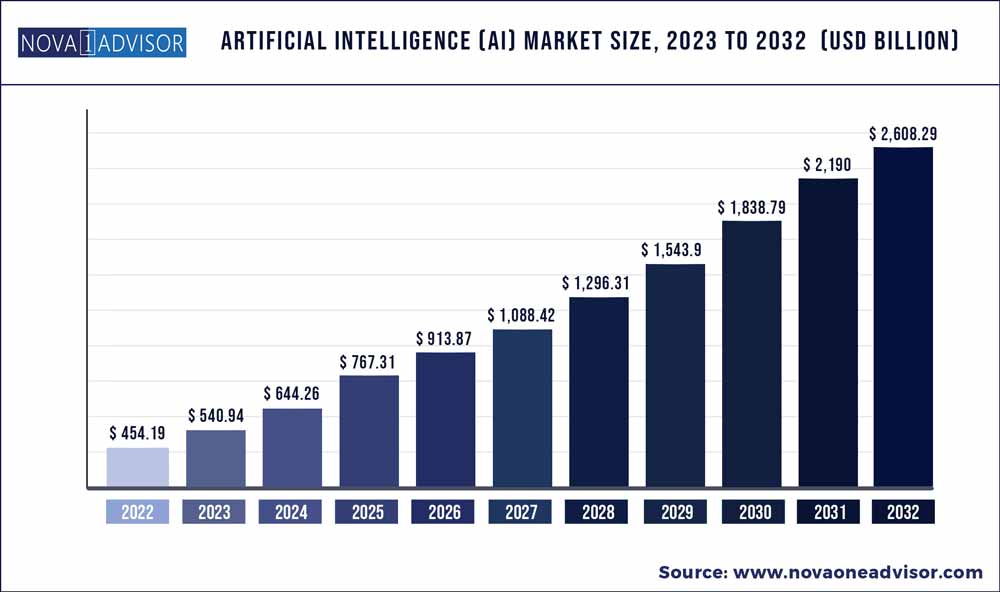

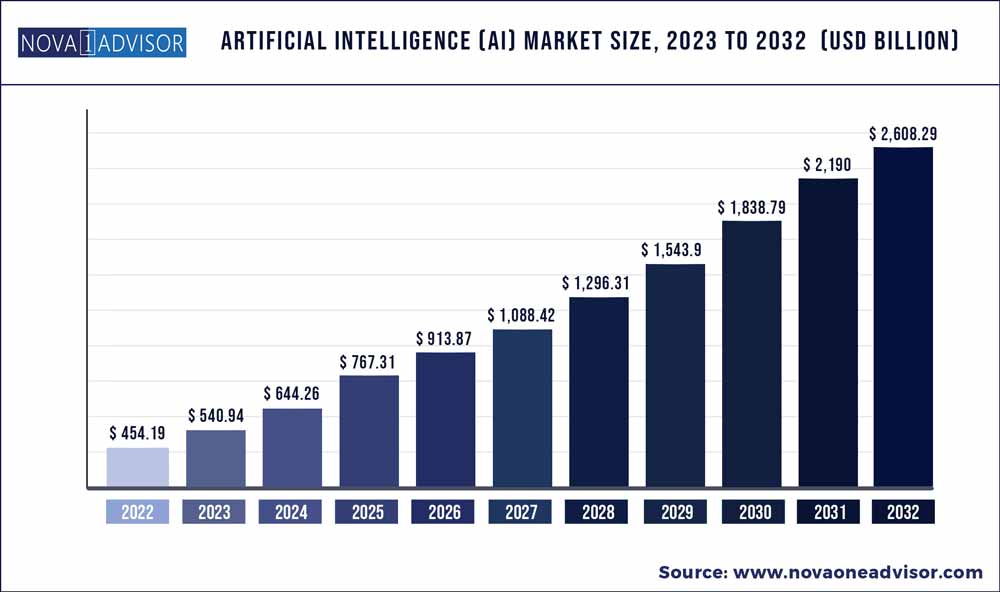

The artificial intelligence (AI) market size was estimated at USD 454.19 billion in 2022 and is expected to surpass around USD 2,608.29 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 19.1% during the forecast period 2023 to 2032.

