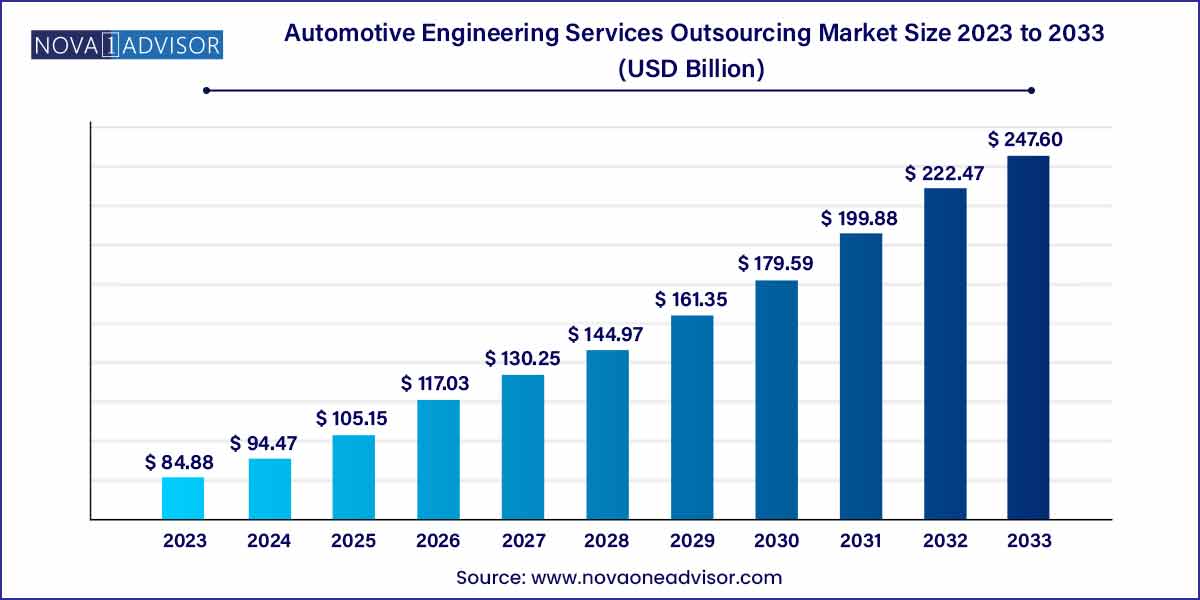

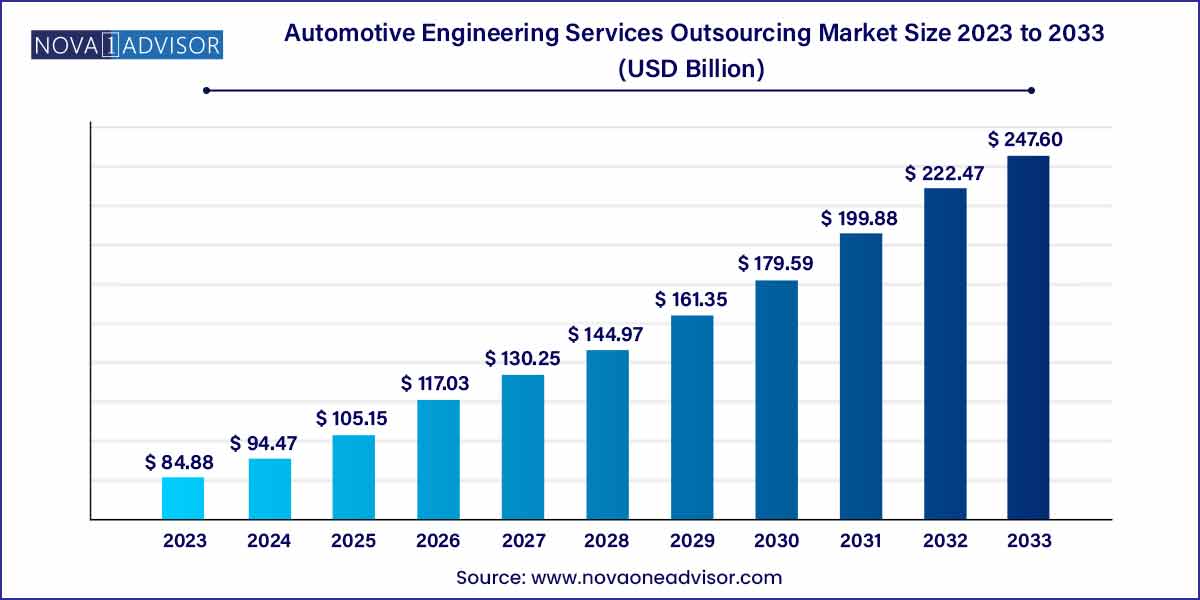

The global automotive engineering services outsourcing market was exhibited at USD 84.88 billion in 2023 and is projected to hit around USD 247.60 billion by 2033, growing at a CAGR of 11.3% during the forecast period of 2024 to 2033.

Key Takeaways:

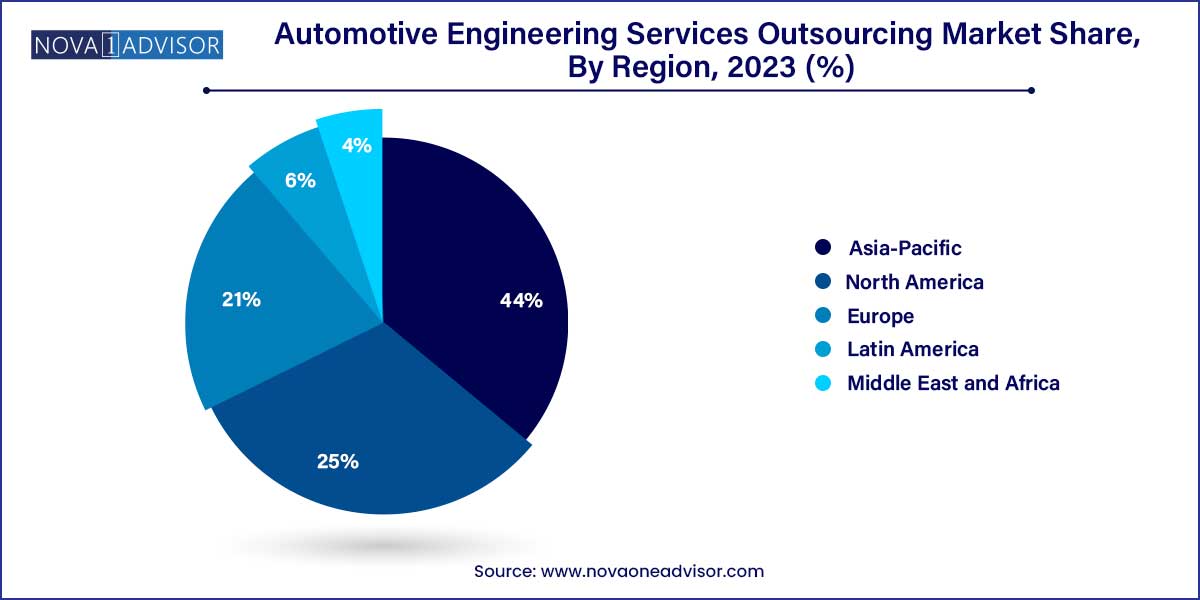

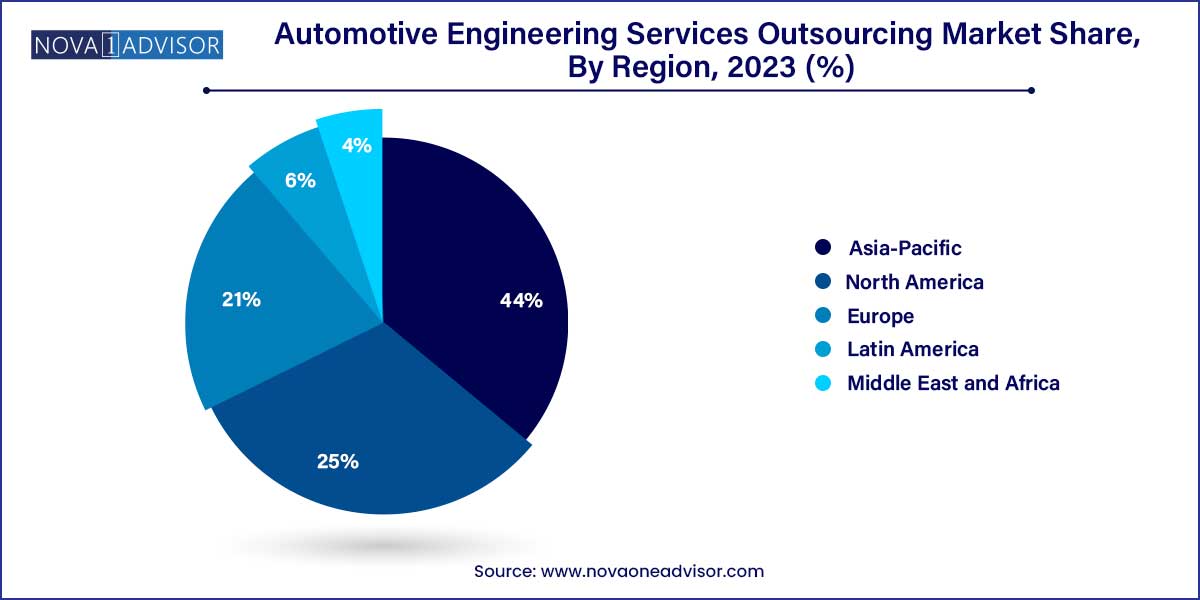

- The Asia Pacific regional market accounted for the largest revenue share of around 44.0% of the automotive ESO market in 2023

- The powertrain and after-treatment segment registered for the largest revenue share of around 31.0% of the automotive ESO market in 2023.

- The prototyping segment accounted for the largest revenue share of more than 31.0% in 2023 and is expected to lead the automotive ESO market throughout the forecast period.

- The on-shore segment accounted for the largest revenue share of around 60.0% of the overall market in 2023 and is expected to register the fastest growth in the forecast period.

Automotive Engineering Services Outsourcing Market by Overview

The automotive engineering services outsourcing (ESO) market has grown into an integral part of the global automotive value chain, supporting automakers and suppliers as they innovate faster, reduce time-to-market, and manage complex new vehicle requirements. ESO involves delegating key engineering functions such as vehicle design, prototyping, system integration, and testing to specialized third-party service providers.

The rising complexity of modern vehicles, driven by the need for connected mobility, electrification, autonomous driving capabilities, and stringent emissions regulations, has made in-house engineering insufficient or uneconomical for many original equipment manufacturers (OEMs). As a result, automotive companies increasingly partner with external engineering specialists who can offer deep domain expertise, flexible resource scaling, and cutting-edge technology access.

