Artificial Intelligence for Healthcare Payer Market Size and Growth 2025 to 2034

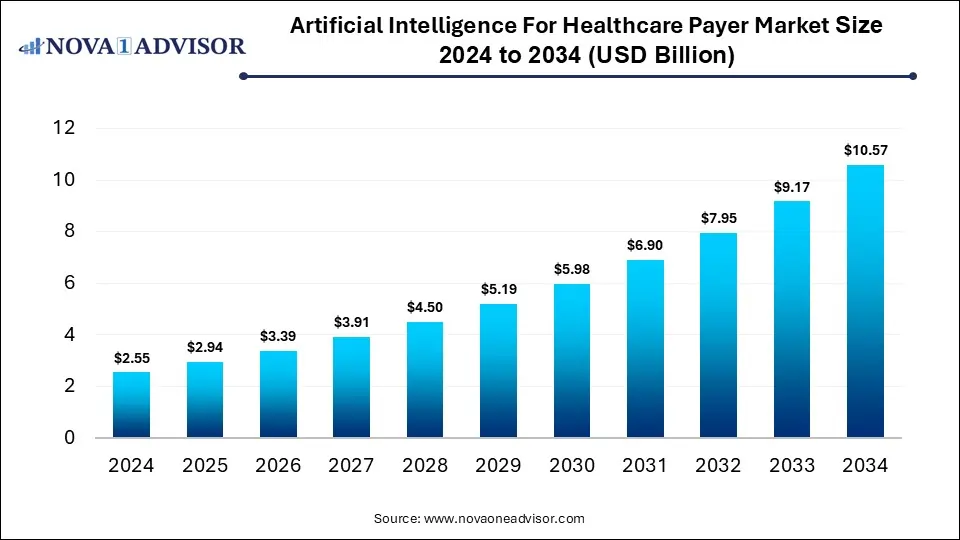

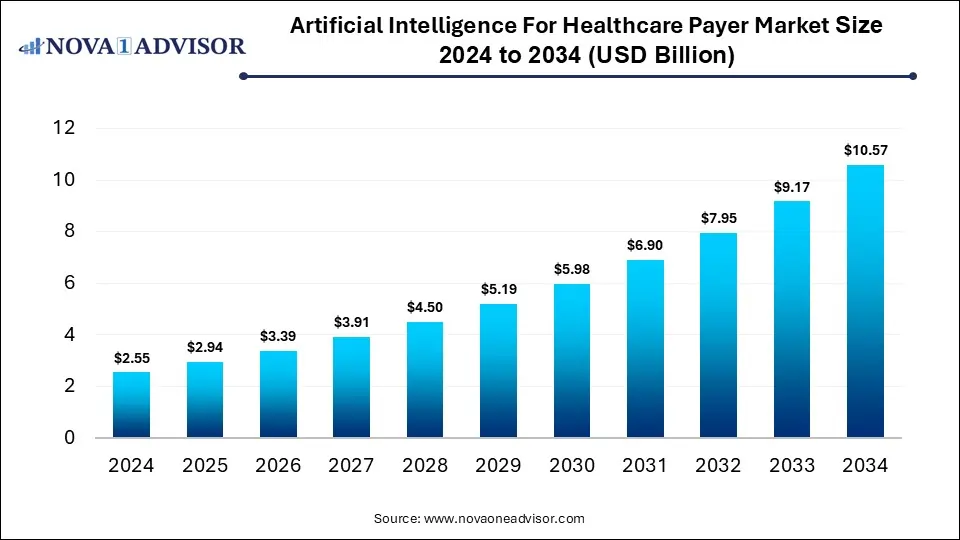

The global artificial intelligence for healthcare payer market size was estimated at USD 2.55 billion in 2024 and is expected to reach USD 10.57 billion in 2034, expanding at a CAGR of 15.28% during the forecast period of 2025 and 2034. The market growth is driven by the growing adoption of AI-driven claims automation, fraud detection, predictive analytics for risk assessment, cost optimization, and enhanced member engagement, enabling payers to improve efficiency and decision-making in healthcare management.

