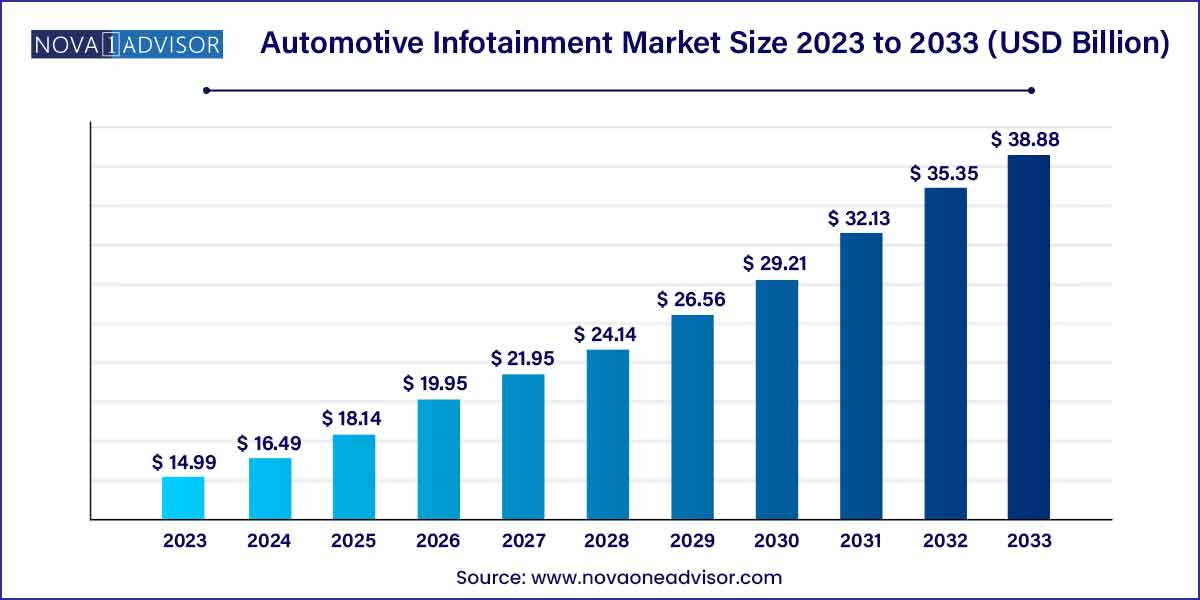

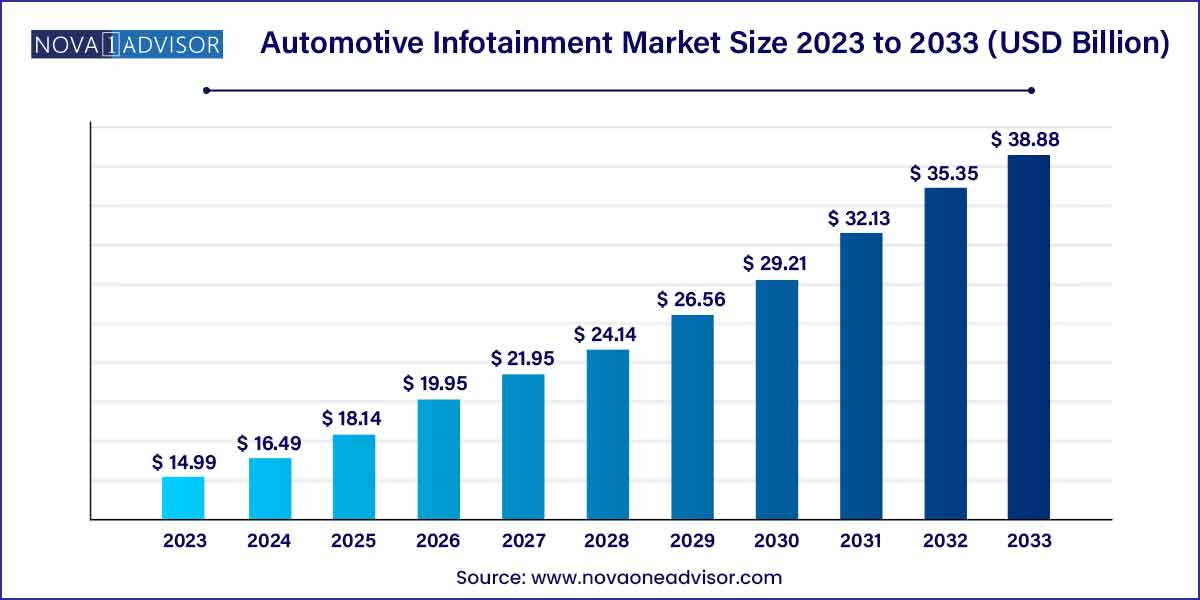

The global automotive infotainment market size was exhibited at USD 14.99 billion in 2023 and is projected to hit around USD 38.88 billion by 2033, growing at a CAGR of 10.0% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific dominated the market and accounted for 41% of the share in 2023.

- The navigation unit segment led the market and accounted for 37.1% in 2023.

- The OEM-fitted segment accounted for the largest market revenue share of 72.99% in 2023 owing to easy service and low maintenance features.

