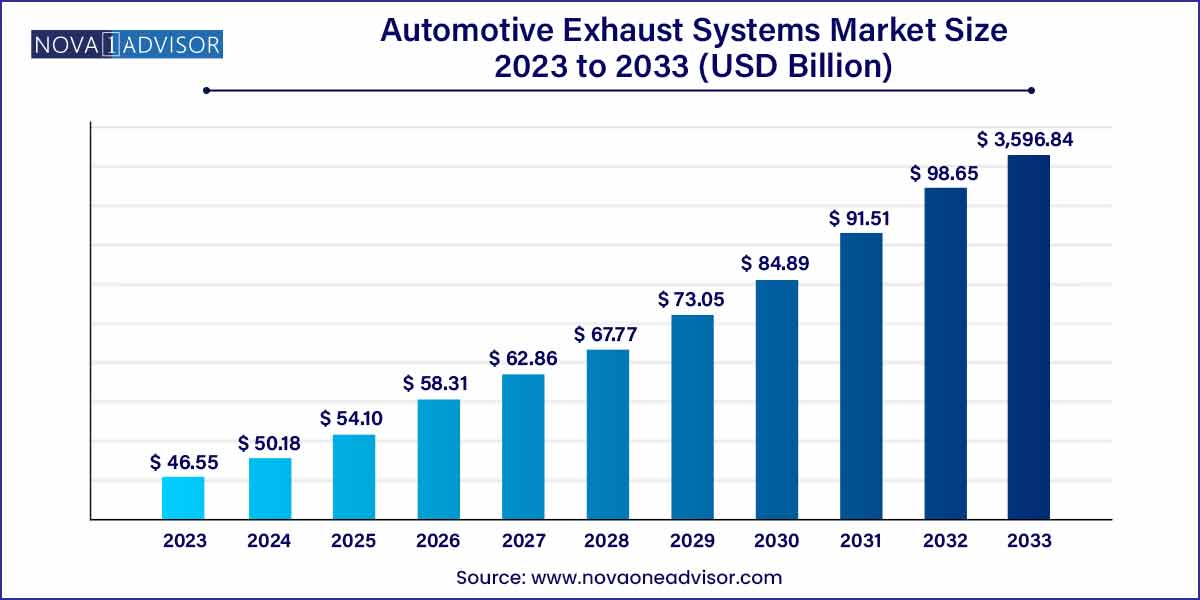

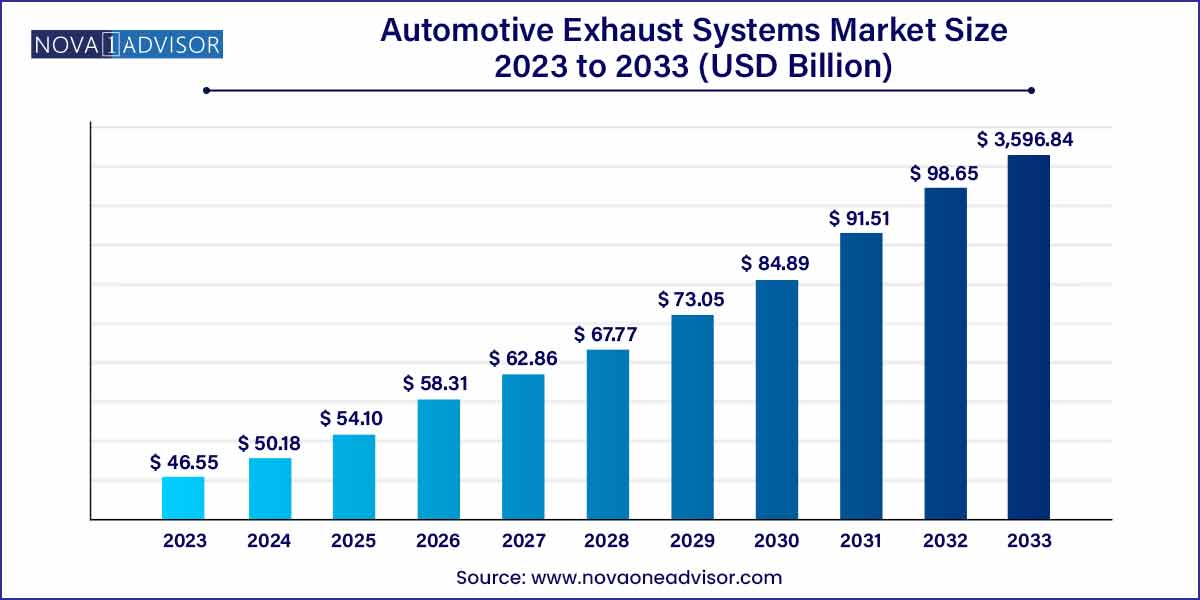

The global automotive exhaust systems market size was exhibited at USD 46.55 billion in 2023 and is projected to hit around USD 98.65 billion by 2033, growing at a CAGR of 7.8% during the forecast period of 2024 to 2033.

