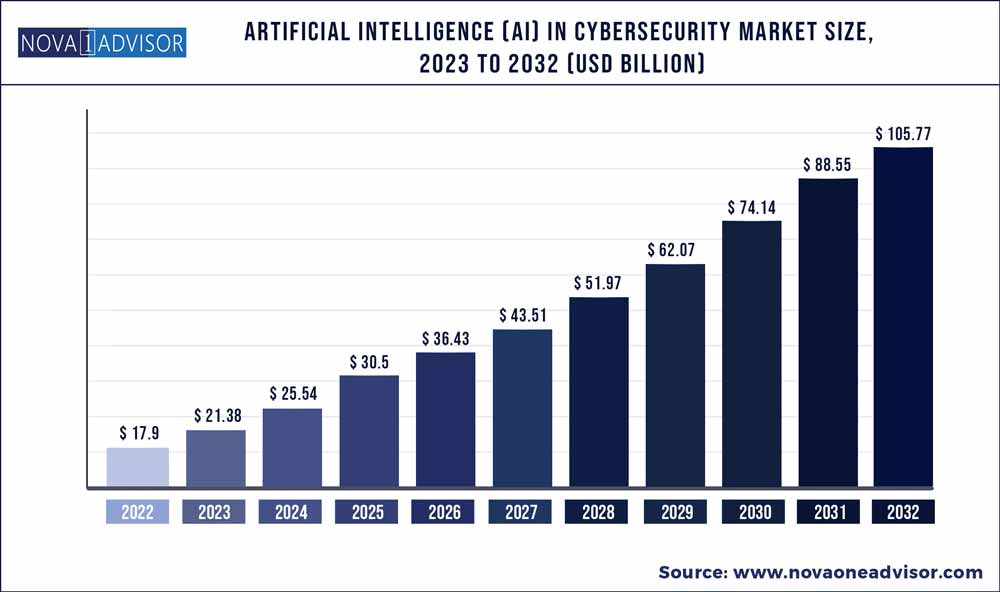

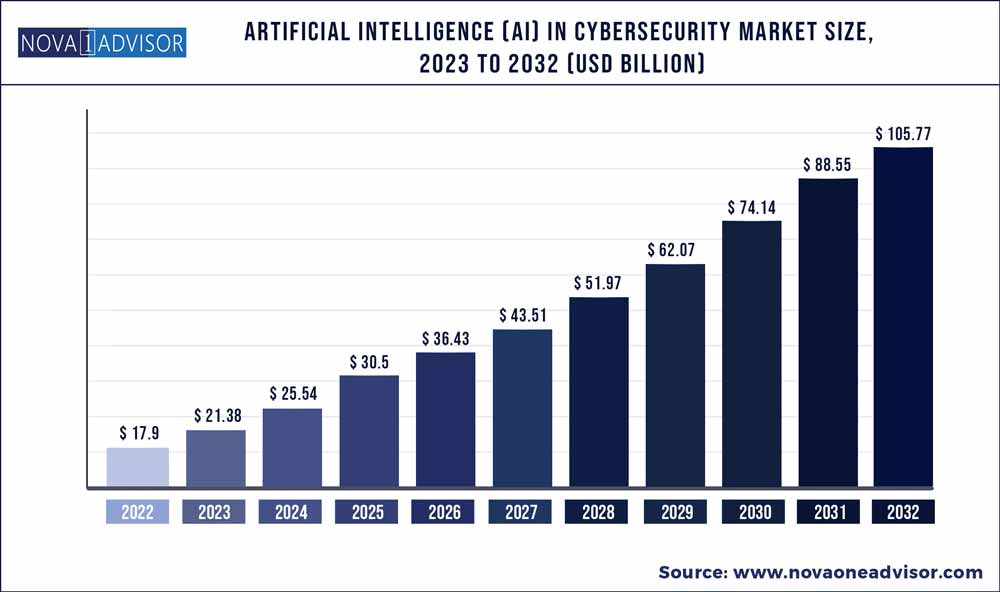

The artificial intelligence in cybersecurity market size was valued at USD 17.9 billion in 2022 and it is expected to surpass around USD 105.77 billion by 2032, growing at a CAGR of 19.44% over the forecast period from 2023 to 2032.

Key Takeaways:

- North America accounted for the majority of the revenue share of 39.1% in 2022.

- The network security segment is anticipated to account for a substantial revenue share of 38.4% in 2022.

- The services segment is anticipated to hold a prominent revenue share of 37.2% in 2022.

- The machine learning segment led with a revenue share of 47.8% in 2022.

- The fraud detection/anti-fraud segment accounted for 23.9% of the global revenue share in 2022.

- The enterprise segment held the leading revenue share of 25.5% in 2022.

