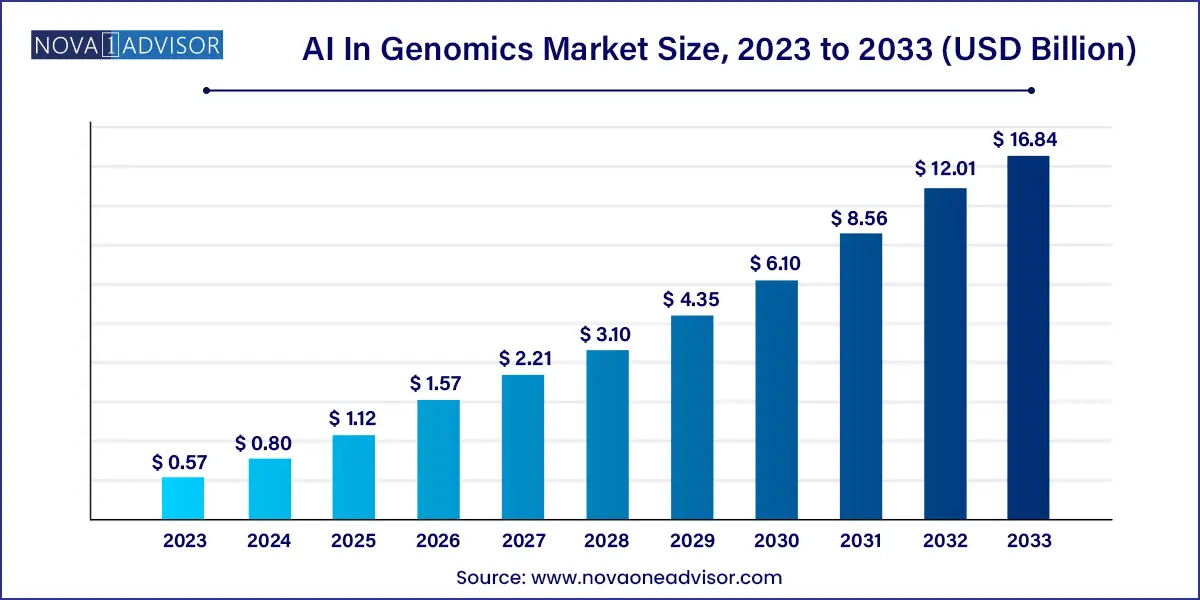

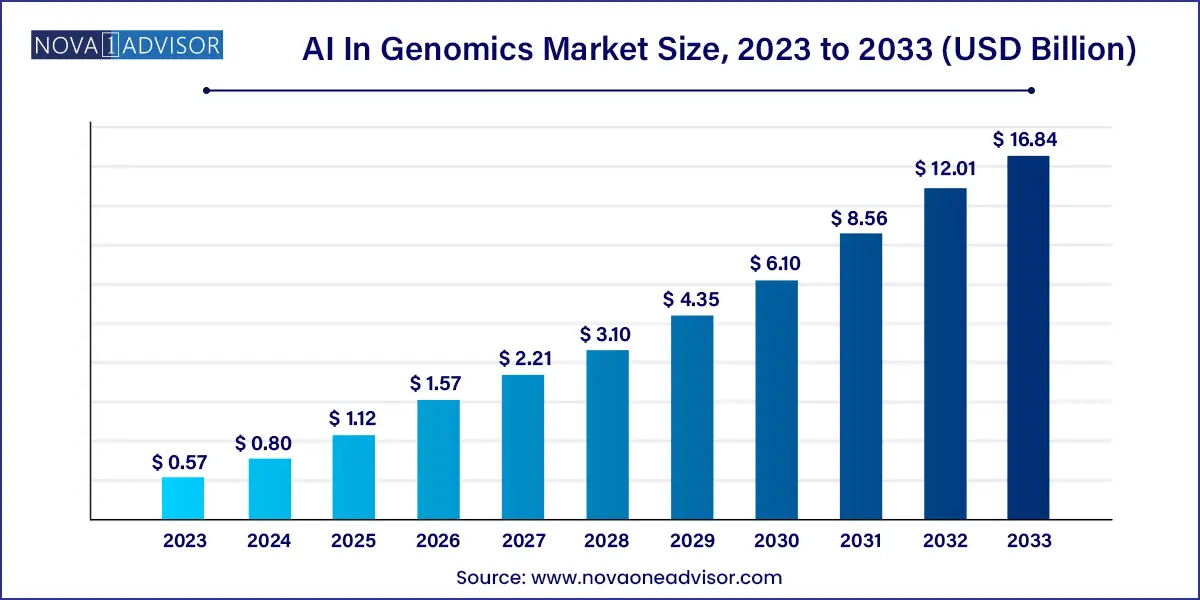

The global AI in genomics market size was estimated at USD 0.57 billion in 2023 and is expected to surpass around USD 16.84 billion by 2033 and poised to grow at a compound annual growth rate (CAGR) of 40.3% during the forecast period 2024 to 2033.