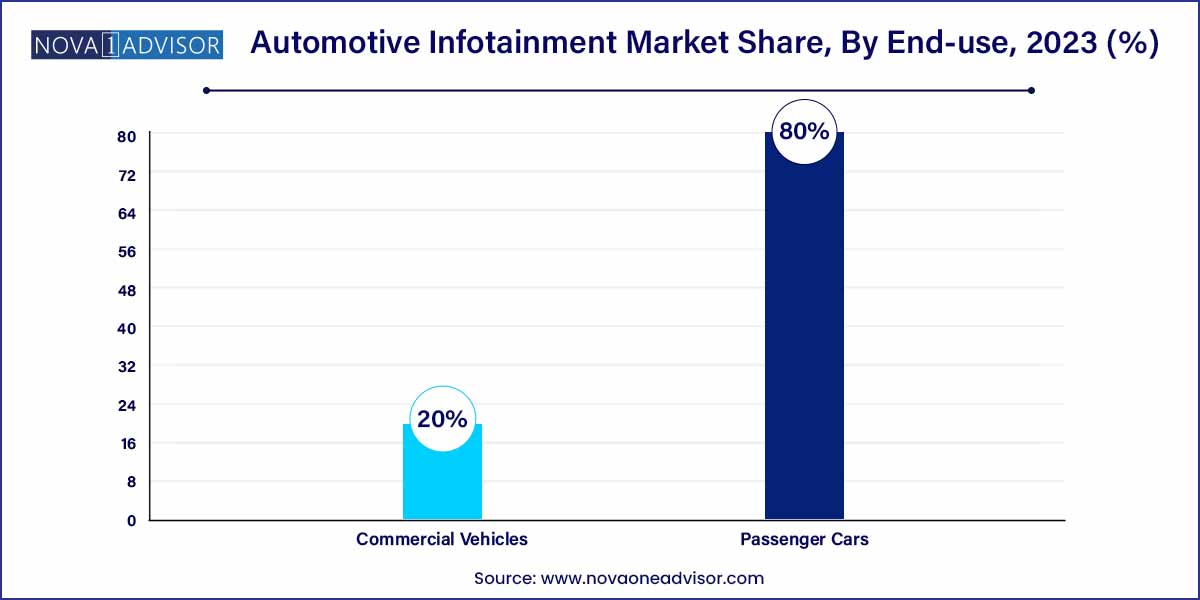

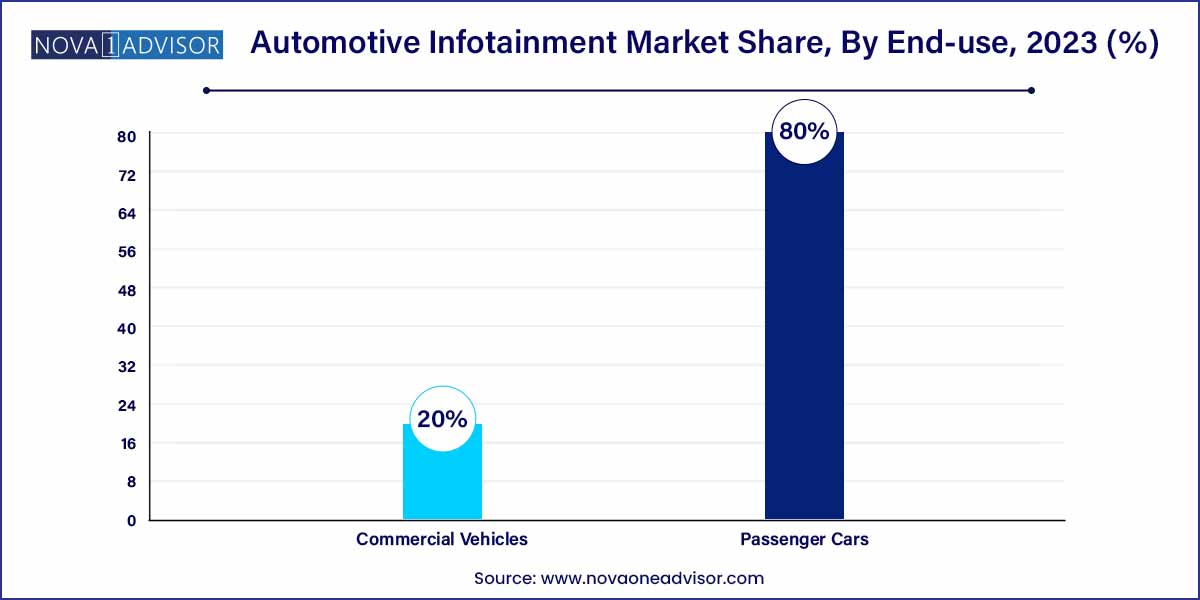

- The passenger car segment led the market with a revenue share of 80.0% in 2023.

Automotive Infotainment Market: Overview

The automotive infotainment market stands at the intersection of the automotive and consumer electronics industries, shaping how drivers and passengers interact with vehicles in the digital age. Automotive infotainment systems, originally developed to provide basic audio functions, have evolved into sophisticated platforms that offer navigation, connectivity, entertainment, driver assistance, and integrated control systems. These systems combine hardware and software to deliver a seamless, connected experience within the vehicle cabin supporting the broader shift toward connected, autonomous, shared, and electric (CASE) mobility.

As the automotive industry undergoes a digital transformation, infotainment systems are becoming central to vehicle differentiation, brand identity, and customer satisfaction. From premium luxury vehicles to budget passenger cars, modern vehicles are increasingly being equipped with large touchscreens, voice assistants, app integration (such as Apple CarPlay and Android Auto), and real-time traffic updates. Infotainment systems are not just entertainment tools; they’re critical interfaces for accessing diagnostics, adjusting vehicle performance settings, and enhancing driver safety through real-time alerts and heads-up displays.

The integration of artificial intelligence (AI), 5G connectivity, and cloud-based computing has further redefined the infotainment landscape. Automakers now partner with tech giants like Google, Amazon, and Qualcomm to build infotainment ecosystems that extend beyond the dashboard enabling over-the-air (OTA) updates, connected navigation, and personalized user profiles. As electric and autonomous vehicles gain traction, the infotainment system is evolving into the primary interface between humans and vehicles, playing a crucial role in delivering value-added services. With the automotive market pivoting toward smart mobility, the infotainment segment is poised for substantial and sustained growth.

Major Trends in the Market

-

Integration of AI-Powered Voice Assistants: OEMs are integrating voice recognition and natural language processing for hands-free controls and intelligent suggestions.

-

Shift Toward Centralized Computing Platforms: Next-gen infotainment systems are consolidating multiple ECUs into single, high-performance computing units for enhanced responsiveness.