Artificial Intelligence for Healthcare Payer Market Key Takeaways

- By region, North America held the largest share of the artificial intelligence for healthcare payer market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By component, the software segment led the market in 2024.

- By component, the services segment is expected to expand at the highest CAGR over the projected timeframe.

- By deployment, the cloud segment led the market in 2024.

- By deployment, the hybrid segment is expected to expand at the highest CAGR over the projection period.

- By technology, the machine learning segment led the market in 2024.

- By application, the claim processing optimization segment led the market in 2024.

How is AI Revolutionizing the Healthcare Payer Industry?

AI is significantly transforming the healthcare payer industry by automating complex administrative processes such as claims management, billing, and fraud detection. AI-powered analytics enable payers to identify high-risk patients, predict healthcare costs, and design personalized health plans for better outcomes. Machine learning and natural language processing tools enhance data accuracy and streamline communication between providers and payers. Moreover, AI helps reduce operational costs while improving efficiency and decision-making, leading to faster reimbursements and improved member satisfaction.

- In December 2024, Helix Advisory and ZignaAI announced a strategic partnership to streamline healthcare revenue cycle processes by combining Helix’s revenue integrity expertise with ZignaAI’s advanced AI in data analysis and natural language processing.

Market Overview

The market is experiencing significant growth, driven by rising healthcare costs, increasing adoption of digital health solutions, and the need for value-based care models. Additionally, the growing volume of healthcare data and demand for real-time analytics are further fueling the expansion of AI applications among healthcare payers. The artificial intelligence for the healthcare payer market refers to the integration of advanced AI technologies such as machine learning, predictive analytics, and natural language processing to optimize payer operations within the healthcare ecosystem.

AI supports healthcare payers by automating claims management, detecting fraud, enhancing member engagement, and enabling data-driven decision-making for cost reduction and improved care outcomes. Key benefits include greater operational efficiency, faster claim settlements, accurate risk prediction, and improved customer satisfaction.

What are the Major Trends in the Artificial Intelligence for Healthcare Payer Market?

- Predictive Analytics for Risk Assessment

Payers are increasingly using predictive analytics to identify high-risk patients and forecast healthcare costs. This allows insurers to design preventive care programs and optimize resource allocation, ultimately reducing long-term expenses.

- Fraud Detection and Prevention

AI algorithms are being employed to detect fraudulent claims and unusual billing patterns by analyzing massive datasets in real time. This trend helps payers save millions of dollars annually and maintain regulatory compliance.

- Personalized Member Engagement

AI-driven tools like chatbots and virtual assistants are enhancing member engagement by providing personalized support, claim updates, and health plan recommendations. This improves customer experience and strengthens payer-member relationships.

Report Scope of Artificial Intelligence for Healthcare Payer Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.94 Billion |

| Market Size by 2034 |

USD 10.57 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 15.28% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Component, By Deployment, By Technology, By Application, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Rising Healthcare Costs

Rising healthcare costs are a major driver of growth in the artificial intelligence for healthcare payer market, as insurers and payers seek efficient ways to reduce operational and clinical expenses. AI technologies help streamline administrative processes such as claims management, billing, and fraud detection, which lowers overhead costs. By leveraging predictive analytics, payers can forecast healthcare expenses, identify high-risk patients, and design preventive care strategies that reduce long-term spending. Moreover, AI enables more accurate decision-making and resource allocation, helping payers manage costs without compromising the quality of care.

Increasing Demand for Automation

The increasing demand for automation is another key factor driving the growth of the artificial intelligence for healthcare payer market, as payers aim to improve efficiency and reduce manual workload. AI-powered automation streamlines repetitive and time-consuming tasks such as claims processing, eligibility verification, and data entry, significantly minimizing human errors. This allows healthcare payers to process large volumes of data more quickly, leading to faster reimbursements and improved customer satisfaction. Automation also frees up staff to focus on strategic tasks like fraud prevention and policy optimization, enhancing overall operational productivity.

Restraint

High Implementation Cost

The market growth is hindered by high implementation cost associated with AI technology, which creates barriers particularly for small and mid-sized organizations. Deploying AI solutions requires substantial investment in advanced software, data infrastructure, and skilled personnel to manage and maintain the systems. Additionally, integrating AI tools with existing legacy IT systems can be complex and costly, often demanding customized solutions. These high upfront expenses make it challenging for many payers to justify short-term returns, delaying large-scale adoption.

