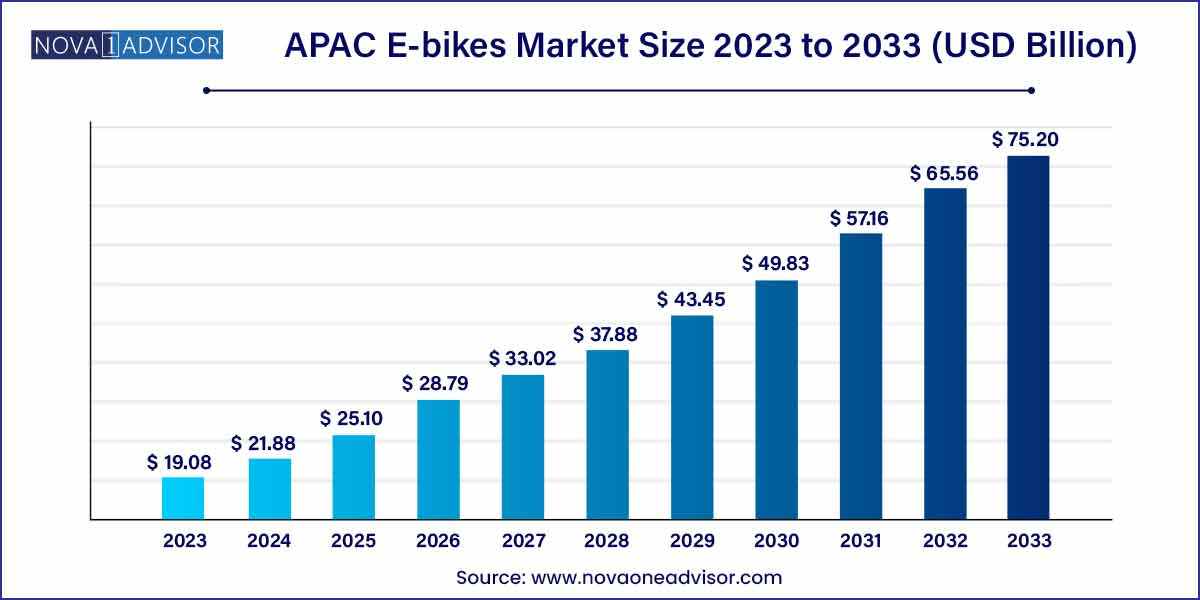

The global APAC e-bikes market size was exhibited at USD 19.08 billion in 2023 and is projected to hit around USD 75.20 billion by 2033, growing at a CAGR of 14.7% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific dominated the e-bikes market and accounted for the largest revenue share of 78.0% in 2023, owing to the increasing consumption expenditure in countries such as China and India.

- The pedal-assisted segment accounted for the largest revenue share of 57.8% in 2023.

- The lead-acid battery segment accounted for the largest revenue share of around 55.2% in 2023 and is expected to expand at the fastest CAGR of 15.0% over the forecast period.

- The above 250W segment held the largest revenue share of 50.7% in 2023.

