Autologous Cell Therapy Market Size and Growth

The global autologous cell therapy market size was exhibited at USD 8.35 billion in 2023 and is projected to hit around USD 49.21 billion by 2033, growing at a CAGR of 19.41% during the forecast period 2024 to 2033.

.webp)

Autologous Cell Therapy Market Key Takeaways:

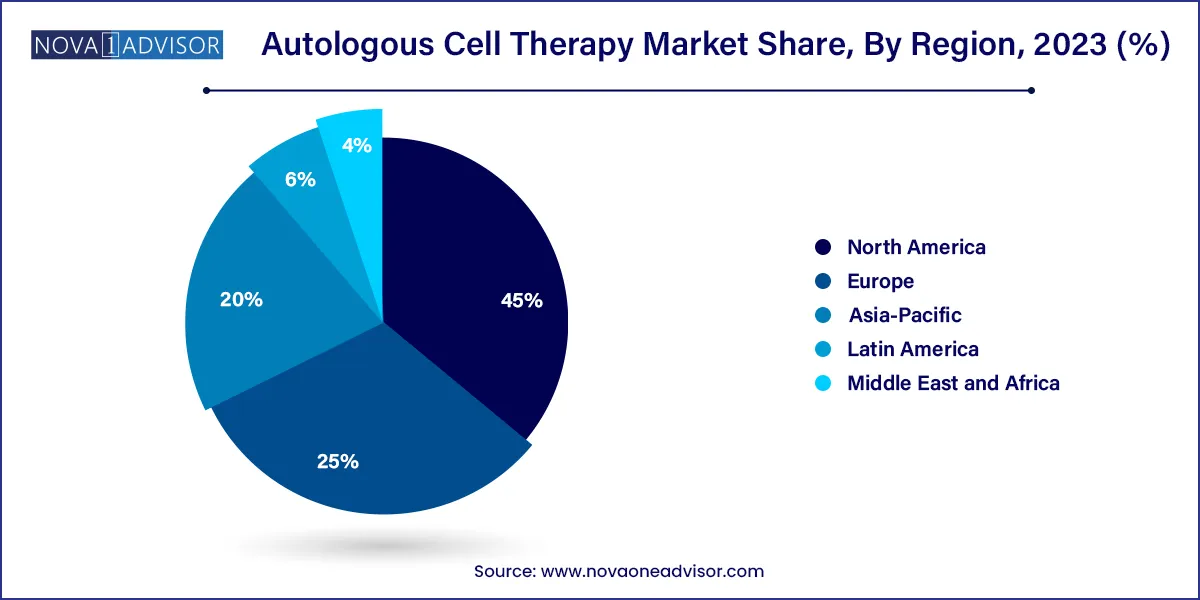

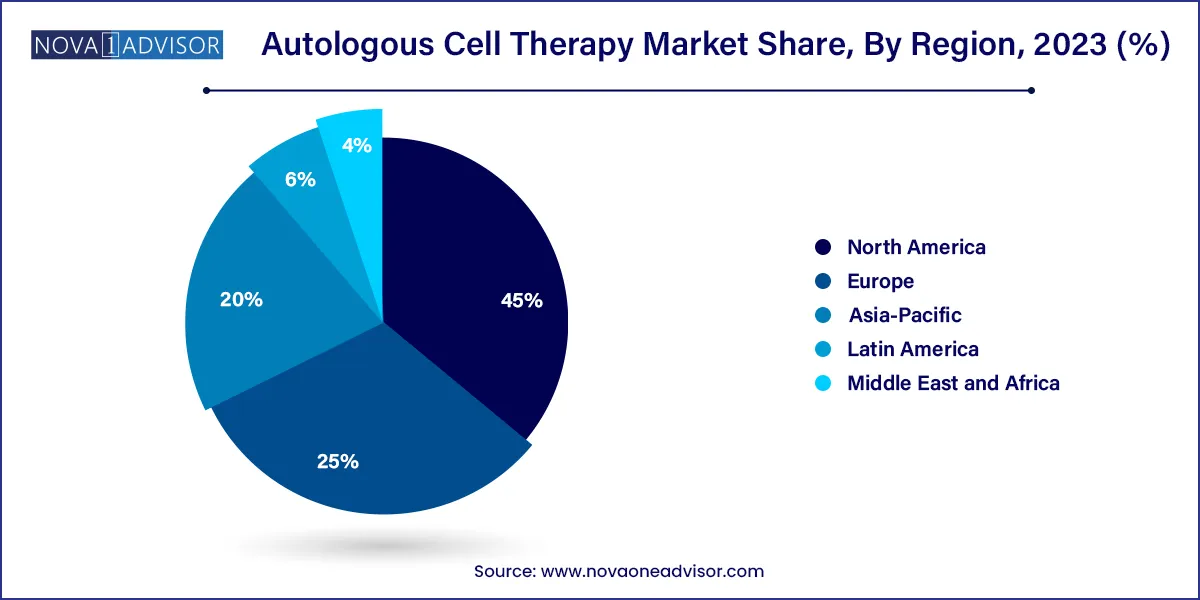

- North America dominated the autologous cell therapy market with a revenue share of 45.0% in 2023.

- In terms of revenue, the bone marrow segment dominated the market with a share of over 42.9% in 2023.

- In terms of revenue, the cancer segment dominated the market with a share of over 20.7% in 2023.

