The global automated parking system market size was exhibited at USD 1.95 billion in 2023 and is projected to hit around USD 10.03 billion by 2033, growing at a CAGR of 17.8% during the forecast period of 2024 to 2033.

.jpg)

Key Takeaways:

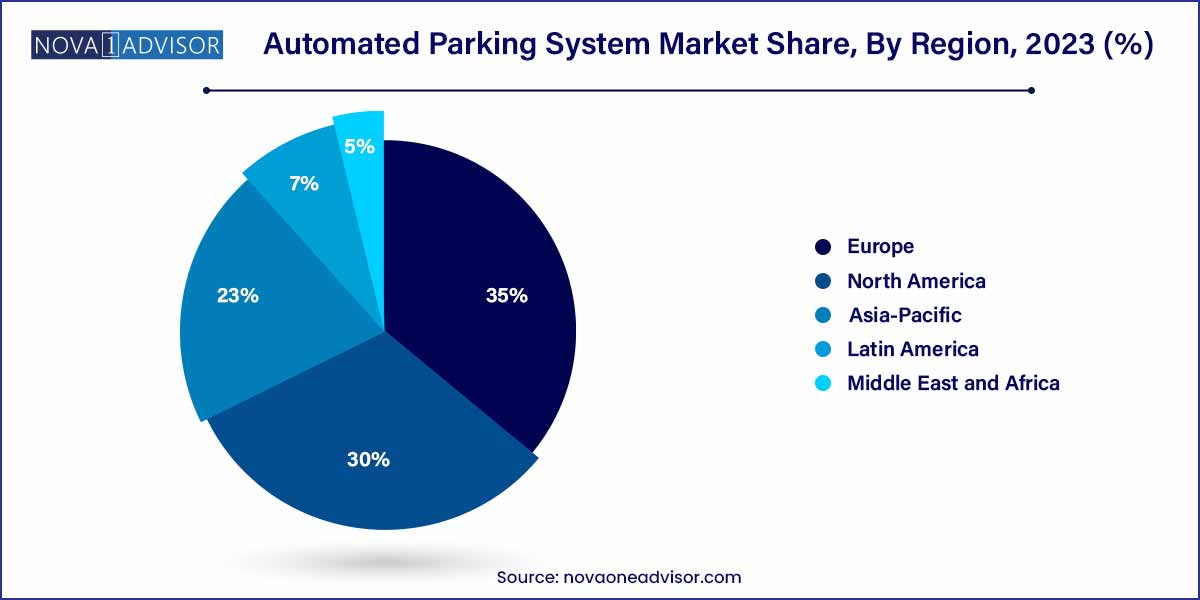

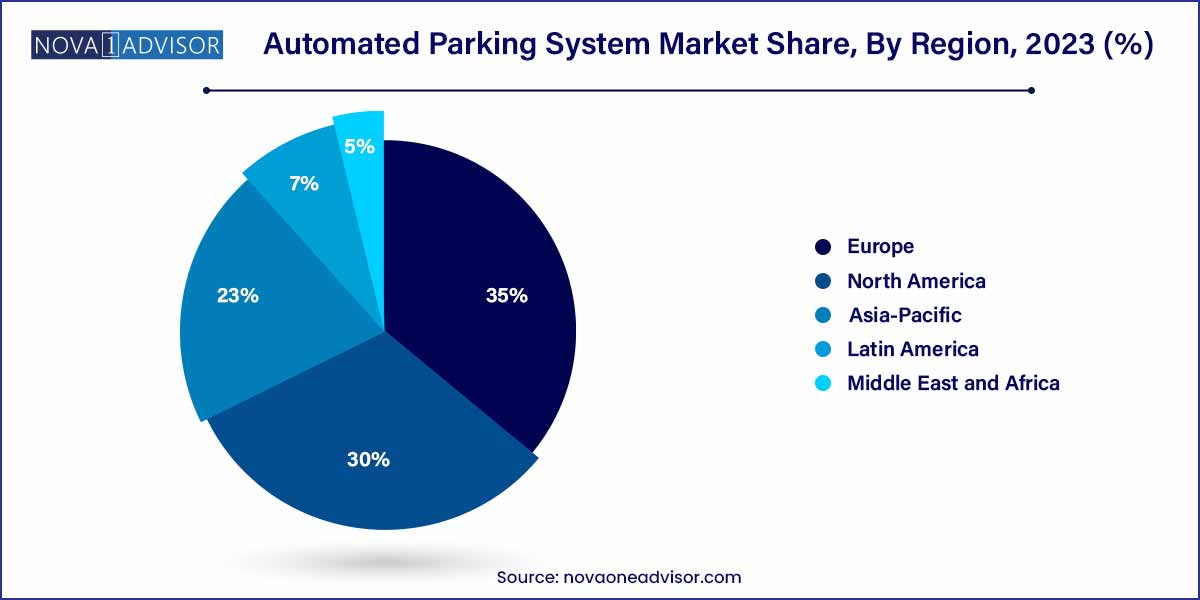

- Europe held the largest revenue share of 35.0% in 2023.

- The hardware segment accounted for a market share of 83.9% in 2023 and is expected to grow at the fastest CAGR of 17.2%.

- The tower system segment accounted for a revenue share of 27.4% in 2023.

- The palleted segment dominated the automated parking system market and accounted for a revenue share of 68.7% in 2023.