Opportunities

Integration with Cloud and Big Data Platforms

Cloud-based AI solutions allow healthcare payers to process vast amounts of structured and unstructured healthcare data in real time, improving decision-making and operational efficiency. Big data analytics enhances the accuracy of AI algorithms, enabling better fraud detection, risk prediction, and personalized member services. Moreover, cloud integration reduces infrastructure costs and facilitates collaboration across departments and geographic regions. As healthcare payers increasingly shift toward digital ecosystems, the synergy between AI, cloud, and big data is expected to accelerate innovation and market growth.

Rising Adoption in Developing Markets

Emerging regions are increasingly investing in digital health infrastructure and insurance modernization. Emerging economies such as India, Brazil, and Southeast Asian nations are focusing on improving healthcare access, reducing administrative inefficiencies, and combating fraud, all areas where AI can deliver significant value. The growing availability of affordable cloud computing and mobile technologies further supports AI adoption among healthcare payers in these regions. Additionally, government initiatives promoting health digitization and partnerships with global AI firms are accelerating deployment.

How Macroeconomic Variables Influence the Artificial Intelligence for Healthcare Payer Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth. enabling higher healthcare spending and greater investments in advanced technologies. As economies expand, healthcare payers and insurers have more resources to adopt AI solutions for improving efficiency, fraud detection, and claims processing. However, in regions with slower GDP growth, limited budgets may delay AI adoption, slightly restraining market penetration.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the artificial intelligence for healthcare payer market by increasing overall healthcare costs and reducing payer budgets for technology investments. Higher operational and medical expenses force payers to prioritize immediate cost-control measures over long-term AI integration. However, in some cases, these pressures may indirectly encourage AI adoption for cost optimization and predictive analytics to manage pricing inefficiencies more effectively.

Exchange Rates

Exchange rate fluctuations can negatively affect, especially in regions that rely on imported AI technologies, software, and data infrastructure. A weaker local currency increases the cost of acquiring AI tools and maintaining global cloud-based services. However, stable or favorable exchange rates can support cross-border collaborations and make AI adoption more affordable for healthcare payers.

Segment Outlook

Component Insights

Why Did the Software Segment Dominate the Artificial Intelligence for Healthcare Payer Market?

The software segment dominated the market with the largest share in 2024. This is because of its critical role in automating complex processes such as claims management, fraud detection, and predictive analytics. AI-powered software solutions enable healthcare payers to analyze massive datasets efficiently, improving decision-making and operational accuracy. The increasing adoption of cloud-based AI platforms and machine learning algorithms has further enhanced scalability and integration with existing payer systems. Moreover, software solutions offer continuous updates, flexibility, and lower long-term costs compared to hardware, making them a preferred choice among insurers and healthcare organizations.

The services segment is expected to grow at the fastest CAGR during the projection period, owing to the increasing need for AI integration, customization, and ongoing support. As healthcare payers adopt complex AI systems, they rely heavily on professional and managed services for implementation, maintenance, and optimization. Service providers assist in aligning AI solutions with regulatory standards, data security requirements, and operational workflows, ensuring smooth deployment. Additionally, the rising demand for training and consulting to enhance staff proficiency in AI tools is fueling this segment’s expansion.

Deployment Insights

What Made Cloud the Dominant Segment in the Market in 2024?

The cloud segment dominated the artificial intelligence for healthcare payer market in 2024 due to its scalability, flexibility, and cost-efficiency in managing vast healthcare data. Cloud-based AI solutions enable payers to process and analyze real-time data from multiple sources without the need for heavy on-premises infrastructure. This model supports seamless collaboration, faster deployment, and remote accessibility, which are critical for large insurance networks and healthcare organizations. Moreover, the integration of AI with cloud platforms enhances predictive analytics, fraud detection, and claims automation capabilities.

- In January 2025, PracticeSuite added cloud platform AI capabilities to its cloud EHR / billing/practice management platform to streamline workflows (from patient onboarding through claims billing) and reduce repetitive tasks.