Key Takeaways:

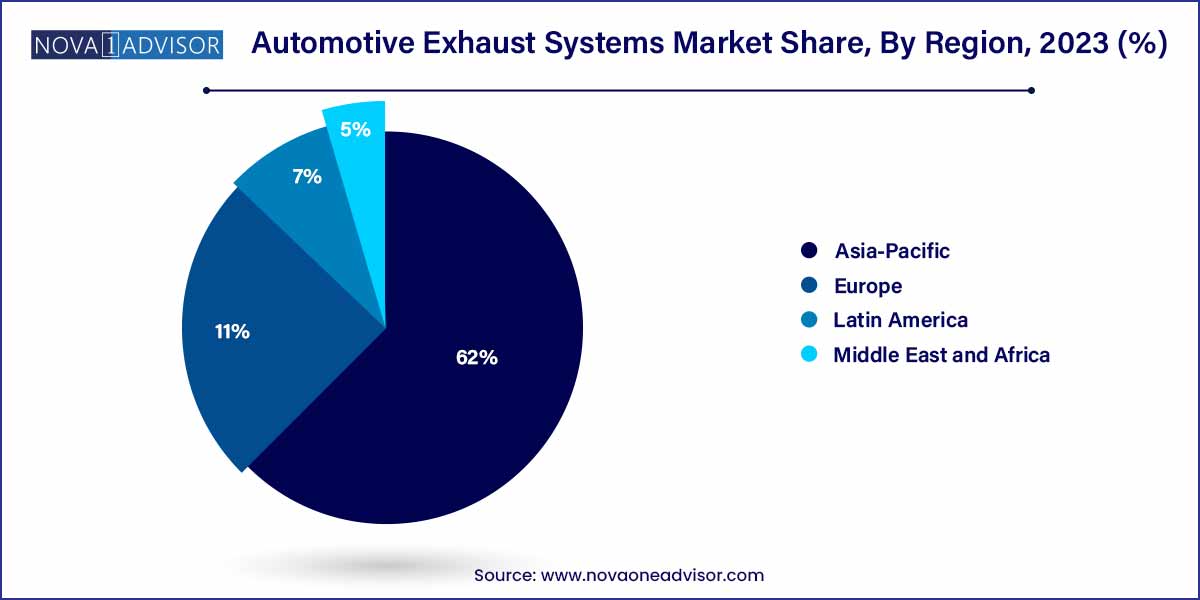

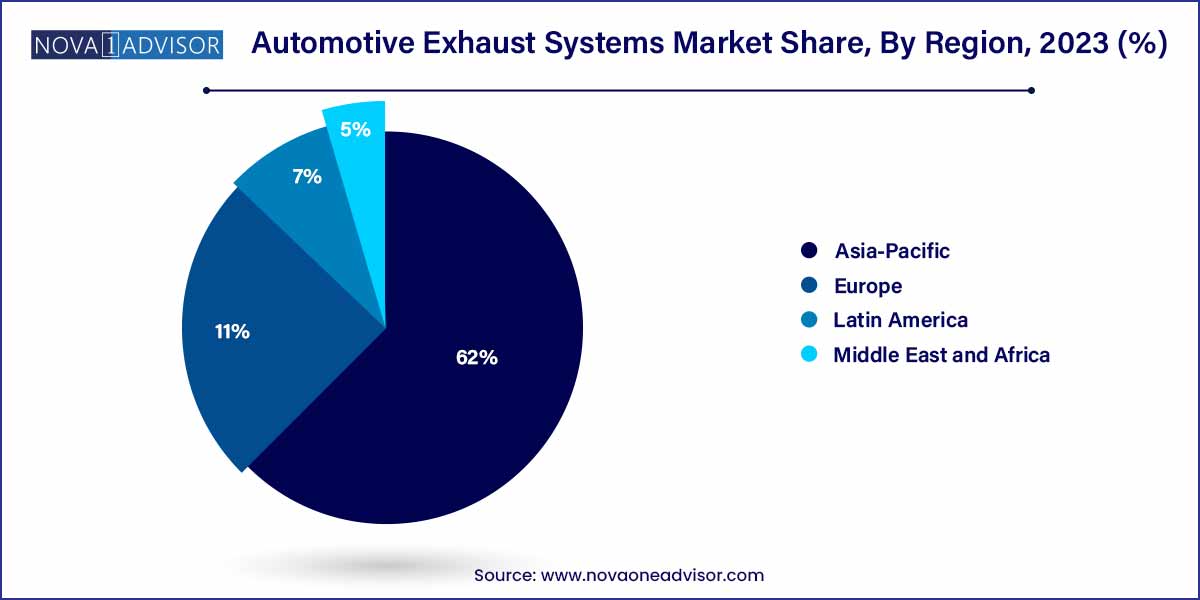

- Asia Pacific dominated the market, accounted for the largest revenue share of 62.0% in 2023, and is expected to register the highest CAGR over the forecast period.

- The exhaust manifold segment accounted for the largest revenue share of 38.8% in 2023.

- The gasoline segment accounted for the largest revenue share of 83.9% in 2023 and is estimated to register the fastest CAGR over the forecast period.

- The passenger car segment accounted for the largest revenue share at 72.0% in 2023.

Automotive Exhaust Systems Market: Overview

The Automotive Exhaust Systems Market plays a pivotal role in the global automotive industry by focusing on vehicle emissions management and performance optimization. Exhaust systems are crucial in maintaining engine efficiency, minimizing noise levels, and, most importantly, controlling the release of harmful gases such as carbon monoxide (CO), nitrogen oxides (NOx), and hydrocarbons (HC) into the atmosphere.

Stringent government regulations mandating emission control standards, such as Euro 6 in Europe, China 6 in China, and EPA regulations in the United States, have been primary catalysts driving innovations in automotive exhaust technologies. Manufacturers are increasingly integrating advanced catalytic converters, oxygen sensors, mufflers, and particulate filters to comply with emission norms while enhancing vehicle performance and fuel efficiency.

The market spans across different vehicle types, including passenger cars and commercial vehicles, and varies based on fuel types — notably gasoline and diesel. Emerging technologies such as gasoline particulate filters (GPFs), selective catalytic reduction (SCR) systems, and exhaust gas recirculation (EGR) are gaining traction.

Furthermore, the automotive sector’s transition towards hybrid and electric vehicles is reshaping exhaust system design strategies, pushing manufacturers to adapt through lightweighting efforts and alternative thermal management solutions. Despite looming electrification, internal combustion engines (ICE) continue to dominate, ensuring sustained demand for exhaust systems globally.

Automotive Exhaust Systems Market Growth