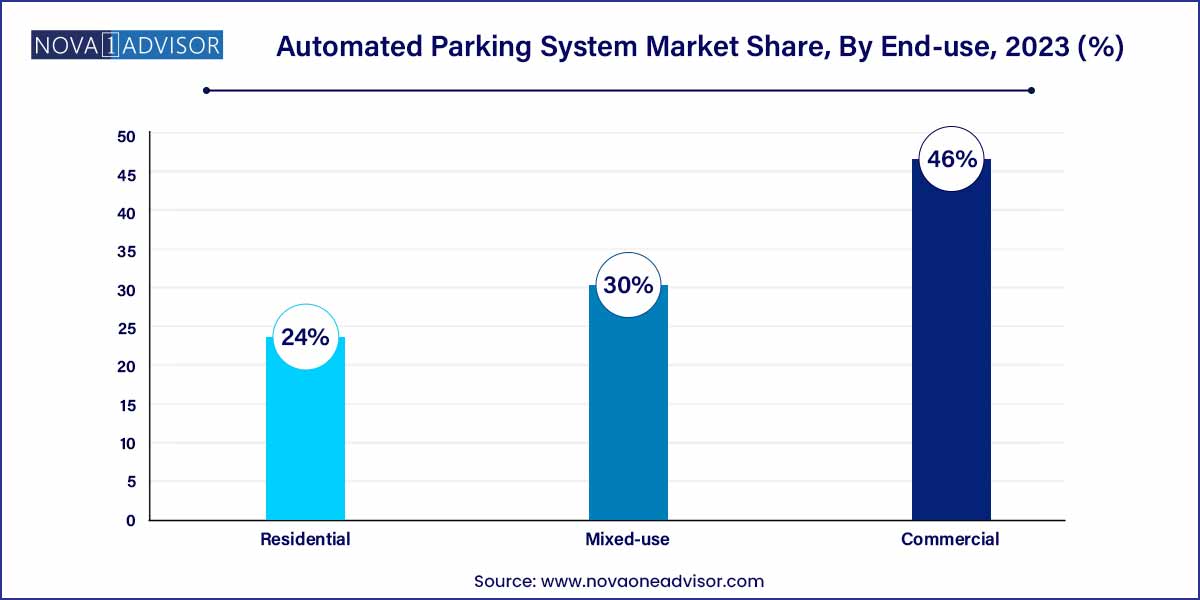

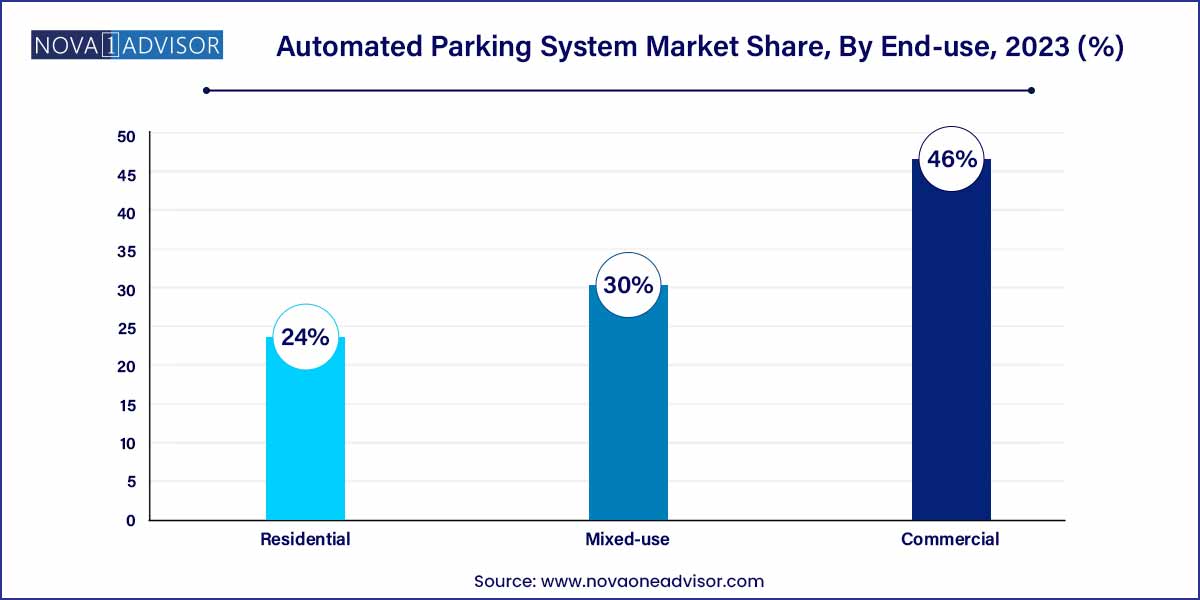

- The commercial segment accounted for a revenue share of 46.0% in 2023.

- The fully automated segment held the largest revenue share of 68.8% in 2023.

Automated Parking System Market: Overview

Market Overview

The Automated Parking System (APS) market is at the forefront of urban infrastructure innovation, responding to a growing need for smarter, space-efficient, and technology-driven parking solutions. Automated Parking Systems refer to mechanical systems designed to automatically park and retrieve vehicles in multi-level structures using computer-controlled systems. These systems reduce the need for human intervention, optimize space utilization, and significantly reduce the land footprint required for traditional parking.

APSs have emerged as vital components in modern urban planning, especially in densely populated regions where real estate is scarce and costly, and traffic congestion is exacerbated by prolonged parking searches. By allowing more vehicles to be parked in less space, APSs offer a strategic solution to urban mobility challenges. Furthermore, these systems improve safety, reduce carbon emissions from vehicles idling or circulating in search of parking, and can be integrated with smart city technologies such as license plate recognition, mobile apps, and automated billing.

The demand for APSs is growing rapidly across residential complexes, commercial centers, airports, hospitals, and mixed-use developments, with key installations seen in global hubs like Tokyo, Dubai, New York, and Singapore. Countries in Europe and Asia-Pacific are leading adoption due to government support, urban space constraints, and rising environmental concerns. The integration of AI, IoT, robotics, and modular construction techniques is driving innovation and deployment flexibility, making APS a compelling investment for real estate developers, municipalities, and technology providers alike.

Major Trends in the Market

-

Integration of AI and IoT for Intelligent Parking Management

Modern APSs are being embedded with AI-driven control algorithms and IoT sensors to improve parking flow, detect anomalies, and provide predictive maintenance alerts.