The hybrid segment is expected to expand at the highest CAGR in the coming years. This is mainly due to its ability to combine the flexibility of cloud deployment with the security and control of on-premises infrastructure. Healthcare payers are increasingly adopting hybrid models to manage sensitive patient and claims data locally while leveraging the cloud for AI-driven analytics and scalability. This approach helps organizations comply with stringent data privacy regulations like HIPAA while still benefiting from real-time processing and machine learning capabilities. Additionally, hybrid deployments enable seamless integration with existing legacy systems, reducing migration risks and operational disruptions.

Technology Insights

Why Did the Machine Learning Segment Lead the Market in 2024?

The machine learning segment led the artificial intelligence for healthcare payer market in 2024 due to the widespread application in predictive analytics, claims automation, and fraud detection. ML algorithms enable healthcare payers to analyze large volumes of structured and unstructured data to identify cost-saving opportunities, optimize claim adjudication, and predict patient risk with high accuracy. The technology’s proven ability to continuously learn from new data enhances decision-making efficiency and operational outcomes. Moreover, the integration of ML models with payer platforms supports personalized member engagement and improved resource allocation.

The generative AI segment is expected to expand at the highest CAGR in the coming years. This is primarily due to the transformative potential in automating complex, language-based tasks. Generative AI, including large language models (LLMs), enables payers to streamline documentation, summarize claims data, and generate personalized member communications with greater accuracy and speed. It enhances productivity by reducing administrative burden and improving the efficiency of processes such as prior authorization and appeals management. Additionally, Generative AI supports intelligent decision-making by synthesizing insights from unstructured data sources like clinical notes and policy documents.

Application Insights

Why Did the Claims Processing Optimization Segment Lead the Market in 2024?

The claims processing optimization segment led the artificial intelligence for healthcare payer market in 2024, due to its critical role in reducing administrative costs and improving operational efficiency. AI-driven claims optimization solutions automate data validation, detect anomalies, and accelerate adjudication, significantly lowering manual errors and processing times. Healthcare payers increasingly rely on these tools to enhance accuracy, prevent duplicate or fraudulent claims, and ensure faster reimbursements. The growing adoption of predictive analytics and machine learning in claims management has also enabled proactive decision-making and improved payment integrity.

The revenue management and billing segment is expected to expand at the highest CAGR in the coming years. This is primarily due to the increasing need for automation and accuracy in financial operations. AI-powered solutions are helping payers streamline billing processes, identify payment discrepancies, and enhance revenue forecasting through predictive analytics. These tools also assist in minimizing claim denials and optimizing reimbursement cycles, ensuring better cash flow management for healthcare organizations. With rising healthcare costs and complex payment models, AI-driven revenue management offers real-time insights and data-driven financial decision-making.

Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the artificial intelligence for healthcare payer market while holding the largest share in 2024. The region’s growth is primarily attributed to its advanced healthcare infrastructure, high technology adoption rate, and strong presence of leading AI solution providers. The region’s healthcare payers, including major insurance companies, have heavily invested in AI to enhance claims processing, fraud detection, and member management efficiency. Supportive government initiatives promoting healthcare digitization and strict regulatory frameworks like HIPAA have further accelerated AI integration. Additionally, the availability of skilled AI professionals and robust cloud infrastructure has enabled the seamless deployment of intelligent solutions.

- In January 2025, the Q4 Health Care Conference Roundup spotlighted increased government enforcement and legal scrutiny of AI use in healthcare, emphasizing the growing importance of compliance, responsible AI use, and cross-state regulation in payer operations.

The U.S. is a major contributor to the North American artificial intelligence for healthcare payer market. The country’s strong healthcare insurance ecosystem, presence of major AI technology providers, and early adoption of digital health solutions have driven rapid AI integration among payers. U.S. healthcare organizations are increasingly using AI for claims automation, fraud detection, and predictive risk analysis to improve cost efficiency and patient outcomes.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for artificial intelligence for healthcare payers. This is due to rapid digital transformation and increasing investments in healthcare infrastructure. Governments and private insurers across countries like India, China, Japan, and Australia are adopting AI to streamline claims management, improve risk assessment, and enhance patient engagement. The region’s expanding middle-class population, rising healthcare expenditures, and growing insurance penetration are further driving demand for AI-driven payer solutions. Additionally, advancements in cloud computing and data analytics, supported by favorable regulatory initiatives, are accelerating adoption.