Key Takeaways:

- In 2023, North America held a majority of the global AI in genomics market share of around 31%.

- Asia Pacific is expected to witness the fastest CAGR of 47.2% over the forecast period.

- The software segment held the largest market share of around 42% and is also expected to witness the fastest CAGR of 46.7% during the forecast period.

- The machine learning segment accounted for the largest market share of around 64.22% and is also expected to witness the fastest CAGR over the forecast period.

- The computer vision segment is likely to register a significant CAGR of over 45% during the forecast period.

- The genome sequencing segment dominated the market with a revenue share of 45.62% in 2023 and is anticipated to retain its dominance over the forecast period.

- The drug discovery & development segment dominated the market with a revenue share of over 32%.

- The precision medicine segment is anticipated to witness the fastest growth of over 46% during the forecast period from 2024 to 2033.

- The pharmaceutical and biotech companies segment dominated the market with a revenue share of around 37.9% in 2023.

- The healthcare providers segment is likely to witness the fastest CAGR of 46.7% over the forecast period from 2024 to 2033.

Market Overview

The AI in genomics market represents one of the most groundbreaking intersections of computational science and life sciences in the 21st century. Artificial Intelligence (AI), encompassing machine learning, deep learning, and neural networks, is fundamentally transforming how genomic data is generated, interpreted, and applied in clinical and research settings. Genomics, with its vast, complex datasets and its pivotal role in personalized medicine, presents an ideal domain for AI-driven innovation.

Genomic datasets often include terabytes of information per individual, including raw sequencing data, epigenetic profiles, transcriptomic data, and population-scale variant information. Processing, analyzing, and deriving actionable insights from this volume of data is beyond human capacity this is where AI excels. AI tools are now routinely used in variant calling, disease prediction, drug target identification, genotype-phenotype correlations, gene editing simulations, and functional genomics.

The integration of AI has drastically shortened the time from sequencing to interpretation, increased accuracy in detecting rare mutations, and enhanced the development of precision medicine therapies tailored to individual genetic profiles. Applications span oncology, rare genetic diseases, neurodegeneration, and infectious disease diagnostics. Moreover, AI algorithms are powering gene editing workflows using CRISPR-Cas systems, ensuring off-target effects are minimized and efficiency is optimized.

As genomic sequencing costs continue to decline and the adoption of whole-genome sequencing expands globally, the need for scalable, automated analytical solutions becomes ever more pressing. Governments, academic institutions, biopharma companies, and digital health startups are all investing in AI-driven genomics platforms to revolutionize healthcare delivery, drug development, and population health management.

Major Trends in the Market

-

Surge in Use of Deep Learning for Variant Interpretation: Deep neural networks are improving the identification of pathogenic variants and predicting structural variation effects.

-

Expansion of Multi-Omics AI Platforms: Integration of genomics with proteomics, transcriptomics, and metabolomics using AI is unlocking complex disease mechanisms.

-

AI-Powered CRISPR Screening and Gene Editing: Machine learning algorithms are refining guide RNA design, off-target prediction, and CRISPR efficiency assessments.

-

Growth of AI-as-a-Service in Genomics: Cloud-based AI platforms are democratizing access to genomic analytics for small labs and emerging biotechs.

-

AI in Population Genomics and Rare Disease Discovery: Large-scale biobank initiatives are leveraging AI to identify novel gene-disease associations.

-

Data Privacy and Ethical AI Frameworks: New models for federated learning and secure multi-party computation are enabling AI analysis without compromising genomic privacy.

-

Development of Explainable AI (XAI) in Clinical Genomics: Efforts are underway to increase transparency and interpretability of AI-driven diagnostic tools.

AI In Genomics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 0.80 Billion |

| Market Size by 2033 |

USD 16.84 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 40.3% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Component, technology, functionality, application, end-use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

IBM; Microsoft Corporation; NVIDIA Corporation; DEEP GENOMICS; Data4Cure, Inc.; Freenome Holdings, Inc.; Thermo Fisher Scientific; Illumina, Inc.; SOPHiA GENETICS; BenevolentAI; Fabric Genomics |

Market Driver: Rising Demand for Precision Medicine and Personalized Therapies

One of the foremost drivers fueling the growth of the AI in genomics market is the increasing demand for precision medicine and personalized therapies. Precision medicine hinges on understanding an individual’s genomic, epigenomic, and proteomic profile to tailor medical treatment to the person rather than the average patient. This paradigm shift in medicine is data-intensive and requires robust analytical tools to derive clinically actionable insights.