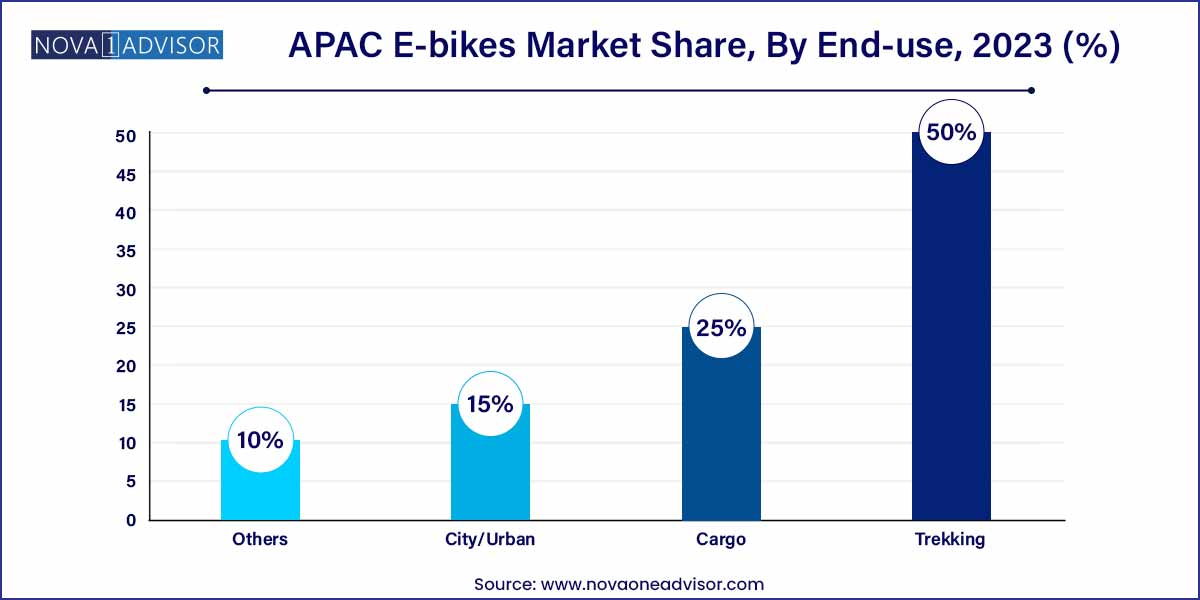

- The trekking segment held the largest revenue share of 50.0% in 2023.

Market Overview

The Asia-Pacific (APAC) E-Bikes market is undergoing rapid expansion, fueled by a unique intersection of environmental policy, urban mobility needs, economic factors, and technological advancements. E-bikes, or electric bicycles, have become one of the most prominent modes of personal and commercial transport across APAC countries such as China, Japan, South Korea, India, Vietnam, and Indonesia. These battery-powered bicycles offer a blend of convenience, cost-efficiency, and eco-friendliness, making them a compelling choice for daily commuting, recreational riding, and light cargo transportation.

Unlike traditional bicycles, e-bikes incorporate electric propulsion systems that either assist pedaling (pedal-assist) or provide full-electric ride support (throttle-assist). The rising popularity of micromobility solutions in congested cities, combined with the affordability and lower total cost of ownership of e-bikes compared to scooters or cars, has turned them into a mainstream urban mobility solution. E-bikes are also being actively promoted by governments in the region to combat air pollution, carbon emissions, and traffic congestion.

The APAC region dominates the global e-bike market, with China being the undisputed leader. As of 2024, China accounted for nearly 80% of global e-bike production and consumption, followed by strong growth emerging in Southeast Asia and India. With the region’s focus on renewable energy, digital mobility, and smart city frameworks, the e-bike ecosystem is being supported by infrastructure developments such as dedicated bike lanes, public charging points, and bike-sharing programs.

Furthermore, the integration of IoT and app-based ride analytics is reshaping the way consumers use, maintain, and interact with their e-bikes. As technology advances and consumer awareness deepens, the APAC e-bike market is poised to maintain its lead while evolving in sophistication and market depth.

Major Trends in the Market

-

Urban Congestion Driving Last-Mile Mobility Demand

Rising traffic congestion in megacities like Jakarta, Tokyo, and Delhi is boosting demand for compact, lightweight transport like e-bikes.

-

Government Subsidies and Green Transport Incentives

Countries like China, India, and South Korea offer tax breaks, rebates, or subsidies on the purchase of electric two-wheelers, including e-bikes.

-

Adoption of Lithium-ion Batteries for Performance Efficiency

A shift away from bulky lead-acid batteries to lightweight, durable lithium-ion batteries is enhancing range and charging performance.

-

Rise of E-Bike Sharing Platforms

Startups and mobility players are offering dockless or semi-dockless e-bike sharing in smart cities, supported by GPS, mobile apps, and subscription models.

-

Customization and Diversification in E-Bike Design

Manufacturers are introducing cargo e-bikes, foldable e-bikes, and high-torque variants for varied use cases—from business deliveries to rural rides.

-

Integration with Smart Mobility Ecosystems

IoT-connected e-bikes can now monitor battery health, theft prevention, ride performance, and allow OTA (over-the-air) firmware updates.

E-bikes Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 19.08 Billion |

| Market Size by 2033 |

USD 75.20 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 14.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Propulsion Type, Battery Type, Power, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Accell Group N.V.; Aima Technology Group Co. Ltd.; Giant Manufacturing Co. Ltd.; Merida Industry Co., Ltd.; Pedego Electric Bikes; Pon.Bike; Rad Power Bikes Inc.; Trek Bicycle Corporation; Yadea Group Holdings Ltd.; Yamaha Motor Company. |

Market Driver – Rising Pollution and Urban Sustainability Goals

A primary driver for the rapid expansion of the APAC e-bike market is the pressing need to reduce urban air pollution and meet sustainability goals. Many cities in Asia—especially in China and India—frequently report some of the world’s highest pollution levels due to vehicular emissions, industrial waste, and fossil fuel dependency. Governments are increasingly implementing policies to transition to clean energy and decarbonize transportation networks.

