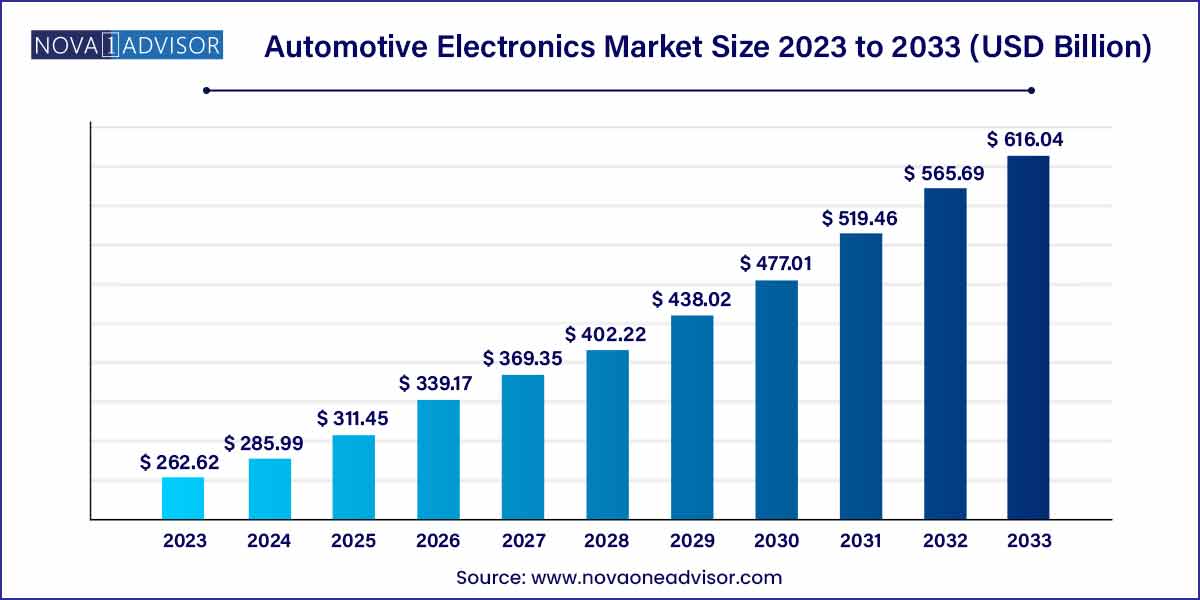

The global automotive electronics market size was exhibited at USD 262.62 billion in 2023 and is projected to hit around USD 616.04 billion by 2033, growing at a CAGR of 8.9% during the forecast period of 2024 to 2033.

Key Takeaways:

- The current carrying devices segment led the market and accounted for 40.2% of the market in 2023.

- The safety systems segment accounted for the largest market revenue share in 2023.

- The OEM segment led the market in 2023.