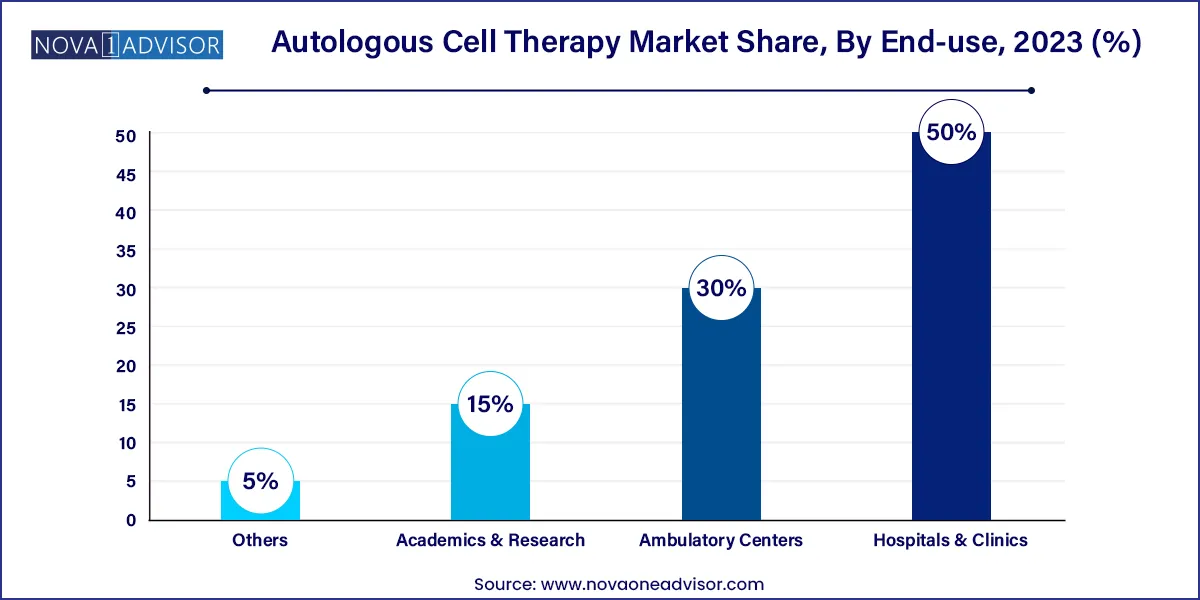

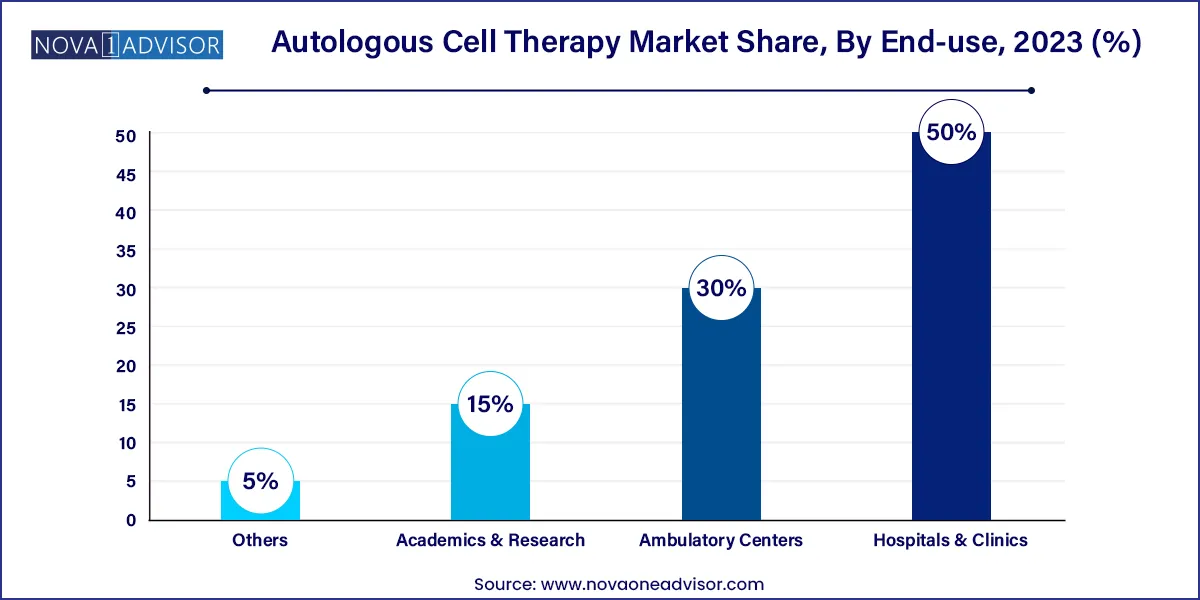

- In terms of revenue, the hospitals & clinics segment dominated the market with a share of over 50.0% in 2023.

