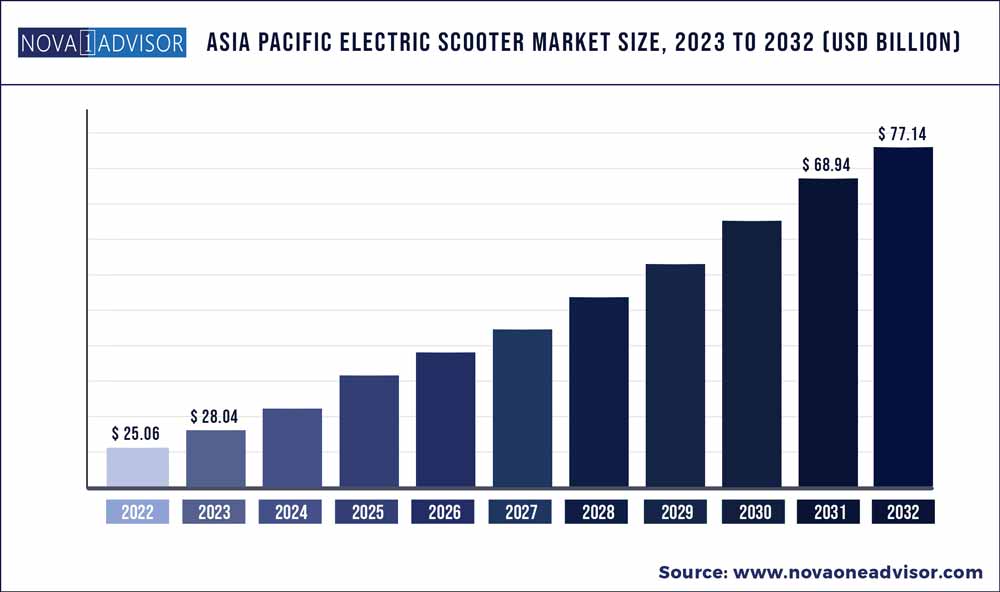

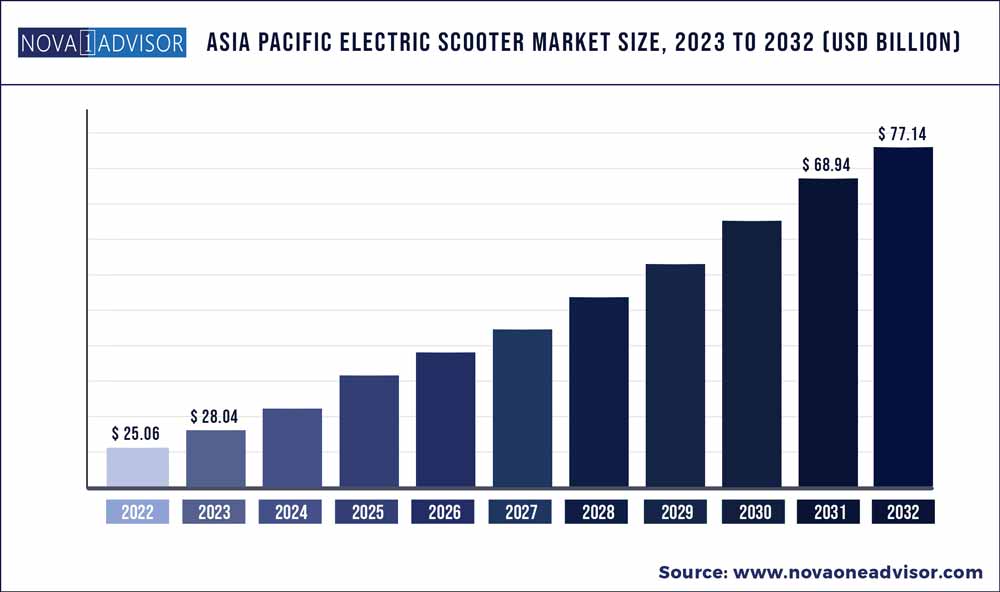

The Asia Pacific electric scooter market size was estimated at USD 25.06 billion in 2022 and is expected to hit around USD 77.14 billion by 2032, poised to reach at a notable CAGR of 11.9% during the forecast period 2023 to 2032.

