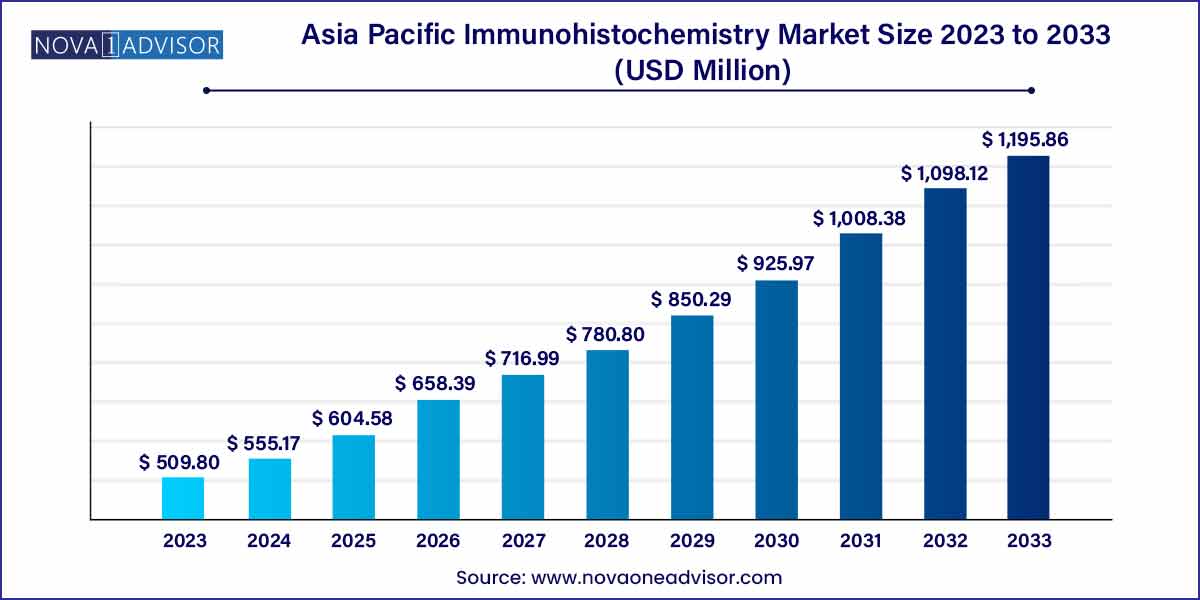

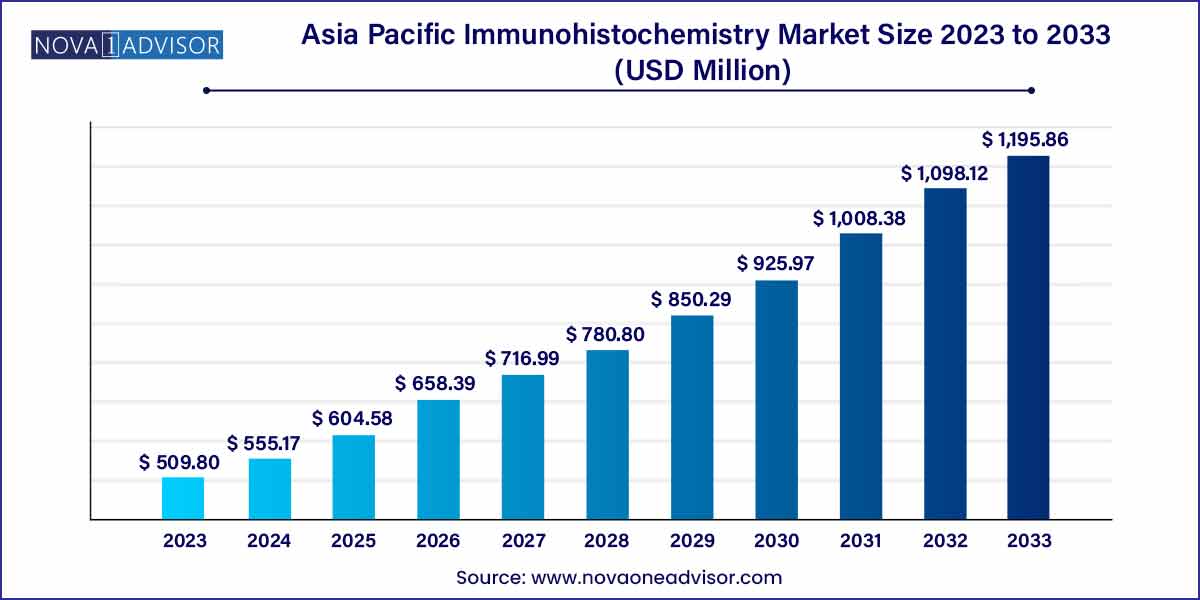

The Asia Pacific immunohistochemistry market size was estimated at USD 509.80 million in 2023 and is expected to surpass around USD 1,195.86 million by 2033 and poised to grow at a compound annual growth rate (CAGR) of 8.9% during the forecast period 2024 to 2033.

Key Takeaways:

- Japan dominated the market and accounted for 29.42% share in 2023

- China is anticipated to witness significant growth in the Asia Pacific market.

- Antibodies led the Asia Pacific market and accounted for 42% of the market in 2023

- Diagnostics segment accounted for the largest market revenue share in 2023.

- Research segment is expected to register the fastest CAGR during the forecast period.

- Hospitals segment accounted for the largest share of the Asia Pacific market in 2023.

- Research institutes sector is projected to witness the fastest CAGR over the forecast period

Asia Pacific Immunohistochemistry Market Overview

The Asia Pacific immunohistochemistry (IHC) market is rapidly evolving as healthcare systems across the region prioritize early diagnosis, precision medicine, and advanced pathology techniques. Immunohistochemistry is a critical tool in pathology laboratories, enabling the detection of specific antigens in tissue sections using antibodies. It plays a pivotal role in oncology diagnostics, infectious disease screening, and biomarker validation.

The growing prevalence of chronic diseases, particularly cancer, combined with rising healthcare investments, research activities, and the adoption of technologically advanced laboratory systems, is fueling market demand. Countries such as China, Japan, India, and South Korea are at the forefront of adopting modern diagnostic technologies, including IHC, to enhance clinical decision-making and therapeutic strategies.

A key factor contributing to the region's growth is the increasing focus on personalized medicine. As pharmaceutical companies and research institutes seek to better understand disease pathogenesis at the molecular level, immunohistochemistry is emerging as a cornerstone in tissue-based diagnostics and drug development.

Major Trends in the Market

-