For example, China’s "Blue Sky" policy, aimed at curbing emissions from combustion vehicles, has been instrumental in replacing fuel-based mopeds with e-bikes. In India, programs such as FAME-II (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) incentivize the purchase and production of electric two-wheelers, including e-bikes. These initiatives, backed by urban planning strategies that include bike lanes and EV infrastructure, significantly support the adoption of e-bikes across the region.

Market Restraint – Poor Charging Infrastructure in Emerging Economies

One of the key restraints hampering the growth of the e-bike market in parts of APAC is the lack of robust charging infrastructure, especially in emerging economies such as Indonesia, the Philippines, and parts of rural India. While urban centers in countries like China and South Korea have seen steady infrastructure development, vast stretches of APAC still lack public or commercial charging stations for e-bikes.

This gap makes long-distance travel and rural adoption challenging, particularly for throttle-assisted or high-powered e-bikes with limited battery ranges. Moreover, the lack of standardization in charging connectors, voltages, and battery swaps adds to user confusion and hinders large-scale integration. The slow pace of battery recycling infrastructure and uncertainty over electricity reliability in certain zones further complicate the ownership experience.

Market Opportunity – E-Bikes in Commercial Logistics and Hyperlocal Delivery

An emerging opportunity in the APAC e-bike market lies in the integration of e-bikes into logistics, fleet, and hyperlocal delivery ecosystems. As e-commerce, food delivery, and courier services explode in urban and semi-urban regions, businesses are seeking low-cost, low-emission vehicles that can maneuver congested areas efficiently. E-bikes, especially cargo variants, offer the perfect blend of mobility, operational cost savings, and environmental responsibility.

Companies like Zomato, Swiggy (India) and Meituan (China) have already begun pilot programs using e-bikes for short-haul delivery, while Grab (Southeast Asia) is exploring partnerships with e-bike OEMs to power its expanding delivery arm. Cargo-specific e-bike models with reinforced chassis, dual battery systems, and large load-bearing platforms are gaining traction. With cities pushing for green logistics, this segment offers substantial commercial opportunity for OEMs and fleet operators alike.

Propulsion Type Insights

Pedal-assisted e-bikes dominate the propulsion segment across APAC due to regulatory preferences, user familiarity, and battery conservation benefits. These bikes offer motorized assistance only while pedaling, enhancing user control, promoting physical activity, and extending battery range. Countries like Japan have specifically approved pedal-assist bikes under their legal two-wheeler classification, leading to widespread adoption. Consumers appreciate the natural riding experience with added torque on slopes or long-distance commutes, making these bikes suitable for both urban professionals and elderly riders.

Throttle-assisted e-bikes are witnessing faster growth, especially in urban centers of China, India, and Indonesia. Throttle control allows riders to use motor power without pedaling, offering scooter-like convenience. These bikes are popular among delivery personnel and riders seeking minimal physical effort. Although regulatory scrutiny remains tighter around throttle-only systems in some markets, OEMs are releasing hybrid models that switch between pedal-assist and throttle modes to align with policy and user demand. Their use in commercial logistics is expanding rapidly, contributing to their accelerated growth rate.

Battery Type Insights

Lithium-ion batteries dominate the battery type segment, driven by their lightweight design, long cycle life, fast charging capability, and better performance under varying climatic conditions. Li-ion-powered e-bikes can typically offer ranges of 40–100 km per charge, depending on usage and load. Chinese manufacturers have heavily invested in Li-ion tech, significantly reducing production costs and making it accessible across mid-tier and even entry-level models. Japanese and South Korean OEMs, such as Panasonic and LG Chem, supply advanced battery modules with smart battery management systems (BMS), further reinforcing this dominance.

Lead-acid batteries are declining but still see application in price-sensitive markets, particularly in India, Pakistan, and smaller Southeast Asian nations. Due to their lower upfront cost, lead-acid batteries are preferred by budget-conscious consumers and local assembly manufacturers. However, their heavier weight, shorter lifespan, and environmental hazards make them less suitable for long-term use. Regulatory changes aimed at phasing out toxic battery types and encouraging Li-ion alternatives are expected to further reduce their market share, though they may remain in use where affordability outweighs performance concerns.

Power Insights

E-bikes with ≤250W power output dominate the market, especially in countries with legal limits on motor wattage. These models are ideal for city commuting and light travel, offering sufficient assistance without crossing regulatory thresholds. For example, Japanese law caps e-bike motor output at 250W, ensuring safety and promoting standardized vehicle design. These bikes are also favored for their energy efficiency and lower cost, making them accessible to a wider demographic, including students, seniors, and daily office commuters.

