Automated Compounding System Market Size and Trends

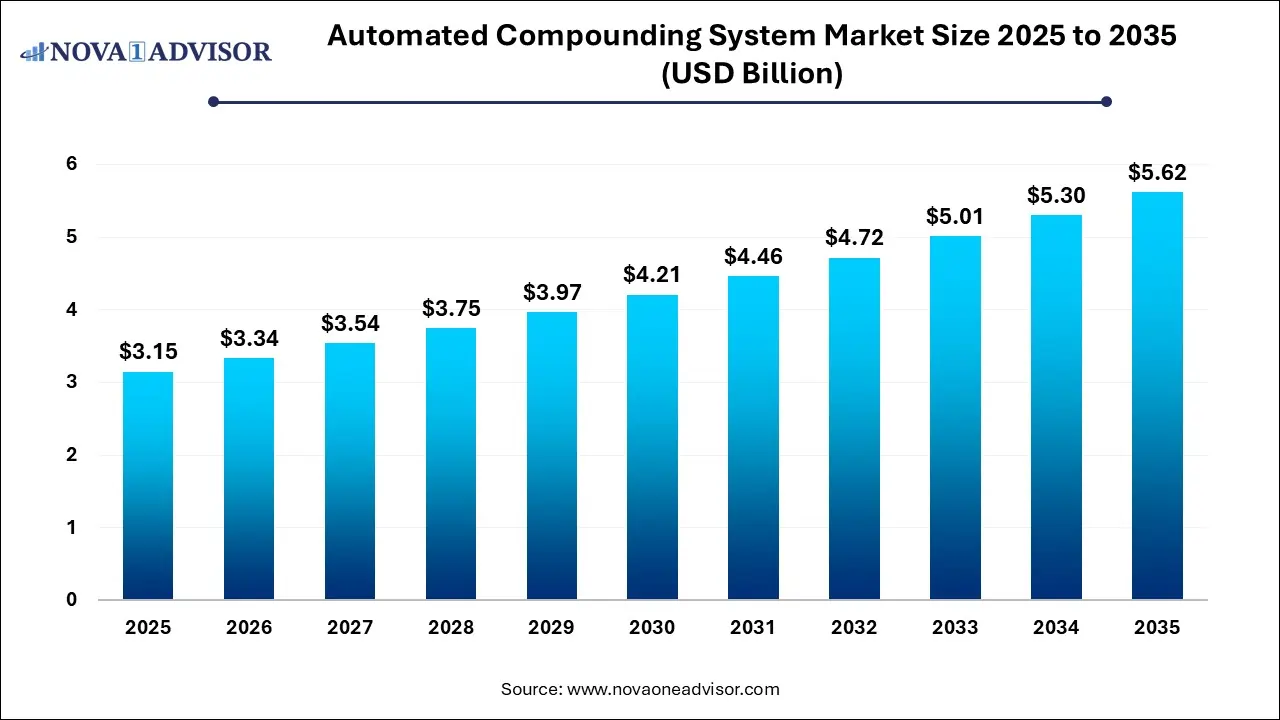

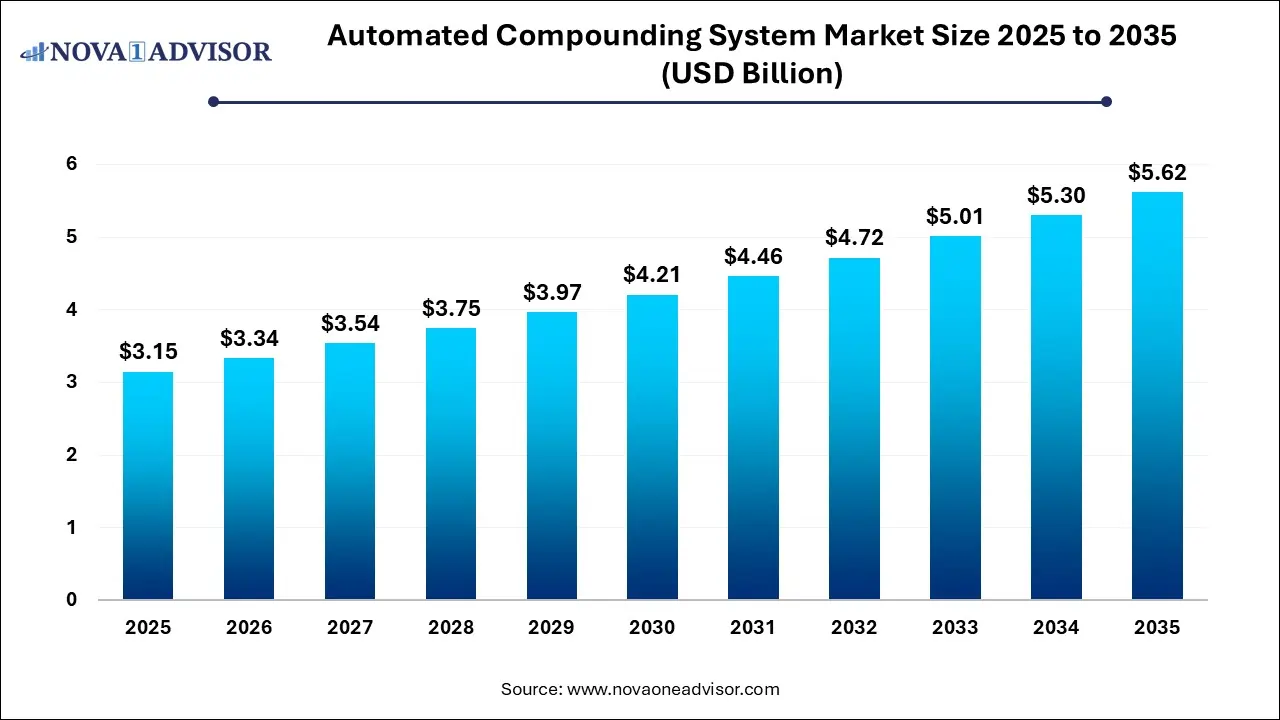

The global automated compounding systems market size is calculated at USD 3.15 billion in 2025, grows to USD 3.34 billion in 2026, and is projected to reach around USD 5.62 billion by 2035, registering a CAGR of 5.94% from 2026 to 2035. The automated compounding systems market growth can be linked to strict regulatory requirements, increased demand for sterile compounded medications, technological innovations and focus on improving patient safety.

Automated Compounding Systems Market Key Takeaways

- North America dominated the global automated compounding systems market in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By type, the centralized automated compounding systems segment dominated the market with the largest share in 2025.

- By type, the decentralized automated compounding systems segment is expected to show the fastest growth over the forecast period.

- By dosage form, the oral solid dosage forms segment held the biggest market share in 2025.

- By dosage form, the parenteral dosage forms segment is expected to show the fastest growth during the forecast period.

- By application, the pharmaceutical industry segment accounted for the highest market share in 2025.

- By application, the nutraceutical industry segment is expected to expand rapidly during the predicted timeframe.

- By technology, the gravimetric dosing systems segment generated the highest revenue in the market in 2025.

- By technology, the hybrid dosing systems segment is expected to grow at the fastest CAGR over the forecast period.

- By end-user, pharmaceutical manufacturers segment dominated the market with the largest revenue in 2025.

- By end-user, contract research organizations segment is expected to register fast growth over the forecast period.

How is the Automated Compounding Systems Market Expanding?

