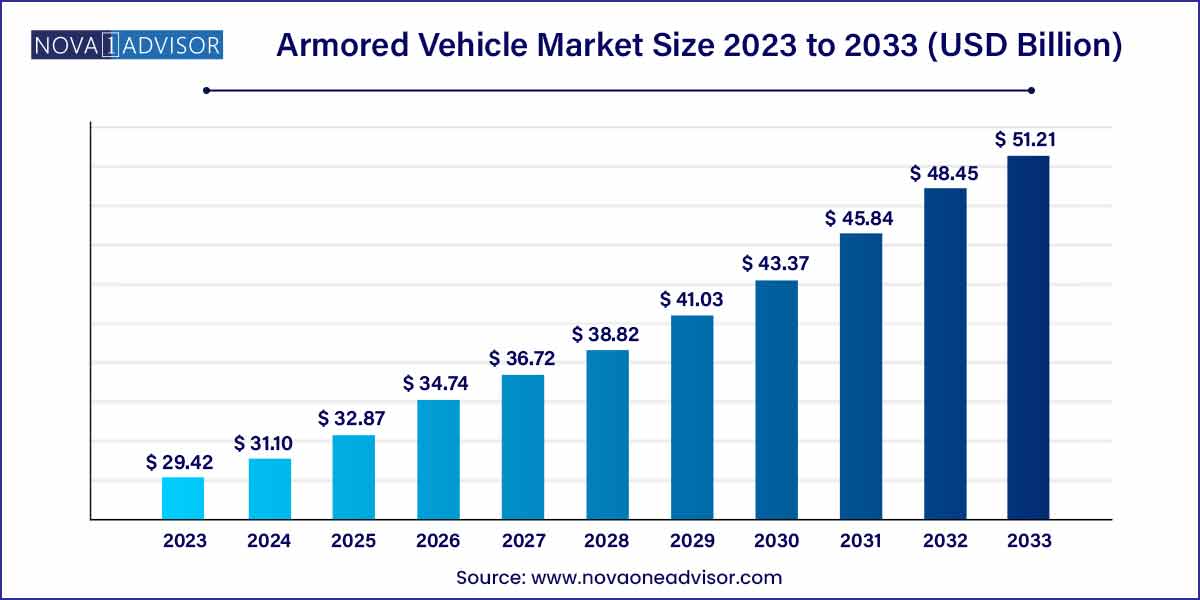

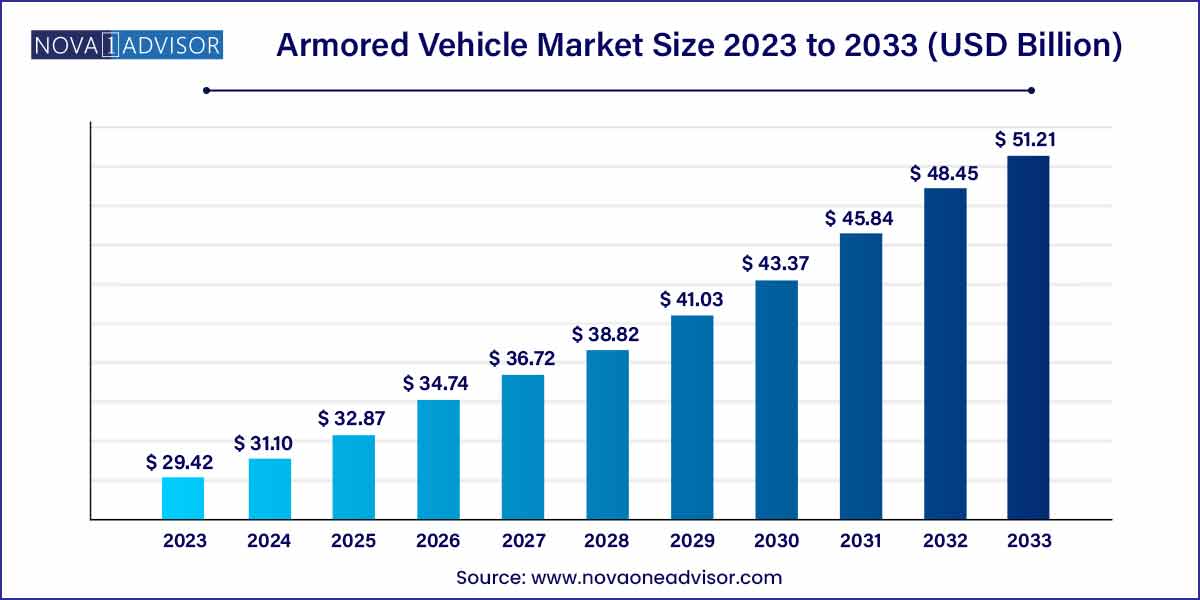

The global armored vehicle market size was exhibited at USD 29.42 billion in 2023 and is projected to hit around USD 51.21 billion by 2033, growing at a CAGR of 5.7% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific accounted for the highest share and over 33% of global revenue in 2023.

- The combat vehicles segment accounted for the highest revenue share of over 64% in 2023.

- The conventional armored vehicles segment witnessed the highest share of over 96% of global revenue in 2023.

- The manned armored vehicles segment held the largest revenue share of over 76% in 2023.

- The OEM segment held the largest revenue share of over 78% in 2023.

- The fire control systems (FCS) segment held the largest revenue share of over 31% in 2023.