-

Display Expansion and Multi-Screen Layouts: Vehicles now feature multiple displays including instrument clusters, central control panels, co-driver screens, and rear-seat displays.

-

Over-the-Air (OTA) Software Updates: Manufacturers are deploying cloud-connected systems to update infotainment software without physical servicing.

-

Adoption of Open-Source Platforms: Android Automotive OS and Linux-based systems are enabling greater customization and faster deployment cycles.

-

Infotainment in Electric Vehicles (EVs): EV startups like Tesla, Rivian, and Lucid are redefining infotainment with immersive in-cabin experiences.

-

5G and V2X Connectivity: Fast data transmission supports real-time navigation, streaming, vehicle-to-vehicle (V2V) communication, and telematics services.

-

Subscription-Based Services: Automakers are monetizing infotainment features through subscription models for navigation, entertainment, and driver assistance apps.

Automotive Infotainment Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 14.99 Billion |

| Market Size by 2033 |

USD 38.88 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, Fit Type, Vehicle Type, And Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Alpine Electronics, Clarion Co., Ltd., Continental AG, Delphi Automotive PLC, Denso Corporation ,Harman International , JVC KENWOOD Corporation, Panasonic Corporation, Pioneer Corporation, Visteon Corporation. |

Automotive Infotainment Market Dynamics

- Growing Consumer Expectations:

The automotive infotainment market is dynamically influenced by the escalating expectations of consumers seeking a more immersive and connected driving experience. Modern drivers demand sophisticated infotainment solutions that seamlessly integrate with their digital lifestyles. Features such as high-resolution touchscreens, intuitive user interfaces, voice recognition, and seamless smartphone connectivity have become essential components of cutting-edge infotainment systems. As consumers increasingly prioritize in-car entertainment and connectivity options, automakers and technology providers strive to meet these expectations by continuously innovating and introducing advanced features.

Rise of Connected Cars:

A pivotal dynamic shaping the automotive infotainment market is the widespread adoption and integration of connected car technologies. As vehicles evolve into connected platforms, infotainment systems play a central role in facilitating real-time connectivity and information exchange. Connected cars enable features like live navigation updates, internet connectivity, and over-the-air software updates, transforming the driving experience. This shift towards connected platforms not only enhances user experience but also opens up new avenues for innovative services and applications. The seamless integration of infotainment systems with connected car ecosystems positions them as integral components of the modern automotive landscape.

Automotive Infotainment Market Restraint

- Technological Complexity and Integration Challenges:

One significant restraint in the automotive infotainment market revolves around the technological complexity associated with the integration of advanced features. As infotainment systems become more sophisticated, incorporating touchscreens, voice recognition, augmented reality, and artificial intelligence, the challenges of seamlessly integrating these technologies within the automotive environment increase. Ensuring compatibility, stability, and a user-friendly interface becomes a complex task for manufacturers. This technological intricacy not only poses engineering challenges but may also lead to increased production costs, potentially hindering widespread adoption, particularly in cost-sensitive market segments.

The rise of connected cars and the increasing dependence on digital technologies in infotainment systems bring forth a notable restraint in the form of cybersecurity concerns. As vehicles become more interconnected, they become potential targets for cyber threats, including hacking and unauthorized access. Infotainment systems, linked to critical vehicle functions, pose a risk if not adequately secured. Manufacturers and stakeholders in the automotive industry face the challenge of implementing robust cybersecurity measures to safeguard user data, ensure system integrity, and prevent potential safety risks associated with unauthorized access to in-car systems. Addressing these cybersecurity concerns is crucial to building trust among consumers and fostering widespread acceptance of advanced infotainment technologies.

Automotive Infotainment Market Opportunity

- Rising Demand for Personalized and Connected Experiences:

A significant opportunity in the automotive infotainment market lies in the increasing consumer demand for personalized and connected driving experiences. As technology continues to advance, there is a growing expectation for infotainment systems to offer tailored content, intuitive interfaces, and seamless connectivity with personal devices. This presents an opportunity for manufacturers to innovate and create solutions that provide users with a customized in-car environment, incorporating preferences such as entertainment choices, navigation routes, and connectivity options.

