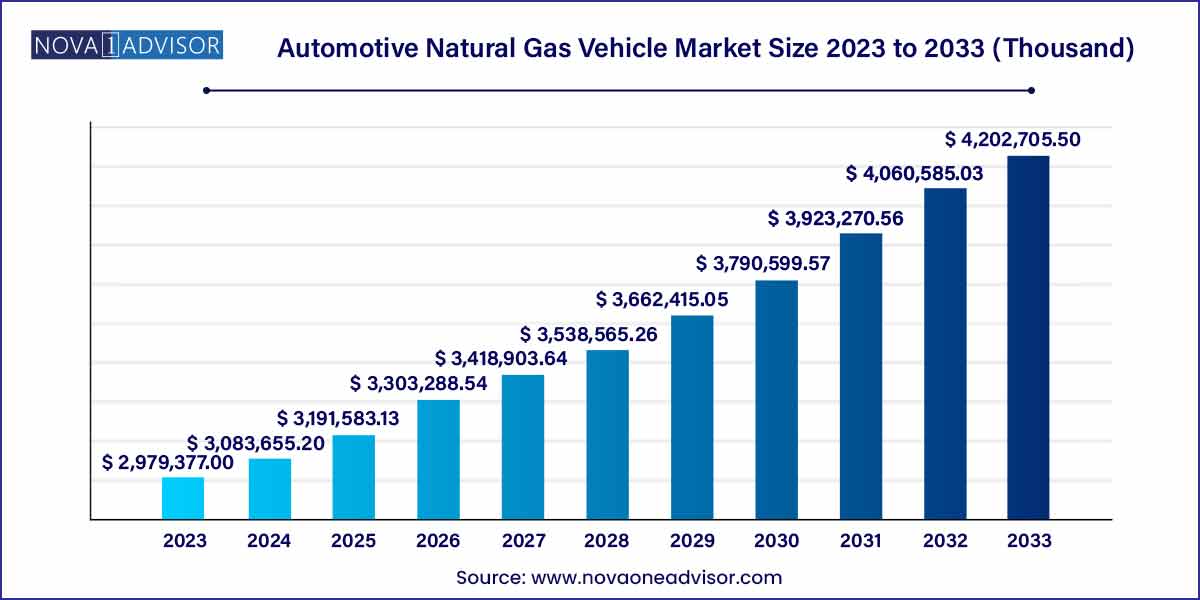

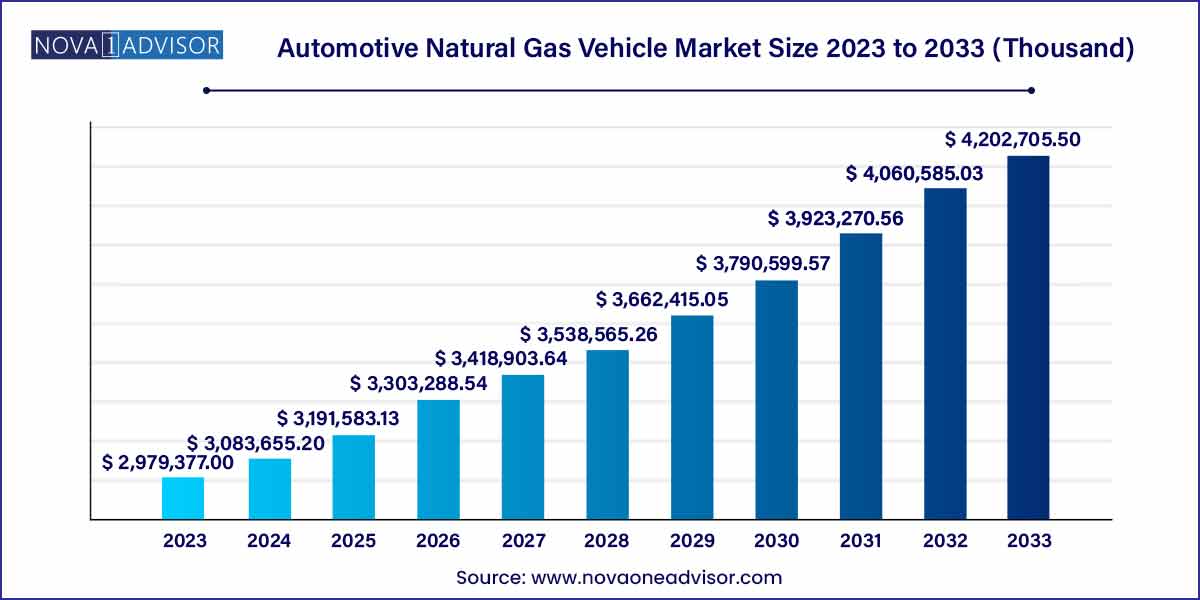

The global automotive natural gas vehicle market size was exhibited at USD 2,979,377.0 thousand in 2023 and is projected to hit around USD 4,202,705.5 thousand by 2033, growing at a CAGR of 3.5% during the forecast period of 2024 to 2033.

Key Takeaways:

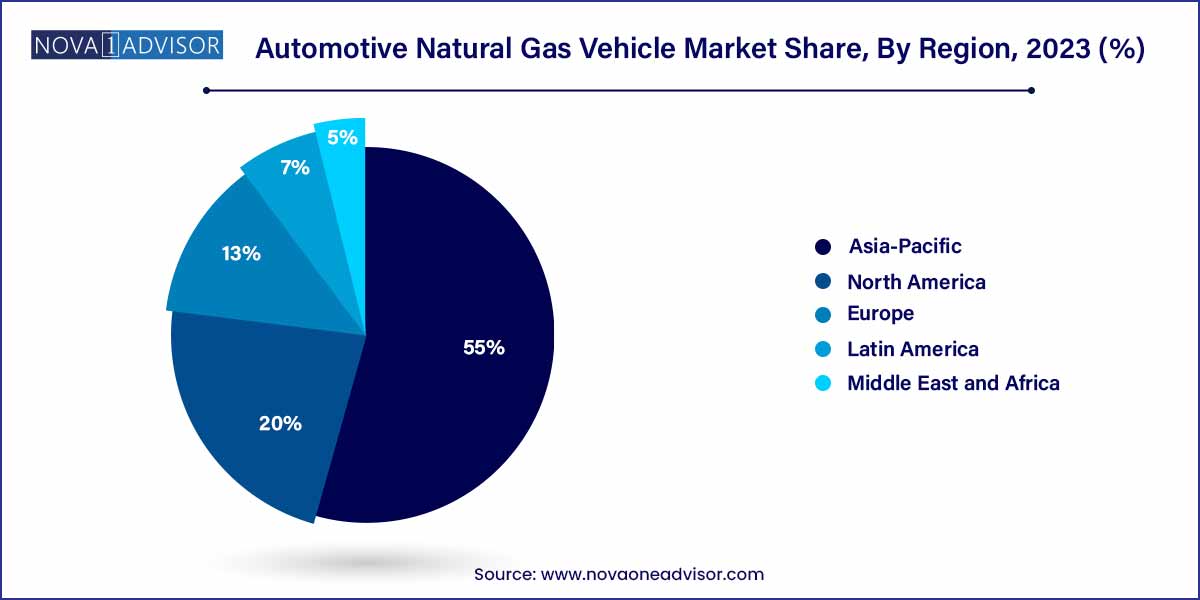

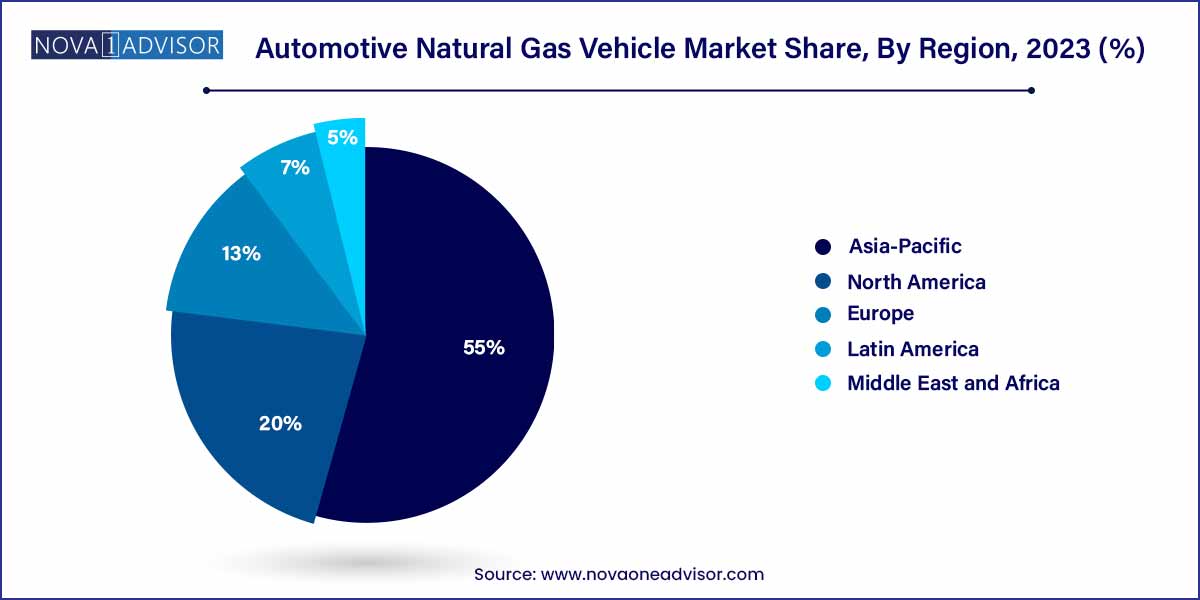

- The Asia Pacific region accounted for the largest share of more than 55% in 2023

- The CNG segment accounted for the largest volume share of over 95% in 2023

- The passenger vehicle type segment accounted for the largest volume share of over 89% in 2023.

Automotive Natural Gas Vehicle Market: Overview

The automotive industry is witnessing a paradigm shift towards sustainable mobility solutions, with natural gas emerging as a promising alternative fuel. This overview delves into the dynamics driving the Automotive Natural Gas Vehicle (NGV) market, providing insights into its growth trajectory, key trends, challenges, and opportunities.

Automotive Natural Gas Vehicle Market Growth

The growth of the Automotive Natural Gas Vehicle (NGV) market is propelled by several key factors. Firstly, heightened environmental concerns are driving demand for cleaner transportation options, with NGVs offering reduced emissions of greenhouse gases and pollutants compared to conventional vehicles. Additionally, the cost efficiency of natural gas relative to gasoline or diesel presents a compelling economic incentive for fleet operators and consumers alike. Moreover, the push towards energy security and diversification of fuel sources further bolsters the adoption of NGVs, leveraging domestically-produced natural gas. Furthermore, ongoing technological advancements in NGV technology, including improvements in engine efficiency and fuel storage, are enhancing vehicle performance and expanding market opportunities. Collectively, these factors underscore the significant growth potential of the automotive NGV market, positioning it as a key player in the transition towards sustainable mobility solutions.

Automotive Natural Gas Vehicle Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2,979,377.0 Thousand |

| Market Size by 2033 |

USD 4,202,705.5 Thousand |

| Growth Rate From 2024 to 2033 |

CAGR of 3.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Fuel Type, Vehicle Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Agility Fuel Solutions; AB Volvo; Beiqi Foton Motor Co., Ltd.; CNH Industrial N.V.; Clean Energy Fuels; Cummins, Inc.; PACCAR, Inc.; Navistar, Inc.; Quantum Fuel Systems LLC; Westport Fuel Systems Inc. |

Automotive Natural Gas Vehicle Market Dynamics

- Environmental Sustainability Drive:

The Automotive NGV market is strongly influenced by increasing environmental concerns and regulatory pressures to reduce vehicle emissions. NGVs offer a compelling solution by emitting lower levels of greenhouse gases and air pollutants compared to traditional gasoline and diesel vehicles. This factor aligns with global efforts to mitigate climate change and improve air quality, driving demand for cleaner transportation options. Government mandates and incentives aimed at promoting the adoption of alternative fuel vehicles further bolster the growth of the NGV market. As sustainability continues to be a priority for consumers, businesses, and policymakers alike, the Automotive NGV market is poised to benefit from this overarching trend.

- Cost Efficiency and Economic Incentives:

Cost efficiency plays a pivotal role in driving the adoption of automotive natural gas vehicles. Natural gas typically costs less than gasoline or diesel on a per-mile basis, offering significant savings for fleet operators and individual consumers. Additionally, governments often provide financial incentives such as tax credits, grants, and subsidies to promote the adoption of NGVs, further enhancing their attractiveness from an economic standpoint. These incentives, coupled with the long-term cost savings associated with natural gas fuel, contribute to the growing market appeal of NGVs. As businesses seek to optimize operational costs and consumers prioritize affordability, the cost efficiency of NGVs positions them as a compelling alternative in the automotive market landscape.

Automotive Natural Gas Vehicle Market Restraint

- Limited Refueling Infrastructure:

One of the primary restraints hindering the widespread adoption of NGVs is the limited availability of refueling infrastructure. Unlike conventional gasoline and diesel vehicles, which benefit from an extensive network of refueling stations, NGV refueling infrastructure remains relatively sparse in many regions. This lack of infrastructure poses a barrier to consumer adoption, as drivers may be hesitant to invest in NGVs without convenient access to refueling stations. Moreover, the cost and logistical challenges associated with establishing new refueling infrastructure present a significant hurdle for market expansion.

- Vehicle Range and Performance Limitations:

Another key restraint facing the Automotive NGV market is the perceived limitations in vehicle range and performance compared to traditional gasoline and diesel vehicles. While advancements in NGV technology have improved vehicle efficiency and performance in recent years, some consumers remain skeptical about the range and power capabilities of NGVs, particularly for long-distance travel or heavy-duty applications. Additionally, the availability of NGV models and options may be limited compared to conventional vehicles, further constraining consumer choice and adoption.

Automotive Natural Gas Vehicle Market Opportunity

- Government Support and Regulatory Incentives:

Government support and regulatory incentives present a significant opportunity for the growth of the Automotive NGV market. Many governments around the world are implementing policies and regulations aimed at reducing greenhouse gas emissions and promoting clean transportation solutions. As part of these initiatives, governments offer various incentives such as tax credits, subsidies, grants, and preferential treatment for NGVs. Additionally, regulatory measures such as emissions standards and vehicle procurement mandates further encourage the adoption of NGVs by fleet operators and government agencies.

- Technological Advancements and Innovation:

Continuous technological advancements and innovation present a significant opportunity for the Automotive NGV market. With ongoing research and development efforts, manufacturers are continuously improving NGV technology to enhance vehicle performance, efficiency, and user experience. These advancements include innovations in engine design, fuel storage systems, lightweight materials, and vehicle integration technologies. Additionally, advancements in renewable natural gas (RNG) production and distribution offer opportunities to further enhance the environmental benefits of NGVs by utilizing renewable and low-carbon fuel sources.

Automotive Natural Gas Vehicle Market Challenges

- Limited Refueling Infrastructure:

A primary challenge hindering the widespread adoption of NGVs is the limited availability of refueling infrastructure. Unlike conventional gasoline and diesel vehicles, which benefit from an extensive network of refueling stations, NGV refueling infrastructure remains relatively sparse in many regions. This lack of infrastructure poses a barrier to consumer adoption, as drivers may be hesitant to invest in NGVs without convenient access to refueling stations. Moreover, the cost and logistical challenges associated with establishing new refueling infrastructure present a significant hurdle for market expansion.