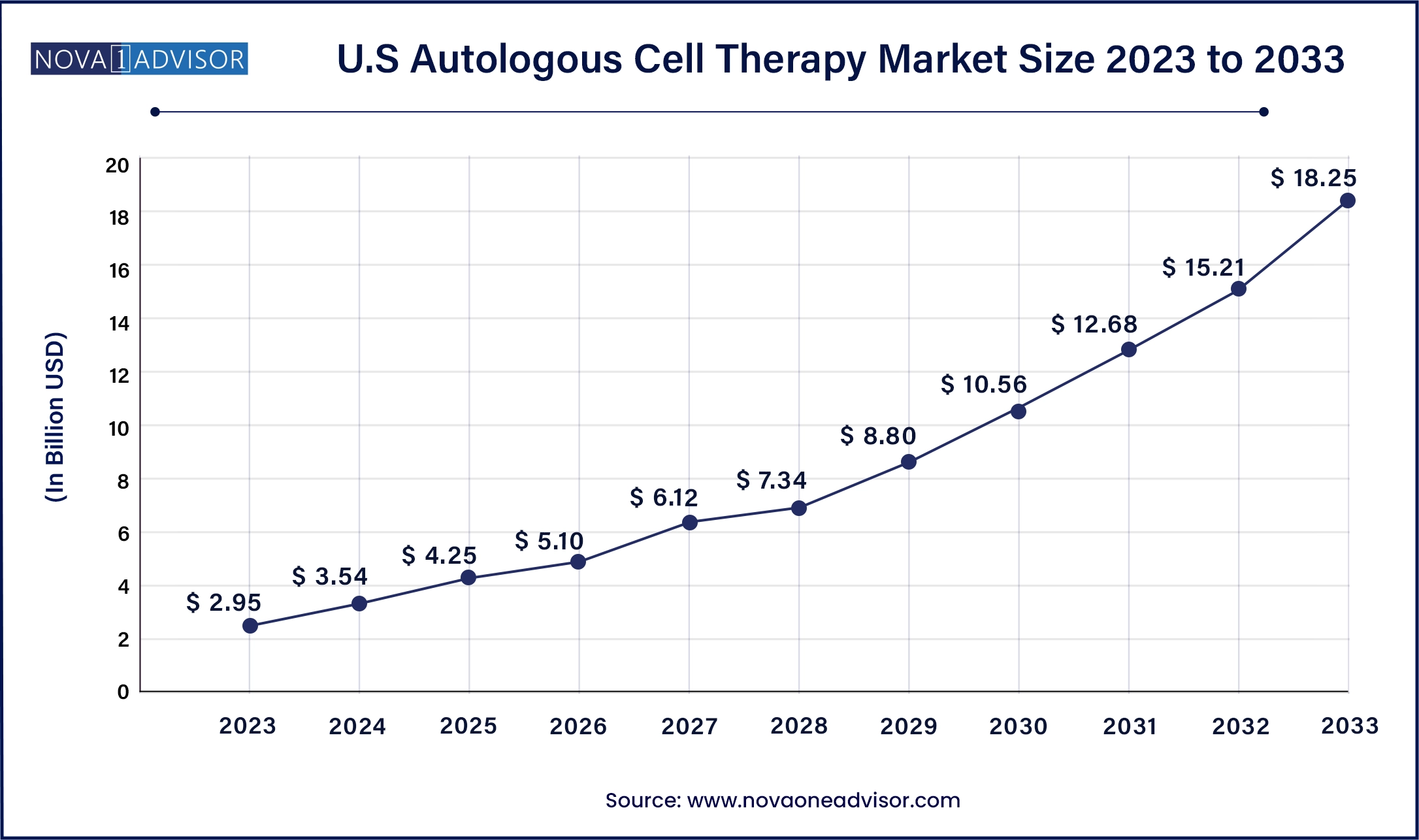

U.S. Autologous Cell Therapy Market Size and Growth 2024 to 2033

The U.S Autologous Cell Therapy market size was valued at USD 2.95 billion in 2023 and is anticipated to reach around USD 18.25 billion by 2033, growing at a CAGR of 19.99% from 2024 to 2033.

North America leads the global autologous cell therapy market, underpinned by a robust healthcare system, early adoption of cutting-edge therapies, and proactive regulatory frameworks. The U.S. Food and Drug Administration (FDA) has established pathways for regenerative medicine advanced therapies (RMAT), facilitating quicker approvals for autologous treatments. Moreover, major pharmaceutical players like Bristol Myers Squibb, Novartis, and Kite Pharma have invested heavily in autologous therapy development and commercialization.

In Canada, the government supports regenerative medicine research through institutions like the Centre for Commercialization of Regenerative Medicine (CCRM), accelerating clinical translation. Public awareness and high per capita healthcare expenditure further contribute to the region’s market dominance. In 2023, over 60% of all global CAR-T therapy patients were treated in North American centers, exemplifying the region’s leadership.

Asia-Pacific is the fastest-growing region in the autologous cell therapy market, driven by increasing healthcare investment, large patient pools, and expanding medical tourism. Countries like Japan and South Korea have enacted progressive regulatory frameworks to foster cell therapy innovation. For instance, Japan’s Act on the Safety of Regenerative Medicine enables conditional and time-limited approval of regenerative products, accelerating market entry.

In China, substantial funding has been channeled into regenerative medicine research under the “Made in China 2025” initiative. With more than 100 registered cell therapy clinical trials, China is quickly becoming a major global player. Additionally, the availability of cost-effective cell processing facilities and government support is enabling local firms to scale. India, with its rising biotech startup ecosystem, is also contributing to regional momentum, especially in the orthopedics and wound care domains.

