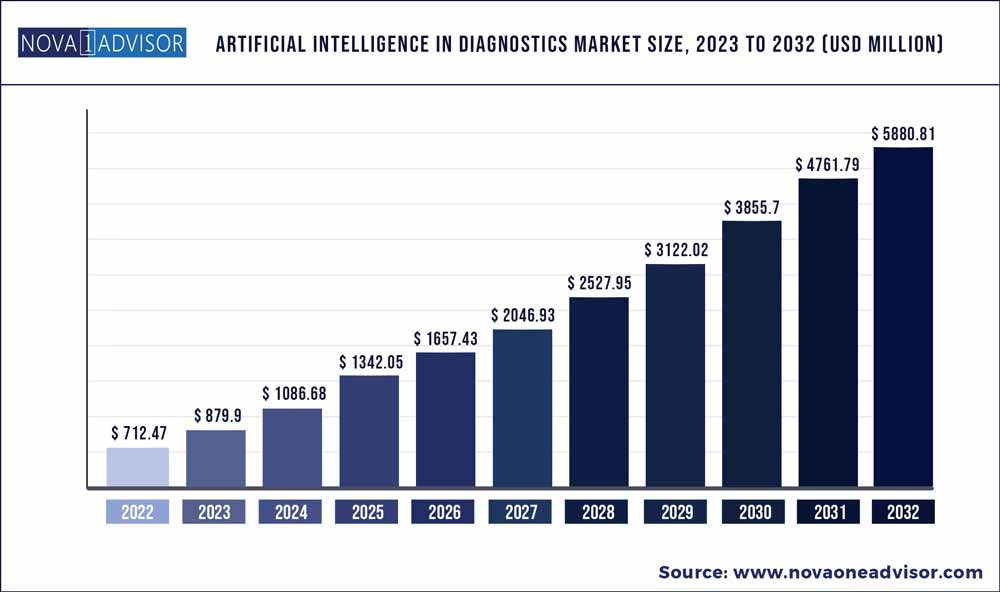

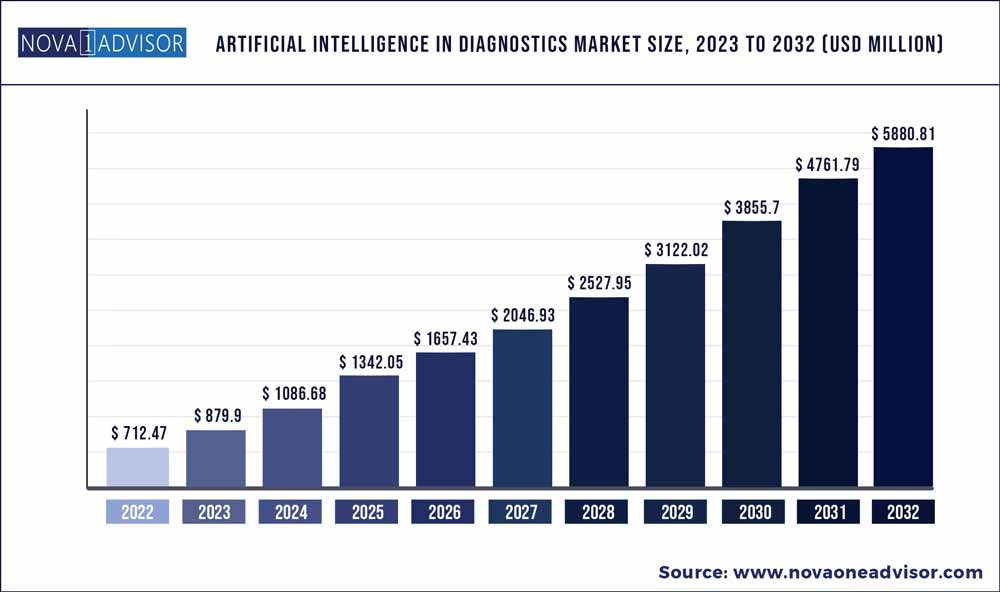

The global artificial intelligence in diagnostics market size was exhibited at USD 712.47 million in 2022 and is projected to hit around USD 5880.81 million by 2032, growing at a CAGR of 23.5% during the forecast period 2023 to 2032.

