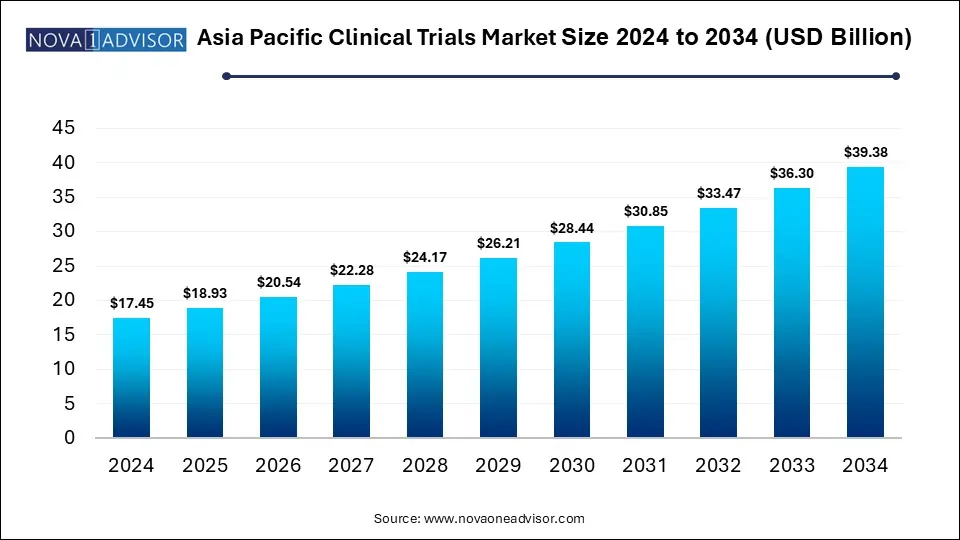

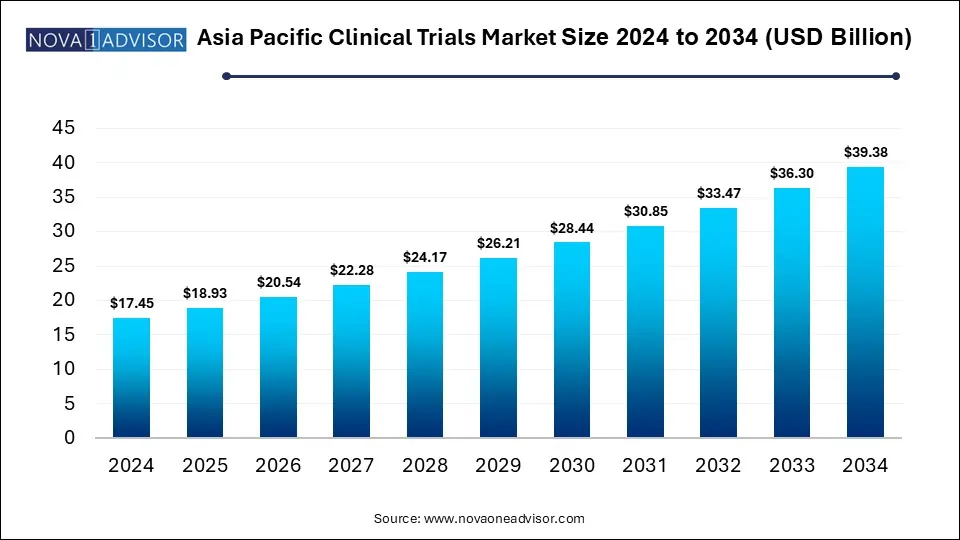

Asia Pacific Clinical Trials Market Size and Growth

The Asia Pacific clinical trials market size is calculated at USD 17.45 billion in 2024, grows to USD 18.93 billion in 2025, and is projected to Hit around USD 39.38 billion by 2034, growing at a CAGR of 8.48% from 2025 to 2034. The Asia Pacific clinical trials market expansion can be linked to increasing healthcare expenditure, supportive regulatory frameworks and rising number of Contract Research Organizations (CROs).

Asia Pacific Clinical Trials Market Key Takeaways

- By country, China dominated the Asia Pacific clinical trials market in 2024.