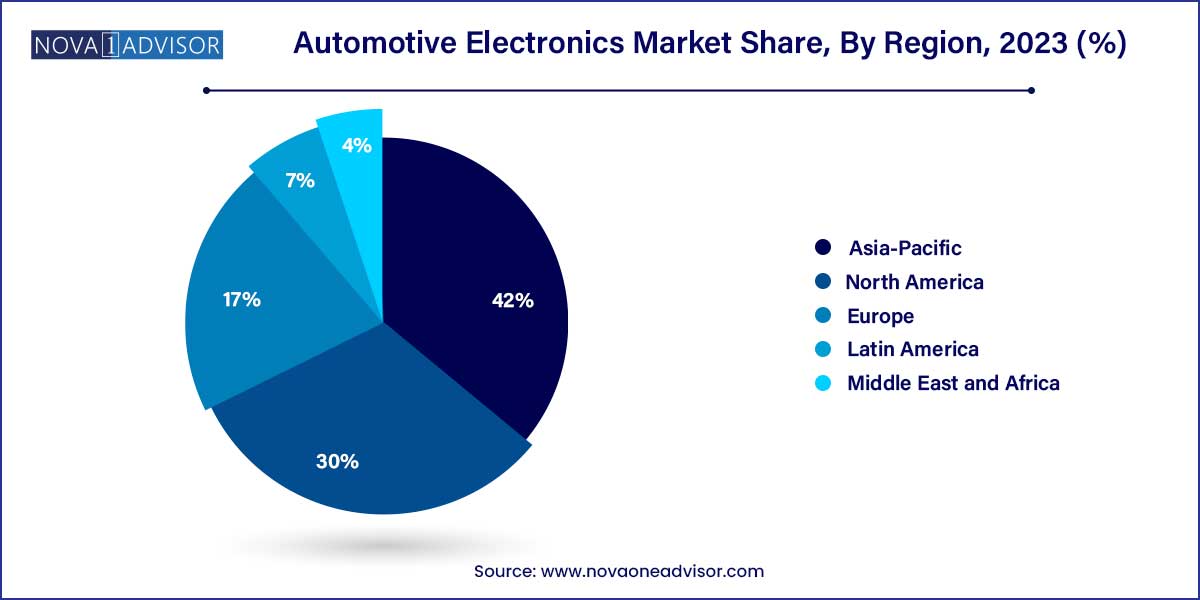

- Asia Pacific dominated the automotive electronics market and accounted for 42.0% of the share in 2023.

Automotive Electronics Market: Overview

The Automotive Electronics Market has become one of the most transformative forces in the global automotive industry, fundamentally altering vehicle architectures and customer expectations. From enhancing driving safety to enabling electrification and connectivity, automotive electronics are now a key differentiator for car manufacturers. These systems include sophisticated Electronic Control Units (ECUs), sensors, current-carrying devices, and a wide range of embedded software applications, supporting functionalities like Advanced Driver Assistance Systems (ADAS), infotainment, safety, powertrain, and body electronics.

Technological advancements in electric vehicles (EVs), autonomous driving, connected cars, and smart mobility are continuously pushing the boundaries of innovation in automotive electronics. OEMs and Tier-1 suppliers are heavily investing in R&D to produce efficient, high-performance, and cost-effective electronic solutions. Government regulations mandating advanced safety systems and stringent emission norms are further accelerating the adoption of automotive electronics globally.

The competitive landscape is characterized by rapid technological shifts, strategic collaborations, acquisitions, and continuous innovation. Companies like Robert Bosch, Continental AG, and Denso Corporation dominate the market by offering a wide portfolio of automotive electronic solutions catering to the evolving needs of the industry.

Automotive Electronics Market Growth

The growth of the automotive electronics market is propelled by several key factors. Firstly, increasing consumer demand for advanced safety features, connectivity, and convenience in vehicles is driving automakers to integrate more sophisticated electronic systems. Regulatory mandates aimed at improving vehicle safety and reducing emissions also contribute to market growth by encouraging the adoption of advanced driver assistance systems (ADAS) and electric powertrains. Furthermore, the rise of electric vehicles (EVs) and autonomous vehicles (AVs) is reshaping the landscape, with EVs relying heavily on electronic components for propulsion and battery management, while AVs require advanced sensor fusion and connectivity technologies. Additionally, the proliferation of connected car services and in-vehicle entertainment systems is creating new revenue streams and business opportunities. With continuous technological innovation and evolving consumer preferences, the automotive electronics market is poised for further expansion in the coming years.

Automotive Electronics Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 262.62 Billion |

| Market Size by 2033 |

USD 616.04 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Component, Application, Vehicle Type, Propulsion, Sales Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Continental AG; DENSO Corporation; Hella GmbH & Co. Kgaa; Hitachi Automotive Systems, Ltd.; Infineon Technologies AG; Robert Bosch GmbH; Valeo Inc.; Visteon Corporation; Xilinx, Inc.; ZF Friedrichshafen AG. |

Automotive Electronics Market Dynamics

- Technological Advancements:

The automotive electronics market is characterized by rapid technological advancements, driven by ongoing innovation and research in areas such as sensors, microcontrollers, software algorithms, and connectivity solutions. These advancements enable the development of increasingly sophisticated electronic systems and components that enhance vehicle performance, safety, and user experience. For example, the integration of advanced driver assistance systems (ADAS) such as adaptive cruise control, lane departure warning, and automatic emergency braking relies on cutting-edge sensor technologies and AI algorithms to enhance vehicle safety. Moreover, the emergence of electric vehicles (EVs) and autonomous vehicles (AVs) is driving the adoption of new electronic architectures and communication protocols to support functions such as battery management, vehicle-to-vehicle (V2V) communication, and autonomous driving capabilities.