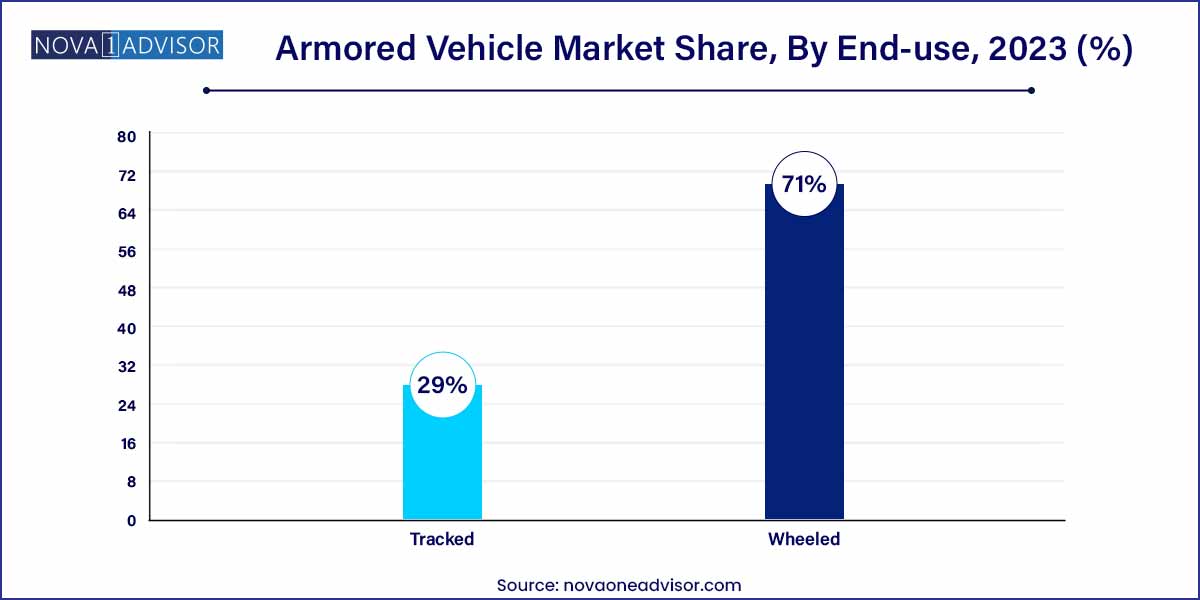

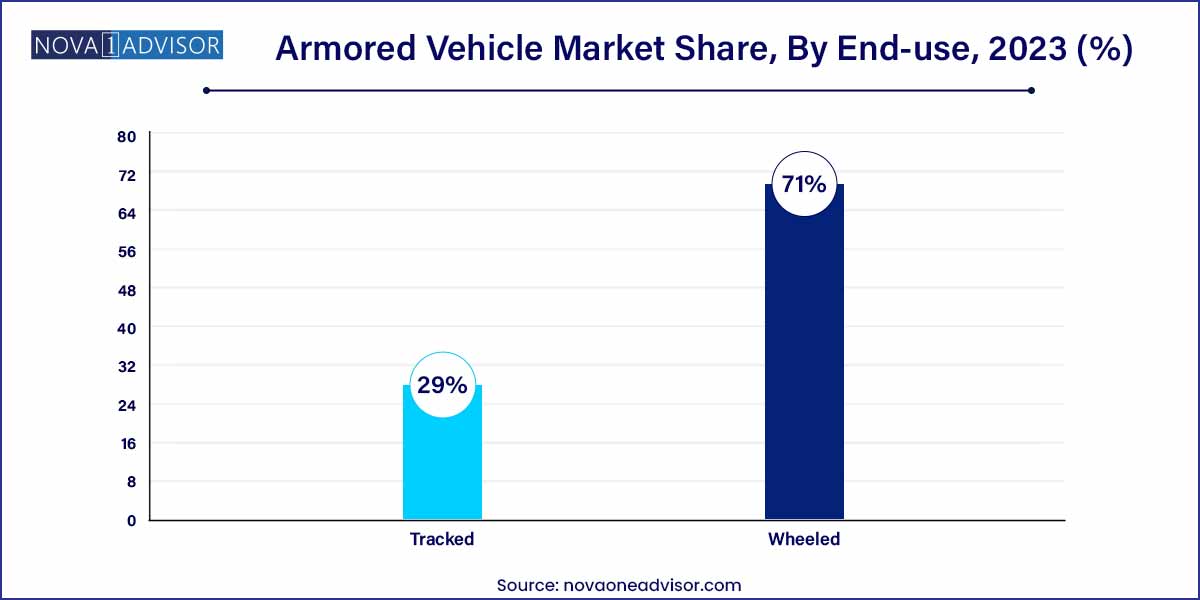

- The wheeled segment held the largest revenue share of over 71% in 2023.

Armored Vehicle Market: Overview

The global armored vehicle market stands at the intersection of technological innovation, national defense priorities, and evolving security needs. Armored vehicles, encompassing a wide spectrum of products such as Main Battle Tanks (MBTs), Infantry Fighting Vehicles (IFVs), Armored Personnel Carriers (APCs), and specialized support vehicles, are critical assets for military, homeland security, and law enforcement operations.

In recent years, the market has witnessed steady growth, fueled by rising geopolitical tensions, an increase in defense spending, modernization initiatives among armed forces, and the evolving threat landscape characterized by asymmetric warfare and terrorism. From patrolling hostile terrains to executing peacekeeping missions, armored vehicles are vital in ensuring the survivability and operational effectiveness of personnel.

At the same time, manufacturers are investing heavily in next-generation platforms integrating advanced armor materials, hybrid propulsion, unmanned capabilities, and network-centric warfare systems. In an era increasingly defined by technological supremacy and rapid response, armored vehicles are evolving beyond brute strength to become agile, smart, and versatile assets. The outlook for the market remains robust, driven by modernization programs, emerging economies' military expansions, and a growing focus on urban warfare and counter-insurgency operations.

Armored Vehicle Market Growth

The armored vehicle market is experiencing robust growth driven by several key factors. Firstly, the increasing global geopolitical tensions and security threats have prompted nations to bolster their defense capabilities, leading to substantial investments in armored vehicles. Additionally, the rise in terrorism, insurgency, and asymmetric warfare has heightened the demand for armored platforms that offer enhanced protection and mobility in hostile environments. Moreover, the modernization efforts of armed forces worldwide, coupled with the need for advanced technologies and capabilities, continue to drive procurement initiatives for next-generation armored vehicles. Furthermore, the expansion of the market beyond military applications into law enforcement, homeland security, and civilian sectors such as VIP transportation and disaster response further contributes to market growth. Overall, the convergence of these factors underscores a promising trajectory for the armored vehicle market, with ample opportunities for manufacturers and suppliers to capitalize on the growing demand for armored solutions across diverse operational domains.

