Aspirin Enteric-Coated Tablets Market Size, Share, Growth, Report 2025 to 2034

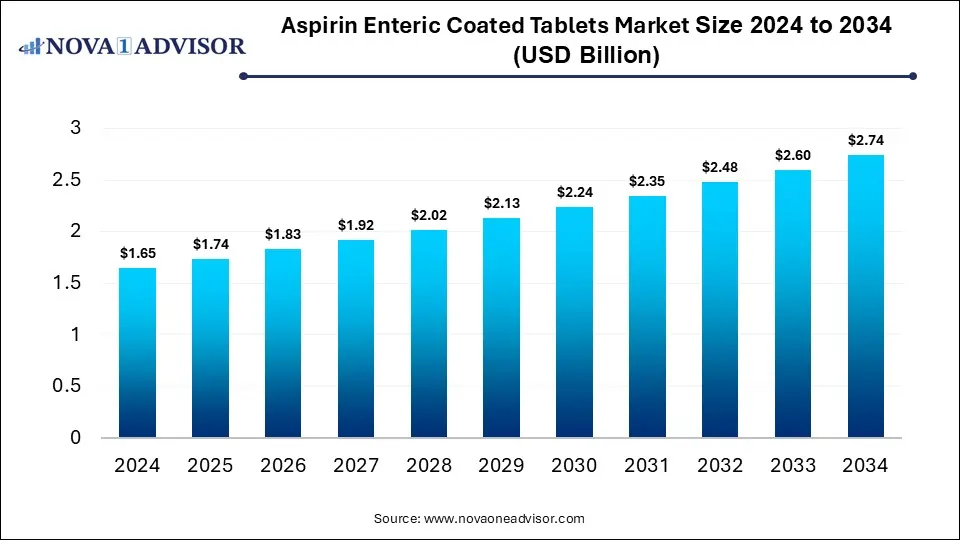

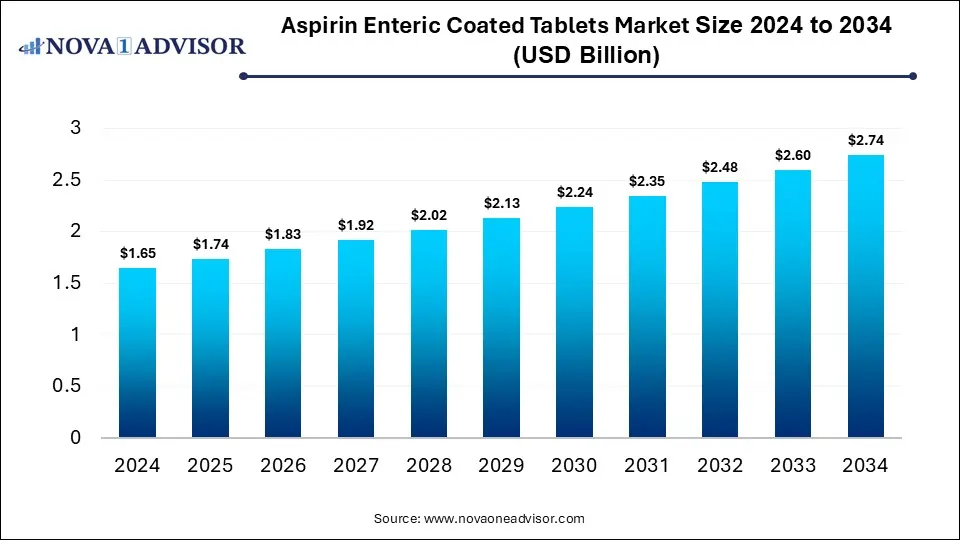

The global aspirin enteric-coated tablets market size was estimated at USD 1.65 billion in 2024 and is expected to reach USD 2.74 billion in 2034, expanding at a CAGR of 5.2% during the forecast period of 2025 and 2034. The growth of the market is driven by increasing cardiovascular disease prevalence, rising demand for gastrointestinal-friendly formulations, an ageing population, and greater adoption of preventive healthcare measures.