Shift Toward Automated IHC Platforms: Rising adoption of fully automated slide staining and scanning systems to improve throughput and accuracy.

-

Integration of Digital Pathology: Growing use of AI and machine learning in slide analysis and image interpretation.

-

Expansion of Companion Diagnostics: Increasing use of IHC in guiding targeted therapies in cancer treatment.

-

Rising Adoption in Non-oncology Applications: Utilization of IHC in infectious, autoimmune, and cardiovascular diseases.

-

Growth of Contract Research Organizations (CROs): CROs expanding IHC-based research services for pharma clients in Asia Pacific.

-

Government Investment in Pathology Infrastructure: National programs supporting early cancer detection and molecular diagnostics.

-

Market Entry of Local Antibody Manufacturers: Emergence of regional biotech firms producing high-quality, cost-effective antibodies.

Asia Pacific Immunohistochemistry Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 555.17 million |

| Market Size in 2033 |

USD 1,195.86 million |

| Growth Rate From 2024 to 2033 |

CAGR of 8.9% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, application, end-use, country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd.; Merck KGaA; Danaher Corporation; PerkinElmer, Inc.; Bio-Rad Laboratories, Inc.; Cell Signaling Technology, Inc.; Bio SB; Agilent Technologies, Inc.; Abcam plc.; HiMedia Laboratories; IMGENEX INDIA Pvt. Ltd.; Sino Biological, Inc.; NICHIREI BIOSCIENCES INC. (NICHIREI CORPORATION); MEDICAL & BIOLOGICAL LABORATORIES CO., LTD.; Immuno-Biological Laboratories Co, Ltd.; Kyowa Kirin Co., Ltd.; Amos Scientific PTY. LTD.; PathnSitu Biotechnologies Pvt Ltd |

Market Driver: Increasing Cancer Incidence Driving Diagnostic Demand

One of the most influential drivers in the Asia Pacific immunohistochemistry market is the rising burden of cancer across the region, which is generating heightened demand for accurate and early diagnosis. According to global cancer statistics, countries such as China and India report some of the highest numbers of cancer cases worldwide. Breast, lung, colorectal, cervical, and liver cancers are particularly prevalent, many of which require histopathological confirmation through IHC.