- Integration of Advanced Technologies like Augmented Reality (AR) and Artificial Intelligence (AI):

The integration of advanced technologies, specifically augmented reality (AR) and artificial intelligence (AI), presents a significant opportunity in the automotive infotainment market. AR can be employed to enhance navigation systems by overlaying real-time information onto the driver's field of view, providing intuitive and context-aware guidance. AI-powered features, such as virtual assistants and predictive content recommendations, can elevate the overall user experience. Manufacturers and developers have the chance to differentiate their offerings by incorporating these cutting-edge technologies, catering to the tech-savvy consumer demographic and staying ahead in a rapidly evolving market.

Automotive Infotainment Market Challenges

- Fragmentation and Standardization Issues:

A prominent challenge in the automotive infotainment market is the fragmentation and lack of standardization across the industry. Different automakers often adopt diverse infotainment platforms and operating systems, leading to compatibility issues and hindering seamless integration of third-party applications. This fragmentation poses challenges for developers and content providers, who must adapt their products to various systems, resulting in increased development costs and potential inconsistencies in user experience.

- Data Security and Privacy Concerns:

The increasing connectivity and data-sharing capabilities of modern infotainment systems raise significant challenges regarding data security and user privacy. As vehicles become more connected, they collect and transmit vast amounts of sensitive information, including personal preferences, location data, and even biometric information. Ensuring robust cybersecurity measures to protect this data from unauthorized access and potential cyber threats becomes paramount. Addressing privacy concerns and complying with stringent data protection regulations are crucial for manufacturers, as mishandling of personal information could lead to legal ramifications and erode consumer trust.

Product Type Insights

Display units dominated the automotive infotainment market, driven by increasing adoption of larger, high-definition screens across all vehicle segments. Modern dashboards are now centered around touch-sensitive LCD and OLED panels, replacing analog buttons with digital interfaces. Dual-screen and tri-screen configurations are common in luxury vehicles, while even mid-range models now feature infotainment screens measuring 10 inches or larger. For example, Mercedes EQS showcases a 56-inch Hyperscreen stretching across the entire dashboard, blending entertainment, navigation, and system control in a unified visual interface.

Heads-up displays (HUDs) are the fastest-growing product segment, experiencing rapid adoption in premium and mid-segment vehicles. HUDs project essential driving information—such as speed, navigation, and ADAS alerts—onto the windshield or a dedicated panel within the driver’s line of sight. This not only enhances safety by minimizing distraction but also contributes to futuristic cockpit aesthetics. OEMs are expanding HUD functionality by integrating augmented reality (AR), allowing real-time navigation cues to overlay the road. BMW’s AR HUD in its iX series and Hyundai’s latest IONIQ 6 are prime examples of how HUD technology is evolving into a core component of advanced infotainment.

Fit Type Insights

OEM-fitted infotainment systems dominate the market, accounting for the majority of installations, particularly in new vehicle sales. Automakers increasingly partner with technology providers to integrate infotainment during vehicle design, ensuring tight alignment with the car’s hardware architecture, aesthetic, and user interface. These systems offer factory-verified performance, seamless integration with other vehicle systems, and often come with manufacturer warranties. Notable collaborations include Qualcomm and General Motors’ Snapdragon Cockpit platforms and Google’s embedded Android Automotive OS in Polestar and Volvo vehicles.

Aftermarket infotainment is the fastest-growing fit segment, particularly in emerging markets and among consumers upgrading older vehicles. Demand is driven by increasing availability of affordable, feature-rich infotainment kits compatible with a wide range of vehicles. These include touchscreen consoles, wireless connectivity modules, GPS devices, and headrest-mounted media units. With rising digital literacy and DIY trends, consumers in regions like Southeast Asia and Latin America are investing in infotainment enhancements for budget vehicles. Companies like Pioneer, Alpine, and Sony dominate this space, offering Android Auto and Apple CarPlay-compatible units.

