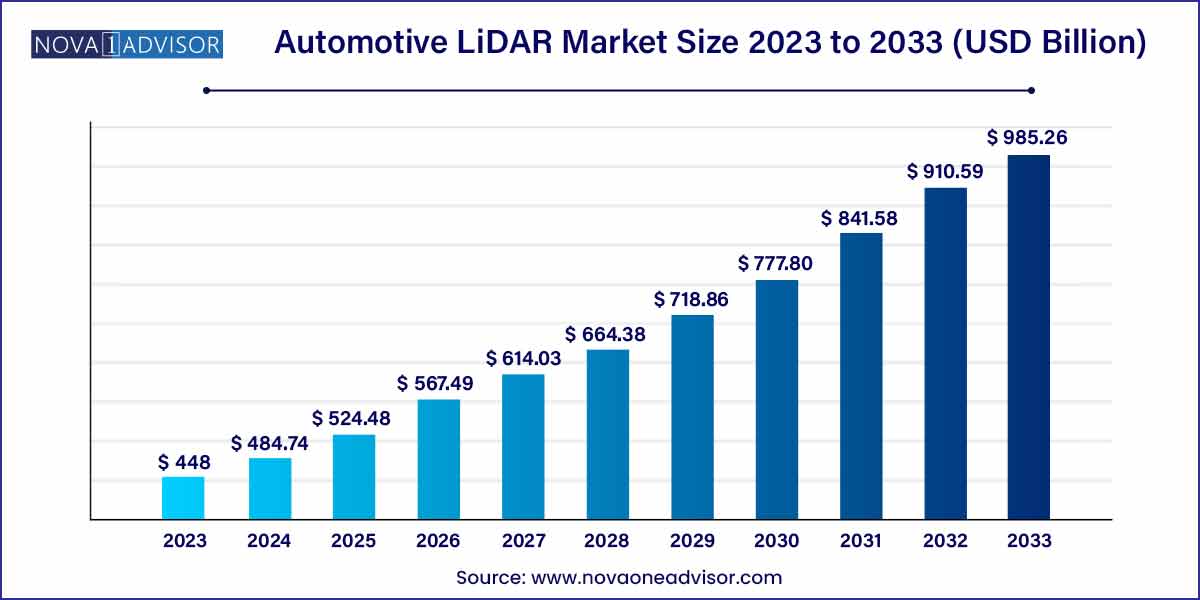

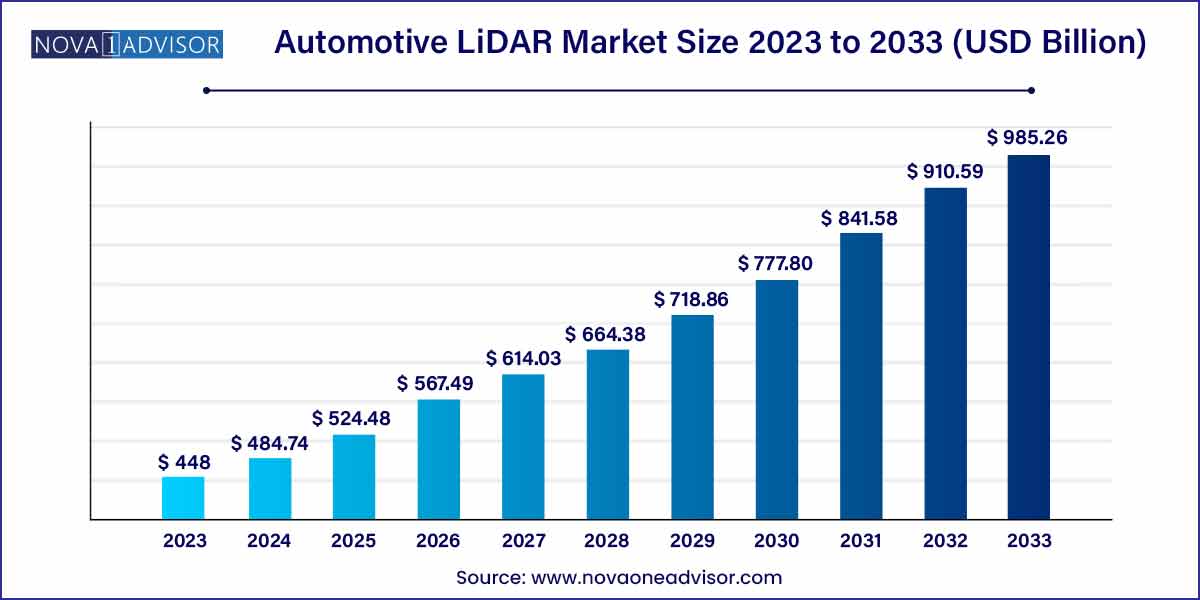

The global automotive LiDAR market size was exhibited at USD 448.00 million in 2023 and is projected to hit around USD 985.26 million by 2033, growing at a CAGR of 8.2% during the forecast period of 2024 to 2033.

Key Takeaways:

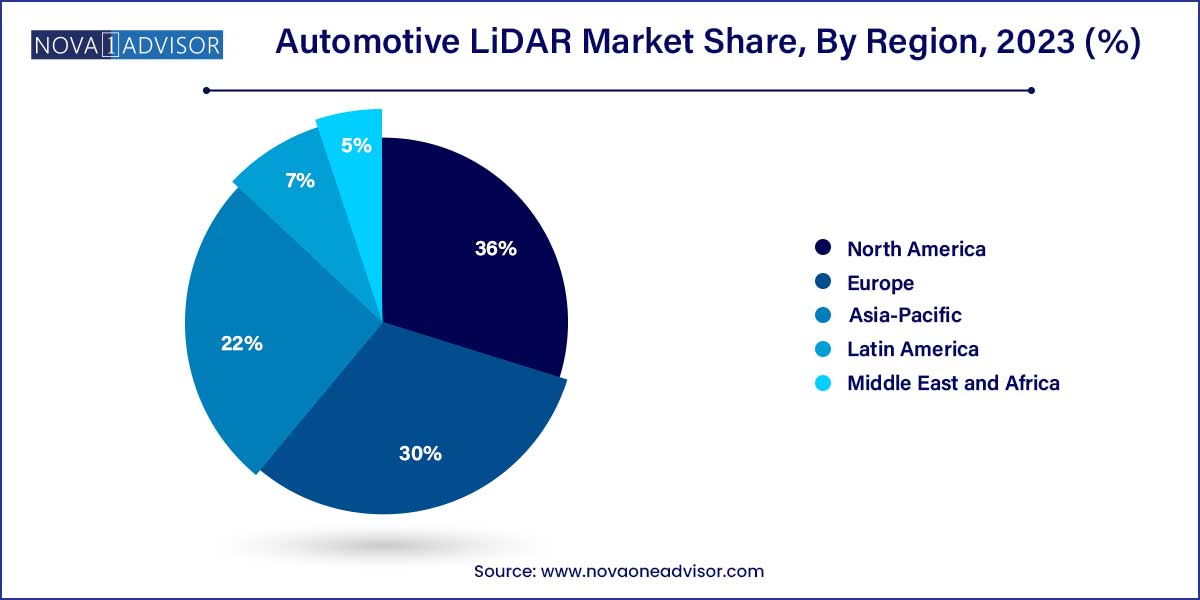

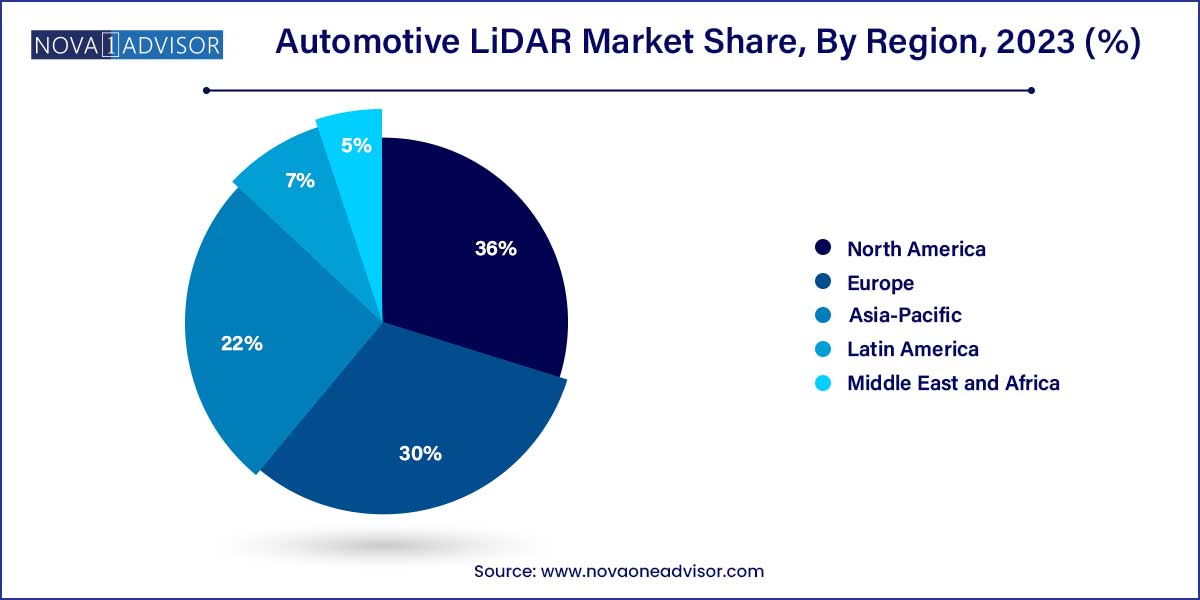

- North America dominated the market and accounted for the largest revenue share of 36.0% in 2023.

- The ADAS segment captured the largest revenue share of over 70% in 2023.

Automotive LiDAR Market: Overview

The automotive LiDAR (Light Detection and Ranging) market has emerged as a critical frontier technology in the development of advanced driver assistance systems (ADAS) and autonomous vehicles. By emitting laser beams and measuring the reflected signals to create detailed three-dimensional maps of the surrounding environment, LiDAR offers unparalleled accuracy and reliability in object detection, ranging, and classification. It is particularly effective in low-light, adverse weather, and complex urban conditions, making it an indispensable component for safe and reliable vehicle autonomy.

The automotive sector's ongoing shift towards vehicle automation, spurred by growing investments from automakers, technology companies, and governments, has propelled the demand for automotive LiDAR systems. Several flagship automotive projects, including Tesla’s FSD (Full Self-Driving) and Waymo's autonomous taxis, have highlighted LiDAR's role either by direct adoption or through discussion and debate. Although Tesla pursues a "vision-only" approach, numerous industry players like Cruise, Aurora, and Volvo have openly endorsed and integrated LiDAR systems.

With advancements in solid-state LiDAR, reduction in costs, and the growing necessity for precise perception systems, the automotive LiDAR market is poised for exponential growth. The rising trend of integrating LiDAR with cameras and radar to form sensor fusion systems is also enhancing market prospects, aiming to deliver robust Level 3 and Level 4 autonomy across diverse vehicle segments.

Automotive LiDAR Market Growth