The growth of the automotive exhaust systems market is fueled by several key factors.Firstly, stringent emission regulations worldwide are compelling automakers to adopt advanced exhaust technologies to meet compliance standards. Additionally, the increasing adoption of electric and hybrid vehicles is driving the development of alternative exhaust solutions. Moreover, the integration of lightweight materials and advanced manufacturing processes is enhancing fuel efficiency and reducing vehicle emissions. Furthermore, the rising demand for modular and customizable exhaust systems to accommodate diverse vehicle architectures and consumer preferences is driving market growth. Overall, these factors are propelling the automotive exhaust systems market forward, presenting lucrative opportunities for industry players.

Automotive Exhaust Systems Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 46.55 Billion |

| Market Size by 2033 |

USD 98.65 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Component, Fuel Type, Vehicle Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BENTELER International Aktiengesellschaft; BOSAL; Continental AG; Eberspächer; FORVIA Faurecia; FUTABA INDUSTRIAL CO.,LTD; Boysen; Sejong Industrial Co.,Ltd; Tenneco Inc.; Yutaka Giken Company Limited. |

Automotive Exhaust Systems Market Dynamics

- Technological Advancements:

The automotive industry is witnessing rapid technological advancements in exhaust system design and functionality. Manufacturers are investing in research and development to integrate advanced technologies such as selective catalytic reduction (SCR), diesel particulate filters (DPF), and gasoline particulate filters (GPF). These technologies enable vehicles to achieve compliance with stringent emission norms while enhancing performance and fuel efficiency. Additionally, the adoption of digitalization and connectivity solutions is enabling real-time monitoring and optimization of exhaust system performance, further driving market growth.

Regulatory policies and emission standards imposed by governments and international organizations play a pivotal role in shaping the automotive exhaust systems market. Stringent emission regulations require automakers to develop and implement innovative exhaust solutions to reduce harmful pollutants and greenhouse gas emissions. These regulations drive the demand for advanced exhaust technologies and catalyze industry investments in emission control systems. Moreover, evolving regulatory frameworks and emission standards across different regions create a dynamic market landscape, influencing product development strategies and market expansion efforts of industry players.