Artificial Intelligence In Cybersecurity Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 21.38 Billion |

| Market Size by 2032 |

USD 105.77 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 19.44% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Type, Offering, Technology, Application, Vertical, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

IBM Corporation; Acalvio Technologies, Inc.; Amazon Web Services, Inc.; Cylance Inc. (BlackBerry); Darktrace; FireEye, Inc.; Fortinet, Inc.; Intel Corporation; LexisNexis; Micron Technology, Inc. |

Increasing AI technologies, such as natural language processing and machine learning, have gained traction to protect, detect, and respond to threats. Furthermore, an exponential rise in cyberattacks on high-tech companies, defense, and government agencies has underscored the need for advanced artificial intelligence (AI) solutions in cybersecurity.

Cyber AI has become sought-after to offer a proactive mechanism of protection with accuracy in detection. For instance, AI has witnessed strong demand to do a relentless verification of a user in terms of behavioral biometrics. Industry participants are expected to prioritize machine learning algorithms to leverage the power of AI to bolster security intelligence.

The rise in privacy concerns, the importance of AI-based cybersecurity solutions in the banking industry, and the frequency and complexity of cyber threats are factors augmenting the market growth. Moreover, it is anticipated that over the next few years, this market will expand in response to SMEs' increasing demand for AI-based cybersecurity solutions.

The onset of the COVID-19 pandemic has advanced the need for state-of-the-art technologies as companies extend their commitment to work-from-home policies. An uptick in demand for digital products and services due to telecommuting employees and other individuals using potentially insecure networks and devices has compelled enterprises to inject funds into machine learning and deep learning algorithms.

Moreover, pervasive scams relating to the novel coronavirus, along with the impersonation of government organizations such as WHO, further challenge organizations. For instance, in April 2020, Google observed more than 18 million daily malware and phishing emails about COVID-19 scams. The American technology company claimed that its AI-powered protections block over 99.9 percent of spam, phishing, and malware from reaching users.

Type Insights

The network security segment is anticipated to account for a substantial revenue share of 38.4% in 2022. The high share of the segment is attributable to the rising prominence of machine learning algorithms and artificial intelligence. Businesses are leveraging cybersecurity to protect and prevent cyber-attacks.

Hardware could be a major growth enabler to boost business efficiency and scalability of operations. Prominently, the zero-trust model - needing all users to be authorized and authenticated - has gained ground. For instance, in June 2022, Cisco revealed its plans to foster a secure hardware strategy through Cisco Security Hardware. The company has prioritized zero trust and is rolling out less intrusive methods for risk-based authentication.

The AI-based endpoint security will receive drive across organizations for continuous monitoring, risk-based application control, and automated classification. Prominently, endpoint security solutions automatically create an allow list based on known goodware and a deny list based on known malware.

With endpoint attacks becoming prevalent, AI-based real-time authentication and behavioral analytics could be pursued to underpin security solutions. Moreover, the soaring penetration of connected devices has prompted companies to apply AI-powered endpoint security technologies to detect suspicious activities and at-risk information.

Offering Insights

The services segment is anticipated to hold a prominent revenue share of 37.2% in 2022. The segment is expected to contribute notably to the global AI in cybersecurity market growth. Robust demand for application program interfaces, such as machine learning algorithms, sensor data, speech, and vision will fuel the market growth. The software has the distinctive ability to detect abnormal activities with a high degree of accuracy.

With the trend for hardware operations, the software platform will gain ground to augment the security portfolio. Industry participants are likely to emphasize state-of-the-art cybersecurity solutions and could inject funds into the software platform. For instance, in November 2020, IBM joined hands with AMD to bolster AI and cybersecurity offerings. They will likely build upon open-source software, open system architecture, and open standards to propel confidential computing.

The hardware-based AI in cybersecurity will gain ground with the rising prominence of networking solutions, processors, and memory solutions globally. AI hardware is expected to be sought to expedite and boost AI-related operations. The hardware applications will receive impetus from the growing footfall of neural networks and processors.

With the evolution of cyberattacks globally, neural networks have become instrumental for fraud detection. Furthermore, the deep learning technique has garnered popularity in predicting credit card fraud detection, auguring well for the market growth.

Technology Insights

The machine learning segment led with a revenue share of 47.8% in 2022. The machine learning technology will witness profound growth against the backdrop of soaring use of deep learning across end-use industries. Leading companies, such as Google and IBM, have been using machine learning to filter emails and threat detection. Organizations are cashing in on the power of machine learning and deep learning to boost cybersecurity practices.

For instance, deep learning has set the trend for image recognition across applications, including medical diagnoses and autonomous vehicles. Additionally, ML platforms have gained popularity to automate the monitoring process, spot deviation from the norm, and sift through the massive volume of data produced by security tools.

The natural language processing segment could foster the growth of the global AI in cybersecurity market during the forecast period. The trend is mainly due to the surging prominence of sentiment analysis, natural language inference, text summarization, and question-answering systems.

Besides, NLP has become sought-after to identify overlaps in data, frameworks, and standards and detect vulnerabilities in the security infrastructure. NLP could make significant strides and expand AI applications in cybersecurity over the next few years through automation and customization.

Application Insights

The fraud detection/anti-fraud segment accounted for 23.9% of the global revenue share in 2022. AI in cybersecurity will receive impetus for fraud detection and anti-fraud as upfront preventing controls. Machine learning has emerged as a viable tool for bolstering the ability of governments and other end-users to deter fraudulent activities amidst a surge in fraud cases.