- Shift Towards Connected and Autonomous Vehicles:

The automotive industry is experiencing a significant shift towards connected and autonomous vehicles, driven by advancements in sensor technology, artificial intelligence (AI), and connectivity solutions. Connected vehicles leverage onboard sensors and communication modules to enable features such as real-time navigation, remote diagnostics, over-the-air (OTA) updates, and in-vehicle entertainment and infotainment services. These features enhance the overall driving experience and enable new business models such as subscription-based services and targeted advertising. Additionally, the development of autonomous vehicles relies heavily on advanced electronic systems such as LiDAR, radar, cameras, and AI algorithms to perceive and interpret the vehicle's surroundings and make real-time driving decisions.

Automotive Electronics Market Restraint

One of the primary restraints impacting the automotive electronics market is the cost associated with developing and implementing advanced electronic systems and components. The integration of sophisticated technologies such as sensors, microcontrollers, and connectivity solutions into vehicles requires significant investment in research, development, and manufacturing. Additionally, the complexity of automotive electronics design and the need for compliance with stringent safety and regulatory standards further contribute to higher production costs. These cost pressures are particularly challenging for automotive manufacturers, who must balance the demand for innovative features with the need to maintain competitive pricing to appeal to consumers. Furthermore, the automotive industry's traditionally thin profit margins and the need to recoup substantial investments in technology development can limit the widespread adoption of advanced electronic systems, especially in price-sensitive market segments.

Another significant restraint affecting the automotive electronics market is the growing concern over cybersecurity risks associated with connected vehicles and electronic control systems. As vehicles become increasingly interconnected and reliant on software-driven functionalities, they become more vulnerable to cybersecurity threats such as hacking, malware, and data breaches. These threats can potentially compromise vehicle safety, privacy, and data integrity, posing significant risks to both consumers and automotive manufacturers. The complexity of modern vehicle architectures, which incorporate multiple communication networks and interconnected electronic control units (ECUs), further exacerbates cybersecurity challenges. Additionally, the proliferation of third-party software and connected services increases the attack surface and introduces potential vulnerabilities that malicious actors can exploit. To address these concerns, automotive manufacturers and suppliers must implement robust cybersecurity measures, such as secure communication protocols, intrusion detection systems, and over-the-air (OTA) security updates.

Automotive Electronics Market Opportunity

- Growth in Electric Vehicle (EV) Adoption:

The increasing adoption of electric vehicles presents a significant opportunity for the automotive electronics market. As governments worldwide implement stringent emission regulations and consumers seek more sustainable transportation options, the demand for electric vehicles is expected to continue growing rapidly. Electric vehicles rely heavily on advanced electronic systems and components, including battery management systems, power electronics, electric drivetrains, and charging infrastructure. Additionally, electric vehicles offer opportunities for innovation in areas such as energy storage, regenerative braking, and vehicle-to-grid (V2G) integration. Furthermore, advancements in battery technology, such as solid-state batteries and fast-charging solutions, are driving improvements in electric vehicle performance, range, and affordability.

- Advancements in Autonomous Driving Technology:

The rapid development of autonomous driving technology presents a significant opportunity for the automotive electronics market. Autonomous vehicles rely on a diverse array of electronic systems and sensors, including LiDAR, radar, cameras, GPS, and AI algorithms, to perceive and interpret their surroundings and make real-time driving decisions. As advancements in sensor technology, artificial intelligence, and connectivity solutions continue to accelerate, autonomous driving capabilities are becoming increasingly sophisticated and reliable. Autonomous vehicles offer the potential to revolutionize transportation by improving safety, reducing traffic congestion, and enabling new mobility services such as ride-hailing and autonomous delivery. Furthermore, the development of autonomous vehicle technology presents opportunities for innovation in areas such as sensor fusion, cybersecurity, human-machine interface (HMI), and vehicle-to-everything (V2X) communication.