Automotive Exhaust Systems Market Restraint

Despite the growing demand for advanced exhaust technologies, cost constraints pose a significant challenge for market growth. The development and integration of innovative exhaust systems with advanced materials and technologies entail substantial research and development expenses. Additionally, stringent quality and performance standards further elevate manufacturing costs. As a result, automakers face pressure to balance the integration of advanced exhaust solutions with cost-effective manufacturing processes to maintain competitiveness in the market. Moreover, price sensitivity among consumers and the presence of low-cost alternatives in the aftermarket segment further exacerbate cost-related challenges for industry players.

- Supply Chain Disruptions:

The automotive exhaust systems market is susceptible to supply chain disruptions, which can arise due to various factors such as raw material shortages, transportation delays, and geopolitical tensions. Interruptions in the supply chain can lead to production delays, inventory shortages, and increased manufacturing costs for industry players. Moreover, the global COVID-19 pandemic highlighted the vulnerabilities of automotive supply chains, disrupting production activities and impacting market dynamics. As automotive manufacturers strive to mitigate supply chain risks and ensure business continuity, they face challenges in maintaining stable and efficient supply chain operations, thereby restraining market growth.

Automotive Exhaust Systems Market Opportunity

- Growing Demand for Electric and Hybrid Vehicles:

The increasing adoption of electric and hybrid vehicles presents a significant opportunity for the automotive exhaust systems market. While these vehicles offer a cleaner alternative to traditional internal combustion engines, they still require exhaust systems for emission control and thermal management. Manufacturers can capitalize on this trend by developing specialized exhaust solutions tailored to the unique requirements of electric and hybrid powertrains. This includes the integration of systems for battery cooling, thermal management, and cabin heating, as well as solutions for capturing and processing emissions from range extenders or internal combustion engine generators in hybrid vehicles.

- Focus on Sustainable and Lightweight Materials:

There is a growing focus on sustainable and lightweight materials within the automotive industry, presenting an opportunity for innovation in exhaust system design and manufacturing. Manufacturers can leverage materials such as aluminum, stainless steel, titanium, and advanced composites to develop lightweight and durable exhaust systems that enhance vehicle performance and fuel efficiency while reducing emissions. Additionally, the adoption of sustainable manufacturing practices, such as recycling and waste reduction, can further enhance the environmental credentials of exhaust system components. By aligning with the industry's sustainability goals and addressing consumer preferences for eco-friendly products, manufacturers can differentiate their offerings and gain a competitive edge in the market.

Automotive Exhaust Systems Market Challenges

- Complexity of Emission Regulations:

One of the major challenges in the automotive exhaust systems market is the complexity of emission regulations imposed by governments and regulatory bodies worldwide. Compliance with stringent emission standards requires continuous innovation and investment in advanced exhaust technologies, which can significantly increase development and manufacturing costs for industry players. Moreover, the diverse and evolving nature of emission regulations across different regions adds complexity to product development and market strategies. Manufacturers must navigate this regulatory landscape effectively to ensure compliance while maintaining competitiveness in the market.

- Rapid Technological Advancements:

The automotive industry is experiencing rapid technological advancements, particularly in the areas of powertrain electrification and alternative fuels. While these advancements offer opportunities for innovation and market growth, they also present challenges for traditional exhaust system manufacturers. The shift towards electric and hybrid vehicles, for example, may reduce the demand for conventional exhaust systems, requiring manufacturers to adapt their product offerings and diversify into new markets. Additionally, the integration of advanced technologies such as selective catalytic reduction (SCR) and gasoline particulate filters (GPF) requires significant investment in research and development, testing, and manufacturing capabilities. Keeping pace with these technological advancements while ensuring cost-effectiveness and competitiveness poses a considerable challenge for industry players.

Segments Insights:

Component Insights

Catalytic converters dominated the component segment, commanding the largest market share due to their indispensable role in emission control. Catalytic converters chemically convert harmful pollutants like NOx, carbon monoxide, and hydrocarbons into less harmful emissions such as nitrogen, carbon dioxide, and water vapor.

The increasing adoption of advanced three-way catalytic converters (TWCs) and selective catalytic reduction (SCR) systems, especially in diesel vehicles, has reinforced catalytic converters as critical exhaust system components. Growing regulatory pressures to reduce emissions across all vehicle categories — from passenger cars to heavy-duty trucks — ensure steady demand for catalytic converters.

Conversely, Oxygen Sensors are anticipated to experience the fastest growth. Oxygen sensors monitor exhaust gases to optimize fuel injection and emission control, playing a crucial role in engine efficiency and pollution reduction. As regulations tighten on real-world driving emissions (RDE), the need for highly accurate, durable, and connected oxygen sensors is surging, particularly in hybrid powertrains.