China is a major player in the Asia Pacific artificial intelligence for healthcare Payer market due to its strong focus on healthcare digitalization and AI innovation. The Chinese government’s strategic initiatives, such as the “Healthy China 2030” plan, and investments in AI-driven healthcare analytics have accelerated adoption among public and private payers. Major Chinese insurers are implementing AI for claims automation, fraud detection, and personalized policy management to enhance efficiency and service quality. Furthermore, the country’s robust technology ecosystem and collaboration between AI startups and healthcare organizations have positioned China as the regional leader in AI adoption for healthcare payers.

Region-Wise Market Outlook

| Region |

Approximate Market Size in 2024 |

Projected CAGR (next 5-10 years) |

Major Growth Factors |

Key Restraints / Challenges |

Growth Overview |

| North America |

USD 1.1 Billion |

5.59% |

Strong healthcare infrastructure, high digital health maturity. |

High implementation cost; data privacy / regulatory/compliance burdens |

Dominant region |

| Asia-Pacific |

USD 0.7 Million |

7.8% |

Rapid digitization of healthcare, rising insurance penetration, growing middle class. |

Infrastructure and technical skill gaps. |

Fastest growth |

| Europe |

USD 0.6 Million |

9.93% |

Strong regulatory frameworks |

Stringent regulatory compliance can slow innovation; data sovereignty issues. |

Steady growth |

| Latin America |

USD 0.2 Million |

3.75% |

A growing private insurance market, rising healthcare spending. |

Weak infrastructure in remote areas; varied regulatory and compliance frameworks. |

Emerging region |

| Middle East & Africa |

USD 0.1 Million |

6.5% |

Investments in health modernization by governments; healthcare demand is growing. |

Fragmented regulation; low digital infrastructure in some countries. |

Gradual growth |

Artificial Intelligence for Healthcare Payer Market Value Chain Analysis

1.Research & Development (R&D) and Data Acquisition

This stage involves developing advanced AI algorithms, machine learning models, and data analytics frameworks tailored for healthcare payer applications. Companies like IBM and Google invest heavily in R&D to enhance data accuracy, predictive modelling, and NLP (Natural Language Processing) for claims analysis and fraud detection. They collaborate with healthcare organizations to acquire large-scale, high-quality datasets that enable continuous improvement and personalization of AI systems.

- Key Players: IBM Corporation, Google LLC (DeepMind), Microsoft Corporation, Oracle Corporation.

2. Software and Platform Development

At this stage, the AI solutions are integrated into robust platforms that provide data management, model training, and automation capabilities for payers. SAS and Optum develop software platforms that streamline claims processing, automate billing, and improve risk stratification. AWS supports the AI infrastructure by offering cloud-based computing power and APIs that facilitate faster model deployment and scalability across payer networks.

- Key Players: SAS Institute Inc., Optum (UnitedHealth Group), Amazon Web Services (AWS), H2O.ai

3. Integration and Implementation Services

This stage focuses on integrating AI tools into healthcare payer systems, including claims management, fraud detection, and customer service platforms. Service providers like Accenture and Deloitte assist payers with customization, compliance alignment, and change management during AI implementation. These companies also provide training and support to help clients maximize ROI from AI-based automation tools and analytics systems.

- Key Players: Accenture, Deloitte, Cognizant, Infosys, Wipro

4. Data Management and Cloud Infrastructure

Data management and cloud infrastructure play a critical role in storing, securing, and processing vast amounts of healthcare and insurance data. Cloud providers such as AWS and Azure enable healthcare payers to deploy AI models securely while ensuring compliance with data protection regulations like HIPAA and GDPR. This stage also supports interoperability between multiple data systems, improving efficiency and scalability for large payer organizations.