- By phase, the phase III segment dominated the market with the largest share in 2024.

- By phase, the phase I segment is expected to show the fastest growth over the forecast period.

- By study design, the interventional trials segment accounted for the highest market share in 2024.

- By study design, the observational trials segment is expected to expand rapidly during the predicted timeframe.

- By indication, the oncology segment held the largest market share in 2024.

- By indication, the autoimmune/inflammation segment is expected to register fastest growth during the forecast period.

- By service, the laboratory services segment captured the largest market share in 2024.

- By service, the patient recruitment segment is expected to show the fastest growth during the forecast period.

- By sponsor, the pharmaceutical & biopharmaceutical companies segment generated the highest market revenue in 2024.

- By sponsor, the medical device companies segment is expected register the fastest CAGR over the forecast period.

How is the Asia Pacific Clinical Trials Market Expanding?

The Asia Pacific clinical trials market is experiencing significant growth, driven by large patient pool, increasing investments in advancing healthcare infrastructure, and a strong base of skilled personnel in clinical research which includes medical professionals, clinical trial coordinators and researchers. Cost-effectiveness of conducting clinical trials in Asia Pacific compared to Western countries is attracting both established pharmaceutical companies and emerging biotech organizations.

Increasing chronic disease burden, supportive regulatory frameworks and streamlined approval processes are incentivizing clinical trial activity in the region. Rising number of Contract Research Organizations (CROs) in the region are offering outsourcing services to pharmaceutical companies for supporting clinical trial management and execution, further enhancing regulatory compliance. Shifting trend towards decentralized clinical trials is improving patient access and accelerating development timelines.

What Are the Key Trends in the Asia Pacific Clinical Trials Market in 2025?

- In June 2025, MSD (Merck & Co.) initiated the MOBILIZE-1 Phase 3 clinical trial (V181-005) for evaluation of the safety, efficacy and immunogenicity of a single dose of V181 which is a quadrivalent vaccine candidate for preventing dengue disease. The recruitment of this late-stage trial have begun with enrollment of first participants in Singapore with plans to include more than 30 trial sites in dengue-endemic areas across Asia Pacific region.

- In June 2025, iNGENÅ« CRO collaborated with Quantum BioPharma Ltd., for launching a Phase 2 clinical trial in Australia to target chronic widespread nociplastic pain associated with idiopathic Mast Cell Activation Syndrome/Disorder (MCAS/MCAD) by assessing safety and efficacy of FSD202, an investigational drug containing ultra-micronized palmitoylethanolamide (PEA).

Where is AI Finding Applications in the Asia Pacific Clinical Trials Market?

Digitalization of healthcare systems, supportive government initiatives and reduced operational costs in drug development process are driving the adoption of artificial intelligence (AI) in the Asia Pacific clinical trials market. Several companies in the Asia Pacific are leveraging AI for streamlining drug discovery, enhancing clinical trial management as well as for improving patient recruitment and engagement. AI algorithms are assisting researchers in analyzing large amounts of data from clinical trials, facilitating more rapid and reliable results. Identification of biomarkers for various diseases by deploying AI tools is enabling the development of personalized treatments and tailored therapies for individual patients.

Report Scope of Asia Pacific Clinical Trials Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 18.93 Billion |

| Market Size by 2034 |

USD 39.38 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.48% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Phase, Study Design, Indication, Indication By Study Design, Service, Sponsor, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

AbbVie , Avance Clinical, ICON Plc., IQVIA Inc., LabCorp, Merck Sharp & Dohme LLC, Novotech, Parexel International Corporation, Syneos Health, Thermo Fisher Scientific Inc. |

Market Dynamics

Drivers

Large and Diverse Patient Population

APAC is home to approximately 60% of the world’s population, offering a vast and genetically diverse pool of potential participants for clinical trials. This availability of large patient cohorts enables sponsors to recruit eligible participants for clinical trials quickly, further reducing overall trial timelines and accelerating time-to-market for new drugs. Additionally, low density of ongoing clinical trials compared to Western countries is reducing the competition for patients, making is easier and faster for recruiting participants in various therapeutic areas for specific studies.