Armored Vehicle Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 29.42 Billion |

| Market Size by 2033 |

USD 51.21 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Type, Mobility, Mode Of Operation, Point Of Sale, System, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BAE Systems; BMW AG; Daimler AG (Mercedes Benz), Elbit Systems; Ford Motor Company; General Dynamics Corporation; INKAS Armored Vehicle Manufacturing; International Armored Group; IVECO; Krauss-Maffei Wegmann GmbH & Co. (KMW); Lenco Industries, Inc.; Lockheed Martin Corporation; Navistar, Inc., Oshkosh Defense, LLC; Rheinmetall AG; STAT, Inc.; Textron, Inc.; Thales Group. |

Armored Vehicle Market Dynamics

- Technological Advancements:

The armored vehicle market is witnessing a paradigm shift driven by rapid technological advancements. Manufacturers are integrating state-of-the-art technologies such as composite materials, active protection systems (APS), and advanced sensors to enhance the survivability, mobility, and lethality of armored platforms. These innovations not only improve the protection levels against a wide array of threats but also offer increased agility and situational awareness to operators. Furthermore, the adoption of modular design approaches facilitates ease of customization and upgradability, allowing end-users to tailor armored vehicles to meet specific mission requirements.

- Geopolitical and Security Dynamics:

Geopolitical tensions, regional conflicts, and the evolving security landscape worldwide play a pivotal role in shaping the dynamics of the armored vehicle market. Heightened security threats, including terrorism, insurgency, and hybrid warfare tactics, drive the demand for armored vehicles across military, law enforcement, and homeland security sectors. Nations facing persistent security challenges allocate substantial budgets for the procurement of armored platforms to enhance their defense capabilities and safeguard critical assets. Additionally, geopolitical shifts and strategic alliances influence procurement decisions, with countries seeking to modernize their armed forces and maintain technological superiority.

Armored Vehicle Market Restraint

One of the primary restraints impacting the armored vehicle market is the presence of budgetary constraints, particularly in regions with limited defense spending. Many nations, especially smaller or developing countries, face challenges in allocating sufficient funds for the procurement and maintenance of armored vehicles amidst competing priorities. This constraint often leads to delays in modernization programs or the prioritization of other defense assets over armored platforms. Additionally, economic downturns or fiscal austerity measures may further exacerbate budgetary constraints, hindering the growth potential of the armored vehicle market and impacting the revenue streams of manufacturers and suppliers.

- Regulatory Compliance and Export Controls:

Stringent export regulations and compliance requirements pose significant challenges for armored vehicle manufacturers seeking to expand their global footprint. Export controls imposed by governments to prevent the proliferation of military technologies and equipment can create barriers to entry into certain markets. Moreover, navigating complex licensing procedures and adhering to international trade regulations add layers of bureaucracy and uncertainty for industry players. Compliance with ethical guidelines and export restrictions becomes paramount, as violations can result in legal repercussions and reputational damage.

Armored Vehicle Market Opportunity

- Urban Warfare and Asymmetric Threats:

The evolving nature of modern conflicts, characterized by urban warfare and asymmetric threats, presents significant opportunities for the armored vehicle market. As armed forces increasingly operate in densely populated urban environments, there is a growing demand for agile and maneuverable armored platforms equipped with advanced technologies for enhanced situational awareness and protection. Manufacturers have the opportunity to develop specialized urban warfare solutions tailored to the unique challenges posed by urban terrain, such as improvised explosive devices (IEDs), ambushes, and close-quarters combat.

- Civilian Applications and Commercial Markets:

Beyond traditional military and security sectors, armored vehicles offer diverse applications in civilian and commercial markets, presenting lucrative opportunities for industry players. The growing demand for VIP transportation, cash-in-transit services, and high-value asset protection fuels the adoption of armored vehicles by private corporations, government agencies, and affluent individuals. Moreover, the rising incidence of natural disasters, civil unrest, and terrorist threats underscores the importance of armored platforms in disaster response, humanitarian aid, and critical infrastructure protection. Manufacturers have the opportunity to diversify their product portfolios and cater to emerging civilian markets by developing customized armored solutions that prioritize safety, comfort, and performance.

