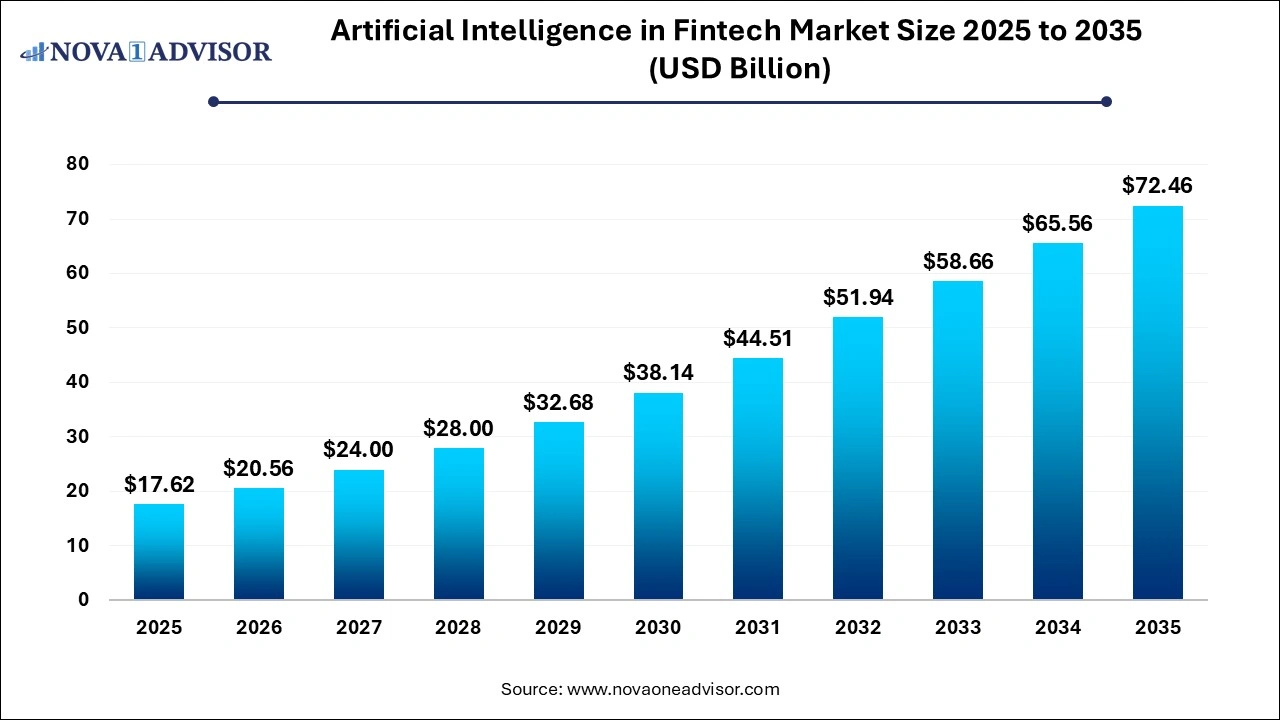

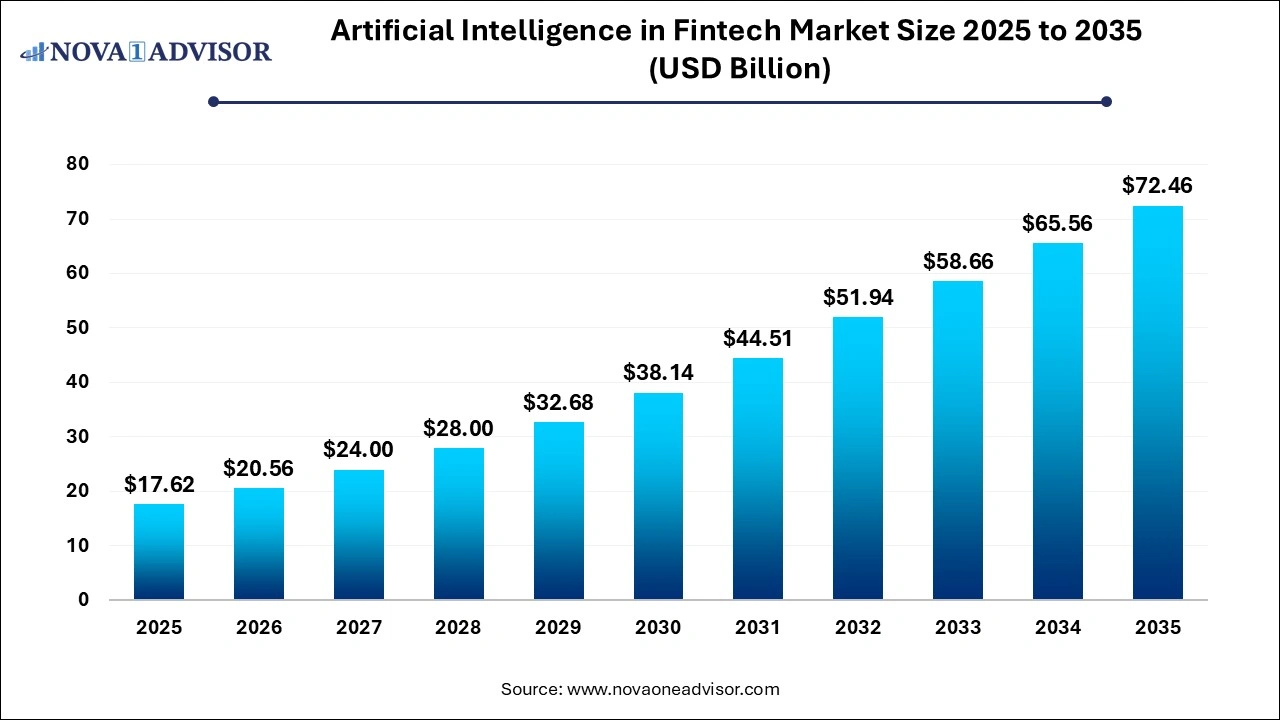

Artificial Intelligence In Fintech Market Size, Growth and Trends 2026 to 2035

The global artificial intelligence in fintech market size was exhibited at USD 17.62 billion in 2025 and is projected to hit around USD 72.46 billion by 2035, growing at a CAGR of 15.19% during the forecast period 2026 to 2035.

Key Pointers:

- The solution segment led the market in 2025, accounting for over 78.5% share of the global revenue.

- The business analytics and reporting segment led the market in 2025 and accounted for over 33.1% of global revenue.

- The on-premise segment held the largest revenue share of more than 57.04% in 2025.

- North America dominated the market in 2025 and accounted for more than 40.09% share of the global revenue.

Artificial Intelligence in Fntech Market Outlook

- Market Growth Overview: The Artificial Intelligence in fintech market is expected to grow significantly between 2025 and 2034, driven by the rising demand in personalization, increased need for enhanced security and fraud detection, and opfinacial institute are adopting operational efficiency and cost reduction.

- Sustainability Trends: Sustainability trends involve green fintech and carbon tracking, energy efficiency and green AI, and blockchain and tokenization for transparency.

- Major Investors: Major investors in the market include Andreessen Horowitz, Sequoia Capital, Lightspeed Venture Partners, General Catalyst, and QED Investors.

Artificial Intelligence in Fntech Market Report Scope

| Report Coverage |

Details |

| Market Size in 2026 |

USD 20.56 Billion |

| Market Size by 2035 |

USD 72.46 Billion |

| Growth Rate from 2026 to 2035 |

CAGR of 15.19% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Components, Deployment, Application, Region |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Artificial Intelligence In Fintech Market Segmental Insights

By Component Insights

The services segment is driven by the critical scarcity of in-house AI talent has transformed managed and professional services into a strategic necessity for financial institutions navigating the shift to complex generative models. These providers are now indispensable for integrating advanced machine learning into legacy infrastructures while ensuring regulatory compliance and model validation under increasing global scrutiny.

By Deployment Insights

The hybrid deployment segment is driven by the definitive architectural standard for fintech, enabling firms to leverage high-performance AI for fraud detection while maintaining strict data localization and privacy compliance. This model provides a strategic bridge for modernising legacy banking systems, allowing institutions to integrate real-time edge computing and advanced risk engines without the liability of a full-scale cloud migration.