Fuel Type Insights

The Gasoline segment captured the largest share within the fuel type category, owing to the dominance of gasoline-powered vehicles in global car sales. Gasoline engines require efficient exhaust systems incorporating catalytic converters and mufflers to meet regulatory emissions targets while maintaining performance.

The rise of turbocharged gasoline direct-injection (GDI) engines has further increased the need for particulate filters in gasoline vehicles, adding complexity and value to exhaust system solutions. As passenger car markets in regions like North America and Asia-Pacific are predominantly gasoline-based, the segment maintains its leadership.

Meanwhile, Diesel vehicles are undergoing a transformation. Although diesel engine popularity has declined in light-duty passenger cars post the "Dieselgate" scandal, diesel powertrains remain critical for commercial vehicles and long-haul transportation. Advanced exhaust treatment technologies like SCR, diesel particulate filters (DPF), and low-NOx systems are propelling continued innovation and investment in diesel exhaust systems, especially for heavy-duty trucks.

Vehicle Type Insights

Passenger cars dominated the vehicle type segment, largely due to their volume dominance in global vehicle production and sales. Exhaust systems in passenger vehicles are evolving to include lightweight, compact, and cost-effective designs to balance emission control with fuel efficiency.

Passenger cars, particularly mid-size sedans, hatchbacks, and SUVs, require a combination of catalytic converters, mufflers, and oxygen sensors for efficient exhaust treatment. Automakers are adopting modular exhaust architectures that can be easily adapted across various models to achieve economies of scale.

Meanwhile, Commercial Vehicles are projected to witness faster growth. The global boom in e-commerce, logistics, and last-mile delivery services is driving demand for commercial vehicles, particularly light commercial vehicles (LCVs) and medium/heavy trucks. Commercial vehicles require more complex, durable, and efficient exhaust aftertreatment systems to comply with stringent emission standards for NOx and particulates.

Regional Insights

Asia-Pacific emerged as the dominant region in the automotive exhaust systems market, led by China, India, Japan, and South Korea. The region's massive vehicle production volumes, rising disposable incomes, rapid urbanization, and stricter emission regulations are major drivers.

China’s implementation of China 6 emission standards, India's Bharat Stage VI transition, and Japan’s continuous technological advancements have fueled demand for advanced exhaust systems. Additionally, the region’s robust automotive supply chain ecosystem and investments in hybrid and electric vehicle technologies sustain innovation in exhaust system design and manufacturing.

The increasing popularity of gasoline-powered and hybrid vehicles in Asia-Pacific also supports catalytic converter and oxygen sensor market growth.

Europe is witnessing the fastest growth in the automotive exhaust systems market, primarily driven by the region’s aggressive environmental policies and high vehicle penetration rates. Europe’s stringent Euro 6d emission standards, focus on real driving emissions (RDE), and push towards carbon neutrality by 2050 necessitate continuous advancements in exhaust aftertreatment technologies.

Germany, France, the UK, and Italy are key markets where OEMs and Tier 1 suppliers are investing heavily in next-generation SCR systems, particulate filters, and NOx traps. The European market’s preference for premium and diesel-powered vehicles, which require complex exhaust systems, further accelerates regional market dynamics.

Moreover, the transition to hybrid electric vehicles (HEVs) in Europe is creating new opportunities for specialized exhaust system solutions optimized for cold-start emissions management.

Recent Developments

-

April 2025 – Faurecia (now part of FORVIA) unveiled its next-generation ultra-lightweight exhaust system designed for hybrid vehicles, offering 30% weight reduction.

-

March 2025 – Tenneco Inc. introduced a new range of gasoline particulate filters (GPF) compliant with Euro 7 emission regulations scheduled for rollout by 2027.

-

February 2025 – Eberspächer announced the expansion of its exhaust technology production facility in Mexico to meet growing North American demand

Some of the prominent players in the Automotive exhaust systems market include:

- BENTELER International Aktiengesellschaft

- BOSAL

- Continental AG

- Eberspächer

- FORVIA Faurecia

- FUTABA INDUSTRIAL CO., LTD

- Boysen

- Sejong Industrial Co., Ltd

- Tenneco Inc.

- Yutaka Giken Company Limited

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive exhaust systems market.

Component

- Exhaust Manifold

- Muffler

- Catalytic Converter

- Oxygen Sensor

- Exhaust Pipes

Fuel Type

Vehicle Type

- Passenger Car

- Commercial Vehicles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)