Key Takeaways:

- The hub motor segment accounted for the largest share of over 80.6% of the Asia Pacific electric scooters market in 2022.

- The belt drive segment is expected to grow significantly over the forecast period.

- The lithium-ion battery segment accounts for the largest market share of over 73.9% in 2022.

- The lithium-ion segment is expected to grow significantly over the forecast period.

- The personal end-use segment accounts for the largest market share of 68.6% in 2022.

- The commercial segment is expected to grow significantly over the forecast period.

Asia Pacific Electric Scooter Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 28.04 Billion |

| Market Size by 2032 |

USD 77.14 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 11.9% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Drive type, battery type, end-use, country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Ola Electric Mobility; Gogoro, Inc.; TVS Motor Company; Yadea Technology Group Co., Ltd.; Greenwit Technologies Inc.; Honda Motor Co. Ltd.; Jiangsu Xinri E-Vehicle Co., Ltd.; Terra Motors Corporation; Yamaha Motor Company Ltd.; Hero Electric; Greaves Electric Mobility Private Limited.; Niu International; Ather Energy Private Limited |

The growth is ascribed to the growing government support for the growth and development of electric vehicles in the region in the form of various tax rebate policies and subsidies for purchasing new vehicles. The rising number of start-ups offering advanced electric scooter models and increasing availability of the scooters at physical stores in Tier 2 & 3 cities of the region are further attributed as key factors driving the market growth. Furthermore, consistent fuel price rises and growing awareness regarding environmental concerns are poised to boost the sale of electric scooters in the region. However, the need for digitization in supply chain operations is observed as a challenging factor enabling marketers to focus more on innovative ways to improve supply chain issues.

The implementation of government initiatives such as subsidies, reduction in customs duty, and manufacturing-related schemes has been propelling the Asia Pacific electric scooters market growth. The active enforcement of these government initiatives supported the initial uptake of electric scooters by attracting buyers. For instance, in 2021, the State Government of Maharashtra, in India, announced to provide a maximum incentive of USD 121 on the purchase of new electric scooters for the first 1,00,000 vehicles produced.

A majority of the consumers in the state benefitted from this incentive program thereby creating opportunities for electric scooters manufacturers. Moreover, to encourage the local production of lithium-ion cells used in batteries of electric vehicles, in February 2023, the government of India eliminated the customs duty on the import of goods and machinery used in the production of lithium-ion cells. As a result, such initiatives are cited as a major factor in the increasing sales of electric scooters.

The growing adoption of 5G across the Asia Pacific and the accelerated adoption of smartphones in the region is prompting manufacturers to integrate connected vehicle solutions in electric scooters. Manufacturers are introducing connected scooters that leverage smartphone-to-vehicle connectivity through Bluetooth, cloud, USB, and LAN. For instance, in May 2022, TVS Motor Company, a major two-wheeler OEM from India, launched the TVS iQube Electric scooter featuring an on-road range of 140 km on a single charge.

The scooter also features a variety of cloud and Bluetooth connectivity options and other advanced features such as voice assistance, infinity theme personalization, and a 7" TFT touchscreen with a clean user interface, intuitive music player control, fast charging with a plug-and-play carry-along charger, OTA updates and safety notifications. TVS has also launched the Smart Xonnect app, which provides information regarding the vehicle speed, battery charging level, and charging stations and enables navigation.

High battery raw material prices are one of the key reasons leading to the high total ownership cost of electric scooters compared to their conventional counterparts. The high battery cost is attributed to factors such as limited reserves of chemical elements such as lithium and cobalt concentrated in countries such as China, Australia, and Indonesia.

Electric scooters from major manufacturers such as Ola Electric Mobility and Okinawa Autotech International Private Limited have reported incidents of electric scooters catching fire, resulting in damage or loss of property and injuries to owners, thereby deterring potential consumers from buying electric scooters. Thus, the threat of lithium-ion batteries catching fire is raising concerns over the safety challenges associated with using lithium-ion batteries.

However, with rising concerns over the prices of raw materials for batteries and battery integration in electric scooters, newer opportunity avenues in terms of battery swapping and Battery-as-a-Service (BaaS) technology are observed in the region. Adopting the battery-as-a-service model allows consumers to keep their electric vehicles running without worrying about the draining of batteries. Electric scooter users using the battery-as-a-service model can rent batteries separately from their vehicles enabling electric scooter buyers to purchase the vehicle for less upfront cost.

Moreover, compared to charging stations, battery switching is quicker and requires minimal infrastructure, making it a practical approach to mitigating battery-associated costs. An electric scooter owner can lease or sign up for a battery subscription plan as a more affordable alternative to purchasing a battery pack with the vehicle. With the help of the battery-as-a-service model, the customer can decide to pay only the rental costs for the batteries in exchange for simply owning the vehicle. The owner can swap out the battery in the same vehicle shell for a new one.

Drive Type Insights

The hub motor segment accounted for the largest share of over 80.6% of the Asia Pacific electric scooters market in 2022. Integrating the hub motor into the electric scooter allows manufacturers to reduce production costs over their counterparts. This has been the key factor driving the segment’s growth. Also, owing to several technical benefits in terms of lower transmission power, considerable performance, and ease in mounting the motor into the electric scooters, manufacturers prefer hub motors over other drive types, thereby driving the segment’s growth.

The belt drive segment is expected to grow significantly over the forecast period. The segment is gaining traction within the scooter market owing to the advantages of this type, such as low maintenance, longevity, and lighter weight. Belt drive-based scooters provide better performance, motor condensation, and enhanced pickup while protecting the scooter from overloading and slips. Over the forecast period, belt-drive scooters are expected to experience higher adoption.

Battery Type Insights

The lithium-ion battery segment accounts for the largest market share of over 73.9% in 2022. Factors such as the development of new battery cell chemistry, which provides improved range, performance, faster charging time, and lower discharge time, are driving segmental growth. Moreover, the growing focus on sustainable mobility in the Asia Pacific region has promoted major economies such as India and China to implement initiatives such as exemption from import duties and providing subsidies to reduce the price of lithium-ion batteries in their countries accelerating the adoption of electric scooters.

For instance, in February 2023, the Indian Government reduced the customs duty on lithium-ion batteries from 21 % to 13 %, which may reduce the price of electric scooters in the country. Moreover, the Indian government has also announced duties exemption on machinery and capital goods required to manufacture lithium-ion batteries, which may further reduce the price of lithium-ion batteries over the forecast period.

The lithium-ion segment is expected to grow significantly over the forecast period. The segmental growth is ascribed to factors such as development in the structure and chemistry of lithium-ion batteries to increase battery storage and lower charging time. Major incumbents operating in the Asia Pacific electric scooters market are also investing a substantial amount in research and development of improved batteries to mitigate challenges such as high battery cost and battery fires are expected to create new opportunities for segmental growth.

End-use Insights

The personal end-use segment accounts for the largest market share of 68.6% in 2022. Integration of telematics, improved battery range, and growing traction of electric two-wheelers among millennials are some of the key factors driving the segmental growth. Moreover, manufacturers are establishing charging stations in locations that are situated in prime locations, major roadways, and places with higher footfall, such as eateries and shopping canter’s, further augmenting the Asia Pacific Electric Scooter industry growth.

The commercial segment is expected to grow significantly over the forecast period. The segmental growth is ascribed to factors such as the deployment of electric scooters for last-mile deliveries by e-commerce companies. Also, the growing need to commute quickly using rental services, to avoid excessive traffic congestion has created opportunities in the e-bike rental services segment. Moreover, the expanding last-mile delivery and logistics segments are further augmenting the deployment of electric scooters, as manufacturers are partnering with last-mile delivery service providers to expand their electric two-wheeler fleets.

For instance, in April 2022, Hero Electric announced its partnership with Shadowfax Technologies Pvt. Ltd., an on-demand crowd-sourced third-party logistics platform for supplying e-scooters for last-mile deliveries. Hero Electric will convert around 25 % of the Shadowfax delivery fleet with electric scooters. The association will ensure the growth of carbon-free mobility in the logistics segment while expanding the last-mile delivery offered by Shadowfax Technologies Pvt. Ltd.

Country Insights

China accounted for the largest market share of 78% in 2022. China is among the world's largest electric scooter users due to the presence of global market leaders and their excessive customer base in the country. Yadea, Jiangsu Xinri Electric Vehicle Co., Ltd., and Niu International are among the key Chinese vendors that account for the maximum market share at the global level.

Furthermore, the China market is also being fuelled by increased urbanization, the increasing affordability of electric scooters, and consumer awareness of clean energy mobility to reduce automobile emissions. Additionally, increasing technological developments in efficient battery management systems and supply of raw materials are further anticipated to create multiple growth opportunities for battery and associated raw material suppliers in China over the forecast period.

The India electric scooter market is expected to grow significantly over the forecast period. The growth is ascribed to factors such as rising central & state government support for the proliferation of electric vehicles, an increasing number of government initiatives such as a reduction on custom duty imposed for importing machinery required to manufacture lithium-ion cells, and rising consumer preference toward electric scooters from tier 2 & 3 cities.

Major players in the Indian electric scooter market, such as Ola Electric Mobility, Ather Energy, and Greaves Electric Mobility Private Limited are aggressively working on enhancing their production capacity and finding better ways to tackle supply chain and raw material procurement issues. As a result, with consistent growth in consumer demands, these companies are poised to capture a large chunk of the Indian market over the forecast period.

Several partnerships among the key players for enhancing their product portfolio, customer base, and production capacity are also witnessed in the Indian electric scooter market. For instance, in January 2022, Hero Electric and Mahindra Group announced a partnership where Mahindra Group would manufacture Hero Electric scooter NYX and Optima at their Pithampur plant in Madhya Pradesh.

Key Companies & Market Share Insights

The market is highly competitive, with incumbents adopting strategic initiatives such as product launches, partnerships, mergers and acquisitions, and expansions to gain greater shares and maintain their market presence. For instance, in March 2023, Hero Electric announced the launch of its new range of electric scooters, NYX CX5.0, Optima CX5.0, and Optima CX2.0, for the Indian Market. The electric scooter is equipped with a dynamically synchronized powertrain and hibernating battery technology, which leverages a close-loop sync system that senses and analyzes variations in road conditions to utilize energy, accordingly, aiding in longer-range commutes.

The OEMs also resort to strategic initiatives such as partnerships with battery cell and power train manufacturers to develop a robust localized supply chain to meet the growing demand for electric scooters. For instance, in November 2022, Hero Electric announced its partnership with Battrixx, an advanced battery pack manufacturer, to develop lithium-ion batteries for Hero electric scooters. The scooter manufacturer will leverage Battrixx's advanced battery cell chemistry pack design to manufacture 3 00,000 battery packs. The batteries are equipped with a smart battery management system, A/V warning system, and live data tracking.

Moreover, manufacturers are providing their target customers with affordable and flexible tenured loans to overcome the challenge of high ownership costs. Manufacturers are leveraging financing options as an effective strategy to make their products accessible to a wider customer range. For instance, in June 2023, Ather Energy Private Limited announced its 60-month vehicle loan in partnership with banks such as Hero FinCorp, IDFC First Bank Limited, and Bajaj Finance Limited. The monthly loan payment offered within 5-year loan tenure has a lower cap of USD 36.33 (INR 2,999).Some prominent players in the Asia Pacific electric scooter market include:

- Ather Energy Private Limited

- Gogoro, Inc.

- Greaves Electric Mobility Private Limited.

- Greenwit Technologies Inc.

- Hero Electric

- Honda Motor Co. Ltd.

- Jiangsu Xinri E-Vehicle Co., Ltd.

- Niu International

- Ola Electric Mobility

- Terra Motors Corporation

- TVS Motor Company

- Yadea Technology Group Co., Ltd.

- Yamaha Motor Company Ltd.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the Asia Pacific Electric Scooter market.

By Drive Type

- Belt Drive

- Chain Drive

- Hub Motors

By Battery Type

- Lead Acid

- Lithium-Ion

- Other

By End-use

By Country

- China

- India

- Japan

- Thailand

- South Korea

- Indonesia

- Philippines

- Vietnam