Armored Vehicle Market Challenges

- Maintenance and Lifecycle Costs:

One of the significant challenges facing the armored vehicle market is the high maintenance and lifecycle costs associated with these complex and specialized platforms. Beyond the initial procurement cost, end-users must allocate substantial resources for ongoing maintenance, repairs, spare parts, and training to ensure operational readiness and longevity of armored vehicles. Moreover, the diverse range of components, subsystems, and integrated technologies necessitates sophisticated maintenance infrastructure and skilled personnel, adding to the overall lifecycle expenditure. Budgetary constraints and competing priorities may limit the availability of funds for maintenance activities, leading to deferred maintenance, reduced operational availability, and potential safety risks.

- Evolving Threat Landscape:

The dynamic nature of modern threats poses significant challenges for the design, development, and deployment of armored vehicles. Emerging technologies such as unmanned aerial systems (UAS), cyber warfare capabilities, and advanced anti-tank weapons systems present new challenges to traditional armored platforms, necessitating continuous innovation and adaptation. Additionally, hybrid warfare tactics, asymmetric threats, and non-conventional conflicts blur the lines between conventional and unconventional threats, requiring armored vehicles to possess multifaceted capabilities beyond traditional armor protection. Manufacturers must anticipate and address evolving threats by incorporating advanced survivability features, active protection systems (APS), and networked capabilities into their armored platforms.

Segments Insights:

Product Insights

Combat Vehicles dominated the product segment of the armored vehicle market. Within combat vehicles, Main Battle Tanks (MBTs) and Infantry Fighting Vehicles (IFVs) hold significant shares due to their frontline engagement roles. MBTs like the M1 Abrams, Leopard 2, and T-90 exemplify the enduring relevance of heavily armored, highly mobile platforms capable of overwhelming enemy forces. Meanwhile, IFVs and APCs provide armored mobility to infantry units, ensuring safe troop deployment in contested zones. The combat vehicle segment remains indispensable for both conventional warfare and hybrid conflict scenarios.

On the other hand, Combat Support Vehicles are experiencing the fastest growth within the product segment. Modern battlefields demand not only frontline engagement but also robust logistical and operational support. Armored supply trucks, command & control vehicles, and repair & recovery vehicles are becoming crucial to ensure sustained combat effectiveness. The increasing complexity of warfare, particularly in multinational and expeditionary operations, drives the demand for specialized support vehicles. The growing interest in unmanned armored support platforms further accelerates this segment's expansion.

Type Insights

Conventional Armored Vehicles dominated the type segment. Diesel-powered and gas-turbine conventional armored vehicles currently account for the vast majority of operational fleets worldwide. Their established logistics chains, field-proven reliability, and compatibility with existing infrastructure make them the primary choice for armed forces. Additionally, ongoing upgrade programs for legacy vehicles ensure that conventional platforms remain relevant in the near future.

However, Electric Armored Vehicles are rapidly emerging as the fastest-growing type. Driven by the need for silent operations, reduced thermal signatures, and lower logistical footprints, electric propulsion systems are gaining traction in the defense sector. Projects like GM Defense's Infantry Squad Vehicle (ISV) with hybrid-electric capabilities and the UK Ministry of Defence's exploration of electric armored vehicles exemplify the growing focus on electrification. Advancements in battery technology and energy management systems are likely to accelerate this transition over the next decade.

Mode of Operation Insights

Manned armored vehicles currently dominate the market. Traditional operational doctrines and the need for human judgment in dynamic combat environments ensure the continued primacy of manned platforms. The training, experience, and decision-making capabilities of human crews remain crucial in complex battlefield scenarios. Countries continue to invest in advanced manned platforms with integrated decision-support systems to enhance crew performance.

Unmanned armored vehicles are emerging as the fastest-growing operational mode. From remote-controlled mine-clearance vehicles to autonomous combat scouts, unmanned systems are reshaping force structures. As autonomy, AI, and remote-control technologies mature, unmanned armored vehicles will progressively supplement and, in certain roles, replace manned platforms, offering tactical advantages in high-risk environments.

Point of Sale Insights

OEM (Original Equipment Manufacturer) sales dominated the point of sale segment. Governments and defense agencies primarily procure brand-new, customized platforms tailored to their strategic requirements from OEMs. These purchases are often bundled with comprehensive training, maintenance, and support packages, ensuring lifecycle management.

