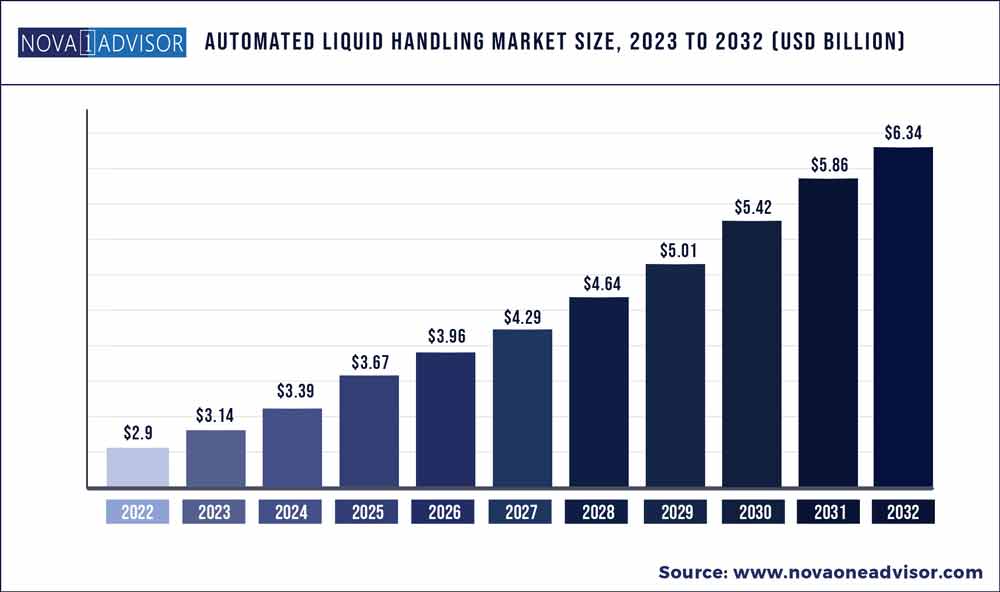

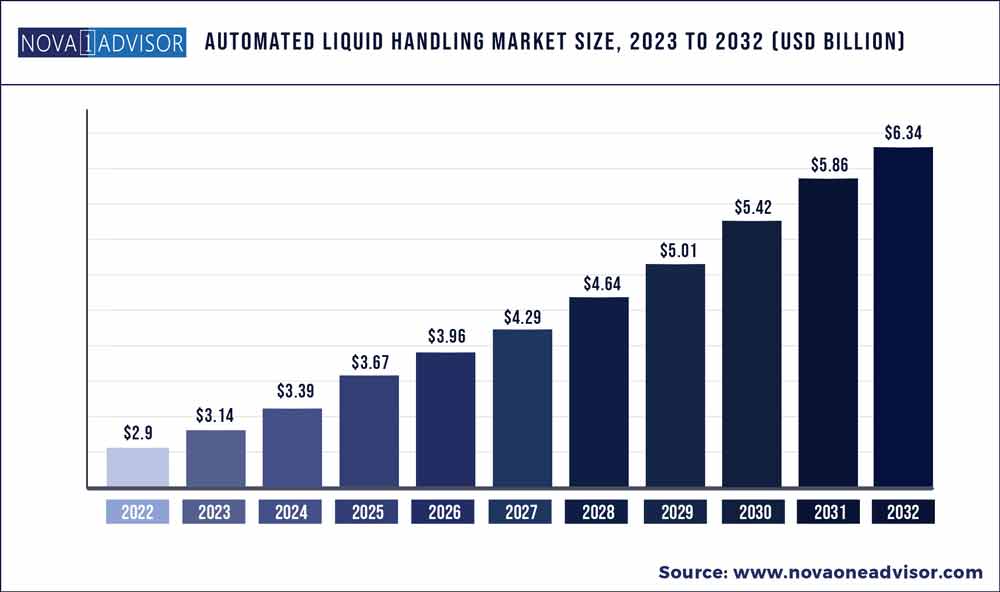

The global automated liquid handling market size was exhibited at USD 2.9 billion in 2022 and is projected to hit around USD 6.34 billion by 2032, growing at a CAGR of 3.14% during the forecast period 2023 to 2032.

Key Pointers:

- North America region contributed the maximum revenue share of in 2022.

- By modality, the disposable tips segment generated more than 75.9% of the revenue share in 2022.