Market Overview

Autologous cell therapy has emerged as a transformative approach in the realm of regenerative medicine and personalized healthcare. This therapy involves using a patient’s own cells to treat diseases, reducing the risk of immune rejection and the need for immunosuppressants. By leveraging the body's inherent healing potential, autologous therapies are becoming increasingly relevant in treating complex, chronic, and previously intractable medical conditions such as cancer, autoimmune diseases, neurodegenerative disorders, and orthopedic injuries.

Unlike allogeneic therapies that involve donor cells, autologous cell therapy ensures biological compatibility, minimizes ethical concerns, and accelerates patient-specific treatment. The market for autologous cell therapy has gained significant momentum over the past decade due to a convergence of technological innovations in stem cell harvesting, processing, and delivery. A surge in clinical trials, FDA approvals, and expanding applications across medical disciplines have also broadened the commercial potential of these therapies.

In oncology, autologous cell therapies such as CAR-T cell treatments (e.g., Kymriah and Yescarta) have demonstrated remarkable efficacy against hematological malignancies. Similarly, mesenchymal stem cell therapies derived from bone marrow or adipose tissue are increasingly utilized in orthopedic and cardiovascular applications. As the cost of cell processing technologies declines and personalized medicine garners greater attention from policymakers and investors, autologous cell therapy is poised for exponential growth.

Major Trends in the Market

-

Expansion of Point-of-Care Manufacturing Facilities: Hospitals and research centers are adopting closed-system manufacturing units for on-site cell therapy preparation, reducing turnaround time.