Aspirin Enteric-Coated Tablets Market Key Takeaways

- By region, North America held the largest share of the aspirin enteric-coated tablets market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By product type, the low‑dose aspirin segment continues to dominate the market during the forecast period.

- By application, the cardiovascular diseases segment led the market in 2024.

- By application, the pain relief segment is expected to grow at the fastest rate over the projection period.

- By consumer / patient type, the adults segment led the market in 2024.

- By consumer / patient type, the senior citizens / aged population segment is expected to expand at the fastest CAGR in the coming years.

- By distribution channel, the retail pharmacies segment dominated the market in 2024.

- By distribution channel, the online pharmacies segment is expected to expand at the highest CAGR in the upcoming period.

Impact of AI on the Aspirin Enteric-Coated Tablets Market

AI is enhancing drug formulation and manufacturing processes through predictive analytics and automation, leading to enhanced product quality and consistency. AI-driven data analysis helps pharmaceutical companies better understand patient needs and optimize dosage forms for enhanced efficacy and reduced side effects. Additionally, AI-powered supply chain management improves distribution efficiency, ensuring the timely availability of the medication in various markets. In clinical research, AI accelerates the identification of potential drug interactions and personalized treatment plans, supporting more targeted and safer use of aspirin therapies. Overall, AI adoption is driving innovation, cost-efficiency, and improved patient outcomes.

Market Overview

The market revolves around the production and sale of aspirin tablets coated with a protective layer that prevents dissolution in the stomach, thereby minimizing gastrointestinal irritation. These tablets offer advantages such as improved patient compliance, reduced risk of stomach ulcers, and better absorption in the intestines. The market is driven by the rising prevalence of cardiovascular diseases, increasing awareness of preventive healthcare, and a growing ageing population requiring long-term aspirin therapy. Additionally, advancements in drug delivery technology and expanding over-the-counter availability are further fueling market growth.

What are the Major Trends in the Aspirin Enteric-Coated Tablets Market?

- Rising Demand for Cardiovascular Preventive Therapy

Increasing awareness of aspirin’s role in preventing heart attacks and strokes is boosting demand for enteric-coated tablets, especially among high-risk and ageing populations.

- Focus on Gastrointestinal Safety

Enteric-coated aspirin tablets are preferred due to their ability to reduce stomach irritation and ulcers, driving market preference over regular aspirin formulations.

- Rising Over-the-Counter (OTC) Availability

Expanded OTC availability of enteric-coated aspirin has increased consumer access and convenience, supporting broader market penetration globally.

- Advancements in Drug Delivery Technology

Innovations in coating materials and manufacturing techniques improve drug stability, release profiles, and patient compliance, further enhancing market growth.

Report Scope of Aspirin Enteric-Coated Tablets Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.74 Billion |

| Market Size by 2034 |

USD 2.74 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product Type, By Application, By Consumer / Patient Type, By Distribution Channel, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Growing Awareness of Gastrointestinal Side Effects of Regular Aspirin

Growing awareness about the gastrointestinal side effects associated with regular aspirin, such as stomach irritation and ulcers, is significantly increasing the demand for enteric-coated aspirin tablets. These formulations are designed to bypass the stomach and dissolve in the intestines, thereby reducing the risk of gastrointestinal discomfort and injury. As more patients and healthcare providers recognize these benefits, the preference for enteric-coated versions increases, especially among long-term aspirin users like those with cardiovascular conditions. This shift enhances patient compliance and safety, which in turn boosts market growth. Consequently, manufacturers are focusing on producing more enteric-coated aspirin products to meet this rising demand.