The automotive LiDAR market is experiencing robust growth due to several key factors. Firstly, the rising demand for enhanced safety features in vehicles, coupled with increasing regulatory pressure to improve road safety, is driving the adoption of LiDAR technology. Additionally, the rapid development of autonomous driving technology is fueling demand for LiDAR sensors, as they play a crucial role in enabling vehicles to perceive and navigate their surroundings accurately. Moreover, advancements in LiDAR technology, including the introduction of solid-state LiDAR systems and the integration of artificial intelligence for data processing, are driving down costs and enhancing performance, making LiDAR solutions more attractive to automotive manufacturers. Furthermore, strategic partnerships and collaborations between automotive companies and LiDAR technology providers are accelerating innovation and market penetration. Overall, these growth factors are propelling the Automotive LiDAR market forward, promising a future where LiDAR technology is integral to the safety and efficiency of vehicles on the road.

Automotive LiDAR Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 448.00 Million |

| Market Size by 2033 |

USD 985.26 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 8.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Continental AG; Denso Corporation; LeddarTech Inc.; KUBOTA Corporation; Quanergy Solutions, Inc.; Robert Bosch GmbH; Teledyne Geospatial; Valeo; Velodyne LiDAR, Inc. |

Automotive LiDAR Market Dynamics

- Technological Advancements and Innovation:

The Automotive LiDAR market is characterized by continuous technological advancements and innovation. Manufacturers are constantly striving to develop more advanced LiDAR sensors that offer higher resolution, longer detection ranges, and improved reliability. These advancements not only enhance the performance of LiDAR systems but also contribute to reducing their cost, making them more viable for mass adoption in automotive applications. Additionally, innovations such as solid-state LiDAR technology and the integration of artificial intelligence for real-time data processing are reshaping the landscape of automotive sensing capabilities.