Automated compounding systems (ACSs) refer to systems utilizing technology for streamlining and improving medication preparing processes, especially those needing sterile compounding such as chemotherapy or Total Parenteral Nutrition (TPN). Enhanced accuracy and efficiency of workflows with minimized human errors, cost savings and mitigated contamination risks offered by automated compounding systems is driving their adoption for improving patient safety. Additionally, ongoing technological advancements such as sophisticated software algorithms and smart sensors in ACS, focus on personnel safety for handling hazardous drugs, drug shortages and growing emphasis on reducing medication errors are the factors driving the growth of the automated compounding systems market.

What are the Key Trends in the Automated Compounding Systems Market in 2025?

- In June 2025, CurifyLabs, a Finnish healthcare technology company, secured funding of €6.7 million for modernizing and automating the manufacturing processes of compounded medications, further making them safe and specifically tailored based individual patient needs.

- In April 2025, Qualthera Health Corporation, a builder of nationwide network of quality, patient-centered compounding pharmacies, officially launched Qualthera Pharmaceuticals Ltd. Co., a new R&D division focused on drug repurposing and innovative delivery systems by leveraging real-world patient insights for developing new therapies.

Can AI Enhance Applications in the Automated Compounding Systems Market?

Automated compounding systems integrated with artificial intelligence (AI) can significantly improve the accuracy, efficiency and safety of pharmaceutical preparations by reducing downtimes and optimizing workflows. AI-powered systems can be deployed for dose prediction and for checking medication interactions, further enhancing safety of medication regimens while reducing errors and optimizing treatment plans. Quality control processes can be streamlined by deploying AI algorithms for analyzing and monitoring the compounding process. Incorporation of AI in closed-system transfer devices (CSTDs) can potentially enhance sterility and minimize contamination risks.