Restraints

Regulatory Hurdles

Numerous countries with their own regulatory authority, guidelines, laws and submission requirements for clinical trials in the Asia Pacific as well as varying standards for trial approvals, data privacy, patient consent, ethics committee review, investigational product management and implementation of Good Clinical Practice (GCP) can be a burdensome process and increase the complexity of trials, especially for multi-country trials.

Additionally, lengthy and unpredictable approval timelines in some APAC countries, mandatory local documentation and language requirements, less developed healthcare infrastructure, limited experience in international clinical trials, and need for local expertise to navigate through complex regulatory environment can potentially increase the operational cost. These factors can restrain the market growth.

Opportunities

Rising Investments in Clinical Research and Development

Local and global multinational pharmaceutical and biotechnology companies as well as various governments within the Asia Pacific region are actively investing into large number of drug candidates in preclinical and clinical development stages across various therapeutic areas. These investments are focused on strengthening clinical product pipelines, developing novel therapeutic modalities for addressing unmet medical needs and improving patient lives, further creating opportunities for market growth. Rising focus on pediatric clinical trials for several marketed drugs is expected to boost the market potential. Expansion of R&D capabilities in countries like Australia, China, India, Japan and South Korea are encouraging local innovation and technological advancements in clinical research.

Asia Pacific Clinical Trials Market Segmental Insights

How is the Phase III Segment Dominating the Market in 2024?

By phase, the phase III segment accounted for the largest market share in 2024. The Asia Pacific region’s large and diverse patient pool, especially in countries like India and China is enabling fast and more comprehensive recruitment of patients for phase III trials. This phase is crucial for evaluating the efficacy and safety of new drugs in thousands of participants across multiple locations. Factors such as favorable regulatory environments accelerating trial timelines, low operational costs for conducting trials, well-established medical infrastructure with ongoing developments as well as rising outsourcing trend in countries such as China, India and South Korea are driving the market dominance of this segment. Additionally, adoption of digital health innovations, development of decentralized trial models and integration of real-world data is streamlining complex research throughout various locations in the region, further facilitating the conduction of large-scale phase III studies.

By phase, the phase I segment is expected to register the fastest growth during the forecast period. Increased focus of pharmaceutical and biotech companies on strengthening clinical product pipelines is driving investments in R&D activities and conducting phase 1 studies across key therapeutic areas such as infectious diseases, central nervous systems disorders, cancer, cardiovascular and metabolic disorders. Rising chronic disease burden and low healthcare spending by governments in several APAC countries, particularly developing nations, are creating opportunities for growth of the phase I clinical trial segment by providing access to innovative therapies for patients unable to afford these treatments. Furthermore, government incentives, streamlined approval processes, increasing number of specialized clinical trial centers, reduced enrolment times and availability of skilled labor are the factors fuelling the market growth.

What Made Interventional Trials the Dominant Segment in 2024?

By study design, the interventional trials segment dominated the market with the highest share in 2024. Interventional trials are referred to as research studies where participants receive specific interventions such as drugs, medical devices or procedures for evaluating their effects on patient health outcomes. Cost-effectiveness of conducting clinical trials as well as government incentives such as Australia’s Research and Development Tax Incentive (R&DTI) scheme is attracting global pharmaceutical and medical device companies to the region for carrying interventional studies. Moreover, significant investments in advancing healthcare infrastructure, presence of globally accredited clinical research facilities, harmonization of regulatory frameworks and rise in local biopharmaceutical innovation are the factors driving the market growth of this segment.

By study design, the observational trials segment is expected to show the fastest growth over the forecast period. In observational trials, researchers observe and collect data on participants without any active intervention or assigning treatments. Increased emphasis of regulatory bodies in the Asia Pacific on Real-World Evidence (RWE) for drug approvals, label expansion and post-market surveillance are driving the demand for observational studies. These studies are crucial for providing insights into drug performance, treatment outcomes and adverse events in diverse and real-world populations.

Why Did the Oncology Segment Dominate the Market in 2024?