- By modality, the fixed tip segment is expected to expand at the fastest CAGR from 2023 to 2032.

- By procedure, the serial dilution segment is predicted to grow at the fastest CAGR from 2023 to 2032.

- By type, the standalone segment is the largest supporter to the market and is expected to grow at a significant CAGR from 2023 to 2032.

- By end-user, the biotechnology and pharmaceutical companies segment generated the maximum market share in 2022.

- By end-user, the serial dilution segment is expected to expand at the fastest CAGR from 2023 to 2032.

Automated Liquid Handling Market Report Scope

Automated liquid handling (ALH) systems are equipment that are precisely programmed to handle liquids and deliver accurate and reproducible results without any complexity in clinical and research settings. Efficient and accurate liquid handling techniques play important role in clinical and research laboratories. Automated liquid handling systems can be optimized for use in techniques, including ELISA, time-resolved fluorescence, nucleic acid preparation, PCR setup, next-generation sequencing for genomic research, TLC spotting, SPE, and liquid– liquid extraction. Automated liquid handling instruments have various advantages like it enables simplified sample preparation with consistent high accuracy and allows labs to free up manual labor and run more samples while maintaining reproducibility. It helps to address sample preparation needs for proteins, metabolites, as well as genomics and NGS applications, reducing set up times and protocol development.

The automated liquid handling market growth is driven by rise in adoption of ALH, rise in adoption of ALH in emerging countries, technological advancements in ALH systems, and surge in demand for miniature process equipment. Moreover, the advantages of ALH systems over manual pipetting such as improved efficiency, enhanced safety also contributes in the growth of the market. However, rise in higher costs of ALH instruments is expected to hinder the market growth. Conversely, untapped potential of emerging markets offers automated liquid handling market opportunity.

Coronavirus (COVID-19) was discovered in late December, 2019, in Hubei province of Wuhan city in China. The disease is caused by a virus, namely, severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), which is transmitted among humans. Testing for COVID-19 has been an ongoing bottleneck in the fight against COVID-19. With growth in need to process specimens faster with greater accuracy, interest in automated liquid handlers and robotics that can handle the workload has been increasing rapidly. Overall, the impact of COVID-19 on the automated liquid handling industry was recorded to be fairly positive. This was attributed to increase in customizations of automated liquid handling systems by different automated liquid handling suppliers specifically for work related to coronavirus. For instance, in April 2020, Hamilton Company and Zymo Research Corporation announced that they have collaborated and launched MagEx STARlet assay-ready workstation with Quick-DNA/RNA Viral MagBead Kit protocol to extract pure DNA/RNA from the novel coronavirus, SARS-CoV-2. The jointly developed automated solution offers significant advantages compared to manual processing of samples via traditional time-consuming methods such as spin columns.

The automated liquid handling market is segmented on the basis of type, modality, procedure, end user, and region. On the basis of type, the market is divided into standalone, individual benchtop workstation, multi-instrument system, and others. By modality, it is bifurcated into fixed tips and disposable tips. By procedure, it is segmented into PCR-set-up, serial dilution, high-throughput screening, cell culture, whole genome amplification, plate reformatting, array printing, and others. On the basis of end user, it is classified into biotechnology & pharmaceutical companies, contract research organizations, and academic & government research institutes. Region wise, the market has been analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some of the prominent players in the Automated Liquid Handling Market include:

- QIAGEN NV.

- Agilent

- Anton-Paar

- Analytik Jena

- Aurora Biomed

- Elemental Scientific

- Distek

- Ellutia

- Fritsch International

- EST Analytical

- GBC Scientific Equipment

- GERSTEL GmbH & Co. KG

- GE Healthcare Life Sciences

- Gilson

- Hamilton Company

- Hitachi

- iChrom

- PerkinElmer Inc.

- Thermo Fisher Scientific

- SPT Labtech

- Shimadzu Scientific

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Automated Liquid Handling market.

By Modality

- Fixed Tips

- Disposable Tips

By Procedure

- PCR Setup

- High-Throughput Screening

- Serial Dilution

- Array Printing

- Whole Genome Amplification

- Cell Culture

- Plate Reformatting

By Type

- Benchtop Workstation

- Standalone

- Multi-Instrument System

By End User

- Biotechnology & Pharmaceutical Companies

- Academic & Government Research Institutes

- Contract Research Organizations

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)