Expanding Ageing Population

Older adults are more prone to cardiovascular diseases and often require long-term low-dose aspirin therapy for heart health. Enteric-coated aspirin is preferred in this demographic because it minimizes gastrointestinal side effects, which are a common concern among elderly patients. With increasing life expectancy, more individuals are adopting preventive measures to reduce the risk of heart attacks and strokes, leading to sustained demand for safer aspirin formulations. This growing patient base encourages pharmaceutical companies to focus on enteric-coated options, further fueling market expansion. As a result, the ageing population significantly contributes to the rising consumption and development of enteric-coated aspirin tablets worldwide.

- By 2030, 1 in 6 people globally is aged 60 or over, with the population rising from 1 billion in 2020 to 1.4 billion. By 2050, the 60+ population doubles to 2.1 billion, while those aged 80 and above triple to 426 million.

Restraints

Potential Side Effects

Gastrointestinal bleeding and hemorrhagic stroke act as significant restraints on the growth of the aspirin enteric-coated tablets market. These risks make healthcare providers cautious when prescribing aspirin, especially for patients with a history of bleeding disorders, ulcers, or those taking other blood-thinning medications. As a result, certain patient groups are either advised to avoid aspirin or use it under strict medical supervision, limiting the overall market potential. Additionally, the fear of adverse effects can reduce patient compliance and demand for aspirin therapy. This caution and restricted use slow down the widespread adoption of even enteric-coated formulations despite their gastrointestinal benefits.

Competition from Alternative Antiplatelet and Anticoagulant Therapies

The availability of alternative antiplatelet and anticoagulant therapies, such as clopidogrel, ticagrelor, and novel oral anticoagulants (NOACs), is restraining the growth of the market by offering more targeted or safer options for certain patient populations. These alternatives often provide benefits like fewer side effects, better efficacy in preventing blood clots, or suitability for patients who cannot tolerate aspirin. As a result, physicians may prefer prescribing these newer drugs over aspirin, reducing its market share. Additionally, ongoing clinical trials and expanding indications for these therapies increase their adoption. This growing competition limits the dominance and growth potential of enteric-coated aspirin products despite their established benefits.

Opportunities

Advancements in Drug Delivery and Coating Technology

Advances in drug delivery and coating technology are opening new opportunities in the market by enhancing the safety, efficacy, and patient compliance of long-term aspirin use. Modern enteric coatings now provide more targeted drug release, protecting the stomach lining and reducing the risk of gastrointestinal side effects, a major concern in chronic cardiovascular therapy. Improved formulation techniques also allow for better control over absorption rates, leading to more consistent therapeutic outcomes. These innovations make aspirin therapy more accessible and tolerable, particularly for aging populations and those requiring daily preventive treatment. As a result, pharmaceutical companies are leveraging these advancements to differentiate their products and meet the growing global demand for safer, patient-friendly cardiovascular medications.

Development of Combination Therapies

The development of combination therapies is creating significant opportunities in the aspirin enteric-coated tablets market by improving treatment adherence and enhancing therapeutic outcomes. Combining aspirin with complementary agents such as statins, proton pump inhibitors (PPIs), or anticoagulants addresses multiple cardiovascular risk factors while reducing side effects like gastrointestinal irritation. These fixed-dose combinations simplify medication regimens, particularly for elderly or chronic disease patients, leading to better compliance. As polypharmacy becomes more common in managing cardiovascular conditions, demand for multi-functional, enteric-coated combination tablets is rising. This trend offers pharmaceutical companies a competitive edge through product innovation and differentiation in both developed and emerging markets.

- In February 2025, Boryung launched Rebetrix Capsules, a once-daily combination of aspirin and rabeprazole designed for patients who require antiplatelet therapy but are at risk of gastrointestinal bleeding. Aspirin increases the risk of GI bleeding by ~40%, often leading to treatment discontinuation. By adding rabeprazole, Rebetrix helps reduce gastric ulcers and mucosal damage. The single-pill formulation offers improved convenience and cost-effectiveness compared to taking both drugs separately.