- Regulatory Landscape and Industry Standards:

The regulatory landscape and industry standards play a significant role in shaping the growth trajectory of the Automotive LiDAR market. Regulatory initiatives aimed at improving road safety and reducing accidents are driving the adoption of LiDAR technology in automotive applications. Governments worldwide are implementing regulations mandating the inclusion of advanced safety features in vehicles, which often include LiDAR-based sensing systems. Moreover, industry organizations are working to establish standards and guidelines for the integration and deployment of LiDAR technology in automotive platforms. Compliance with these standards not only ensures the reliability and effectiveness of LiDAR systems but also instills confidence among automotive manufacturers and consumers.

Automotive LiDAR Market Restraint

One of the primary restraints hindering the widespread adoption of LiDAR technology in the automotive industry is its high cost. Traditional LiDAR sensors are often expensive to manufacture due to their complex components and precision engineering requirements. This high cost presents a significant barrier, particularly for mass-market vehicles where cost-effectiveness is paramount. Additionally, the integration of LiDAR sensors into vehicles adds to the overall cost of production, further limiting their adoption. While advancements in technology have led to cost reductions in recent years, achieving cost parity with alternative sensing technologies such as radar and cameras remains a challenge.

- Technological Limitations and Performance Challenges:

Despite significant advancements, LiDAR technology still faces certain technological limitations and performance challenges that constrain its widespread adoption in automotive applications. One notable limitation is the sensitivity of LiDAR sensors to environmental factors such as adverse weather conditions (e.g., rain, fog, snow) and varying lighting conditions (e.g., bright sunlight, low light). These conditions can affect the accuracy and reliability of LiDAR data, potentially compromising the safety and effectiveness of autonomous driving systems relying on LiDAR sensing. Additionally, LiDAR sensors may encounter challenges in accurately detecting certain objects, such as transparent or low-reflectivity surfaces, which can impact their ability to provide comprehensive situational awareness.

Automotive LiDAR Market Opportunity

- Rapid Growth in Autonomous Vehicle Development:

One of the most promising opportunities in the Automotive LiDAR market is the rapid growth of autonomous vehicle development. As automotive manufacturers and technology companies continue to invest heavily in the research and development of autonomous driving technology, the demand for LiDAR sensors is expected to surge. LiDAR plays a crucial role in enabling autonomous vehicles to perceive and understand their surroundings with high precision and accuracy. With advancements in LiDAR technology enhancing its performance, reliability, and cost-effectiveness, there is a growing opportunity for LiDAR manufacturers to capitalize on the expanding market for autonomous driving solutions.

- Diversification of Applications Beyond Automotive:

While the Automotive LiDAR market primarily focuses on applications within the automotive industry, there is a significant opportunity for diversification into other sectors and industries. LiDAR technology has demonstrated its utility across various fields, including robotics, agriculture, urban planning, and environmental monitoring. As advancements in LiDAR technology continue to drive down costs and improve performance, the potential for expanding into these non-automotive applications grows substantially. For example, LiDAR sensors can be utilized in agricultural drones for precision farming, in urban planning initiatives for mapping and infrastructure development, and in environmental monitoring systems for assessing ecosystem health and mitigating natural disasters.

Automotive LiDAR Market Challenges

- Regulatory Uncertainty and Compliance Issues:

One of the primary challenges confronting the Automotive LiDAR market is regulatory uncertainty and compliance issues. As LiDAR technology becomes increasingly integrated into autonomous driving systems and advanced driver-assistance systems (ADAS), regulatory bodies around the world are grappling with the development of standards and regulations governing its use. The absence of clear and standardized regulations can create uncertainty for automotive manufacturers and LiDAR technology providers, hindering investment and adoption efforts. Moreover, navigating the complex regulatory landscape across different regions and jurisdictions presents additional compliance challenges, as requirements may vary significantly from one market to another.