-

Growing Adoption of Modular and Stackable Parking Towers

Space-saving, vertical tower systems are gaining traction in urban cores, enabling high-density vehicle storage with minimal land use.

-

Expansion of Fully Automated Robotic Parking

Fully automated systems using robotic arms, AGVs (Automated Guided Vehicles), or shuttles are being deployed in premium residential and commercial developments.

-

Increase in EV Charging Integration with APS

Developers are incorporating electric vehicle (EV) chargers within automated parking bays, supporting sustainability goals and user demand.

-

Software as a Service (SaaS) in APS Control Platforms

Cloud-based software systems now manage APS remotely, enabling real-time monitoring, data analytics, and system optimization.

-

Rise of Semi-Automated Solutions for Tier-II Cities

Cost-effective semi-automated systems are gaining popularity in developing markets where full automation is cost-prohibitive.

-

Automated Parking as a Branding Differentiator

Luxury real estate and commercial projects are leveraging APS as a unique selling proposition for affluent buyers and tenants.

Automated Parking System Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.95 Billion |

| Market Size by 2033 |

USD 10.03 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 17.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Component, Structure Type, Platform Type, Automation Level, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Skyline Parking AG; Westfalia Parking; Unitronics; Klaus Multiparking GmbH; Robotic Parking Systems, Inc.; City Lift Parking, LLC; Park Plus Inc.; Wohr Parking System Pvt. Ltd.; Parkmatic; AutoMotion Parking Systems. |

Automated Parking System Market Dynamics

The dynamics of the automated parking system market are intricately influenced by two primary factors. Firstly, the relentless pace of urbanization, particularly in densely populated areas, is a driving force behind the adoption of automated parking solutions. As cities grapple with limited space and escalating parking demands, automated systems emerge as a strategic response, efficiently utilizing available space through innovative stacking and storage mechanisms. This addresses the pressing need for optimal land use in urban environments.

Secondly, technological advancements play a pivotal role in shaping the dynamics of the automated parking system market. The integration of cutting-edge technologies, such as IoT sensors, artificial intelligence, and machine learning, has ushered in a new era for these systems. This infusion of technology enhances overall system efficiency, resulting in reduced retrieval times, improved reliability, and an elevated user experience.

Automated Parking System Market Restraint

The automated parking system market faces certain constraints that impact its widespread adoption. One significant restraint is the high initial capital investment required for implementing automated parking solutions. The sophisticated technology and infrastructure needed for these systems often involve substantial upfront costs, posing a financial barrier for potential adopters.

Another notable restraint lies in the necessity for standardized regulations and industry guidelines. The automated parking system market lacks universally accepted standards, leading to variations in system specifications and functionalities. This lack of standardization can result in compatibility issues and hinder seamless integration, making it challenging for stakeholders to navigate the diverse landscape of automated parking solutions.

Automated Parking System Market Opportunity

The automated parking system market presents compelling opportunities driven by the increasing emphasis on sustainable urban development. One notable opportunity lies in the environmental benefits offered by these systems. Automated parking helps reduce the need for expansive parking lots, contributing to land conservation and mitigating urban sprawl. This aligns with the global push for eco-friendly solutions, creating opportunities for the market to position itself as a key player in sustainable urban infrastructure.

Furthermore, the ongoing smart city initiatives worldwide present a significant opportunity for the automated parking system market. Governments and municipalities are increasingly investing in technology-driven urban solutions to address challenges like traffic congestion and environmental impact. Automated parking systems, with their ability to optimize space, reduce emissions, and enhance overall urban mobility, fit seamlessly into the framework of smart city development. As cities continue to evolve into tech-savvy urban centers, the automated parking system market has the chance to capitalize on these initiatives, fostering widespread adoption and integration within the broader context of smart urban planning.