How Macroeconomic Variables Influence the Aspirin Enteric-Coated Tablets Market?

Economic Growth and GDP

Economic growth and rising GDP positively impact the market by increasing healthcare spending, improving access to preventive medicines, and expanding insurance coverage. In wealthier economies, patients are more likely to afford and prioritize long-term cardiovascular treatments, including safer options like enteric-coated aspirin. Additionally, governments and the private sector invest more in public health infrastructure, making such medications more widely available and adopted.

Inflation

It can negatively affect the growth of the market by increasing production costs and reducing consumers' purchasing power, especially in price-sensitive and low-income markets. As the cost of raw materials, packaging, and distribution rises, pharmaceutical companies may be forced to raise prices or face thinner profit margins. Additionally, tighter healthcare budgets and reimbursement challenges can limit patient access to premium formulations like enteric-coated aspirin, slowing overall market expansion.

Exchange Rates

Exchange rate fluctuations can have both positive and negative impact on the market for aspirin enteric-coated tablets, depending on the direction and stability of currency movements. A strong local currency can reduce import costs for raw materials and finished drugs, supporting market growth, especially in developing countries reliant on pharmaceutical imports. Conversely, unfavorable exchange rates can increase production and distribution costs for multinational manufacturers, leading to higher prices and reduced affordability, which may restrain market growth in affected regions

Segment Outlook

Product Type Insights

What Made Low‑Dose Aspirin the Dominant Segment in the Market?

The low‑dose aspirin segment dominated the aspirin enteric-coated tablets market with the largest share in 2024 and is likely to continue its upward trajectory throughout the forecast period. This is mainly due to its widespread use in cardiovascular disease prevention, particularly among older adults and high-risk patients. Typically prescribed in 75–100 mg doses, low-dose enteric-coated aspirin helps reduce the risk of heart attacks and strokes while minimizing gastrointestinal side effects, making it ideal for long-term daily use. Its role in secondary prevention, especially after cardiac events or procedures, has solidified its presence in clinical guidelines across major healthcare systems. Additionally, strong physician recommendations, over-the-counter availability, and growing awareness of heart health have further boosted its adoption globally.

Aspirin Enteric-Coated Tablets Market By Product Type, 2024-2034 (USD Billion)

| By Product Type |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| High-Dose |

0.17 |

0.17 |

0.18 |

0.19 |

0.20 |

0.21 |

0.22 |

0.24 |

0.25 |

0.26 |

0.27 |

| Low-Dose |

0.91 |

0.95 |

1.00 |

1.06 |

1.11 |

1.17 |

1.23 |

1.29 |

1.36 |

1.43 |

1.51 |

| Regular-Dose |

0.58 |

0.61 |

0.64 |

0.67 |

0.71 |

0.74 |

0.78 |

0.82 |

0.87 |

0.91 |

0.96 |

Application Insights

Why Did the Cardiovascular Diseases Segment Dominate the Aspirin Enteric-Coated Tablets Market in 2024?

The cardiovascular disease segment dominated the market with the largest share in 2024. This is mainly due to aspirin’s critical role as a low-cost, effective antiplatelet agent used to reduce the risk of heart attacks and strokes. Its widespread inclusion in global clinical guidelines for secondary prevention, particularly among high-risk and elderly patients, drives consistent demand for long-term daily use. The enteric-coated formulation is especially preferred in this segment to minimize gastrointestinal side effects, enhancing patient adherence. Additionally, the increased global prevalence of cardiovascular diseases, coupled with heightened awareness of preventive healthcare, further solidifies this segment's leading market position.

- According to WHO, cardiovascular diseases (CVDs) are the leading cause of death globally, taking an estimated 17.9 million lives each year. CVDs were the leading cause of death globally in 2022, accounting for 19.8 million deaths—or 32% of all deaths. Heart attacks and strokes made up 85% of these cases.