By indication, the oncology segment captured the biggest market share in 2024. According to the World Health Organization, cancer is the second leading cause of death in the Asia Pacific region, estimated about 5 million deaths in 2021. The high prevalence of cancer in the large and diverse population of Asia Pacific offers a vast pool of potential oncology trial participants, further enabling fast patient recruitment times and access to cutting-edge treatments, especially for the treatment-naïve population in less developed areas. Furthermore, increased shift towards personalized medicine approaches, rising investments in genomic screening initiatives and large-scale platforms for the identification of oncogenic drivers, a focus on precision oncology as well as rising emphasis on conduction of early-phase oncology trials for local pharmacokinetic (PK) and pharmacodynamic (PD) data in Asian populations is fueling the market growth.

By indication, the autoimmune/inflammation segment is expected to expand rapidly during the predicted timeframe. The rising burden of autoimmune disorders and inflammatory conditions such as inflammatory bowel disease (IBD), multiple sclerosis, psoriasis, systemic lupus erythematosus (SLE) and rheumatoid arthritis due to aging demographics, changing lifestyles, rapid urbanization and environmental exposures are creating a large patient pool in need of new and effective treatments. Existing treatments with significant unmet medical needs such as severe side effects, lack of complete remission, and limited long-term efficacy in certain patients are driving investments by pharmaceutical and biotech companies in clinical research and development for discovering and testing more targeted and safer therapeutic approaches for treating these conditions.

What Drives the Laboratory Services Segment’s Market Dominance in 2024?

By service, the laboratory services segment dominated the market with the highest market share in 2024. The rising complexity of clinical trials with a particular focus on oncology and precision medicine, relying on advanced biomarker testing, molecular diagnostics, genomic profiling, and pharmacogenomics for the identification of specific patient populations, assessment of drug safety and monitoring drug response are driving the demand for sophisticated laboratory services. Technological innovations such as telemedicine platforms, electronic consent and remote monitoring devices are enabling the adoption of decentralized and hybrid trials, further increasing accessibility and convenience for participants, especially in remote areas. Centralized laboratory services equipped with advanced biorepositories and digital pathology are enhancing the cost-effectiveness, efficacy and scalability of clinical trials, by ensuring consistent quality and data management across various trial sites, and facilitating regulatory compliance.

By service, the patient recruitment segment is expected to register the fastest CAGR over the forecast period, due to large and diverse demographics of the region creating the need for efficient and fast patient recruitment services. Pharmaceutical and biotech companies as well as regional Contract Research Organizations (CROs) are actively leveraging digital technology and online platforms for patient recruitment. Patient-centric approaches such as providing informed consent documents and educational materials in local languages with adherence to specific cultural contexts as well as offering multilingual support are crucial for building trust, ensuring effective communication and enabling comfortable participation with better understanding of trial procedures. Strategies are being developed for addressing geographical and socioeconomic barriers to assure equitable access to trials, especially for patients in rural areas.

How Pharmaceutical & Biopharmaceutical Companies Segment Generated the Largest Revenue in 2024?

By sponsor, the pharmaceutical & biopharmaceutical companies segment generated the largest market revenue in 2024. Factors such as fast patient recruitment and enrollment, accelerated trial timelines and cost-effectiveness of conducting trials is allowing pharmaceutical and biopharmaceutical companies to gain a competitive edge and optimize their R&D budgets, further attracting investments in the Asia Pacific region. Increased emphasis of APAC nations on harmonizing their regulatory frameworks with international standards is enabling global companies to conduct multi-regional trials with reduced regulatory complexity. Companies are digitalizing data collection through Electronic Data Capture and eSource systems which mitigates errors, accelerates monitoring and improves regulatory compliance. Furthermore, access to state-of-the-art clinical trial facilities, government support, skilled workforce, increased strategic collaborations and growing outsourcing trend through CROs are boosting the market growth of this segment.

By sponsor, the medical device companies segment is expected to show the fastest growth during the forecast period. Rising chronic disease burden, aging demographics, need for advanced diagnostic and monitoring technologies, increased healthcare expenditure and emerging economies are driving the growth of the medical device industry in the Asia Pacific region. Advancements and innovations in medical devices such as development of minimally invasive devices, implantable technologies, miniaturization, AI-powered diagnostics and wearable devices with latest biosensors are improving clinical research workflows.

Country Insights

China Clinical Trials Market Trends

China dominates the Asia Pacific clinical trials market due to high number of planned trials being conducted in the country favored by large and diverse pool of patients, leading to reduced trial timelines and costs for sponsors. Reforms implemented by the Chinese government such as the Marketing Authorization Holder (MAH) system are expediting clinical trial and drug approval processes. Increased investments in pharmaceutical R&D as well as rapid advancements in product pipelines in areas immunology, oncology and rare diseases by biopharmaceutical companies is bolstering the market growth. National Medical Products Administration (NMPA) is the key regulatory body facilitating clinical trial supervision, drug registration and safety monitoring. Increased government funding for establishing national-level clinical research centers is boosting clinical trial activity.

India Clinical Trials Market Trends

India is expected to show rapid growth in the Asia Pacific clinical trials market. The market growth is driven by immense patient pool with extensive diversity, high presence, treatment-naïve patient, unmet medical needs, and increasing burden of communicable and non-communicable diseases. Progressive regulatory reforms such as the New Drugs and Clinical Trial Rules, 2019 (NDCTR 2019) which streamlines approval processes, enhances transparency, promotes innovation and allows for the waiver local clinical trials if a drug is approved by specific countries such as the U.S. FDA. Increased efforts of the Central Drugs Standard Control Organization (CDSCO) for aligning Indian regulations with international standards as well as government initiatives such as National Digital Health Mission are contributing to the clinical trials market in India.

Some of The Prominent Players in The Asia Pacific Clinical Trials Market Include:

- AbbVie

- Avance Clinical

- ICON Plc.

- IQVIA Inc.

- LabCorp

- Merck Sharp & Dohme LLC

- Novotech

- Parexel International Corporation

- Syneos Health

- Thermo Fisher Scientific Inc.

Asia Pacific Clinical Trials Market Recent Developments

- In March 2025, Avance Clinical and China Medical University Hospital (CMUH) in Taiwan signed a Memorandum of Understanding (MOU) for strengthening early-to-late phase clinical trial pathway by accelerating drug development processes for international biotech companies from first-in-human studies to regulatory approval and commercialization.

- In February 2025, Equinix entered into a strategic partnership with AiHPC for launching the Orchestration AI (OrchAI), a dedicated open AI healthcare and life sciences platform on Platform Equinix. The collaboration focuses on accelerating healthcare and life sciences R&D, clinical trials as well as the application of advanced biomedical technologies in Hong Kong to attract research organizations and pioneering enterprises from across the world to set up operations in the city.

- In August 2024, the Australian government launched the Western Cluster Clinical Trials Support Unit (CTSU) in Dubbo, New South Wales (NSW). The CTSU works in key areas such as cardiology, oncology, critical care and respiratory teams for establishing new clinical trials.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Asia Pacific Clinical Trials Market.

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Interventional Trials

- Observational Trials

- Expanded Access Trials

By Indication

-

- Rheumatoid Arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

-

- Blood Cancer

- Solid Tumors

- Others

-

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular Diseases

- Others

By Indication by Study Design

-

- Interventional Trials

- Observational Trials

- Expanded Access Trials

-

- Interventional Trials

- Observational Trials

- Expanded Access Trials

-

- Interventional Trials

- Observational Trials

- Expanded Access Trials

-

- Interventional Trials

- Observational Trials

- Expanded Access Trials

-

- Interventional Trials

- Observational Trials

- Expanded Access Trials

-

- Interventional Trials

- Observational Trials

- Expanded Access Trials

-

- Interventional Trials

- Observational Trials

- Expanded Access Trials

-

- Interventional Trials

- Observational Trials

- Expanded Access Trials

By Service

- Protocol Designing

- Site Identification

- Patient Recruitment

- Laboratory Services

- Analytical Testing Services

- Clinical Trial Data Management Services

- Others

By Sponsor

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

By Regional

-

- Japan

- China

- India

- Thailand

- South Korea

- Australia