Report Scope of Automated Compounding Systems Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 3.34 Billion |

| Market Size by 2035 |

USD 5.62 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.96% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Dosage Form, Application, Technology, End-User, Regional |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

AptarGroup Inc., Baxter International Inc., Bausch + Lomb Inc., Catalent Inc., Cytiva, DFE Pharma, Fedegari Group Spa., JMS Co. Ltd., Nuance Technologies Inc., Ompi S.p.A, Optima Pharma, Phoenix Group Ltd., Thermo Fisher Scientific Inc., Recipharm AB |

Market Dynamics

Drivers

Increased Emphasis on Personalized Medicine Approaches

Rising focus on addressing unique patient needs such as allergies or sensitivities, alternative delivery methods, catering pediatric and geriatric populations as well as development of specialized drug combinations for patients with rare diseases which is not met by mass produced pharmaceuticals is driving the demand for tailored treatments. Automated compounding systems can assist in preparing specific dosage combinations in various forms with increased precision and ensuing compliance with regulatory standards.

Restraints

High Capital Expenditure

Buying, installation and configuration of automated compounding systems can lead to significant upfront expenses for adopting and utilizing these systems, especially for small healthcare facilities in developing regions. Moreover, complexities in integrating these systems with existing hospital information systems, pharmacy management systems and electronic medical records can be quite challenging and requires specialized training and maintenance.

Opportunities

Ongoing Advancements in Automated Technologies

Development of closed-loop medication management systems is facilitating integration of automated compounding with electronic health records (EHRs), pharmacy information systems and patient monitoring devices are enabling real-time tracking of medications starting with compounding till administrations of medications, leading to enhanced patient safety and reduced medication errors. Integration of automated compounding systems with telemedicine supporting remote verification and dispensing of prescription as well as development of small, scalable and cost-effective ACS is creating lucrative opportunities for market growth.

Segmental Insights

How Centralized Automated Compounding Systems Segment Dominated the Market in 2025?

By type, the centralized automated compounding systems segment dominated the market in 2025. These systems offer several benefits such as enhanced efficiency and patient safety while mitigating errors. Central fill systems can streamline medical distribution processes which include automated dispensing, storage and retrieval. Rising number of prescription volumes, unification of automation with pharmacy management systems, real-time inventory tracking and increased prevalence of chronic diseases are the factors driving the market dominance of this segment.

By type, the decentralized automated compounding systems segment is expected to grow at the fastest rate over the forecast period. The market growth is driven by shift towards personalized medicine, need to comply with stringent regulatory frameworks, and focus on sterile compounding practices for enhancing the safety and accuracy of medicated preparations. Decentralized automated models streamline the compounding processes and also improve the efficiency of workflows by reducing errors and manual labor leading to potential cost savings and enhanced patient safety.

What Made Oral Solid Dosage Forms the Dominant Segment in 2025?

By dosage form, the oral solid dosage forms segment accounted for the largest market share in 2025. Increased patient preference towards oral solid dosage forms due to their ease of administration and availability of patient-friendly dosage forms such as orally disintegration tablets and chewable tablets is driving their demand in various patient populations from pediatric to geriatric class. Furthermore, demand for customized dosage forms, rising chronic disease burden, advancements in drug delivery technologies, adoption of continuous manufacturing processes and supportive regulatory environment are fuelling the market growth.

By dosage form, the parenteral dosage forms segment is expected to register the fastest growth over the forecast period. Automated systems offer a controlled environment with enhanced accuracy and streamlined compounding processes, ensuring strict sterility standards critical in the process of manufacturing parenteral dosage forms which can mitigate the risk of contaminations. Continuous technological advancements such as the development of remote monitoring devices and portable infusion pumps have improved the safety and management of home parenteral nutrition (HPN).

Why Did Pharmaceutical Industry Segment Dominate in 2025?

By application, the pharmaceutical industry segment held the highest market share in 2025. Increased emphasis on personalized treatment approaches, rising regulatory scrutiny, growing awareness among pharmacists as well as multitude of applications such as in chemotherapy and preparation of sterile and non-sterile formulations is driving the acceptance of automated compounding systems (ACS) in the pharmaceutical industry. Continuous technological advancements such as automation, robotics and software in ACS are enhancing the accuracy and efficiency of workflows.