- Technological Limitations and Performance Constraints:

Despite significant advancements, LiDAR technology still faces certain technological limitations and performance constraints that pose challenges to its widespread adoption in automotive applications. One of the primary limitations is the sensitivity of LiDAR sensors to environmental factors such as adverse weather conditions (e.g., rain, fog, snow) and varying lighting conditions (e.g., bright sunlight, low light). These conditions can affect the accuracy and reliability of LiDAR data, potentially compromising the safety and effectiveness of autonomous driving systems relying on LiDAR sensing. Additionally, LiDAR sensors may encounter challenges in accurately detecting certain objects, such as transparent or low-reflectivity surfaces, which can impact their ability to provide comprehensive situational awareness.

Segments Insights:

Application Insights

ADAS dominated the application segment. Advanced Driver Assistance Systems (ADAS) such as automatic emergency braking (AEB) and adaptive cruise control (ACC) have become increasingly standard in modern vehicles, particularly in mid-range and luxury segments. LiDAR integration enhances ADAS functionalities by providing precise distance measurement, obstacle detection, and environmental mapping. The integration of LiDAR ensures higher accuracy compared to camera-only or radar-only systems, reducing the likelihood of false positives or undetected threats. Automakers like Audi and Mercedes-Benz are embedding LiDAR into their ADAS frameworks to deliver superior semi-autonomous driving experiences and meet upcoming regulatory safety mandates.

Autonomous Cars are the fastest-growing application segment. While ADAS applications are foundational, the future of automotive LiDAR lies with fully autonomous vehicles. Companies such as Cruise, Waymo, and Baidu Apollo are investing billions into developing autonomous cars equipped with multiple LiDAR units to achieve 360-degree perception. Robo-taxi deployments, pilot programs, and Level 4 autonomous vehicle prototypes are increasingly relying on LiDAR to navigate dynamic urban environments. As the industry progresses towards Level 4 and Level 5 autonomy, the demand for robust, high-resolution LiDAR solutions is projected to grow exponentially, making autonomous cars the fastest-expanding segment.

Regional Insights

North America dominated the automotive LiDAR market. The region's leadership can be attributed to its early and aggressive investments in autonomous vehicle technology and a strong presence of key LiDAR manufacturers such as Velodyne, Luminar Technologies, and Aeva. Regulatory support, such as the U.S. Department of Transportation's AV policies, and active pilot projects in states like California and Arizona, provide a conducive ecosystem for LiDAR integration. Furthermore, major technology giants and automotive OEMs based in the U.S. continue to invest heavily in R&D, ensuring North America's dominance.

Asia-Pacific is the fastest-growing region. Rapid urbanization, government initiatives promoting smart mobility, and rising automotive production make Asia-Pacific a hotspot for LiDAR adoption. China, in particular, is investing heavily in autonomous driving infrastructure, with companies like Baidu, AutoX, and Pony.ai integrating LiDAR technologies. Japan and South Korea, with their advanced automotive industries led by players like Toyota, Hyundai, and Honda, are also accelerating the adoption of LiDAR in both passenger vehicles and public transport solutions. Additionally, favorable government policies supporting autonomous vehicle testing further bolster Asia-Pacific's growth trajectory.

Recent Developments

-

April 2025: Luminar Technologies announced a partnership with Polestar to integrate its Iris LiDAR system into upcoming EV models, enhancing advanced safety features.

-

March 2025: Velodyne Lidar unveiled its next-generation "Velarray H800" solid-state LiDAR sensor designed for high-speed highway applications in ADAS and autonomous vehicles.

-

February 2025: Innoviz Technologies secured a production deal with a leading Asian OEM to supply its InnovizOne LiDAR units for Level 3 autonomous driving vehicles.

-

January 2025: Valeo introduced "SCALA 3" LiDAR sensors offering enhanced resolution and range, aimed at mass-market autonomous vehicle applications.

-

December 2024: Aeva Technologies launched its 4D LiDAR-on-chip technology, promising improved perception capabilities at a reduced size and cost.

Some of the prominent players in the automotive LiDAR market include:

- Continental AG

- Denso Corporation

- LeddarTech Inc.

- KUBOTA Corporation

- Quanergy Solutions, Inc.

- Robert Bosch GmbH

- Teledyne Geospatial

- ValeoVelodyne LiDAR, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive LiDAR market.

Application

-

- Automatic Emergency Braking (AEB)

- Adaptive Cruise Control (ACC)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)