In 2024, North America dominated the market due to its advanced healthcare infrastructure, high prevalence of cancer and chronic illnesses, and increased use of chemotherapy and surgical procedures. The presence of major pharmaceutical companies, strong regulatory support, and favorable reimbursement policies further boosted the market. Additionally, early adoption of innovative antiemetic therapies and high awareness among healthcare professionals and patients contributed to the region’s leading position in the global antiemetics market.

- For Instance, In 2024, the American Cancer Society projected nearly 2 million new cancer cases in the United States. Among these, female breast cancer is expected to account for approximately 310,720 cases, followed by prostate cancer with 299,010 cases and lung cancer with 234,580 cases. This sharp rise in cancer incidence emphasizes the increasing healthcare burden and the growing need for advanced treatment options and supportive therapies across the country.

How is the Asia Pacific Accelerating the Antiemetics Drugs Market?

Asia-Pacific is projected to grow at the highest rate in the market during the forecast period due to rising healthcare investments, an increasing elderly population, and a growing cancer burden. Countries like China and India are expanding access to medical care and modern treatments, leading to greater demand for antiemetic drugs. Additionally, heightened awareness, improved healthcare infrastructure, and the presence of local pharmaceutical manufacturers are further accelerating market growth across the region.

How is the Antiemetics Drugs Market Evolving?

Antiemetics are medications that help prevent or control nausea and vomiting by acting on the central nervous system or gastrointestinal tract to block the signals that trigger these symptoms. The market is evolving due to rising cases of nausea and vomiting associated with chemotherapy radiation therapy and surgeries. Increased awareness about supportive care, wider adoption of combination therapies, and advancements in drug delivery systems like oral dissolving tablets and transdermal patches are boosting demand. Moreover, growing accessibility to healthcare in developing regions and the expansion of online pharmacies are making antiemetic drugs more available, enhancing treatment compliance and overall patient outcomes.

- For Instance, As per the American Cancer Society, it was estimated that the United States would see approximately 1.96 million new cancer cases and around 609,820 cancer-related deaths in 2023.

What are the Key Trends in the Antiemetics Drugs Market in 2025?

- In October 2023, Astellas Pharma Inc. shared research findings at the ESMO Congress, including a study on how antiemetics affect gastric damage and vomiting frequency in ferrets. Such initiatives by major companies are likely to raise awareness about antiemetic drugs, supporting market growth in the coming years.

- In January 2023, Glenmark Pharmaceuticals Ltd introduced AKYNZEO I.V. in India, a distinctive intravenous formulation designed to help prevent nausea and vomiting caused by chemotherapy.

How Can AI Affect the Antiemetics Drugs Market?

AI can significantly impact the market by enhancing drug discovery, predicting patient response, and improving clinical trial efficiency. It enables personalized treatment plans by analyzing patient data to determine the most effective antiemetic therapies. AI also supports faster identification of side effects and optimizes dosage recommendations. Additionally, it helps pharmaceutical companies streamline research and development, reduce costs, and bring innovative antiemetic solutions to market more quickly, ultimately improving patient outcomes and boosting market growth.

Report Scope of Antiemetics Drugs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 8.85 Billion |

| Market Size by 2034 |

USD 14.95 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.0% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Drug Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Pfizer Inc.; Cipla Inc.; Merck KGaA.; Inc., Eagle Pharmaceuticals, Inc.; Johnson & Johnson Services, Inc.; GSK plc.; Astellas Pharma Inc.; GLENMARK PHARMACEUTICALS LTD.; Viatris Inc.; Baxter |

Market Dynamics

Driver

Rising Prevalence of Cancer

The growing number of cancer cases directly increases the need for treatment that helps manage therapy-related side effects. Since chemotherapy and radiation often lead to nausea and vomiting, antemetic drugs become essential in patient care. This rising dependency on antiemetics to ensure patient comfort and adherence to cancer treatment drives consistent demand, encouraging pharmaceutical companies to invest in improved formulations and expand availability, thus supporting the steady growth of the antiemetics market.

For Instance, In March 2025 phase III PROFIT trial in China, which tested a new fixed-dose IV combo fosnetupitant + palonosetron (HR20013)—plus dexamethasone against the standard regimen (fosaprepitant + palonosetron + dexamethasone) in patients receiving highly emetogenic cisplatin chemotherapy. HR20013 demonstrated a comparable overall complete response rate of 77.7% vs. 78.2%, confirming it as a viable, effective alternative antiemetic option.

Restraint

Limited Awareness in Developing Areas

Many patients and healthcare providers may not fully understand the availability or importance of these drugs in managing nausea and vomiting. This lack of knowledge leads to the underutilization of antiemetics therapies, especially in cancer and postoperative care. Additionally, insufficient training and limited access to updated treatment guidelines further hinder adoption ultimately slowing market growth in these areas despite the rising need for supportive care.