By application, the nutraceutical industry segment is expected to show the fastest growth over the forecast period. Globally rising aging population with soaring healthcare costs is making consumers more health conscious leading to increased emphasis on preventive healthcare and adoption of dietary supplements. Proven health benefits of nutraceuticals, demand for tailored medications and formulations for specific patient needs, and advanced compounding techniques for developing innovative functional foods are boosting the market growth.

What Drives the Dominance of the Gravimetric Dosing Systems Segment?

By technology, the gravimetric dosing systems segment dominated the market with the largest revenue in 2025. High accuracy and reliability for measuring ingredients by weight offered by gravimetric dosing systems while ensuring patient safety and mitigating medication errors drives the adoption of these systems. Moreover, enhanced traceability, streamlined documentation processes, reduced waste and cost efficiency are enabled with the implementation of gravimetric dosing systems.

By technology, the hybrid dosing systems segment is predicted to show fastest market growth during the forecast period. Hybrid dosing systems leverage the precision of gravimetric systems for active pharmaceutical ingredients (APIs) and use volumetric systems addition of larger solvents or excipients offering enhanced flexibility and scalability for development of diverse formulations while ensuring compliance with regulatory standards.

Why Did the Pharmaceutical Manufacturers Segment Generate Highest Revenue in the Market in 2025?

By end-user, pharmaceutical manufacturers segment generated the highest revenue in the market in 2025. Increased emphasis of regulatory bodies on ensuring the safety, quality and sterility of compounded medications is driving the adoption of automated compounding systems by manufacturers to maintain a consistent, controlled and auditable environment ensuring compliance with current Good Manufacturing Practices (cGMP) and USP standards. Advancements in pharmaceutical R&D leading to increased complexity of drug formulations and focus on improving the scalability and cost-effectiveness of production processes are the factors driving the market growth of this segment.

By end-user, contract research organizations segment is expected to show the fastest growth during the predicted timeframe. Contract research organizations (CROs) offer specialized expertise as well as access to advanced technologies for operation, maintenance and are integrated with various other laboratory information management systems (LIMS) to their clients. Significant investments, increased collaborations and enhanced regulatory compliance provided by CROs is leading to accelerated drug development timelines.

Regional Insights

How is North America Dominating the Automated Compounding Systems Market?

North America dominated the global market with the largest share in 2025. Rising demand for personalized treatments, increased emphasis on mitigating medication errors in hospitals and compounding pharmacies and adoption of advanced technologies such as robotic compounding systems are the factors fuelling the region’s market dominance. Rigorous regulatory requirements published in the U.S. Pharmacopoeia (USP) is driving the adoption of automated compounding systems to ensure safety and accuracy in drug compounding practices.

Asia Pacific is expected to show the fastest CAGR in the market over the forecast period. The market growth can be linked to the rising healthcare expenditure, increased prevalence of chronic diseases, aging demographics, demand for personalized medicine and integration of digital technologies in the healthcare infrastructure. Rapidly expanding pharmaceutical industries in China and India are driving the adoption of automated dispensing systems.

Some of the Prominent Players in the Automated Compounding Systems Market

Recent Developments in the Automated Compounding Systems Market

- In May 2025, PCI Pharma Services, an international contract development and manufacturing organisation (CDMO) acquired Ajinomoto Althea, a sterile fill-finish CDMO based in U.S. and division of Japan-based Ajinomoto.

- In December 2025, EQUASHIELD, a leading innovator in compounding solutions and their closed system transfer device (CSTD) for protecting healthcare workers, entered into a strategic alliance with Pharmacy Stars, a leading cloud-based platform provider for pharmacy compliance. The partnership aims at integrating EQUASHIELD's technology with Pharmacy Stars' Compounding360 system for enhancing training and compliance of staff as well as implementation of comprehensive safety measures for healthcare workers handling hazardous drugs.

- In December 2025, Germfree launched Smarthood, a software-agnostic solution with fully integrated intravenous (IV) workflow hardware designed for addressing enduring problems in sterile compounding.

Segments Covered in the Report

By Type

- Centralized Automated Compounding Systems

- Decentralized Automated Compounding Systems

By Dosage Form

- Oral Solid Dosage Forms

- Parenteral Dosage Forms

- Others

By Application

- Pharmaceutical Industry

- Nutraceutical Industry

- Veterinary Industry

- Others

By Technology

- Gravimetric Dosing Systems

- Volumetric Dosing Systems

- Hybrid Dosing Systems

By End-User

- Pharmaceutical Manufacturers

- Contract Research Organizations

- Hospitals and Clinics

- Research and Development Laboratories

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa