Aortic Valve Replacement Devices Market Size and Growth

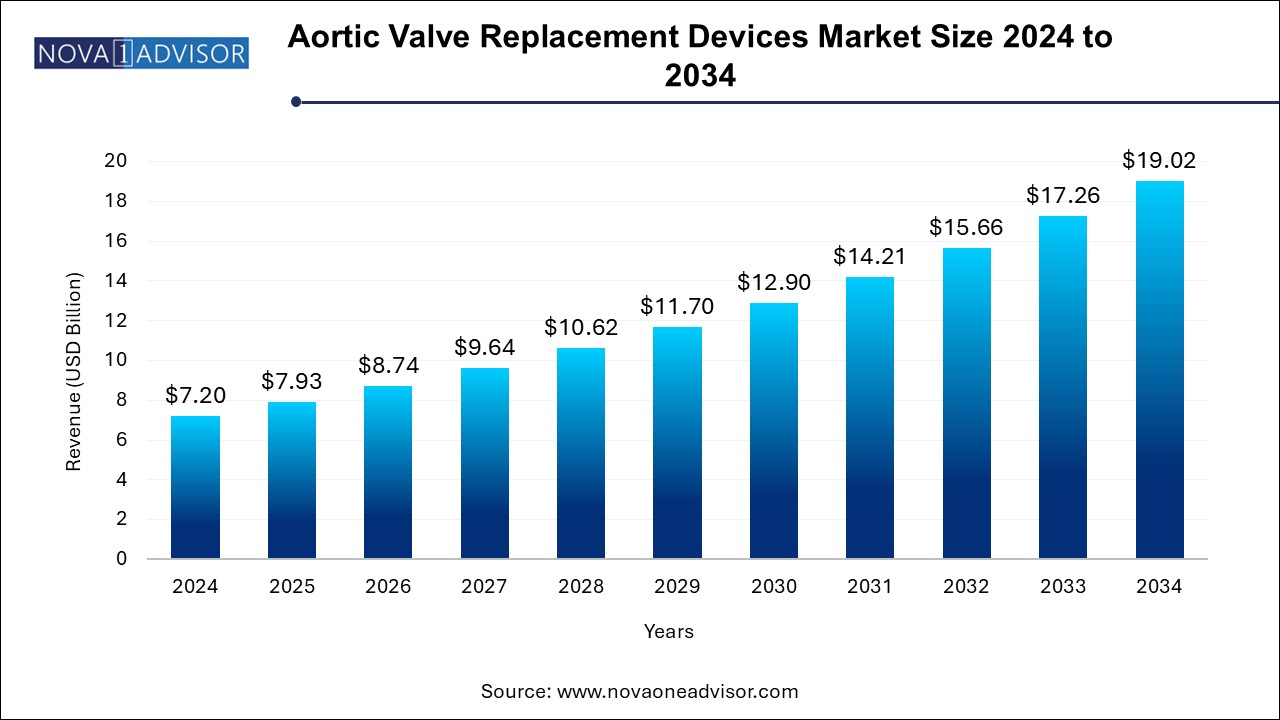

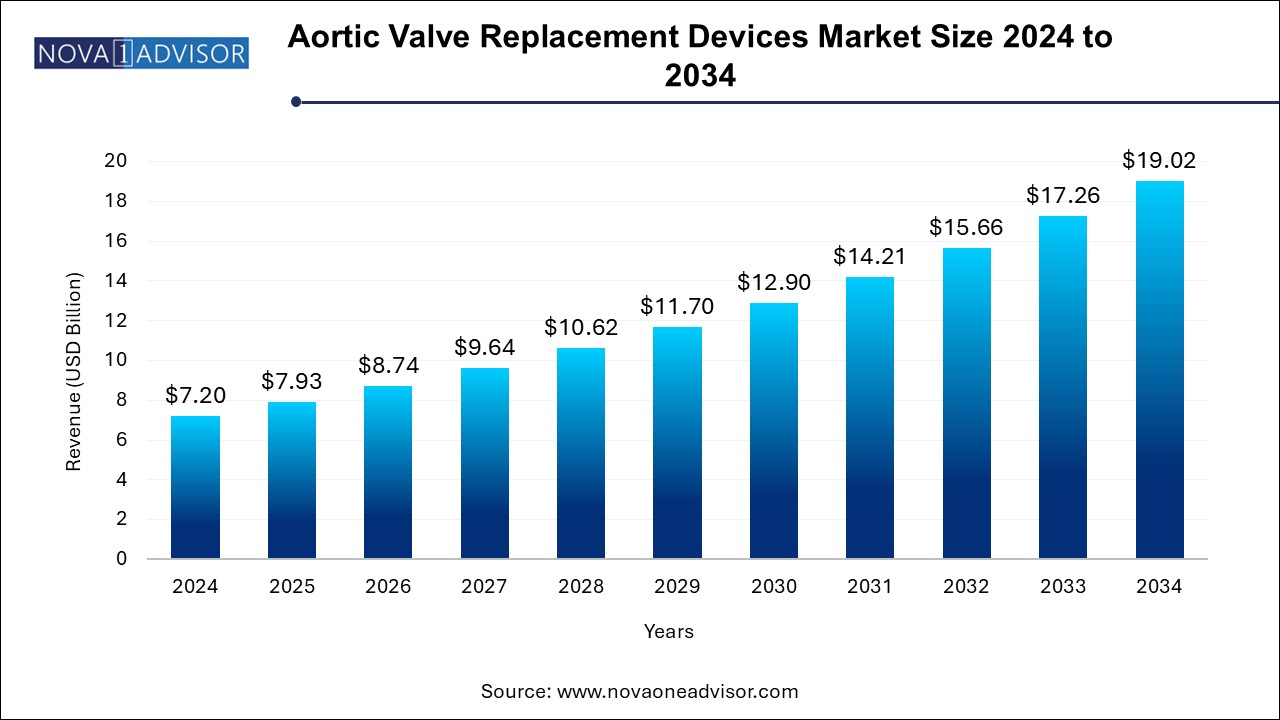

The aortic valve replacement devices market size was exhibited at USD 7.20 billion in 2024 and is projected to hit around USD 19.02 billion by 2034, growing at a CAGR of 10.2% during the forecast period 2024 to 2034. The aortic valve replacement devices market growth can be linked to the rapidly aging population, rising prevalence of valvular diseases and preference for minimally invasive procedures.

Aortic Valve Replacement Devices Market Key Takeaways:

- Balloon-expandable valves dominated the market with a revenue share of 68.7% in 2024.

- The bovine pericardium segment led the market with a revenue share of 72.5% in 2024.

- Cobalt-chromium frames held the largest market share of 64.0% in 2024.

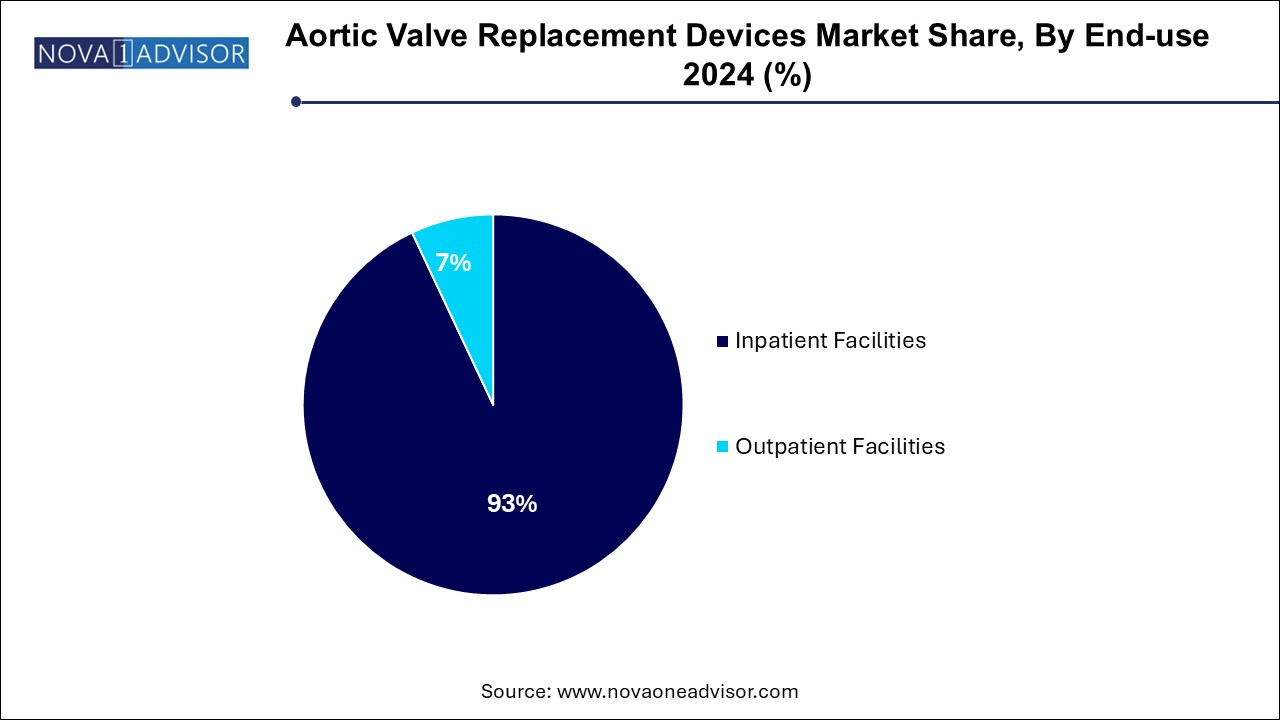

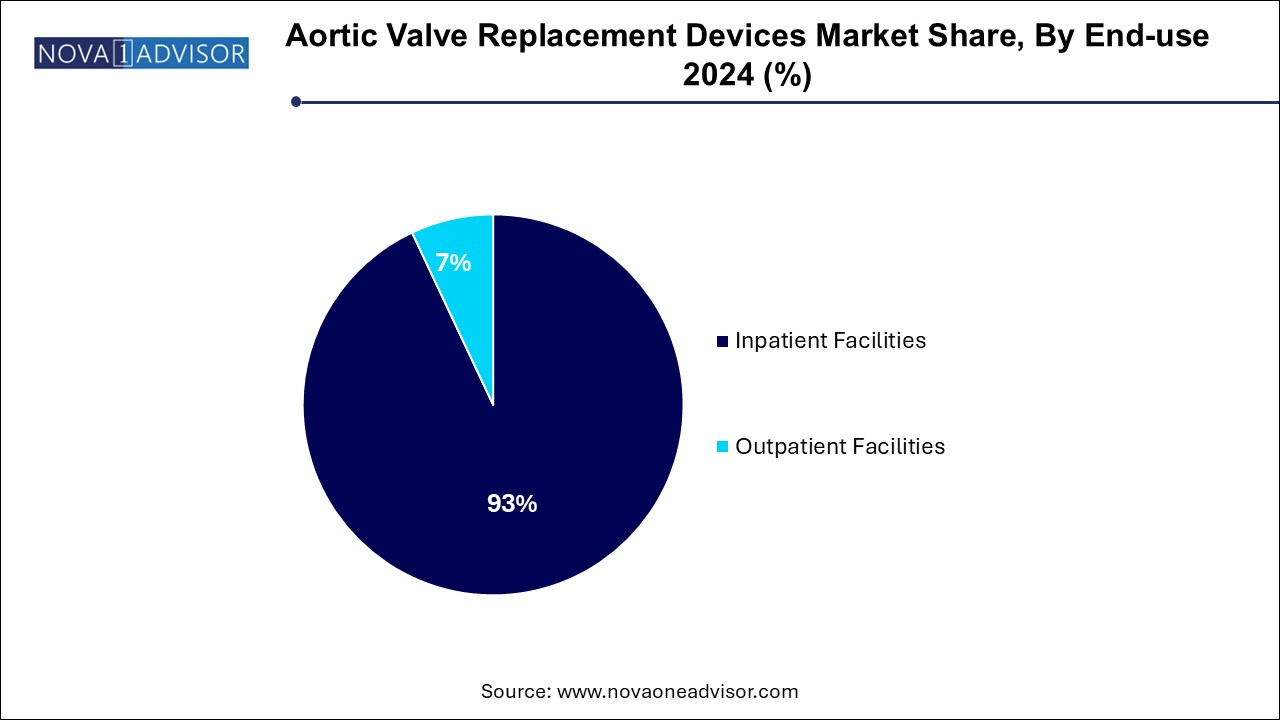

- Inpatient facilities dominated the market and accounted for a share of 93.0% in 2024.

- North America aortic valve replacement devices market dominated the global market with a revenue share of 59.7% in 2024.

Market Overview

The Aortic Valve Replacement (AVR) Devices Market is a vital segment within the broader cardiovascular medical device industry. It plays a pivotal role in the management of aortic valve disorders such as aortic stenosis and aortic regurgitation, which affect millions globally. As cardiovascular diseases continue to rank among the leading causes of mortality worldwide, the need for effective and minimally invasive interventions is driving innovations in aortic valve replacement technologies. AVR devices include mechanical and biological prosthetic valves designed to restore normal blood flow and function within the heart by replacing the diseased aortic valve.

The increasing prevalence of degenerative valve diseases among aging populations, particularly in developed nations, has sharply driven the demand for aortic valve replacements. Furthermore, the emergence of transcatheter aortic valve replacement (TAVR) has revolutionized the field by offering a viable alternative for patients who are at high or intermediate surgical risk. These devices are also increasingly being used in younger, low-risk patients due to improved valve durability and better procedural outcomes.

Major Trends in the Market

-

Expansion of Indications for TAVR Devices: Previously reserved for high-risk patients, TAVR is now approved for low-risk populations, expanding the target demographic.

-

Advancements in Bioprosthetic Valve Technologies: Development of long-lasting, biocompatible valve leaflets derived from bovine or porcine tissues is enhancing device longevity.

-

Increasing Preference for Minimally Invasive Procedures: Surgeons and patients alike are gravitating towards less invasive solutions that reduce hospital stay and improve recovery times.

-

Emergence of Next-Generation Imaging Modalities: Improved echocardiography, CT, and MRI imaging aid in accurate diagnosis and procedural planning.

-

Strategic Collaborations and Mergers: Major companies are forming alliances to strengthen product pipelines and expand global reach.

-

Customized Valve Design and Patient-Specific Solutions: 3D printing and advanced imaging allow for tailor-made valves suited to individual anatomies.

-

Focus on Emerging Markets: Rising investment in healthcare infrastructure in Asia Pacific and Latin America is opening new revenue streams.

Report Scope of Aortic Valve Replacement Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 7.93 Billion |

| Market Size by 2034 |

USD 19.02 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 10.2% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Leaflet Material, Frame Material, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Boston Scientific Corporation; Artivion, Inc; Edwards Lifesciences Corporation; LivaNova PLC; Medtronic; Abbott |

Key Market Driver – Aging Population and High Prevalence of Aortic Stenosis

One of the most influential drivers of the aortic valve replacement devices market is the rising prevalence of aortic stenosis among the geriatric population. With increasing life expectancy across the globe, more individuals are experiencing age-related calcific degeneration of the aortic valve. Aortic stenosis affects nearly 3% of people over 75 years and is associated with a high risk of mortality if left untreated. Traditional surgical aortic valve replacement (SAVR) was often considered too risky for elderly patients with comorbidities, but the development of TAVR has dramatically shifted the paradigm.

This minimally invasive solution has been shown to reduce procedural complications, decrease ICU time, and improve the overall quality of life for older adults. Clinical trials such as PARTNER 3 and Evolut Low Risk Trial have validated the use of TAVR in younger, low-risk cohorts as well, further driving market demand. As the global population continues to age, this trend is expected to remain a dominant force behind market growth.

Key Market Restraint – High Cost and Limited Accessibility

Despite its clinical benefits, the high cost of aortic valve replacement devices and associated procedures remains a major restraint, especially in developing economies. The average cost of a TAVR procedure can range from USD 30,000 to USD 50,000, which is unaffordable for many without robust health insurance or government support. The infrastructure and expertise required for such advanced interventions are also lacking in rural areas and low-resource settings, leading to inequitable access.

Furthermore, while developed regions may have established reimbursement models, patients in emerging markets often face out-of-pocket expenditures. These cost barriers limit the widespread adoption of technologically advanced valves, hindering market penetration in price-sensitive geographies.

Key Market Opportunity – Expansion into Emerging Markets

The Asia Pacific, Latin America, and Middle East & Africa regions represent significant untapped potential for aortic valve replacement device manufacturers. These regions are experiencing a surge in healthcare investments, infrastructure development, and rising prevalence of lifestyle-related heart conditions. With improved regulatory frameworks and increased awareness about valvular heart diseases, there is a clear opportunity for companies to expand their presence.

Additionally, the growing presence of medical tourism in countries like India, Thailand, and Mexico is attracting international patients seeking affordable and quality cardiac care. Companies that tailor their strategies to local market needs, such as offering cost-effective solutions or partnering with regional hospitals, stand to gain a competitive edge in these high-growth territories.

Aortic Valve Replacement Devices Market By Product Insights

The balloon-expandable valve segment holds the dominant share in the product category. These devices have become the gold standard in TAVR procedures due to their controlled deployment, strong radial force, and compatibility with challenging anatomies. Popularized by Edwards Lifesciences' SAPIEN valve series, balloon-expandable valves offer excellent procedural success rates, especially in patients with calcified aortic annuli. Their low profile allows for transfemoral access, which is less invasive and reduces complications compared to surgical alternatives. In addition, the ability to reposition or retrieve certain newer models has further strengthened the adoption of this product type in the clinical landscape.

On the other hand, the self-expandable valve segment is anticipated to grow at the fastest CAGR during the forecast period. These valves, typically made from nitinol, self-deploy once inside the body and offer better conformability to the aortic annulus. Their flexibility and adaptability make them suitable for patients with complex anatomies or those with a horizontal aorta. Medtronic’s Evolut series is a key player in this segment, offering supra-annular valve positioning that optimizes hemodynamics, particularly in younger patients with longer life expectancy.

Aortic Valve Replacement Devices Market By Leaflet Material Insights

Bovine pericardium-based valves dominate the leaflet material segment, owing to their superior durability, flexibility, and biocompatibility. These leaflets closely mimic native aortic valve movement, allowing for better hemodynamic performance. Valves constructed from bovine tissue have been a standard in both surgical and transcatheter approaches. Their resistance to calcification and favorable long-term data make them a preferred choice among clinicians, especially in older populations who do not require long-term anticoagulation.

Meanwhile, porcine pericardium is gaining traction as the fastest-growing segment, particularly in regions where cultural or religious considerations affect bovine usage. Technological improvements in porcine tissue treatment—such as anti-calcification coatings—have significantly enhanced their lifespan and performance. As a result, porcine-based valves are increasingly adopted in newer-generation devices, especially in Asia and Latin America.

Aortic Valve Replacement Devices Market By Frame Material Insights

Cobalt-chromium frames account for the largest share in the market, driven by their robustness, fatigue resistance, and radiopacity. These properties allow for precise positioning and consistent performance during valve deployment. Cobalt-chromium is widely used in balloon-expandable valves, as seen in the SAPIEN 3 platform. The material supports thin struts while maintaining strength, which is critical in reducing the overall profile of the device.

Nitinol, however, is the fastest-growing frame material segment, due to its shape memory and superelasticity properties. This allows self-expanding valves to deploy gradually and conform better to anatomical irregularities. Nitinol-based valves are preferred in TAVR procedures for patients with tortuous vascular pathways or annular eccentricities. As minimally invasive techniques gain prominence, the usage of nitinol is projected to rise significantly.

Aortic Valve Replacement Devices Market By End-use Insights

Inpatient facilities dominated the market and accounted for a share of 93.0% in 2024. As aortic valve replacement procedures, especially surgical ones, traditionally require advanced surgical suites, intensive care units, and longer post-operative monitoring. Major hospitals and specialized cardiac centers have the required expertise and infrastructure to conduct these interventions safely. These centers also play a key role in training and research, further supporting their market dominance.

However, outpatient facilities are emerging as the fastest-growing end-use segment. Thanks to advancements in TAVR techniques, same-day discharge protocols, and improvements in patient monitoring technology, more centers are adopting outpatient models. In countries like the U.S. and parts of Europe, select low-risk patients are now able to undergo valve implantation and be discharged within 24 hours. This shift not only reduces healthcare costs but also improves patient satisfaction and throughput for facilities.

