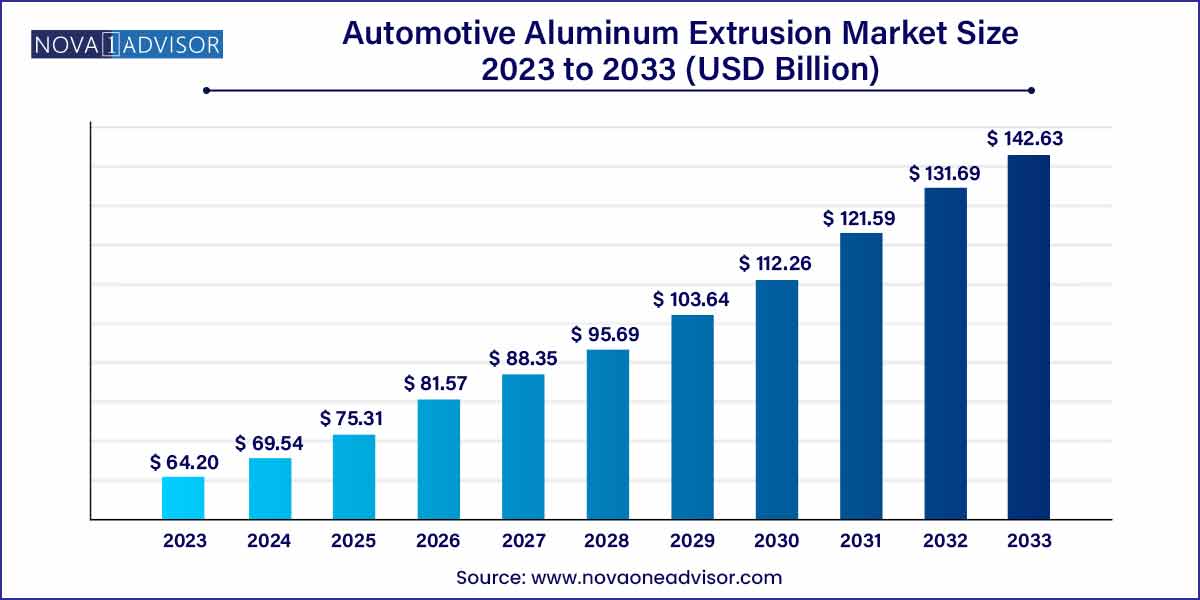

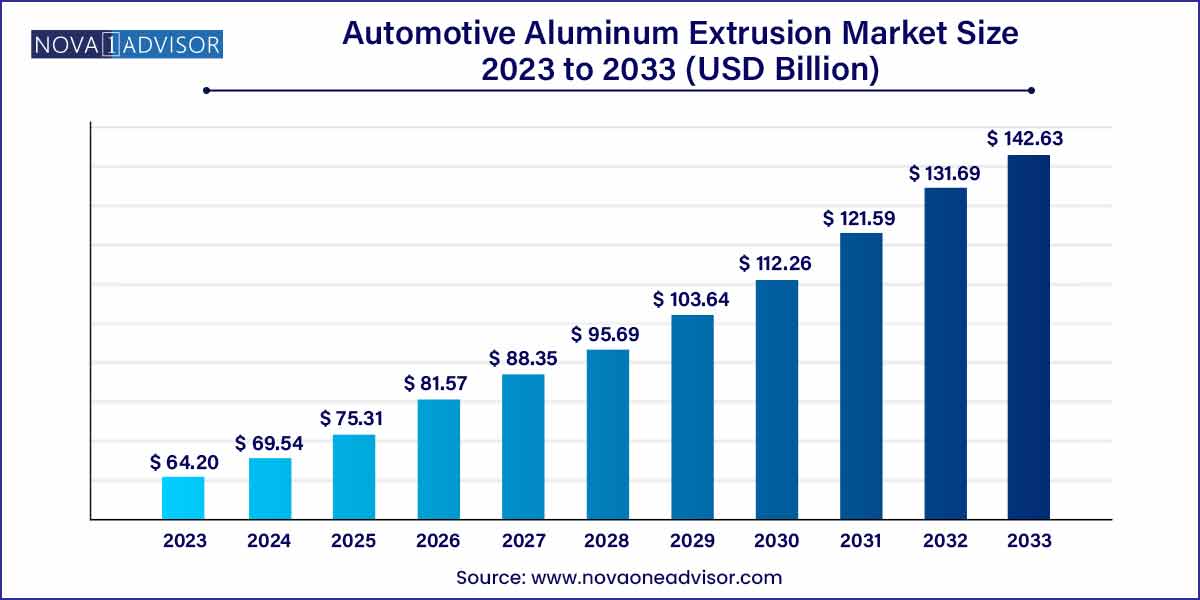

The global automotive aluminum extrusion market size was valued at USD 64.20 billion in 2023 and is expected to reach over USD 142.63 billion by 2033, with a registered CAGR of 8.31% from 2024 to 2033.

Automotive Aluminum Extrusion Market: Overview

The automotive aluminum extrusion market is experiencing remarkable growth as the global automotive industry increasingly focuses on lightweighting solutions to meet stringent emission regulations and enhance vehicle performance. Aluminum extrusions, due to their excellent strength-to-weight ratio, corrosion resistance, and formability, have become indispensable in modern vehicle manufacturing. From structural components like sub-frames and bumpers to intricate parts like door beams and pillars, aluminum extrusions play a critical role in improving vehicle safety, fuel efficiency, and overall sustainability.

Automakers worldwide are actively shifting toward the use of extruded aluminum components not only in electric vehicles (EVs) but also in traditional internal combustion engine (ICE) vehicles. This transition is driven by the need to comply with Corporate Average Fuel Economy (CAFE) standards and Euro 6 norms, as well as to address consumer demand for greener, more efficient vehicles. Advances in aluminum alloys and extrusion technologies have further expanded the scope of aluminum applications across vehicle categories, from compact cars to heavy commercial vehicles.

Automotive Aluminum Extrusion Market Growth

The automotive aluminum extrusion market is experiencing robust growth driven by several key factors. Firstly, the industry's increasing emphasis on lightweighting to improve fuel efficiency and reduce emissions has propelled the demand for aluminum extrusions, known for their exceptional strength-to-weight ratio. Secondly, advancements in manufacturing technologies have enabled the production of complex extruded components with enhanced precision and performance, further expanding the market's capabilities. Additionally, the rising adoption of aluminum alloys tailored for specific automotive applications, coupled with the material's inherent corrosion resistance and durability, is fueling market expansion. Moreover, collaborative partnerships between automotive OEMs and aluminum extrusion manufacturers are fostering innovation and driving product differentiation, contributing to the market's sustained growth trajectory. Overall, these growth drivers underscore the pivotal role of aluminum extrusions in shaping the future of the automotive industry.

Automotive Aluminum Extrusion Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 64.20 Billion |

| Market Size by 2033 |

USD 142.63 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.31% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Vehicle, Aluminum Grade, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Hindalco Industries Ltd., QALEX, Arconic Corporation, Constellium N.V., Norsk Hydro ASA, Bonnell Aluminum, China Zhongwang Holdings Ltd., ETEM Group. |

Automotive Aluminum Extrusion Market Dynamics

- Lightweighting Imperative:

The overarching trend towards lightweighting in the automotive sector, driven by stringent regulations and consumer demand for fuel efficiency, is a primary dynamic shaping the Aautomotive aluminum extrusion market. Aluminum extrusions, renowned for their high strength-to-weight ratio, are increasingly favored by automotive manufacturers seeking to reduce vehicle mass without compromising structural integrity. This imperative for lightweighting has spurred a surge in demand for aluminum extrusions across various automotive applications, including body frames, chassis components, and structural reinforcements. As the industry continues to prioritize weight reduction as a means to enhance performance and sustainability, the demand for aluminum extrusions is expected to maintain a steady upward trajectory.

- Sustainable Manufacturing Practices:

Another significant dynamic influencing the automotive aluminum extrusion market is the growing emphasis on sustainable manufacturing practices within the automotive industry. Aluminum extrusions offer inherent environmental advantages, including high recyclability and energy efficiency in production processes. As automotive OEMs strive to minimize their carbon footprint and adhere to regulatory mandates for eco-friendly manufacturing, the adoption of aluminum extrusions as a lightweight and recyclable material has gained considerable momentum. Moreover, the integration of aluminum extrusions enables vehicles to achieve higher fuel efficiency and lower emissions, aligning with global sustainability goals. This emphasis on sustainability is driving increased investment in aluminum extrusion technologies and expanding the market's scope to include innovative solutions that prioritize environmental responsibility.

Automotive Aluminum Extrusion Market Restraint

One prominent restraint in the automotive aluminum extrusion market is the cost associated with aluminum extrusion processes and materials. While aluminum offers numerous advantages such as lightweight properties and corrosion resistance, it tends to be more expensive than traditional materials like steel. The high initial investment required for equipment and tooling for aluminum extrusion manufacturing can deter some automotive manufacturers, particularly those operating on tight budgets or in price-sensitive segments of the market. Additionally, fluctuations in the prices of aluminum raw materials and energy costs can impact the overall production expenses, further exacerbating the cost concerns associated with aluminum extrusions.

Another restraint affecting the automotive aluminum extrusion market is the inherent design limitations associated with the extrusion process. While aluminum extrusions offer versatility in creating complex shapes and profiles, certain design requirements, such as intricate geometries or tight tolerances, may pose challenges during extrusion. The need for specialized tooling and processing techniques to achieve intricate designs can increase production lead times and costs, limiting the feasibility of aluminum extrusions for certain automotive components. Moreover, the structural integrity of aluminum extrusions may be compromised in highly demanding applications that require exceptional strength and rigidity, necessitating additional reinforcements or alternative materials.

Automotive Aluminum Extrusion Market Opportunity

- Electric Vehicle (EV) Adoption:

One of the most compelling opportunities in the automotive aluminum extrusion market lies in the rapid adoption of electric vehicles (EVs). As the automotive industry undergoes a transformative shift towards electrification to mitigate emissions and meet regulatory mandates, the demand for lightweight materials such as aluminum extrusions is poised to soar. EVs inherently require lightweight components to maximize driving range and battery efficiency, making aluminum extrusions an ideal solution for various structural and non-structural applications. From battery enclosures and chassis components to interior trim and heat sinks, aluminum extrusions offer the versatility and lightweight properties necessary to support the evolving needs of the burgeoning EV market.

- Urban Mobility and Autonomous Vehicles:

Another promising opportunity in the automotive aluminum extrusion market stems from the emergence of urban mobility solutions and autonomous vehicle technologies. With the proliferation of ride-sharing services, micro-mobility solutions, and autonomous vehicle fleets in urban environments, there is a growing need for lightweight and durable materials to support the development of compact and energy-efficient transportation solutions. Aluminum extrusions, with their ability to offer high strength-to-weight ratios and design flexibility, are well-suited for the fabrication of lightweight structural components and modular assemblies tailored to urban mobility applications. Furthermore, as autonomous vehicles evolve to incorporate advanced sensor arrays and computing systems, the demand for lightweight materials that enable efficient thermal management and electromagnetic shielding is expected to increase.

Automotive Aluminum Extrusion Market Challenges

- Material Compatibility and Joining Techniques:

A notable challenge in the automotive aluminum extrusion market revolves around ensuring compatibility and effective joining techniques for aluminum extruded components within vehicle assemblies. While aluminum offers excellent lightweight properties and corrosion resistance, it can present challenges in terms of compatibility with other materials commonly used in automotive construction, such as steel and composites. Ensuring proper bonding and integration of aluminum extrusions with dissimilar materials requires advanced joining techniques, such as adhesive bonding, mechanical fastening, or hybrid joining methods. However, achieving robust and reliable joints between aluminum extrusions and other materials can be technically demanding and may require specialized expertise and equipment. Moreover, variations in thermal expansion coefficients between aluminum and other materials can pose challenges during assembly, potentially leading to dimensional distortions or structural issues.

