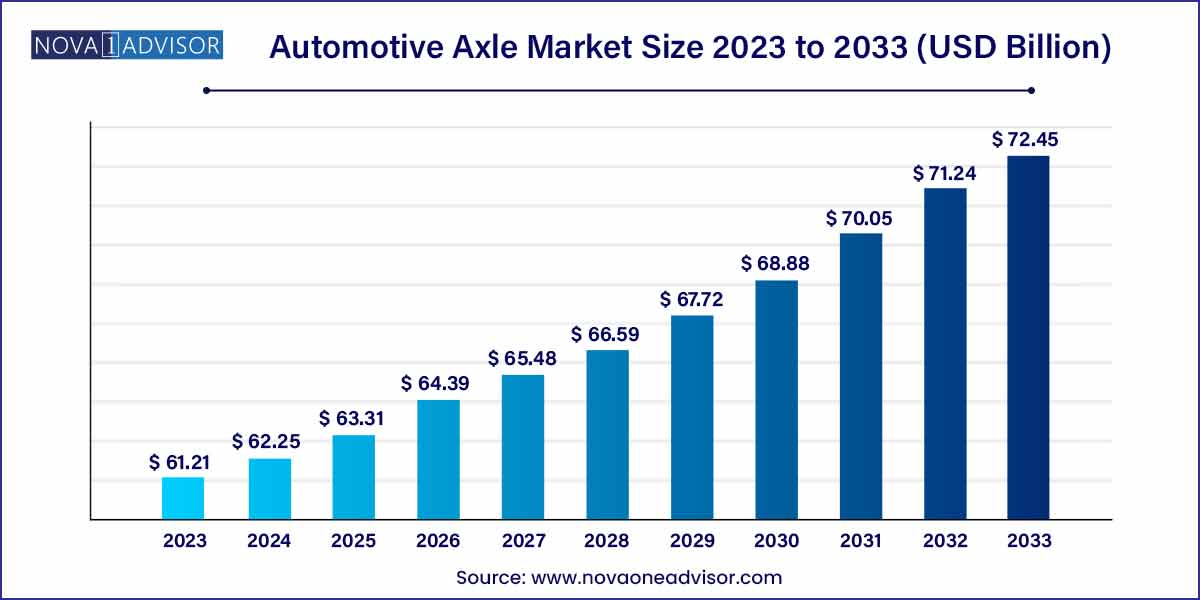

The global automotive axle market size was exhibited at USD 61.21 billion in 2023 and is projected to hit around USD 72.45 billion by 2033, growing at a CAGR of 1.7% during the forecast period of 2024 to 2033.

Key Takeaways:

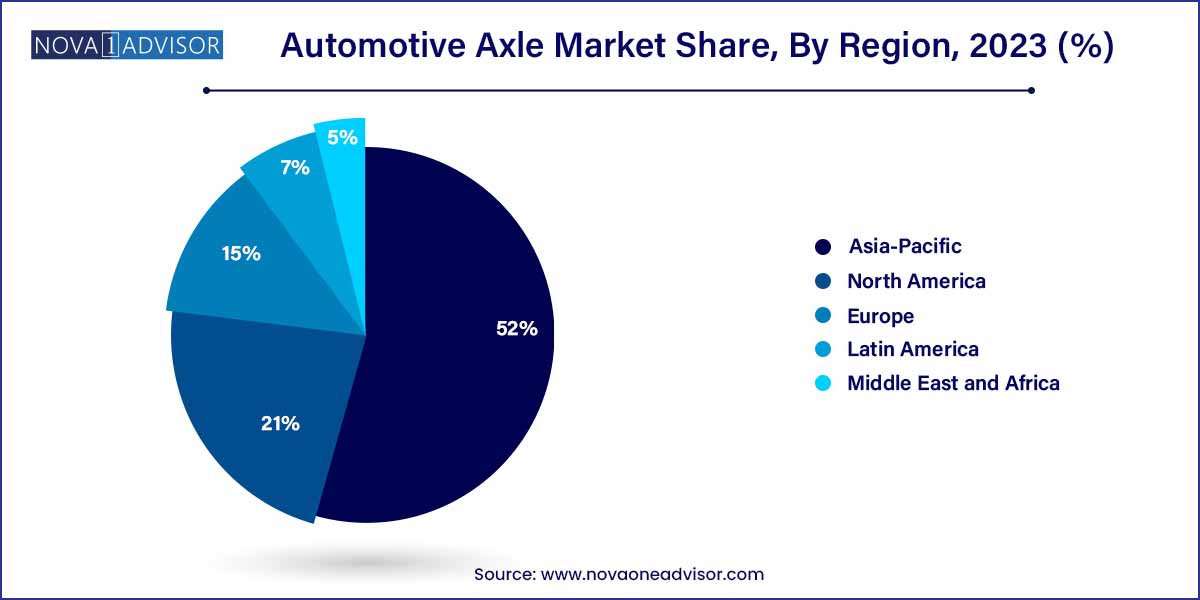

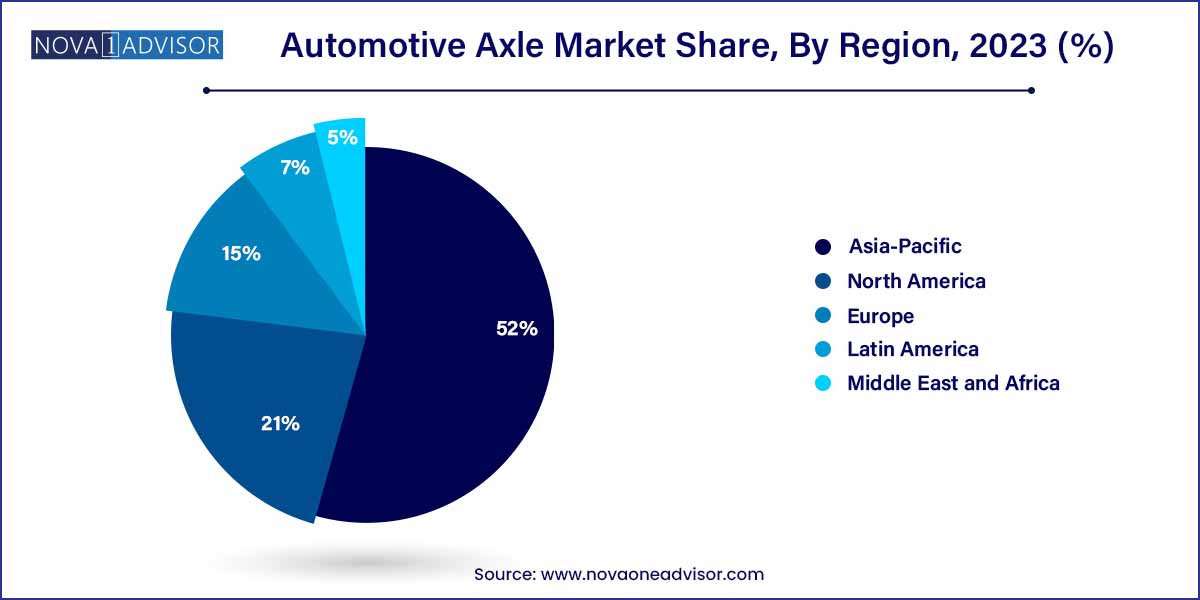

- Asia Pacific dominated the automotive axle market and accounted for the largest revenue share of 52.0% in 2023.

- The drive axle type segment dominated the market and accounted for the highest revenue share of over 65.0% in 2023.

- The front application axle segment will dominate the market, with the highest market share of over 50% in 2023.

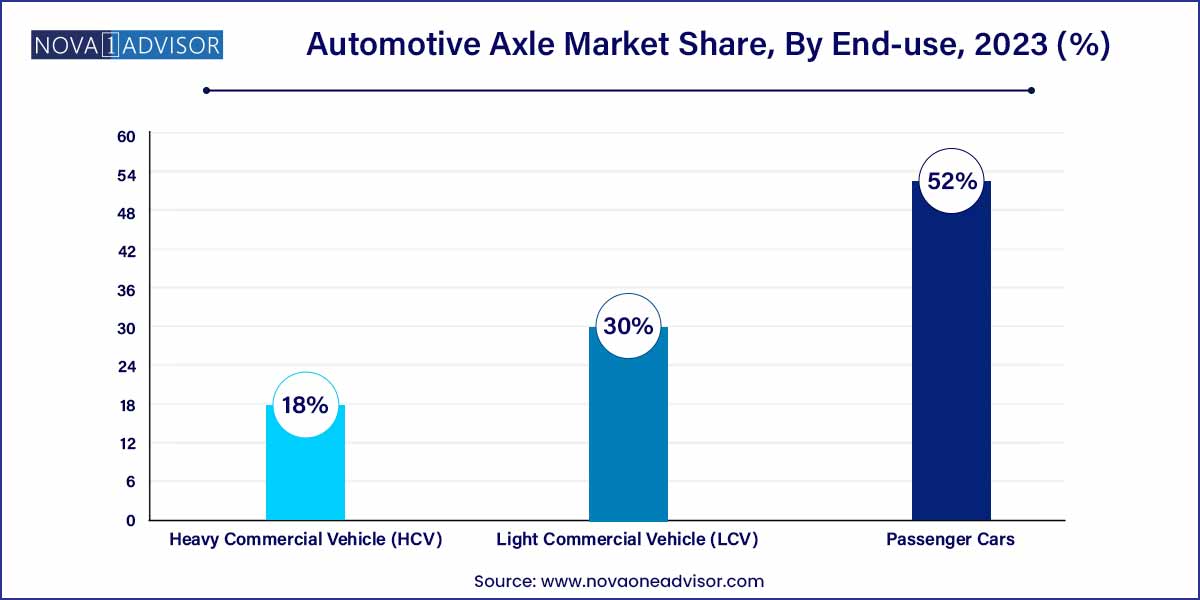

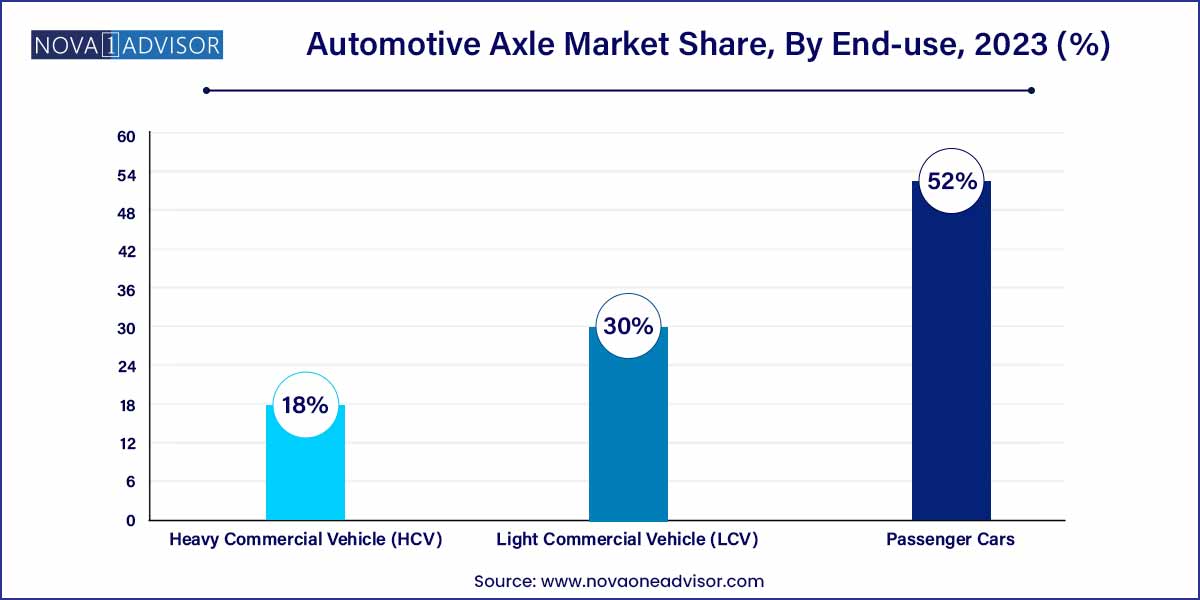

- The passenger car segment dominated the market and accounted for the largest revenue share of over 52.0% in 2023.

Automotive Axle Market: Overview

The automotive axle market plays a pivotal role in the global automotive sector, serving as a fundamental component in vehicle architecture. An axle is a central shaft that connects wheels, supports vehicle weight, and transfers driving torque from the powertrain to the wheels. Axles contribute not only to vehicular motion but also to steering control, shock absorption, and load-bearing functions, making them essential for performance, durability, and safety.

Over the past decade, the axle market has experienced significant transformation, fueled by advancements in vehicle design, electrification trends, lightweight materials, and the growing complexity of modern drivetrains. Manufacturers are increasingly designing axles that integrate multiple functions such as anti-lock braking, torque vectoring, and electronic stability control. The demand for high-efficiency and low-weight axles is particularly pronounced as automakers aim to meet strict fuel efficiency and emission standards.

In terms of application, axles are classified by their position (front or rear), type (drive, dead, lift), and vehicle category (passenger cars, light commercial vehicles, and heavy-duty trucks). The market serves a broad spectrum—from compact cars to electric SUVs, from refrigerated delivery vans to multi-axle trailers in mining and freight transport. The rise of electric and hybrid vehicles has also introduced new axle configurations such as e-axles, where electric motors are integrated into the axle system.

OEMs, tier-1 suppliers, and aftermarket providers together form the value chain of this market, with regional manufacturing hubs in Asia-Pacific, North America, and Europe dictating global supply trends. As automotive demand recovers post-COVID, along with the surge in electric vehicle adoption, the automotive axle market is poised for innovation and structural evolution.

Major Trends in the Market

-

Adoption of Lightweight and High-Strength Materials

Axles made from alloys like aluminum, carbon fiber composites, and high-strength steel are gaining popularity to reduce overall vehicle weight and enhance fuel economy.

-

Integration of Electric Drive Units (E-Axles)

Electrification has led to the development of e-axles—integrated systems combining motor, power electronics, and transmission into the axle assembly, ideal for EVs and hybrids.

-

Focus on Advanced Suspension Systems

Axle designs are being adapted to support independent suspensions and multi-link arrangements for better ride comfort and handling.

-

Modular Axle Architectures

OEMs are developing modular axle platforms that allow easy configuration changes across various vehicle models, reducing manufacturing complexity.

-

Growth of Off-Highway and Construction Axles

With infrastructure spending on the rise, demand for durable and high-capacity axles in construction vehicles and agricultural equipment is surging.

-

Rise in Demand for 4WD and AWD Axle Systems

Consumer preference for SUVs and pickup trucks is driving the adoption of advanced axles with all-wheel and four-wheel drive capabilities.

Automotive Axle Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 61.21 Billion |

| Market Size by 2033 |

USD 72.45 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 1.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application, Vehicle Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

American Axle & Manufacturing, Inc. Dana Incorporated; Daimler AG; GNA Group; Meritor Inc.; ZF Friedrichshafen AG; Melrose Industries PLC; Talbros Engineering Limited. |

Automotive Axle Market Dynamics

- Market Size and Growth Trends:

The dynamics of the automotive axle market are prominently shaped by its current size and ongoing growth trends. The market has experienced a notable expansion, driven by increasing vehicle production and a rising emphasis on advanced axle technologies. Manufacturers are continually investing in research and development to introduce innovative axle designs that enhance vehicle performance and safety. The growth trajectory is further influenced by the demand for axles in diverse vehicle segments, including passenger cars, commercial vehicles, and electric vehicles.

- Technological Advancements and Integration:

A key driving force in the automotive axle market dynamics is the relentless pursuit of technological advancements and their seamless integration into axle systems. Evolving consumer expectations, coupled with stringent regulatory standards, push manufacturers to develop axles that are not only robust but also technologically sophisticated. The incorporation of smart technologies, such as sensor-based systems and electronic control units, enhances axle efficiency and responsiveness.

Automotive Axle Market Restraint

- Regulatory Hurdles and Emissions Standards:

One significant restraint impacting the automotive axle market is the presence of regulatory hurdles and stringent emissions standards. As global environmental concerns intensify, governments worldwide are imposing increasingly stringent regulations to curb vehicle emissions. Compliance with these standards necessitates the development and implementation of advanced axle technologies that contribute to enhanced fuel efficiency and reduced environmental impact. Adherence to these regulations often poses a challenge for manufacturers, requiring substantial investments in research and development to meet evolving standards.

Global Economic Fluctuations:

The automotive axle market is susceptible to the impact of global economic fluctuations, presenting a significant restraint to its growth. Economic uncertainties, such as recessions, trade tensions, and currency fluctuations, can adversely affect consumer purchasing power and, subsequently, vehicle demand. As axles are integral components of automobiles, any downturn in the automotive industry directly influences the market's performance. Manufacturers face challenges in predicting and managing production volumes amidst economic uncertainties, leading to potential overcapacity or supply chain disruptions.

Automotive Axle Market Opportunity

- Rising Demand for Electric Vehicles (EVs):

One prominent opportunity within the automotive axle market lies in the escalating demand for electric vehicles (EVs). As the automotive industry undergoes a transformative shift towards sustainable mobility, EVs are gaining traction globally. The unique requirements of electric powertrains, including efficient energy transfer and regenerative braking, present a significant avenue for axle innovation. Manufacturers can capitalize on this opportunity by developing specialized axles tailored to the distinct needs of electric vehicles.

- Integration of Advanced Materials and Lightweight Designs:

The integration of advanced materials and lightweight designs presents a compelling opportunity for the automotive axle market. With a growing emphasis on fuel efficiency and emissions reduction, vehicle manufacturers are increasingly incorporating lightweight components to enhance overall vehicle performance. Axle manufacturers can leverage this trend by developing lightweight yet durable axle solutions through the adoption of advanced materials such as high-strength alloys and composite materials.

Automotive Axle Market Challenges

- Global supply chain disruptions:

A significant challenge facing the automotive axis market is its vulnerability to global supply chain disruptions. The industry relies on a complex network of suppliers for raw materials and components, and any disruptions in the supply chain can have cascading effects on production schedules. Factors such as natural disasters, geopolitical tensions, or unexpected events (as seen with the COVID-19 pandemic) can lead to shortages, delayed deliveries, and increased costs.

- Intensive competition and price pressures:

Intensive competition within the automotive axle market poses a considerable challenge for manufacturers. The industry is characterized by numerous players vying for market share, leading to price pressures and slim profit margins. Manufacturers must constantly innovate and differentiate their products to stay competitive, often requiring significant investments in research and development. Additionally, price pressures may lead to compromises in product quality or the adoption of cost-cutting measures, impacting the overall value proposition.

Segments Insights:

By Type Insight

Drive axles dominated the market, as they are essential for transmitting power from the engine or motor to the wheels. In ICE vehicles, drive axles form the backbone of motion transmission, while in EVs, they support electric propulsion directly. These axles are particularly prominent in front-wheel and rear-wheel drive vehicles, commercial trucks, and buses. Their importance is heightened in AWD and 4WD applications, where both front and rear axles may be configured as drive axles for enhanced traction. Moreover, innovations in torque vectoring and active differentials further elevate the performance of modern drive axles.

Lift axles are the fastest-growing type, particularly in multi-axle commercial vehicles. These auxiliary axles are raised or lowered depending on load requirements and road conditions, improving fuel efficiency and reducing tire wear when not in use. Their usage is expanding in long-haul trucks, waste management vehicles, and construction fleets. With the rising demand for payload optimization and road tax compliance in Europe and North America, fleet operators are increasingly adopting lift axle-equipped vehicles, creating growth momentum in this niche segment.

By Application Insights

Rear axle applications lead the segment, owing to their dominance in both rear-wheel drive passenger cars and commercial vehicles. The rear axle bears the load of propulsion in most trucks, buses, and rear-wheel passenger cars. In pickups and utility vehicles, the rear axle is often more robust, housing differential gears and supporting increased cargo weight. Rear axles are also central in hybrid powertrains and in regenerative braking systems in EVs, where electric motors are mounted directly on the rear axle for better weight distribution.

Front axle usage is growing rapidly, especially in urban vehicle categories such as compact cars and front-wheel drive models. Front axles often house steering mechanisms, suspension systems, and sometimes propulsion in front-wheel drives. The shift toward compact, fuel-efficient cars in densely populated cities, combined with increased manufacturing of front-wheel electric vehicles, is driving higher demand for advanced front axle assemblies. Additionally, independent front suspension systems are being integrated into front axles to improve ride comfort and handling, boosting their technological sophistication.

By Vehicle Type Insights

Passenger cars dominate the vehicle type segment, attributed to their massive global production and consumer base. Whether sedans, hatchbacks, or SUVs, every passenger vehicle depends on front and rear axle systems for performance and safety. With growing demand for SUVs and crossovers, which often include 4WD capabilities, the need for advanced axle designs is increasing. Manufacturers are focusing on quieter, lighter axles that contribute to fuel economy and better cabin experience—key purchase drivers for consumers.

Heavy commercial vehicles (HCVs) are the fastest-growing segment, driven by global expansion in logistics, construction, mining, and infrastructure development. Multi-axle trucks, dumpers, and trailers require complex axle systems with high load-bearing capacity, torsional strength, and durability. In North America, twin and tri-axle trucks are used extensively in freight hauling, while in Asia and Africa, HCVs support large-scale construction and mining projects. Advancements in axle cooling, modular hubs, and electronic control integration are increasing the demand for sophisticated axle systems in this segment.

By Regional Insights

Asia-Pacific leads the global axle market due to its massive vehicle manufacturing base, growing consumer population, and robust infrastructure development. China, India, Japan, and South Korea are central to this dominance. China alone manufactures over 25 million vehicles annually, requiring millions of axles for both domestic use and export. India’s commercial vehicle sector is also rapidly growing, creating demand for high-performance axles suited to rough terrain and long-haul transportation. Japanese OEMs such as Toyota and Honda, and Korean manufacturers like Hyundai and Kia, are continuously innovating axle systems for fuel efficiency and performance.

The region’s cost-effective labor, expanding automotive component ecosystem, and government incentives for electric mobility further drive investment in axle production and innovation. Companies like AAM, Dana, and Meritor operate manufacturing facilities across the region, supporting both local and international demand.

North America is witnessing accelerated growth in the axle market, primarily due to the rise in electric vehicle adoption, off-road recreation, and advanced commercial vehicle manufacturing. The U.S. is a global hub for 4x4 utility vehicles, large pickup trucks, and high-performance off-roaders, all of which require high-capacity and specialized axle systems. In addition, stringent safety and fuel economy regulations have prompted American OEMs to invest in lightweight and smart axle solutions.

The rise of e-commerce has also fueled demand for delivery vans and freight trucks, creating a surge in axle replacement and innovation. The region is also at the forefront of e-axle development, with companies like Tesla, Rivian, and Ford integrating advanced e-axle configurations into their EV platforms. With growing government support for electrification, the North American axle market is expected to witness strong CAGR over the next decade.

Some of the prominent players in the automotive axle market include:

- American Axle & Manufacturing, Inc.

- Dana Incorporated

- Daimler AG

- GNA Group

- Meritor Inc.

- ZF Friedrichshafen AG

- Melrose Industries PLC

- Talbros Engineering Limited

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive axle market.

Type

Application

Vehicle Type

- Passenger Cars

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)