- Consumer Perceptions and Awareness:

Another key challenge facing the Automotive NGV market is consumer perceptions and awareness. Despite the environmental and economic benefits of NGVs, many consumers remain unfamiliar with this alternative fuel technology or hold misconceptions about its performance, range, and availability. Additionally, the limited visibility and marketing of NGV options compared to conventional vehicles contribute to low consumer awareness and adoption rates. Overcoming these challenges requires targeted education and outreach efforts to raise awareness about the benefits and capabilities of NGVs among consumers, businesses, and fleet operators.

Segments Insights:

Fuel Type Insights

CNG dominated the automotive NGV market in 2024, given its widespread availability, lower fuel cost compared to gasoline and diesel, and well-established infrastructure in regions like Asia-Pacific, Europe, and Latin America. CNG is particularly popular in urban transportation networks, taxis, and fleet operations because of its cost-effectiveness and proven emissions reduction capabilities. Countries such as India, Iran, and Pakistan have witnessed a tremendous surge in CNG-powered vehicles, underlining the segment's dominance.

On the other hand, LNG is the fastest-growing fuel segment, primarily driven by the logistics and freight industry's need for long-haul transport solutions. LNG offers a higher energy density compared to CNG, allowing vehicles to travel longer distances between refueling stops, making it ideal for heavy-duty trucks and inter-city buses. Companies like Shell and Clean Energy Fuels are investing heavily in LNG refueling corridors across North America and Europe, accelerating the segment's growth trajectory.

Vehicle Type Insights

Passenger vehicles dominated the NGV market, accounting for the largest volume share owing to their vast numbers and daily operational needs, particularly in densely populated cities facing air quality challenges. Affordable CNG-powered passenger cars from manufacturers like Maruti Suzuki, Honda, and Hyundai have found significant traction in markets such as India and Iran. Urban consumers are increasingly opting for CNG passenger vehicles due to lower running costs and growing environmental awareness.

Meanwhile, light-duty and heavy-duty buses and trucks are the fastest-growing vehicle segments. Governments and corporations aiming to decarbonize public transport and logistics are replacing diesel fleets with natural gas-powered buses and heavy trucks. For example, China's commitment to replacing thousands of diesel trucks in key urban areas with LNG trucks exemplifies this shift. The benefits of cleaner emissions, noise reduction, and operational cost savings are driving momentum in this segment.

Regional Insights

Asia-Pacific dominated the automotive NGV market in 2023, accounting for the highest market share. Countries like China, India, Pakistan, and Thailand have embraced NGVs to address escalating urban air pollution and reduce crude oil imports. India’s ongoing expansion of its city gas distribution network and initiatives like "SATAT" (Sustainable Alternative Towards Affordable Transportation) have spurred CNG vehicle adoption. Similarly, China's investments in LNG-powered commercial trucks to tackle pollution from freight transport underpin the region's dominance.

Latin America is the fastest-growing region. Countries such as Argentina, Brazil, and Colombia have a long history with NGVs, initially driven by cost considerations. However, environmental motivations are now complementing economic ones. Argentina, for instance, has one of the highest numbers of CNG vehicles per capita globally. The recent recovery in natural gas production in the Vaca Muerta shale formation and government initiatives to expand CNG infrastructure are expected to drive rapid growth across Latin America over the next few years.

Some of the prominent players in the automotive natural gas vehicle market include:

- Agility Fuel Solutions

- AB Volvo

- Beiqi Foton Motor Co., Ltd.

- CNH Industrial N.V.

- Clean Energy Fuels

- Cummins, Inc.

- PACCAR, Inc.

- Navistar, Inc.

- Quantum Fuel Systems LLC

- Westport Fuel Systems Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive natural gas vehicle market.

Fuel Type

Vehicle Type

- Passenger Vehicles

- Light-duty & Heavy-duty Buses and Trucks

- Three-wheelers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)