Hospitals and diagnostic centers increasingly rely on IHC to identify tumor-specific markers such as HER2, ER, PR, and Ki-67, which are essential for diagnosis, prognosis, and therapy selection. Moreover, the emergence of companion diagnostics—where a patient’s biomarker profile determines eligibility for targeted therapy—has made IHC indispensable in clinical oncology workflows. The demand for cost-effective, localized IHC testing is especially strong in urban and tier-II cities where access to molecular testing remains limited.

Market Restraint: Lack of Skilled Pathologists and Standardization

A major restraint for the Asia Pacific immunohistochemistry market is the shortage of trained pathologists and inconsistent protocol standardization across diagnostic laboratories. While urban centers in countries like Japan, South Korea, and Singapore boast highly trained professionals and automated infrastructure, many parts of India, Indonesia, and Vietnam continue to face capacity constraints.

The interpretation of IHC results can be subjective and relies heavily on technical precision and experience. Moreover, variations in antibody specificity, tissue preparation, and staining techniques can lead to inconsistent results. The lack of standardized operating procedures (SOPs) for IHC across smaller labs can result in diagnostic errors or false negatives, affecting treatment outcomes. In rural or underfunded regions, laboratories often rely on manual staining methods with lower reproducibility and quality control.

Market Opportunity: Rising Investment in Personalized Medicine and Translational Research

The emergence of precision medicine and translational research presents a significant opportunity for the IHC market in Asia Pacific. Governments and private organizations are increasingly supporting initiatives that aim to understand disease biology at the molecular and cellular level. IHC plays a vital role in these efforts, bridging the gap between basic research and clinical application.

For instance, research institutions in Japan and China are collaborating with pharmaceutical companies to study novel cancer biomarkers using IHC in clinical trial settings. Similarly, national cancer screening programs in Australia and South Korea are investing in tissue biomarker analysis for early detection of high-mortality cancers like pancreatic and liver cancer.

In India, biotechnology parks and innovation hubs are being developed to support IHC-based drug discovery platforms, especially in oncology and infectious diseases. The expanding academic-industry partnerships, combined with greater access to funding and laboratory automation, are expected to open new avenues for IHC innovation.

Segmental Analysis

By Product

Antibodies dominate the Asia Pacific IHC product segment due to their central role in staining specificity and diagnostic accuracy. Primary antibodies, particularly those targeting well-established cancer markers (e.g., HER2, p53, EGFR), are in high demand across hospital pathology labs. Secondary antibodies, used for signal amplification, also contribute significantly, especially in high-throughput laboratories.

The fastest-growing product category is equipment, particularly slide staining systems and slide scanners. The shift from manual to automated processing in large urban laboratories and private hospital chains has driven adoption. These systems improve standardization, reduce human error, and increase throughput. Countries like South Korea, Japan, and Australia are leading adopters, while China and India are rapidly catching up through public-private investments.

By Application

Diagnostics dominate the IHC application landscape, particularly in cancer detection. Over 70% of IHC tests in high-volume labs are used to classify tumors, determine prognosis, and guide therapy. Markers such as Ki-67 for proliferation, CD20 for lymphomas, and ER/PR for breast cancer are routinely used. Increasing awareness of personalized cancer treatment is further expanding the diagnostic application base.

Research applications are the fastest-growing, especially within academic and biotech laboratories. Translational research studies rely on IHC to analyze tissue microenvironments, validate animal models, and study disease progression. Governments in Japan and China have announced grant programs to fund immunological and oncology research, leading to higher demand for multiplex IHC tools and biomarker discovery assays.