Opportunity

Development of Personalized Medicine

Personalized medicine offers a promising opportunity in the antiemetics market by allowing more precise treatment approaches. Instead of a one-size-fits-all method, therapies can be tailored to match a patient’s unique biological profile, improving how well they tolerate and respond to antiemetic drugs. This reduces trial-and-error prescribing and minimizes unwanted side effects. As research in genomics and AI advances, the ability to deliver patient-specific antiemetic care will likely expand, opening new pathways for market growth.

Segmental Insights

How Serotonin Receptor Antagonists Segment Dominate the Antiemetics Drugs Market in 2024?

The serotonin receptor antagonist segment dominated the market due to its high effectiveness in managing nausea and vomiting caused by chemotherapy, radiation therapy, and surgeries. Drugs like ondansetron and granisetron are widely used because of their rapid action, safety profile, and availability in multiple formulations. Their strong clinical success, broad approval across treatment settings, and frequent inclusion in antiemetic guidelines have driven their dominance in the market.

The dopamine receptor antagonist segment is projected to witness the fastest growth due to its increasing application beyond cancer care, including in conditions like migraines and gastrointestinal issues. These drugs are often preferred and cost-effective. Growing awareness among healthcare providers and improved accessibility in developing regions are also contributing to the market expansion.

How Does the Chemotherapy Segment Dominate the Market?

In 2024, the chemotherapy segment led the antiemetics market due to the growing number of cancer patients undergoing aggressive treatment regimens that often trigger intense nausea and vomiting. To ensure the patient can complete their therapy without interruption, antiemetics are routinely prescribed as part of supportive care. Increased adoption of guideline-recommended antiemetic protocols and the availability of combination drugs tailored for chemotherapy-induced symptoms further supported the market growth.

The post-operative surgery segment is anticipated to grow rapidly due to the rising number of surgical procedures worldwide, particularly among aging populations. Post-operative nausea and vomiting (PONV) are common complications, prompting routine use of antiemetic drugs to improve recovery outcomes. Increased focus on enhanced recovery protocols greater awareness among healthcare professionals, and advancements in anesthesia management are driving the demand for antiemetics in post-surgical care, boosting the market expansion.

Why Did the Retail Pharmacies Segment Dominate in the Antiemetics Drugs Market 2024?

In 2024, the retail pharmacies segment dominated the antiemetics market due to its widespread availability and convenience for patients. Retail pharmacies offer both prescription and over-the-counter antiemetic medication, making it easier for individuals to manage nausea and vomiting without visiting hospitals. Increased consumer preference for self-care, growing access to community pharmacies, and the availability of trusted brands contributed to the segment's strong market presence, especially in urban areas with high outpatient and post-treatment medication demand.

The hospitals and clinics segment is expected to grow at the fastest rate in the antiemetics market due to rising inpatient admissions for cancer treatment, surgeries, and acute illnesses that often require immediate nausea control. These facilities are equipped to administer intravenous and combination antiemetic therapies under close supervision. Moreover, the expansion of multispecialty hospitals and improved access to healthcare services in both urban and semi-urban regions are fueling higher demand for antiemetics in clinical care settings.

Some of The Prominent Players in The Antiemetics Drugs Market Include:

- Pfizer Inc.

- Cipla Inc.

- Merck KGaA

- Eagle Pharmaceuticals, Inc.

- Johnson & Johnson Services, Inc.

- GSK plc.

- Astellas Pharma Inc.

- GLENMARK PHARMACEUTICALS LTD.

- Viatris Inc.

- Baxter

Recent Developments in the Antiemetics Drugs Market

- In July 2024, Amneal Pharmaceuticals, a U.S.-based specialty drugmaker, introduced FOCINVEZ—the first ready-to-use injectable form of fosaprepitant. This medication is developed to help prevent both immediate and delayed nausea and vomiting caused by highly emetogenic cancer chemotherapy. The launch reflects ongoing efforts to improve supportive care options for cancer patients through more convenient and effective antiemetic treatments.

- In 2024, Avenacy, a U.S.-based specialty pharmaceutical company, launched Palonosetron Hydrochloride Injection, USP in the United States as a generic version of Aloxi®, following FDA approval. This antiemetic is available in 0.25 mg/5 mL single-dose vials and is designed to support accurate administration through its unique packaging and labeling. The product aligns with Avenacy’s commitment to patient safety and will be distributed through wholesale partners, backed by a global network of FDA-compliant manufacturing partners.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the antiemetics drugs market

By Drug Type

- Serotonin-receptor Antagonists

- Anticholinergics

- Dopamine Receptor Antagonists

- Neurokinin Receptor Antagonists

- Others (Antihistamines, Cannabinoids)

By Application

- Chemotherapy

- Gastroenteritis

- Post Operative Surgery

- Others

By End-use

- Hospital & Clinics

- Retail Pharmacy

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)