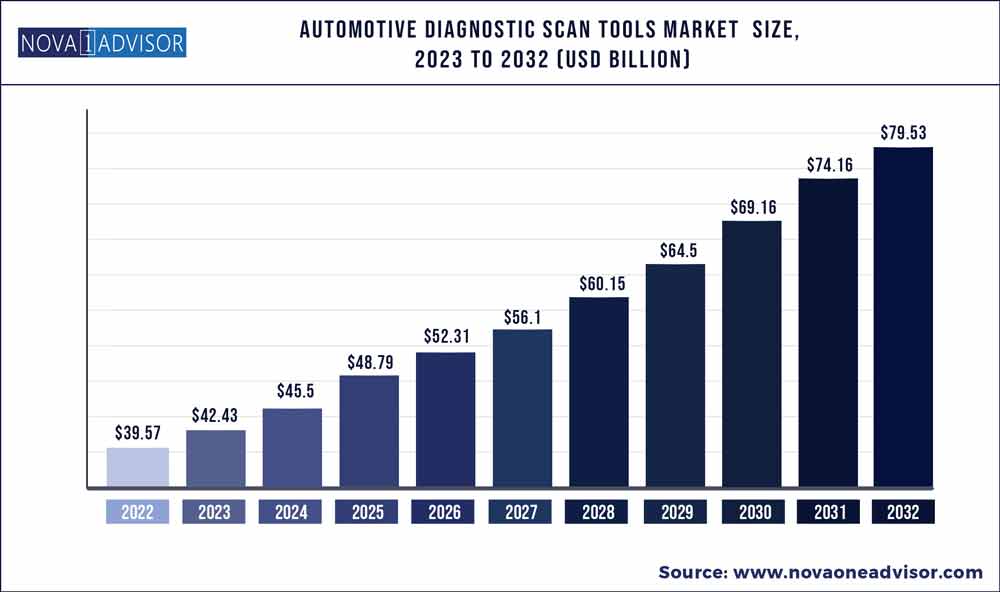

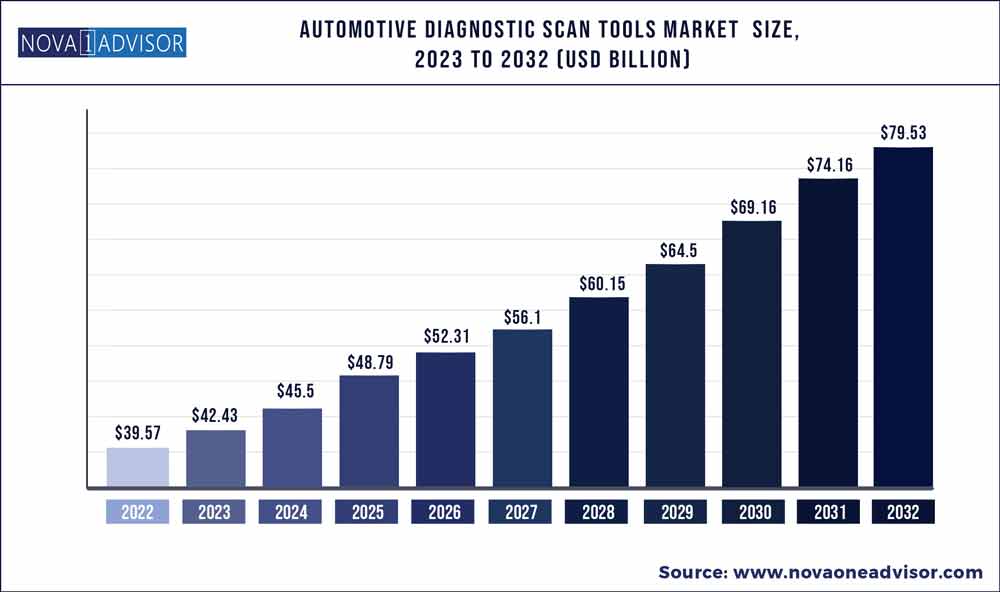

The global automotive diagnostics scan tool market size was exhibited at USD 39.57 billion in 2022 and is projected to hit around USD 79.53 billion by 2032, growing at a CAGR of 7.23% during the forecast period 2023 to 2032.

Key Pointers:

- Asia Pacific automotive diagnostics scan tool market size was valued at USD 17.8 billion in 2022.

- By vehicle type, the passenger vehicle segments accounted 90.2% market share in 2022.

- By offering type, the diagnostic software segment held 17.9% market share in 2022.