AI provides the computational backbone for this transformation. For instance, in oncology, AI algorithms analyze tumor sequencing data to identify driver mutations and recommend targeted therapies. Platforms like IBM Watson Genomics and Deep Genomics are being used to match cancer patients with clinical trials or design new therapeutic RNA molecules. In rare genetic disorders, AI-enabled variant prioritization tools accelerate the diagnosis process, often within days compared to the months or years required by traditional methods.

Furthermore, pharmaceutical companies use AI in genomics to identify biomarkers, predict drug response, and stratify patient populations in clinical trials—resulting in more efficient drug development pipelines and higher success rates. As demand for personalized care continues to rise across diseases and healthcare systems, the reliance on AI-powered genomic tools will only deepen.

Market Restraint: Data Complexity and Standardization Challenges

Despite rapid growth, the AI in genomics market faces a major restraint in the form of data complexity and the lack of standardization across genomic datasets. Unlike traditional medical data, genomic data is multi-dimensional, highly variable, and context-specific. Integrating data from various sources whole-genome sequencing, RNA-seq, epigenomics, and clinical records requires careful normalization and harmonization.

The diversity of file formats (FASTQ, BAM, VCF), sequencing technologies (short-read, long-read), and reference genomes across studies often hampers the interoperability of AI algorithms. In addition, labelled training datasets for rare diseases are limited, and phenotypic annotations are frequently inconsistent or missing. These gaps affect the accuracy, reproducibility, and generalizability of machine learning models.

Moreover, regulatory bodies like the FDA and EMA are yet to formalize guidelines for validating and approving AI algorithms in genomics, especially for clinical use. This uncertainty poses challenges for developers looking to commercialize their tools. Until these issues are resolved through collaborative standard-setting and better data curation, the full potential of AI in genomics may remain constrained.

Market Opportunity: Integration of AI with Real-Time Sequencing and Edge Analytics

A key opportunity lies in the integration of AI with real-time sequencing and edge computing platforms, particularly in point-of-care, decentralized, and global health settings. Technologies like nanopore sequencing (e.g., Oxford Nanopore’s MinION) allow genomic data to be generated at bedside or in the field. When coupled with on-device AI algorithms, these platforms can deliver immediate insights without needing centralized computation or internet access.

For instance, real-time AI analysis of pathogen genomes during infectious disease outbreaks can enable faster containment strategies and drug resistance detection. In remote regions, portable sequencers embedded with AI can assist in diagnosing inherited disorders or cancer mutations where traditional lab infrastructure is unavailable.

Additionally, wearable biosensors and implantable devices that continuously monitor gene expression or epigenetic markers can be paired with edge-AI for dynamic health tracking and intervention. As genomics moves closer to real-world applications, edge-AI will become indispensable in making genomic intelligence accessible, scalable, and responsive.

Segmental Analysis

By Component

The software segment dominates the AI in genomics market, given the central role of data analytics platforms, genomic data interpretation tools, and algorithm development kits. These software tools are used in variant calling, genome annotation, disease association studies, and clinical diagnostics. Leading platforms like Google DeepVariant, NVIDIA Parabricks, and Deep Genomics offer customizable and scalable software packages for various genomics applications. The increased availability of cloud-based genomic AI software has allowed researchers and biopharma companies to process petabytes of data without heavy local infrastructure.

Conversely, the services segment is the fastest-growing, driven by the outsourcing of AI-based genomic analytics by pharmaceutical firms, research institutions, and diagnostics companies. Services include custom model training, multi-omics integration, AI pipeline development, and regulatory consulting. Many AI-genomics companies now offer "AI-as-a-Service" models, where clients can upload datasets and receive insights without needing in-house data science teams. This trend is especially popular among startups and mid-sized biotechs looking to access cutting-edge analytics with minimal investment.

By Technology

Machine learning remains the dominant technology, particularly in tasks like predictive modeling, variant classification, phenotype-genotype mapping, and RNA splicing prediction. Subsets like deep learning and supervised learning are widely used for training on large genomic datasets where outcomes are known (e.g., pathogenic vs. benign variants). AI models such as convolutional neural networks (CNNs) and recurrent neural networks (RNNs) are utilized to detect patterns in nucleotide sequences, methylation profiles, or histone modifications.

However, computer vision is rapidly gaining ground, especially in histogenomics and digital pathology. AI models can now correlate genomic features with visual data from tissue slides or tumor microenvironments, aiding in integrated diagnostics. Emerging applications include image-based cell classification, tissue annotation for spatial transcriptomics, and genotype-inferred phenotype prediction from microscopy images. As sequencing merges with imaging in research and clinical practice, computer vision is set to become a vital technology pillar.