Key Takeaways:

- North America dominated the market and accounted for over 37.8% share of global revenue in 2022.

- The regional market in Asia Pacific is anticipated to witness significant growth in the artificial intelligence market.

- Software solutions led the market and accounted for more than 38.7% of the global revenue in 2022.

- The deep learning segment led the market and accounted for around 35.4% share of the global revenue in 2022.

- The advertising & media segment led the market and accounted for more than 20.5% of the global revenue share in 2022.

Artificial Intelligence (AI) denotes the concept and development of computing systems capable of performing tasks customarily requiring human assistance, such as decision-making, speech recognition, visual perception, and language translation. AI uses algorithms to understand human speech, visually recognize objects, and process information.

These algorithms are used for data processing, calculation, and automated reasoning. Artificial intelligence researchers continuously improve algorithms for various aspects, as conventional algorithms have drawbacks regarding accuracy and efficiency. These advancements have led manufacturers and technology developers to focus on developing standard algorithms. Recently, several developments have been carried out for enhancing artificial intelligence algorithms. For instance, in May 2020, International Business Machines Corporation announced a wide range of new AI-powered services and capabilities, namely IBM Watson AIOps, for enterprise automation. These services are designed to help automate IT infrastructures, make them more resilient, and cost reduction.

Various companies are implementing AI-based solutions such as RPA (Robotic Process Automation) to enhance the process workflows to handle and automate repetitive tasks. AI-based solutions are also being coupled with the IoT (Internet of Things) to provide robust results for various business processes. For instance, Microsoft announced an investment of USD 1 billion in OpenAI, a San Francisco-based company. The two businesses teamed up to create AI supercomputing technology on Microsoft's Azure cloud.

The COVID-19 pandemic has emerged as an opportunity for AI-enabled computer systems to fight against the outbreak, as several tech companies are working on preventing, mitigating, and containing the virus. For instance, LeewayHertz, a U.S.-based custom software development company, offers technology solutions using AI tools and techniques, including the Face Mask Detection System, to identify individuals without a mask, and the Human Presence System to monitor patients remotely. Besides, Voxel51 Inc., a U.S.-based artificial intelligence start-up, has developed Voxel51 PDI (Physical Distancing Index) to measure the impact of the global pandemic on social behavior across the world. AI-powered computer platforms or solutions are being used to fight against COVID-19 in numerous applications, such as early alerts, tracking & prediction, data dashboards, diagnosis and prognosis, treatments & cures, and maintaining social control. Data dashboards that can visualize the pandemic have emerged with the need for coronavirus tracking and prediction. For instance, Microsoft Corporation's Bing's AI tracker gives a global overview of the pandemic's current statistics.

Artificial Intelligence is becoming vital to big data as the technology allows the extraction of high-level and complex abstractions through a hierarchical learning process. The need for mining and extraction of significant patterns from high-volume information is driving the growth of artificial intelligence in big data analytics. Furthermore, the technology helps overcome challenges associated with big data analytics, such as the trustworthiness of data analysis, format variation of raw information, highly distributed input sources, and imbalanced input data. Another challenge includes a lack of efficient storage and poor information retrieval as it is collected in large quantities and made available across numerous domains. These challenges are overcome by using semantic indexing to facilitate comprehension and knowledge discovery.

Artificial Intelligence (AI) Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 540.94 Billion |

| Market Size by 2032 |

USD 2,608.29 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 19.1% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

By Offering, By Technology, By Deployment, By Organization Size, By Business Function and By End-Use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Intel Corporation, Microsoft, IBM, Google, Amazon Web Services, Baidu, Inc., NVIDIA Corporation, H2O.ai., Lifegraph, Sensely, Inc., Enlitic, Inc., AiCure, HyperVerge, Inc., Arm Limited

|

Artificial Intelligence Market Growth Dynamics

Driver: Growth in the adoption of autonomous artificial intelligence

The increasing adoption of autonomous artificial intelligence (AI) is driving the growth of the Artificial Intelligence Market. This trend is fueled by advancements in algorithms, machine learning techniques, and natural language processing, enabling the development of sophisticated autonomous AI systems. These systems offer improved accuracy and reliability, attracting organizations from various industries. Autonomous AI optimizes operations, leading to cost savings and enhanced productivity. It finds applications in healthcare, finance, manufacturing, transportation, and retail sectors. The cost reduction associated with autonomous AI, driven by automation, further drives its adoption. As technology advances and more industries recognize its benefits, the Artificial Intelligence (AI) Market is poised for expansion, fostering innovation and new opportunities.