By Application Insights

The processor segment is driven by the escalating sophistication of GenAI-powered deepfakes and the need for real-time transaction monitoring in milliseconds. By adopting behavioral biometrics and cloud-based systems, institutions can now reduce fraud losses and minimize false positives, transforming a regulatory burden into a clear return on investment (ROI).

Key Players in the Artificial Intelligence In Fintech Market

- Microsoft: Microsoft contributes to AI in fintech through Azure OpenAI Service and Microsoft 365 Copilot, which help financial institutions automate document analysis, enhance customer support, and detect fraud.

- Google LLC: Google Cloud offers specialized Artificial Intelligence in Fintech (AML AI) to help banks detect money laundering more precisely while significantly reducing false positives and operational costs.

- Salesforce, Inc.: Salesforce leverages Einstein AI within its Financial Services Cloud to provide predictive insights, automating routine tasks like onboarding and enabling personalized, proactive customer engagement.

- International Business Machines Corp. (IBM): IBM contributes with watsonx, a platform for building AI agents that automate complex workflows in finance, such as planning, budgeting, and compliance, while using hybrid cloud for flexibility. They also provide AI-driven cybersecurity tools to identify fraudulent activities and secure sensitive financial data across diverse environments.

- Amelia U.S. LLC: Amelia (now part of Yellow.ai) offers an enterprise-grade AI agent that acts as a digital coworker, facilitating secure, human-like conversations to automate customer service inquiries in banking.

- Nuance Communications, Inc.: Nuance (a Microsoft company) specializes in conversational AI and voice biometrics to secure digital transactions and enhance customer service experiences in the financial sector.

- ComplyAdvantage.com: ComplyAdvantage uses AI and machine learning to revolutionize anti-money laundering (AML) and compliance, providing real-time insights to identify, assess, and mitigate financial crimes.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global artificial intelligence in fintech market.

By Components

By Deployment

By Application

- Virtual Assistant (Chatbots)

- Business Analytics and Reporting

- Customer Behavioural Analytics

- Fraud Detection

- Quantitative and Asset Management

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)