Automotive Electronics Market Challenges

- Complexity of Integration and Interoperability:

One of the primary challenges in the automotive electronics market is the complexity of integrating diverse electronic systems and components into vehicles and ensuring interoperability between different subsystems. Modern vehicles incorporate a multitude of electronic control units (ECUs), sensors, actuators, and communication networks, each performing specific functions and requiring seamless integration with other systems. However, the integration process is complicated by factors such as varying hardware and software architectures, proprietary communication protocols, and compatibility issues between different components and suppliers. As a result, automotive manufacturers face significant challenges in managing the complexity of electronic system design, testing, validation, and production. Furthermore, ensuring interoperability between electronic systems is crucial for enabling functionalities such as advanced driver assistance systems (ADAS), vehicle-to-everything (V2X) communication, and in-vehicle infotainment.

- Shortened Product Lifecycles and Rapid Technological Obsolescence:

Another significant challenge in the automotive electronics market is the shortened product lifecycles and rapid technological obsolescence driven by the fast-paced nature of technological innovation. As new electronic components, sensors, and software algorithms are developed at a rapid pace, automotive manufacturers must continually update and upgrade their vehicle platforms to incorporate the latest advancements and remain competitive in the market. However, the automotive industry's traditionally long development cycles and stringent validation processes present challenges in adapting to rapid technological changes. Moreover, the integration of advanced electronic systems into vehicles requires substantial investments in research, development, testing, and validation, which can further extend product development timelines. Additionally, the risk of technological obsolescence poses challenges for automotive manufacturers in terms of inventory management, aftermarket support, and vehicle resale value. To address these challenges, automotive OEMs and suppliers must adopt agile development methodologies, flexible manufacturing processes, and modular architectures that enable faster product iterations and updates.

Segments Insights:

By Component

Electronic Control Units (ECUs) dominated the component segment within the automotive electronics market in 2024. ECUs are the brains behind most modern automotive functionalities, managing everything from engine performance and braking systems to infotainment and ADAS. The proliferation of functionalities like autonomous driving, telematics, and advanced safety systems has drastically increased the number of ECUs per vehicle. On average, premium vehicles today incorporate up to 100 ECUs, significantly contributing to this segment's dominance.

Sensors are anticipated to be the fastest-growing component segment. With the rise of autonomous vehicles and ADAS technologies, demand for LiDAR, radar, ultrasonic, and camera sensors is skyrocketing. These sensors enable real-time environment monitoring and decision-making, critical for autonomous and semi-autonomous driving functionalities. In 2024, major OEMs like Ford and GM heavily invested in sensor technologies, forecasting exponential growth for this segment over the coming years.

By Application

Advanced Driver Assistance Systems (ADAS) dominated the application segment. Increasing regulatory mandates and consumer demand for enhanced vehicle safety have made ADAS features standard or highly desired in new vehicles. Technologies such as adaptive cruise control, automated parking, collision avoidance, and pedestrian detection are driven by sophisticated electronic systems, firmly positioning ADAS at the forefront of the application landscape.

Infotainment is expected to be the fastest-growing application. Modern consumers expect seamless connectivity, smartphone integration, in-car entertainment, and navigation solutions. With the introduction of technologies like 5G connectivity and AI-driven voice assistants, the infotainment segment is witnessing rapid innovation and adoption. Companies like Tesla and BMW are setting benchmarks by offering advanced infotainment systems that continuously evolve via OTA updates, fueling growth in this segment.

By Vehicle Type

Passenger cars dominated the vehicle type segment in 2024. The sheer volume of passenger car production and sales, combined with consumers' growing preference for high-tech features, has led to widespread integration of sophisticated electronics. OEMs are increasingly equipping even mid-range passenger cars with features like adaptive headlights, wireless charging pads, and advanced infotainment systems.