Vehicle Type Insights

Passenger cars dominate the infotainment market, accounting for the highest volume and value share. With growing consumer preference for comfort, connectivity, and tech-savvy features, automakers are prioritizing infotainment systems in sedans, hatchbacks, and SUVs. Premium vehicles are equipped with multi-display dashboards, smart assistants, and surround sound systems, while even entry-level models now include integrated infotainment with basic navigation and smartphone mirroring. This trend is especially pronounced in markets like China, the U.S., and India where personal car ownership is high.

Commercial vehicles are the fastest-growing segment as fleet operators and logistics firms increasingly recognize the benefits of infotainment. Systems tailored for commercial applications now offer driver behavior monitoring, fleet navigation, fuel efficiency optimization, and integrated communication tools. In-vehicle infotainment is also enhancing the working environment for long-haul truck drivers by providing entertainment, navigation, and voice command tools. As telematics and fleet management become crucial, infotainment systems are evolving to become essential business tools in the commercial vehicle ecosystem.

Regional Insights

Asia-Pacific dominates the global automotive infotainment market, driven by massive vehicle production volumes, increasing smartphone penetration, and rapid adoption of connected technologies. Countries like China, Japan, South Korea, and India have emerged as both major production hubs and high-growth consumer markets. Chinese automakers such as NIO, XPeng, and BYD are integrating AI-driven infotainment and augmented dashboards into EVs to enhance in-cabin experience. Meanwhile, Japan’s legacy OEMs Toyota, Honda, and Nissan are adopting open-source systems and developing proprietary user interfaces to compete globally. Government initiatives supporting digitization and local production are further propelling market growth.

.jpg)

North America is the fastest-growing market, particularly due to early adoption of AI, voice assistants, and subscription-based services. The U.S. market is witnessing strong demand for advanced infotainment in both ICE and EV segments. Tesla continues to redefine infotainment standards with gaming capabilities, video conferencing, and full-screen streaming. Traditional OEMs like Ford and GM have also ramped up investments in in-house software development. Qualcomm’s recent expansion of the Snapdragon Ride Flex platform in March 2024, designed for both infotainment and ADAS, illustrates the region’s push for integrated computing. Canada and Mexico are also key contributors due to strong manufacturing bases and trade ties.

Recent Developments

- In October 2023, Alps Alpine Co., Ltd. partnered with DSP Concepts, Inc., an audio processing solution provider, to provide customers with sound technology. Through the partnership, a former company used Audio Weaver audio system development platform, DSP, to develop next-generation audio products.

- In July 2023, Pioneer Corporation announced its R&D expansion plan in India. By expanding its R&D facility in India, the company aims to accelerate the development of innovative products in the mobility field and cater to the growth in Indian automotive market.

- In February 2023, Continental AG announced the launch of a driver identification display equipped with an integrated camera for biometric driver identification. The Driver Identification Display, the first inside automotive display in the world that supports contactless, highly secure identification and deters fraud and theft, is designed to identify the driver. TrinamiX created and patented the technology on which integrated facial authentication is based. It combines a novel sort of liveness detection with facial recognition to confirm the user's identification.

- In January 2023, Visteon Corporation partnered with Qualcomm Technologies to develop integrated cockpit domain controller technology together. The technology is developed using Visteon’s SmartCore software powered by Snapdragon cockpit platforms for software-defined vehicles.

Some of the prominent players in the automotive infotainment market include:

- Alpine Electronics

- Clarion Co., Ltd.

- Continental AG

- Delphi Automotive PLC

- Denso Corporation

- Harman International

- JVC KENWOOD Corporation

- Panasonic Corporation

- Pioneer Corporation

- Visteon Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive infotainment market.

Product Type

- Audio Unit

- Display Unit

- Heads-Up Display

- Navigation Unit

- Communication Unit

Fit Type

Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.jpg)