The outbreak of the COVID-19 pandemic is not expected to affect the extraction of materials such as steel, copper, and aluminum. With trade restrictions in place during the first six months of 2020, raw material extraction was continued by major extractors in China. However, the prices of raw materials such as copper will continue to rise, with copper price hitting USD 10,000 per ton for the first time in 10 years in May 2021. The automotive diagnostic scan tools market, however, is expected to witness a significant boost in 2022 owing to the rise in awareness for timely vehicle repair and maintenance, stringent emission norms by different countries. The COVID-19 pandemic has had a severe impact on the global automotive industry. This is witnessed in terms of the supply chain disruptions of part exports from China, large-scale manufacturing interruptions across Europe, and closure of assembly plants in the US and other major countries, such as India and Brazil, where the automotive sector highly contributes to the GDP

Automotive Diagnostic Scan Tools Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 42.43 Billion

|

|

Market Size by 2032

|

USD 79.53 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 7.23%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Offering Type, Tool Type, Vehicle Type, Propulsion, Application, Workshop Equipment, Connectivity, Handheld Scan Tools

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Horiba Ltd, SGA SA, Continental AG, SPX Corporation, Denso Corporation, Delphi Technologies, Robert Bosch GmBH, Softing AG, Snap-on Incorporated, ACTIA Group, Autel Intelligent Technology Corp., Ltd, AV List GmbH, BMW AG, Bosch Automotive Service Solutions, DG Technologies, Fluke Corporation, Honda Motor Company, Volkswagen AG, Volvo Group, KPIT Technologies, Launch Tech, Hickok Incorporated

|

Market Dynamics:

Automotive Diagnostic Scan Tools Market Driver: Increasing sales of passenger cars

The market for automotive diagnostic scan tools is expected to grow with the increase in sales of passenger vehicles. Passenger vehicle sales have surged, with growth in all three top auto markets: China, the US, and Europe. Factors such as growing demand for low emission commuting and governments supporting vehicle inspection mandates have compelled the manufacturers to provide automotive diagnostic scan tools around the world. Passenger car is the fast-growing segment in the automotive market and is expected to witness significant growth during the forecast period. According to Business Insider, the total number of passenger cars on the road will double by 2040 as passenger cars are projected to reach 2 billion by 2040. The global passenger car sales is estimated to reach 72.5 million units in 2025 from 64.1 million units in 2021. This has led to a growing demand for automotive diagnostic tools in the market. The Passenger Cars market is generally influenced by the distribution of wealth within a country or region and serves as a good indicator when it comes to financial stability. The growth of automotive diagnostic scan tools market is driven by rapid urbanization in emerging economies that have led to the increase in demand for personal motor vehicles.

Automotive Diagnostic Scan Tools Market Restraint: High initial cost of advanced diagnostic tools

With constant advancements in vehicle computer technology, workshops require more sophisticated scan tools to keep up, but most workshops cannot afford them all. Diagnostic scan tools have witnessed a decline in their overall price levels. However, newer technologies are more expensive than conventional OBD-I systems. This can reduce the demand for newer and innovative technologies. Diagnostic scan tool manufacturers are under constant pressure from OEMs to curtail the prices of diagnostic scan tool equipment. Many manufacturers are also hesitant to invest in R&D activities due to high costs, particularly in emerging countries, wherein OEMs are still launching new models with basic diagnostic scanning systems. Since automobiles must successfully meet stringent safety regulations, automotive diagnosis requires highly sophisticated instruments and equipment, which add to the overall cost. The equipment also needs to be updated whenever there are changes in regulations.

Automotive Diagnostic Scan Tools Market Opportunity: Consumer preference for high-end cars

The ongoing trend in developed countries across the globe is inclined more toward purchasing premium segment cars, featuring accurate, improved, and quick diagnosis tools. A significant growth of tangible luxury offerings in vehicles, shifting consumer preferences from sedans to SUVs, and increasing disposable incomes of consumers have been propelling the demand for luxury cars worldwide. The demand for OBD solutions continues to be high in personal and commercial vehicles, as there is the adoption of newer technologies in vehicles to make them more efficient and sustainable. Automotive trends such as connected cars and electric vehicles demand advanced diagnostic tools for managing and controlling high-tech vehicle components. The high-end car market accounted for 6% of automobile sales in the US in 2020, resulting in a small but highly lucrative segment. According to Statista, the global market for high-end cars is grew from USD 327.1 billion (245 billion euros) in 2010 to USD 593.5 billion (503 billion euros) in 2020. The growth can be attributed to the increasing consuming power of emerging markets such as China. Germany, Italy, France, and Spain are leading the path of adopting newer and modern scan tools. The demand for high-end passenger vehicles is expected to grow at a substantial rate in the coming years, with major demand from the Asia Pacific region.

Automotive Diagnostic Scan Tools Market Challenges: Lack of awareness

Lack of awareness to deal up with the latest technologies act as major challenges in growth of the automotive diagnostic scan tools market. The cost of the technology is immensely high, which may not be easily affordable to many consumers. Moreover, the complexities involved in the functioning of such diagnostic scan tools may limit the growth of market. Some OBD2 scanners are more budget-friendly and generalized in their capabilities, designed to appeal to the average car owner. Advanced OBD2 scanners are equipped with much more extensive and detailed diagnostic capabilities, clearly designed with serious DIYers and pro mechanics. Higher quality OBD2 scanners, on the other hand, come equipped with a much greater range of capabilities.