-

Increased FDA and EMA Approvals for Autologous Therapies: Recent years have seen a surge in regulatory approvals, particularly in oncology and musculoskeletal conditions.

-

Rising Integration with AI and Machine Learning: AI is being used to optimize cell quality prediction, patient stratification, and therapy personalization.

-

3D Bioprinting for Autologous Tissue Engineering: Innovations in bioprinting are enabling the creation of customized tissue scaffolds using patients' cells.

-

Growth in Cryopreservation Techniques: Advanced cryogenic technologies are facilitating longer storage and transportation of harvested cells without loss of potency.

-

Shift Toward Decentralized Trials and Home-Based Monitoring: Especially post-COVID-19, remote patient monitoring systems are being incorporated into autologous therapy trials.

-

Collaborations Between Pharma and Biotech Startups: Large pharmaceutical companies are partnering with startups to co-develop autologous therapies and scale commercial manufacturing.

Autologous Cell Therapy Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 8.15 Billion |

| Market Size by 2033 |

USD 9.97 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 19.41% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Source, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BrainStorm Cell Therapeutics; Holostem Terapie Avanzate S.R.L; Pharmicell Co. Inc; Opexa Therapeutics; Caladrius Biosciences Inc; U.S. Stem Cell Inc; Lonza; Bristol Myers Squibb; Novartis; Autolus therapeutics; Tego Science; Corning Incorporated; Bio Elpida; Vericel Corporation; Catalent, Inc; Sartorius AG . |

Key Market Driver: Rising Prevalence of Chronic and Degenerative Diseases

The increasing incidence of chronic illnesses and degenerative disorders globally is a major driver propelling the autologous cell therapy market. Conditions such as cancer, Parkinson’s disease, multiple sclerosis, and osteoarthritis are on the rise due to aging populations and lifestyle changes. Conventional treatments often fail to provide long-term remission or cure, creating an urgent need for innovative solutions.

Autologous therapies offer a paradigm shift by enabling tissue regeneration, immune modulation, and disease reversal. For instance, in patients with ischemic heart conditions, autologous mesenchymal stem cell therapy has shown promising results in regenerating damaged myocardium. Similarly, in multiple sclerosis, autologous hematopoietic stem cell transplantation (AHSCT) is demonstrating higher remission rates compared to standard immunosuppressive drugs. The personalized nature of these therapies is also aligned with precision medicine initiatives being adopted worldwide, further accelerating demand.

Key Market Restraint: High Cost and Complexity of Therapy

Despite the therapeutic advantages, the high cost and logistical complexity associated with autologous cell therapy limit its widespread adoption. The process of harvesting, culturing, modifying, and reinfusing a patient’s cells involves sophisticated technologies and a highly regulated infrastructure. Each therapy must be customized, making it inherently resource-intensive and time-consuming.

For instance, CAR-T therapies can cost upwards of $350,000 per patient, excluding hospitalization and ancillary treatments. This price barrier makes access challenging for patients in developing regions or those lacking comprehensive insurance coverage. Additionally, quality assurance and reproducibility across batches are difficult to standardize, especially in decentralized healthcare settings. To overcome these challenges, innovation in scalable manufacturing, automated cell processing, and government subsidies will be crucial.

Key Market Opportunity: Expansion into Non-Oncology Indications

While oncology remains a dominant application, a major opportunity lies in expanding autologous cell therapy into non-oncology indications such as orthopedics, cardiology, and autoimmune diseases. The application of mesenchymal stem cells (MSCs) and chondrocytes is already gaining traction in conditions like osteoarthritis, Crohn’s disease, and myocardial infarction.

Clinical trials have shown that injecting autologous MSCs into the knees of patients with degenerative joint disease results in pain reduction and cartilage regeneration. Similarly, cardiac cell therapy using autologous bone marrow cells has demonstrated improvement in ejection fraction among post-MI patients. The growing body of evidence supporting such treatments, along with increased regulatory openness toward accelerated approvals, makes non-oncology domains a fertile ground for commercial expansion.

Autologous Cell Therapy Market By Source Insights

Bone Marrow dominated the source segment, owing to its historical role in autologous cell therapy and its richness in hematopoietic and mesenchymal stem cells. Bone marrow-derived cells are widely used in hematological malignancies, cardiovascular therapies, and orthopedic interventions. Their proven efficacy and established extraction protocols make them the most utilized source. Institutions across the U.S. and Europe continue to prioritize bone marrow cell therapies due to the volume of supporting clinical data and regulatory familiarity.