Automated Parking System Market Challenges

The automated parking system market encounters notable challenges that impact its widespread adoption. Firstly, the high initial capital investment required for implementing automated parking solutions poses a significant hurdle. The sophisticated technology and infrastructure needed for these systems involve substantial upfront costs, deterring potential adopters who may find the initial financial commitment prohibitive. Overcoming this challenge requires innovative financing models and a compelling business case to demonstrate the long-term benefits and return on investment associated with automated parking systems.

Secondly, a lack of standardized regulations and industry guidelines presents a considerable challenge for the market. The absence of universally accepted standards leads to variations in system specifications and functionalities. This lack of standardization can result in compatibility issues, making it challenging for stakeholders to navigate the diverse landscape of automated parking solutions. Establishing comprehensive and widely accepted regulations is crucial for fostering market growth, ensuring interoperability, and instilling confidence among potential users and investors alike.

Segments Insights:

Component Insights

Hardware components dominate the APS market, accounting for the largest share due to the mechanical and structural complexity involved in building these systems. Hardware includes the lifting mechanisms, pallets, conveyors, AGVs, sensors, gates, and supporting infrastructure required for parking, transporting, and retrieving vehicles. Companies such as WÖHR, Klaus Multiparking, and Robotic Parking Systems Inc. focus heavily on advanced mechanical innovations to minimize space usage and enhance reliability. As systems become more compact and modular, hardware remains a central investment area in automated parking.

Software is the fastest-growing component segment, due to the increasing demand for intelligent control systems, user interfaces, real-time monitoring, and remote diagnostics. Software platforms power everything from vehicle positioning and navigation to user access and mobile app integration. AI-powered software is now capable of dynamically optimizing space allocation based on traffic flow predictions, vehicle size, or user preferences. Cloud-based management tools are also enabling remote monitoring and predictive maintenance, making software essential to modern APS functionality.

Structure Type Insights

Tower systems are the dominant structure type, particularly in high-density urban environments where vertical expansion is preferred over horizontal sprawl. These systems use robotic platforms or elevators to move vehicles vertically and laterally into compact bays. Tower APSs are widely adopted in countries like Japan, South Korea, and parts of Europe, where land is limited and premium. Their architectural flexibility allows integration into both standalone and mixed-use developments, making them a preferred choice for urban developers.

Rail-Guided Cart (RGC) systems are the fastest-growing segment, known for their scalability, high throughput, and lower operating costs compared to AGVs or tower lifts. These systems use horizontal carts that run on rails to transport vehicles to empty slots within multi-story garages. RGC systems are increasingly deployed in airports, hospitals, and commercial complexes requiring high-capacity parking. Their lower maintenance needs and faster vehicle retrieval times make them attractive for high-traffic sites.

Palleted systems dominate the platform type segment, owing to their ability to lift and move cars without requiring direct vehicle handling. These systems place cars on movable platforms or pallets, reducing risk of vehicle damage and simplifying navigation through narrow spaces. Palleted systems are especially useful in retrofitting existing structures and are favored in residential and commercial buildings where vehicle protection and ease of use are key.

Non-palleted systems are growing rapidly, particularly in advanced installations where robotic arms or AGVs directly interact with vehicles. These systems reduce mechanical complexity and improve space utilization by eliminating the extra space needed for pallets. Non-palleted systems, though currently limited in adoption, are seeing increased R&D investment due to their potential for high-speed operation and AI integration. They're most commonly used in luxury or tech-forward installations, such as smart garages in high-end condominiums.

End Use Insights

Commercial end use dominates the APS market, as commercial establishments like shopping malls, airports, corporate buildings, and hotels see high demand for automated solutions to manage parking congestion. These venues require efficient throughput, enhanced security, and user convenience. APS not only improves traffic flow but also boosts property value and tenant satisfaction. Systems such as the one installed at the Dubai Mall or the Audi Forum Ingolstadt in Germany exemplify how APS is revolutionizing commercial real estate.