Retrofit and upgrade services are rapidly gaining momentum. Budget constraints and the need to extend service lives of existing fleets have led many countries to opt for retrofitting older platforms with modern technologies. Programs upgrading legacy MBTs with new armor packages, fire control systems, and situational awareness enhancements exemplify the growing importance of retrofit solutions.

System Insights

Ballistic Armor systems dominated the system segment of the armored vehicle market. Protection remains the core mission of armored vehicles, driving continuous innovation in armor solutions. Modern ballistic armor systems, incorporating composite materials, reactive armor, and modular protection kits, ensure vehicles can withstand a wide spectrum of threats.

Simultaneously, Fire Control Systems (FCS) are emerging as the fastest-growing system segment. Advanced FCS incorporating AI algorithms, automated target recognition, and integrated optics greatly enhance lethality and situational awareness. Upgrades to FCS are pivotal in enabling legacy armored platforms to remain effective in modern, high-threat environments.

Mobility Insights

Wheeled armored vehicles dominated the mobility segment of the armored vehicle market. Their strategic mobility, operational flexibility, and lower life-cycle costs make them ideal for rapid deployment, peacekeeping missions, and urban warfare. Platforms like the Stryker Infantry Carrier Vehicle and Patria AMV have demonstrated the effectiveness of wheeled designs in modern conflict scenarios. They offer superior speed, easier maintenance, and better road mobility compared to tracked vehicles, especially important in hybrid conflict zones.

Meanwhile, Tracked armored vehicles are witnessing notable growth in specific applications. Heavy combat roles requiring high off-road mobility, superior armor protection, and firepower still rely on tracked platforms. Recent orders for tracked IFVs like the Rheinmetall Lynx and upgrades to MBTs reflect the continued importance of this segment for high-intensity conflict environments.

Regional Insights

North America dominated the global armored vehicle market in terms of revenue and technological leadership. The United States, with its substantial defense budget and advanced R&D ecosystem, is the primary driver of North American dominance. Programs like the U.S. Army's Armored Multi-Purpose Vehicle (AMPV) and the Robotic Combat Vehicle initiative showcase North America's leadership in both conventional and next-generation platforms. Additionally, strong export programs to allies further bolster the region's market position.

Asia-Pacific is the fastest-growing region in the armored vehicle market. Rapid military modernization, border tensions, and rising defense budgets across countries like China, India, South Korea, and Australia are fueling unprecedented demand for armored vehicles. Indigenous manufacturing programs, such as India's Future Infantry Combat Vehicle (FICV) and China's ZBL-09, reflect the region's commitment to self-reliance in defense production. Regional conflicts and strategic competition are expected to sustain Asia-Pacific's robust growth trajectory.

Some of the prominent players in the armored vehicle market include:

- BAE Systems

- BMW AG

- Daimler AG (Mercedes Benz)

- Elbit Systems

- Ford Motor Company

- General Dynamics Corporation

- INKAS Armored Vehicle Manufacturing

- International Armored Group

- IVECO

- Krauss-Maffei Wegmann GmbH & Co. (KMW)

- Lenco Industries, Inc.

- Lockheed Martin Corporation

- Navistar, Inc.

- Oshkosh Defense, LLC

- Rheinmetall AG

- STAT, Inc.

- Textron, Inc.

- Thales Group.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global armored vehicle market.

Product

-

- Armored Personnel Carrier (APC)

- Infantry Fighting Vehicles (IFV)

- Light Protected Vehicles (LPV)

- Main Battle Tanks (MBT)

- Mine-resistant Ambush Protected (MRAP)

- Tactical Vehicle

- Others

-

- Armored Supply Trucks

- Armored Command & Control Vehicles

- Repair & Recovery Vehicles

- Unmanned Armored Ground Vehicles

Type

- Electric Armored Vehicles

- Conventional Armored Vehicles

Mobility

Mode of Operation

- Manned Armored Vehicles

- Unmanned Armored Vehicles

Point of Sale

System

- Engines

- Drive Systems

- Ballistic Armor

- Fire Control Systems (FCS)

- Navigation Systems

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)