- Key Players: Amazon Web Services (AWS), Microsoft Azure, Google Cloud, Oracle Cloud

5. End-User Applications (Healthcare Payers & Insurers)

This final stage represents the practical application of AI within payer organizations. Healthcare payers use AI for claims automation, fraud detection, risk prediction, and member engagement. Companies like UnitedHealth Group and Anthem have already implemented AI-driven analytics to improve operational efficiency and enhance decision-making, resulting in reduced administrative costs and improved service delivery.

- Key Players: UnitedHealth Group, Anthem Inc. (Elevance Health), Cigna, Humana Inc., Aetna (CVS Health)

Artificial Intelligence for Healthcare Payer Market Companies

IBM is a leader in AI-driven healthcare solutions through its Watson Health platform, offering advanced data analytics, automation, and cognitive computing tools for payer organisations. The company helps payers enhance claims processing, detect fraud, and improve decision-making efficiency using machine learning and natural language processing.

- Optum, Inc. (UnitedHealth Group)

Optum provides AI-powered analytics and automation tools that streamline claims management, billing, and risk adjustment for healthcare payers. Its robust data analytics capabilities enable predictive modelling, improving population health management and reducing administrative costs.

- Google LLC (Google Cloud Healthcare & DeepMind)

Google leverages its AI and cloud infrastructure to deliver scalable data management and predictive analytics solutions for healthcare payers. Its DeepMind and Google Cloud Healthcare API support real-time data integration and insights that improve claims accuracy and fraud detection.

Microsoft’s Azure AI and cloud solutions enable healthcare payers to modernize their infrastructure and optimize operations using advanced machine learning models. The company focuses on enhancing interoperability, data security, and automation for claims and revenue cycle management.

SAS provides powerful AI and predictive analytics platforms that help healthcare payers detect fraud, manage risk, and optimize costs. Its tools support real-time data analysis and compliance reporting, helping insurers make evidence-based decisions efficiently.

- Amazon Web Services (AWS)

AWS supports the healthcare payer market with cloud-based AI tools and infrastructure that enable scalable model deployment and secure data storage. Its services facilitate automation, real-time analytics, and interoperability across complex payer systems.

Oracle integrates AI into its cloud and data management platforms to help healthcare payers improve operational efficiency and compliance. Its AI-driven analytics assist insurers in claims adjudication, member engagement, and predictive financial planning.

Deloitte offers consulting and AI implementation services tailored to healthcare payer operations. The firm supports digital transformation through AI-based claims processing, fraud management, and data-driven insights for operational optimization.

- Cognizant Technology Solutions

Cognizant helps healthcare payers automate administrative processes and optimize workflows using AI-powered digital solutions. The company focuses on integrating intelligent automation and predictive analytics to improve claims accuracy and reduce operational costs.

Accenture provides end-to-end AI transformation solutions for healthcare payers, enhancing automation and efficiency in claims and payment operations. Its expertise in cloud and data analytics supports payers in improving patient experience and cost control.

- Anthem Inc. (Elevance Health)

Anthem utilizes AI to automate claims adjudication, detect anomalies, and personalize member services. The company’s investment in predictive analytics enhances care coordination and operational efficiency within payer networks.

Recent Developments

- In April 2025, UiPath launched its generative AI-based Medical Record Summarization agent, powered by Google Cloud Vertex AI and Gemini 2.0 Flash. Now in private preview, the solution enables healthcare payers and providers to automate and streamline medical document analysis, aligning with UiPath’s strategy to deliver industry-specific AI solutions.

- In June 2024, Infinx Healthcare launched Intelligent Payer Mapping within its Patient Access Plus suite to streamline and standardize payer data, addressing a key challenge in healthcare revenue cycle management.

