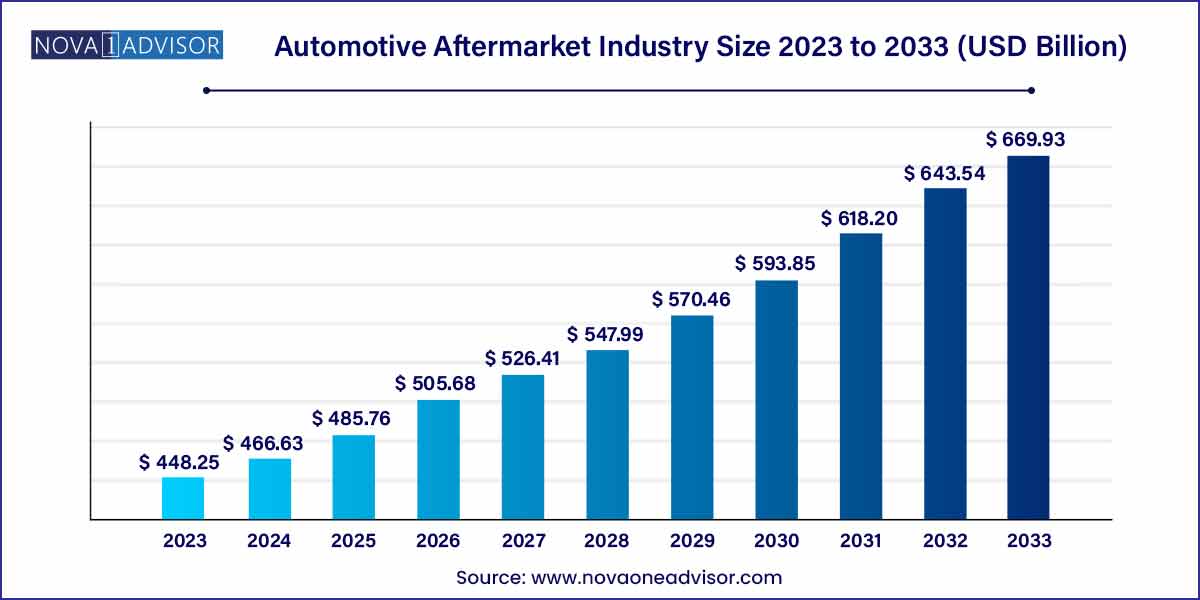

The global automotive aftermarket industry size was exhibited at USD 448.25 billion in 2023 and is projected to hit around USD 669.93 billion by 2033, growing at a CAGR of 4.1% during the forecast period of 2024 to 2033.

Key Takeaways:

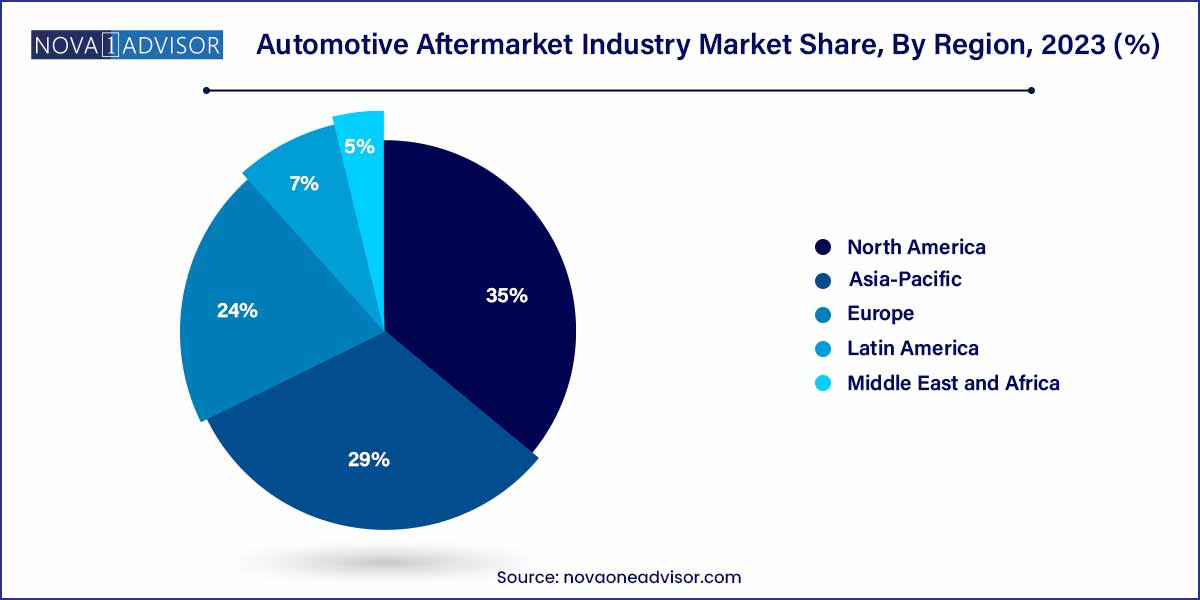

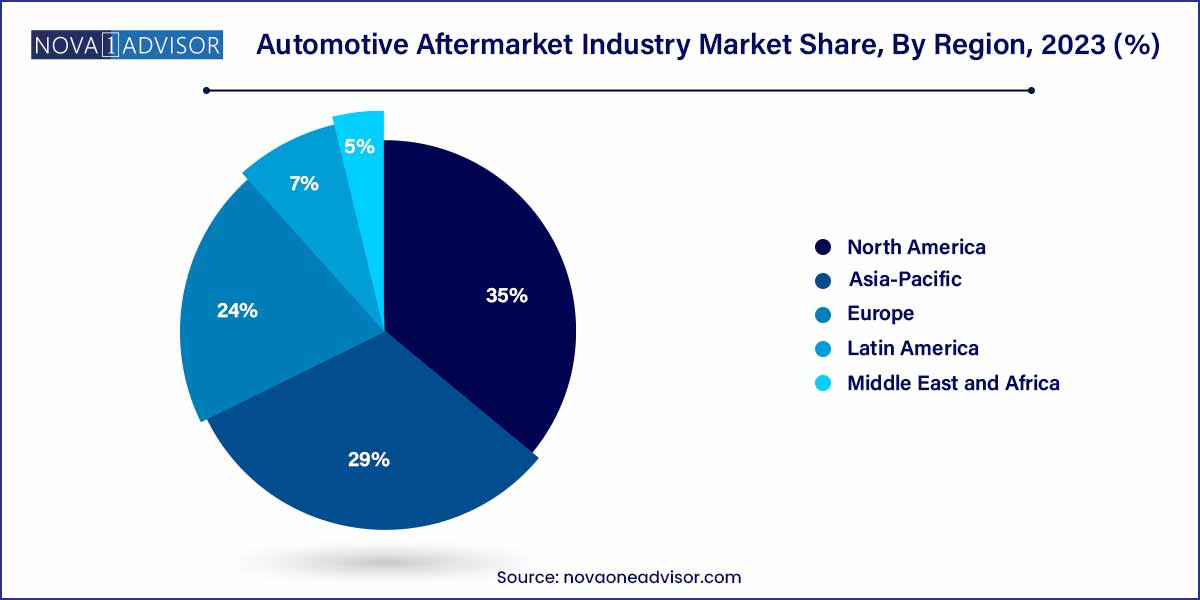

- Asia Pacific dominated the market with a share of 29.0% in 2023.

- The other segment dominated the market with a share of 48.3% in 2023.

- The retail segment dominated the market with a share of 56.0% in 2023.

- The original equipment segment dominated the market with a share of 71.1% in 2023.

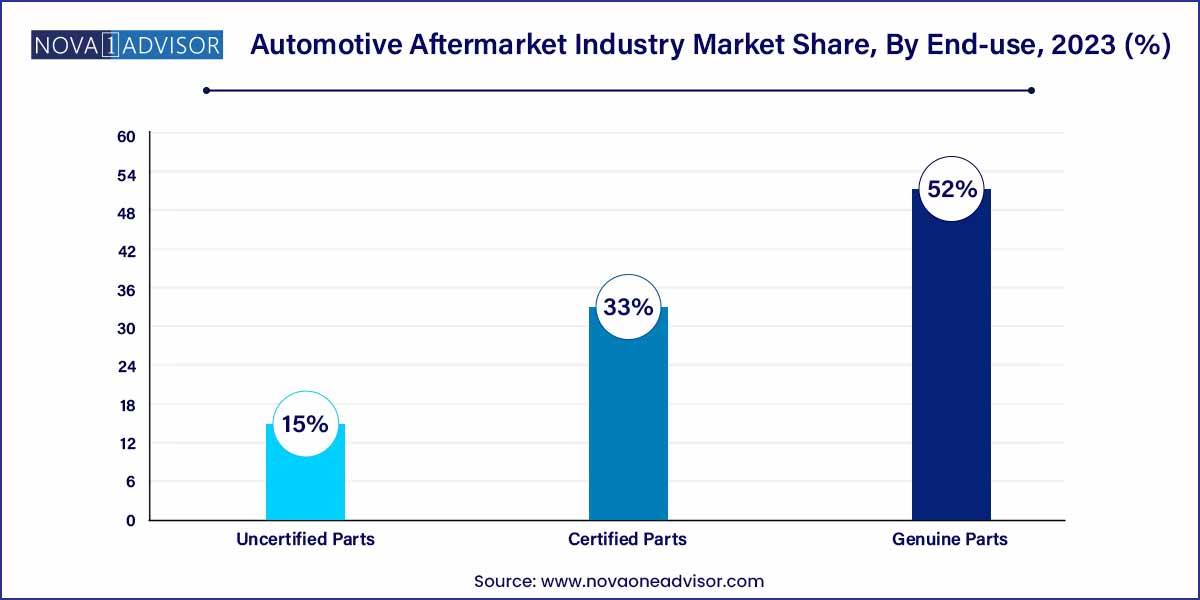

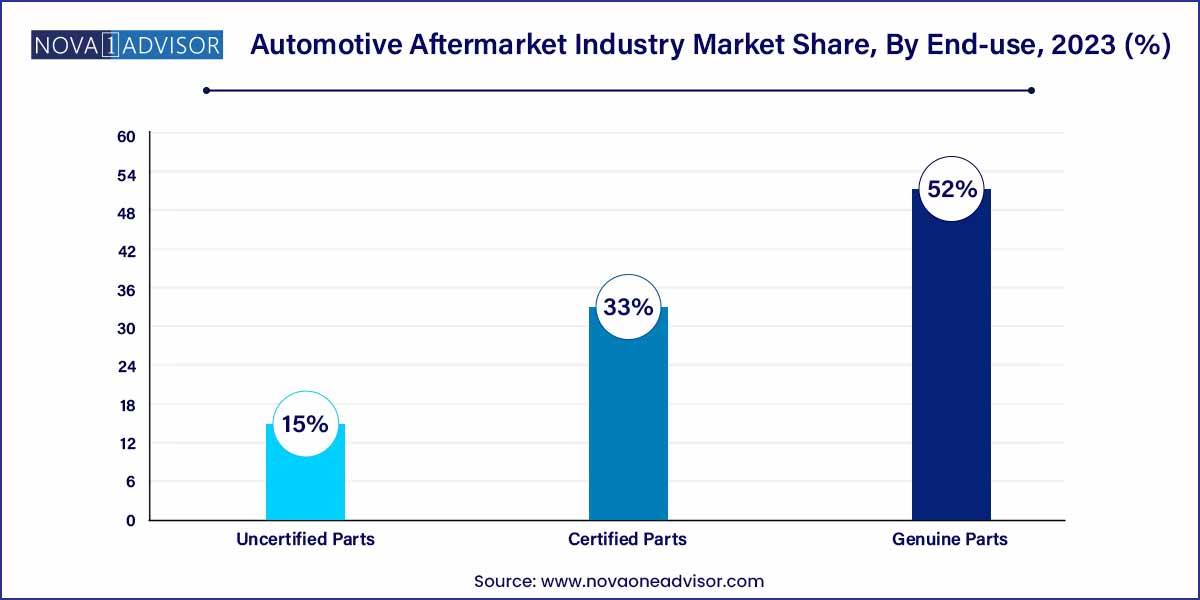

- The genuine parts segment dominated the market with a share of 52.0% in 2023.

Market Overview

The global automotive aftermarket is a vital pillar of the automotive industry, encompassing all services and parts sourced after the initial sale of a vehicle. From routine maintenance like oil changes and brake replacements to performance upgrades, collision repairs, and cosmetic enhancements, the aftermarket sector sustains vehicles through their lifecycle. It plays a crucial role in enabling personal and commercial vehicle owners to retain value, ensure safety, and optimize performance.

With the global vehicle parc steadily growing and aging, the demand for replacement parts and maintenance services continues to rise. Consumers are retaining vehicles for longer periods, leading to increased opportunities for aftermarket suppliers and service providers. The market is also evolving with advancements in vehicle technology, prompting shifts in part complexity, repair protocols, and diagnostics. Digital platforms, e-commerce penetration, and connected vehicle data have further transformed the way automotive services and parts are marketed, sold, and delivered.

Automotive Aftermarket Industry Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 448.25 Billion |

| Market Size by 2033 |

USD 669.93 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.1% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Replacement Parts, Distribution Channel, Certification, Service Channel, Regions |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

3M Company, Continental AG, Cooper Tire & Rubber Company, Delphi Automotive PLC, Denso Corporation, Federal-Mogul Corporation, HELLA KGaA Hueck & Co., Robert Bosch GmbH, Valeo Group, ZF Friedrichshafen AG. |

Automotive Aftermarket Industry Dynamics

- Digital Transformation and E-Commerce Integration:

The automotive aftermarket industry is undergoing a profound shift with the widespread adoption of digital technologies. E-commerce platforms have become integral to the industry, offering a convenient and efficient channel for consumers to access a diverse range of aftermarket products and services. The digital transformation is not only limited to sales but also extends to marketing and customer engagement. Online platforms leverage data analytics and personalized marketing strategies to enhance customer experience and tailor product recommendations.

Sustainability and Eco-Friendly Products:

An emerging and influential dynamic in the automotive aftermarket industry is the growing emphasis on sustainability and environmentally conscious practices. Consumers are increasingly seeking eco-friendly aftermarket products, ranging from recycled materials in manufacturing to energy-efficient components. This shift is not only driven by consumer preferences but also by global initiatives aimed at reducing the environmental impact of automotive activities. As regulations and consumer awareness regarding environmental sustainability continue to rise, aftermarket businesses are compelled to adapt and innovate, introducing eco-friendly solutions and practices.

Automotive Aftermarket Industry Restraint

- Counterfeit products and quality concerns:

A significant restraint facing the automotive aftermarket industry revolves around the proliferation of counterfeit products. The market is plagued by a multitude of substandard and imitation components, posing a considerable challenge to both consumers and legitimate aftermarket businesses. Counterfeit parts not only compromise vehicle performance but also jeopardize safety standards, raising concerns among consumers about the reliability and quality of aftermarket products.

- Rapid Technological Changes and Compatibility Issues:

The fast-paced evolution of automotive technologies presents a notable restraint for the aftermarket industry. As vehicles become more technologically advanced, integrating features like IoT, AI, and complex electronic systems, aftermarket components must keep pace to ensure compatibility. Rapid technological changes can lead to a scenario where aftermarket parts may not seamlessly integrate with newer vehicle models, posing challenges for both manufacturers and consumers.

Automotive Aftermarket Industry Opportunity

- Electric and Hybrid Vehicles Market Expansion:

A compelling opportunity within the automotive aftermarket industry lies in the growing market for electric and hybrid vehicles. As the automotive landscape shifts towards sustainable mobility solutions, there is a burgeoning demand for aftermarket products and services tailored to these eco-friendly vehicles. Opportunities include the development of specialized components, such as batteries and charging systems, along with maintenance services and performance enhancements specific to electric and hybrid platforms.

Connectivity Solutions and Smart Aftermarket Products:

The increasing integration of connectivity features in modern vehicles presents a lucrative opportunity for the automotive aftermarket. As vehicles become more connected, there is a rising demand for aftermarket products that enhance connectivity and offer smart solutions. This includes aftermarket devices for vehicle tracking, diagnostic tools, and entertainment systems. The demand for seamless integration of smartphones, navigation systems, and other digital applications in vehicles opens up avenues for aftermarket businesses to develop and provide cutting-edge connectivity solutions.

Automotive Aftermarket Industry Challenges

- Regulatory Compliance Complexities:

One of the foremost challenges facing the automotive aftermarket industry is the complexity of regulatory compliance. The industry operates in a global landscape with diverse regulations and standards across different regions. Adapting to and ensuring compliance with these varying regulations poses a significant challenge for aftermarket businesses. Meeting safety, emissions, and quality standards demands continuous monitoring and adjustment to evolving regulatory frameworks, adding a layer of complexity to product development, distribution, and overall business operations.

- Impact of Rapid Technological Changes:

The rapid evolution of automotive technologies represents a substantial challenge for the aftermarket industry. As vehicles incorporate advanced features such as artificial intelligence, IoT connectivity, and sophisticated electronic systems, aftermarket components must keep pace. The challenge lies in developing aftermarket products that are not only technologically compatible with modern vehicles but also economically viable for consumers. The need for ongoing research and development to stay abreast of technological advancements can strain resources for aftermarket businesses.

Segments Insights:

By Replacement Parts Insights

Tires dominate the replacement parts segment, owing to their relatively short lifespan and mandatory nature for vehicle safety. Frequent wear from road friction, punctures, and seasonal replacements ensures a consistent stream of demand across both passenger and commercial vehicles. The rise in road travel, increased vehicle miles traveled (VMT), and a growing inclination toward performance tires have further expanded this category.

Lighting and electronic components are among the fastest-growing segments, driven by vehicle electrification, integration of ADAS features, and rising consumer interest in custom LED lighting systems. Modern vehicles increasingly rely on sensors, cameras, ECUs, and infotainment systems that require periodic maintenance and replacement. The growing demand for enhanced in-cabin experiences and safety upgrades makes electronics a high-margin aftermarket category.