Furthermore, with the advent of CASE (Connected, Autonomous, Shared, Electric) mobility trends, traditional automotive engineering paradigms have shifted toward multidisciplinary integration involving software, electronics, materials science, and advanced manufacturing processes. Engineering service providers offer the agility and multi-domain competencies required to meet these evolving demands.

Cost advantages from offshoring, the global distribution of automotive R&D centers, and strategic collaborations between automakers and engineering firms are collectively propelling the market. As the industry continues its digital transformation, engineering services outsourcing is expected to play a pivotal role in shaping the future of automotive innovation.

Major Trends in the Market

-

Shift Towards Electrification: Outsourcing projects for EV powertrains, battery management systems, and lightweight design.

-

Boom in Autonomous Vehicle Engineering: Extensive outsourcing of ADAS and autonomous driving development tasks.

-

Integration of Software-Defined Vehicles (SDVs): Rise in software engineering services for infotainment, connectivity, and over-the-air updates.

-

Emergence of Offshore Delivery Models: Asia-Pacific and Eastern Europe emerging as key outsourcing hubs.

-

Focus on End-to-End System Integration: From design to validation across multi-disciplinary domains.

-

Use of AI and Simulation Tools: Accelerating design iterations and improving system validation.

-

Collaborative Development Platforms: Adoption of cloud-based engineering collaboration solutions.

-

Rising Engagement of Tier 1 Suppliers in Outsourcing: Suppliers outsourcing non-core engineering to enhance competitiveness.

Automotive Engineering Services Outsourcing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 84.88 Billion |

| Market Size by 2033 |

USD 247.60 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Service, Location, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

AKKA; Altair Engineering Inc.; Alten Group; Altran (Cap Gemini Engineering); ARRK Product Development Group Ltd.; ASAP Holding GmbH; AVL List GmbH; Bertrandt AG; EDAG Group; ESG Elektroniksystem- und Logistik-GmbH; FEV Group GmbH; Horiba, LTD.; IAV; ITK Engineering GmbH Kistler Group; P3 group GmbH; RLE International Group. |

Automotive Engineering Services Outsourcing Market Dynamics

- Technological Advancements Driving Demand:

The dynamics of the Automotive Engineering Services Outsourcing market are significantly influenced by ongoing technological advancements in the automotive industry. The rapid evolution of electric vehicles (EVs), autonomous driving technologies, and connectivity solutions has created a demand for specialized engineering expertise. Automotive companies increasingly turn to outsourcing partners to access the latest technological know-how and stay ahead in the competitive landscape.

- Globalization and Access to Diverse Talent:

A key dynamic shaping the automotive engineering services outsourcing market is the globalization of talent. Companies seek to tap into a global pool of skilled professionals to gain access to diverse expertise and perspectives. The ability to engage engineering teams from different regions provides automotive companies with a strategic advantage in terms of flexibility and innovation.

Automotive Engineering Services: Outsourcing Market Restraint

A prominent restraint in the automotive engineering services outsourcing market is the persistent concern over data security. With the increasing reliance on digital technologies and the exchange of sensitive engineering data between automotive companies and outsourcing partners, ensuring robust cybersecurity measures becomes paramount. Companies often grapple with the challenge of safeguarding intellectual property and confidential information throughout the outsourcing process. Mitigating data security risks requires stringent protocols, transparency, and collaborative efforts to establish a secure environment for information exchange.

Another significant restraint in the automotive engineering services outsourcing market is the presence of communication barriers. The collaboration between automotive companies and outsourcing partners often spans geographical and cultural boundaries, leading to challenges in effective communication. Differences in time zones, languages, and work cultures can impede seamless collaboration and hinder project progress.

Automotive Engineering Services Outsourcing Market Opportunity

- Electric and Autonomous Vehicle Engineering Opportunities:

A significant opportunity within the Automotive Engineering Services Outsourcing market lies in the increasing demand for expertise in electric and autonomous vehicle engineering. As the automotive industry undergoes a transformative shift towards electrification and autonomous technologies, companies are seeking specialized engineering services to stay competitive. Outsourcing partners can capitalize on this trend by offering comprehensive solutions, including electric powertrain design, battery technology optimization, and autonomous vehicle software development.

- Digital Twin Technology Integration:

An emerging opportunity in the automotive engineering services outsourcing market is the integration of digital twin technology. Digital twins, or virtual replicas of physical products or processes, offer immense potential for enhancing product development and testing in the automotive sector. Outsourcing partners can seize this opportunity by providing advanced simulation and modeling services, enabling companies to create and analyze digital twins for various components and systems.

Automotive Engineering Services Outsourcing Market Challenges

A primary challenge in the automotive engineering services outsourcing market is the persistent concern surrounding data security. With the increasing digitalization of engineering processes, sensitive information, including intellectual property and proprietary designs, is exchanged between automotive companies and outsourcing partners. Mitigating the risk of data breaches and ensuring the confidentiality of critical information becomes a paramount challenge.

Communication barriers pose a significant challenge in the automotive engineering services outsourcing market, particularly when collaborating across diverse geographical and cultural landscapes. Differences in time zones, languages, and work cultures can lead to misunderstandings, delays, and misalignment of expectations. Overcoming these communication challenges requires proactive strategies, such as the use of effective collaboration tools, regular updates, and fostering a shared understanding of project objectives.

Segments Insights:

Application Insights

Autonomous driving/ADAS dominates the application segment, driven by the enormous engineering resources required to develop, validate, and scale autonomous features. Building SAE Level 2+ and higher autonomy solutions requires millions of miles of simulation and road testing, data labeling, AI model training, sensor fusion algorithm development, and safety case validation. OEMs increasingly outsource these tasks to specialists to manage project complexity and costs.