The pain relief segment is expected to grow at the fastest rate in the upcoming period. This is mainly due to increasing awareness of aspirin’s effectiveness in managing mild to moderate pain. The enteric coating helps reduce gastrointestinal side effects, making it a safer choice for long-term pain management. Additionally, the rising prevalence of chronic pain conditions and the preference for over-the-counter pain relief options contribute to its growth. Growing consumer demand for safer, easy-to-use analgesics further accelerates this segment’s expansion.

Aspirin Enteric-Coated Tablets Market By Application, 2024-2034 (USD Billion)

| By Application |

Share (2024 Baseline) |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Cardiovascular Diseases |

0.50 |

0.83 |

0.87 |

0.91 |

0.96 |

1.01 |

1.06 |

1.12 |

1.18 |

1.24 |

1.30 |

1.37 |

| Inflammatory Conditions |

0.15 |

0.25 |

0.26 |

0.27 |

0.29 |

0.30 |

0.32 |

0.34 |

0.35 |

0.37 |

0.39 |

0.41 |

| Others |

0.05 |

0.08 |

0.09 |

0.09 |

0.10 |

0.10 |

0.11 |

0.11 |

0.12 |

0.12 |

0.13 |

0.14 |

| Pain Relief |

0.30 |

0.50 |

0.52 |

0.55 |

0.58 |

0.61 |

0.64 |

0.67 |

0.71 |

0.74 |

0.78 |

0.82 |

By Consumer / Patient Type Insights

How Does the Adults Segment Contributed the Largest Market Share in 2024?

The adults segment held the largest share of the aspirin enteric-coated tablets market in 2024 because adults represent the largest population group prescribed aspirin for cardiovascular disease prevention and pain management. This age group has a higher prevalence of conditions like heart attacks, strokes, and chronic pain, driving consistent demand. Additionally, adults are more likely to self-medicate with over-the-counter aspirin products, boosting market sales. The enteric-coated formulation is preferred by adults to minimize gastrointestinal side effects during long-term use.

The senior citizens/aged population segment is expected to grow at the fastest CAGR in the coming years due to the increasing prevalence of cardiovascular diseases and related health conditions in older adults. This group often requires long-term aspirin therapy for prevention of heart attacks and strokes, making safer formulations like enteric-coated tablets highly desirable to reduce gastrointestinal risks. Additionally, greater health awareness and improved access to healthcare services among the elderly are driving demand. The aging global population further fuels the growth of this segment as more seniors seek effective and tolerable cardiovascular treatments.

Aspirin Enteric-Coated Tablets Market By Consumer / Patient Type, 2024-2034 (USD Billion)

| By Consumer / Patient Type |

Share (2024 Baseline) |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Adults |

0.60 |

0.99 |

1.04 |

1.10 |

1.15 |

1.21 |

1.28 |

1.34 |

1.41 |

1.49 |

1.56 |

1.64 |

| Pediatric / Children |

0.10 |

0.17 |

0.17 |

0.18 |

0.19 |

0.20 |

0.21 |

0.22 |

0.24 |

0.25 |

0.26 |

0.27 |

| Senior Citizens / Aged Population |

0.30 |

0.50 |

0.52 |

0.55 |

0.58 |

0.61 |

0.64 |

0.67 |

0.71 |

0.74 |

0.78 |

0.82 |

By Distribution Channel Insights

Why Did the Retail Pharmacies Segment Lead the Market in 2024?

The retail pharmacies segment led the aspirin enteric-coated tablets market in 2024 due to their broad accessibility and convenience for consumers seeking preventive and maintenance therapies. Many patients prefer purchasing low-dose aspirin directly from retail pharmacies without the need for a prescription, particularly for cardiovascular disease prevention. The widespread availability of OTC enteric-coated formulations makes it easier for individuals to manage their long-term heart health while minimizing gastrointestinal side effects. Additionally, strong brand presence, pharmacist recommendations, and cost-effective pricing further support consumer trust and usage through this channel.