To illustrate, in February 2022, the Federal Trade Commission data suggested that it received 2.8 million fraud reports from consumers in the preceding year. Accordingly, AI tools could gain ground to prevent fraud, email phishing, and fake records. Enterprises have exhibited increased traction for unified threat management (UTM) to protect their digital assets against threats, such as spyware-infected files, phishing attacks, unapproved website access, and trojans.

UTM approach is expected to gain ground to provide multiple security functions, including business VPN, intrusion detection and prevention, network firewalls, gateway anti-virus, and web content filtering. Organizations are likely to prioritize UTM software tools to detect advanced threats quickly with increased accuracy. UTM tools are expected to gain traction for scalable hardware-based monitoring and prevent the attack before it enters the network.

Vertical Insights

The enterprise segment held the leading revenue share of 25.5% in 2022. However, the BFSI sector could emerge as a major market for cyber AI to prevent data leaks, resist cyberattacks, and bolster security. The wave of innovations and technological advances has brought a paradigm shift in making payments, purchases, applying for loans, and withdrawals to crowdfunding. Furthermore, banks and financial institutions are likely to count on the zero-trust model on the Hardware to boost threat intelligence-based actions.

Industry participants expect the adoption of AI in the fintech sector to boost the market share of artificial intelligence in cybersecurity. The robust forecast is mainly due to the penetration of AI-based solutions to prevent and identify financial crimes and fraud. Furthermore, rampant distributed denial of service (DDoS) attacks across banks and fintech sectors have furthered the demand for AI. Besides, neural networks will also receive impetus to anticipate hackers’ behavior, enabling banks to respond to attacks in real time.

The government and defense sector has exhibited an increased inclination toward AI following a surge in cyber incidents. The Center for Strategic and International Studies asserted that March 2022 witnessed a slew of Israeli government websites being taken offline against the backdrop of a DDoS attack targeting a major Israeli telecommunication provider. Meanwhile, in January 2022, a cyberattack reportedly targeted 90 websites of the Ukrainian government and deployed malicious software, taking a toll on dozens of government agencies’ computers. Accordingly, governments are poised to bank on Cloud Security and zero-trust architecture to keep cyber incidents at bay.

The media & entertainment industry is expected to witness substantial growth during the forecast period. Vendors are focusing on data enrichment, automated reporting, analyzing, metadata insights, etc. for improved customer experience and operations. Moreover, the rising number of client dealings outside of the branch through various channels, including mobile, web, chat, and social media, is expected to drive the adoption of corporate metadata management tools.

Regional Insights

North America accounted for the majority of the revenue share of 39.1% in 2022. The trend is primarily attributed to the surge in network-connected devices with the growing footfall of IoT, 5G, and Wi-Fi 6. Organizations across automotive, healthcare, government, energy, and mining have propelled 5G network expansion, providing a possible entry point for hackers.

Leading organizations are likely to infuse funds into machine learning platforms, advanced analytics, and asset mapping and visualization platforms for a real-time assessment. North America is slated to be the prominent adopter of natural language processing, ML, and neural networks to deter attacks and spot strange user behavior and other abnormal patterns.

Soaring penetration of mobile devices, including smartwatches, tablets, and phones, is also likely to augment the need for AI solutions and services for increased security. According to CUJO AI’s security data, nearly 60% of threats to mobile device security emanate from browsing activities. Stakeholders across North America are likely to seek AI algorithms to overcome cybersecurity concerns.

Europe is likely to provide lucrative growth opportunities in the wake of strong government policies and escalating cyber cases across the automotive, healthcare, government, and IT & telecommunication sectors. To illustrate, in November 2020, the U.K. announced pouring £16.5 billion (USD 21.8 billion) into AI and sensor-laden connected hardware over four years.

The government remains bullish that the defense spending will solidify its position in Europe amidst efforts to respond to cyber threats from Russia and other belligerent states. Stakeholders expect the U.K., France, Germany, and Russia to augment investments in detecting anomalous activity and threats on their networks, prompting cybersecurity solution providers to boost their AI portfolios.

Some of the prominent players in the Artificial Intelligence In Cybersecurity Market include:

- Acalvio Technologies, Inc

- Amazon Web Services, Inc.

- Cylance Inc. (BlackBerry)

- Darktrace

- FireEye, Inc.

- Fortinet, Inc.

- IBM Corporation

- Intel Corporation

- LexisNexis

- Micron Technology, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the Artificial Intelligence In Cybersecurity market.

By Type

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

By Offering

- Hardware

- Software

- Services

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Context-aware computing

By Application

- Identity And Access Management

- Risk And Compliance Management

- Data Loss Prevention

- Unified Threat Management

- Fraud Detection/Anti-Fraud

- Threat Intelligence

- Others

By Vertical

- BFSI

- Retail

- Government & Defense

- Manufacturing

- Enterprise

- Healthcare

- Automotive & Transportation

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)