- Supply Chain Disruptions and Raw Material Sourcing:

Another significant challenge facing the Automotive Aluminum Extrusion Market relates to supply chain disruptions and uncertainties in raw material sourcing. The global automotive industry relies heavily on a complex network of suppliers and manufacturers to deliver components and materials on time and at competitive prices. However, disruptions in the supply chain, such as geopolitical tensions, natural disasters, or trade disputes, can lead to shortages or price fluctuations in critical raw materials used in aluminum extrusion manufacturing, such as primary aluminum ingots or alloying elements. Additionally, the increasing demand for aluminum extrusions across various industries, including automotive, aerospace, and construction, has heightened competition for raw materials and production capacity, further exacerbating supply chain pressures.

Segments Insights:

Type Insights

Sub-structures dominated the type segment.

Sub-structures, including underbody frames and cross-members, represent the largest application of aluminum extrusions in vehicles. These components play a vital role in ensuring vehicle rigidity, crash energy absorption, and weight optimization. Automakers such as Audi and Jaguar Land Rover have adopted aluminum-intensive sub-structures in models like the Audi A8 and Jaguar XE to achieve significant weight reductions and enhanced safety.

Meanwhile, space frames are growing at the fastest pace.

Space frames, consisting of extruded aluminum tubes and profiles, are gaining popularity for their lightweight construction and modular assembly benefits. Tesla’s Model S and Model X use aluminum space frames extensively, showcasing how this technology can be leveraged for superior crashworthiness and weight savings. As more automakers move toward modular, scalable EV architectures, the demand for aluminum space frames is expected to rise rapidly.

Vehicle Insights

Utility vehicles dominated the vehicle type segment.

Utility vehicles, including SUVs and crossovers, account for a significant share of aluminum extrusion applications due to their larger size and higher weight, necessitating extensive lightweighting measures. Popular models like the Ford Explorer and Range Rover Velar employ aluminum extrusions in their structures to balance size, strength, and fuel efficiency requirements, consolidating the segment's dominance.

Electric powered vehicles are the fastest-growing vehicle category.

EVs demand rigorous lightweighting to offset the weight of battery packs and extend driving range. Companies like Lucid Motors and Rivian have adopted aluminum-intensive designs to optimize their electric platforms. Aluminum extrusions facilitate flexible design, better battery protection, and superior crash safety in EVs, propelling their adoption at an exponential rate.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting different marketing strategies, such as new product launch, investments, partnerships, and mergers & acquisitions. The companies are also spending on the development of improved products. Moreover, they are also focusing on competitive pricing.

In March 2022, the Norsk Hydro ASA made an investment by purchasing two extrusion plants at Arconic, Brazil.

The various developmental strategies such as investments, new product launches, acquisition, partnerships,joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Some of the prominent players in the automotive aluminum extrusion market include:

- Hindalco Industries Ltd.

- QALEX

- Arconic Corporation

- Constellium N.V.

- Norsk Hydro ASA

- Bonnell Aluminum

- China Zhongwang Holdings Ltd.

- ETEM Group

- EMERUS

- ST Extruded Products Germany GmbH

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive aluminum extrusion market.

By Type

- Sub-structures

- Door Beam

- Bumpers

- Pillars

- Sub Frames

- Seat Back Bar

- Front Side Rail

- Space Frames

- Body Panels

- Others

By Vehicle

- Mini-compact

- Supermini

- Compact

- Mid-size

- Executive

- Luxury

- Utility Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Buses & Coaches

By Aluminum Grade

- 5000 Series

- 6000 Series

- 7000 Series

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)