The online pharmacies segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing adoption of e-commerce and digital health platforms. Consumers are increasingly turning to online pharmacies for the convenience of home delivery, especially for chronic medications like low-dose aspirin used in long-term cardiovascular prevention. The shift toward digital purchasing was accelerated by the COVID-19 pandemic and continues to be supported by rising internet penetration, mobile app usage, and improved logistics networks. Additionally, online platforms often offer competitive pricing, subscription models, and access to a wider range of brands and formulations. As consumers prioritize convenience, privacy, and affordability, the online channel is poised for rapid and sustained growth.

Aspirin Enteric-Coated Tablets Market By Distribution Channel, 2024-2034 (USD Billion)

| By Distribution Channel |

Share (2024 Baseline) |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Hospital Pharmacies |

0.20 |

0.33 |

0.35 |

0.37 |

0.38 |

0.40 |

0.43 |

0.45 |

0.47 |

0.50 |

0.52 |

0.55 |

| Online Pharmacies |

0.25 |

0.41 |

0.43 |

0.46 |

0.48 |

0.51 |

0.53 |

0.56 |

0.59 |

0.62 |

0.65 |

0.68 |

| Others |

0.05 |

0.08 |

0.09 |

0.09 |

0.10 |

0.10 |

0.11 |

0.11 |

0.12 |

0.12 |

0.13 |

0.14 |

| Retail Pharmacies |

0.50 |

0.83 |

0.87 |

0.91 |

0.96 |

1.01 |

1.06 |

1.12 |

1.18 |

1.24 |

1.30 |

1.37 |

By Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the aspirin enteric-coated tablets market while holding the largest share in 2024. The region’s dominance is primarily attributed to its well-established healthcare infrastructure, high awareness of cardiovascular disease prevention, and widespread use of over-the-counter medications. The region has a large ageing population, which drives consistent demand for low-dose, long-term aspirin therapy, especially in enteric-coated form to minimize gastrointestinal risks. Furthermore, favorable regulatory environments, strong physician recommendations, and the easy availability of branded and generic products through retail and online pharmacies support high market penetration. The presence of major pharmaceutical companies and ongoing investment in preventive healthcare also contribute to North America's market leadership.

The U.S. is a major contributor to the North American aspirin enteric-coated tablets market due to its high prevalence of cardiovascular diseases, widespread awareness of preventive healthcare, and the easy availability of low-dose aspirin as an over-the-counter medication. Additionally, the U.S. has a strong pharmaceutical industry, robust retail and online pharmacy networks, and a large ageing population, all of which fuel consistent demand for enteric-coated formulations. Supportive clinical guidelines and healthcare provider recommendations further reinforce aspirin's role in long-term cardiovascular care.

- In January 2025, a U.S. based Preeclampsia Foundation and NY based Patients & Purpose partnered and launched GAP—SPIRIN, an educational campaign promoting low-dose aspirin to prevent preeclampsia and address maternal health equity. Preeclampsia affects 5-8% of pregnancies and is 60% more common among Black expectant mothers. The campaign was announced on January 23rd on Maternal Health Awareness Day.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for aspirin enteric-coated tablets. This is due to the rising burden of cardiovascular diseases, fueled by ageing populations, sedentary lifestyles, and increasing rates of diabetes and hypertension. As healthcare infrastructure improves across countries like China, India, and Southeast Asian nations, access to preventive therapies like low-dose aspirin is expanding significantly. Growing public health awareness, along with government initiatives focused on non-communicable disease management, is driving demand for safer formulations such as enteric-coated tablets. Additionally, the rise of e-commerce is making these products more accessible to a broader population.