By Distribution Channel Insights

Wholesalers & Distributors hold the largest market share, serving as intermediaries between parts manufacturers and retailers or repair shops. Their wide product portfolios, warehousing capabilities, and supplier relationships allow them to serve a broad range of B2B customers efficiently. In many regions, they operate via extensive dealer networks and regional hubs, ensuring timely delivery and inventory management.

Retailers, especially online platforms, are growing rapidly, fueled by consumer preference for convenient ordering, comparison tools, and doorstep delivery. Platforms such as Amazon, AutoZone, and RockAuto have made it easier for consumers and DIY enthusiasts to access a wide range of parts at competitive prices. Online channels have also introduced BOPIS (Buy Online, Pick Up In-Store) models to blend digital and physical retail.

By Service Channel Insights

Do-It-For-Me (DIFM) services dominate the aftermarket, especially in urban areas where consumers prefer convenience and lack the tools or time for self-servicing. Professional service centers, quick lube shops, and tire replacement centers offer bundled services that appeal to time-conscious vehicle owners. DIFM is particularly strong in fleet maintenance, where uptime is critical.

DIY (Do It Yourself) is growing steadily, particularly among hobbyists, auto enthusiasts, and cost-sensitive consumers. YouTube tutorials, online part sourcing, and easy-to-use repair tools have encouraged vehicle owners to attempt basic repairs and upgrades on their own. The growth of electric and modular componentry also supports DIY culture in some vehicle categories.

By Certification Insights

Genuine parts continue to dominate, especially in vehicles under warranty or leased through OEM channels. These parts, sourced directly from automakers or their licensed suppliers, guarantee compatibility, performance, and warranty compliance. Premium vehicle brands emphasize genuine parts to maintain brand integrity and safety standards.

Certified aftermarket parts are gaining traction, offering a cost-effective alternative to genuine parts with third-party quality assurance. These parts strike a balance between affordability and reliability, particularly for out-of-warranty vehicles. As awareness of quality standards improves, certified parts are increasingly accepted by consumers and workshops alike.

By Regional Insights

North America dominates the global automotive aftermarket, driven by a large and aging vehicle fleet, a well-established repair infrastructure, and a strong culture of vehicle maintenance. The U.S., in particular, leads the region with a dense network of independent garages, national service chains, and parts retailers. Government regulations on vehicle safety and emissions also ensure steady demand for replacement components. The prevalence of personal vehicle ownership and high average vehicle age (over 12 years) sustains a healthy aftermarket ecosystem.

Asia-Pacific is the fastest-growing region, propelled by a rapidly expanding vehicle parc in countries like China, India, and Indonesia. Rising disposable income, growing middle-class car ownership, and increased awareness of preventive maintenance are fueling the aftermarket sector. The presence of low-cost manufacturing hubs also supports the local availability of affordable aftermarket parts. As regulatory frameworks and digital ecosystems mature, Asia-Pacific is expected to offer substantial opportunities for both local and global aftermarket players.

Recent Developments

-

Bosch Automotive Aftermarket (March 2025): Launched a new line of diagnostic tools with integrated AI capabilities to improve repair accuracy and efficiency.

-

AutoZone (January 2025): Announced the expansion of its e-commerce logistics network with two new distribution centers in the Midwest.

-

Advance Auto Parts (February 2025): Partnered with Walmart to offer same-day delivery of essential parts via the Walmart GoLocal platform.

-

ZF Aftermarket (December 2024): Introduced a suite of remanufactured brake components aimed at reducing environmental impact.

-

eBay Motors (November 2024): Rolled out an AI-powered part matching system to improve product search and compatibility assurance for buyers.

Some of the prominent players in the automotive aftermarket industry include:

- 3M Company

- Continental AG

- Cooper Tire & Rubber Company

- Delphi Automotive PLC

- Denso Corporation

- Federal-Mogul Corporation

- HELLA KGaA Hueck & Co.

- Robert Bosch GmbH

- Valeo Group

- ZF Friedrichshafen AG

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive aftermarket industry.

Replacement Parts

- Tire

- Battery

- Brake Parts

- Filters

- Body parts

- Lighting & Electronic Components

- Wheels

- Exhaust components

- Turbochargers

- Others

Distribution Channel

- Wholesalers & Distributors

Service Channel

- DIY (Do it Yourself)

- DIFM (Do it for Me)

- OE (Delegating to OEM’s)

Certification

- Genuine Parts

- Certified Parts

- Uncertified Parts

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)