Restraint: Issues related with data availability and quality

Data availability and quality play a crucial role in restraining the growth of the Artificial Intelligence Market. Limited data availability, particularly in niche industries or specialized domains, hinders the development and application of AI solutions. Without access to comprehensive and diverse datasets, AI algorithms lack the necessary training to make accurate predictions and decisions. Moreover, the quality of data is vital for the effectiveness of AI systems. Inaccurate, incomplete, or biased data leads to flawed outcomes and unreliable AI models. Ensuring data quality requires meticulous data cleaning, preprocessing, and validation processes, which are time-consuming and resource-intensive. Organizations with limited resources struggle to meet these requirements, hindering the development and deployment of AI solutions. To address these issues, it is important to promote data sharing collaborations, invest in data collection and preprocessing capabilities, and establish industry-wide standards for data quality and privacy. These efforts will enhance data availability, improve data quality, and create a more conducive environment for the growth of the Artificial Intelligence (AI) Market.

Opportunity: Rapid growth in the digital data form various sources

The exponential growth of digital data from various sources presents immense opportunities for the AI market. With the proliferation of connected devices, social media platforms, online transactions, and sensors, an unprecedented volume of data is generated every day. This abundance of data offers a vast and diverse resource for AI algorithms to leverage. AI thrives on data, and the availability of large and diverse datasets enables AI systems to learn, analyze, and make accurate predictions. The more data available, the better AI algorithms understand patterns, trends, and correlations. This empowers businesses and organizations to gain valuable insights, make data-driven decisions, and drive innovation. For instance, in marketing, AI algorithms analyze extensive customer data to identify preferences, personalize campaigns, and improve engagement. In healthcare, AI analyzes patient data to identify early signs of diseases, provide personalized treatment plans, and enhance patient care. Furthermore, the growth of digital data fuels the development of AI technologies and solutions. The increasing availability of data spurs investment in AI research and development, leading to advancements in algorithms, machine learning models, and data processing techniques.

Challenge: Concerns related to inaccurately and bias generated output

Issues related to bias and inaccurately generated output pose significant challenges to the growth of the AI market. When AI algorithms are biased or trained on biased data, they perpetuate discriminatory practices or reinforce societal prejudices. For instance, biased facial recognition systems have exhibited higher error rates for women and people with darker skin tones, leading to potential misidentification and discrimination. Such biases erode trust and hinder the adoption of AI technologies, particularly in sensitive areas such as hiring, law enforcement, and healthcare. Moreover, inaccurately generated output from AI systems has serious consequences. For instance, in the healthcare sector, if an AI system inaccurately diagnoses a medical condition or recommends incorrect treatments, it poses risks to patients' health and safety. Such incidents undermine confidence in AI and slow down its adoption. Addressing these challenges requires ongoing efforts to detect and mitigate bias in AI algorithms, improve data quality, and enhance the accuracy and transparency of Artificial Intelligence Market systems to build trust and ensure responsible AI deployment.

Solution Insights

Software solutions led the market and accounted for more than 38.7% of the global revenue in 2022. This high percentage can be attributed to prudent advances in information storage capacity, high computing power, and parallel processing capabilities to deliver high-end services. Furthermore, the ability to extract data, provide real-time insight, and aid decision-making, has positioned this segment to capture the most significant portion of the market. Artificial intelligence software solutions include libraries for designing and deploying artificial intelligence applications, such as primitives, linear algebra, inference, sparse matrices, video analytics, and multiple hardware communication capabilities. The need for enterprises to understand and analyze visual content to gain meaningful insights is expected to spur the adoption of artificial intelligence software over the forecast period.