Mesenchymal Stem Cells (MSCs) are projected to be the fastest-growing source. MSCs can be harvested from bone marrow, adipose tissue, and umbilical cords, and they exhibit strong immunomodulatory and regenerative properties. Their low immunogenicity and versatility in treating autoimmune, orthopedic, and neurological conditions make them highly attractive. The ability to culture and expand MSCs with high yields in vitro has further supported their scalability for clinical applications.

Autologous Cell Therapy Market By Application Insights

Cancer continues to dominate the application segment, driven by the revolutionary impact of autologous CAR-T cell therapies for hematological cancers. Therapies like Novartis' Kymriah and Gilead's Yescarta have set benchmarks by achieving durable remissions in relapsed leukemia and lymphoma patients. The integration of genetic engineering to enhance targeting and persistence of autologous T-cells has significantly improved therapeutic outcomes, pushing oncology to the forefront of this market.

Wound Healing is emerging as one of the fastest-growing applications. In cases of diabetic foot ulcers and pressure sores, autologous platelet-rich plasma (PRP) and stem cell-enriched grafts have shown accelerated healing and reduced infection rates. Advanced hospitals and trauma centers are increasingly utilizing patient-derived epidermal and dermal cells to regenerate skin and underlying tissues. This segment is expected to gain momentum, particularly with the rise of chronic wounds in aging and diabetic populations.

Autologous Cell Therapy Market By End-use Insights

Hospitals & Clinics dominate the end-use segment, primarily due to their infrastructure, skilled workforce, and compliance capabilities necessary for performing complex autologous procedures. Academic medical centers and tertiary hospitals often collaborate with biotech firms to deliver advanced cell therapies under clinical trials and compassionate use programs. Their ability to house specialized laboratories, clean rooms, and cryopreservation units enhances patient access and procedural safety.

Academics & Research institutions are forecasted to be the fastest-growing end-use segment. These centers serve as innovation hubs where new protocols are developed, pre-clinical trials are conducted, and translational medicine is advanced. Government grants, industry-academic partnerships, and the emergence of university-affiliated biotech incubators are contributing to this growth. Institutions like Stanford, Harvard, and Karolinska Institute are pioneering autologous therapies beyond oncology, broadening the research landscape.

Autologous Cell Therapy Market Recent Developments

-

In March 2024, Kite Pharma (a Gilead company) announced expanded FDA approval for its CAR-T therapy “Yescarta” to treat relapsed follicular lymphoma, reinforcing the dominance of autologous therapies in cancer care.

-

In February 2024, Vericel Corporation received FDA fast-track designation for its autologous chondrocyte implantation product “MACI” for treating degenerative cartilage lesions, with trials expanding to pediatric use.

-

In January 2024, Celularity Inc. initiated a collaboration with South Korea-based GC Cell to co-develop autologous cell therapies targeting osteoarthritis and autoimmune disorders, signaling growing global partnerships.

-

In December 2023, BrainStorm Cell Therapeutics received EMA approval to commence Phase III trials in Europe for its autologous mesenchymal cell therapy for amyotrophic lateral sclerosis (ALS).

-

In October 2023, Novartis announced an investment of $250 million into expanding its autologous cell therapy manufacturing facility in New Jersey, aiming to meet global demand for Kymriah and future pipeline therapies.

Some of the prominent players in the Autologous cell therapy market include:

- BrainStorm Cell Therapeutics

- Holostem Terapie Avanzate S.R.L

- Pharmicell Co. Inc

- Opexa Therapeutics

- Caladrius Biosciences Inc

- U.S. Stem Cell Inc

- Lonza

- Bristol Myers Squibb

- Novartis

- Autolus therapeutics

- Tego Science

- Corning Incorporated

- Bio Elpida

- Vericel Corporation

- Catalent, Inc

- Sartorius AG

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global autologous cell therapy market.

Source

- Bone Marrow

- Epidermis

- Mesenchymal Stem Cells

- Haematopoietic Stem Cells

- Chondrocytes

- Others

Application

- Cancer

- Neurodegenerative Disorders

- Cardiovascular Disorders

- Autoimmune Disorders

- Orthopedics

- Wound Healing

- Others

End-use

- Hospitals & Clinics

- Ambulatory Centers

- Academics & Research

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.webp)