By vehicle type: Passenger cars segment is estimated to hold the largest share of the overall Automotive Diagnostic Scan Tools Market

Passenger cars are major contributors to the amount of pollution caused due to vehicular emissions. The diagnostic scan tools monitor and detect faults in the emission control system. The dashboard light is illuminated, indicating ‘check engine’ whenever a fault is dedicated. Earlier, vehicle faults where diagnosed by trained technicians certified with ASE A6, A8, and L1 standards. However, with the introduction of handheld tools for diagnostics, DIY for minor defects has gained momentum in passenger cars. The standard of living of consumers has improved in the recent decade due to the rapid globalization and economic growth of emerging countries such as Brazil, Mexico, and India. The increase in disposable income of consumers has fueled the demand for passenger cars, which, in turn, has driven the passenger car market. OEMs such as General Motors, Ford, and Honda have launched their new passenger car models by employing a customer-focused strategy.

By Offering: Diagnostic equipment/hardware segment is expected to dominate the Automotive Diagnostic Scan Tools Market

The growth of this segment can be attributed to the increasing vehicle population in both developed and emerging countries and the growing complexity in vehicle electronics. Automotive diagnostic equipment/hardware tools are generally physical devices that are designed to determine the conditions of various automotive hardware components. The increase in complexity of vehicles has increased the requirement of automotive diagnostic equipment/hardware in automobile workshops hence leading to the growth of the automotive diagnostics equipment/hardware market. Over the years, there has been an exceptional surge in the production and sales of vehicles along with a steady increase in the number of automotive workshops, which has simultaneously bolstered the automotive diagnostic scan tools market across the globe.

By Connectivity: USB is estimated to be the largest market during the forecast period

The USB connectivity is widely used in all vehicles equipped with OBD-II. OBD-II is an on-board computer that monitors emissions, mileage, speed, and other data about a vehicle. It is connected to the Check Engine light, which illuminates when the computer detects a problem. USB is cost-effective, and user friendly. It is an adapter that turns tablet, laptop, or netbook into a sophisticated diagnostic scan tool, and real-time performance monitor. However, with higher demand for wireless diagnostic scan tools, the USB connectivity is expected to be replaced by Bluetooth and Wi-Fi.

Asia Pacific is expected to account for the largest automotive diagnostic scan tools market size during the forecast period

In recent years, Asia Pacific has emerged as a hub for automobile production. Infrastructural developments and industrialization activities in emerging economies have opened new avenues, creating several opportunities for automotive OEMs. In addition, the increased purchasing capability of the population has triggered the demand for automobiles. Global OEMs such as Volkswagen and General Motors cater to this market through joint ventures with domestic manufacturers. The implementation of new technologies, establishment of additional manufacturing plants, and creation of value-added supply chains between manufacturers and material providers have made Asia Pacific a market with high growth potential. China is the largest market in Asia Pacific and is witnessing significant growth in the sales and the demand for premium vehicles. China is a major market for premium vehicles, given the rising disposable income in the country. Nearly all major OEMs have invested in the Chinese market, which is inclined toward small and affordable passenger vehicles. A surge in demand is expected, as the current vehicle penetration is low as compared to developed countries. The growing automotive production levels in China have driven the demand for automotive diagnostic scan tools.

Some of the prominent players in the Automotive Diagnostic Scan Tools Market include:

- Horiba Ltd

- SGA SA

- Continental AG

- SPX Corporation

- Denso Corporation

- Delphi Technologies

- Robert Bosch GmBH

- Softing AG

- Snap-on Incorporated

- ACTIA Group

- Autel Intelligent Technology Corp., Ltd

- AV List GmbH

- BMW AG

- Bosch Automotive Service Solutions

- DG Technologies

- Fluke Corporation

- Honda Motor Company

- Volkswagen AG

- Volvo Group

- KPIT Technologies

- Launch Tech

- Hickok Incorporated

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Automotive Diagnostic Scan Tools market.

By Offering Type

- Diagnostic Hardware

- Scanner

- Analyzer

- Tester

- Code reader

- Others

- Diagnostic Software

- Vehicle system testing software

- Vehicle tracking and emissions analysis

- ECU diagnosis software

- Others

- Diagnostic services

- Vehicle Maintenance and repair

- Custom, training, support and integration

By Tool Type

- DIY diagnostic

- OEMS diagnostics

- Professional diagnostics

By Vehicle Type

- Passenger vehicle

- Commercial vehicle

By Propulsion

By Application

- Emission control

- Repair maintenance

- Vehicle health alert and road side assistance

- Vehicle tracking

- Automatic crash notification

- Others

By Workshop Equipment

- Engine analyser

- Pressure leak detection

- Fuel injecting diagnosis

- Headlight tester

- Dynamometer

- Painscan equipment

- Wheel alignment equipment

- Exhaust gas analyser

By Connectivity

By Handheld Scan Tools

- Scanners

- Code Readers

- TPMS Tools

- Digital Pressure Tester

- Battery Analyzer

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)