Electric two-wheelers are emerging as the fastest-growing vehicle type for automotive electronics. The rise in urbanization, environmental awareness, and government incentives for electric mobility is fueling electric two-wheeler adoption, particularly in Asia-Pacific regions like India and China. These vehicles are increasingly being equipped with smart dashboards, regenerative braking systems, GPS tracking, and smartphone connectivity, creating lucrative opportunities for electronic component manufacturers.

By Propulsion

Internal Combustion Engine (ICE) vehicles continued to dominate the propulsion segment in 2024. Despite the rapid growth of EVs, ICE vehicles still represent the majority of global vehicle sales, especially in regions with limited EV infrastructure. ICE vehicles increasingly incorporate electronic systems for emission control, performance enhancement, and fuel efficiency improvements, sustaining demand within this segment.

Electric vehicles (EVs) are the fastest-growing propulsion segment. Driven by environmental policies, declining battery costs, and heightened consumer interest, EVs are witnessing unprecedented growth. In January 2024, BYD reported a 60% year-on-year increase in EV sales, underlining the market’s momentum. EVs are electronics-intensive by nature, requiring complex battery management, motor control, and charging interface systems, hence driving substantial demand for automotive electronics.

By Sales Channel

OEMs dominated the sales channel segment within the automotive electronics market. OEM-fitted electronics ensure seamless integration, compliance with stringent safety standards, and better consumer appeal. Automakers are increasingly offering factory-installed ADAS, infotainment, and connected car solutions to differentiate their models in a competitive market.

Aftermarket sales are expected to grow rapidly over the coming years. Consumers are increasingly opting for aftermarket upgrades such as advanced infotainment units, telematics systems, and driver-assistance accessories. Additionally, the growing used vehicle market is propelling demand for electronics retrofitting services, expanding the aftermarket opportunities.

Regional Insights

Asia-Pacific dominated the global automotive electronics market in 2024. The region’s dominance is largely attributed to the massive automotive production hubs in China, Japan, South Korea, and India. China alone accounts for a significant share of global vehicle production, and its strong push toward NEVs (New Energy Vehicles) is further boosting the demand for automotive electronics. Major players such as Denso, Hyundai Mobis, and Panasonic Automotive have a substantial presence in the region. Government initiatives like "Made in China 2025" and India’s FAME scheme are further propelling electronics integration in vehicles.

Europe is the fastest-growing region for automotive electronics. The continent's strong focus on environmental sustainability, electrification, and road safety regulations is driving adoption. European automakers like Volkswagen, BMW, and Mercedes-Benz are investing heavily in EVs, connected vehicles, and autonomous driving technologies. In March 2024, the European Commission announced additional funding for EV infrastructure, reinforcing the region's commitment to automotive innovation and boosting electronics demand.

Recent Developments

-

March 2024: Robert Bosch GmbH announced a $1 billion investment plan to expand its semiconductor production facilities to meet growing automotive demand.

-

January 2024: Continental AG partnered with Ambarella to develop AI-based camera systems for next-generation ADAS solutions.

-

February 2024: Denso Corporation unveiled a new generation of radar sensors optimized for Level 3 autonomous driving applications.

-

April 2024: Infineon Technologies introduced its new AURIX™ microcontroller family designed specifically for advanced automotive safety and autonomous driving functions.

-

March 2024: Aptiv PLC announced the acquisition of Wind River Systems to enhance its software-defined vehicle platform capabilities.

Some of the prominent players in the automotive electronics market include:

- Continental AG

- DENSO Corporation

- Hella GmbH & Co. Kgaa

- Hitachi Automotive Systems, Ltd.

- Infineon Technologies AG

- Robert Bosch GmbH

- Valeo Inc.

- Visteon Corporation

- Xilinx, Inc.

- ZF Friedrichshafen AG

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive electronics market.

Component

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

Application

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

Vehicle Type

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Propulsion

Sales Channel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)