Infotainment and connectivity services are growing fastest, reflecting the consumer-driven demand for digital cockpits, seamless smartphone integration, in-car entertainment, and cloud-connected features. Engineering services for infotainment systems now encompass UX/UI design, embedded operating system development (like Android Automotive), cybersecurity hardening, and OTA platform integration.

Service Insights

Designing services dominate the automotive ESO market, covering vehicle exterior and interior design, platform architecture, mechanical component design, and system-level electrical and electronic schematics. High demand stems from continuous pressure on automakers to differentiate models through styling, safety features, and modular platform flexibility.

Testing services are growing fastest, propelled by the need for rigorous validation of complex electronic systems, ADAS features, crashworthiness, thermal management, battery safety, and emissions compliance. Outsourced testing now includes both physical (crash labs, climate chambers) and virtual (simulation, digital twins) modalities, enabling faster, cost-effective product launches.

Location Insights

On-shore outsourcing dominates the location segment, as many OEMs and Tier 1 suppliers prefer to keep engineering activities geographically closer for better communication, regulatory compliance, and IP protection. On-shore models also facilitate iterative design collaboration and agile sprint-based project management.

Off-shore services are expanding rapidly, especially to Asia-Pacific and Eastern Europe, due to significant cost advantages, growing technical expertise, and favorable time zone overlaps with Western markets. India, in particular, has emerged as a global hub for automotive engineering R&D with established players offering turnkey design, development, and validation services at competitive costs.

Regional Insights

Europe leads the global automotive ESO market, supported by its strong base of premium automakers (such as BMW, Daimler, Volkswagen Group, and Stellantis), leading Tier 1 suppliers (like Bosch, Continental, and ZF), and world-class engineering service providers (such as AVL, Bertrandt, and EDAG).

Europe’s leadership in automotive innovation particularly in electrification (e.g., Volkswagen’s ID series), advanced driver assistance systems (ADAS), and sustainable mobility is driving robust demand for outsourced engineering support. Moreover, strict regulations related to emissions (e.g., Euro 7) and safety are encouraging automakers to accelerate new vehicle platform development, further boosting ESO demand.

Asia-Pacific is the fastest-growing region, driven by the expansion of automotive manufacturing hubs in China, India, Japan, and South Korea, alongside growing investments in local R&D capabilities.

The region’s OEMs, such as Hyundai, BYD, Tata Motors, and Toyota, are aggressively investing in electric vehicles (EVs), connected technologies, and affordable autonomous features. As these companies scale globally, they are partnering with regional ESO providers for engineering support. Additionally, global automakers are increasingly setting up offshore engineering centers in Asia-Pacific to optimize development costs and localize models for emerging markets.

Some of the prominent players in the automotive engineering services outsourcing market include:

- AKKA

- Altair Engineering Inc.

- Alten Group

- Altran (Cap Gemini Engineering)

- ARRK Product Development Group Ltd.

- ASAP Holding Gmbh

- AVL List GmbH

- Bertrandt AG

- EDAG Group

- ESG Elektroniksystem- und Logistik-GmbH

- FEV Group GmbH

- Horiba, LTD.

- IAV

- ITK Engineering GmbH Kistler Group

- P3 group GmbH

- RLE INTERNATIONAL Group

Recent Developments

-

March 2025: Tata Technologies announced a major partnership with Jaguar Land Rover to provide end-to-end engineering services for the automaker’s next-generation electric vehicle platforms.

-

February 2025: Capgemini Engineering expanded its mobility engineering division by acquiring a German automotive design consultancy specializing in EV platform development.

-

January 2025: Tech Mahindra launched a new Automotive Centre of Excellence in Detroit, focusing on ADAS, electric mobility, and infotainment system engineering.

-

December 2024: HCLTech signed a multi-year engineering services agreement with a leading North American EV startup to support powertrain and battery management system development.

-

November 2024: AVL List GmbH introduced a new AI-driven vehicle testing platform, enabling faster virtual validation of ADAS and autonomous driving systems, targeted at outsourcing projects.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive engineering services outsourcing market.

Application

- Autonomous Driving/ADAS

- Body & Chassis

- Powertrain and After-Treatment

- Infotainment & Connectivity

- Others

Service

- Designing

- Prototyping

- System Integration

- Testing

- Others

Location

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)