Companies adopt AI services to reduce their overall operational costs, yielding more profit. Artificial Intelligence as a Service, or AIaaS, is being used by companies to obtain a competitive advantage over the cloud. Artificial intelligence services include installation, integration, maintenance, and support undertakings. The segment is projected to grow significantly over the forecast period. AI hardware includes chipsets such as GPU (Graphics Processing Unit), CPU, application-specific integrated circuits (ASIC), and field-programmable gate arrays (FPGAs). GPUs and CPUs currently dominate the artificial intelligence hardware market due to their high computing capabilities required for AI frameworks. For instance, in September 2020, Atomwise partnered with GC Pharma to offer AI-based services to the former and help develop more effective novel hemophilia therapies.

Technology Insights

On the back of its growing prominence because of its complicated data-driven applications, including text/content or speech recognition, the deep learning segment led the market and accounted for around 35.4% share of the global revenue in 2022. Deep learning offers lucrative investment opportunities as it helps overcome the challenges of high data volumes. For instance, in July 2020, Zebra Medical Vision collaborated with TELUS Ventures to enhance the availability of the former’s deep learning solutions in North America and expand AI solutions to clinical care settings and new modalities.

Machine learning and deep learning cover significant investments in AI. They include both AI platforms and cognitive applications, including tagging, clustering, categorization, hypothesis generation, alerting, filtering, navigation, and visualization, which facilitate the development of advisory, intelligent, and cognitively enabled solutions. The growing deployment of cloud-based computing platforms and on-premises hardware equipment for the safe and secure restoration of large volumes of data has paved the way for the expansion of the analytics platform. Rising investments in research and development by leading players will also play a crucial role in increasing the uptake of artificial intelligence technologies. During the forecast period, the NLP segment is expected to gain momentum. NLP is becoming increasingly widely used in various businesses to understand client preferences, evolving trends, purchasing behavior, decision-making processes, and more, in a better manner.

End-use Insights

The advertising & media segment led the market and accounted for more than 20.5% of the global revenue share in 2022. This high share is attributable to the growing AI marketing applications with significant traction. For instance, in January 2022, Cadbury started an initiative to let small business owners create their AD for free using the face and voice of a celebrity, with the help of an AI tool. However, the healthcare sector is anticipated to gain a leading share by 2030. The healthcare segment has been segregated based on use cases such as robot-assisted surgery, dosage error reduction, virtual nursing assistants, clinical trial participant identifier, hospital workflow management, preliminary diagnosis, and automated image diagnosis. The BFSI segment includes financial analysis, risk assessment, and investment/portfolio management solicitations.

Artificial intelligence has witnessed a significant share in the BFSI sector due to the high demand for risk & compliance applications along with regulatory and supervisory technologies (SupTech). By using AI-based insights in Suptech tools in financial markets, the authorities are increasingly examining FinTech-based apps used for regulatory, supervisory, and oversight purposes for any potential benefits. In a similar vein, regulated institutions are creating and implementing FinTech applications for reporting and regulatory and compliance obligations. Financial institutions are using AI applications for risk management and internal controls as well. The combination of AI technology with behavioral sciences enables large financial organizations to prevent wrongdoing, moving the emphasis from ex-post resolution to proactive prevention.

Other verticals for artificial intelligence systems include retail, law, automotive & transportation, agriculture, and others. The conversational AI platform is one of the most used applications in every vertical. For instance, in April 2020, Google LLC launched a Rapid Response Virtual Agent for call centers. This new chatbot is built to respond to issues customers might be experiencing due to the coronavirus (COVID-19) outbreak over voice, chat, and other social channels. The retail segment is anticipated to witness a substantial rise owing to the increasing focus on providing an enhanced shopping experience. An increasing amount of digital data in text, sound, and images from different social media sources is driving the need for data mining and analytics. In the entertainment and advertising industry, AI has been creating a positive impact, and companies are using AI techniques to promote their products and connect to the customer base.

Regional Insights

North America dominated the market and accounted for over 37.8% share of global revenue in 2022. This high share is attributable to favorable government initiatives to encourage the adoption of artificial intelligence (AI) across various industries. For instance, in February 2019, U.S. President Donald J. Trump launched the American AI Initiative as the nation’s strategy for promoting leadership in artificial intelligence. As part of this initiative, Federal agencies have fostered public trust in AI-based systems by establishing guidelines for their development and real-life implementation across different industrial sectors.