Key Pointers:

- The software component segment dominated the market and accounted for the largest revenue share of more than 45%.

- The neurology diagnosis segment led the market accounting for the largest revenue share of more than 25% owing to the growing incidence of neurological disorders.

- North America dominated the global AI in diagnostics market and accounted for the largest revenue share of more than 57.5%.

The healthcare industry is rapidly integrating artificial intelligence (AI)-powered solutions in various verticals to achieve higher operational & clinical outcomes, which is a key contributing factor to the growth. Overburdened healthcare systems struggling with the rapidly rising global prevalence of chronic diseases are driving the demand for automated, innovative processes. Furthermore, the shortage of care providers is contributing to the growing demand for AI-powered systems. For instance, the WHO estimates in 2019 recorded the shortage of care providers to be approximately 4.3 million across the globe.

The growing demand for integrating AI-enabled algorithms in diagnostics to provide precise and accurate diagnosis at the earliest, which enhances clinical and operational outcomes, is driving the growth of this market. The rapidly growing cases of acute & chronic disorders across the globe are driving the demand for AI-based solutions since most of these ailments could be either prevented or delayed if diagnosed early and given appropriate treatments. The shortage of healthcare personnel is also supporting the product demand.

The emergence of startups, increasing funding opportunities, and growing public-private partnerships are also boosting market growth. Furthermore, medical technology is witnessing significant transitions & transformations and is rapidly adopting advanced AI-powered solutions to provide precise diagnosis, which enables care providers to design adequate treatment plans. Radiology and pathology are widely implementing AI-based algorithms & solutions and have provided proven results. In radiology, these solutions use information collected from multiple modalities to create image datasets to run data analysis, which could be used by the radiologist in delivering an accurate and timely diagnosis. Similarly, in pathology, these solutions could be integrated to run data analysis and provide accurate results.

The growing burden of chronic conditions across the global population is also driving the demand for AI-based diagnostic solutions. The key participants in AI in diagnostics market are focusing on the development of new, innovative products and the expansion of their business offerings to gain a competitive edge over others. In addition, many startups specializing in the development of advanced AI-based technologies are receiving favorable support and funding opportunities. This will also have a positive impact on the overall market growth. For instance, in September 2018, IDx received funding of USD 33 million from Optum Ventures and 8VC and the company will use this funding for the development of innovative AI-based solutions.

On the basis of geographies, the market has been divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa. In 2022, North America dominated the global AI in diagnostics market and accounted for the largest revenue share of more than 57.5%. This growth was credited to the presence of well-established healthcare IT infrastructure, constant technological advancements, increasing digital literacy, the emergence of startups, favorable government initiatives, rising funding options, and presence of key players in the region. On the other hand, Asia Pacific is anticipated to be the fastest-growing regional market over the forecast years.

This growth can be attributed to a rise in the number of public and private initiatives promoting the adoption of AI-based diagnostic solutions. In addition, the emergence of startups along with the growing recognition and funding is boosting the regional market growth. Moreover, the availability of private funding and startup incubators is shaping regional market development. The growing geriatric population base coupled with the rising prevalence of acute & chronic diseases in the region is also expected to augment the market growth.

Artificial Intelligence in diagnostics Market Segmentation

| By Component |

By Diagnosis type |

|

Software

Hardware

Services

|

Cardiology

Oncology

Pathology

Radiology

Chest and Lung

Neurology

Others

|

Artificial Intelligence in diagnostics Market Key Players And Regions

| Companies Profiled |

Regions Covered |

|

Siemens Healthineers

Zebra Medical Vision, Inc.

Riverain Technologies

Vuno, Inc.

Aidoc

Neural Analytics

Imagen Technologies

Digital Diagnostics, Inc.

GE Healthcare

AliveCor Inc.

|

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa (MEA)

|