China is a major player in the Asia Pacific aspirin enteric-coated tablets market due to its large ageing population, increasing prevalence of cardiovascular diseases, and rapidly expanding healthcare infrastructure. With growing awareness of preventive health and the widespread use of low-dose aspirin for heart disease management, demand for enteric-coated formulations is rising significantly. The government's focus on improving access to essential medicines and expanding health insurance coverage also supports broader adoption. Additionally, the growth of e-commerce and OTC drug availability has made aspirin more accessible to rural and urban populations alike.

Region-Wise Market Outlook

| Region |

Market Size (2024) |

Projected CAGR (2024 2035) |

Growth Factors |

Restraints |

Growth Overview |

| North America |

USD 0.7 billion |

5.79% |

High cardiovascular disease prevalence; strong healthcare infrastructure; well-established OTC & preventive care usage |

Concerns over bleeding risks, competition from newer cardiovascular/antiplatelet drugs, and regulatory scrutiny |

Dominant in 2024; steady growth expected as preventive healthcare continues, and awareness rises |

| Europe |

USD 0.5 billion |

6.5% |

Ageing populations, strong public health policies for cardiovascular disease prevention, and awareness of GI safety |

Regulatory barriers, high healthcare costs, stricter labelling/warnings, and less OTC flexibility in some countries |

Mature market with consistent growth |

| Asia Pacific |

USD 0.4 billion |

9.63% |

Rapidly growing middle class; increasing CVD burden; improving access to healthcare; rising OTC & self-medication |

Price sensitivity; infrastructure gaps (especially in rural areas); regulatory variability; concerns over safety for long-term use |

Fastest growing region |

| Latin America |

USD 0.1 billion |

6.5% |

Increasing healthcare spending, growing burden of cardiovascular diseases, and improving OTC access |

Economic instability, lower per capita income, weak regulatory enforcement, and distribution challenges |

Moderate growth |

| Middle East & Africa (MEA) |

USD 0.1 billion |

0% |

Urbanization, increasing awareness of non-communicable diseases, and expanding healthcare infrastructure in Gulf states |

Low access in remote regions; regulatory hurdles; limited awareness; cost barriers |

Emerging and nascent market |

Aspirin Enteric-Coated Tablets Market Value Chain Analysis

1.R&D

The aspirin enteric-coated tablets market involves advancements in coating materials and controlled-release technologies, which are enhancing drug effectiveness and patient adherence. The market is also seeing trends towards personalised medicine and increased over-the-counter availability.

- Key players: Bayer AG, GlaxoSmithKline plc (GSK), and AstraZeneca PLC.

2. Clinical Trial Planning & Regulatory Approval

The aspirin enteric-coated tablets market focuses on safety and efficacy, especially regarding gastrointestinal (GI) events, but existing evidence suggests ECA may not effectively prevent GI complications and can reduce aspirin's platelet inhibition efficacy compared to uncoated aspirin

3. Patient Support and Services.

Improving patient adherence, managing gastrointestinal side effects, and offering accessible purchasing options.

- Key players: Perrigo Company plc, Allegiant Health, and LNK International, Inc.

Aspirin Enteric-Coated Tablets Market Companies

1. Bayer AG

Bayer is one of the original aspirin pioneers and continues to lead in branding, R&D, and global reach, offering both standard and enteric-coated formulations. Its strong market presence and reputation help sustain high consumer trust, particularly in preventive cardiovascular therapy.

2. Pfizer Inc.

Pfizer leverages its extensive global distribution network and experience in both prescription and OTC medications to push enteric-coated aspirin products in multiple markets. Its investments in improving formulation and patient safety foster its competitive positioning, especially in developed countries.

3. GlaxoSmithKline plc (GSK)

GSK provides enteric-coated aspirin products, often bundled with a strong, established OTC presence, which helps it reach consumers seeking safer aspirin options. Their marketing, regulatory compliance, and global operations support its role in both the pharmaceutical and consumer health segments.