Segments Covered in the Report

By Component

By Deployment

By Technology

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Robotic Process Automation (RPA)

- Predictive Analytics

- Generative AI

By Application

- Claims Processing Optimization

- Fraud Detection and Prevention

- Revenue Management and Billing

- Member Engagement and Personalization

- Risk Adjustment & Predictive Analytics

- Administrative Workflow Automation

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

- Table 1: Global AI for Healthcare Payer Market Size (USD Billion) by Component, 2024–2034

- Table 2: Global AI for Healthcare Payer Market Size (USD Billion) by Deployment, 2024–2034

- Table 3: Global AI for Healthcare Payer Market Size (USD Billion) by Technology, 2024–2034

- Table 4: Global AI for Healthcare Payer Market Size (USD Billion) by Application, 2024–2034

- Table 5: North America Market Size (USD Billion) by Component, 2024–2034

- Table 6: North America Market Size (USD Billion) by Deployment, 2024–2034

- Table 7: North America Market Size (USD Billion) by Technology, 2024–2034

- Table 8: North America Market Size (USD Billion) by Application, 2024–2034

- Table 9: U.S. Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 10: Canada Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 11: Mexico Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 12: Europe Market Size (USD Billion) by Component, 2024–2034

- Table 13: Europe Market Size (USD Billion) by Deployment, 2024–2034

- Table 14: Germany Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 15: France Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 16: UK Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 17: Italy Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 18: Asia Pacific Market Size (USD Billion) by Component, 2024–2034

- Table 19: Asia Pacific Market Size (USD Billion) by Deployment, 2024–2034

- Table 20: China Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 21: Japan Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 22: India Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 23: South Korea Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 24: Southeast Asia Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 25: Latin America Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 26: Brazil Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 27: Middle East & Africa Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 28: GCC Countries Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 29: Turkey Market Size (USD Billion) by Component & Technology, 2024–2034

- Table 30: Africa Market Size (USD Billion) by Component & Technology, 2024–2034

List of Figures

- Figure 1: Global Market Share by Component, 2024

- Figure 2: Global Market Share by Deployment, 2024

- Figure 3: Global Market Share by Technology, 2024

- Figure 4: Global Market Share by Application, 2024

- Figure 5: North America Market Share by Component, 2024

- Figure 6: North America Market Share by Deployment, 2024

- Figure 7: North America Market Share by Technology, 2024

- Figure 8: North America Market Share by Application, 2024

- Figure 9: U.S. Market Share by Component, 2024

- Figure 10: U.S. Market Share by Technology, 2024

- Figure 11: Canada Market Share by Component, 2024

- Figure 12: Canada Market Share by Technology, 2024

- Figure 13: Mexico Market Share by Component, 2024

- Figure 14: Mexico Market Share by Technology, 2024

- Figure 15: Europe Market Share by Component, 2024

- Figure 16: Europe Market Share by Deployment, 2024

- Figure 17: Germany Market Share by Component, 2024

- Figure 18: Germany Market Share by Technology, 2024

- Figure 19: France Market Share by Component, 2024

- Figure 20: France Market Share by Technology, 2024

- Figure 21: UK Market Share by Component, 2024

- Figure 22: UK Market Share by Technology, 2024

- Figure 23: Italy Market Share by Component, 2024

- Figure 24: Italy Market Share by Technology, 2024

- Figure 25: Asia Pacific Market Share by Component, 2024

- Figure 26: Asia Pacific Market Share by Deployment, 2024

- Figure 27: China Market Share by Component, 2024

- Figure 28: China Market Share by Technology, 2024

- Figure 29: Japan Market Share by Component, 2024

- Figure 30: Japan Market Share by Technology, 2024

- Figure 31: India Market Share by Component, 2024

- Figure 32: India Market Share by Technology, 2024

- Figure 33: South Korea Market Share by Component, 2024

- Figure 34: South Korea Market Share by Technology, 2024

- Figure 35: Southeast Asia Market Share by Component, 2024

- Figure 36: Southeast Asia Market Share by Technology, 2024

- Figure 37: Latin America Market Share by Component, 2024

- Figure 38: Latin America Market Share by Technology, 2024

- Figure 39: Brazil Market Share by Component, 2024

- Figure 40: Brazil Market Share by Technology, 2024

- Figure 41: Middle East & Africa Market Share by Component, 2024

- Figure 42: Middle East & Africa Market Share by Technology, 2024

- Figure 43: GCC Countries Market Share by Component, 2024

- Figure 44: GCC Countries Market Share by Technology, 2024

- Figure 45: Turkey Market Share by Component, 2024

- Figure 46: Turkey Market Share by Technology, 2024

- Figure 47: Africa Market Share by Component, 2024

- Figure 48: Africa Market Share by Technology, 2024