E-bikes with power output >250W are the fastest-growing segment, particularly in regions with relaxed regulations and applications requiring more power, such as hilly terrain, delivery cargo, or trekking. Models with 350W to 750W motors offer superior torque, higher speeds, and are often equipped with advanced suspension and disc braking systems. Adventure riders and logistic operators are increasingly turning to these high-power variants for their performance edge. As battery and motor technologies evolve, more compact and efficient high-power e-bikes are expected to flood the market.

Application Insights

City/Urban use dominates the APAC e-bike application segment, accounting for a significant majority of sales. In densely populated cities like Shanghai, Tokyo, Bangkok, and Bengaluru, e-bikes provide an affordable, reliable, and agile mode of daily transport. They help reduce commute time, bypass traffic congestion, and minimize environmental impact. Urban consumers often seek foldable or lightweight designs that can be combined with public transport systems. Government investments in cycling infrastructure, such as bike lanes and parking facilities, have further boosted urban adoption.

Cargo applications are growing rapidly, driven by the rise of gig economy services, local deliveries, and urban freight movement. E-bikes customized for cargo use—featuring reinforced frames, large storage boxes, or towing capabilities—are being adopted by small businesses, couriers, and food delivery platforms. These vehicles offer massive cost savings compared to petrol-based delivery scooters and contribute to a brand's green credentials. With continued demand for contactless delivery and sustainable logistics, this segment is poised to expand rapidly in both mature and emerging APAC cities.

Regional Insights

China holds the leading position in the APAC—and global—e-bike market by a significant margin. With a strong domestic manufacturing base, favorable government policies, and decades of two-wheeler usage culture, China has turned e-bikes into a national mobility staple. Cities like Beijing, Guangzhou, and Shenzhen are equipped with robust charging infrastructure, dedicated bike paths, and public rental systems that support both consumer and shared e-bike models.

The government’s aggressive push to phase out petrol scooters, combined with subsidies for electric two-wheelers, has made e-bikes more accessible and popular across demographics. Local OEMs such as Yadea, AIMA, and TAILG dominate the domestic market, while also exporting to global regions. Smart features, ultra-fast charging, and connected services are making Chinese e-bikes models of global innovation and affordability.

India represents the fastest-growing market for e-bikes in the APAC region, spurred by rapid urbanization, rising fuel costs, and a young, tech-savvy population. Though the market is still in a nascent stage compared to China, strong policy frameworks like FAME-II and incentives for electric mobility are accelerating adoption. State-level policies across Delhi, Maharashtra, and Tamil Nadu are promoting electric vehicle usage through rebates and charging infrastructure rollouts.

Indian startups like Hero Lectro, EMotorad, and TronX are actively introducing cost-effective and locally manufactured e-bikes tailored to Indian road conditions and consumer preferences. E-bikes are also gaining interest among delivery aggregators and wellness-conscious consumers in metro cities. With increasing awareness, innovation, and affordability, India is on a steep upward curve in e-bike market development.

Recent Developments

-

February 2025 – Yadea launched its new carbon-frame, ultra-light e-bike series targeting premium urban commuters across Southeast Asia, integrating GPS, theft protection, and voice control.

-

January 2025 – Hero Lectro (India) announced the launch of a cargo e-bike line designed for small businesses and e-commerce delivery partners, backed by a partnership with B2B logistics firm LoadEx.

-

November 2024 – AIMA partnered with Panasonic to deploy smart lithium-ion battery management systems in its high-speed e-bike models across China and Thailand.

-

October 2024 – EMotorad secured Series A funding to scale its export operations to Australia and the Middle East, while also expanding manufacturing in Pune, India.

-

September 2024 – Gogoro launched an urban-focused B2B fleet solution in Taiwan using modular e-bike units integrated with swappable battery stations.

Some of the prominent players in the E-bikes market include:

- Accell Group N.V.

- Aima Technology Group Co. Ltd.

- Giant Manufacturing Co. Ltd.

- Merida Industry Co., Ltd.

- Pedego Electric Bikes

- Pon.Bike

- Rad Power Bikes Inc.

- Trek Bicycle Corporation

- Yadea Group Holdings Ltd.

- Yamaha Motor Company

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global e-bikes market.

Propulsion Type

- Pedal-assisted

- Throttle-assisted

Battery Type

- Lithium-ion Battery

- Lead-acid Battery

Power

- Less than or equal to 250W

- Above 250W

Application

- City/Urban

- Trekking

- Cargo

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)