The regional market in Asia Pacific is anticipated to witness significant growth in the artificial intelligence market. This growth owes to the significantly increasing investments in artificial intelligence. For instance, in April 2018, Baidu, Inc., a China-based tech giant, announced that it had entered into definitive agreements with investors concerning the divestiture of its financial services group (FSG), providing wealth management, consumer credit, and other business services. The investors are led by Carlyle Investment Management LLC and Tarrant Capital IP, LLC, with participation from ABC International and Taikanglife, among others. Also, a growing number of start-ups in the region are boosting the adoption of AI to improve operational efficiency and enable process automation.

Recent Developments

- In June 2023, AMD unveiled its AI Platform strategy with the introduction of the AMD Instinct MI300 Series accelerator family, which included a first look at the AMD Instinct MI300X accelerator. The accelerator has been developed for the purpose of large language model training and inference for generative AI workloads.

- In September 2022, AiCure launched its clinical site services program that partners with sponsors and sites through the course of research and offers data-driven, actionable insights to minimize study risks and optimize the workflow.

- In August 2022, Atomwise announced an exclusive, strategic research collaboration with Sanofi for AI-powered drug discovery. As part of the deal, Sanofi is leveraging Atomwise’s AtomNet platform for the purpose of computational discovery & research of up to 5 drug targets.

- In April 2023, H20.ai announced a strategic partnership with GeoTechnologies, a Japan-based provider of map data & location information solutions for vehicle navigation systems. The company has leveraged H20.ai’s H2O AI Cloud to develop an AI-powered platform that uses on-board camera footage for gauging sidewalk safety.

- In July 2022, Clarifai announced the launch of its ‘Clarifai Community’ free service for enabling everyone to share, create, and use The World’s AI. Moreover, it also announced the development of the ‘AI Lake’ product category, which collects and centralizes every AI resource of an enterprise, and offers tools for sharing across the enterprise.

- In January 2023, Iris.ai announced that it had received the EIC Accelerator Blended finance, which is EIC’s flagship startup funding program. The funding includes a €2.4 million grant as well as up to €12 million in investments from the EIC and the European Investment Grant.

- In June 2022, Francisco Partners announced that it had acquired the healthcare analytics and data assets that formed a part of the Watson Health business of IBM. As part of this development, the new standalone company was named Merative, with its products organized in 6 product categories.

- In June 2023, IBM announced that it would be partnering with The All England Lawn Tennis Club at the 2023 Wimbledon Championship. The company would be leveraging IBM watsonx’s generative AI technology to product commentary for video highlights during the tournament. Additionally, the IBM AI Draw Analysis will offer insights regarding how favorable the draws would be for every singles player.

- In April 2022, Sensely and Keralty S.A.S, along with its American affiliate Sanitas USA, Inc., announced a multi-year partnership. Through this collaboration, Sanitas aims to power its next-gen mySanitas application by leveraging Sensely’s advanced visual UI and multilingual symptom assessment tool.

- In March 2023, Enlitic introduced the latest release of Enlitic Curie, a platform that makes it easy for radiology departments to manage their workflow. The platform hosts Curie|ENDEX, which utilizes NLP and computer vision for the analysis & processing of medical images; and Curie|ENCOG, which leverages AI to identify and protect Protected Health Information.

Some of the prominent players in the Artificial Intelligence (AI) Market include:

- Intel Corporation

- Microsoft

- IBM

- Google

- Amazon Web Services

- Baidu, Inc.

- NVIDIA Corporation

- H2O.ai.

- Lifegraph

- Sensely, Inc.

- Enlitic, Inc.

- AiCure

- HyperVerge, Inc.

- Arm Limited

- Clarifai, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the Artificial Intelligence (AI) market.

By Offering

- Hardware

- Software

- Services

By Technology

- Machine Learning

- Natural Language Processing

- Context-Aware Computing

- Computer Vision

By Deployment

By Organization Size

- Large enterprises

- Small & medium enterprises (SMEs)

By Business Function

- Marketing and Sales

- Security

- Finance

- Law

- Human Resource

- Other

By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)