Mixed-use developments are emerging as the fastest-growing end-use segment, combining residential, retail, office, and recreational spaces. These projects demand flexible, multi-access parking systems that cater to diverse user types. APS enables zoning of parking areas based on user groups (residents, employees, guests) and supports integrated access control. As smart city projects expand globally, mixed-use APS installations are expected to rise rapidly.

Automation-Level Insights

Fully automated systems dominate the market, offering the highest efficiency, space savings, and user experience. These systems eliminate the need for human intervention by automating vehicle parking and retrieval entirely through robotics, sensors, and software. Fully automated systems are ideal for premium commercial or residential spaces where user convenience and land optimization are critical. Countries like Germany and Singapore are investing in fully automated public parking projects that feature real-time data monitoring, emergency protocols, and seamless digital interfaces.

Semi-automated systems are the fastest-growing segment, particularly in Tier-II and Tier-III cities of developing countries. These systems offer a blend of automation and manual control, typically automating only the horizontal or vertical transport components. Their lower cost and operational simplicity make them appealing to small-scale builders or retrofit projects. As awareness and technological familiarity improve, semi-automated systems are likely to become stepping stones toward full automation in emerging markets.

Regional Insights

Europe leads the global Automated Parking System market, thanks to urban density, high real estate prices, environmental regulations, and widespread smart city initiatives. Countries like Germany, France, the UK, and the Netherlands are investing heavily in automated parking, particularly in metropolitan areas where space optimization is crucial. Germany, home to top APS companies like WÖHR and Klaus, is known for its sophisticated vertical and rotary tower systems.

Cities like Amsterdam are pioneering modular underground parking solutions to preserve public space while addressing mobility needs. The EU’s green agenda also supports APS integration with EV infrastructure and sustainable building codes. With advanced construction practices and strong regulatory frameworks, Europe continues to lead in both innovation and deployment.

Asia-Pacific is the fastest-growing market for Automated Parking Systems, driven by rapid urbanization, smart city investments, and technology adoption in countries like China, Japan, South Korea, and India. In Japan, where parking laws require proof of space before vehicle purchase, APS is deeply embedded in both residential and commercial planning. South Korea has developed high-speed robotic APS systems for busy metro stations and luxury apartments.

China is witnessing an explosion in smart city development, with cities like Shenzhen and Beijing investing in automated parking to tackle congestion. Startups and real estate developers in India are exploring semi-automated systems to optimize space in housing societies and business parks. Government incentives, rising vehicle ownership, and shrinking parking space are all catalyzing the region’s APS momentum.

Recent Developments

-

February 2025 – Klaus Multiparking launched its next-generation 'TrendVario 6500+', a fully automated tower parking solution with dynamic platform height adjustment and integrated EV charging.

-

January 2025 – Robotic Parking Systems Inc. completed the installation of the world’s largest robotic parking garage in Abu Dhabi, capable of housing 2,200 vehicles with retrieval times under 180 seconds.

-

November 2024 – Wohr Autoparksysteme GmbH announced a partnership with a South Korean real estate group to deploy vertical parking towers in Seoul’s upcoming tech corridor.

-

October 2024 – CityLift Parking (USA) secured $35 million in funding to expand modular APS solutions in U.S. urban areas, particularly for hospitals and residential high-rises.

-

September 2024 – ShinMaywa Industries (Japan) introduced a fully solar-powered automated parking garage, supporting Japan’s zero-emission infrastructure goals.

Some of the prominent players in the automated parking system market include:

- Skyline Parking AG

- Westfalia Parking

- Unitronics

- Klaus Multiparking GmbH

- Robotic Parking Systems, Inc.

- City Lift Parking, LLC

- Park Plus Inc.

- Wohr Parking System Pvt. Ltd.

- Parkmatic

- AutoMotion Parking Systems

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automated parking system market.

Component

Structure Type

- AGV System

- Silo System

- Tower System

- Rail-Guided Cart (RGC) System

- Puzzle System

- Shuttle System

Platform Type

Automation Level

- Fully Automated

- Semi-automated

End Use

- Residential

- Commercial

- Mixed-use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.jpg)