By End-use

Hospitals and diagnostic laboratories dominate, as they are the primary centers for clinical testing and patient care. Tertiary hospitals in Singapore, Japan, and South Korea have sophisticated histopathology labs with fully automated IHC capabilities, while private diagnostic chains in India and China are investing in automated platforms to meet rising urban demand.

Research institutes are the fastest-growing end-users, fueled by government support and a growing biotech ecosystem. Institutions like RIKEN (Japan), CSIR (India), and Chinese Academy of Sciences are leading users of IHC tools for pathology-based research. These organizations often partner with pharma companies to conduct biomarker validation studies and early-phase clinical trials.

Country Insights

China

China represents the largest share of the Asia Pacific immunohistochemistry market. With a robust investment strategy in healthcare infrastructure, the country has witnessed widespread expansion in cancer centers, diagnostic labs, and academic research institutes. The National Health Commission of China supports IHC-based cancer screening initiatives under national health plans. Additionally, China's domestic biotech sector is producing competitively priced antibodies and reagents, improving local access.

Japan

Japan is a technology leader, known for its precision diagnostics and adoption of advanced automated histopathology systems. Academic hospitals in Tokyo and Osaka are at the forefront of digital pathology integration, using IHC data to support AI-driven diagnosis. The aging population and high cancer incidence rates continue to drive demand for high-quality IHC tests.

India

India is one of the fastest-growing markets, fueled by rising cancer incidence, improved healthcare spending, and the expansion of private diagnostic chains like Thyrocare and SRL Diagnostics. Tier-I and Tier-II cities are witnessing the adoption of semi-automated IHC platforms, while metro cities are exploring fully automated tissue processing and slide scanning systems. However, challenges remain in terms of skilled workforce and access in rural areas.

Recent Developments

-

April 2025 – Roche Diagnostics launched a new panel of HER2 and PD-L1 antibodies for IHC use in clinical cancer diagnostics across Japan and South Korea.

-

March 2025 – BioGenex announced a collaboration with a major Indian hospital network to supply automated IHC workstations and reagents for cancer labs in India.

-

February 2025 – Cell Signaling Technology expanded its regional distribution partnership in Southeast Asia to improve access to high-quality rabbit monoclonal antibodies for IHC research.

-

January 2025 – Abcam opened a new antibody manufacturing facility in China to cater to the Asia Pacific research and clinical market, focusing on high-yield primary antibodies.

-

December 2024 – Leica Biosystems signed a strategic agreement with Australia’s Royal College of Pathologists to train technicians on digital pathology integration using IHC.

Key Asia Pacific Immunohistochemistry Companies:

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd.

- Merck KGaA

- Danaher Corporation

- PerkinElmer, Inc.

- Bio-Rad Laboratories, Inc

- Cell Signaling Technology, Inc.

- Bio SB

- Agilent Technologies, Inc.

- Abcam plc.

- HiMedia Laboratories

- IMGENEX INDIA Pvt. Ltd.

- Sino Biological, Inc.

- NICHIREI BIOSCIENCES INC. (NICHIREI CORPORATION)

- MEDICAL & BIOLOGICAL LABORATORIES CO., LTD.

- Immuno-Biological Laboratories Co, Ltd.

- Kyowa Kirin Co., Ltd.

- Amos Scientific PTY. LTD.

- PathnSitu Biotechnologies Pvt Ltd

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific Immunohistochemistry market.

By Product

- Antibodies

- Primary Antibodies

- Secondary Antibodies

- Reagents

- Histological Stains

- Blocking Sera and Reagents

- Chromogenic Substrates

- Fixation Reagents

- Organic Solvents

- Proteolytic Enzymes

- Diluents

- Other Reagents

- Equipment

- Slide Staining Systems

- Tissue Microarrays

- Tissue Processing Systems

- Slide Scanners

- Others

- Kits

By Application

- Diagnostics

- Cancer

- Infectious Diseases

- Cardiovascular Diseases

- Autoimmune Diseases

- Diabetes Mellitus

- Nephrological Diseases

- Others

- Research

By End-use

- Hospitals and Diagnostic Laboratories

- Research Institutes

- Others

By Country

- Japan

- China

- India

- South Korea

- Australia

- Singapore

- Thailand

- Malaysia

- Indonesia

- Philippines

- Vietnam