4. Sanofi S.A.

Sanofi contributes via its R&D, formulations, and its global reach in preventive healthcare, including aspirin for cardiovascular protection. It also focuses on product differentiation (e.g., coating technologies) to improve gastrointestinal tolerability, thus appealing to long-term users.

5. Teva Pharmaceutical Industries Ltd.

Teva plays an important role by producing generic and enteric-coated aspirin options at competitive prices, facilitating access in price-sensitive markets. Their scale in manufacturing and regulatory approvals across many geographies helps in broadening the market’s reach.

6. Dr Reddy’s Laboratories

Dr Reddy’s focuses on generic formulations, often targeting emerging markets, enabling wider access to enteric-coated aspirin. They also emphasise cost efficiency and distribution partnerships to penetrate rural or less affluent regions.

7. Mylan N.V.

Mylan provides generic aspirin products, including enteric-coated versions, which help keep prices competitive and support massâ€market penetration. Their strength lies in supply chain efficiency and wide OTC availability.

8. Novartis AG

While not always leading in the aspirin segment specifically, Novartis contributes via its strong global footprint and capacity to leverage its regulatory and marketing resources to support enteric coated formulations. Their involvement ensures high visibility of such products in multiple therapeutic and preventive healthcare channels.

Recent Developments

- In August 2025, Bayer announced that the Aspirina, the leading pain relief brand in Mexico, is now available in the U.S., offering a familiar and trusted option to the Hispanic community. With a strong focus on serving Hispanic consumers, Aspirina aims to deliver accessible and effective pain relief.

- In April 2023, Pharmacy Health (Australia) introduced a new formulation of Low Dose Aspirin 100 mg Enteric-Coated Tablet (blister pack) under ARTG for 2023–24.

Segments Covered in the Report

By Product Type

- Low-Dose

- Regular-Dose

- High-Dose

By Application

- Cardiovascular Diseases

- Pain Relief

- Inflammatory Conditions

- Others

By Consumer / Patient Type

- Adults

- Senior Citizens / Aged Population

- Pediatric / Children

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

By Product Type

- Table 1: U.S. Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 2: Canada Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 3: Germany Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 4: France Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 5: UK Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 6: Italy Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 7: China Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 8: Japan Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 9: South Korea Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 10: India Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 11: Brazil Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 12: Turkey Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 13: GCC Countries Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

- Table 14: Africa Aspirin Enteric-Coated Tablets Market Size, by Product Type (USD Billion)

By Application

- Table 15: Country-wise Aspirin Enteric-Coated Tablets Market Size, by Application (USD Billion)

By Consumer / Patient Type

- Table 16: Country-wise Aspirin Enteric-Coated Tablets Market Size, by Consumer/Patient Type (USD Billion)

By Distribution Channel

- Table 17: Country-wise Aspirin Enteric-Coated Tablets Market Size, by Distribution Channel (USD Billion)

By Product Type

- Figure 1: Country-wise Aspirin Enteric-Coated Tablets Market Share, by Product Type (%)

By Application

- Figure 2: Country-wise Aspirin Enteric-Coated Tablets Market Share, by Application (%)

By Consumer / Patient Type

- Figure 3: Country-wise Aspirin Enteric-Coated Tablets Market Share, by Consumer/Patient Type (%)

By Distribution Channel

- Figure 4: Country-wise Aspirin Enteric-Coated Tablets Market Share, by Distribution Channel (%)

By Region

- Figure 5: North America Aspirin Enteric-Coated Tablets Market Size & Forecast (USD Billion)

- Figure 6: Europe Aspirin Enteric-Coated Tablets Market Size & Forecast (USD Billion)

- Figure 7: Asia Pacific Aspirin Enteric-Coated Tablets Market Size & Forecast (USD Billion)

- Figure 8: Latin America Aspirin Enteric-Coated Tablets Market Size & Forecast (USD Billion)

- Figure 9: Middle East & Africa Aspirin Enteric-Coated Tablets Market Size & Forecast (USD Billion)