Aortic Valve Replacement Devices Market By Regional Insights

North America holds the largest share of the aortic valve replacement devices market, led by the United States. This dominance can be attributed to the high burden of cardiovascular disease, early adoption of new technologies, and a mature healthcare infrastructure. According to the CDC, nearly 2.5 million Americans live with aortic valve disease, and over 100,000 valve replacement procedures are performed annually. Regulatory bodies such as the FDA have also played a crucial role in accelerating the approval of innovative devices, including new-generation TAVR systems.

Moreover, the strong presence of leading manufacturers such as Edwards Lifesciences, Medtronic, and Abbott ensures continuous product innovation. Favorable reimbursement scenarios, patient awareness, and access to skilled interventional cardiologists further support North America’s leadership in this market.

What Drives the Expansion of Aortic Valve Replacement Devices Market in U.S.?

U.S. is a major contributor to the market in North America. The market growth can be attributed to the high incidences of cardiovascular diseases in the aging population, advancements in minimally invasive procedures like TAVR, increased awareness among healthcare professionals and patients driving early detection and presence of well-developed healthcare infrastructure. Continuous innovations in medical devices, regulatory support and favourable reimbursement policies through government programs like Medicare are bolstering the market growth.

While developed regions continue to dominate, Asia Pacific is expected to grow at the fastest pace during the forecast period. Rapid urbanization, a growing middle-class population, and increasing prevalence of lifestyle diseases have contributed to a surge in cardiac cases. Governments in countries like China, India, and Japan are investing heavily in expanding healthcare access and upgrading hospitals with cardiac cath labs and hybrid operating rooms.

Furthermore, international players are forming strategic alliances with regional hospitals and distributors to improve market penetration. In Japan, for instance, local studies and registries have enabled the widespread approval of TAVR procedures. The growing popularity of medical tourism in Thailand and India also supports the influx of international patients seeking affordable AVR procedures.

How is Japanese Government’s Influence Driving the Growth of Aortic Valve Replacement Devices Market?

Japan represents a significant share in the Asia Pacific and is expected to grow at a fast rate during the forecast period. Aging demographics with increasing prevalence of aortic stenosis, rising patient preference towards minimally invasive procedures, growing awareness among healthcare professionals as well as increased approvals of new transcatheter aortic valve replacement (TAVR) devices and procedures are the factors driving the market expansion.

Reimbursement policies for TAVR devices like Edwards Sapien XT for treating severe symptomatic aortic stenosis provided by the Japanese government through the Central Social Insurance Medical Council (Chuikyo) is enabling patient to these procedures. Japan stands among one of the few Asian countries where government-funded TAVR devices are enhancing patient lives.

Some of the prominent players in the aortic valve replacement devices market include:

- Boston Scientific Corporation

- Artivion, Inc

- Edwards Lifesciences Corporation

- LivaNova PLC

- Medtronic

- Abbott

- Comp7

Aortic Valve Replacement Devices Market Recent Developments

- In April 2025, Edwards Lifesciences designed device, Sapien M3, a transcatheter mitral valve replacement system received Europe’s CE mark.

- In January 2025, Abbott launched its latest transcatheter aortic valve implantation/ replacement (TAVI/ TAVR) system, the Navitor Vision which is a state-of-the-art valve technology designed for treatment of symptomatic severe aortic stenosis in patients at high or extreme risk from conventional surgery.

- In September 2024, Pi-Cardia’s transcatheter ShortCut device received a de novo clearance from the FDA. The device is designed for opening up previously implanted heart valves and for clearing up path for blood flow into the coronary arteries, further facilitating transcatheter aortic valve replacement procedure for patients.

- In July 2024, Edwards Lifesciences, a U.S.-based medical technology company, completed the acquisition of Innovalve Bio Medical, a company specializing in transcatheter heart valve devices, further expanding Edwards’s offerings of valve repair and valve replacement services.

- In June 2024, Medtronic plc, a globally leading healthcare technology company, launched a next-generation surgical aortic tissue valve, the Avalus Ultra valve which is engineered for ease of implant and clear visibility for future valve-in-valve procedures with straightforward sizing.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the aortic valve replacement devices market

Product

- Balloon-expandable

- Self-expandable

- Mechanically Expandable

- Aortic Regurgitation

Leaflet Material

- Bovine Pericardium

- Porcine Pericardium

Frame Material

- Cobalt-Chromium

- Nitinol

- Others

End-use

- Inpatient Facilities

- Outpatient Facilities

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)