By Functionality

Genome sequencing is the dominant functionality in the AI in genomics market. AI algorithms are extensively used in every step of the sequencing workflow from base calling and error correction to genome assembly and annotation. Tools like DeepVariant and GATK integrate machine learning to improve sequencing quality, especially in difficult genomic regions. AI also helps prioritize and classify variants in clinical whole-genome and exome sequencing for rare disease diagnosis or cancer mutation profiling.

That said, gene editing is the fastest-growing segment. AI is playing a key role in designing optimal guide RNAs, predicting off-target effects, and improving CRISPR specificity. Deep learning tools are now being embedded in CRISPR editing platforms to guide experimental design in agriculture, cancer gene therapy, and inherited disease correction. Startups like CRISPR.ai and Benchling are developing AI modules specifically for genome editing research, signaling a rapid expansion in this area.

By Application

Drug discovery and development remains the leading application of AI in genomics. AI tools are used to identify novel drug targets by analyzing large genomic datasets from cancer cohorts or population biobanks. Pharmaceutical giants are leveraging AI to stratify patients, predict adverse events, and simulate gene-drug interactions. For instance, Deep Genomics is working with leading drugmakers to develop RNA therapeutics targeting genetically validated pathways.

Precision medicine, however, is the fastest-growing application. The increasing adoption of whole-genome sequencing in clinical settings is generating vast volumes of patient-specific data. AI helps translate this data into personalized risk assessments, treatment recommendations, and prognostic models. Hospitals and diagnostics firms are integrating AI platforms into their electronic health records to support genomics-informed decision-making for oncology, cardiology, and rare diseases.

By End-use

Pharmaceutical and biotech companies are the primary end-users of AI in genomics. They invest in AI to accelerate drug development, reduce trial failures, and optimize patient selection. Genomics-driven R&D is becoming a standard in precision therapeutics, and companies are building or licensing AI platforms to stay competitive.

However, research centers and academic institutions are the fastest-growing end-user category. Supported by grants and large consortium projects, they are deploying AI to uncover novel biological insights, improve data curation, and develop open-source tools. Initiatives like NIH’s Bridge2AI and European programs in digital genomics are funding the development of AI-native research ecosystems across universities and academic hospitals.

Regional Analysis

North America leads the AI in genomics market, backed by a robust biotech sector, cutting-edge research institutions, and favorable funding and regulatory environments. The United States is home to companies like NVIDIA, Illumina, and Deep Genomics that are pioneers in AI-biology convergence. National initiatives such as All of Us, the Cancer Moonshot, and the Precision Medicine Initiative are integrating AI into genomics pipelines for real-world application.

Academic institutions such as Harvard, Stanford, and MIT have developed AI frameworks for rare disease diagnosis, population genomics, and cancer biology. The presence of major cloud infrastructure providers (Google Cloud, AWS) further supports the scalability of AI-genomics platforms. Regulatory bodies like the FDA are also taking active steps to evaluate and integrate AI in diagnostics, which encourages clinical deployment.

Asia-Pacific is the fastest-growing region, driven by government-backed genomics programs, expanding biotech ecosystems, and aggressive digital health investments. China’s Precision Medicine Initiative and the development of national genomic databases are pushing the boundaries of AI applications in large-scale population health analytics. Companies like BGI Genomics and Genetron Health are investing in AI tools for clinical genomics.

India’s rising genomics ecosystem, fueled by affordable sequencing and cloud adoption, is witnessing the emergence of AI-powered genomics startups focused on rare diseases and reproductive health. Japan and South Korea, with strong aging populations, are investing in genomic data infrastructures integrated with AI for disease prevention and therapy optimization. As AI literacy and computational capabilities improve across the region, APAC is expected to continue its rapid ascent in the global market.

Key Companies & Market Share Insights

- IBM

- Microsoft Corporation

- NVIDIA Corporation

- DEEP GENOMICS

- Data4Cure, Inc.

- Freenome Holdings, Inc.

- Thermo Fisher Scientific

- Illumina, Inc.

- SOPHiA GENETICS

- BenevolentAI

- Fabric Genomics

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the AI In Genomics market.

By Component

- Hardware

- Software

- Services

By Technology

- Machine Learning

- Deep Learning

- Supervised Learning

- Unsupervised Learning

- Others

- Computer Vision

By Functionality

- Genome Sequencing

- Gene Editing

- Others

By Application

- Drug Discovery & Development

- Precision Medicine

- Diagnostics

- Others

By End-use

- Pharmaceutical and Biotech Companies

- Healthcare Providers

- Research Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)